- Somabay’s Ibrahim El Missiri on how tourism can unlock FX “like flicking a light switch.” (CEO Poll on FDI + Exports)

- The central bank is mulling ways to bring in more FX to the country. (Economy)

- Egypt’s economy grew 4.4% y-o-y in 1Q FY 2022-2023. (Economy)

- One week and counting until the Enterprise Climate X Forum. (What We’re Tracking Today)

- BP snags two new exploration blocks in the Mediterranean. (Energy)

- Passenger vehicle sales hit a fresh low in October. (Automotive)

- Could Cairo and Turkey restart diplomatic relations within months? (Watch This Space)

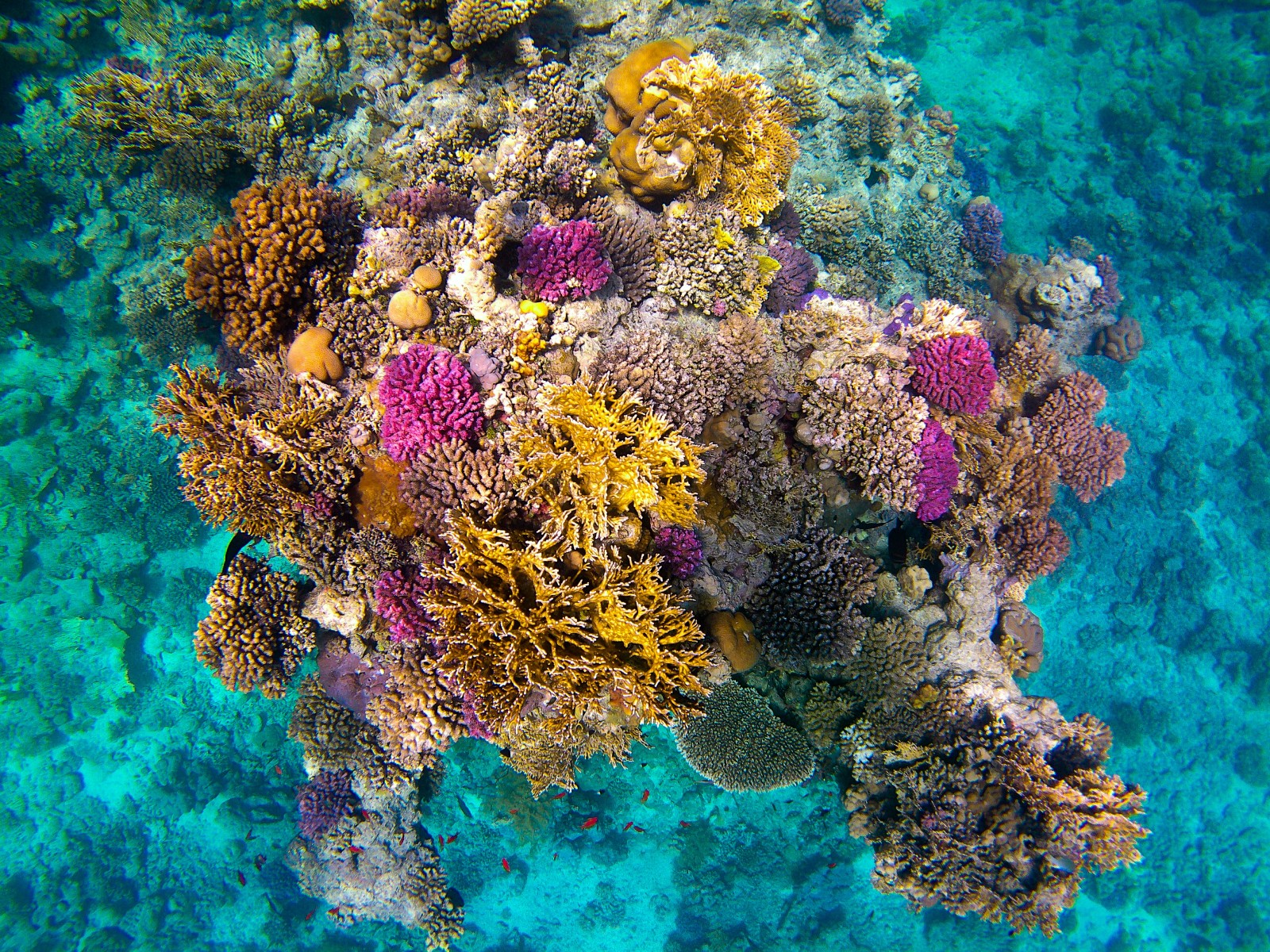

- Coral farming could help repair damage to Red Sea reefs. (Going Green)

- The UAE’s Adnoc will invest USD 150 bn to grow its gas, chemicals, and green energy business + Investors want their driverless cars, stat. (Planet Finance)

Tuesday, 29 November 2022

AM — It’s a macro-heavy kind of morning

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and happy hump day. One week from today — right about now — a bunch of us will be heading toward the Grand Egyptian Museum to get ready to meet many of you at the Enterprise Climate X Forum. It’s our first-ever large-scale event, with more than 200 C-suite execs, bankers, investors, DFI folks and more set to join us to talk through what we think is the world’s largest and most exciting industry.

More on that below…

MEANWHILE: It’s another macro-heavy kind of day here at home. Topping headlines: The central bank is reportedly looking at ways to shore up our FX liquidity. That can’t come too soon for the auto industry, which saw sales fall once again in October on the back of import jams. The one ray of sunshine: The economy grew 4.4% in the first quarter of the state’s current fiscal year. That has prompted the Planning Ministry to revise its full-year forecast to 5.0% (down by 0.5 percentage points), but still a ray of sunshine compared to what many emerging markets are facing right now.

WATCH THIS SPACE- Turkey could appoint an ambassador to Egypt within months, Turkish Foreign Minister Mevlut Cavusoglu told reporters in statements picked up by Reuters. Cavusoglu’s statements came one day after Turkish President Recep Tayyip Erdogan hinted at the possibility of meeting with President Abdel Fattah El Sisi again as Cairo and Ankara work on restoring ties after nearly a decade of hostility. El Sisi and Erdogan’s first, informal meeting on the sidelines of the World Cup in Qatar last week triggered a “flurry” of negotiations over the weekend between Egyptian and Turkish intelligence officials, Reuters reports, as the two countries appear to accelerate moves to mend a decade-long rift.

HAPPENING TODAY-

Is today the day the Senate signs off on the wildcat building bill? Senate Speaker Abdel Wahab Abdel Razek postponed for a second day the Senate’s final vote on legislation aimed at making it easier for owners of illegal buildings to go legit. The bill should now pass in a special session being held today.

The House Manpower Committee will continue hearings on the new draft Labor Act for a second day today, with representatives from the Federation of Egyptian Industries (FEI) and the Egyptian Trade Union Federation expected to attend. The bill, which was approved by the Senate in February, extends both maternity leave and notice periods, caps working hours, and changes minimum raise increments, among other things. We have more on the bill’s finer points here.

NO LONGER HAPPENING TODAY-

Russia has postponed weeklong nuclear talks with the US that were set to kick off in Cairo today, Reuters reports, citing a statement by the US State Department. “The Russian side informed the United States that Russia has unilaterally postponed the meeting and stated that it would propose new dates,” the US said. The Russian Foreign Ministry confirmed to Reuters the postponement of the talks, which had aimed to discuss resuming mutual nuclear inspections between Washington and Moscow.

WORLD CUP UPDATE-

It’s day 10 of the World Cup: Teams in Group A and B face off today (all times CLT):

- Ecuador v Senegal (5pm)

- Netherlands v Qatar (5pm)

- Iran v USA (9pm)

- Wales v England (9pm)

There were lots of goals yesterday:

- Cameroon made a thrilling comeback against Serbia to tie 3-3.

- Ghana v South Korea was another nail-biter, with the African side netting a final goal for a 3-2 victory, after South Korea scored twice within three minutes in the second half to level the game.

- Brazil secured its spot in the knockout stage, beating Switzerland 1-0 after Casemiro fired a stunning 83rd minute goal.

- Portugal was the third team to reach the knockout stage after France and Brazil, defeating Uruguay 2-0. That game was interrupted when a protester carrying a rainbow flag and wearing a shirt that read “Respect For Iranian Women” ran onto the pitch, Reuters reports.

MORNING MUST READ-

We’re on our way to a greener aviation industry: Rolls Royce and easyJet successfully used green hydrogen instead of traditional jet fuel to power an aircraft engine, the carmaker said in a statement. Traditional jet fuel emits 3.16 kg of carbon per kg of fuel consumed, but the statement does not provide figures for the emissions from using green hydrogen. The companies are planning on carrying out further tests to prove that hydrogen is a safe alternative to jet fuel.

THE HOMETOWN ANGLE- Egypt is working to position itself as a regional hub for green hydrogen, having signed framework agreements for nine green hydrogen and ammonia facilities in the Suez Canal Economic Zone worth a combined USD 83 bn during COP27.

SOUND SMART- Pundits believe that shipping could be one of the first hard-to-decarbonize industries that could really adopt hydrogen, providing a unique in for the SCZone and Egyptian producers.

|

DATA POINT- Our LNG exports are expected to rise 14% y-o-y by the end of the year to 8 mn tons, 90% of which has been directed to Europe to meet growing demand as Egypt looks to replace Russian supply, Oil Minister Tarek El Molla said, according to the State Information Service. The government is aiming to export USD 1 bn-worth of LNG per month by January as it looks to capitalize on the European energy crunch and position the country as a regional energy powerhouse.

DATA POINT #2- The government secured some USD 10.3 bn worth of climate funding agreements for its flagship Nexus on Water, Food and Energy (NWFE) program at COP27, International Cooperation Minister Rania Al Mashat told President Abdel Fattah El Sisi yesterday, according to an Ittihadiya statement. Al Mashat had previously estimated the sum at around USD 10 bn. The NWFE program seeks to implement some USD 15 bn worth of projects to turbocharge the country’s green transition, including an energy project worth USD 10 bn and eight food security, agriculture, and irrigation and water projects.

MARKET WATCH-

More on how the week ahead could mark a turning point for oil markets: The world is gearing up for a planned price cap on Russian crude and a defining OPEC+ meeting next Monday, but the jury’s out on how these fundamental shifts in the way the market operates will impact global oil prices and supply, the Financial Times writes in its Big Read. As uncertainty abounds on whether or not the EU will move to completely ban imports of Russian crude, analysts speculate that markets will be in for significant supply tightening come spring, once it becomes clear that Europe is serious about an embargo on Russian oil.

How Russia will react to Western sanctions is also uncertain thus far, with some expecting it to stop at nothing to fight back against Western countries supporting a price cap or embargo. Nevertheless, analysts at Bernstein expect supply to fall and prices to hit USD 120 a barrel next year, even amid a recession. Oil trader Vitol sees Russian exports dropping by as much as 1 mn barrels a day. “We don’t know how this market is going to function after a certain date. The adjustment will be dramatic… it’s going to be confrontational and it’s going to be volatile,” says one oil analyst at S&P Global Commodity Insights.

** CORRECTIONS- In a story last week, we concluded that the Madbouly cabinet was not rushing to restart the state privatization program. In point of fact, the statement from Cabinet Spokesperson Nader Saad at the time had said only that ministers were closely monitoring economic and market conditions globally and locally. The statement did not mention a delay in the program. The story has since been corrected on our website and we extend our apologies to Amb. Saad.

In yesterday’s issue we inaccurately quoted a statement from the cabinet on Prime Minister Moustafa Madbouly’s meeting with CBE Governor Hassan Abdullah earlier this week, where the two discussed facilitating FX for imports of strategic and critical goods. They did not suggest that there had been a slowdown in the pace of clearing imports from customs. We have corrected the story on our website.

THE BIG STORY ABROAD-

The international press is still keeping a close eye on China after demonstrations broke out across the country against the country’s strict covid restrictions over the weekend. China analysts are telling Reuters and the AP how they expect President Xi Jinping could respond to the unprecedented civil disobedience. The Financial Times focuses on the impact of the protests on global financial markets (global equities and crude prices dropped, while the USD got yet another boost.)

Meanwhile, Apple’s shares closed down 1.4% yesterday as ongoing unrest at the world’s biggest iPhone factory in China fuels supply worries, Reuters reports.

Mohamed Mansour, co-founder and CEO of Infinity is joining us for the Enterprise Climate X Forum, taking place at the Grand Egyptian Museum. Are you? We’re proud to announce that our friend Mohamed Mansour is going to be speaking at the forum on why he thinks climate is the biggest business and investment opportunity of our generation. He is joined on stage for that discussion by Amr Allam, co-CEO of Hassan Allam Holding (Amr and Mohamed are working on a ton of projects together) and Sherif El Kholy, partner and head of MENA at Actis (a longtime investor in climate themes).

They’re not the only ones: Among the top execs, bankers, and development finance folks speaking at the conference are: Todd Wilcox, CEO and deputy chairman of HSBC Egypt; Tarek El Nahas, group head of international banking, Mashreq; Khaled Hamza, director and head of Egypt at European Bank for Reconstruction and Development (EBRD); Simon Kitchen, head of strategy at EFG Hermes Research; Nader Abushadi, group treasurer at Dar Group; Karim Hussein, managing partner at Algebra Ventures; Aly El Tayeb, CEO and co-founder of ShiftEV; Jorgo Chatzimarkakis, CEO of Hydrogen Europe; and Leslie Reed, Mission director for Egypt, USAID.

Topics and live interviews will include:

- What is green hydrogen, why is it important, and what signs will tell us that USD 85 bn in framework agreements are real?

- How CEOs across global emerging markets are dealing with climate change.

- What’s the difference between sustainability-linked and climate finance? How much do CEOs need to know about their supply chain?

- Meet the startup and VC in line to be Egypt’s first climate bn’aires.

For the full agenda please click here.

** Have you confirmed your attendance? We’ll be sending you on Sunday, 4 December the QR code you’ll need to gain admission to the Grand Egyptian Museum, along with a Google Maps link and some other pointers.

CIRCLE YOUR CALENDAR-

Payment and fintech conference Pafix is being held as part of Cairo ICT 2022 through Wednesday at the Egypt International Exhibition Centre in New Cairo. The conference kicked off yesterday.

EGX-listed Pachin will brief shareholders on acquisition offers it has received in its ordinary general assembly on Tuesday, 20 December, according to an EGX disclosure (pdf). Dubai-based National Paints Holdings is offering to purchase 100% of Pachin for EGP 29 per share — far outbidding earlier offers from Universal Building Materials and Chemicals (Sipes) and Saybad Industrial Investment that have since been withdrawn.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: We ask if pioneering coral farming techniques could help repair damage to our Red Sea reefs, which are vital for biodiversity and tourism.

Enjoy renting with home comfort, privacy, exclusive privileges, and tailor-made packages for an unforgettable guest experience. A signature collection of handpicked serviced villas, chalets, apartments, and studios to transform your vacation into an exceptional experience, and to discover the magic of Somabay in luxury bliss. For booking inquiries, contact us by phone at +20155 600 5693, by email at info@stayr.somabay.com, or through our website holidays.somabay.com

CEO POLL

Somabay’s Ibrahim El Messiri on how a tourism push could draw immediate FX

We recently had breakfast with 20 top CEOs to talk about why exports and FDI are key to our economy going forward. After reading our five-step recipe for turning Egypt into a global export hub and FDI magnet, participating CEOs agreed to answer two questions on the record for our latest CEO Poll.

We have already heard from:

- GSK’s Mohamed El Dababy, who says the starting point is tourism;

- McKinsey’s Jalil Bensouda, who points to business process outsourcing and customer relationship management.

Today, we hear from Ibrahim El Missiri (LinkedIn), CEO of Somabay, the high-profile Red Sea coast destination whose hotels, short-term rentals, and homes attract visitors and investors from all over the world. Ibrahim has previously been a guest on our podcast (The Enterprise Show) and has appeared in our My Morning Routine column. Excerpts from our discussion:

ENTERPRISE- Which industry would you put on a focused short list — and why?

IM- I would love for tourism and aviation to be the focus for Egypt, as it was in the past. They’re the two industries that can bring foreign currency into the country tomorrow — it’s like flicking a light switch. You don't need to build factories or develop farms. You’ve got a significant inventory of hotel rooms that need to be filled. And the demand is there — it’s just a matter of connecting the demand and the supply. We don't have feasibility study requirements, because the hotels have been built and the customers are there.

Tourism can bring in USD 30-40 bn a year — it’s a quick, immediate fix. Look at what happened with COP27: There was appetite. Sharm had capacity. So just by increasing the number of flights, you managed to get c. 75k people to the destination. The problem is that we had to slow the pipeline to other destinations, because we just don’t have enough flights.

You can’t really come to Egypt by car, train or ship — Egypt's problem is the lift. It’s easier to get to the Maldives or Seychelles in the Indian Ocean than it is to come to Egypt. It's not even an infrastructure problem: The airports are there and they have the capacity. You just don't have the “flying buses” to carry people. Solve this problem, and Egypt will be flush with FX, in my view.

Now imagine if we focus on increasing the spend per guest. The USD you get per tourist or per landing is not low because tourists don't want to spend. They don’t spend because we need to improve our offering. Our airports need improvement. Our airport shopping experience, our transport experience, all of it — it pales in comparison to Heathrow or Dubai. Anywhere else, tourists spend USD 100-200 before they even get to the hotel. Not here — even though we have the products, from traditional clothing to replica artifacts.

E: Why are exports and FDI the way forward?

IM- For the past 100 years or more, we have been getting FX from the same three sources: tourism, the Suez Canal, and remittances. In other words, Egyptians living in Egypt don’t really make a contribution when it comes to bringing in FX. We consume everything we produce. So we need to start producing to export. We need to empower businesses to export, and that demands legislative and regulatory stability.

Laws change too frequently, which is a problem for investors — it makes it difficult to put a business plan together with certainty about how much it's going to cost.

ECONOMY

Plenty of options on the table

CBE looks at proposals to help shore up FX liquidity: The Central Bank of Egypt (CBE) is mulling a handful of options as part of its strategy to increase FX liquidity, after CBE Governor Hassan Abdalla met with the heads of the nation’s banks on Sunday, Bloomberg Asharq reports, citing sources it says attended the meeting.

The options reportedly on the table include:

- Offering service and funding incentives in exchange for tourism operators and hotels depositing their FX in local banks;

- Launching USD-denominated savings schemes for Egyptian expats;

- Easing banks’ regulatory requirements (including KYC regulations) for customers making USD deposits;

- Mulling the use of USD derivatives.

This week has seen extensive discussion on how to bring in more FX: Abdalla’s meeting with the country’s banking bigwigs appears to have coincided with discussion in the Senate of a report by the pro-government Mostaqbal Watan party that aims to overhaul how we approach foreign direct investment (FDI), with the ultimate goal of ramping up our USD inflows. Abdalla also met with Prime Minister Moustafa Madbouly on Sunday, where the pair stressed that they’re working to boost foreign reserves by drumming up FX, including by attracting more FDI, boosting tourism, and through the expat car import scheme.

ICYMI- Through December, we’re publishing a series of conversations with top CEOs on our five-step recipe to boost FDI and exports. Catch our discussion with Somabay’s Ibrahim El Missiri in today’s issue, above.

ALSO FROM THE MEETING-

More time for banks to ramp up MSME loan portfolios: Banks will reportedly get a one-year grace period to comply with a previous CBE directive to increase micro, small, and medium enterprises’ share of their loan portfolios to 25%, up from 20% previously, Masrawy reports, citing sources who attended the meeting. The deadline is now set for December 2023, the sources say.

ECONOMY

Economy grew 4.4% y-o-y in the first quarter of 2022 despite global headwinds

Egypt’s economy grew 4.4% y-o-y in 1Q FY 2022-2023, according to preliminary data from the Planning Ministry. GDP growth in the first quarter of the state’s current fiscal year (which starts in July) came despite continued global headwinds thanks to the pandemic, the war in Ukraine, and climate change, Planning Minister Hala El Said said yesterday in a meeting with Prime Minister Moustafa Madbouly.

AND- Gov’t revises growth estimates for the full fiscal year: The Planning Ministry is now expecting our economy to grow by around 5.0% in FY 2022-2023, El Said said in a separate meeting yesterday with President Abdel Fattah El Sisi and Madbouly, according to an Ittihadiya statement. The draft budget for this fiscal year had penciled in growth of 5.5%.

The government’s 5.0% estimate is more optimistic than forecasts from some international institutions because it reflects the “resilience” our economy has shown “as a result of the growth and activity generated by public investment,” El Said is quoted as saying. Last quarter’s 4.4% growth is in line with the International Monetary Fund’s most recent estimate for Egypt for the full fiscal year, while the World Bank in October predicted our economy to grow 4.8% in FY 2022-2023.

Balancing growth + inflation is key: Madbouly and El Said discussed measures meant to achieve a balance between maintaining high growth and containing inflation. They also discussed how to protect jobs and reduce the country’s external debt burden. Urban inflation hit its highest level in four years in October, coming in at 16.2% on the back of surging food prices, while the external debt-to-GDP ratio stands at around 34.6%.

ENERGY

BP gets two new Mediterranean gas blocks

BP has been awarded gas exploration rights in two offshore blocks in the Mediterranean Sea, the company said in a statement (pdf). The oil and gas giant has now been awarded four blocks so far this year, along with a block extension, “which offer the potential for gas discoveries that could be developed using existing infrastructure,” said BP Regional President Karim Alaa.

The details: The first block is in the Northwest Abu Qir concession, where BP is the operator with an 82.75% stake in the block, while Germany’s Wintershall Dea holds the remaining 17.25%. The second block is in the Bellatrix-Seti East concession, in which BP and Italian oil and gas giant Eni each hold 50%. Eni is the operator.

More exploration tenders coming: Egypt plans to hold new global tenders for oil and gas exploration before the end of the year, covering concessions in the Mediterranean, the Western Desert, and the Eastern Desert, Oil Minister Tarek El Molla said earlier this month.

AUTOMOTIVE

Egypt car sales down again in October

Auto sales down yet again: Monthly auto sales fell in October as the industry faces continued import difficulties. Less than 6.1k passenger vehicles were sold last month, down 69% from the same month last year, according to figures released by the Automotive Information Council (AMIC), an industry group.

Passenger vehicle sales hit a 4.5 year low for a second consecutive month — excluding April 2020, when sales slumped amid the outbreak of the pandemic. We’ve tracked AMIC sales data going back to the start of 2018.

Buses and trucks were no exception: Around 1.4k buses were sold during the month, down 43% from October last year. Truck sales were down 63% to 1.5k units. Total vehicle sales dropped 65% y-o-y to 9k in October. AMIC figures reflect data contributed by member distributors, who include most (but not all) industry participants.

It’s been an annus horribilis for the auto industry — but there may be light at the end of the tunnel: The central bank is in the process of rolling back import restrictions it introduced in February to preserve foreign currency. The new rules made it almost impossible for distributors to bring fully built up vehicles, assembly kits, and spare parts into the country and forced a number of global car manufacturers to suspend sales to Egypt. The restrictions could be fully lifted by the end of the year — but it will likely take longer to solve an FX shortage that is reportedly slowing the release of goods at ports — and to repair the severed links in our auto supply chain.

In other words: Don’t expect showrooms to be significantly restocked until closer to mid-year 2023 by the time local assemblers place and receive kit orders and importers of fully built-up units are able to place, pay for and receive goods.

EGYPT IN THE NEWS

No single story is driving the conversation on Egypt in the international press this morning:

- Investors and analysts are expecting the EGP to weaken a bit more against the greenback, possibly before the IMF executive board approves a funding package in December, Bloomberg reports.

- Reuters is out with a story on the Egyptian Mercantile Exchange (EMX) going live this week, providing a direct channel for the sale and purchase of commodities including wheat.

LAST NIGHT’S TALK SHOWS

Last Night’s Talk Shows: Port snarls could be resolved by end of December?

It was another slow-ish night on talk shows yesterday, with the talking heads focusing on efforts by the government to release shipments piled up at ports.

Goods worth some USD 6 bn are currently stuck at ports amid a shortage of FX needed to get them released, Alaa Ezz, secretary-general of the Federation of Egyptian Chambers of Commerce (FEDCOC), told Kelma Akhira (watch, runtime: 11:12).

On the bright side: Banks have issued some 25k letters of credit (L/Cs) worth USD 4.5 bn since October’s float, helping to ease the backlog and keep new shipments moving through ports, Ezz said. He expects all backlogged shipments to be released from ports by the end of December, when the CBE plans to have lifted import restrictions including the requirement to issue L/Cs, adding that prices should then “begin to stabilize.”

MEANWHILE- No changes to this year’s Thanaweya Amma exams: Changes introduced last year to move secondary school leaving exams to an “open book” system will stay in place this year, Education Minister Reda Hegazy said at a presser yesterday, according to a ministry statement. Hegazy had previously suggested the system — which led to lower pass rates last year — could see more reforms. Essay questions make up 15% of exam questions under the system, with the rest multiple choice. Education Ministry Spokesman Shady Zalata discussed the details with Al Hayah Al Youm (watch, runtime: 8:37). Masa’a DMC also had coverage. (watch, runtime: 1:36).

ALSO ON OUR RADAR

Among the other stories we’re paying attention to this morning:

ECONOMY-

Employees will pay more towards social ins. starting in January: The subscription wage used to calculate national ins. contributions for public and private sector workers will be raised to a minimum of EGP 1.7k and a maximum of EGP 10.9k as of 1 January 2023, up between 10-20% from last year, according to a statement from the National Social Ins. Authority. The hike comes in line with a plan laid out in the 2019 Pension Act to gradually increase national ins. contributions.

Pensioners will also get a bit more in their pockets each month, the statement said. Payouts to retirees and other beneficiaries will rise on 1 January to a minimum of EGP 1.1k and a maximum of EGP 8.7k.

CONSUMER FINANCE-

Cairo-based e-payments firm Damen plans to establish an investment arm focused on consumer finance and microfinance during Q2 2023, with funding from private equity player Aur Capital, CEO Tamer El Hussainy told Al Mal.

COMMODITIES-

New state silos company: The Egyptian Holding Company For Silos and Storage and the Agricultural Bank of Egypt are setting up a new company for silos and warehouses named Ard Misr (Egypt’s Land), according to a Supply Ministry statement.

GREEN ECONOMY-

Honeywell and Intro Group subsidiary Environ Adapt could set up a chemical plastic recycling facility. Enterprise Climate has the story.

ELECTRONICS-

IT infrastructure contractor Benya Group will sign by mid-December final agreements with Saudi’s Al Fanar to establish a tech-focused JV in the Gulf country, Chairman Ahmed Mekky told Bloomberg Asharq in an interview (watch, runtime: 1:22).

PLANET FINANCE

Adnoc is spending big: The UAE’s Abu Dhabi National Oil Company (Adnoc) will invest USD 150 bn under a five-year business plan that will see it up hydrocarbon production and sell a minority stake in its gas and LNG operations, as well as work toward net-zero emissions by 2050, the company said in a statement. The plan will see Adnoc combine its LNG and gas-processing arms into a single entity, Adnoc Gas, that it plans to list in an IPO on the ADX next year. Adnoc is looking to expand its gas, LNG, chemicals, and clean energy business, and will bring forward by three years an earlier target to up its crude oil production capacity to 5 mn barrels a day by 2030.

Is it now or never for driverless cars? Investors are growing impatient with the seemingly endless wait for self-driving technology, which appears to be gaining a reputation as a bottomless pit for their investments, the Wall Street Journal reports. TCI Fund Management has recently called into question Alphabet’s self-driving unit Waymo, writing in a letter to execs that the unit has “not justified its excessive investments.” Waymo has been working on driverless cars for over a decade now.

Some have already given up: Last month, Ford and Volkswagen decided to call it quits on their joint autonomous-driving venture, Argo, as it reportedly struggled to bring in fresh investment.

ALSO-

- Saudi’s sovereign wealth fund (PIF) is considering setting up one of the world’s largest airports and a new airline as part of the kingdom’s USD 1 tn plan to create a tourism industry beyond the Hajj and Umrah pilgrimages. (Bloomberg)

- Facebook parent Meta has been slammed with an EUR 265 mn fine by Irish authorities over the mishandling of users’ personal data. (Statement)

- Crypto lender BlockFi filed for bankruptcy yesterday, becoming the latest in the crypto world to go belly up in the wake of FTX’s collapse. (Statement)

|

|

EGX30 |

12,917 |

-0.7% (YTD: +8.1%) |

|

|

USD (CBE) |

Buy 24.54 |

Sell 24.62 |

|

|

USD at CIB |

Buy 24.54 |

Sell 24.60 |

|

|

Interest rates CBE |

13.25% deposit |

14.25% lending |

|

|

Tadawul |

10,747 |

-0.5% (YTD: -4.7%) |

|

|

ADX |

10,406 |

-1.2% (YTD: +22.6%) |

|

|

DFM |

3,287 |

-0.5% (YTD: +2.9%) |

|

|

S&P 500 |

3,964 |

-1.5% (YTD: -16.8%) |

|

|

FTSE 100 |

7,474 |

-0.2% (YTD: +1.2%) |

|

|

Euro Stoxx 50 |

3,936 |

-0.7% (YTD: -8.4%) |

|

|

Brent crude |

USD 83.19 |

-0.5% |

|

|

Natural gas (Nymex) |

USD 6.79 |

-3.4% |

|

|

Gold |

USD 1,755.50 |

0.0% |

|

|

BTC |

USD 16,196 |

-1.5% (YTD: -64.9%) |

THE CLOSING BELL-

The EGX30 fell 0.7% at yesterday’s close on turnover of EGP 1.94 bn (36% above the 90-day average). Local investors were net buyers. The index is up 8.1% YTD.

In the green: Qalaa Holdings (+2.2%), Abu Qir Fertilizers (+1.3%) and Alexandria Containers and Cargo Handling (+1.3%).

In the red: Talaat Moustafa Group (-3.4%), Heliopolis Housing (-2.6%) and Juhayna (-2.3%).

There’s plenty of volatility in global markets this morning as Asian shares whipsawed out of the red despite ongoing unrest in China. The main Shanghai and Hong Kong indexes were both very comfortably in the green this morning at dispatch time, clawing back losses yesterday. Futures suggest a mixed open later today for European and North American markets.

Could coral farming become part of the defense against climate change for marine ecosystems in the Red Sea? As we reported back in March, the c. 400 sq km of coral reefs that line the country’s eastern coast are coming under increasing threat from the relentless forces of climate change, unregulated coastal development, tourist activity, and overfishing. Research suggests that Red Sea coral reefs are resilient to warming waters — but not immune. A form of marine agriculture known as coral farming has shown some promise in rehabilitating devastated coral reefs elsewhere around the world. Could it work here?

Egypt is one of the last remaining safe havens for coral: “Egyptian coral are among the very few remaining colonies that have remained in mostly good health,” Dr. Mahmoud Hanafy, Professor of Marine Environment at Suez Canal University and advisor to the Red Sea governorate and the Hurghada Environmental Protection and Conservation Agency (HEPCA), told Enterprise. Coral populations in Egyptian waters are uniquely capable of withstanding higher temperatures, while strong currents in the Red Sea also help reduce water temperatures, he said.

But it's still important that we take steps to protect our coral: Though coral reef ecosystems in Egypt are healthy compared to other reefs around the world, certain areas have sustained significant damage over the years through commercial development and unfettered tourism — like Hurghada, Hanafy said. Hard coral reef cover declined by 13.6% on average between 2005 and 2019 at the ten most-affected sites off Egypt’s coasts, according to a report by the Global Coral Reef Monitoring Network (GCRMN) (pdf).

Lab-grown coral is one option: New coral can be grown in controlled settings at a much faster rate than it otherwise might do in the seas and oceans. Scientists extract living coral samples and place them in semi-controlled environments, where they can grow unhindered by the pressures present in their natural environments. These lab-grown corals have already been planted in places like the Florida Keys to help kickstart spawning and reproduction, according to a report on Phys.org.

But this method isn’t optimal, according to Hanafy, who says it has a tendency to weaken the coral’s genetic profile, its immunity to disease, and ultimately its lifespan. Scientists have also said the method is difficult to scale, especially because it has to happen on a local level first to avoid mixing breeds from different regions that could be detrimental to the wider ecosystem, the Associated Press reports.

There’s another way of promoting coral growth that seems to hold greater promise. By transferring large quantities of coral larvae and placing them near rocky undersea formations, the coral can often latch on to these structures and continue to grow at a much healthier rate, Hanafy explains.

These methods have already been put to use elsewhere around the world: Australia's cultivation efforts have been the north star for coral farming outfits around the globe, Hanafy tells us. Australian scientists have since 2016 been bringing in new larvae from healthy coral to locations where significant bleaching events have taken place, in a process they call “coral IVF.” Last year, the researchers were for the first time able to witness the “babies” they had brought to damaged parts of the Great Barrier Reef spawn themselves, hopefully creating a fresh generation of coral, Time reports. Adopting this kind of cultivation technique in Egypt would be the best way to move forward, Hanafy says.

Local authorities are starting to look into coral reef cultivation: Coral reef cultivation is “under review” at the Red Sea Natural Protectorates Authority, authority head Dr. Osama Kamal told us. Meanwhile, an internal committee has been put together within the Environment Ministry to work on launching a pilot farming project in the near future, Kamal said.

One pilot is already on its way: Separately, the Egyptian Environmental Affairs Agency, the Academy of Scientific Research and Technology, and Gabrtek have agreed to work on a pilot project to restore coral reefs in the Red Sea, according to a cabinet statement. The coral reef cultivation project sets out to create new coral nurseries in damaged locations. Artificial purple boulders capable of sustaining coral will be installed underwater to house samples, Ahmed Gabr, founder and CEO of Gabrtek, said.

Coral farming can help repair pockets of damage to coral reefs: Farming could help patch up sections of our reef destroyed by boat collisions, according to a report (pdf) on coral farming prepared by a Red Sea governorate scientific committee. Amid several projects by the government to expand the country’s ports, coral farming techniques could also be used to transport large sections of coral-covered reef away from shipping areas to safer locations, the report said.

But it’s not a panacea: In reef locations where significant dredging and industrial dumping has taken place, it’s unlikely that we’ll ever see new coral flourish, the report warns. Certain kinds of pollutants and sediment left behind from construction from decades ago have made it challenging for marine life to return, it says.

USAID’s >EGP 1.2 bn program to reserve the Red Sea coast

A new USAID-backed program is putting a spotlight on preserving the coastal ecosystem on the Red Sea, with the US government contributing USD 15 mn to what it hopes will be a USD 50 mn program to preserve reefs “while promoting high-value, low-environmental impact ecotourism.” USAID’s Red Sea Initiative is looking to raise investment from other donors as well as the private sector to preserve reefs and “establish a blended finance mechanism to support businesses in building resilience against climate change, reducing emissions, and creating jobs.” You can go deeper with the funding announcement or dive into the concept note behind the Red Sea Initiative (pdf). We’re not aware of a larger or more ambitious program designed not just to preserve nature on the Red Sea coast, but to ensure that it remains a magnet for Egyptians and tourists for generations to come.

Your top green economy stories for the week:

- H2 Industries is discussing offtake agreements for its waste-to-hydrogen facility, CEO Michael Stusch reportedly told Zawya.

- The World Bank could provide support for electricity and green hydrogen projects in Egypt, following talks between Electricity Minister Mohamed Shaker and the bank’s country director Marina Wes.

- Three Qatari companies are mulling investing in new and renewable energy production materials in Egypt, Muharram Helal, the chairman of the Egypt-Qatar Business Council, reportedly said.

- The Enterprise guide to the Green Star program: We laid out the details on the government’s recently announced “Green Star” program, which offers a number of incentives to businesses compliant with the new environmental standards.

- Gov’t gets the ball rolling on desalination: Developers interested in bidding for a piece of the Madbouly government’s multi-bn USD water desalination program started handing in pre-qualification files last Thursday and will need to wrap up their submissions this week, two government sources and a top private-sector CEO told us.

CALENDAR

NOVEMBER

20 November-18 December (Sunday-Sunday): 2022 Fifa World Cup, Qatar.

27-30 November (Sunday-Wednesday): Cairo ICT and Pafix, Egypt International Exhibition Center, New Cairo.

DECEMBER

1 December (Thursday): Sphinx International Airport will begin operating international flights.

1 December (Thursday): Contractors to break ground on Egypt-Saudi interconnection project.

2-3 December (Thursday-Saturday): BiznEX kicks off at Mamsha Ahl Misr.

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

4 December (Sunday): House back in session.

4 December (Sunday): OPEC+ meeting.

5-8 December (Monday-Thursday): QS Reimagine Education Awards and Conference, multiple locations.

5-7 December (Monday-Wednesday): Food Africa 2022 kicks off at Egypt International Exhibitions Center.

6 December (Tuesday): Enterprise Climate X Forum, Grand Egyptian Museum.

7 December (Wednesday): Euromoney Egypt 2022 conference

10 December (Saturday): The TriFactory’s Pyramids Half Marathon.

10-12 December (Saturday-Monday): The 2nd edition of the Nebu Expo for Gold and Jewelry kicks off.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

20 December (Tuesday): EGX-listed Pachin will brief shareholders on offers received to acquire the company in an ordinary general assembly.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

December: Chinese President Xi Jinping visit to Saudi Arabia

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): President El Sisi will visit India as “chief guest” at celebrations to mark the 74th anniversary of Indian independence.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

End of December/early January: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q 2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Arabia’s Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.