- EGX30 extends rally in first session after CBE rate cut. (Speed Round)

- Gov’t mulls industry-wide development tax for the automotive industry. (Speed Round)

- EFG Hermes lands role on Saudi Aramco IPO. (Speed Round)

- Glamera raises USD 250k in seed round. (Speed Round)

- Dice wants EGP 200 mn in overdue export subsidies. (Speed Round)

- Machine learning and big data analysis to transform white-collar jobs. (Worth Reading)

- Waste collection mobile app Dawar launches today. (What We’re Tracking Today)

- Gov’t detains noted activist Alaa Abdel Fattah. (Speed Round)

- Get the lowdown on just about everything business-relevant the House will discuss when it convenes this week for its new legislative season. (Spotlight)

- The Market Yesterday

Monday, 30 September 2019

Last week’s sell-off a thing of the past as EGX30 surges 3.3%.

TL;DR

What We’re Tracking Today

We’re one trading session into the week, and so far so good. The EGX gained another 3.3% yesterday, continuing last week’s late rally to claw back losses in a torrid Sunday-Tuesday sell-off. The EGP also strengthened against the USD on the back of Thursday’s interest rate cut and improving sentiment among investors about the country’s political climate. We have more details in this morning’s Speed Round, below.

Our elected representatives will trudge back to the House of Representatives tomorrow fresh for the start of the final legislative session of the current parliament. We have a full round-up of key legislation we expect to be on the government’s agenda for the coming months in our Spotlight section, below.

Indicators we’re keeping our eye on as we head into October:

- PMI: The purchasing managers’ index for Egypt, the UAE, and Saudi Arabia will be released on Thursday, 3 October at 6:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release net foreign reserves figures for August this week or next.

- Monthly inflation figures for September are due at the end of next week. Inflation cooled for the second consecutive month in August to 7.5%, marking the lowest reading in six-and-a-half years.

Among the conferences taking place in the coming days:

- The launch of the Mediterranean Business Angels Network is taking place at the three-day Techne Summit 2019, which wraps up today at Bibliotheca Alexandrina.

- The three-day China Trade Fair Egypt finishes today, bringing more than 195 Chinese manufacturers to the Cairo International Convention Center to meet with Egyptian businessmen.

- Beltone is running an investor conference in Dubai this week.

Waste collection mobile app Dawar launches today: Environ-Adapt and the Environment Ministry are launching their Dawar mobile app today. The app allows users to report garbage on Cairo’s streets and direct authorities to clean it up, Al Mal reports. It links to the Waste Management Authority, the relevant district office (hayy), Cairo Governorate, and the Environment Ministry, which will jointly coordinate pickups. The app has been in beta testing in Maadi and Tora for the better part of a year.

It looks like our friend Lamees Al Hadidi is returning to the small screen on 20 October with a new show called Cairo Now (El Qahera Al Aan) on Al Arabiya Al Hadath channel, Al Shorouk reports. The show, which will cover local and regional affairs, will air on Sundays and Mondays from 21:00 to 23:00 pm. We’ll be adding business-relevant segments of Lamees’ new show to our Last Night’s Talk Shows roundup.

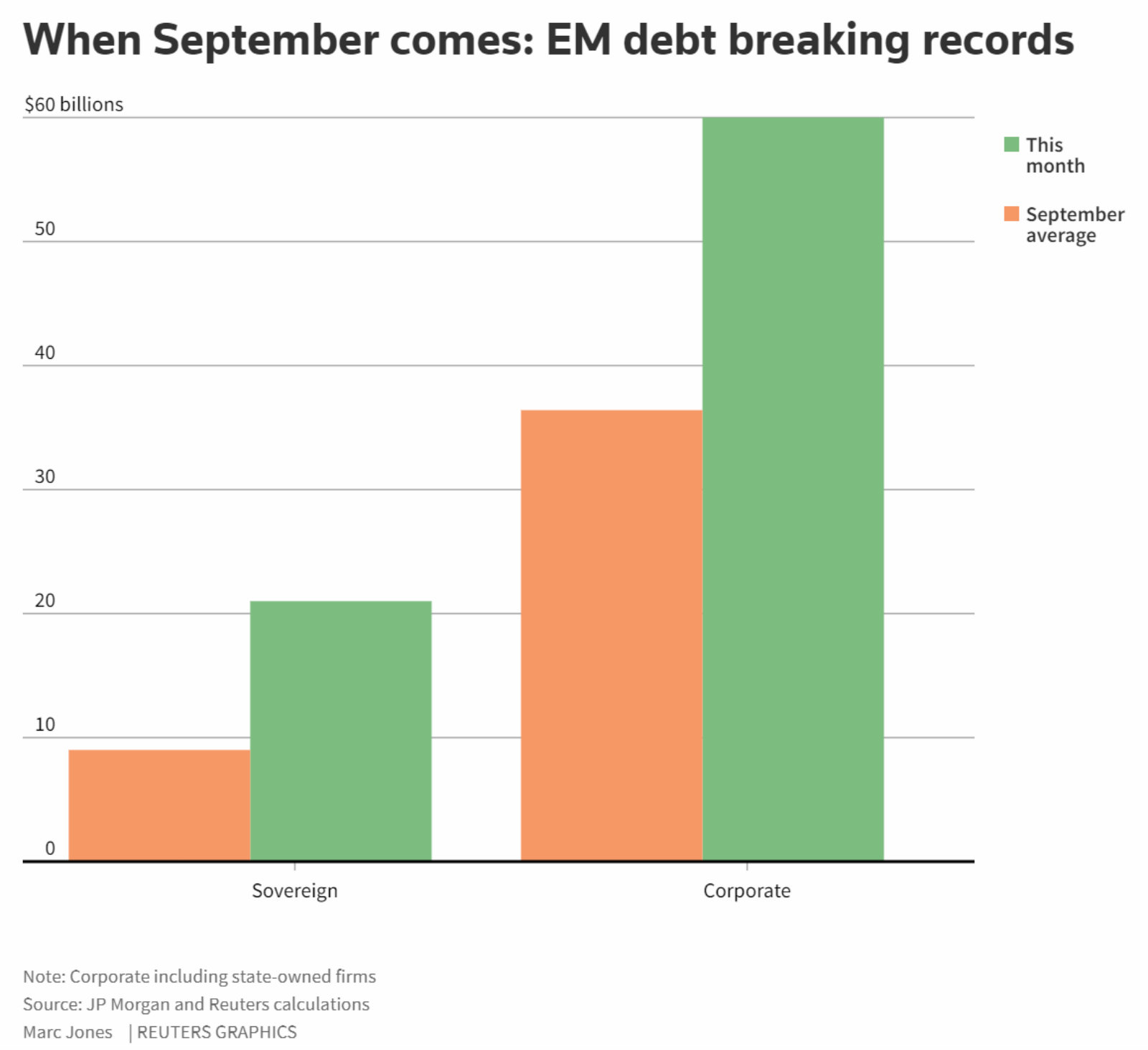

EM debt issuance breaks records in September: Corporate bond issuances in emerging markets broke September records last week as companies and governments took advantage of record low borrowing costs, Reuters reports, citing JPMorgan data. Corporate issuances reached USD 60 bn on Thursday, surpassing the previous record of USD 53.9 bn set in 2017. The average amount raised in September in recent years has been USD 36.4 bn. Meanwhile, sovereigns sold more than USD 21 bn in bonds during the month, more than double the USD 9 bn issued during the previous six Septembers. “It has been an exceptionally heavy week for issuance,” Koon Chow, EM macro and FX strategist at UBP, said. “I think people are having a bit of trouble digesting it all.”

Nasdaq gets tough on Chinese IPOs: Nasdaq is limiting new offerings by Chinese companies due to a small number of Chinese investors crowding out US market players, Reuters reports. Listed Chinese companies tend to have a low trading volume due to the fact they raise the bulk of their capital from Chinese investors who hang onto their shares. Nasdaq is worried that a more illiquid stocks will drive away the large institutional investors it is trying to attract. The rule change comes as the US-China trade war continues to simmer.

WTO’s Airbus ruling this week could escalate US-EU trade spat: The World Trade Organization is this week expected to allow the US to impose tariffs on USD 7.5 bn of European goods in retaliation for bns of USD in illegal subsidies allegedly given to Airbus by the EU, Reuters reports. The EU will not be able to respond until next year when the WTO rules whether the EU can slap the Americans for playing the same type of subsidy game with rival aerospace firm Boeing. The Donald has already slapped tariffs on European steel and aluminium and has threatened to expand them to include cars and car parts.

Support for impeaching The Donald increases bigly: US public opinion is shifting in favor of an impeachment investigation into Donald Trump’s alleged attempt to convince Ukraine’s prime minister to investigate political rival Joe Biden. (Axios)

Don’t know your fusion from your fission? Bloomberg has you covered in this long-form article that delves into the history, the science and the possible future of a technology that could one day be the solution to our growing climate crisis.

April 2020 is D-Day for companies in the streaming war: HBO, NBC and Jeffrey Katzenberg’s video app Quibi will all launch next April in what Axios suggests will be a “decisive moment for the future of television.”

Enterprise+: Last Night’s Talk Shows

The EGP flexed its muscles against the USD yesterday, rallying on the first market day after the central bank cut key interest rates by another 100 bps in last week’s MPC meeting (watch, runtime: 02:22). The EGP strengthened to 16.31 against the greenback on Sunday compared to 16.38 on Thursday.

The EGX30 picked up where it left off last week, rising 3.3% during the session and reversing some of the losses it made during a sell-off last week that saw it drop 11% following protests the week before. We have more on both these stories in our Speed Round, below.

President Abdel Fattah El Sisi urged the government yesterday to complete the Grand Egyptian Museum by the agreed time and in accordance with international standards, Al Hayah Al Youm’s Lobna Assal highlighted (watch, runtime: 01:28). The museum is scheduled to open in 4Q2020.

Speed Round

Speed Round is presented in association with

EGX30 extends rally after CBE loosens monetary policy: The benchmark EGX30 index climbed 3.3% at session close yesterday in response to the central bank’s 100 bps interest rate cut on Thursday and muted protests over the weekend. All of EGX30 shares rose yesterday, led by Qalaa Holdings, which surged 13.7%. Index heavyweight CIB rose 2.5%. The EGX30 has now rallied for three consecutive sessions following last week’s abysmal performance when the first three trading days of the week saw it nosedive 11% on the back of investor anxiety about protests, almost wiping out 2019 gains. A recovery on Wednesday and Thursday helped the index claw back some of the losses, finishing the week down 6%.

A quiet weekend and the CBE rate cut are driving the rebound, Bloomberg quoted Naeem Brokerage’s Allen Sandeep as saying. Investors “miscalculated” the risk of political instability which caused them to dump stocks, he said. Raffaele Bertoni, head of debt capital markets at Gulf Investment Corp, added that, “The repricing of near-term political risk through a sell-off in Egyptian assets has already happened and investors should continue to look for confirmation that the good macro story is intact before taking any more aggressive positions in the country.” Reuters also took note of the recovery.

The EGP strengthened on Sunday to 16.31 to the greenback compared to 16.38 at the end of last week, CBE data showed. Banking sources told Reuters the appreciation was driven by inflows sparked by last week’s interest rate cut. “We are seeing hot money flooding the gates before the yields go down any further,” an unnamed banker told the newswire. “The EGP carry trade is still the most attractive in the world.”

Commentary on last Thursday’s interest rate cut continues to roll in: Beltone Financial said in a note yesterday it expects the Central Bank of Egypt (CBE) to sustain its monetary easing cycle in the coming months, with “a favorable base effect and EGP strength” helping to keep inflation rates within the CBE’s targets through the end of the year. Beltone doesn’t expect the currency to rally beyond the EGP 16 / USD 1 mark, with limited fluctuations that will help keep inflation in check and allow for further rate cuts. The firm sees another 50 bps rate cut at the Monetary Policy Committee’s next meeting in November, with a further 300 bps worth of cuts coming in 2020.

Falling interest rates and slowing inflation will provide a boost to consumer spending, HC said in a research note yesterday (pdf).

EXCLUSIVE- Gov’t mulls industry-wide development tax for the automotive industry: The government is considering imposing a development tax on all imported and locally produced cars, two government sources told Enterprise. The idea of a sliding tax that varies with engine size is now being discussed by a ministerial committee tasked with revamping the so-called automotive directive, which would offer a measure of protection to domestic assemblers facing competition from EU, Turkish and Moroccan imports

At the same time, the committee is debating whether to lower import duties on non-EU cars while simultaneously hiking taxes across the board. Car imports from the EU are now entering Egypt at zero customs.

So how would this help local assemblers? The short answer: rebates. Under one model now being discussed, the two sources said, local assemblers could become eligible for a rebate of the full development tax if they meet one of three conditions: hike production output from their assembly lines; “significantly” increase their production (or use of) locally made car parts; or export more.

Look for this to go before the House, the source said: The measures would collectively require approval by legislators.

Background: We’re having flashbacks to the old automotive directive, which was designed to allow local manufacturers to better compete with EU, Moroccan and Turkish imports that receive customs breaks here in Egypt. The previous legislation had stalled last year in the House, in no small part thanks to extensive lobbying by EU car importers. This had led the government to quit seeking new legislation for the auto industry and provide incentives through amendments to the Customs Act.

Is EFG getting a slice of the Aramco pie? EFG Hermes has reportedly landed a gig as joint bookrunner in Saudi Aramco’s anticipated IPO, according to Bloomberg. Our friends will reportedly be working alongside global investment banks Bank of America, Citigroup, Credit Suisse, Goldman Sachs, JPMorgan Chase, and Morgan Stanley, who are serving as joint global coordinators. Sources said last week that the oil giant could kick off the process around 20 October ahead of a potential listing on the Tadawul in November, contradicting statements earlier in the week that the blockbuster IPO is being shelved due to the recent attacks on the company’s facilities.

Aramco’s post-attack recovery could face new challenges as it ramps up production at offshore fields to compensate for the loss of output at Abqaiq and Khurais, writes Bloomberg oil strategist Julian Lee. “All three [alternative] fields produce heavier grades of crude… Until those two plants are able to operate at their per-attack [sic] levels Saudi Arabia’s crude export slate will remain heavier, on average, than it was last month and the kingdom will likely continue to ask its customers to accept heavier alternatives to the grades they initially sought,” he writes.

STARTUP WATCH- Glamera raises USD 250k in seed round: Egyptian beauty services startup Glamera has raised USD 250k in a seed funding round from an unnamed Saudi-based angel investor, reports Menabytes. The Glamera app — which was founded earlier this year by Mohamed Hassan, Omar Fathy, and Zafer Alshehri — allows users to book appointments and sessions at beauty salons, clinics, spas, and gyms. The platform currently allows users to book appointments at 200 service providers in Cairo, Hassan told Menabytes. The startup is planning to launch in Alexandria later this year.

Dice wants a piece of the Export Subsidy Fund: Dice Sport and Casual Wear has said the government owes it EGP 200 mn in overdue export subsidies and has requested payment under the newly-implemented EGP 6 bn subsidy export framework, Al Mal reported. The company said it is owed EGP 125.8 mn from the government in overdue payments for 2018.

Background: Egypt last week inked undisclosed settlement agreements with Schneider Electric and Sumitomo Tires under the Export Subsidy Fund. The government has received 100 requests from companies to settle around EGP 900 mn worth of overdue subsidy payments through the new mechanism. The government has said large companies could speed up their repayments by announcing future investment plans in Egypt.

Noted activist Alaa Abdel Fattah detained: Alaa Abdel Fattah, a journalist, blogger and developer whose activism predates the 2011 revolution, was arrested on Sunday. He was reportedly detained while inside a police station to which he reports daily at 6pm for a 12-hour stay as part of his parole six months ago after having completed a five-year sentence related to his activism. His sister Mona Seif wrote on social media that Abdel Fattah had been detained by national security officers. A security source told Reuters that Abdel Fattah had been arrested on charges of spreading rumors and encouraging protests. His lawyer, Mohamed El Baqer, was also arrested on Sunday, according to Seif and another lawyer, Amr Imam.

The story is getting wide attention, having been picked up by the Associated Press and the Financial Times. Meanwhile, Sudan’s foreign ministry has summoned Egypt’s ambassador to Khartoum after demonstrators there called yesterday for the release of a Sudanese student reportedly arrested in Egypt, Agence France-Presse reports. RT Arabic also has the story.

Background: Nearly 2k people have been detained since protests two weekends ago.

Spotlight

The House of Representatives will reconvene for the fifth legislative session on Tuesday, 1 October. This will be the final legislative cycle before parliamentary elections are held at the end of 2020.

We maintain a legislative tracker that keeps tabs on bills the government could introduce, with a heavy focus on business and economy-relevant legislation. Here’s what we expect this fall and winter:

TAXATION- The Madbouly Cabinet looks to continue making significant changes to the tax system in the coming months as it pushes ahead with amendments to the VAT and Customs acts. There have been suggestions the Income Tax Act itself could be brought before MPs for changes, but it is still unclear if this will be ready during the current legislative cycle. All in all, we expect plenty of changes on the tax front this session.

VAT Act changes: A number of officials have told us this year of plans circulating in the ministry to impose VAT on digital businesses, including social media, online search ads, and download sites. A source told us in August that the government could place a 5-10% schedule tax on social media and internet search ads on top of the standard 14% VAT rate. Maait said in July that the ministry is looking to amend the VAT Act, assuring us that no changes will be made to the headline rate. While nothing is graven in store, expect the VAT to be a key part of the legislative agenda over the coming months, with public hearings and a review by House representatives expected to take place during the current legislative cycle.

Customs Act amendments: Long-awaited changes to the Customs Act are expected to make a comeback during the fifth legislative cycle after the government requested that the bill be withdrawn and amended further. The amendments could expedite clearance through a white list of importers and a revamped system of temporary clearances. They could also broaden the powers of customs clearance agents as well as provide an alternative pathway to settle customs disputes.

New incentives for EGX listings: Plans to introduce new incentives for companies to list on the EGX are currently in the drafting phase and reportedly close to being finalized by the ministry, we learned last month. Egyptian companies would see their tax bill cut in half for seven years if they list 35% or more of their shares on the exchange. Finance Minister Mohamed Maait is expected to review the package in the coming weeks.

Plans afloat to bring back capital gains tax: Sources told Enterprise in July of plans to restore the 10% capital gains tax (CGT) on gains made trading EGX-listed shares; the measure has been suspended and is currently scheduled to come into effect in May 2020. Resident investors could enjoy full exemptions from the CGT and stamp tax under a proposal now in the works, while non-residents would see stamp tax reduced to 0.1% from 0.15%. The proposal still seems to be with the cabinet, but sources said that it would be introduced to the House in the coming legislative cycle.

Unified tax payment system: A draft bill to reform the tax payment system was approved by the cabinet in July and is now awaiting parliamentary review. The legislation would establish a single system for filing returns for income tax, stamp duty and VAT, as well as billing for and paying tax.

SMEs Act: Progress on the government’s flagship legislation to convince the informal economy to go legit has been slow this year, with the Finance Ministry originally hoping to pass the bill to the House in 2018. Inter-ministerial negotiations over the shape of tax incentives ground on until April, when we got word that the finance and trade ministries had finally agreed on a package. The Council of State approved the bill and sent it to the cabinet in June. We currently understand that the act will include tax and non-tax incentives, including exemptions from the stamp tax as well as the fees to register contracts to set up companies and credit facilities for five years from the commercial registration date. SMEs would also be exempt from land registration fees for their projects, among other things. The act will set up a tier system based on an SME’s revenues that would set a flat tax for each tier. These flat rates will be reassessed every three years.

One big note: When the government says “SME” legislation, it’s generally talking about folks who play at the low end of the “small” in SME.

On the subject of SMEs: The FRA is looking to make SME-dedicated lenders subject to the 2014 microfinance law in a series of new amendments approved by the regulator in May. The changes would also introduce a new EGP 20 mn capital requirement for SME lenders. The Central Bank of Egypt granted the first license to a SME lender, CDC Group, in June. Amendments to make this law currently sit with cabinet for approval.

Open questions:

Will we see a new Income Tax Act this legislative cycle? Finance Minister Mohamed Maait announced that the government had begun working on a new income tax law at the end of July, and an initial draft was finished towards the end of last month. Not much is known about what the ministry is proposing, but Tax Authority head Abdel Azim Hussein told Enterprise that the bill will amend the procedure for filing tax returns, change how tax appeals are handled, and reform the ministry’s internal tax committees. Maait has explicitly ruled out tinkering with tax rates, but the Cairo Chamber of Commerce is pushing for the ministry to raise the nil-rate band to EGP 24,000 per year, from a current EGP 8,000. The draft is now being sent for public consultations before going to the cabinet, but a government source tells us that no fixed deadline has been set for when the legislation will make it to the House.

Amendments to the Universal Healthcare Act: The Finance Ministry is considering making further changes to the Universal Healthcare Act that would set an across-the-board limit on the healthcare tithe paid by businesses to fund the new universal healthcare system, two government sources told Enterprise earlier this month. The amendments would see businesses pay the 0.25% levy on revenues, but the payment would be capped at EGP 10,000, regardless of the size of the company or its revenues.

BUSINESS AND ECON- You can expect the regulatory framework for finance to change significantly, with amendments to the Banking Act expected to make their way to the House. Sweeping changes to the insurance landscape are also in the cards with the coming of the new Insurance Act, which could expand the powers of the Financial Regulatory Authority as the sector’s regulator. And speaking of the FRA: Look for it to be made an autonomous agency this legislative cycle. Meanwhile, consumer finance is expected to be regulated for the first time, and you can expect legislation regulating “new” industries including medical tourism and electric vehicles.

Banking Act: Legislation granting the Central Bank of Egypt increased oversight of the banking sector and strengthened corporate governance regulations has been in the works for a while now and finally made its way to cabinet in May. Probably the biggest revelation this year was the news that the legislation could impose strict new capital requirements on domestic and foreign banks, as well as foreign exchange bureaus. Commercial banks could be forced to hold 10x more (EGP 5 bn) in their capital reserves, while foreign banks may see their requirements triple to USD 150 mn. The act will also impose term limits on board members at state-owned banks — not on managing directors as was rumored earlier this year — as well as introduce new licensing requirements for crypto businesses. The bill was expected to enter the House at the end of May but as far as we know is still being reviewed by the cabinet.

Insurance Act: New legislation giving the Financial Regulatory Authority (FRA) oversight over the insurance sector has been in the pipeline since 2018, and has been in the consultation stage for much of 2019. From what we know so far, the act would grant the FRA significant new powers over licensing, business formation and board composition, and monitor bank deposits. Provisions to raise minimum capital requirements by as much as 733% remain intact, much to the chagrin of insurance companies which came out against the proposals earlier this year.

New mandatory insurance covers: Recent amendments to the legislation would make insurance mandatory in 21 cases, according to Masrawy. These cover everything from electronic and non-banking financial transactions, to insurance on utilities, health insurance for students, and more controversially, marriage. The last thing we heard, the FRA was scheduled to hand the final draft to cabinet for approval in September.

Consumer Credit Act: New legislation that would set up a federation for non-bank consumer finance and require companies to obtain a license from the FRA to sell goods on installment was approved by the cabinet in February. All consumer finance players would be subject to the Consumer Credit Act, but retailers and manufacturers would only fall under the act if more than 25% of their annual sales are made on installment plans. The House Economic Committee greenlit the draft in June following consultations. House representatives are expected to discuss the law further with the expectation that the House general assembly will vote on the act in the coming legislative cycle.

Legislation granting FRA autonomy: Legislation that would grant Financial Regulatory Authority (FRA) Act operational autonomy is expected to be revisited during the next cycle. The bill, if passed, would give the authority status as a separate legal entity with its own balance sheet. The authority’s head would be appointed by the president and would effectively have cabinet rank. The law had been introduced during the fourth cycle, but had been delayed during public hearings, as companies expressed concern that this would grant the FRA sweeping powers, a source from the House tells us.

New central clearing company for Egyptian debt: The Madbouly Cabinet’s economic group approved in June establishing a new central clearing and depository company, which is expected to handle all the clearing and registry of government debt issuances, as well as collect taxes from these issuances.

Public Enterprises Act amendments: A package of amendments to the Public Enterprises Act remains in the drafting stage, a year after Public Enterprises Minister Hisham Tawfik announced the legislation. Plans to remove listed companies that are 75% government-owned from the act were revealed in April, and are meant to improve governance for companies slated as part of the state privatization program and increase appetite for them.

PPP Act amendments: The Finance Ministry completed amendments to the PPP law in June. The changes would make it easier for private sector firms to participate in public-private partnership (PPP) projects by eliminating competitive bidding in favor of direct negotiations, allowing unsolicited proposals, and broadening the range of projects on offer. The legislation should be introduced to the House in the coming legislative session.

Real estate developers could face new regulation: Fresh legislation announced by the Housing Ministry at the start of the previous legislative session to regulate real estate developers is currently being reviewed by the government and industry stakeholders. The bill would create a new federation for the sector armed with licensing powers and set up an insurance fund to protect consumers. Companies were understandably unhappy to learn of proposals to fine and jail developers which miss deadlines. This is a key issue to be resolved before the bill passes to the cabinet for approval.

Amendments to the “old rent” law: Amendments to the old rent law, which would increase rents on pre-1996 commercial contracts, were sent back to the House Housing Committee in June after causing “wide controversy” in parliament. The legislation is also expected to be expanded to encompass non-residential leases. The amendments will be re-introduced to the House in the coming session.

Medical tourism legislation: A bill to regulate the medical tourism industry was placed on the legislative agenda back in December. The legislation would create a national authority for the industry, and it appears to require the government to develop a plan to market medical tourism abroad. A draft of the bill was recently completed by the House Tourism Committee and it will be discussed in the upcoming legislative cycle, according to Al Shorouk.

Regulating electric vehicles: We learned in January that the House Energy Committee was close to completing legislation to regulate the import and sale of electric vehicles. While we have heard nothing from the House on the new legislation, we have heard that the Madbouly Cabinet approved this month legislative amendments to the Industry Act that would set up a regulatory framework (including standards and quality control measures) for the industry, according to Veto Gate.

IN LIMBO- There are a number of business and econ-related bills that seem to have been consigned to legislative limbo. These include:

- Fast-tracking international arbitration cases: The House Legislative Committee was said to be reviewing a proposed law in October that could accelerate the investor dispute resolution process during cases where the Administrative Court attempts to reverse the privatization of state-owned companies. Provisions would grant the prime minister the power to transfer such cases to the Investment Ministry’s dispute resolution committees for arbitration.

- Trademark Act amendments: The Trade Development Authority said last year that it was working on draft amendments to the trademark law to provide better protection to investors and consumers. The current status is unknown.

SOCIAL AND POLITICAL- The government is expected to make strides in overhauling the cash subsidies system this year, but it appears that the House’s social and political legislative agenda will be focused on protecting personal data and combating fake news.

Cash Subsidies Act: The Social Solidarity Ministry revealed in July that a new Cash Subsidies Act would command the government to review subsidy rolls once every three years in an effort to keep track of ineligible beneficiaries. The bill also tightens eligibility criteria, and mandates the government to assist the ineligible in finding work. It was even reported that no new recipients to the cash subsidy program would be added until the act is passed by the House. The ministry said on the penultimate day of the previous legislative session that it would send the bill to the House for approval but this doesn’t appear to have happened.

Data Protection Act: The House is due to review the Data Protection Act when it returns this month. The bill will introduce minimum one-year prison terms and fines ranging between EGP 100k and EGP 1 mn for any company caught illegally collecting, trading or disclosing personal data.

Combating fake news: The deputy house speaker announced plans to draft an “anti-fake news” act in March in which a newly-established body would monitor media and internet propaganda. The House ICT Committee, which is currently drafting the legislation, will include the death penalty as a punitive measure is certain cases, committee chair Ahmed Badawy said, according to Al Masry Al Youm.

Egypt in the News

The conversation about Egypt in the foreign press continues to be driven by the prospect of additional protests, with international outlets largely agreeing that videos by former government contractor Mohamed Ali are fanning the flames of underlying grievances, including rising poverty and a lack of space for expression. Many put forward the view that the high level of arrests will not help restore stability, pointing to Sunday’s re-arrest of high-profile activist Alaa Abdel Fattah while under probation. (Agence France-Presse | Deutsche Welle | The Conversation)

Other stories to skim this morning:

- Prioritizing palaces: The Arab Weekly wades into the controversy over El Sisi’s presidential palaces, quoting the recently-arrested Cairo University professor Hassan Nafaa to argue that the government should focus more on alleviating poverty, and and improving healthcare and education.

- Child abuse in the spotlight after five-year-old tortured to death: The death of a five-year-old girl who was burned and tortured by her grandmother after being [redacted] assaulted by her father is being used to highlight child abuse issues in Egypt by Gulf News.

- Brits missing in Cairo: UK police are assisting family members search for a British woman and her daughter who went missing in Cairo over two weeks ago, reports Yahoo News UK.

- Thai student arrested: A Thai student was arrested in Cairo last week for suspected links to Daesh, the Bangkok Post reports.

- Museums galore: CNN travel has gathered a list of 11 up and coming museums in Egypt showcasing a variety of artifacts, palaces, historical people, religious areas, and cultures. In keeping with the museum theme, the Times explores some of the ancient treasures that are being taken to the Grand Egyptian Museum, set to open at the end of 2020.

Worth Reading

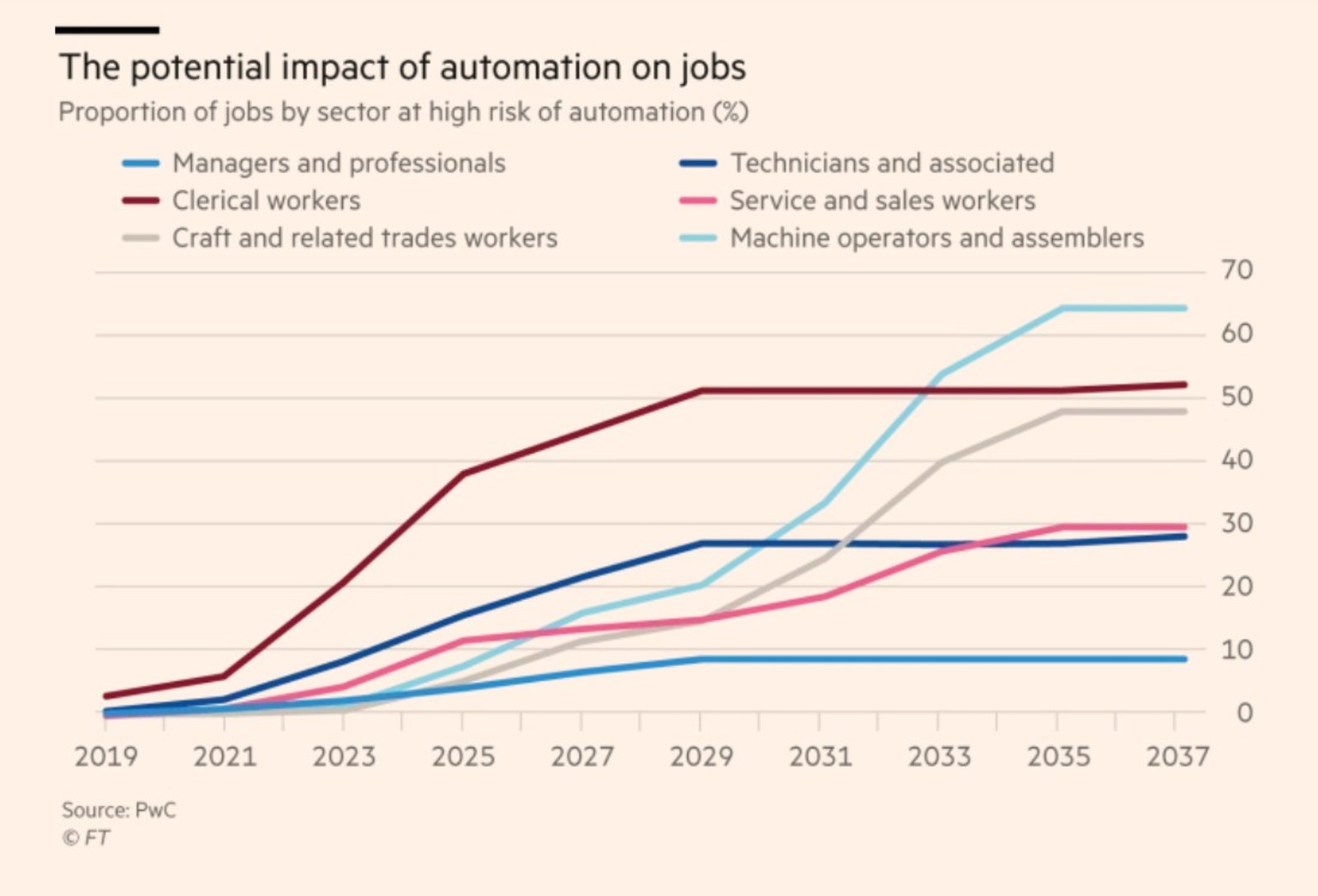

Machine learning and big data analysis set to transform white-collar jobs: White-collar jobs may be swept away faster by digital change than in any previous economic transformation, but employees will reap the benefits of machine learning, writes Robert Wright in the Financial Times. As machine learning systems become more sophisticated, their ability to spot patterns in large pools of data, undetectable to humans, opens up new possibilities for workplace efficiency and productivity. The change is expected to impact more than basic jobs, instead extending to previously unforeseen areas like law, that were thought to be immune to the robot takeover because they require more judgment and analysis. Nearly a third of jobs in finance and insurance in developed economies may be automated by 2029, as well as 50% of all clerical roles, research from PwC shows.

But the robots learn slowly, and probably can’t supplant us entirely: Whether it’s complex analytical and sorting work — such as the assessment of insurance claims — or using motor-like skills to lift a piece of wood, machine learning systems need time and a lot of human feedback to learn. While cost-effective in the long term, they are cost- and effort-intensive in the short term. So although it is straightforward for workplace systems to automate standardized processes or conduct a relatively superficial analysis of documents, anything that requires greater nuance, flexibility, judgement, or relationship-building is still dependent on human input. The automation of white-collar jobs will therefore likely happen at a slower rate than predicted, says the head of global research and development for the law firm Baker McKenzie, with new technologies being gradually introduced alongside employees, rather than replacing them.

Diplomacy + Foreign Trade

Shoukry rallying int’l support to resolve GERD gridlock: Foreign Minister Sameh Shoukry brought up the Grand Ethiopian Renaissance Dam (GERD) negotiations in several meetings with other foreign ministers during the UN General Assembly in New York last week after President Abdel Fattah El Sisi called on the international community to help Egypt, Sudan, and Ethiopia reach a resolution. Shoukry expressed Egypt’s “dissatisfaction with the prolonged talks” to the Russian, Dutch, Finnish, South Sudanese, Senegalese, and Burundian foreign ministers in separate meetings.

The Market Yesterday

EGP / USD CBE market average: Buy 16.19 | Sell 16.31

EGP / USD at CIB: Buy 16.21 | Sell 16.31

EGP / USD at NBE: Buy 16.23 | Sell 16.33

EGX30 (Sunday): 14,316 (+3.3%)

Turnover: EGP 939 mn (38% above the 90-day average)

EGX 30 year-to-date: +9.8%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 3,3%. CIB, the index’s heaviest constituent, ended up 2.5%. EGX30’s top performing constituents were Qalaa Holdings up 13.7%, Ezz Steel up 9.1%, and Sidi Kerir Petrochemicals up 7.4%. The market turnover was EGP 939 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -106.0 mn

Regional: Net long | EGP +32.3 mn

Domestic: Net long | EGP +73.6 mn

Retail: 70.3% of total trades | 73.9% of buyers | 66.6% of sellers

Institutions: 29.7% of total trades | 26.1% of buyers | 33.4% of sellers

WTI: USD 56.02 (+0.2%)

Brent: USD 61.94 (+0.05%)

Natural Gas (Nymex, futures prices) USD 2.39 MMBtu, (-0.6%, October 2019 contract)

Gold: USD 1,498.80 / troy ounce (-0.5%)

TASI: 8,055 (+0.3%) (YTD: +2.9%)

ADX: 5,074 (+0.1%) (YTD: +3.2%)

DFM: 2,780 (-0.6%) (YTD: +9.9%)

KSE Premier Market: 6,199 (-0.4%)

QE: 10,365 (-0.2%) (YTD: +0.9%)

MSM: 4,032 (+0.4%) (YTD: -6.8%)

BB: 1,517 (-0.2%) (YTD: +13.5%)

Calendar

28-30 September (Saturday-Monday): Techne Summit, Alexandria.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

1 October (Tuesday): The House of Representatives reconvenes for its fourth legislative session.

3 October (Thursday): Emirates NBD / Markit PMI for Egypt released.

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

8-10 October (Tuesday-Thursday): A delegation of 20 Korean companies visits Egypt.

10-13 October (Thursday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

20-24 October (Sunday-Thursday): German-Arab Chamber of Industry and Commerce’s ROI Week with ROI Institute, JW Marriott Hotel, New Cairo

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23-24 October (Wednesday-Thursday): Russian-African Summit, Sochi City, Russia

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14 November (Thursday): The Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, to be announced and Pitch by the Pyramids, Giza Pyramids

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): The Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.