- Qatar is officially un-blockaded. (From the region)

- Business activity contracts in December on covid fears. (Sentiment)

- Daily covid cases in Egypt are plummeting. (Covid Watch)

- The 2020s ≠ the 1930s — but we’re in danger of a “lost decade,” the World Bank warns. (Economy)

- Foreign reserves grew at their fastest rate of 2020 in December. (Economy)

- Carrefour is coming to Omar Effendi. (Retail)

- CIB “very bullish” on Egypt’s securitization scene. (Debt Watch)

- Infrastructure: What’s to come in 2021? (Hardhat)

- Planet Finance: Wall Street is (too?) optimistic about ‘21 + KSA’s oil curveball

Wednesday, 6 January 2021

Qatar comes in from the cold. (Merry Christmas, everyone. See you back here Sunday.)

TL;DR

WHAT WE’RE TRACKING TODAY

Merry Christmas to everyone who will be celebrating today and tomorrow — we wish you a beautiful, relaxing day with family and friends.

Banks and the EGX are closing their doors tomorrow in observance of the national holiday, the Central Bank of Egypt and EGX said. We’re also off tomorrow and we’ll be back in your inboxes at the usual hour on Sunday.

The big news at home this morning: Qatar is, indeed, coming in from the cold under the Al-Ula accords signed yesterday. We have chapter and verse in this morning’s news well, below. In the first sign that Egypt is really on board with the truce: Qatar’s finance minister is reported to have quietly arrived in Cairo yesterday for the opening of the Nileside St Regis Hotel, developed by Qatari Diar.

The big news abroad: It’s a big day for the US of A as votes are counted in two races in Georgia that will determine the balance of power in the Senate. Meanwhile, Agent Orange is ramping up pressure on VP Mike Pence to throw the presidential election results out when Congress meets today to certify the results of the Electoral College vote count.

It’s going to be a nail-biter in Georgia: At dispatch time, the two GOP challengers leapfrogged the Dems who had been leading earlier in our shift. The New York Times says the results are so close that counting could drag on until some time later this week.

WEEKEND MUST READ- A compelling argument that the virus that causes covid escaped from a lab in China. Nope, we’re not joining the tinfoil hat brigade on this one — it’s plausible. And yes, we all need to be a bit concerned. Read the epic Lab-leak hypothesis in New York magazine.

Also epic, also a must-read: The mutated virus is a ticking time bomb by Zeynep Tufekci in The Atlantic. Ignore her at your own peril — she’s been ahead of much of the scientific community in her reporting on covid-19, starting with her entirely on-point argument that masking would be the best way of slowing the spread of the bug. (Remember when the WHO told us all that masks were overkill?)

|

CIRCLE YOUR CALENDAR-

- The government’s fuel pricing committee will announce new rates when it meets on Sunday, Oil Ministry Spokesperson Hamdy Abdelaziz said earlier this week.

- Inflation figures for December are due out on Sunday, 10 January.

- Flights from Russia: Russian inspectors are due in Hurghada Airport again this month as they continue to probe whether security procedures can allow the return of charter flights.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: Many industries in Egypt took a covid-19 hit in 2020, though the ones that digitized and diversified managed to thrive. As we kick off 2021, we look ahead to what’s gearing up to be a packed year for infrastructure, and what’s in store for key segments of the industry. Part two runs next week.

FROM THE REGION

Qatar is officially un-blockaded

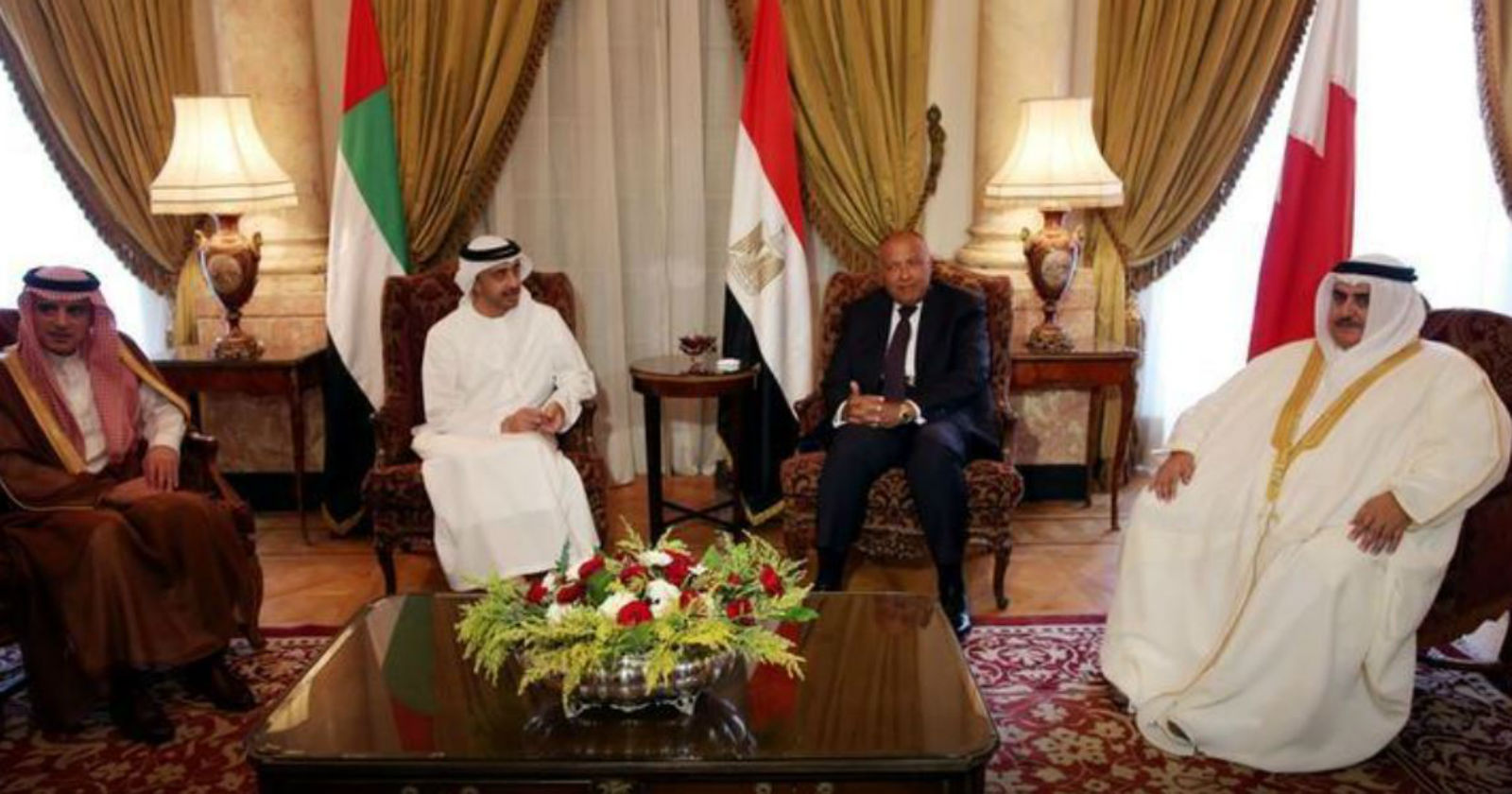

Egypt + the GCC have kissed and made up with Qatar: Egypt, Saudi Arabia, the UAE and Bahrain yesterday signed a declaration to end the diplomatic rift with Qatar. The inking of the Al-Ula accord at a summit in Saudi seems to have been spearheaded by the outgoing Trump administration and sees Saudi Arabia and its allies agree to bury the hatchet and restore full diplomatic, trade and travel ties with the statelet following 3.5 years of tension. Saudi foreign minister Prince Faisal bin Farhan called the accord a “very important breakthrough” that will “contribute very much to the security” of the region.

Egypt is on board with the agreement: Foreign Minister Sameh Shoukry, who attended the summit yesterday, agreed to the declaration and expressed Cairo’s keenness to maintain “solidarity between the Arab Quartet countries and [on supporting] their direction towards uniting,” a Foreign Ministry statement said. It also praised Kuwait’s mediation efforts to end the dispute.

Like Saudi, Cairo has reopened its airspace to Qatari flights: Qatari Finance Minister Ali Sharif Al Emadi landed in Cairo hours after the agreement was signed. He’s the first senior official to fly directly to Egypt from Qatar on board a Qatari jet since the crisis began in 2017, Masrawy said. His visit came as real estate developer Qatari Diar held the official opening ceremony of its St Regis Hotel on the Nile Corniche.

We have little information about what the countries have actually agreed to: Following statements by UAE foreign affairs minister Anwar Gargash yesterday, it’s clear that the quartet have had to compromise on some of their original 13 demands, which included closing a Turkish base, shutting down Al Jazeera, cutting links with the Ikhwan, and demoting ties with Iran.

All five countries are in wait-and-see mode, especially as they don’t know what to expect from the Middle East policy of a Biden administration, Yahduth Fi Misr’s resident pundit and politician Moustafa El Feki told Amer (watch, runtime: 6:18). A major concern some have is if the president-elect looks more favorably on Iran and less so on the Gulf, he added.

The Foreign Ministry had previously expressed subtle support for rapprochement, pledging cooperation with “sincere efforts” to resolve the dispute. It’s still unclear whether the agreement signed yesterday ensures reconciliation, or if there will be further negotiations.

IN OTHER DIPLOMACY NEWS-

As the sun sets on the Trump administration, US Treasury Secretary Steven Mnuchin was in Egypt yesterday for his final official visit. Mnuchin discussed the current status of the Grand Ethiopian Renaissance Dam (GERD) talks during meetings with President Abdel Fattah El Sisi and Irrigation Minister Mohamed Abdel Aty. The US had previously attempted to mediate the dispute but was accused by Ethiopia of siding with Cairo, resulting in Washington suspending about USD 100 mn worth of aid to Addis Ababa.

Mnuchin, who is currently on a regional tour that includes Egypt, Israel, the UAE, Sudan and Qatar, also appeared alongside Finance Minister Mohamed Maait and Qatari Finance Minister Ali Sharif Al Emadi to inaugurate the St. Regis Cairo Hotel, owned by Qatari Diar.

SENTIMENT

Covid bites once again

Egypt’s non-oil private sector recovery stalled again in December as covid-19 cases climbed steadily throughout the month, causing muted consumer demand, according to IHS Markit’s purchasing manager’s index (PMI) (pdf). The PMI gauge fell to 48.2 in December, down from 50.9 in November, signaling a “moderate deterioration” in business conditions as both output levels and new orders showed a “solid fall.” PMI readings above 50.0 indicate expansionary activity, while a reading below means it is contracting. Bloomberg also had the story.

December’s reading ended a three-month growth streak as the private sector activity began to recover from an all-time low in April. But even though there was a downturn, it was nowhere near the plunge in output and sales seen at the height of the pandemic.

Customers are still apprehensive of the uptick in cases and the possibility of another lockdown, with businesses surveyed saying that “fears of a ‘second wave’ of the pandemic and renewed lockdown measures meant some businesses held off from completing new orders,” said David Owen, economist at IHS Markit.

The drop in new orders “was a surprise” to businesses, which had begun stockpiling inputs in 4Q2020 as recovering activity built a pipeline of new orders. The accelerated stock building on an anticipated uptick in demand that didn’t pan out left unused inventory levels rising at the quickest pace since June 2012.

As a result, purchasing activity fell sharply and easing backlog pressures led to employment levels dropping at the strongest pace since August, “albeit still only moderate overall.”

Output prices rose only slightly in December, with some businesses cutting charges to attract new customers and orders. For those who did raise prices, “higher charges were generally linked to the pass-through of greater costs to clients, as raw materials such as copper and iron were sharply up in price.”

Amid the downturn, sentiment for the 12-month outlook was (kind of) a bright spot: The outlook for activity over the next year showed improvement last month as businesses placed their hopes on a recovery in 2021. “Optimism around effective covid-19 vaccines led the improvement, while there were also expectations of new contracts and business expansion.” That being said, overall sentiment was lower than the series average.

Meanwhile, in the Gulf:

- Saudi Arabia’s non-oil private sector showed “robust growth” last month, registering the highest reading in more than a year, according to the December PMI (pdf).

- Business activity in the UAE expanded for the first time since September as export orders and output accelerated, the PMI (pdf) showed.

ECONOMY

The 2020s ≠ the 1930s, but…

Global growth is expected to be slightly lower than previously expected as cases continue to accelerate in advanced economies, the World Bank has said in its semi-annual Global Economic Prospects report. Output will likely expand 4% in 2021, down from a 4.2% the Bank had forecast in its June report, before slowing to 3.8% in 2022.

That’s the optimistic scenario. What do they have for the bears? An “exceptional level of uncertainty” caused by the trajectory of the pandemic and the global vaccine rollout mean that growth could come in at just 1.6%. "In a more severe downside scenario including widespread financial stress, global growth could even be negative in 2021," it said.

After 2020 any growth is welcome — but the threat of a “lost decade” is real: Ayhan Kose, the bank’s acting vice president for equitable growth and financial institutions, told the Wall Street Journal that the actions of policymakers in the months ahead will shape the decade to come. “If history is any guide, unless there is substantial reform, we think the global economy is headed for a decade of disappointing growth outcomes,” he said. “The world can’t wait for everyone to be vaccinated to inoculate the global economy against another lost decade for growth … that means policy makers need to act and act aggressively to get ahead of the pandemic.”

What’s the prognosis for Egypt? Egypt’s economy is forecast to end the current fiscal year on 30 June with 2.7% growth, the World Bank said. Growth will be milder than the 3.6% recorded last fiscal year, but higher than previous forecasts of 2.3% and 2.1% the lender had penciled in October and June. The economy has avoided sliding into contraction thanks to reforms, solid policy buffers, “resilient” consumption patterns, international help, and mega-projects, but nonetheless has been “heavily disrupted” by covid-19. The collapse in tourism, natural gas extractives, and manufacturing dampened growth which will remain subdued until FY2021-2022 when the bank forecasts a return to pre-pandemic growth levels of 5.8%.

MENA faces “lasting economic scars”: The region is estimated to have contracted 5% in 2020, largely driven by both the pandemic-induced disruption and the collapse in oil prices and demand. Growth is forecast to rebound to 2.1% this year, provided the pandemic is tamed, global oil demand rises, geopolitical tensions are calmed, balance of payments remain stable, and policymakers continue to lend a helping hand. Despite this, the pandemic will cause long-term damage to productivity and capital accumulation, dampening economic growth in the years ahead.

The region’s oil-importers (including Egypt) are expected to bounce back with 3.2% growth in 2021 after collectively contracting 2.2% last year, but at the beginning of 2022 will remain 9% below levels projected at the start of the decade. Importers will be held back by “tepid investment,” contracting exports and industrial output, weak public finances limiting scope for stimulus, and reliance on tourism.

Oil exporters face a slower recovery: The bank expects growth among oil exporters to reach 1.8% in 2021 having contracted 5.7% last year. It expects the global vaccine rollout to finally put an end to the need for lockdowns, which will help to normalize oil demand. But the potential for delays in vaccination programs, further waves of covid outbreaks, and a sustained downturn in oil prices pose “significant risks” ahead.

From the EM-verse: The bank estimates output in emerging markets to have shrunk 2.6% in 2020, slightly worse than June’s expectations for a 2.5% contraction. The pandemic is expected to “inflict long-term damage” on EM growth prospects by putting a damper on investment and human capital, it said. Growth in EMs will, however, improve to a robust 5% in 2021, and will continue to outpace advanced economies the following year, helped by China, which is expected to grow 7.9% after having already been the only major economy to avoid contraction.

You can read the full report here (pdf), or visit the landing page here.

ECONOMY

We’re stocking up on greenbacks

Foreign reserves reached their highest level since April last month, rising almost USD 800 mn in December to top USD 40 bn, according to central bank figures released yesterday. This was the largest monthly increase in 2020.

Foreign reserves came under serious pressure amid the sell-off in emerging markets earlier this year: Egypt’s FX stockpile fell by around USD 10 bn between March and May when the central bank stepped in to cover portfolio outflows, meet debt repayments, and pay for commodity imports during the global selloff of emerging market assets. Reserves have now clawed back almost half of 2020’s losses, and remain more than USD 5 bn short of the USD 45.5 bn peak in February.

RETAIL

Carrefour is coming to Omar Effendi

Majid Al Futtaim-owned supermarket chain Carrefour is setting up shop in 14 Omar Effendi’s branches after MAF signed a cooperation protocol with the state-owned retailer, according to the local press. The agreement is part of Omar Effendi’s strategy to develop and upgrade its business by adding new products, introducing electronic payments, and automating their system. Omar Effendi has been tangled in disputes since 2011, when the Administrative Court issued a ruling scrapping several privatization agreements, including the sale of a 90% stake in Omar Effendi to Saudi’s Anwal United Trading Company.

Speaking of MAF: The mall operator is giving shoppers the option to pick up their purchases from a MAF mall or parking lot through a partnership with Via Drive Thru, according to a press release (pdf). People can order items from the Via application which will include several stores and avoid shop queues or the hassle of parking. The service will be available in all of MAF’s malls in Egypt: City Centre Alexandria, City Centre Almaza, City Centre Maadi, and Mall of Egypt.

DEBT WATCH

CIB’s securitization streak

CIB is “very bullish” on the outlook for Egyptian securitized bonds and is planning to continue tapping the market, our friends at the leading private sector bank tell us. CIB wrapped 2020 with a combined EGP 12 bn-worth of successful securitized bond sales under its belt after most recently closing securitized bond issuances for GB Auto’s Drive Finance and another issuance for Arabia Investment Holdings’ Rawaj Finance worth a combined EGP 1.2 bn at the tail-end of the year. The bank acted as sole advisor, arranger, bookrunner, and custodian, as well as a co-underwriter and participant for the two issuances. In the 15 years since CIB introduced securitized bonds as a debt instrument to the market, “the bank has successfully concluded 47 transactions with a total market share of 75%.”

COMMODITIES

Bring the bling

Aton Resources aims to open Egypt’s second operating gold mine at Hamama this year, CEO Mark Campbell said in a statement on Aton’s website. The Egypt-focused gold miner — which owns the Abu Marawat concession in the Eastern Desert — is gearing up for an ambitious exploration drilling and development program in 2021, which includes bringing in two new rigs for drilling at Rodruin, Hamama and elsewhere, and drill testing prospective exploration targets including Abu Gaharish, Sir Bakis, Bohlog, West Garida and Zeno, Campbell wrote. The company plans to spend USD 7-8 mn on its operations in Egypt this year, after getting a three-year extension to its Abu Marawat exploration license last year.

CABINET WATCH

Hit up Luxor and Aswan this winter

The Madbouly Cabinet signed off yesterday on a campaign to promote domestic winter tourism that will see national flag carrier EgyptAir slashing its airfare on domestic flights and hotels across a handful of tourist destinations also marking down their prices, according to a statement. The campaign will run from 15 January until 28 February in a bid to boost revenues for the tourism industry after tourism receipts last year fell to a third of their 2019 levels on the back of tourist arrivals tumbling 70% y-o-y because of the pandemic.

Also approved yesterday: A bill that will set up a specialized fund to benefit survivors of those killed or injured in terrorist attacks or any military operations.

STARTUP WATCH

Hit the books

Book summary and education platform Akhdar has raised a six figure sum from Nahdet Misr Publishing House’s venture capital arm, EdVentures, to add new learning tools to its app and improve its user interface, Wamda reports. EdVentures’ seed funding will be used to create an interactive gaming function and “to enrich the readers community with a smart and fun learning experience,” said EdVentures founder and Nahdet Misr CEO Dalia Ibrahim. Akhdar, which was founded in 2017, offers simplified audio and video explainers for “people who don’t have time to read,” according to co-founder Mohamed Osama. Akhdar currently offers educational resources for books across 16 genres.

MOVES

Abdel Raouf Farouk Ahmed has been appointed head of the Trade Ministry’s Industrial Control Authority (ICA), Youm7 reports.

THURSDAY KUDOS

Thursday Kudos (on a Wednesday): Shahid opens in Sudan, photographer gets global recognition

Our friends at Shahid Law Firm are setting up shop in Khartoum in association with Sudanese lawyer Yousra Elhassan Badi’s firm, according to a statement from Shahid. The Khartoum office, which begins operations on 1 February, comes after the US lifted its sanctions on Sudan, creating a window for Shahid to grow its regional presence in a market with a “changing economic and political landscape.” The firm will have a full range of services available, the statement reads.

CIB is disclosing its carbon footprint through the global nonprofit organization Carbon Disclosure Project, and completed last year the project’s climate change and water security questionnaire, the bank said in a statement. Some 9.6k companies have signed up to the CDP, which tracks the environmental impact of businesses around the world.

Also earning some kudos on this fine Christmas Eve:

- Egyptian photographer Somaya Abdelrahman’s work on FGM, which recently earned the Emerging Photographers Fellowship Award from international nonprofit Too Young to Wed and Canon USA, is getting some digital ink in the Washington Post.

- Upper Egypt’s first woman mechanic Lekaa El Kholy, who runs her own car maintenance repair shop in Luxor and organizes workshops for women in Tanta is being recognized by Reuters.

- Producer, scriptwriter and head of Cairo International Film Festival Mohamed Hefzy has been named in the Variety500 annual list of media and entertainment’s most influential business leaders.

ALSO ON OUR RADAR

Ceramic manufacturers have secured easier repayment terms for natural gas debts after the Oil Ministry agreed to let them pay over 10 years at 7% interest, the local press reports. The Egyptian Federation of Investors Associations has been lobbying the ministry to offer companies better terms and originally wanted a 15-year repayment period.

Two pieces of oil and gas news for you this morning: SDX Energy finally struck gas at its South Disouq concession in December and estimates to have found 24 bcf of gas at the exploration well, the company said yesterday. Meanwhile, United Oil and Gas has kicked off its first drilling campaign in Egypt this year with its ASH 3 development well at its Abu Sennan concession, it said in a statement. The oil well is expected to be cleared for production in two months time once testing and drilling is complete.

Other things we’re keeping an eye on:

- Sarwa Life Ins. Company has launched (pdf) its first fixed-income investment fund. It will be managed by Misr Capital and will invest in treasury bills, corporate bonds, sukuk, central bank certificates and repurchase agreements, and other short-term securities, with tenors of no longer than 150 days.

- Shuaa Capital is investing in music streaming service Anghami, as the fund directs its portfolio towards technology and services.

- Egypt Ventures invested EGP 104 mn last year in startups and accelerators.

COVID WATCH

Daily covid cases are continuing to fall, dropping to 1,119 yesterday from 1,277 the day before, according to Health Ministry figures. Cases rose to a recent peak of 1,418 on 31 December. The government has previously said it expects this second wave to start peaking some time in late December. The ministry also reported 55 new deaths yesterday, bringing the country’s total death toll to 7,918. Egypt has now disclosed a total of 144,583 confirmed cases of covid-19.

Nurseries may keep their doors open at their 50% capacity limit until further notice, but could close down if the cases spike, the Social Solidarity Ministry said in a statement.

The Tahya Misr Fund will set aside at least EGP 2 bn to subsidize vaccination, the fund’s spokesperson, Mohamed Mokhtar, told Ala Mas’ouleety’s Ahmed Moussa last night (watch, runtime: 14:46). The fund was assigned by the president to fully cover the cost of vaccines for healthcare workers, low-income senior citizens, and other vulnerable people.

The government has tapped 34 medical facilities across the country where the Sinopharm vaccine will be made available by the end of the month, El Watan reports. All 27 governorates will have at least one facility with access to jabs. Cairo and Giza will each have three locations equipped with the jab once the vaccination program is rolled out.

DONATIONS- The private sector is chipping in: Qalaa Holdings will donate EGP 30 mn to support the fund’s bid to pay for vaccines, Chairman Ahmed Heikal told Moussa (watch, runtime: 2:02). Kenwood kitchen appliances importer Union Trade (runtime: 3:04) will also donate EGP 5 mn, real estate player Pyramids Development (runtime: 4:00) EGP 2 mn, and businessman Ahmed Abou Hashima (runtime: 3:24) EGP 2 mn.

Some 21k people were fined EGP 50 for not wearing masks in indoor public spaces or public transport on Sunday alone — the first day of the newly introduced penalty, according to an Interior Ministry statement. Of those, 19k paid the fines on the spot, while the remaining 2k who were unwilling or unable to pay the fines and now face charges.

The UAE is showing the world what a good mass vaccination campaign looks like: The country has already vaccinated 8% of its population and aims to reach 50% by the end of the first quarter, Bloomberg reports. The GCC state has already administgered 826k shots to its 10 mn-strong population.

PLANET FINANCE

Optimism for the year ahead reigns supreme on Wall Street, as the world’s biggest banks and investment firms predict broad economic growth this year. Bloomberg has collected forecasts from 40 investment banks and asset managers on everything from covid and inflation to regulation and the greenback, and buoyancy is underpinning everything as we start the new year.

File this under ‘Obvious’: The positive sentiment is being driven by the belief that central banks will leave the stimulus taps on for the long-term, according to a Bloomberg quarterly policy review. The piece finds that no major western central bank will raise rates, with the key assumption being that policymakers will need to evaluate the strength of the economy before tightening policy.

Saudi Arabia threw oil traders a curveball yesterday after it announced unexpectedly that it would unilaterally cut production in February and March to support the oil market, Bloomberg reports. The kingdom will reduce output by an additional 1 mn barrels per day as of next month, lifting pressure on smaller producers to do likewise. Finding a way through the demand slump caused by the pandemic has been problematic for the loose ‘OPEC+’ alliance of exporters, many of whom have been unhappy about cutting their production quotas.

|

|

EGX30 |

10,830 |

+0.2% (YTD: -0.1%) |

|

|

USD (CBE) |

Buy 15.65 |

Sell 15.75 |

|

|

USD at CIB |

Buy 15.65 |

Sell 15.75 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,682 |

+0.2% (YTD: -0.1%) |

|

|

ADX |

5,143 |

+0.6% (YTD: +2.0%) |

|

|

DFM |

2,608 |

+1.2% (YTD: +4.7%) |

|

|

S&P 500 |

3,726 |

+0.7% (YTD: -0.8%) |

|

|

FTSE 100 |

6,612 |

+0.6% (YTD: +2.4%) |

|

|

Brent crude |

USD 53.66 |

+5.0% |

|

|

Natural gas (Nymex) |

USD 2.71 |

+4.9% |

|

|

Gold |

USD 1,952.70 |

+0.3% |

|

|

BTC |

USD 33,906 |

+9.7% |

The EGX30 rose 0.2% yesterday on turnover of EGP 1.4 bn (5.1% above the 90-day average). Local investors were net sellers. The index is down 0.1% YTD.

In the green: Ezz Steel (+5.1%), Qalaa Holdings (+4.8%) and Sidi Kerir Petrochemical (+3.3%).

In the red: Egypt Kuwait Holding (-3.7%), CIRA (-3.0%) and Edita (-2.0%).

Asian markets were mixed early this morning as traders awaited results from the US Senate run-off election. Futures have US markets falling in early trading.

Infrastructure: What’s to come in 2021? (Part 1 of 2): In 2020, Egypt saw some industries impacted by covid-19 supply chain disruptions, while infrastructure businesses able to digitize and diversify did well. We look at five key infrastructure areas — three today, two next week.

Water will remain our big security priority: With climate change and GERD negotiations threatening Egypt’s water security, government-led water conservation efforts are vital — and we expect the situation to grow in urgency throughout 2021. 2021 will see Egypt focus on saving water through three major projects, Irrigation and Water Resources Ministry spokesman Mohamed Ghanem told Enterprise:

#1- Expanding irrigation networks to reduce agricultural water use: The government will provide loans and technical support to farmers, their target area being 300k feddans. Egypt loses some bns of cubic meters of water through agricultural use, due to an aging network of canals and outdated irrigation methods.

#2- Making better use of rainwater for agriculture and electricity generation: An estimated EGP 6 bn may be invested in building and maintaining infrastructure to better use rainwater and protect areas that see heavy rainfall, says Ghanem. March’s Dragon Storm caused at least EGP 1.2 bn of infrastructure damage. What would it take to withstand another? (Hint: it’s expensive.)

#3- Installing utilities in selected informal areas: Assistant Minister of Housing Khaled Siddiq requested some EGP 19 bn from the Planning Ministry for 2021 to install utilities, and some EGP 10 bn is expected to be approved, he tells Enterprise. This includes one project targeting at least five areas in Greater Cairo, at an anticipated cost of EGP 5 bn, he adds.

Ambitious gov’t plans for desalination plant construction are moving forward too: Some 19 new desalination plants are scheduled for completion within 18 months, at an estimated cost of EGP 11 bn and with planned capacity of 550k cbm/d, Ater Hanoura, the Finance Ministry’s head of the private sector partnership unit, told Enterprise. The coming period will see tenders offered to the private sector for desalination projects, he adds. The government plans to spend some EGP 134.2 bn through 2050 to build seawater desalination plants providing some 6.4 mn cbm/d of water.

Renewables will also see a big jump start in 2021, with lots of investment and activity: With government plans to authorize 2.4 GW of renewable energy projects by 2022, at an implementation cost of USD 1.5 bn, we already know 2021 is going to be full of renewable energy developments. These include government plans to generate 300 MW of electricity from waste-to-energy (WtE) projects by 2025.

Several projects will be funded through green bonds, first issued in 2020: The 12 projects already allocated green bond funding include a 240 MW wind farm in Gabal El Zeit, a 50 MW PV project in Kom Ombo, wind energy projects in the Gulf of Suez, and solar energy projects in Benban, according to Mohamed Al Khayyat, head of the Renewable Energy Authority.

The focus isn’t just on electricity generation, but network transmission capacity and distribution: 2021 will see Egypt meet its energy needs in each area, with transmission and distribution projects launched as part of the FY 2020-21 economic plan, Ayman Hamza, Electricity Ministry spokesman, told Enterprise. This plan involves investments in electricity and energy projects — including the new smart grid — amounting to EGP 45 bn, according to the Planning Ministry.

Upping our electricity exports would free up capacity for renewables to form a bigger part of the energy mix: Egypt has some 58 GW of electricity generation capacity but peak demand ranges from 30-32 GW. The vast majority of our electricity generation comes from fossil fuels. So to meet current aims of producing 20% of our electricity from renewable energy by 2022, winding down parts of our fossil fuel-generation infrastructure is crucial. So is upping electricity exports.

So keep an eye out for electricity exports kicking off in 2021: Egypt could become a gateway between Africa and Europe to export electricity, Hamza previously said. Contracts to implement the linkage project with Saudi Arabia — allowing us to export electricity there — should be finalized this year, he now adds. The Sovereign Fund of Egypt (SFE) has been in talks to urge European investors and energy traders to invest in the EuroAfrica transmission link and import electricity from Egypt through Greece and Cyprus. and held talks to export electricity to Africa. The Egypt-Sudan electricity interconnection grid came online in April, and plans to extend its capacity from 300 MW to 600 MW were disclosed by Electricity Minister Mohamed Shaker in June, without further details given.

NEXT WEEK: We look at what you can expect this year in transportation, the natural gas revolution, technology and the “reconstruction” mechanism with Iraq, among other sectors.

Your top infrastructure stories for the week:

- Natural gas transition: The Central Bank of Egypt launched a multi-bn EGP program to encourage car owners to outfit their vehicles with dual-fuel engines, which will include reduced rates on loans and other incentives.

- Fueling stations: Taqa Arabia’s Master Gas and two state-owned players are working to expand the country’s network of natgas stations, to reach some 300 stations over the next three years.

- Telecom: Google and Telecom Egypt signed a subsea cable and crossing network agreement that will see the state-owned landline monopoly provide Google with a three meshed solution that connects several of TE’s cable landing stations in the Red and Mediterranean seas.

- Energy: Toyota and Siemens have both qualified to bid for the tender to establish a supervisory energy control center for the Alexandria Electricity Distribution Company.

- Logistics: Tenders to set up three commercial and logistics parks in Qalyubia will be offered to investors by the Supply Ministry’s Internal Trade Development Authority in 2021.

- Water: Egypt’s water consumption for irrigation purposes increased 10.2% y-o-y in 2019 to 40.2 bn cubic meters (bcm) compared to 36.5 bcm in 2018, the Central Agency for Public Mobilization and Statistics (CAPMAS) said in an annual bulletin (pdf). Check out our previous Hardhat article on the subject here.

CALENDAR

4-6 January: (Monday-Wednesday): The Go Green Exhibition to support the government’s campaign to convert vehicles to natural gas engines, Egypt International Exhibition Center, New Cairo.

7 January (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship in four venues in Alexandria, Cairo, Giza and the New Capital.

25 January (Monday): 25 January revolution anniversary / Police Day.

25-29 January (Monday-Friday): The World Economic Forum’s “Davos Dialogues” (virtual)

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic)

20 February (Saturday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day.

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labour Day (national holiday)

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

18-21 May (Tuesday-Friday): The World Economic Forum’s annual meeting “The Great Reset”

31 May-2 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo.

30 May-15 June (Wednesday-Thursday): Cairo International Book Fair.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June (Wednesday): June 30 Revolution Day

1 July: (Thursday): National holiday in observance of 30 June Revolution

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday)

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday)

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 October (Friday): Expo 2020 Dubai opens

6 October (Wednesday): Armed Forces Day

7 October (Thursday): National holiday in observance of Armed Forces Day

18 October (Monday): Prophet’s Birthday

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.