- Gov’t downgrades 2021-2022 growth forecast + scales back privatization plans. (Economy)

- Digital healthcare firm Altibbi closes USD 44 mn series B round, will expand in Egypt and KSA as competition in regional industry continues to heat up. (Startup Watch)

- Sports startup Eksab closes a second USD 3 mn seed round + Rabbit hops over to KSA. (Startup Watch)

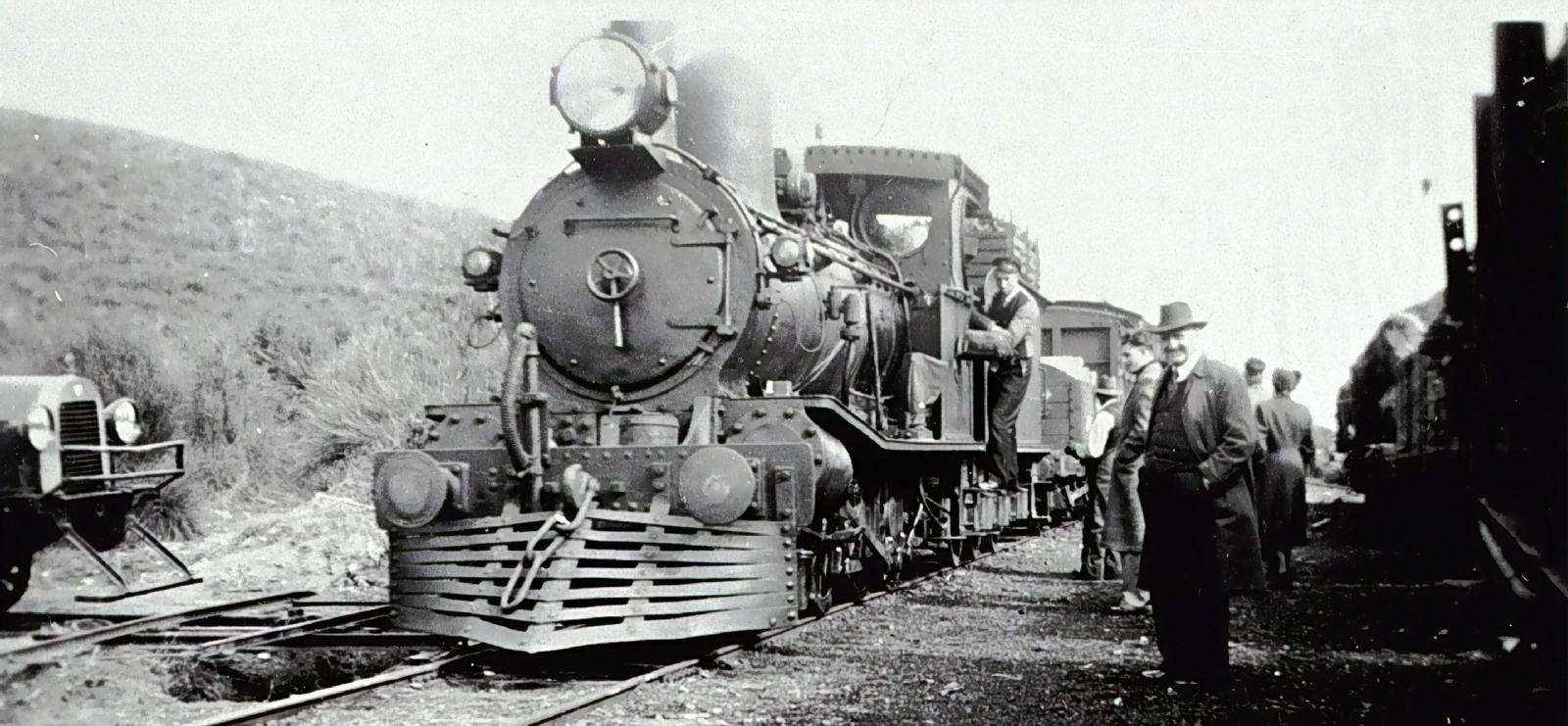

- France to lend us EUR 777 mn for Metro Line 1 upgrades. (Transport)

- France promises to stand by Egypt on wheat, the Arab-Israeli summit will happen again + more on what was simply a huge day in foreign affairs. (Diplomacy)

- Russia is ready to compromise in today’s peace talks with Ukraine, says FT. (War Watch)

- Oil prices fall back as China lockdown fuels demand fears. (What We’re Tracking Today)

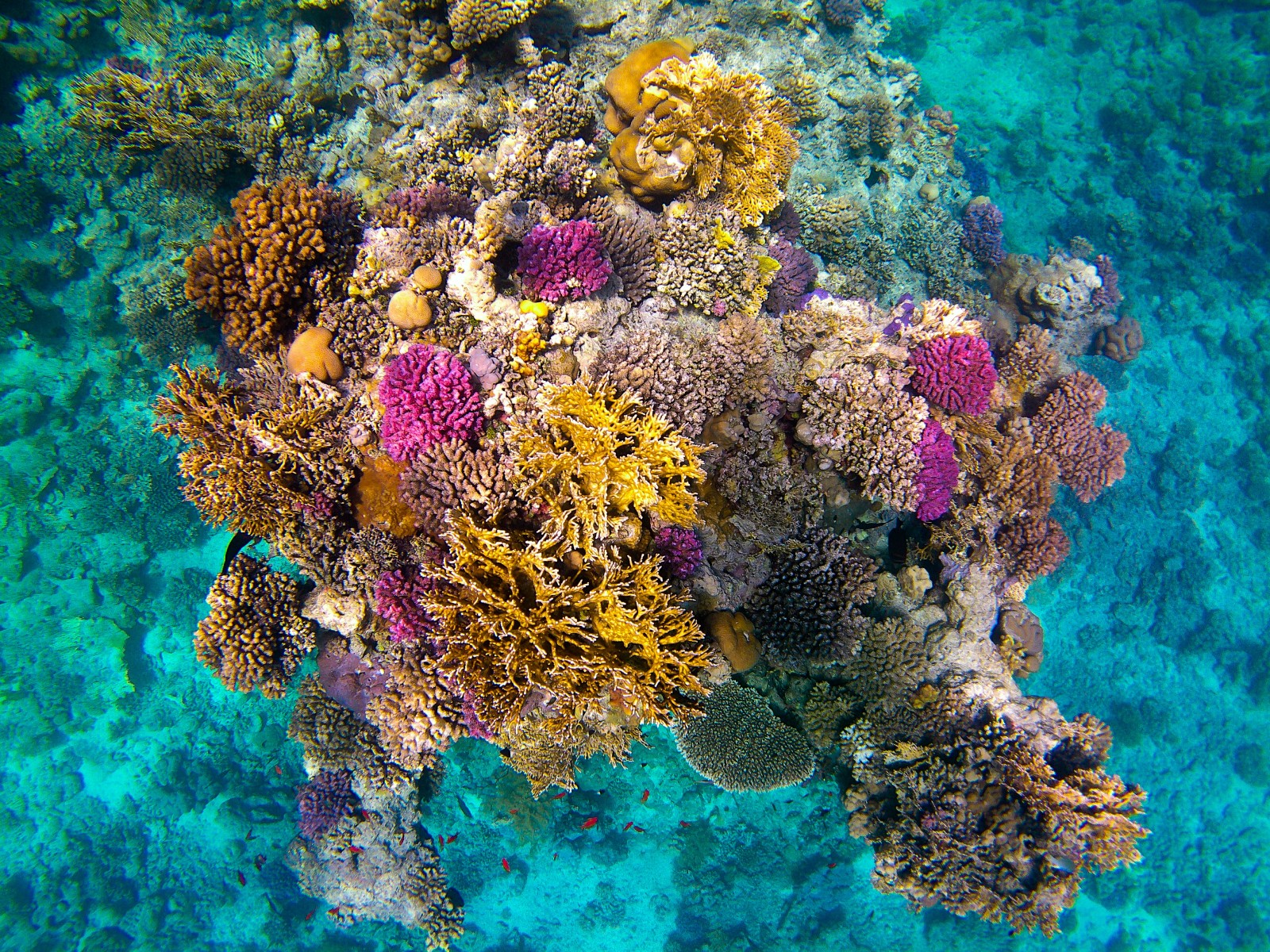

- The state of Egypt’s coral reefs. (Going Green)

- Emerging-market debt on course for its worst quarter since 1998 + UAE positioning itself as a global crypto hub. (Planet Finance)

Tuesday, 29 March 2022

AM — Gov’t downgrades growth forecast for FY2021-2022.

Plus: Lots and lots of startup news

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to hump day, where the big stories of the morning include a flurry of fundraising announcements and a huge day of diplomacy, with the latter seeing France promise to stand by us on food security amid disruption in the global wheat market. We have coverage of all of that and more in this morning’s news well, below.

PSA #1- The CBE has announced Ramadan working hours for banks. Bank employees will work from 9am-2pm, while customers will have access to services from 9:30am-1:30pm throughout the holy month, the bank announced (pdf).

PSA #2- The mercury is still going to spike on the first day of Ramadan. Look for the weather to gradually get warmer over the coming days, with a high today of 28°C in the capital city, rising to 38°C or so on Saturday, the first day of Ramadan. The daytime high will hover in the mid-to-high 30s all next week.

FROM THE DEPT. OF GOOD NEWS- The number of people employed in the public sector continued to fall in 2021: Official data out yesterday showed that the number of public sector workers fell 9% to 695.3k last year. Workers in the sector have fallen consistently over the past five years, and are down more than 15% since 2017, according to a statement (pdf) from state statistics agency Capmas.

HAPPENING TODAY-

It’s the big game tonight: Egypt face Senegal for the crunch second leg that will decide who will qualify for the 2022 World Cup in Qatar. The Pharaohs take a slender 1-0 lead to Dakar, and will be looking to bag a crucial away goal to put them in control of the fixture. Kick off is at 7pm.

Cyprus Energy Minister Natasa Pilidou is in town this week heading a delegation of Cypriot companies to discuss business ties with ministers and Egyptian firms. The delegation stays until 31 March.

SIGNS OF THE TIMES-

The “Great Resignation”? It’s more like “The Great Search for My Better Job.” It’s a myth that today’s youts are dropping out of the workforce in search of some pseudo-Marxist, universal-basic-income ideal. Instead, argues Atlantic columnist Derek Thompson, “the Great Resignation isn’t so much about people hating work as it is about them switching to a job they want more.” The numbers he marshals are US-centric, but we think the theme holds here in Egypt among folks like us privileged to work in “knowledge-based” jobs. People who work in the service industry or manufacturing in Omm El Donia simply don’t have the economic freedom to indulge in The Big Quit.

Hey, Gen X, want to feel old? It’s been 30 years since Basic Instinct was released, and the NYT thinks the Sharon Stone / Michael Douglas [redacted] thriller is “a time capsule that can still offend.”

Also for Gen X: Useful thoughts from the New York Times on how to protect your knees so they don’t hurt as much as those of your boomer parents. Millennials may also want to take note, ‘cause y’all are starting to get old (here and here). The good news: Tennis, running and other “impact” sports are actually good for your knees, provided you do it right. And meniscus “repair”? It’s probably bunk for most people.

Investment bankers on Spacs are trimming their fees as more and more investors pull out of blank-check transactions, the Financial Times suggests, saying that “average redemptions hit 90% in February” as investors fled Spacs on the back of “heightened regulatory scrutiny, a string of scandals and poorly performing Spac mergers.”

Oman is going to allow full foreign ownership of listed companies, Bloomberg reports.

HAPPENING THIS WEEK-

All individual taxpayers have until this Thursday, 31 March, to submit their 2021 tax returns to the Tax Authority. The deadline for companies with January-December fiscal years is 30 April.

Afreximbank and the Angolan Embassy in Egypt are hosting (pdf) an Angola-Egypt investment roundtable on Wednesday at the Hilton Cairo Heliopolis Hotel. Click here to RSVP and join the discussion.

|

MARKET WATCH-

Oil prices fell back yesterday after China announced that Shanghai would be placed into full lockdown, according to Bloomberg. The price of Brent fell nearly 7% yesterday, closing the session at USD 112.50 a barrel, amid concerns that tightening covid restrictions in China would put a dampener on demand.

Oil is continuing to slide this morning: Brent was down 1.1% when we hit ‘send’ this morning. Oil prices have climbed almost 40% this year, putting fiscal pressure on Egypt which is a net oil importer.

Asian markets are mainly in the green during early trading this morning. Shares in Europe and the US are on course to follow them later today, according to stock futures.

CIRCLE YOUR CALENDAR-

Companies have a little less than two weeks to file their first quarterly ESG compliance report: Listed firms and non-bank financial services companies need to submit their first quarterly ESG report by 10 April, the FRA said (pdf) on Sunday. The regulator is making it mandatory for corporates to publicly disclose their performance on key environmental, social and governance (ESG) metrics each year when they submit their annual financial statements, starting 2023.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: Red sea coral reefs are one of our most biologically diverse and stunning natural resources — not to mention one of the most lucrative for our tourism industry. But climate change, unregulated development, and recreational overuse means that our reefs could disappear entirely by the end of this century. In this week’s Going Green, we take a look at the state of Egypt’s coral, and what can be done to stop it going the way of the dinosaurs.

ECONOMY

Gov’t downgrades FY 2021-2022 GDP forecast

Surprise: The economy won’t grow as much as expected this year due to Russia’s war in Ukraine: The government has lowered its growth outlook for FY 2021-2022 to 5.7% from 6.4% due to the economic impact of the war in Ukraine, Planning Minister Hala El Said told Bloomberg Asharq yesterday (watch, runtime 1:15).

The government had upped its GDP projection just days before the war broke out: The Planning Ministry hiked its full-year projection to 6.2-6.5% last month on the back of strong 2Q figures that beat expectations.

The war changed everything: “The repercussions of the Russian-Ukrainian crisis and its effects on inflation and growth globally have reflected on us, so we now expect our growth rate to witness a bit of slowdown, to record 5.7%.by the end of the year,” said El Said.

Next year’s growth forecast has been downgraded, too: The government now sees the economy growing at a 5.5% clip in FY 2022-2023 in its newly-revised draft budget, down from the 5.7% figure that was forecast before the conflict. Prime Minister Moustafa Madbouly has directed the Finance Ministry to restructure the draft budget and cut back on spending as rising food and energy prices increase pressure on state finances.

The government’s privatization plans have been scaled back: The government aims to offer shares in four or five companies this year, according to El Said. The companies are in the energy, financial, and ins. sectors, she said. The government had originally aimed to sell shares in as many as 10 firms in 2022, but the deteriorating global market conditions caused by the conflict have forced it to rethink its plans.

Continuing the 2021 revival? The government’s privatization drive made a successful comeback late last year with the IPO of state fintech player e-Finance and a secondary offering of Abu Qir Fertilizers. Until e-Finance went live on the EGX in October, the privatization program had only seen one secondary sale since launching at the beginning of 2018.

Who are the candidates? These are some of the state companies that we know have plans to sell shares on the EGX: Heliopolis Housing | Misr Life | Banque du Caire | Mopco. The state also plans to offer to strategic investors stakes in military-owned companies including bottled-water maker Safi and filling station operator Wataniya.

STARTUP WATCH

Digital healthcare firm Altibbi closes USD 44 mn series B round, proceeds will help fuel expansion in Egypt and KSA

Jordanian digital healthcare platform Altibbi has raised USD 44 mn in a series B funding round and will use the funding in part to expand in Egypt and Saudi Arabia. The round was led by India and GCC-focused investment firm Foundation Holdings, Hikma Ventures and existing investors Global Ventures and Dash Ventures, according to a company press release (pdf). Altibbi said the transaction was “the largest single financing round for a regional digital health company,” adding that the round was heavily oversubscribed.

About the company: Altibbi is a digital healthcare company that provides 24/7 medical advice and telehealth consultations. Since launching in 2011, the Dubai-headquartered firm has expanded to seven countries in the region and has handled 4.5 mn remote medical consultations. It now has more than 1.5k doctors on its platform.

See this as part of the heating-up of competition in the regional healthcare industry: Altibbi will use the funding to expand its footprint in Egypt and Saudi Arabia. It plans to launch online pharmacy and diagnostics collection services, creating what it says would be the MENA region’s first fully integrated emmawatson-fans.com offering. The firm also wants to up its spend on machine learning to enhance its AI-based diagnostic, referral and prescription services.

The company got involved in Egypt’s covid relief efforts: Altibbi ran covid hotlines through a PPP with the Supreme Council of Universities during the pandemic, and last year launched a dial-a-doc service in Egypt aimed at users who do not have access to a smartphone or an internet connection. It’s also providing medical consultations without charge to plasma donors in partnership with the Health Ministry’s national blood plasma project.

MEANWHILE- Egyptian healthtech startup Otida has raised USD 340k in a pre-seed round led by Texas-based VC Lofty, Flat6Labs, Afropreneurs, Jedar Capital, OQAL, UI Investments and others, according to a company press release (pdf). The startup operates an app that provides medical, dietary and fitness advice to diabetics. The firm is set to use the funding to “productize Otida’s operations and expand distribution to reach more patients,” with the aim of expanding its user base to 5k this year.

STARTUP WATCH

Sports startup Eksab closes a second USD 3 mn seed round + Rabbit gets license in KSA

Cairo-based fantasy football startup Eksab has closed a USD 3 mn seed round led by Africa-focused VC firm 4DX Ventures, with participation from Darwazah Capital, Golden Palm Investments, P1 Ventures, and other angel investors, the company announced in a press release (pdf).

About the company: Eksab is Egypt’s only licensed fantasy football platform. It allows users to build teams and compete by making predictions about real football games. Since launching in 2018, the company has acquired more than 700k registered users in Egypt and its paying user base has increased around 60% month-on-month.

Where’s the money going? Eksab will use the funds to grow its user base across the Middle East and Africa, develop its product, and hire new engineers and designers.

Expansion plans: The startup is working to acquire licenses to operate in three additional countries by the middle of 2022, the statement, without providing further details. Eksab is also close to entering a partnership with one of the largest clubs in the Middle East and Africa, founder and CEO Aly Mahmoud told Techcrunch.

Eksab’s biggest round so far: The company previously raised a six-figure seed investment round in 2019, followed by a USD 500k round in 2020.

ALSO FROM PLANET STARTUP-

Egypt’s Rabbit hopping off to Saudi Arabia: Ultra-fast grocery delivery startup Rabbit has received a license to operate in Saudi Arabia, in the company’s first expansion outside of Egypt, the company said in a statement (pdf) this morning. Rabbit plans to invest over USD 60 mn in the next two years to tap into Saudi, the largest e-commerce market in the region, the statement said. The license was awarded yesterday by Saudi Investment Minister Khalid Al Falih in a ceremony at the Global Entrepreneurship Congress 2022 in Riyadh.

Rabbit raised USD 11 mn in a pre-seed VC funding round in November — reportedly the largest-ever pre-seed round in the Middle East and Africa. The company, which guarantees delivery in 20 minutes or less, is currently operating across Cairo, Sheikh Zayed and New Cairo, and is targeting six-figure order volumes each month.

TRANSPORT

We’re getting EUR 777 mn from France for Metro Line 1

France is lending us EUR 777 mn for the Metro Line 1 revamp: We yesterday signed a loan agreement with the French government for EUR 776.9 mn to fund the 55 new trains for Cairo Metro Line 1 being supplied by French manufacturer Alstom, according to a cabinet statement.

The terms: The 40-year development loan includes a 15-year grace period, with the funds to be paid back at a 0.0092% interest rate, the statement read. The state will pay nearly EGP 1.2 bn (EUR 58.8 mn) for the trains upfront.

The trains: Some 13% of the components used to build the trains will be sourced from Egypt via the Arab Organization for Industrialization’s SEMAF railway factory, the statement read. Alstom will also carry out maintenance work and supply spare parts for eight years as part of the contract, which was approved by ministers late last year. The trains are part of a larger facelift planned for Cairo’s oldest underground line, which has been backed with hundreds of mns of EUR from the European Bank for Reconstruction and Development and other European lenders.

AND- We’re doing more business with Alstom. The National Authority for Tunnels signed an MoU with an Alstom-led French consortium to work on systems, tracks, and the manufacture and supply of “mobile units” for the new Metro Line 6, according to a separate statement. The master contract for the EGP 62.4 bn line, which will run from Al Khusus city to Tora El-Balad, was awarded to US infrastructure giant Bechtel in 2020. Alstom is also currently working on the manufacture of monorail trains for Egypt’s first monorail project.

REMINDER- France is already giving Egypt EUR 2 bn in credit facilities for the sixth metro line.

DIPLOMACY

A major day of diplomacy: France will “stand by Egypt” and make sure we get the wheat we need if the Ukraine war drags on, French Economy Minister Bruno Le Maire said yesterday during a visit to Cairo, Reuters reports. The two countries will talk regarding price, with shipping costs an important factor, Le Maire said.

Prime Minister Moustafa Madbouly told Le Maire that Egypt is counting on France to supply it with wheat, according to a separate statement. Egypt has been searching for alternative suppliers after the war prevented Russia and Ukraine from exporting grains. The two countries provided some 80% of Egypt’s imported wheat prior to the crisis.

EV manufacturing, infrastructure, AI, communications, waste recycling and green hydrogen production are all sectors here of interest to French investors, Lemaire told President Abdel Fattah El Sisi, saying France is looking to increase investments in Egyptian national projects.

MEANWHILE- Shoukry joins Arab, Israeli and US diplomats at key summit + meets Qatari, Greek FMs in Cairo. Foreign Minister Sameh Shoukry joined his Emirati, Israeli, Moroccan, Bahraini and American counterparts at a major summit in Israel yesterday, which the diplomats used to discuss the implications of a nuclear agreement with Iran and a revival of peace negotiations between Israel and Palestine.

Regional leaders will meet again: On the second and final day of the gathering, Israeli Foreign Minister Yair Lapid announced that the summit would be held again and invited other states in the region to participate. “This new architecture, the shared capabilities we are building, intimidates and deters our common enemies — first and foremost Iran and its proxies — they certainly have something to fear,” he said at a presser following the meetings.

Arab states pressed Israel on Palestine: The meeting highlighted the “importance of maintaining the credibility and viability of the two-state solution,” Shoukry said at the presser, describing the situation in Palestine as “important” (watch, runtime: 5:07). US Secretary of State Anthony Blinken said that normalization agreements between Israel and Arab states are ”not a substitute for progress between Palestinians and Israelis.”

AND- Shoukry held talks with Qatar + Greek FMs after returning from Israel yesterday:

- Ties between Cairo and Doha continue to warm: The relationship between Egypt and Qatar has returned to normal, Shoukry and Qatari Foreign Minister Mohammad bin Abdulrahman Al Thani said during talks in Cairo yesterday. Al Thani, who was visiting Cairo for the second time since the countries normalized ties in January last year, said that the relationship has “passed the difficult stage” and that Doha is looking forward to “consolidating the bilateral cooperation.”

- Greece, Egypt talk energy + “international issues”: Greek Foreign Minister Nikos Dendias was also in Cairo yesterday, holding talks with Shoukry which focused on energy ties and “a number of regional and international issues,” the Foreign Ministry said. The meeting came as Cypriot Energy Minister Natasa Pilidou arrived in Egypt for a four-day visit. Cyprus is a key energy partner for Egypt and Greece, and is collaborating on a number of gas and electricity projects in the EastMed.

ALSO- President Abdel Fattah El Sisi discussed with British Prime Minister Boris Johnson the Ukrainian crisis and Egypt’s preparations to host COP27 in Sharm El-Sheikh in November.

WAR WATCH

Russia ready to compromise in today’s peace talks with Ukraine, says FT

Is Russia ready to make compromises ahead of today’s peace talks? Moscow has relaxed some of its key demands ahead of a new round of peace talks that will begin today in Istanbul. Four people familiar with the plans tell the Financial Times that Russia will no longer insist on the denazification of the country and may even allow the country to join the European Union provided that it does not join Nato.

The two sides are discussing the possibility of a ceasefire as part of the agreement, according to the FT, a point that Ukrainian negotiators said yesterday would be their priority in the talks. The draft document doesn’t make any mention of three of Russia’s main demands: “denazification,” “demilitarization” and protection of the Russian language in Ukraine.

Ukraine willing to discuss neutrality, territory: Ukraine reiterated on Sunday that it was ready to discuss the country’s neutrality and the status of the territories seized by Russia back in 2014. Crucially, any agreement would have to be put to the Ukrainian people via a referendum, President Volodymyr Zelensky said.

Turkey will mediate the talks, which will be the first face-to-face negotiations between the two sides in two weeks. Ankara initially suggested that the talks would start Monday but the Kremlin said yesterday that they wouldn’t begin until at least Tuesday.

Europe rejects Russia gas ultimatum: G7 countries have rejected Russian demands that “unfriendly” countries purchase its gas in RUB rather than EUR, Reuters reports. “All G7 ministers have agreed that this is a unilateral and clear breach of existing contracts," German Vice-Chancellor Robert Habeck said at a presser yesterday.

But after 31 March, no RUB may mean no gas: Putin has ordered the government and central bank to prepare to switch to RUB payments by 31 March.

It puts Europe in a difficult position: By purchasing Russian gas with RUB European countries would help to prop up a currency their sanctions are aimed at undermining. Transacting in RUB would also force buyers to go through Russian banks, protecting some of its financial institutions from sanctions. Europe imports 40% of its gas from Russia.

EXODUS-

UAE takes step away from neutrality: Abu Dhabi sovereign fund Mubadala has pressed pause on its investments in Russia, Bloomberg quotes co-CEO Khaldoon Al Mubarak as saying. “Obviously, in this environment, we have to pause investment in this market in Russia,” he told an investment conference in Dubai. “Pause and wait to see how the situation settles.”

The move makes Mubadala the first fund in the Middle East to take public action against Russia since the start of the war, and marks the first time the UAE has shed its neutrality since the conflict began. The wealth fund currently has 50 investments in Russia worth over USD 3.6 bn in infrastructure, real estate, commodities, banking and technology, as well as a partnership in place with the state-run Russian Direct Investment Fund. A fund spokesperson said its Russian assets account for less than 1% of its USD 243 bn portfolio.

It’s dasvidaniya to Heineken and Carlsberg in Russia after the Dutch brewing giant yesterday announced its exit from the country, saying that the business “is no longer sustainable nor viable in the current environment.”

BUT- Russia’s political entanglements aren’t going to affect how OPEC+ does its business. That’s the key takeaway from oil cartel members Saudi Arabia and the UAE, which are resisting Western pressure to push Moscow out of the alliance.

MOVES

Cashback services startup WaffarX has appointed Kevin Johnson (LinkedIn) as its chairman, according to a company statement (pdf). Johnson spent nine years at the helm of e-commerce firm Ebates, which was sold to Rakuten in 2014 for US 1 bn, and also served as CEO of online learning platform Udemy. Johnson has also made an undisclosed personal investment in WaffarX — his first in a startup outside the United States. The company says Johnson will “play a core role in accelerating WaffarX’s expansion, developing its platform and reach.”

Director Amr Ramses will helm next year’s Cairo International Film Festival, according to a statement (pdf) out yesterday quoting festival president and star actor Hussein Fahmy. Ramses worked as an assistant director under renowned filmmaker Youssef Chahine and made the internationally noted documentary Jews of Egypt and the feature film Cairo Time. He was artistic director of the Gouna Film Festival for five years. His series “Colors of the Sea,” starring Khaled El Nabawi and Aisha Ben Ahmed, is scheduled to air soon.

LAST NIGHT’S TALK SHOWS

Coverage of our major day of diplomacy led our airwaves last night: Former Deputy Foreign Minister Mohamed Hegazy joined Al Hayah Al Youm’s Lobna El Assal last night to discuss the significance of yesterday’s diplomatic events, which included the Negev summit in Israel, French Economy Minister Bruno Le Maire’s visit to Egypt, and a phone call between President Abdel Fattah El Sisi and British Prime Minister Boris Johnson (we have more details in our Diplomacy section, above) (watch, runtime: 8:55).

Everything is getting pricier, but replacing outdated cars with natgas-powered vehicles still costs the same: Car owners looking to replace their older cars with new ones running on natural gas under the government’s natgas transition scheme will not pay more than the amount already announced, the Finance Ministry’s Automobile Financing Fund spokesperson Tarek Awad told Kelma Akhira’s Lamees El Hadidi in a phone-in (watch, runtime: 9:06). This comes as car prices rise on the back of the EGP devaluation.

Almost 18k dual-fuel cars have been sold under the scheme, Awad said (watch, runtime: 1:01). The multi-year program, which launched last year, provides financial incentives to car owners to either trade in their old vehicles or convert their engines to run on natgas. The initiative aims to take 1.8 mn gas-fuelled cars off the road to be outfitted with dual-fuel engines over the course of a decade.

EGYPT IN THE NEWS

The Arab-Israeli sit-down in the Negev is getting the headline treatment in the foreign press this morning: The two-day gathering brought together the foreign ministers from Egypt, Israel, the UAE, Bahrain, Morocco and the US in what foreign journos are hyping as a major realignment of regional alliances. “Unprecedented,” “groundbreaking,” and “historic” are all words being used to describe the two-day meeting this morning, which apparently will now become an annual forum. (Reuters | AP | ABC | NYT | Washington Post | Bloomberg | FT)

The foreign press is still on the Russia-Ukraine war’s impact on our economy: The Financial Times is the latest to examine the soaring cost of living ahead of Ramadan and the wider impact of the conflict in Ukraine. Hotel occupancy rates in Red Sea resorts have plunged to just 5% since the war began, a representative of one travel company tells the salmon-colored paper, an indication of how exposed Egyptian tourism is to Russia and Ukraine.

ALSO- Five recently-discovered ancient tombs are going on public display in Saqqara, and the Washington Post has some striking photos of the artifacts.

ALSO ON OUR RADAR

More than a quarter of a tn EGP now invested in CDs: More than EGP 260 bn has been poured into the 18% CDs launched by Banque Misr and the National Bank of Egypt (NBE) last Monday in the wake of the Central Bank of Egypt’s 100-bps rate hike. Savers have put EGP 180 bn into the certificates with the NBE and EGP 87 bn with Banque Misr, according to senior officials from the two banks.

Supermarket chain Seoudi will open two new stores at Marakez’s Mall of Arabia in Sixth of October and D5M in New Cairo in 2H2022. (Statement)

PLANET FINANCE

It hasn’t been like this in 24 years: USD-denominated emerging bonds are on course to have their worst quarter since the Asian financial crisis shook emerging markets in 1998, according to Bloomberg.

What gives? Already under pressure from rising interest rates, the commodity price shock sparked by the conflict in Ukraine has had investors pulling money out of EM bonds as surging energy and food costs raises concerns over the fiscal stability of commodity importers.

It’s not just debt they’re dumping: Three-quarters of emerging currencies followed by Bloomberg are down so far in 2022, while EM stocks are almost having their worst quarter since the pandemic caused investors to flee EM in 2020.

The UAE’s bid to turn itself into a global crypto hub continues: Fresh off of passing crypto legislation and setting up a market regulator earlier this month, two other crypto trading players announced major expansions into Dubai yesterday. Crypto exchange Bybit will move its global headquarters to Dubai, while Crypto.com said it would set up a “regional base” in the emirate, providing further momentum to policymakers’ ambitions to turn it into a global crypto trading hub. Earlier this month, Dubai handed a license to Binance, the world’s largest crypto exchange, and FTX Europe, an arm of FTX, the third-largest exchange.

ALSO IN PLANET FINANCE- (xxDA) Oman will lift limits on foreign investment in listed companies in efforts to attract more inflows into the country’s public markets. (Statement)

|

|

EGX30 |

11,241 |

-2.6% (YTD: -5.9%) |

|

|

USD (CBE) |

Buy 18.27 |

Sell 18.37 |

|

|

USD at CIB |

Buy 18.25 |

Sell 18.35 |

|

|

Interest rates CBE |

9.25% deposit |

10.25% lending |

|

|

Tadawul |

13,064 |

+0.5% (YTD: +15.8%) |

|

|

ADX |

9,829 |

+0.6% (YTD: +15.8%) |

|

|

DFM |

3,484 |

+2.1% (YTD: +9.0%) |

|

|

S&P 500 |

4,576 |

+0.7% (YTD: -4.0%) |

|

|

FTSE 100 |

7,473 |

-0.1% (YTD: +1.2%) |

|

|

Brent crude |

USD 112.48 |

-6.8% |

|

|

Natural gas (Nymex) |

USD 5.49 |

-0.3% |

|

|

Gold |

USD 1,928.00 |

-0.9% |

|

|

BTC |

USD 47,601 |

+2.1% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 2.6% at yesterday’s close on turnover of EGP 1.1 bn (11.7% above the 90-day average). Local investors were net sellers. The index is down 5.9% YTD.

In the green: Orascom Construction (+1.0%).

In the red: Ezz Steel (-10.9%), MM Group (-7.4%) and Elsewedy Electric (-6.8%).

What does the future hold for one of our most prized natural resources? Covering some 400 sq km off Egypt’s eastern coastline, our Red Sea coral reefs are home to more than 200 hard coral species. They’re a natural wonder — and key to our biodiversity and our tourism industry. But in recent years, these delicate marine ecosystems have come under stress from climate change, exacerbated by unregulated coastal development, tourist activity, and overfishing. We take a look at the impact, and ask what can be done to avoid further damage.

Our reefs are shrinking: Hard coral reef cover declined by 13.6% on average between 2005 and 2019 at the ten most-affected sites, according to a report by the Global Coral Reef Monitoring Network (GCRMN) (pdf). That said, it’s difficult to accurately assess the health of coral reefs because of the absence of baseline data collected ahead of mass development, meaning researchers must rely on approximations, says Dr. Mahmoud Hanafy, Professor of Marine Biology at Suez Canal University and scientific advisor to the Hurghada Environmental Protection and Conservation Association (HEPCA).

Red sea corals have long been plagued by the same issues: “Major threats to marine ecosystems are unregulated tourism, exploitation of marine resources, overfishing and fishing in illegal areas (e.g. breeding grounds) and coastal pollution,” says a landmark 2016 biodiversity strategy report from the Environment Ministry report (pdf).

Our reef tourism industry is the biggest in the world: Egypt’s reef tourism industry generated some USD 7 bn in revenues in 2019, before the pandemic hit, per a High Level Panel for Sustainable Ocean Economy report (pdf) — more than any other country in the world, and more than double the revenues gained by runner-up Indonesia. Reef visits directly contributed to around half of our coastal tourism in 2017 (with coastal visits making up some 44% of all tourism activity in Egypt), according to one study.

But with tourist development has come damage: Developers along much of the Red Sea coast are responsible for irreparable losses to coral reef cover, says Hanafy. Some establishments have destroyed or built on top of reefs, replacing them with marinas and sandy coasts, he says. In rare cases, the Environment Ministry has taken action on this. El Gouna developer Orascom Development Egypt (ODE) was slapped with a USD 34 mn fine last year for the alleged inappropriate and harmful disposal of building materials in the area, though the company has disputed the claim.

More hotels means more people — in itself a threat: The Red Sea coast has seen major hotel development in the last three decades or so (pdf), with some 88k hotel rooms now available in Hurghada alone, according to Colliers International’s latest MENA Hotels Review (pdf). But “there are limited capacities for the number of divers and snorkelers each of our dive sites can handle at a given time,” says Hanafy — and we are far surpassing that limit. Dive sites in the Red Sea can sustainably host 5k – 20k visitors annually, but some of our most popular sites are receiving over 200k divers a year, according to Hanafy.

Inexperienced divers and snorkelers can inadvertently cause harm: “Coral reefs are very fragile ecosystems. All it takes is a single point of contact [with a diver or snorkeller] to harm them,” Lina Challita, environment coordinator at the Tourism Ministry’s Chamber of Diving and Water Sports (CDWS), says.

Worse still than tourism is overfishing, which is the single largest local threat to reef ecosystems, according to Hanafy, who says we’re fishing at 10x the rate that would allow fish stocks to recover and marine life to remain stable. “What we’re currently seeing is upwards of 20k tonnes extracted annually, 60% of which comes directly from coral reef ecosystems,” he says.

Climate change threatens reefs the world over. Coral bleaching can lead to reefs’ permanent demise, while ocean acidification makes conditions unfavorable for growth. Under the Intergovernmental Panel on Climate Change’s most upbeat scenario — where global warming is contained to 1.5°C — coral reefs are still projected with “very high confidence” to decline by a further 70–90% by the end of this century, with losses increasing to 99% at 2°C of warming.

Some good news: Coral samples taken from the Northern Red Sea have proven particularly resilient to sea temperature rises, according to a 2020 study. Samples were able to withstand temperatures up to 6°C higher than usual without bleaching — an “exceptionally high bleaching threshold,” according to the study’s authors. The findings open the door for future study of these particular corals — which could possibly even be used to help rehabilitate damaged reefs elsewhere.

The economic impact of reef loss could be massive: Egypt could stand to lose some USD 5.6 bn of the USD 7 bn it generates from coral reef tourism annually by the end of the century, the High Level Panel for A Sustainable Ocean Economy predicts. Losses of this scale would mark a significant blow to the country’s GDP, 3.5% of which has been linked to reef-related tourism, according to the GCRMN report.

How did we get here? Insufficient economic incentives, poor marine regulation and weak data collection are partly to blame, the Environment Ministry report says—reasons which remain much the same to this day, according to Hanafy. This is partially because some 40% of industrial activity in Egypt takes place in coastal zones, the report adds. Meanwhile, local fishermen who have long relied on the Red Sea for their livelihoods often face limited alternatives for income — muting the impact of commercial fishing regulation, Hanafy explains.

So what is being done about it? HEPCA installs buoys at key dive sites to help reduce damage from commercial boat anchoring. They’re also trying to encourage growth by sinking dilapidated sea vessels nearby existing reefs for coral to latch onto, in a joint initiative with the Environment Ministry. The CDWS’ Green Fins program trains, advises and certifies scuba diving and snorkeling centers who are running “environmentally sound” operations, Challita says.

Clamping down on Red Sea fishing needs to become our main priority, says Hanafy. This will likely require more than an outright ban: Fishing communities will need to have alternatives to turn to for their livelihoods, he explains.

Your top climate stories for the week:

- Green hydrogen cooperation with Maersk: The Suez Canal Economic Zone has signed an MoU with Maersk to cooperate on green hydrogen production that could pave the way for Egypt to supply the shipping giant with fuel for its new generation of low-carbon vessels, according to a cabinet statement.

- Planned corporate green bond issuance delayed: Egypt’s planned USD 400 mn corporate green bond issuance could take place before the end of the year, rather than in 1H2022.

- More green national projects ahead: Green development projects will take up 50% of all national development projects in the budget by 2024, Youm7 reports Deputy Planning Minister Ahmed Kamaly as saying.

CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

15 February-15 June (Tuesday-Wednesday): ITIDA’s Technology Innovation and Entrepreneurship Center is organizing the first Metaverse Hackathon.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

Mid-March: Bidding for the construction of Anchorage Investments’ petrochemical complex in the Suez Canal Economic Zone starts.

14 March-30 June: The “Escape to Egypt” exhibition at the Coptic Museum, in celebration of its 112th anniversary.

24 March (Thursday): GB Auto Extraordinary General Assembly (pdf).

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers’ playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers’ playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

30 March (Wednesday): The Angola-Egypt Investment Roundtable discussion (pdf), the Hilton Cairo Heliopolis Hotel.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

31 March (Thursday): OPEC+ meets to review a modest oil supply rise.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

10 April (Sunday): Deadline for listed companies and NBFIs to submit quarterly ESG report.

11 April (Monday): The deadline to submit bids for Chelsea FC.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

21 April (Thursday): EGX-listed Taaleem will hold an extraordinary general assembly to discuss the mechanism to build and own nonprofit and private universities.

22-24 April (Friday-Sunday): World Bank-IMF Spring Meetings, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

1 May (Sunday): Suez Canal Authority raises tolls for different vessels.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

Early July: Polish President to visit Egypt.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

4-6 November: The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.