- Egyptian policymakers project calm as the world faces what the worst commodities shock in decades. (Commodities)

- Putin threatens Ukraine statehood after Zelensky renews calls for Nato no-fly zone. (War Watch)

- PMI says business activity contracted again, but we’re not feeling it (yet). (Economy)

- No company should be exempt from paying the national private-sector minimum wage. (Economy)

- CBE issues new updates clarifying import rules. (Trade)

- Israel begins shipping natural gas to Egypt via Jordan. (Energy)

- EBRD, Green Growth and Sanad funds all have money for Egypt + there’s more competition coming in consumer finance. (Also on our Radar)

- What’s keeping Egyptian fintech players up at night? (What’s Next)

- Planet Finance — Stocks slip as investors fret over Ukraine conflict.

Sunday, 6 March 2022

AM — The world is facing the biggest commodities shock in decades

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and happy Sunday to you all. This morning’s issue is a bit like drinking from a fire hose, so let’s jump straight in:

THE BIG STORY ABROAD THIS MORNING- The war in Ukraine and sanctions on Russia will have a “severe impact” on the global economy, the IMF said in a statement yesterday. Price shocks will likely be felt worldwide, especially in poor households where food and fuel make up a significant proportion of expenses. “The sanctions on Russia will also have a substantial impact on the global economy and financial markets, with significant spillovers to other countries,” the statement said.

We have the latest on the war and its impact on Egypt in this morning’s news well, below.

DATA POINT OF THE MORNING- Egypt’s net foreign reserves rose to USD 40.99 bn in February, up from USD 40.98 bn in January, according to central bank data out last week.

PSA- Keep your windows closed today — there’s a sand storm incoming. The Egyptian Meteorological Authority is predicting (pdf) high winds will whip up dust today in parts of Cairo, the North Coast and elsewhere across the country. The mercury will reach a high of 27°C in the capital today before things cool to a milder 21-22°C through the rest of the week. Overnight lows will range from 10-12°C through until Thursday.

EDITOR’S NOTE- We’re discontinuing our regular Covid Watch section, ending our two-year-old count of new daily cases. The peak of this omicron-led wave is now well behind us, Egypt is making progress on vaccination that was unimaginable a year ago, and more and more holdouts are going back to (some form of) working from the office. With omicron so mild, what matters far more than new case numbers is the official death count — and that was at 10 yesterday, a fifth of what it was just a few weeks ago. (And as we all know, the official case count has always been from government labs only, so it gives us “directionality” only when you consider that the majority of tests are done at private labs.)

“But Enterprise, we’re still in the middle of the pandemic,” you say. Yes, we are — for the moment. Nations around the world have for some time been moving to “live with” the virus — something we did here in Egypt more than 18 months ago. The simple fact is that we’re in a far better position today than at any time in the past two years when it comes to this bug (touch wood). We’ll continue to monitor developments, and if there’s a need, we’ll bring back Covid Watch.

We will keep track once a week of the government’s vaccination figures. About 50% of those eligible have now been vaccinated, Acting Minister of Health Khaled Abdel Ghaffar said during last week’s cabinet meeting. The latest health ministry figures show that almost 30.4 mn people are now fully vaccinated and another 10.1 mn have received their first shot. More than 1.2 mn have now received a booster jab. Around 121.6k children aged 12-15 and around 769k 15-18 year-olds have received two shots of a covid jab, Abdel Ghaffar said.

|

HAPPENING TODAY-

Mansour is not heading to Stamford Bridge: CEO of Mantrac Group and Man Capital Loutfy Mansour is not considering making a bid to buy Chelsea, Mansour’s spokesperson told the Guardian. The Telegraph last week reported that the business mogul was considering a takeover bid after the club’s owner, Russian b’naire Roman Abramovich, announced he would sell the club amid Western sanctions imposed on Russia in the wake of its invasion of Ukraine.

The House of Representatives is holding plenary sessions today through Tuesday to discuss a handful of bills, including amendments to the law regulating real estate brokerage that would see a registry set up for licensed brokers. The changes would also regulate fees, among other moves to professionalize the largely informal sector, Youm7 reports.

Also on the agenda:

- Amendments to the law on illegal migration and people smuggling that will see tougher penalties and a national coordination committee set up, Youm7 reports.

- Amendments to a law regulating the safety of vessels at sea that will make it mandatory for ship owners to report the sale or rent of their units to the relevant authorities, according to Youm7.

Military Production Minister Mohamed Morsy is attending the World Defense Show in Saudi Arabia, which kicks off today and runs through 9 March. Many of the ministry’s products will be on display at the Egyptian pavilion, from armored vehicles through munitions, according to a statement by the ministry yesterday.

CIRCLE YOUR CALENDAR-

US Deputy Secretary of State Wendy Sherman will be in town this Thursday and Friday, the State Department said in a statement on Thursday. Sherman will meet with Foreign Minister Sameh Shoukry and “other senior officials”, as well as the head of the National Council of Human Rights Moushira Khattab.

*** It’s What’s Next day: We have our weekly deep-dive into what makes and shapes pre-listed companies and startups in Egypt, the UAE and KSA, touching on investment trends, future sector insights and growth journeys.

In today’s issue: Last week, we took a look at a recent CBE report on the recent evolution of Egypt’s local fintech scene. Today, we explore what it tells us about what keeps Egypt’s fintech players up at night.

Experience luxury in every thoughtful detail where prestige hospitality is rediscovered with genuine warmth and passion. Awaken forgotten desires and build unforgettable memories to fuel a lifetime of inspiration. Spend your winter break at Somabay with special rates and choose among five different hotels at one destination. Visit: www.Somabay.com/hotels/

COMMODITIES

The biggest global commodities shock in decades is inbound

The world is facing the biggest commodities shock in decades as conflict in Ukraine cuts off a quarter of the world’s wheat supply and western nations try to isolate Russia — the world’s second-largest commodities producer — from the global economy.

A snapshot of the global commodities markets last week, courtesy of Bloomberg (here, here, and here):

- Bloomberg’s raw materials index saw its largest weekly gain since at least 1960;

- Brent futures rose almost 20% to near USD 120 a barrel — its highest level since 2012 and almost double the price forecast in Egypt’s 2021-2022 budget;

- European natural gas prices hit new records;

- Metals saw one the biggest weekly gains on record, with aluminum hitting all-time highs and nickel and zinc the highest in 10+ years;

- Coal prices spiked 80%;

- US wheat futures surged more than 40% to a 14-year high.

From Goldman Sachs’ Department of the Obvious: “You don’t shut down the second-largest commodity producer in the world and not expect bad things to happen,” Jeff Currie, head of commodities research at Goldman, told Bloomberg.

Global food prices hit all-time highs in February — and that was before Russian shells started landing in Kyiv: New figures from the UN’s Food and Agriculture Organization yesterday showed that food prices hit a record high in February, surpassing the previous record set in February 2011.

We don’t mean to beat a dead horse, but: Wheat and oil are both vital commodities here in Egypt. The country imports some 60-80% of its wheat from Ukraine and Russia, whose grains — which account for around a quarter of global supply — have been all but removed from the market.

Finance Minister Mohamed Maait acknowledged the situation last week, telling Al Masry Al Youm that the Egyptian economy is inevitably going to suffer the consequences of the war. The surge in oil prices — which hit USD 118.11 over the weekend — is not “good news” for the economy, he said, pointing out that Egypt currently imports more than 120 mn barrels of crude a year. The minister also highlighted the war’s impact on the domestic tourism industry, saying that Russia and Ukraine account for 35-40% of tourists at Egyptian resorts.

Maait moved to calm fears over events in the wheat markets, suggesting that Egypt’s stockpile, a bigger domestic harvest, and new suppliers will mitigate the incoming pressures. The country currently has enough wheat in reserve to sustain the country for 4.5 months and the local harvest will provide a further 4 months’ worth, he said.

The same message was relayed by Deputy Supply Minister Ibrahim Ashmawy who told Reuters on Thursday that Egypt’s stockpile means it doesn’t need to rush to find new suppliers. This came as traders told the newswire that two cargoes carrying 120k tonnes of Egypt-bound wheat were being held up in Ukrainian ports. State grains buyer GASC, which has already canceled two tenders since the beginning of the war, was said to have agreed to an extended shipment deadline and is offering more flexibility over documentation. “We don't know what's going to happen to the vessels, but we do have our negotiations,” Ashmawy said.

What would happen if suppliers don’t meet the extended deadline? Suppliers are obligated to look for an alternative origin for the purchase if they fail to execute the purchase themselves, since GASC contracts do not include a force majeure clause, traders said.

Egypt is eyeing the EU for future imports, but “will not exclude other exporters like the US, Kazakhstan, Romania," Ashmawy added.

Shrinking supply and rising prices is putting more pressure on the state to act on subsidies: The Supply Ministry is still considering several scenarios for tapering bread subsidies for the first time in decades, with a final decision on how they will be reworked expected by the end of March.

WAR WATCH

Egypt looking after Ukrainian tourists as Russia-Ukraine peace talks sputter

Talk of a diplomatic off ramp to the Ukraine conflict is being overshadowed by increasingly hostile rhetoric from both sides: Ukrainian and Russian officials will hold a third round of talks tomorrow attempting to find a solution to end the 10-day conflict, Reuters reports citing Ukrainian negotiator David Arakhamia, who did not provide further details. A Russian negotiator was not quite as committal, saying only that the talks “might” start on Monday.

BUT: Zelensky really wants Nato to effectively declare war: Ukrainian President Volodymyr Zelensky again urged Nato to enter the conflict by imposing a no-fly zone over the country during a call with 300 US senators and representatives. Western governments have so far rejected the Ukrainian government’s calls, which would likely require Nato forces to engage in direct combat with the Russian military. In a separate speech from the country’s capital, the president said that western leaders were “weak, under-confident inside” for refusing to heed his calls and accused them of being responsible for the deaths of Ukrainians.

And Moscow is threatening to end Ukraine as a country: “If they continue to do what they are doing, they are calling into question the future of Ukrainian statehood,” President Vladimir Putin said yesterday. He warned that any country that attempts to prevent Russian planes from entering Ukrainian airspace will be treated as a participant in the war, and compared western sanctions as “akin to a declaration of war.”

ON THE GROUND- For the most reliable picture of what’s happening on the ground as of yesterday, check out the Institute for the Study of War’s 5 March bulletin. Tl;dr: Moscow’s push to take Kyiv and Kharkiv is on hold, but is intensifying its attacks on the besieged southern coastal city of Mariupol (see below).

The fog of war: A negotiated humanitarian corridor allowing civilians to escape Mariupol quickly collapsed yesterday, with both Russia and Ukraine accusing each other of breaching the ceasefire.

Nuclear freakout: The seizure of a large nuclear plant by Russian forces on Thursday had Ukrainian officials warning of a 10x Chernobyl-scale disaster. None of the plant’s reactors were affected and no radiation leaked due to a resulting fire, but the operation was still met with condemnation from western nations.

EGYPTIANS IN UKRAINE- More than 200 Egyptian expats who escaped Ukraine into neighboring countries have been flown back to the country: Two Air Cairo flights carrying 177 Egyptians arrived at Cairo Airport from Poland last night, while EgyptAir brought back 30 expats from Budapest on Friday.

More are coming: Another flight from Romania is due to fly 175 Egyptians back home within the next couple of days, according to Egypt’s embassy in Bucharest. Authorities will send two daily flights through Friday to Hungary to bring back Egyptians who crossed the border from Ukraine, Egypt’s embassy in Budapest said yesterday. Senior Foreign Ministry Official Salah Abdel Sadek discussed the government’s repatriation efforts with Kelma Akheera’s Lamis El Hadidi in a phone-in last night (watch, runtime 6:02).

Around 6k Egyptians had been living in Ukraine before the war broke out, including almost 4k students whose evacuation is being prioritized. The government has launched an online registration form for Egyptians studying in Ukraine, Higher Education Minister Khaled Abdel Ghaffar told Amr Adib last night(watch, runtime 4:18).

UKRAINIANS IN EGYPT- Egypt to pay for accommodation for Ukranians: The Tourism and Antiquities Fund will pay USD 10 a night for Ukrainian tourists stranded here to stay at three-star hotels, the Egyptian Hotel Association said in a statement (pdf). Last week, hotels received directives requiring them to extend stays of Ukrainian tourists stranded in Egypt. Last week there were some 20k Ukrainians stranded in Egypt, though around 4k were flown to neighboring European countries over the past few days, Egyptian Cabinet Spokesperson Nader Saad told Al Hayah Al Youm (watch, runtime 9:05) last night.

RUSSIANS NOT IN EGYPT- We can say goodbye to Russian tourists for the foreseeable future after sanctions yesterday forced flag carrier Aeroflot to suspend travel to all countries except Belarus. The airline operates direct flights to Cairo, Sharm El Sheikh and Hurghada from Moscow. Russia’s second biggest airline, S7 Airlines, has also halted all international flights while Ural Airlines will cease scheduled flights to Egypt from 14 March to 20 May. Charter flights are also canceling runs into Egypt.

EGYPT-UKRAINE IN THE FOREIGN PRESS- Is the topic everywhere from Bloomberg to the Middle East Institute (here and here).

ECONOMY

PMI says you’re not optimistic, but our survey said you are…

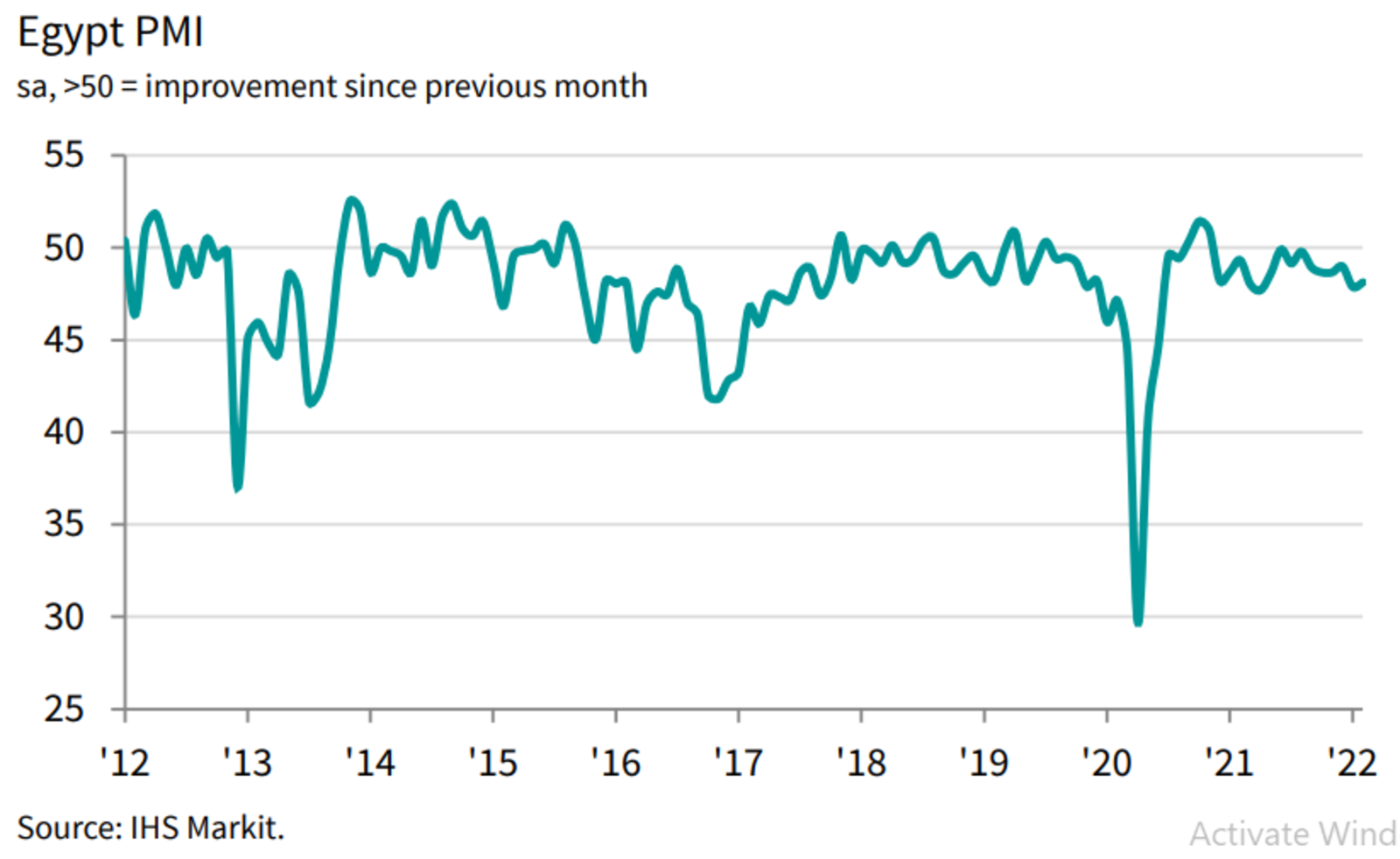

Non-oil business activity in Egypt saw a “solid decline” in February as inflationary pressures continued to impact business confidence and demand, according to IHS Markit’s purchasing managers’ index (PMI) survey (pdf). The contraction eased slightly to 48.1 from 47.9 in January but concerns about economic conditions sent confidence levels to the lowest in the survey’s history.

This is the 15th consecutive month that Egypt’s private sector has been in contraction since the two months’ of growth in September and October 2020.

What they said: “The pandemic-led surge in input prices and the omicron wave continued to derail Egypt's recovery in the first quarter of 2022,” said David Owen, IHS Markit economist. “Output, new business, employment and purchases were all down.”

Confidence is at an all-time low: “Overall confidence fell to its lowest level in the series history, with just 11% of firms reporting a positive outlook for the upcoming year,” said Owen. That’s in stark contrast to our Enterprise 2022 reader poll taken at the start of the year, when most of you were pretty optimistic about doing business in Egypt in 2022.

ELSEWHERE IN THE REGION- The UAE and Saudi Arabia both recorded strong growth in the non-oil private sector in February, as rising demand and confidence levels buoyed activity. The UAE’s PMI (pdf) rose to 54.8 in February from 54.1 in January as output levels rose and growing confidence saw input purchases hit their highest level since 2019. Meanwhile, KSA’s PMI (pdf) rose to 56.2 in February from 53.2 in January, with purchasing growth hitting a 33-month high.

ECONOMY

Need an exemption from the minimum wage? Prove you really need it.

SMART POLICY- Companies need to cough up lots of info before they can qualify for an exemption to the new national minimum wage. The National Council for Wages (NCW) has not yet started reviewing the 6k requests companies have filed for exemptions from the new private sector minimum wage, Manpower Minister Mohamed Saafan said in a statement Friday. None of the companies have submitted financial statements, leaving the council unable to assess the potential losses caused by the wage hike, the minister said.

What qualifies a company for exemption? Firms requesting exemptions are required to present proof that they will incur losses or other evidence that their industry has faced disruptions, head of the NCW’s complaints committee Abdelhamid Belal told Enterprise. Officials will subsequently visit the companies to verify the evidence, he added.

WE DON’T LIKE EXEMPTIONS. Sorry to be hard(redacted) about this, but we hate the idea that any company or industry should get anything more than a passing exemption from the minimum wage. We have a duty to our people to pay living wages — and the minimum wage barely meets that threshold. If your industry or company can’t afford to do that, you need to go back to the drawing board.

Companies that receive exemptions will get a one-year grace period before authorities revisit their status, Manpower Ministry spokesman Haitham Saad El Din told us. Companies that are eventually found to be ineligible for an exemption could be slapped with a retroactive fine for not raising salaries in line with the new minimum wage, he added, without disclosing the amount they would be required to pay.

The NCW will finish reviewing applications by the end of March, Belal said, after which the Manpower Ministry and NCW will meet to make a final decision on which companies will be exempted.

Background: Thousands of companies have been handed a temporary reprieve from implementing the new EGP 2.4k minimum wage that came into effect at the start of the year, while the government decides whether to grant their requests for exemptions. The firms claim that high employment counts, increased production costs, and the pandemic have left them unable to pay for the additional labor costs. We’d previously been told to expect rulings on a case-by-case basis by mid-February.

TRADE

CBE issues updates to its L/Cs FAQ sheet

CBE issues updates clarifying new import rules: The central bank on Thursday issued updates (pdf) to its responses to importers’ questions about new rules requiring them to get letters of credit (L/Cs) for their purchases.

What new rules? As of the beginning of March, banks have stopped documentary collection as part of the import cycle after the CBE instructed banks to only accept letters of credit. The central bank has in recent weeks announced moves to ease the transition after pushback from trade and industry organizations who said it would drive up the price of goods in the local market and hurt the competitiveness of Egyptian exports.

The updates include clarification on downpayments to foreign sellers: The CBE will continue to allow importers to send downpayments on shipments to foreign suppliers through banks, if that was their previous arrangement. However, importers will also need to open an L/C for the remaining amount owed to foreign sellers.

And on the status of freezone companies: Any trade between the local market and freezones — whether in EGP or foreign currency — need to be done using L/Cs but transactions between freezones and overseas companies do not.

L/Cs aren’t necessary for some types of cross-border trade: Cross-border trade conducted by companies who are already exempt from filing certain CBE import paperwork — like firms in special economic zones and oil companies — is exempt from the new rules, according to the CBE. All other forms of trade by these companies will require L/Cs.

BACKGROUND- The CBE had previously announced exemptions for temporary imports and imports for re-export, imports by foreign companies, those made via express shipment, imports of goods worth up to USD 5k, and a raft of commodity and pharma imports.

ENERGY

Israel is now sending us natural gas through Jordan

Israel has begun exporting additional natural gas to Egypt through a pipeline traversing Jordan, Israeli energy company NewMed Energy — formerly Delek Drilling — announced in a statement (pdf) to the Tel Aviv bourse and securities regulator. Chevron and NewMed, which operate Israel’s two biggest offshore reservoirs — the Tamar and Leviathan gas fields — are expected to export 2.5-3 bn cubic meters (bcm) of gas this year, the Israeli energy ministry said last month following an agreement announced by Israeli Energy and Water Minister Karine Elharrar. This could increase to 4 bcm in subsequent years, the ministry said.

This marks the first time Israel exports natural gas to Egypt via the Arab Gas Pipeline, which has been renovated in recent months as part of a plan to export natural gas from Egypt to crisis-stricken Lebanon via Jordan and Syria.

Israel currently ships gas to Egypt via the Eastern Mediterranean Gas (EMG) pipeline that runs between Ashkelon and Arish, which has an approximate annual capacity of 7 bcm.

All part of our east-Med energy hub ambitions: The Oil Ministry has been looking to increase the amount of gas it imports from Israel for re-export to Europe, which is in search of alternative suppliers to decrease its reliance on Russian gas. Late last year, the Madbouly government signed agreements with Greece and Israel laying the groundwork to up import and re-export volumes. That said, it’s not clear whether Egypt or the EU have the capacity to up their gas trade: Oil Minister Tarek El Molla said in December that Egypt’s Idku and Damietta LNG terminals are both running at full capacity while Europe doesn’t have catapacity at import terminals needed to significantly increase LNG imports.

Background: We first started importing gas from Israel in 2020 under a landmark USD 15 bn contract signed in 2018 that saw Egyptian firm Dolphinus agree to purchase 64 bcm over a 10-year period. In 2019, the two sides agreed to increase the supply to 85.3 bn bcm over 15 years.

IN OTHER ENERGY NEWS-

More Egyptian-Greek energy cooperation: President Abdel Fattah El Sisi held virtual talks with Greek Prime Minister Kyriakos Mitsotakis on Thursday to talk about electricity and gas interconnection projects, according to a presidential statement. The two countries are considering establishing a new subsea gas pipeline that would allow Egypt to export gas directly to Europe. Egypt and Greece are also working on the EuroAfrica connector, which will enable Cairo to ship surplus electricity across the Mediterranean via Cyprus,

STARTUP WATCH

Egyptian app Elves partners with travel group Der Touristic Eastern Europe

(xxDA) Travel app Elves will be getting a slew of new users as part of a new partnership with major travel operator Der Touristik Eastern Europe, the companies announced yesterday in a statement (pdf). The two companies will cooperate together and direct up to 200k tourists visiting Egypt to use Elves, as well as help the homegrown app tap into new, international destinations including Greece, Spain, Mexico, and Africa, said Elves CEO Karim El Sahy.

About Elves: After launching as a general digital concierge service, last year the AI-powered app repositioned itself in the tourism sector and now provides a range of services targeted at travelers, such as hotel and flight bookings, restaurants reservations, and covid travel advice.

Learn more about how Elves has been focusing on expanding its machine learning capabilities from our podcast, Making It, where we interviewed co-founders Karim El Sahy and his business partner (and wife) Abeer El Sisi. You can listen to the episode here.

MOVES

Vodafone Egypt has appointed Mahmoud El Khateeb (LinkedIn) as its director of enterprise business, Hapi Journal reports. El Khateeb previously held positions at IBM and Microsoft focusing on data, AI, and cloud computing.

LAST NIGHT’S TALK SHOWS

Leading the conversation on the airwaves last night was the government’s efforts to repatriate Egyptians fleeing the conflict in Ukraine. We have more information in this morning’s War Watch wrap-up, above.

Fuel fury: Oil Ministry spokesman Hamdi Abdel Aziz denied allegations that “poor quality-petrol” sold in Egypt has resulted in “vehicle technical problems” in a phone-in with El Hekaya’s Amr Adib (watch, runtime 9:12). The European Automobile Manufacturers' Association (ACEA) said that several hundred cars broke down in Egypt in 2021 due to inferior fuel quality and that traces of manganese were detected in the fuel in Cairo and Suez, which Abdel Aziz unequivocally denied. “Egyptian petrol conforms to standard specifications,” and “it is free of manganese,” he said. Kelma Akheera (watch, runtime 12:41) and Al Hayah Al Youm (watch, runtime 6:06) also had coverage.

Also on the airwaves last night:

- Economist Mahmoud Mohieldin talked about the implications of the Ukraine war and how Egypt is preparing for COP27 in Sharm El Sheikh in a phone-in with Masaa DMC (watch, runtime 42:53 )

- Blame Russia sanctions for rising cement prices: Ahmed Sherine, a reported expert on the cement industry, explained to El Hekaya that cement is getting pricier due to the rising global price of coal — which is used in the production of cement and which Russia is a major exporter of — in a phone-in with El Hekaya (watch, runtime 6:53)

- Unsubsidized bread is getting more expensive due to sellers pushing up flour prices on the back of the Russia-Ukraine conflict, head of the bakeries division at the Cairo Chamber of Commerce Attia Hamad told Ala Mas’ouleety (watch, runtime 10:15)

ALSO ON OUR RADAR

EBRD, Green Growth and Sanad funds all have money for Egypt + more competition in consumer finance

The European Bank for Reconstruction and Development (EBRD) has put pen to paper on its financing of the Alexandria metro project, which will see it provide the Transport Ministry with EUR 250 mn to transform the Abu Qir railway into an electrified metro line. Al Borsa reports that the EBRD and the ministry signed the agreement yesterday during the launch event for the lender’s new 2022-2027 Egypt strategy, which will continue to see it support economic growth and its transition towards a greener economy.

That’s not all: The EBRD will assess Egypt’s potential to build a hydrogen industry, as well as support skills in the local tourism industry, after signing separate MOUs with the oil and tourism ministries, the newspaper reported.

Banque Misr has received USD 75 mn from the Green for Growth Fund (GGF) and Sanad Fund for on-lending to green projects as well as micro-, small- and medium-sized enterprises, according to a press release (pdf). Some USD 40 mn of the funding is from GGF and USD 35 mn from Sanad. Both funds are backed by German development bank KfW, among others.

This is the GGF’s second green lending agreement in Egypt in a month: State-owned Banque du Caire last month snagged USD 30 mn from the GGF for on-lending to green projects. The loan marked the GGF’s first tier-two investment in Egypt, after it received a license from the Central Bank of Egypt (CBE) in January to provide funds to local banks for on-lending.

*** MORE COMPETITION IN CONSUMER FINANCE: The National Investment Bank has established an EGP 100 mn consumer financing arm — the Egyptian Company for Consumer Finance Services — for its subsidiary Ayady Investment and Development, which plans to release its first product in 3Q2022, Ayady announced in a press release (pdf).

MEANWHILE: EFG Hermes’ fintech platform valU is targeting 750k customers and EGP 5 bn in sales this year, while Egypt Post is set to launch e-payment services via its mobile app.

PLANET FINANCE

US stocks continued to slip on Friday on the back of the war, with the tech-heavy Nasdaq falling 1.7% and the S&P 500 slipping 0.8% in volatile trading, the Financial Times reports. Investors flocked from equities to safe haven assets including gold and government bonds.

|

|

EGX30 |

11,306 |

+1.0% (YTD: -5.4%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

12,756 |

+0.8% (YTD: +13.1%) |

|

|

ADX |

9,683 |

-0.6% (YTD: +14.1%) |

|

|

DFM |

3,449 |

-0.9% (YTD: +7.9%) |

|

|

S&P 500 |

4,329 |

-0.8% (YTD: -9.2%) |

|

|

FTSE 100 |

6,987 |

-3.5% (YTD: -5.4%) |

|

|

Brent crude |

USD 118.11 |

+6.9% |

|

|

Natural gas (Nymex) |

USD 5.02 |

+6.2% |

|

|

Gold |

USD 1,967 |

+1.6% |

|

|

BTC |

USD 39,295 |

+0.5% (as of midnight) |

THE CLOSING BELL-

The EGX30 rose 1.0% at Thursday’s close on turnover of EGP 865 mn (13% below the 90-day average). Foreign investors were net sellers. The index is down 5.4% YTD.

In the green: AMOC (+6.0%), Sidi Kerir Petrochem (+5.0%) and Ezz Steel (+4.7%).

In the red: Oriental Weavers (-1.2%), TMG Holding (-1.1%) and Fawry (-1.0%).

CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

24 February-7 March (Thursday-Monday): Diarna Handicrafts Fair. Cairo Festival City, Cairo.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will

replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

20 March (Sunday): Applications close for Visa’s global startup competition, the Visa Everywhere Initiative.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.