- Egypt’s maiden sukuk + green bond sales in the pipeline. (Speed Round).

- Analysts see Egyptian economy growing at a 3.1% clip in the 2020-2021 fiscal year, ahead of gov’t forecasts. (Speed Round)

- Private school tuition fee hikes capped at 7% -Shawki. (What We’re Tracking Today)

- Egypt reports lowest single-day covid death toll in almost six weeks. (What We’re Tracking Today)

- Egypt, Ethiopia and Sudan agree to continue GERD talks at leaders’ summit. (Speed Round)

- SODIC awards EGP 1.2 bn in contracts at flagship SODIC East development. (Speed Round)

- STMicroelectronics acquires IoT tech developer Riot Micro, with an Egypt twist (Speed Round)

- NUCA closes Egypt’s largest-ever securitized bond issuance. (Speed Round)

- Uber launches first intercity bus service here in Egypt. (Speed Round)

- How feasible is the plan to convert vehicles to natgas from gasoline on a national scale? (Hardhat)

- The Market Yesterday

Wednesday, 22 July 2020

Of green bonds and tuition caps to send you into your long weekend. See you back here on Sunday.

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to the last business day of the week.

The nation is sliding into a three-day weekend that begins tomorrow as we observe the anniversary of the 23 July Revolution, which will be a paid vacation day for both the public and private sectors, the Manpower Ministry said yesterday. Banks and the stock exchange will be closed tomorrow and will open their doors again on Sunday, the Central Bank of Egypt said yesterday.

We’re also off tomorrow and will be back in your inboxes on Sunday morning.

It’s official — public universities will begin the new academic year on Saturday, October 17 and the first term will wrap on Thursday, 21 January, the Supreme Council of Universities decided, according to a Higher Education Ministry statement. The council also approved the proposal to implement a blended learning system next academic year.

Private school tuition fee hikes capped at 7% -Shawki: Private schools will not be permitted to raise their fees by more than 7% in the coming school year lest the face legal repercussions, Education Minister Tarek Shawki told Ala Mas’ouleety’s Ahmed Moussa last night. Shawki also said next year’s examinations will likely use an “open book” format to emphasize comprehension rather than memorization and will be conducted online (watch, runtime: 21:58).

Universities will transfer more of their curricula online in the coming academic year to reduce footfall on campuses amid the covid-19 pandemic, the local press reports, citing Assistant to the Minister of Higher Education and Scientific Research Hisham Farouk.

Parliament to discuss additional support for tourism next week: Lawmakers will next week discuss the bill that would set up a fund dedicated to providing emergency financial support to the tourism sector, Vice President of the Federation of Chambers of Tourism Assem Wahid said, according to Al Shorouk. We assume that these will be committee-level discussions, given the parliamentary session has been adjourned until the middle of next month.

Are you an Egyptian living abroad? You can vote by mail-in ballot for the first time, it seems, rather than lining up to vote at the nearest Egyptian embassy or consulate to cast a ballot for then nation’s first Senate elections, National Elections Authority chief Lasheen Ibrahim said, according to Masrawy. You’ll need to register if you want to vote by mail. Do so between Saturday, 25 July and Friday, 31 July on elections.eg to be eligible to later download your ballot and participate in the 9-10 August poll for citizens living abroad. Mail in ballots will need to be sent via courier or express mail to meet the 12 August cutoff to be counted. Voters in Egypt go to the polls 11-12 August.

It’s time to take a sabbatical. Lawyer, author, podcaster and inveterate iSheep David Sparks recently wrote about his experience planning and taking a one-week sabbatical from work. In true workaholic fashion, Sparks doesn’t explain why he he’s talking about a “sabbatical” and not a “vacation,” but what he’s talking about is a break that (a) is more “vacation” than a typical academic sabbatical (in which you’re expected to spend a six months or a year engaged in research, writing or otherwise ruminating on matters professional while being relieved from your daily teaching duties), but still (b) includes more thinking about the future of work than one would normally do on a vacation.

How did it work out? Execs at all levels can learn from his conclusion that whatever qualms he may have had about his (kind of) week off, “I am going to build these slow weeks into my schedule going forward, though I am not exactly sure how often, or what I will call them.”

When was the last time you purposefully booked a slow week? Not a crazy four-day week so you can get a long-weekend on the coast. But a slow week at the office that gave you ample time to think about strategy, your business and what you want out of your career and life?

COVID-19 IN EGYPT-

The Health Ministry confirmed 676 new cases of covid-19 yesterday, bringing the country’s total infections to 89,078. There have now been 4,399 deaths after the ministry reported 47 new fatalities yesterday — the lowest daily death toll since 12 June. We now have a total of 29,473 cases who have fully recovered.

The Red Sea and South Sinai governorates have reported zero new covid-19 cases for a full day, a first since the outbreak of the pandemic, the Health Ministry said in a statement. Nine of 21 medical centers in Beheira governorate also reported no new cases for the first time, Al Masry Al Youm reports.

Covid shaved 5.7% off Egypt’s non-oil exports in the first six months of the year, with export sales down to USD 12.3 bn in 1H2020 according to figures from the General Organization for Export and Import Control. Egypt’s largest export market during the first half of the year was the Arab world, followed by the European Union.

Demand for so-called “immune boosters,” vitamins and nutritional supplements has dropped by 80% m-o-m so far in July as citizens feel less anxious about covid-19 according to an official at the Cairo Chamber of Commerce.

ON THE GLOBAL FRONT-

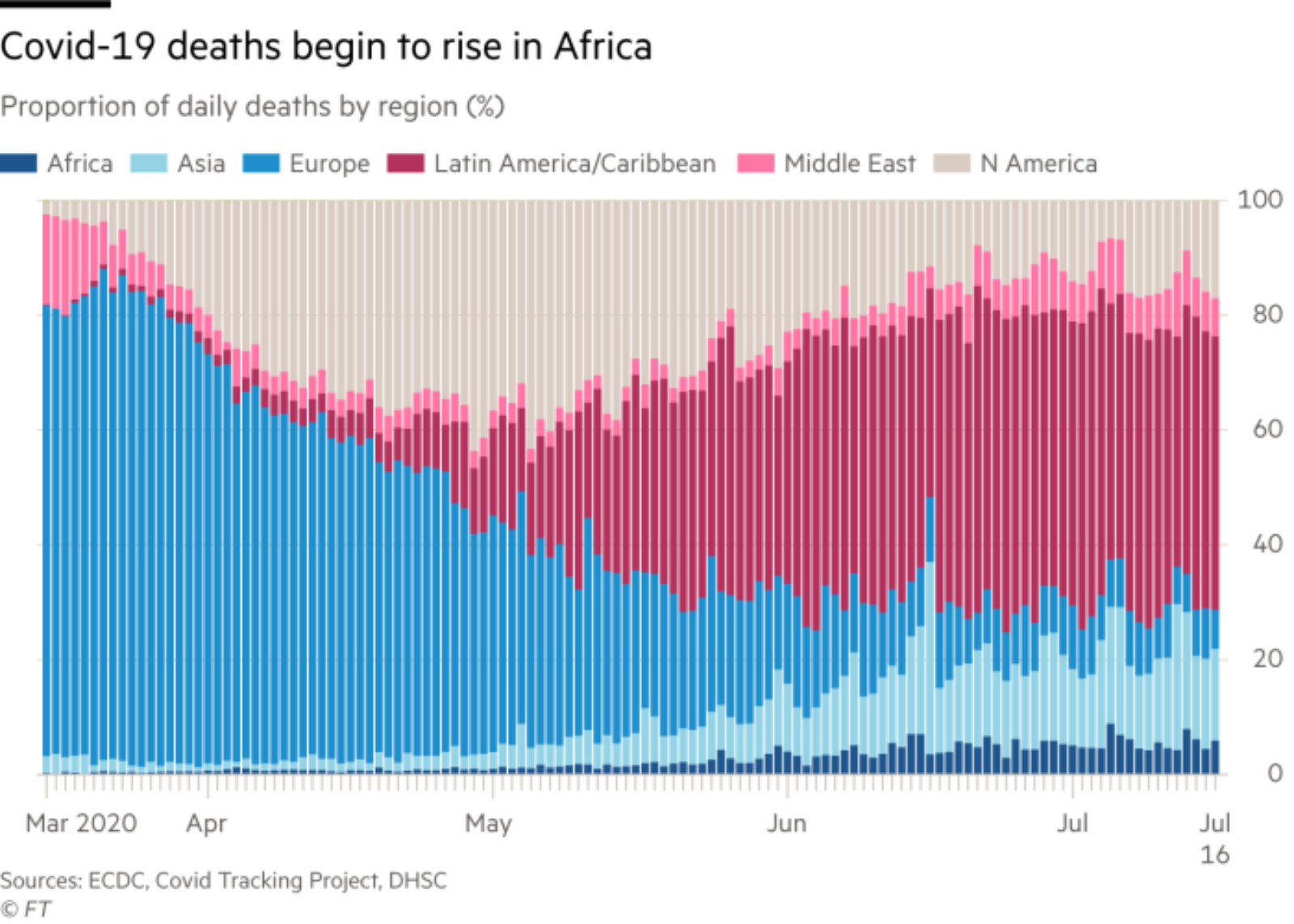

The virus may appear to be starting to wane in Egypt, but it is taking hold in Africa: Although initially being concentrated in five countries on the continent, cases of coronavirus have more than doubled in 22 nations in the past month while two-thirds are now seeing community transmission, the Financial Times reports.

Early trials from at least three vaccine developers are showing positive results in raising antibody count in the short term, but there remain questions about whether they will successfully provide widespread protection for a range of demographics, according to the NYT. Antibodies are reaching levels near those seen in recovered covid-19 patients in results from partnerships between Oxford University and AstraZeneca, China’s CanSino Biologics, and a JV between Pfizer and German BioNTech, but building real immunity to the virus will likely require a second dose of its vaccine.

We’re not entirely sure if Moscow also has a vaccine ready as conflicting statements emerged from the Russian defense and health ministries. While the country’s defense ministry claims to have a vaccine ready with plans to produce 200 mn doses with foreign partners by the end of this year, the health ministry denied that the trials are complete, according to the Moscow Times.

Have you had covid? You may only be immune for two-and-a-half months after catching it, according to a new study which finds that the half-life of covid-19 antibodies is just 73 days, Bloomberg reports.

Moderna execs are certainly not letting a good crisis go to waste: Executives at the US giant made mns dumping company shares in the days after it announced a breakthrough in its research for a vaccine, CBS News reports. CEO Stephane Bancel more than tripled the amount of shares sold through his executive stock plan after its share price surged 30% in May, netting him almost USD 4.8 mn.

GLOBAL MACRO-

EU agrees landmark stimulus package: EU leaders yesterday inked a EUR 750 bn (USD 860 bn) economic stimulus program after days of fraught negotiations that pitted hawkish northern countries against the corona-ravaged Mediterranean economies, Bloomberg reports. Following a night of talks, leaders agreed to disperse EUR 360 bn of low-interest loans and EUR 390 bn of grants to the hardest hit nations, one of the key sticking points for the so-called ‘frugal four’ countries which were concerned about the size of the package. In what EU president Charles Michel called a “pivotal moment” for the bloc, the agreement unlocks funds desperately needed by the highly-indebted southern economies wracked by the pandemic and sends a message that European nations are capable of acting in concert during times of crisis.

News of the agreement and covid-19 vaccine optimism spurred a leap in oil prices, with Brent crude up to USD 44.53 / bbl, on track for its biggest daily rise since mid-June at 3%, Reuters reports. Oil traded at closer to USD 60 / bbl before the pandemic took hold. Italian bonds and European stocks also gained yesterday, market data shows. European equities have outperformed US and global shares since the stimulus package was first announced in mid-May.

Over in the US, traders are asking: “What pandemic?” US stocks are continuing their stunning liquidity-fuelled recovery, with the S&P 500 turning positive year-to-date during Monday’s trading session, CNBC reports. Amazon shares surged 7.9% after a Goldman analyst raised the price target on the stock to USD 3.8k per share. The uptick added USD 13 bn to Jeff Bezos’ net worth.

But the market is increasingly resembling the 1990s tech bubble, bn’aire investor Mark Cuban told CNBC. “In some respects it’s different because of the Fed and the liquidity they’ve introduced and the inflation for financial assets that comes with that. But on a bigger picture, it’s so similar,” he said.

European banks are at risk of losing EUR 800 bn in non-performing loans as revenues plummet this year, the FT reports. A report by US consultancy Oliver Wyman sees junk debt more than doubling to EUR 400 bn if its base scenario — a drawn-out recovery that avoids a new round of lockdowns. “The pandemic is unlikely to cripple the sector” but banks will be “highly susceptible” to further instability and will clamp down on lending activity, said Christian Edelmann, co-head of European financial services at Oliver Wyman.

AND THE REST OF THE WORLD-

Saudi Arabia’s Al Othaim family is said to be looking to IPO its malls unit on the Tadawul, Bloomberg reports, putting the value of the transaction at up to USD 2 bn.

Private equity heavyweights are looking to Europe as the coronavirus continues to haunt the US. PE firms announced agreements worth USD 143 bn outside of the US during the first six months of the year, accounting for almost 60% of global total, according to data collected by Bloomberg. If the trend continues for the rest of the year, it will amount to the highest proportion in almost 20 years. In a further sign that the US has lost its luster for the biggest in the industry, there were no US businesses in the five biggest agreements for the first time since 2003.

(xxYE) The UAE launched its first ever Mars-bound spacecraft earlier this week, marking the Arab world’s first interplanetary space mission, the Associated Press reports. The spacecraft, Amal, was constructed in Boulder, Colorado by a group of Emirati and US scientists and took off from a Japanese launch site on Monday. Set to reach the red planet in seven months, Amal will be monitoring climate change while circling Mars for two years.

Enterprise+: Last Night’s Talk Shows

School tuition fees, GERD and thwarted terror attack all headlined the talk shows last night.

GERD negotiations are now talks about talks: Ala Mas'ouleety's Ahmed Moussa spoke with Alaa Al Zawahiri, a member of Egypt's technical team in the Grand Ethiopian Renaissance Dam (GERD) talks, who discussed the virtual summit yesterday between the leaders of Egypt, Ethiopia and Sudan. He noted the Ittihadiya statement which said the sides were committed to more talks to reach a legally binding agreement on the filling and operating of the dam (watch, runtime: 19:52), Masaa DMC’s Ramy Radwan spoke with Mohamed Hegazy, the former assistant to the foreign minister, to discuss the summit and its outcome (watch, runtime: 11:05). Yahduth Fi Misr’s Sherif Amer also covered the statement (watch, runtime: 3:47). We have more coverage of the GERD summit in this morning’s Speed Round, below.

The thwarted terrorist attack was all over the airwaves: Yahduth Fi Misr’s Sherif Amer (watch, runtime: 1:54), Masaa DMC’s Ramy Radwan (watch, runtime: 12:39), and Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 1:53) all covered the army’s announcement (warning: graphic content) that it had foiled an attempted terrorist attack on a security directorate in north Sinai’s Bir El Abd area, killing 18 terrorists. Two army personnel were killed and four others wounded in the attack.

Immigration minister discusses repatriation, Senate elections: Ala Mas'ouleety's Ahmed Moussa spoke with Immigration Minister Nabila Makram, who discussed repatriating Egyptians in Gulf states. She said that the United Arab Emirates, Saudi Arabia, and Kuwait each had their own set of regulations for allowing workers to return, and that the ministry was advising Egyptians on where to take PCR tests that are required for boarding flights. Makram also discussed the upcoming Senate elections, and how Egyptians abroad are eligible to vote, which includes registering with the National Elections Authority from 25-31 July (watch, runtime: 15:30). Radwan also covered the voting process for Egyptian abroad (watch, runtime: 2:23).

Red Sea governorate makes progress on covid: Amer spoke with the Red Sea governor Amr Hanafi, who discussed the governorate announcing zero covid-19 cases over 24 hours for the first time since the pandemic began (watch, runtime: 1:33).

Speed Round

Egypt’s maiden state sukuk + green bond sales are in the pipeline as gov’t eyes return to debt diversification strategy: The government is currently “in an advanced stage” of a USD 500 mn green bond offering in what would be Egypt’s maiden sovereign sale of the debt instrument, head of the debt management unit at the Finance Ministry Mohamed Hegazy tells Bloomberg. The ministry had tapped four banks earlier this year to manage and market the bond sale, which has been in the works for several months: Credit Agricole, Citibank, Deutsche Bank, and HSBC. Credit Agricole and HSBC were also hired as “structural advisors.” The issuance was originally slated for FY2019-2020 as the Egyptian treasury planted a flag amid its effort to diversify its sources of funding.

Also on the menu is Egypt’s first-ever issuance of sharia-compliant sukuk, Hegazy tells the business information service. The government is “waiting on final approvals” to begin selling the Islamic bonds, he said, without providing further information on when we can expect to see an issuance going to market. The government is also considering selling as much as EUR 7 bn-worth of USD- or EUR-denominated eurobonds during the current fiscal year, Hegazy said. Egypt closed a record USD 5 bn eurobond sale in May in what was the country’s largest-ever international issuance.

The diversification in debt instruments comes as the government is looking to get its comprehensive debt strategy back on track. The strategy, which the Finance Ministry began implementing in March 2019, relies largely on diversifying its debt instruments and borrowing currencies to widen its investor base and shifting towards longer-term debt. Egypt resorted to borrowing from the IMF and other international lenders to plug its financing deficit, which some analysts suggest has made it among the emerging markets that are most vulnerable to sovereign debt default in the next year.

Analysts see Egypt’s economy growing at a 3.1% clip in FY2020-2021, according to a Reuters poll, down from 3.5% in a similar survey the newswire carried in April. Economists have revised downwards their growth expectations as the economic fallout from the pandemic — including the drop in tourism, remittance inflows, and foreign direct investment — takes its toll. That still leaves Egypt on track to be one of the only countries in the region to grow its economy in the current fiscal year.

Despite the downgrade, the poll is still more optimistic than the government’s outlook: Planning Minister Hala El Said revised downwards the growth forecast for the current fiscal year to 2% in May, down from the 3.5% that was forecast in April. The April forecast was based on a scenario where the pandemic would have largely abated by June. The state budget for FY2020-2021, which was prepared back in November and before the pandemic broke out, had penciled in 4.5% growth. The Finance Ministry made it clear that the budget’s key figures, including growth assumptions, would be revised as the economic impact of the pandemic becomes clearer.

The economy is poised to bounce back next fiscal year, when economists see growth recovering to 5%. The pandemic will continue to be a drag on the economy through 1H2020-2021, but these effects will eventually begin to wear off and the economy will rebound by capitalizing on reforms that were put in place between 2016 and 2019, says HC Securities. Inflation is expected to average at 7% in FY2020-2021 and FY2021-2022.

It’s back to the drawing board on the Grand Ethiopian Renaissance Dam. The leaders of Egypt, Ethiopia and Sudan have agreed to hold more talks to break the impasse over the Grand Ethiopian Renaissance Dam (GERD). Their goal: a legally binding agreement over the filling of the dam’s reservoir and its operational rules, an Ittihadiya statement said. The decision was announced during a virtual mini-summit that marked the conclusion of the latest round of African Union (AU)-sponsored negotiations, which ended without the countries reaching an agreement.

Ethiopia voices optimism: Ethiopian Prime Minister Ahmed Abiy said on Twitter that the meeting was “fruitful.” “Ethiopia is committed to a balanced and win-win negotiation that ascertains the Abbay River will benefit all the three countries,” the PM’s office said in a statement posted on Twitter.

The GERD has already reached its filling quota for the first year: “It has become evident over the past two weeks in the rainy season that the GERD first year filling is achieved and the dam under construction is already overtopping,” the statement said. The dam is expected to take between 5-7 years to fill although the exact timeline for this remains one of the key points of disagreement between the three countries. Previous misstatements on the sensitive issue of the dam’s filling last week prompted Ethiopian TV to issue an apology and clarification.

Sudan also kept the tone upbeat: Sudanese Prime MInister Abdalla Hamdok described Tuesday’s summit as a “promising discussion” on Twitter, confirming that the parties had “reached an understanding to continue negotiations that aim to finalize the GERD filling and operating agreement.”

The AU will sponsor the next round of talks, Abiy’s statement noted. Current AU chairman, South African President Cyril Ramaphosa, said on Twitter that talks remain on track. There have been no reports of when the next round of talks would resume.

Background: The latest round of talks on GERD were sponsored by the AU, and ran from 3-13 July. They failed to reach an agreement. Ahead of Tuesday’s closing summit Ethiopia’s Water and Irrigation Minister Seleshi Bekele had said that the initial filling of the reservoir shouldn’t be part of the negotiations and that Addis Ababa would not accept negotiations that will lead to “legally binding” arrangements as they limit the country’s fair and equitable access to the Nile.

The story is leading coverage on Egypt in the foreign press this morning: Reuters | Associated Press | Bloomberg.

Upmarket real estate developer SODIC has awarded EGP 1.2 bn in contracts at its flagship SODIC East development to date since breaking ground on the project in 2018, according to a statement (pdf). More than 65% of the development’s single family homes now have a complete concrete skeleton, the statement says. Delivery is set to begin on schedule at the start of 2021 and infrastructure work is underway, SODIC boss Magued Sherif said. Sodic is positioning the community as an alternative for younger professionals seeking a “quality lifestyle” who have been priced out of the market in New Cairo. The master plan for the 655-acre development was designed by Massachusetts-based firm Sasaki.

In other news of SODIC: Act Financial, Concrete Plus raise their holdings in SODIC: Act Financial has increased its stake in SODIC to 3.2% while Concrete Plus Engineering and Construction now holds 1.75% of the company and Mohamed Hassan Allam a 0.27% stake, according to Al Mal. Act Financial is itself reported to be in the process of completing a EGP 100 mn capital increase with plans to make purchases in real estate, health and logistics companies during the coming period.

M&A WATCH- TMicroelectronics acquires IoT tech developer Riot Micro, including its chip design operations in Egypt: French-Italian electronics manufacturer STMicroelectronics has acquired Canada-based Riot Micro which develops wireless chips that are meant to build smart objects in the internet of things (IoT), according to Globe Newswire.

The cool part: Riot Micro set up shop here in Egypt back in 2014. Cairo is where a bulk of its chip design and engineering operations happen. STM is also planning to establish a local presence as part of its acquisition of Riot Micro, with plans to expand its footprint here, we’re told.

DEBT WATCH- NUCA closes EGP 10 bn securitized bond offering: The New Urban Communities Authority has closed its three-tranche, EGP 10 bn securitized bond issuance, Al Mal reports. The issuance was the largest of its kind in Egypt; proceeds are earmarked to finance development of new urban areas including the new administrative capital and New El Alamein. The European Bank for Reconstruction and Development (EBRD), Qatar National Bank, Attijariwafa and Suez Canal Bank all participated in the issuance.

About the issuance: The three-tranche issuance is comprised of a EGP 2.6 bn, three-year offering; a EGP 6.2 bn, five-year offering; and a EGP 1.2 bn, seven-year offering. The bonds are backed by EGP 10 bn of receivables from private sector real estate developers. CIB, the National Bank of Egypt, AAIB and the Housing and Development Bank are financial advisors and lead arranger for the transaction. Dreny & Partners was legal counsel.

DEBT WATCH- Raya Holding is looking at another potential securitized bond offering around the end of this year or at the beginning of 2021 for three of its subsidiaries — Raya Electronics, Aman Financial Services, and Aman Microfinance, according to the local press. No further details were provided. Raya closed earlier this week a four-tranche, EGP 562 mn securitized bond sale with a weighted average yield of 10.78%.

Ride-hailing app Uber has debuted an intercity bus service in Egypt, the company announced (pdf) this week. The service, which is already operational, runs between Cairo and Alexandria as a first phase and will be expanded to other governorates in the coming months. The service is accessible through the regular Uber app, where riders can make reservations for any of the eight daily trips per day, with some 9 pick-up and drop off points across both cities. Uber had also piloted its bus service in Egypt back in 2018, which CEO Dara Khosrowshahi told us at the time came as Egypt was one of the fastest-growing markets for Uber and made sense for the company to cater to a wider customer base.

We could be hear the details of the government’s consumer-spending initiative within a week, if local press reports citing government officials are anything to go by. According to the officials, the initiative — which is designed to stimulate EGP 100 bn-worth of consumer spending over three months, starting from the end of July — will initially cover durable goods and food commodities.

Background: The government announced last week a package of measures designed to support consumer spending and end the demand slump caused by the pandemic. The government has made agreements with manufacturers and merchants to offer 15-25% discounts on consumer goods for all citizens, and will spend between EGP 10-12 bn to subsidize a 10% discount for ration card holders. A new fund will also be used to back up to EGP 2 bn in consumer loans and mortgages in an effort to encourage lending, and provide cheap financing for consumers to engage in government projects such as the installation of dual-fuel engines into cars.

The Public Enterprises Ministry and GB Auto have ended talks to jointly manufacture an alternative to tuk-tuks, Al Mal reports, citing an unnamed government source. Word that GB Auto and the ministry were negotiating a potential agreement came earlier this year after the government said in 2019 that it wanted to phase out the three-wheeled vehicles for natural gas-powered mini bus alternatives. The ministry appears to be seeking a private sector entity to partner with state-owned El Nasr Automotive to manufacture the vehicles, as the ministry pushes for more public-private partnerships.

PRIVATIZATION WATCH- Restructuring plans for Holding Co for Maritime to be complete this year: A consortium of consulting firms tapped to evaluate the Holding Company for Maritime and Land Transport is expected to complete a restructuring and development plan for the company and its subsidiaries by the end of 2020, a consultant on the strategy tells Al Mal. The consortium comprises US-based Brisk, France’s EFESO, and Egypt’s Eissa Law Firm. The holding company had begun talks with international firms last year for the planned restructuring, which is now expected to cover 11 of its subsidiaries. The restructuring plans come as the Public Enterprises Ministry has been pushing a privatization drive for several months, which could see private investors snap up management rights for three state-owned bus companies.

Stories worth noting in brief this morning:

The Electricity Ministry is temporarily shelving plans to potentially export electricity to Iraq and Syria citing challenges in the two markets, Al Mal reports, quoting unnamed ministry sources. Egypt had been planning to sell 500 MW of electricity to Iraq and Syria through a power linkage with Jordan.

Prime Minister Mostafa Madbouly has ordered a plan be drafted to develop Al-Raha valley in St. Catherine into a tourism hub, according to a cabinet statement.

The Supply Ministry is forming a committee to set prices for subsidized bread and flour prices from next month, Al Shorouk reports.

Egypt in the News

The agreement between Egypt, Ethiopia and Sudan to resume GERD talks yesterday is leading coverage on Egypt in the foreign press: We have the full story in this morning’s Speed Round, above. Elsewhere, the UK Independent speculates about the likelihood of a direct conflict between Egypt and Turkey in Libya, while Egypt gets mention in connection with Libya in a Financial Times opinion piece headlined Donald Trump’s allies race for gains in a combustible Middle East.

Worth Watching

New 3D map of universe sheds light on “gap” of 11 bn years: A new comprehensive 3D map of the universe compiled from data gathered by the Sloan Digital Sky Survey (SDSS), tracks its expansion from the Big Bang to the present, capturing some 4 mn galaxies, and helping scientists fill in gaps in their knowledge of cosmological history while also raising novel questions about the fundamental laws of nature. Some 11 bn years in the mid-period of the universe’s expansion, previously unaccounted for, can now be seen and explained. However, the new data also reveals a different expansion rate in the current era compared to the early millenia, giving scientists a new puzzle to solve.

Diplomacy + Foreign Trade

Egypt is shoring up Russian support in Libya after Foreign Minister Sameh Shoukry yesterday discussed Egypt’s proposal to end the Libyan conflict during a phone call with Russian FM Sergey Lavrov. Egypt’s proposed roadmap to peace — known as the Cairo Declaration — has received lukewarm responses from the US and the EU for being outside the Berlin process. Shoukry yesterday insisted that the proposal complements the UN-led peace plan and is the option preferred by Libyans, ministry spokesperson Ahmed Hafez said in a statement. This comes a day after ex-foreign minister Nabil Fahmy said that the government should look to Moscow to influence the conflict in its favor, rather than Washington.

Egypt purchased 115k tons of Ukrainian wheat in an international tender yesterday, Reuters reports. State grain buyer the General Authority for Supply Commodities was looking to buy an unspecified amount of the commodity for shipment from 21-31 August in yesterday’s tender.

How feasible is the plan to convert vehicles to natgas from gasoline on a national scale? The government recently announced an ambitious multi-year plan to replace car engines powered by traditional fuels with dual-fuel engines that run on both gasoline and natural gas. Although promising for the automotive sector in the long term, experts we spoke with said that the project faces several challenges in the short term, from securing financing for conversion to inadequate infrastructure.

In the first part of our two-part series we explore where the plan came from and explore challenges the pro-environment policy will face.

Background — we are not starting from scratch: The newly announced project is very similar to an older and successful scheme that emerged in 2009 to replace some 70k old black and white cabs by offering new, subsidized vehicles and no-interest payment plans along with funding to outfit the new vehicles with dual fuel engines. The program has remained up and running ever since, but participation has been voluntary, unlike the new initiative, which the president intimated this month would make vehicle licensing conditional on cars being equipped with natgas engines.

The idea has been on the table for a while. Last year, President Abdel Fattah El Sisi said the government was working to promote natural gas-powered vehicles through the Oil Ministry and the SMEs Development Authority. Throughout the year, several manufacturers have expressed interest in helping out. The Arab Organization for Industrialization (AOI) approached 11 global auto companies to partner on replacing diesel buses with natgas-powered vehicles. Japan’s Toyota Tsusho Corporation agreed to manufacture 240k natural gas-powered minibuses while Volkswagen said it was interested in manufacturing natgas cars in Egypt.

Why has the government decided to pursue the project now?

#1- Alleviate financial pressure on middle and lower classes: Coming after a period in which some 74% of the population saw a drop in income, the usage of natgas instead of gasoline or diesel would help citizens drastically cut fuel costs, Mohamed Hanafi, managing director of the consultancy Lynx, told Enterprise. While the price of 92-octane is EGP 7.50 per liter and 80-octane is EGP 6.25, natgas is sold to vehicles at only EGP 3.5 per cubic meter. Consumers who use an average of 10 liters of gasoline a day would save EGP 825-1200 a month using natgas.

#2- Cut the oil import bill: Egypt imports about 35-40% of its total consumption of oil products through long-term agreements and tenders. Last year, for example, Egypt spent USD 6.8 bn importing 11.7 mn tonnes of oil products to bridge a gap in the consumption estimated at 30.2 mn tonnes of fuel.

#3- Maximize the use of surplus natgas: Egypt is now a net exporter of liquefied natural gas (LNG), bringing imports to zero in 2019 whilst exporting USD 1.24 bn-worth of LNG — a near 150% y-o-y increase as more output from gas fields is connected to the national grid. However, the viability of our current LNG selling prices were doubted earlier this year, pushing the Oil Ministry to explore long term contracts to sell gas at USD 5/mmBtu in response to falling gas prices. Households and cars account for only 5% of total gas consumption in Egypt, a source in the Oil Ministry told Enterprise. Hanafi also noted that even if the figure was to quadruple, cars would only end up consuming a fraction of the total consumption. The project can also be expedited by allowing the entry of the private sector by the Gas Regulatory Authority granting more licenses for companies to use the national gas pipelines, as per the regulations amended in 2018, and distribute and sell gas directly to consumers. Shell had already requested earlier this year to use the national pipeline and is awaiting the approval of the market regulator and the cabinet to move ahead with the project, though the process could take several years.

#4- Reduce pollution, improving the environment and quality of life: There is a global trend, especially in Europe, of moving towards natgas as an alternative to gasoline to reduce pollution, Professor of Petroleum Engineering at AUC Gamal El Kaliouby told Enterprise. Government estimates in 2011 suggested the previous program had contributed to a significant drop in the capital city’s total carbon emissions in the first six months it was in place. The World Bank said in 2018 that the program cut 310k tons of CO2 emissions between 2013 and 2017, and forecast this number to rise to 350k tons by the end of that year.

But the shift will not be easy: Financing the conversion of old cars would come at a huge cost. The government has estimated that 1.8 mn cars will either be converted or replaced at a cost nearing EGP 320 bn. Lynx’s Hanafi told Enterprise that the first stage would see 147k cabs and microbuses fitted with dual fuel engines, costing EGP 1.2 bn and taking up to three years at a cost of EGP 1.2 bn, followed by substituting 240k diesel microbuses — a process that would require EGP 53 bn. The next step would involve replacing 50k cabs over 20 years’ old at a cost of EGP 10 bn. The biggest challenge in financing will be converting 1.3 mn passenger cars to run on natgas, as it would come with a price tag of EGP 8k-12k per vehicle, totalling about EGP 250 bn.

In Part 2 we look at how these challenges can be overcome and the cost of developing the infrastructure for it. We also speak with auto industry players to get their take on the extent of the disruption to the auto industry, and what they would need to get on board with the plan.

Your top infrastructure stories of the week:

- European Investment Bank to fund transport upgrades: More than half of the EUR 1.9 bn of EIB funding agreed last week will be allocated to public transport infrastructure.

- Joint Egypt-Saudi electricity grid delayed to 2023: The Egyptian-Saudi electric interconnection project has been delayed by two years and is now expected to be operational at the end of 2023.

- New logistics zones: The Supply Ministry plans to set up new logistics zones for commercial supply chains in South Sinai.

- Metro railcar purchase postponed: The National Authority for Tunnels has postponed its purchase of railcars for Cairo Metro Line 4 to 15 September.

- CPC invests in Sadat City industrial zone: Saudi Arabia’s Construction Products Holding Company has invested EGP 300 mn into its infrastructure development project for the Sadat City industrial zone

The Market Yesterday

EGP / USD CBE market average: Buy 15.92 | Sell 16.02

EGP / USD at CIB: Buy 15.92 | Sell 16.02

EGP / USD at NBE: Buy 15.92 | Sell 16.02

EGX30 (Tuesday): 10,558 (+1.7%)

Turnover: EGP 1.3 bn (41% above the 90-day average)

EGX 30 year-to-date: -24.4%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.7%. CIB, the index’s heaviest constituent, ended up 2.7%. EGX30’s top performing constituents were Porto Group up 9.3%, Palm Hills up 3.3%, and Sidi Kerir up 3.3%. Yesterday’s worst performing stocks were Ibnsina Pharma down 3.8%, Egypt Kuwait Holding down 0.4% and Credit Agricole down 0.4%. The market turnover was EGP 1.3 bn, and regional investors were the sole net sellers.

Foreigners: Net long | EGP +15.2 mn

Regional: Net short | EGP -22.0 mn

Domestic: Net long | EGP +6.8 mn

Retail: 55.7% of total trades | 53.5% of buyers | 57.8% of sellers

Institutions: 44.3% of total trades | 46.5% of buyers | 42.2% of sellers

WTI: USD 41.96 (+2.82%)

Brent: USD 43.96 (+1.57%)

Natural Gas (Nymex, futures prices) USD 1.68 MMBtu, (+2.07%, August 2020 contract)

Gold: USD 1,841.92 / troy ounce (+0.01%)

TASI: 7,417 (+0.54%) (YTD: -11.59%)

ADX: 4,256 (+0.43%) (YTD: -16.14%)

DFM: 2,088 (+1.14%) (YTD: -24.46%)

KSE Premier Market: 5,420 (-0.2%)

QE: 9,396 (+0.26%) (YTD: -9.87%)

MSM: 3,746 (+0.51%) (YTD: -12.67%)

BB: 1,302 (+0.73%) (YTD: -19.08%)

Calendar

23 July (Thursday): 23 July revolution anniversary, national holiday.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

5 August (Wednesday): IHS Markit PMI for Egypt released.

9-10 August (Sunday-Monday): Egyptian expats vote by post in Senate elections.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 August (Thursday-Saturday): RiseUp from Home digital event. Pre-registration available here.

20 August (Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.