- Egypt, Sudan draft UN resolution on GERD as Khartoum appeals to UN. (Diplomacy)

- We’ve used 80% of our vaccines sent through Covax + jabs are beginning to run dry in Africa and Asia. (Covid Watch)

- Gov’t likely to leave fuel prices unchanged next month, says former oil minister. (Energy)

- The Suez Canal is offering more price breaks on transit fees. (Suez Canal)

- Folks earning less than EGP 2.4k a month could soon get ration cards. (Welfare)

- Cairo is still one of the world’s more affordable cities for expats. (Life)

- The dean of Georgetown Uni Qatar, Ahmed Dallal, has been named the new AUC president. (Moves)

- What will our real estate market look like by 2025? (Hardhat)

- Planet Finance— Inflation, inflation, inflation.

Wednesday, 23 June 2021

Are you long real estate? Your investment is looking good, Savills says.

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people and welcome to the next-to-last business day of the week. We have a very policy-focused issue for you this morning, as the tl;dr suggests, but don’t despair if your inner Mr. Burns needs to be thrown a bone: We have a long look at the state of the real estate market in this morning’s Hardhat, and the news is good for folks who are homeowners or mulling an investment in real estate.

Also of perennial interest to our readers: Egypt remains one of the most affordable cities in the world for expats, as you’ll read in this morning’s news well.

SIGN OF THE TIMES- Morgan Stanley will not let unvaccinated clients or staff into its New York offices starting in mid-July, writes the Financial Times, which picked up a copy of an internal memo that says the “vast majority” of the bank’s staff have been jabbed.

FROM THE DUMPSTER FIRE that is our Twitter feed:

- So Mohamed or Omar can’t have a Coke in Amreeka? We’re thinking Coca-Cola wasn’t expecting this? But should have? Like, printing names on cans and making them available for purchase is one thing. You control the feedstock. But when you propose letting people write whatever they want, and then constrain them? Good luck.

- Why is Cuba’s covid-19 vaccine named Abdala? Seriously. Also: It’s allegedly 92.28% effective.

It’s nearly mid-year, so how about you get serious about that “New Year’s resolution” you made to get into shape and maybe improve your overall health? It may not help you look better in a swimsuit before you set foot on the beach in Sahel, but it could pay dividends by the end of the season. Not sure where to get started? We heartily recommend Tim Ferriss’ A simple 2021 reboot — My short letter to a friend who wants to get in shape.

Sound smart: The literal “middle of the year” is… 2 July when it’s not a leap year. It’s the first day of the second half of the year in mathematical, if not financial, terms. 182 days before it, and 182 days after.

WHAT’S HAPPENING TODAY-

It’s day two of the CIB PSA World Tour Finals 2020-2021 at Mall of Arabia. Up today: In the men’s draw, world no.1 Ali Farag plays fifth-seed Mohamed El Shorbagy and last year’s victor Marwan El Shorbagy faces Mostafa Asal. In the women’s, world no.1 Nour El Sherbini will play Salma Hany while Nouran Gohar plays France’s Camille Serme. The tournament runs until 27 June. Tickets are currently on sale for the final two days on TicketsMarche.

HAPPENING THIS WEEK-

Microsoft will release its “next generation” of Windows tomorrow. You can expect Windows 11 to come with a new (similar to Windows 10X) and a new app store experience, writes the Verge. The upgrade will likely be available without charge to folks who are on Windows 10 now, the site says.

The IMF’s board will meet Friday to discuss a new USD 650 bn SDR allocation, which will allow it to provide more post-covid relief to emerging and low-income nations and support the global recovery from the pandemic, Bloomberg reported, quoting two unnamed sources familiar with the matter. Having already got backing from both the Biden administration and G7 nations, the proposal to issue new special drawing rights (SDRs) will be reviewed by the 24-member board during a meeting at the weekend, and could be tabled for a final approval by all 190 IMF member countries if there are no objections or requests for changes. IMF chief Kristalina Georgieva expects procedures for the plan’s approval to conclude in mid-August, according to the business information service.

What’s happening with our final IMF tranche? Finance Minister Mohamed Maait suggested a few weeks ago that we could see the USD 1.6 bn tranche paid out at the end of this month, but the IMF’s executive board doesn’t appear to have plans to discuss the disbursement before the beginning of July.

More GERD diplomacy? Intelligence chief Abbas Kamel will be in Washington this week for talks, according to an unconfirmed report out of Washington, DC.

*** CATCH UP QUICK with the top stories from yesterday’s edition of EnterprisePM:

- Your electricity bill is going up on 1 July: Residential electricity bills are going up by as much as 26% at the start of the new fiscal year as the government pushes ahead with its plan to gradually phase out electricity subsidies by 2025.

- Slow vaccine rollout could dent our tourism recovery: A slow vaccine rollout means we could lose out on a second summer tourist season, with travel restrictions from the likes of the US, UK, and EU likely to stay with us until the start of 2022, Capital Economics said in a research note.

- KSA classifies Egypt as “very high risk”: Saudi Arabia’s Public Health Authority is advising residents against travelling to Egypt and 10 other Arab countries in the same classification due to covid-19.

MORNING MUST READS-

Covid-19 is exacerbating wealth inequality across nations: Wealth inequality rose across the board in 2020, with ultra-low interest rates, a boom in the equity markets, and rising house prices making the rich even richer, according to Credit Suisse’s 2021 Global Wealth Report by Credit Suisse Group. The richest 1% in nations including the US, China and India saw their wealth share rise last year, with the world’s 500 richest people adding USD 1.8 tn to their combined net worth, according to the Bloomberg Bn’aires Index.

And that’s a trend that is set to continue on the corporate front, with US companies expected to still pay lower taxes than their foreign peers despite President Joe Biden’s proposal to raise the corporate income tax, according to analysis by Reuters. US companies paid an average tax rate of 16% last year, compared to an average of 24% paid by 200 overseas competitors. If Biden’s planned 28% rate was imposed on the US firms’ same earnings, they would have paid effective rates averaging 21% — below the average rate imposed on their rivals, the analysis showed. US corporations may still end up paying less than competitors, given that the Reuters estimates did not consider tax breaks, and given that Biden's new tax plan would also charge foreign companies with US operations higher income tax.

|

CIRCLE YOUR CALENDAR-

The Clean Energy Business Council (CEBC) MENA are holding a webinar titled Energy Efficiency in the MENA region: Status and Outlook on 6 July at 3:30pm. The session will focus on energy efficiency developments and provide recommendations for businesses and policymakers. Later on next month, CEBC will also host the webinar Women Entrepreneurs in Clean Energy on 21 July at 3pm in cooperation with the initiative, Women in Clean Energy MENA and WiRE.

The British Egyptian Business Association (BEBA) is organizing a virtual education week from 5-6 July with three seminars planned. The first, taking place at 10am on 5 July, will discuss skills-based learning while the future of investment in education will be the topic on the table at 12:30pm the same day. On 6 July, a talk on the digitalization of education in Egypt will be held at 12pm.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, and urban development as well as social infrastructure such as health and education.

In today’s issue: Between office, residential and retail spaces, Egypt’s real estate market has been hit hard by covid. But almost a year has since passed, and plenty appears to have happened to turn the market around, with the real estate outlook for 2025 looking quite rosy. We took a deep-dive into Savills’ report on the real estate sector in Egypt to know what to expect in the coming four years.

DIPLOMACY

Sudan wants the UN Security Council to wade into GERD dispute

Sudanese Foreign Minister Mariam Al-Sadiq has called on the UN Security Council to hold an urgent session to discuss the Grand Ethiopian Renaissance Dam (GERD) impasse, and push for a quick resolution before Ethiopia resumes unilaterally filling the dam next month, Sudanese state news agency SUNA reports. In a letter sent to the council, Al Sadiq also called on the African Union and the international community to support its position on the GERD support, and bolster mediation efforts between the three countries. The minister said Sunday that she has requested that the UN Security Council consider imposing sanctions on Ethiopia over the GERD.

A draft resolution is being drawn up by Cairo and Khartoum to be presented to the nine-member UN Security Council for a vote, the Arab League’s Permanent Observer at the UN Maged Abdel Fattah said in a phone-in to Ala Mas’ouleety (watch, runtime: 17:04). The Arab League will meet at the weekend to put the final touches on the draft resolution ahead of shipping it to the council for deliberation, in hopes that Ethiopia would dial back tensions following the elections this week, Abdel Fattah suggested.

But Sudan doesn’t seem to think Ethiopia is amenable to compromise — it’s irrigation minister likened Sudan’s PM to deposed strongman Omar Bashir: Sudan’s Irrigation Minister Yasir Abbas tells Bloomberg that Ethiopia’s civil war is making it less amenable to accept a compromise over its use of the Nile’s water with Sudan and Egypt. Ethiopian PM Abiy Ahmed and his ruling party are taking a hard line on foreign policy to shore up support domestically, amid the ongoing ethnic conflict in Tigray, he said,

The UN Security Council could adopt a presidential statement on Ethiopia to call on Addis Ababa from proceeding with plans for the dam’s second filling until a three-way agreement is reached, political commentator Mostafa El Fekky told Yahduth fi Misr (watch, runtime: 2:02) last night. While not legally binding, presidential statements are often issued to reflect the consensus of the council on a certain issue in case a resolution cannot be reached for some reason, according to El Fekky.

Egypt and Sudan have both been trying to rally international support against the GERD, with Cairo appealing to the council earlier this month to take action against Ethiopia. An emergency Arab League meeting called by the two countries last week led to Arab states calling on the Security Council to hold an urgent session to discuss the dispute.

As well as countries in the region: In past weeks, Egypt has strengthened military ties with several states, signing defense agreements with Sudan, Kenya, Uganda and Burundi, while President Abdel Fattah El Sisi visited Djibouti for talks with the country’s president.

GERD was the subject of discussion in South Sudan yesterday, when Irrigation Minister Mohamed Abdel Aty met yesterday with his South Sudanese counterpart Manawa Peter on the second day of his visit to South Sudan, the Irrigation Ministry said in a statement. This came following Abdel Aty’s sitdown on Monday with the country’s foreign minister, at which the two talked GERD and discussed a joint higher committee meeting set to take place in Cairo next month.

COVID WATCH

We’re really going to need those locally produced covid jabs

At least 40 out of the 80 countries first allocated vaccines through the Gavi / Covax program are now facing the prospect of vaccine shortages, the World Health Organization (WHO) has said, according to Bloomberg. “Well over half of countries have run out of stock and are calling for additional vaccines,” a WHO adviser said. “But in reality it's probably much higher."

Egypt and six other countries have used 80% of the shots sent by Covax, the WHO said. Others, such as the Ivory Coast, Gambia and Kenya, have consumed all of their shipments. Egypt has so far received 2.6 mn vaccines from Covax, more than half of the 4.5 mn it has been allocated.

Covax is falling far short of its targets: The goal of the organization is to distribute 1.8 bn doses to more than 90 developing countries by early next year, but almost six months into the rollout, it has delivered just 80 mn.

Why the delay? The shortage has been caused in large part by India’s export ban, which took offline one of the program’s biggest suppliers of Oxford / AstraZeneca shots, the Serum Institute.

Our next 1.9 mn-dose shipment has been delayed: Health Minister Hala Zayed said last month that the batch would arrive in Egypt by the first week of June, but we are yet to hear anything from the ministry or from Covax.

Luckily for us, we have other sources: China has sent over more than 2.1 mn Sinopharm and Sinovac vaccines, while Vacsera’s production facility is expected to produce 6 mn shots of Sinovac by the end of the year. The US is also going to donate some of its surplus to us, but given that we’re splitting 14 mn shots between at least 30 other countries, the shipment will be relatively small.

What’s the solution to all of this? Take a leaf out of China’s book. Beijing has now handed out more than 1 bn vaccines to its citizens. As this graph in Axios shows, China’s vaccination campaign has left the US, the EU and India in the dust, administering 500 mn doses in just one month. As of Wednesday, more than 945 mn doses were administered in China, which is 3x the doses given in the US, and almost 40% of the 2.5 bn shots given globally, according to CNN’s covid-19 tracker.

How did China manage it? Local production — a model Egypt is going to follow as we look to make a jab from Sinovac at Vacsera. The first batches should be rolling off the lines these days and could be distributed as early as next month of quality control checks go well.

The Health Ministry reported 498 new covid-19 infections yesterday, down from 509 the day before. Egypt has now disclosed a total of 278,295 confirmed cases of covid-19. The ministry also reported 37 new deaths, bringing the country’s total death toll to 15,935.

ENERGY

Fuel prices unlikely to go up in 3Q

The Madbouly government’s fuel pricing committee is likely to leave prices unchanged for 3Q when it meets during the first week of July, former oil minister Osama Kamal said on Sada El Balad yesterday (watch, runtime: 7:01). The committee — which meets every quarter to review fuel prices under a pricing mechanism that pegs prices to Brent crude and global exchange rates — will discuss whether the recent rise of global oil prices warrants a hike in fuel prices here at home. This is unlikely, according to Kamal, who said that projects to upgrade the country’s power infrastructure have decreased the country’s oil consumption, suggesting that there is now less of a need to raise prices in line with what is happening internationally.

This really depends on how much further oil rises over the next two weeks: Brent eclipsed the USD 70/bbl mark for the first time since October 2018 last week, and is now up to USD 75/bbl. This is USD 10 above the benchmark price used to calculate the FY2021-2022 state budget.

SUEZ CANAL

The Suez Canal is offering more discounts on transit fees

The Suez Canal Authority will slash transit fees for car carriers travelling between Northern Europe and Southeast Asia by 5% starting 1 July as it looks to boost traffic through the critical shipping route, the authority announced yesterday. The breaks will run through December.

Container ships and bulk carriers travelling between West Africa and the Far East will get a 75% break as of next month until the end of the year, the SCA said in a separate announcement.

The SCA has also extended lower costs for tankers: The SCA also decided on Tuesday to extend price breaks on container ships and bulk carriers travelling between the Americas and Southeast Asia to average 15-75% until the end of this year.

This follows cuts offered at the end of last year, which provided LNG, oil and LPG carriers up to 75% off transit fees

Why is the SCA targeting more shipping traffic through the canal, you ask? Suez Canal revenues are an important source of hard currency for Egypt, bringing in more than USD 550 mn in April — the highest month on record.

WELFARE

The social safety net is about to get bigger

Individuals earning less than EGP 2.4k a month will be eligible for subsidy ration cards at the start of the state’s upcoming fiscal year on 1 July, with the government upping the monthly salary cap for those eligible from the current EGP 1.5k, Al Masry Al Youm reports. Pensioners earning up to EGP 1.5k (previously EGP 1.2k) will also be eligible for the cards — which allow holders access to subsidized bread and a range of other low-cost commodities, and enable them to add up to four family members to the card.

Keeping pace with minimum wage: This comes as basic salaries for public sector workers are set to increase to EGP 2.4k from EGP 2k next fiscal year, which effectively means the nation will have a higher poverty line.

Speaking of subsidy recipients, what happened to the proposed Cash Subsidies Act? The bill, which has been in the works since right before the pandemic hit in early 2020, was expected to govern a new system of direct money transfers instead of the current setup of in-kind subsidies using ration cards. It was sent to the House of Representatives back in July 2019, but has been in limbo since. Our best guess is that, well, covid happened.

LIFE

Cairo is still one of the world’s more affordable cities for expats

Cairo is one of the least expensive cities for expats in the world, according to an annual cost-of-living survey by HR consulting firm Mercer. The nation’s capital was ranked 137 out of 209 global cities in the annual report, down 11 spots from 2020. The findings are based on the prices of more than 200 goods and services in each city including housing, transportation, food, clothing, household goods, and entertainment. The consultancy firm compiles the report each year to help multinationals calculate how much to pay expat employees.

Cairo is the fifth-cheapest Middle Eastern city listed on the index, behind Tunis, Algiers, Istanbul and Rabat.

The three most expensive global cities for expats are: Ashgabat, Hong Kong, and Beirut. The Lebanese capital is now the most expensive in the region, climbing 42 places on the index due the ongoing economic crisis and the collapse of its currency. Beirut is followed by Tel Aviv, which is ranked 15 globally. Also expensive regionally: Riyadh (29) and Dubai (42).

The three least expensive cities for expats in the Middle East and Africa are: Lusaka (208), Tunis (206) and Windhoek (204).

LEGISLATION WATCH

Smoking up in the office will now cost you your job

Public-sector employees can now be automatically dismissed if they test positive for illegal substances after President Abdel Fattah El Sisi ratified an amendment to the criminal code, Youm7 reports, carrying a copy of the decision published in the Official Gazette on 16 June. The law — approved by the House of Representatives last month — allows government authorities to randomly test employees, who will be suspended for three months and have half of their pay docked should they test positive. Failing multiple tests could result in employees being handed jail terms and fines of up to EGP 200k.

The recent spate of rail accidents seems to have motivated the legislation: The amendment comes a few months after the fatal train crash in Sohag, which the Public Prosecution partly blamed on intoxicated employees. The accident, which killed 20 people and injured 200 others, was said to have been caused by the train driver, his assistant and a control tower guard, the latter two are alleged to have been under the influence of narcotics. And following another crash in Qalyubia that occurred just a few weeks later, noises were being made about the need to test railway workers more regularly for use of narcotics.

MOVES

AUC has a new president

Ahmed Dallal named new AUC president: Ahmed Dallal (LinkedIn) has been appointed president of the American University in Cairo, succeeding Francis Ricciardone who will step down at the end of the current academic year this month, the uni announced in a statement (pdf) yesterday. An Arabic and Islamic studies scholar, Dallal currently serves as the dean of Georgetown University’s campus in Qatar and has taught at several institutions in the US and Middle East, including the American University Beirut, Stanford, and Yale. “Dr. Dallal's academic and administrative acumen, inclusive leadership style and a deep sense of purpose will serve to propel AUC to even greater heights,” said Mark Turnage, chair of the AUC’s board of trustees.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Most of the talking heads were focused yesterday on the nation’s second rail accident in 24 hours after two trains collided in Alexandria, leaving at least 40 people injured. The conductor and other staff members now face investigation. The accident came just hours after a train ploughed into two microbuses in Helwan overnight, killing at least two people and injuring six others. Ala Mas’ouleety (watch, runtime: 19:40) also had coverage. Masaa DMC’s Ramy Radwan took note of a third accident that could have taken place in Suez last night as a vehicle was parked on the railroad before the train conductor stopped the train at the last minute and prevented the crash (watch, runtime: 6:58).

Elsewhere: The Supply Ministry is looking to ramp up its local production of wheat to reach 3.6 mn tonnes by the end of this year, Minister Aly El Moselhy said in a phone-in to Yahduth fi Misr (watch, runtime: 4:39) last night. Current reserves should last six-and-a-half months until the start of the next local wheat season in January 2022, El Moselhy said (watch, runtime: 4:23).

EGYPT IN THE NEWS

The biggest story in the foreign press this morning: The BBC, the National and the Telegraph are all covering the fate of two female TikTok influencers, who were handed long jail terms earlier this week on charges they “incited debauchery” and engaged in human trafficking.

Laying the groundwork for the fintech boom: Reuters’ Patrick Werr talks to several players in Egypt’s fintech and VC scene about the new regulatory framework being put in place by the central bank and the Financial Regulatory Authority. “We believe that within the next few months or couple of years we will see a big bang in fintech,” Matouk, Bassiouny and Hennawy’s Mohamed Essam tells the newswire.

On the human rights front, the Washington Post’s editorial board is calling on the Biden administration to put pressure on Egypt, Amnesty International has condemned a case in which a grad student has been handed a four-year sentence for spreading “false news,” and International Federation for Human Rights says executives at two French firms have been are being investigated after it filed a complaint related to their companies’ activities in Egypt and Libya.

And finally: Reuters reports that an Italian hospital is performing CT scans on some ancient Egyptian mummies, hoping that modern tech would help them identify new interpretations based on medical imaging.

ALSO ON OUR RADAR

Other things on our radar this morning:

- Egypt launched its first waste-to-energy plant in Fayoum yesterday. The plant produces 100 kW/h of electricity with zero carbon emissions.

- Egypt will locally produce chassis for Humvees under an MoU signed between the Military Production Ministry and US heavy-vehicle manufacturer AM General.

PLANET FINANCE

INFLATION STORY OF THE DAY #1: House prices in the US and parts of Europe have surged to record highs as emergency measures introduced in response to covid-19 cause a wave of new borrowing, the Financial Times reports. Purchases in the US last year hit their highest level since the peak of the housing bubble in 2006 despite the pandemic devastating large parts of the economy, while in the Netherlands prices are growing at their fastest pace in 20 years.

More boom (and bust) to come? Analysts are split on where the market goes from here. Falling sales last month has some suggesting that the market has topped out, but others see the boom continuing. “Loose monetary conditions could push asset prices even higher, risking an eventual sharp correction,” said Adam Slater, economist at Oxford Economics. “For central banks, neither this outcome nor persistently higher inflation are attractive prospects.”

INFLATION STORY OF THE DAY #2: Growing chorus of industry players suggest we’re heading back to USD 100 / bbl oil: Leading oil firms and Bank of America have joined a number of commodities players to float the possibility of USD 100 / bbl oil. This would be the first time we’ve seen three-figure oil since the 2014 oil crash. Oil has seen strong gains in 2021 on the back of a surge in post-lockdown demand and shrinking supply.

INFLATION STORY OF THE DAY #3: Slightly less temporary- Recent inflation figures were larger than the Federal Reserve expected and higher prices may stick around for longer than previously thought, Fed chief Jay Powell said yesterday. “I will say that these effects have been larger than we expected and they may turn out to be more persistent than we expected,” he said, before reiterating his belief that inflation will soon start to decelerate. The Associated Press and Bloomberg have more.

Also worth noting this morning:

- Globalization probably isn’t to blame for the past decade of low inflation in advanced economies: Policymakers have been concerned that a possible tilt towards deglobalization may feed into inflationary pressures, but a study by the European Central Bank argues otherwise. Researchers found that while fewer trade barriers, integrated supply chains, and globalized communication does help to curb inflation, the effect is relatively minimal. (ECB)

- Is Gamestop back (again)? The videogame retailer / meme stock raised as much as USD 1.13 bn in an equity offering by selling up to 5 mn shares yesterday, further capitalizing on a Reddit-fueled mega-rally earlier this year. (Bloomberg)

- US-based chip maker GlobalFoundries is building a new USD 4 bn facility to manufacture semiconductors in Singapore as it looks to capitalize on the historic demand for chipsets that has led to a global shortage. (Company statement)

|

|

EGX30 |

10,206 |

+1.4% (YTD: -5.9%) |

|

|

USD (CBE) |

Buy 15.61 |

Sell 15.71 |

|

|

USD at CIB |

Buy 15.61 |

Sell 15.71 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

10,891 |

+0.3% (YTD: +25.3%) |

|

|

ADX |

6,650 |

+0.5% (YTD: +31.8%) |

|

|

DFM |

2,856 |

+0.3% (YTD: +14.6%) |

|

|

S&P 500 |

4,246 |

+0.5% (YTD: +13.1%) |

|

|

FTSE 100 |

7,090 |

+0.4% (YTD: +9.7%) |

|

|

Brent crude |

USD 75.00 |

+0.1% |

|

|

Natural gas (Nymex) |

USD 3.26 |

+2.1% |

|

|

Gold |

USD 1,777.40 |

-0.3% |

|

|

BTC |

USD 32,283 |

+2.1% (as of midnight) |

THE CLOSING BELL-

The EGX30 rose 1.4% at today’s close on turnover of EGP 1.71 bn (26.1% above the 90-day average). Local investors were net sellers. The index is down 5.9% YTD.

In the green: TMG Holding (+8.5%), Palm Hills Development (+5.7%) and Cleopatra Hospital (+5.3%).

In the red: Ezz Steel (-1.7%), Oriental Weavers (-1.0%) and Orascom Financial Holding (-1.0%).

Is our real estate market in line for a full post-covid recovery? Savills seems to think so: Egypt’s five largest listed real estate companies reported a combined drop in profits of around 31% in 2Q2020 due to the covid-induced economic slowdown. Initial sales dropped and deliveries were delayed, while a “fear of buying” spread among customers.

But almost a year has since passed, and plenty appears to have happened to turn the market around: Lockdown measures were eased; interest rates were cut 50 bps in November, we saw the launch of capital mortgage companies and real estate SPVs; and finally, a CBE mortgage financing program was launched in March. Now we’re seeing more international corporations looking to set up shop in Cairo office spaces, new asset classes for residential buildings emerging, and a near-perfect occupancy rate of retail outlets and strips, according to Savills’ 2021 report on the Egypt property market.

By 2025, Savills predicts Egypt’s real estate sector will see much more high-income, mixed-use, and retail strip developments in East Cairo, according to the global property advisor’s report. The report tells us that the residential market in Greater Cairo may likely face a supply surplus, despite a demand increase. Office spaces will grow tremendously in terms of amount of mixed-use sqm, as foreign companies resume expansion plans in Egypt after a covid-induced halt. Retail spaces across Greater Cairo will move towards retail strips and open shopping streets.

We will see almost 7.6 mn homes across Greater Cairo, compared to the current 7.1 mn homes by 2025, Savills writes. Grade A (high-end, luxury homes) homes will increase to almost 170k in West and New Cairo, from almost 70k currently. Residential demand is expected to grow resiliently throughout the post-covid recovery, but a supply surplus may be in the books, Savills writes in its report. Demand for residential homes will remain concentrated across the mid- to high-end segment, attracting mainly the top income category of the population. But with the large inventory of new projects rolled out across several areas and market segments, a surplus will definitely take place, the company states.

Serviced residences will grow faster in Egypt than anywhere else in the world. In the long run, organized and Grade A developments, as well as serviced residences are expected to gain popularity. More mid-to-high projects will be delivered in the next few years, while new types of real estate products, such as branded residences (think Four Seasons residence, etc.) are becoming so popular that the sector is forecast to grow faster in Egypt than in any other country in the world over the coming four years, Catesby Langer-Paget, who heads Savills Egypt, writes.

Consequently, areas like West Cairo and New Cairo are where we should see the most growth, while the rest of Greater Cairo appears to be saturated with limited supply. This is also thanks to a strong push by the New Urban Communities Authority (NUCA) and other governmental authorities making land available to a number of private developers for master plan projects.

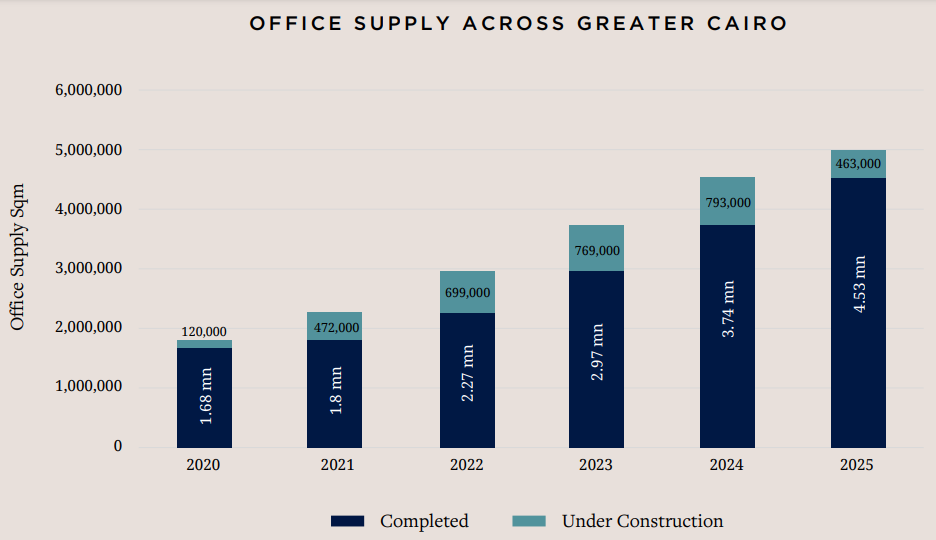

Office space will increase to over 4.5 mn sqm in Greater Cairo by 2025, compared to today’s 1.7 mn sqm. “Mixed-use office parks” is the new buzzword for corporate tenants seeking office spaces. Developers and occupants are moving towards office parks that offer amenities and sufficient parking. These developments have witnessed skyrocketing prices over the past year, due to high demand. Developers usually offer part of their parks for sale, while leasing the remaining space.

And this is being driven by more foreign corporate residents: Foreign corporations and investors have increasingly been either setting foot in Egypt or expanding their footprint, Langer-Paget says. Recent years have seen multinational companies moving either to East or West Cairo, abandoning Downtown Cairo and Giza, with East Cairo becoming the preferred destination, thanks to its proximity to the New Administrative Capital and Cairo International Airport, according to the report.

Just in time for a post-covid recovery: Although the pandemic has put some expansion plans of multinational companies on hold, confidence in the Egyptian economy’s growth has pushed global firms to resume their plans. The product offering has thus changed towards “modern investment grade and integrated developments to match the international corporates’ requirements,” Langer-Paget adds.

This clearly has had an impact on prices: New Cairo boasts the highest office rents, with an average of EGP 450 per sqm/month, an increase over an average of EGP 350 per sqm/month in 2019, we previously wrote. Today, the price can jump to about EGP 650 in certain neighborhoods. Lowest average office rent can be found in Mohandessin and Maadi at EGP 350. Even neighborhoods such as Heliopolis and downtown Cairo can see rents of EGP 350-450 per sqm/month on average.

What if I'm a startup and can’t afford these prices? Read our Hardhat series on how new companies are struggling and overcoming the high rents here, here, and here.

Annual retail sales are expected to grow to USD 160 bn in 2023 from USD 149 bn in 2019, Langer-Paget states. This comes off the back of an expected increase in consumer spending. As consumer spending goes up, demand for retail centers focusing on F&B and family entertainment concepts will remain strong.

And the proof is in the pudding: Major malls and retail strips are seeing an average occupancy rate of over 90%. Galleria40, Tivoli and Waterway even boast a 100% occupancy rate, Savills suggests.

Egypt’s real estate market shows little sign of slowing down, the report tells us. And while a lot of the policies we mentioned earlier in the piece have contributed to this, Savills sees the fundamentals as being the main driver for this growth. Namely, a young population with many still yet to enter their prime earning and purchasing years, and steady economic growth. Add to that, the very real perception that real estate is a safe and preferred investment asset that has been steadily rising since the EGP float back in 2016.

Your top infrastructure stories for the week:

- Orange, SODIC partner for smarter infrastructure: Orange Egypt will provide SODIC’s real estate projects with smart technology services including “triple play” broadband, internet protocol television, and other smart home solutions.

- Egypt continues infrastructure diplomacy in Iraq: Egypt’s ICT Ministry inked an MoU with its Iraqi counterpart to boost digital infrastructure investments by companies in the two countries.

- Alex is getting a new logistics zone: French market Rungis and the Supply Ministry will set up a EUR 100 mn logistics zone for agricultural goods in Alexandria’s Borg El Arab.

- Chinese finance: HSBC has provided finance to Chinese companies who are investing in USD 20 bn worth of Egyptian projects.

- EBA eyes up Africa: The Egyptian Businessmen Association (EBA) is considering establishing a consortium to compete for infrastructure and reconstruction developments in Africa.

CALENDAR

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26 June (Saturday): International Cooperation Ministry and Egypt Ventures’ Generation Next entrepreneurship conference, Cairo, Egypt

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt. The Big 5 Egypt Impact Awards will also be taking place at the event on 27 June.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: The Cairo International Book Fair, Egypt International Exhibition Center.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 July (Thursday): Deadline for 17 EGX-listed companies to file their 1Q2021 earnings.

1-10 July (Thursday-Saturday): The government’s fuel pricing committee will meet to announce 3Q prices.

4 July (Sunday): Ismailia Economic Court to hold hearing on Ever Given compensation case.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

2-4 August (Monday-Wednesday): Egypt is hosting the Africa Food Manufacturing exhibition at the Egypt International Exhibition Center.

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.