What we’re tracking on 25 September 2019

Aside from the fact that the EGX has, in just three days, largely erased its gains of this year (more on that in Speed Round, below), the big news of the day is taking place outside Egypt as world leaders grapple with political headaches.

It could be shaping up to be a spectacularly bad day for The Donald, who could (finally) be looking down the barrel of a formal impeachment inquiry over “allegedly betraying his oath of office and the nation’s security by seeking to enlist a foreign power to tarnish a rival for his own political gain.” House Speaker Nancy Pelosi announced overnight she would launch the inquiry after the US president allegedly pushed the president of Ukraine to investigate presidential hopeful Joe Biden and his son over potential corruption, according to the New York Times.

Like a schoolboy recalled from summer break to start class early, Boris Johnson is trudging back into parliament today. He’ll be listening to calls from opposition parties for his resignation after the Supreme Court ruled yesterday that he had acted illegally in suspending parliament earlier this month, the BBC reports. Boris was due to fly back to London from New York overnight.

The big news of the week here in Egypt is due tomorrow. That’s when the central bank’s Monetary Policy Committee meets to review key interest rates. Eight of nine economists we surveyed expect the CBE to cut interest rates by 50-150 bps for the second consecutive month on the back of unexpectedly low inflation figures in August. Meanwhile, all 11 economists polled by Reuters also predict a cut: Five forecast a 100 bps cut, three predicted 150 bps, and three see a 50 bps coming.

All eyes then cast toward the weekend as the business community waits to see if there is a repeat of the events of last Friday and Saturday.

Also happening this week:

- It’s the final day of the Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) today, which is taking place at the Kempinski Royal Maxim.

- The launch of the Mediterranean Business Angels Network will take place at Techne Summit 2019, which runs 28-30 September at Bibliotheca Alexandrina in Alexandria.

Looking ahead: Beltone Financial Holding will hold its Beltone Access conference in Dubai next week. Funds with a combined USD 1 tn in assets under management as well as representatives from more than a dozen sovereign wealth funds will attend the event, which will highlight the economic successes brought about by the government’s reform program.

EM easing causes “yield mania” with investors: Monetary easing is encouraging emerging market governments to step up their bond issuances — and investors are lapping them up, according to Bloomberg. EM bond funds have seen USD 900 mn in inflows over the past week in what the Bank of America refers to as a “yield mania.”

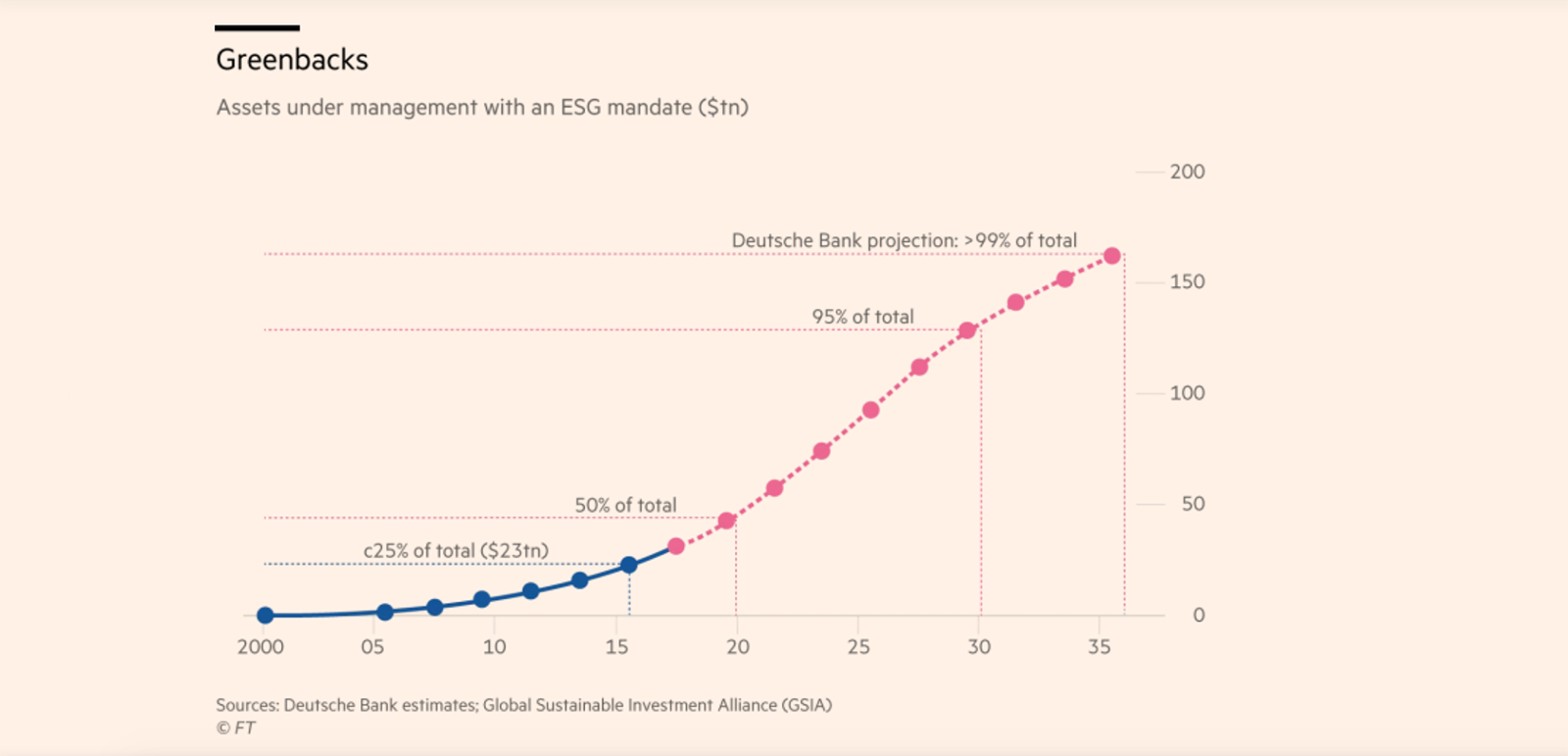

EMs should pay attention to ESG scores or be ready to fall out of favour. Emerging markets stand to lose if ESG or “ethical” investors, who are “on the verge of taking over,” expand their mandates to emerging market debt, says this piece by the FT. ESG — short for environmental, social, and governance — principles are about to factor into 50% (some USD 40 tn) of all assets under management, but the love of ESG principles among equity investors has yet to carry over to sovereign debt. EMs tend to have lower ESG scores and would therefore be more susceptible to capital flight should debt investors follow the lead of equity investors and start giving more weight in their portfolios to ESG ratings. Paradoxically enough, the very investor who adopts this ethical approach “threatens to starve poorest countries of much-needed cash.”

Aramco IPO may not materialize this year: Saudi Aramco looks unlikely to move ahead with its blockbuster IPO this year after investor confidence was shaken from this month’s attack on two of its facilities, two sources in the know told Reuters. “The attacks have spooked investors by exposing how ill-prepared Saudi Arabia is to defend itself despite repeated attacks on vital assets during the more than four years it has been embroiled in a conflict in neighboring Yemen.” In addition to restoring investor sentiment, the Saudi company also still needs time to bring its output levels back to normal, after they were down by half as a result of the attacks.

Investment banks have a hand in the WeWork fiasco: WeWork’s swelling losses and lurching valuations — which have alienated potential investors, caused We Company CEO Adam Neumann to push its planned IPO, and in turn spurred calls for his removal from one of its biggest investors, Softbank — are the partial result of advisory oversights by banks, including JPMorgan and Goldman Sachs, the Financial Times says. By enabling a business model and corporate governance behavior that has inspired little confidence in stock market investors, these and other advisers helped to precipitate WeWork’s current crisis, in turn calling their own reputations into question, the piece says.

Big Oil attends climate week in NY: The heads of some of the world’s biggest oil and gas companies gathered in New York this week for the “Oil and Gas Climate Initiative” — a project that aims to reduce emissions and gas flaring in the energy sector. Bloomberg has the key quotes from the Shell, BP and Total CEOs, among others.