- Up to 6 private companies in IPO talks with the EGX, says El Dokany. (IPO Watch)

- EGX suffers biggest single-day loss since early July. (EGX)

- Egypt’s climate czar Mahmoud Mohieldin talks with Enterprise on climate finance, who’s paying their fair share, and the adaptation-mitigation debate. (Countdown to COP)

- One of Capiter’s key investors is reportedly considering taking an 80% in the crisis-stricken company. (What We’re Tracking Today)

- Global Ventures’ fintech fund reaches USD 105 mn second close. (Fintech)

- Egypt gas revenues could rise more than 50% this fiscal year. (Energy)

- The new and improved executive regulations for the PPP Act are out. (Regulation Watch)

- Qatar eyes investment in Egypt’s container terminals. (Investment Watch)

- Scholarship providers require students to work in Egypt after their degrees — how does this pan out in real life? (Blackboard)

- The US tech IPO market hasn’t been doing this badly since the 1990s. (Planet Finance)

Monday, 19 September 2022

AM — Up to 6 private companies in IPO talks with the EGX, says El Dokany

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning from Atlantis The Palm, our home for the week as we settle in for the first EFG Hermes One on One to take place in person since 2019 (Thank you, covid-19). We’re expecting some 205 corporates from 33 countries to show up over the course of the week for face-to-face meetings with 655 institutional investors from 270 different institutions — making the One on One the world’s premier frontier and emerging markets investor conference.

Corporates here cover every industry in F/EM you could imagine, including energy (huge, with COP27 slated for Sharm El Sheikh later this fall and COP28 next year in the UAE), consumer-driven sectors, banking, finance, healthcare, industrials, tech, telecommunications, utilities, real estate and more.

“We’re excited to finally bring back the physical iteration of the One-on-One for the first time since the onset of covid-19 under the patronage of H.H. Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum,” our friend Karim Awad says this morning in a statement (pdf). Karim, group CEO of EFG Hermes Holding, says that the firm’s role in serving as a conduit for investment is more important than ever as businesses and investors grapple with the aftermath of covid, ongoing supply chain snarls, and sharp inflationary pressure.

WHAT YOU CAN EXPECT TODAY- Tons of one-on-one meetings as well as group sit-downs with in-demand companies.

On the stage this morning: Helal Saeed Almarri, who wears many hats in Dubai including that of director general of the Department of Economy and Tourism. Almarri is also a member of the Executive Council of Dubai and chairman of the Dubai Financial Market, among other posts he holds. He’ll be interviewed on stage at 11:50am Dubai time by our friend Simon Kitchen, head of strategy at EFG Hermes Research.

ALSO THIS MORNING- Attendees will be asked to vote in the Consensus for 2023, the largest (and only live) F/EM research poll. We’ll have the results for you in tomorrow morning’s EnterpriseAM.

WATCH THIS SPACE- Is a Capiter bailout in the cards? US-based Quona Capital wants to acquire 70-80% of crisis-stricken B2B e-commerce startup Capiter in efforts to reform and restructure the company, Al Mal reported yesterday, citing informed sources. Quona is a key investor in Capiter, having co-led its USD 33 mn series A round with MSA Capital last year. Representatives of Capiter did not respond to requests for comment when we reached out yesterday.

Capiter was the talk of the town this past week after social media exploded with allegations of financial impropriety (including embezzlement) at the company after the board fired the company’s co-founders. Internal and external investigations are ongoing, while the news has sparked a wider conversation on what lies in store for the local startup scene as VC funding dries up on the back of rising borrowing costs and fears of a global slowdown.

PSA- Your commute around New Cairo may take a little longer for a few months: Authorities have shut several roads in New Cairo for two months due to the construction of the monorail, according to state news agency MENA. Baqi Zaki tunnel on southern Road 90, the Al Mushir ramp on Road 90 heading towards Maadi, and the entrance to the southern Road 90 coming from Maadi via the Ring Road are all affected.

|

HAPPENING TODAY-

Prime Minister Moustafa Madbouly is in the UK to attend the funeral of Queen Elizabeth II on behalf of President Abdel Fattah El Sisi. The prime minister attended a reception hosted by King Charles III and Queen Consort Camilla for world leaders at Buckingham Palace on the eve of the funeral yesterday.

The funeral is one of the big stories in the foreign press this morning: Reuters | AP | Washington Post | FT | BBC | The Guardian.

Shoukry in New York for UN General Assembly session: Foreign Minister Sameh Shoukry is in New York to participate in the high-level meetings ahead of the UN General Assembly session. The general debate for the 2022 session will take place from Tuesday, 20 September to Monday, 26 September.

Indian Defense Minister Rajnath Singh is in Cairo for a three-day visit focused on bolstering defense ties.

HAPPENING THIS WEEK-

The Central Bank of Egypt will meet to discuss interest rates on Thursday, and the signs are pointing towards a third hike of 2022. Six of seven analysts and economists surveyed in our regular poll expect the Monetary Policy Committee to raise rates as inflation rises and the EGP continues to weaken.

Make that seven of eight: HC Securities sees the central bank raising rates by 100 bps on Thursday and another 100 bps in the November meeting due to Egypt’s deteriorating external position and expectations for inflation to accelerate in the coming months.

Intellectual property strategy coming this week: Egypt will launch its intellectual property strategy on Wednesday. World Intellectual Property Organization (WIPO) Director-General Daren Tang will make an appearance at a ceremony being put on to launch the program.

FURTHER AFIELD-

HSBC is hosting an energy transition webinar series next Tuesday-Thursday, 27-29 September. The series will look at the “latest climate analysis in relation to the global energy market and transition to net zero” in six different sessions covering energy security, what is required to ensure the success of COP27, financing and investment needs for the energy transition, and the scaling up of renewables in the region, among other topics. You can register for the series here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

FACT CHECK- Al Baraka Bank denies plans to take over First Investment Development Company: The bank said reports that we picked up from local media yesterday of plans to acquire 100% of the company were “completely untrue” in a statement (pdf) sent to the bourse. First Investment Development Company also refuted the news in a separate statement (pdf), saying it is not in any official talks over a sale.

DATA POINT- The Suez Canal Authority (SCA) expects an additional USD 700 mn in annual revenues thanks to the 15% hike in transit fees for most vessels crossing the canal starting January 2023, SCA Chairman Osama Rabie told CNBC Arabia.

People will be able to pay government dues of EGP 4k and above at some 4k post office branches and 38 banks, after the cabinet reduced the existing EGP 10k minimum, according to a statement.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Corporates and organizations providing scholarships to Egyptian students pursuing undergraduate and graduate degrees locally or abroad typically require students to work here in Egypt for at least two years after graduation. We look at how these organizations implement the requirement, and whether students actually abide by this stipulation.

The Somabay Endurance Festival, organized by The TriFactory, returns this month for the fourth time. Featuring four different races that combine swimming, cycling, and running, as well as the 1K Kids Race (ages 5-10) and the 10K Race, the Somabay Endurance Festival has got something for everyone. Taking place from 29 September though 1 October, spots are running out for Egypt’s favorite multi-sport event. To find out more and sign up, head to www.thetrifactory.com/somabay.

IPO WATCH

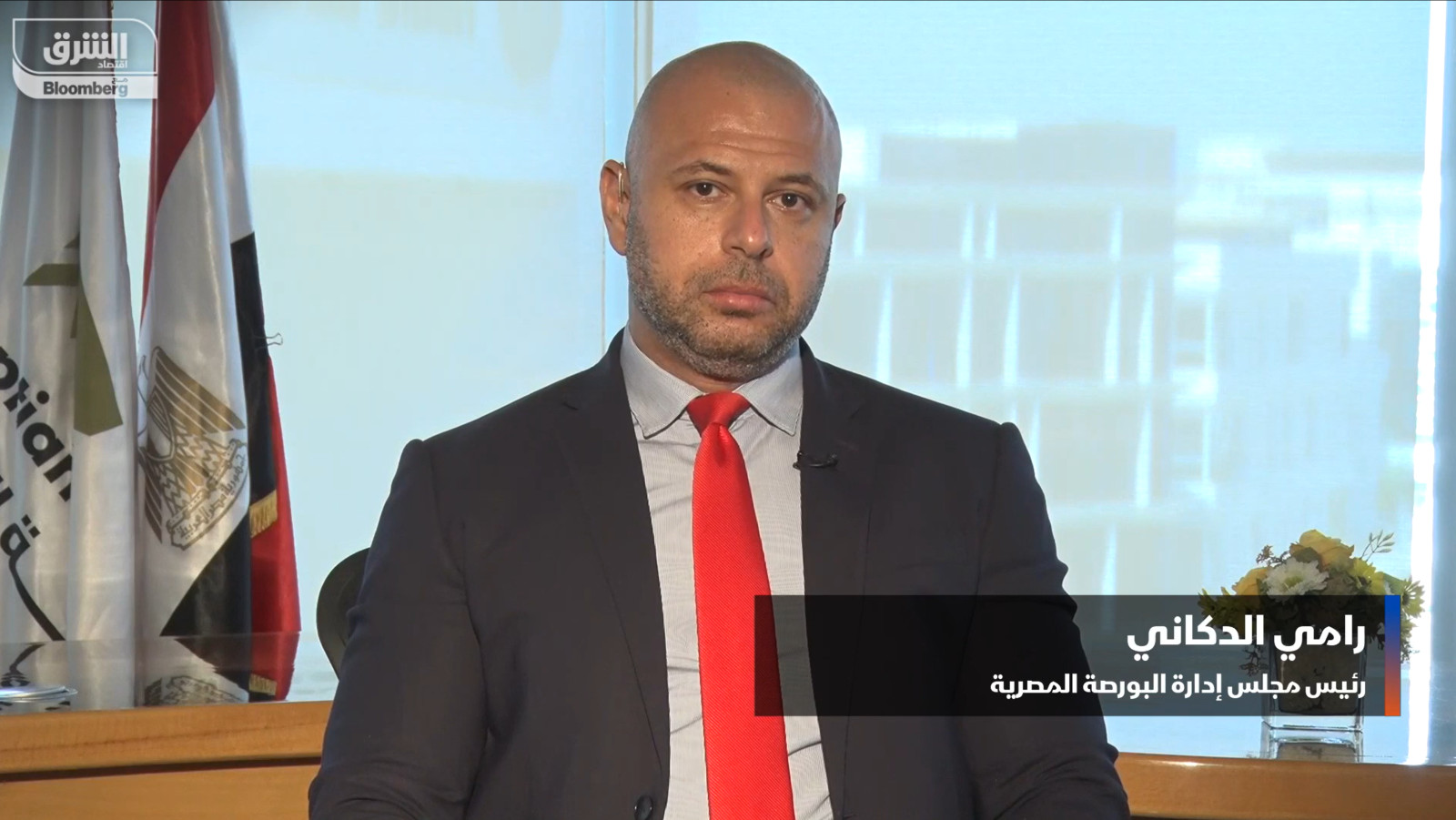

Up to 6 private companies in IPO talks with the EGX, says El Dokany

The EGX is in “serious talks” with five or six private sector companies to list on the bourse, new EGX boss Ramy El Dokany told Bloomberg Asharq. He said the negotiations are at an “advanced stage” and came on the back of the bourse’s moves to simplify listing procedures.

REMEMBER- Companies now have longer to meet the EGX’s listing requirements and are able to temporarily list shares before getting approval from the Financial Regulatory Authority under changes introduced last week to boost liquidity on the bourse.

What kind of companies can we expect? El Dokany said that petrochemical, energy, fuel, and fertilizer companies are best suited to IPO amid the current turmoil in the global economy.

Liquidity is key for foreign money: “To be able to attract foreign investments, we have to first bolster the confidence of the local investor and raise liquidity in the market … this will increase listing and IPOs in the bourse,” he said.

But so is a stable global economic environment: Trading volumes have been anemic for most of this year after foreign investors pulled back from Egypt and other emerging markets on the back of the war in Ukraine. The benchmark EGX30 index has fallen more than 18% this year, leading to the postponement of at least two IPOs and forcing the government to rethink its privatization plans, which at the beginning of the year envisaged as many as 10 state-owned companies selling shares on the bourse.

The bourse is turning to state-owned institutions: The EGX has held talks with a number of state-owned institutions about increasing their investments in listed-companies. Egypt Post, Misr Ins. Holding and other ins. companies have all been involved in meetings, which come as the bourse tries to find ways of boosting trading volumes.

The government is now trying to reboot its privatization program with the listing changes and a new pre-IPO fund set up by the Sovereign Fund of Egypt (SFE) earlier this month. The fund will offer stakes in state-owned companies to strategic investors and sovereign funds ahead of listing them on the bourse, and is expected to announce the first batch of companies within the next month.

SUEZ IPO COMING END OF 2022?

The Suez Canal Authority (SCA) will IPO the Canal Mooring & Lights Company on the EGX at the end of 2022, SCA Chairman Osama Rabie told CNBC Arabia yesterday. The authority plans to offer 10-15% of the company to investors, he said, without providing further details. Rabie said in August that the authority was planning to list three of its companies on the bourse before the end of the year.

EGX

The EGX sell-off continues

EGX WATCH: Egyptian shares suffered their biggest single-day loss since early July yesterday amid growing investor concerns about global growth. The benchmark index fell 3.1% during trading yesterday to reach its lowest level in seven weeks, leaving it down more than 18% year-to-date. The broader EGX70 index was harder hit, losing 6.8%.

Leading the declines: The sell-off was broad-based, with only five of the 30 companies in the EGX30 finishing in the green. Fawry shares were hardest hit, ending the day 9.1% in the red and leaving them down more than 48% since the start of the year. GB Auto (-8.7%) and Heliopolis Housing (-8.4%) also suffered heavy losses.

Reversing the rally: The EGX30 has now fallen 6.4% across a four-day losing streak, paring much of the gains seen in recent weeks. The index has staged a modest recovery over the past 2.5 months after hitting its lowest level since November 2016 in early July.

It wasn’t just us: Gulf stocks also fell yesterday as investors priced in the impact of a global recession on oil prices, which earlier this month dropped to the lowest levels since the start of the war in Ukraine. Saudi Arabia’s benchmark index fell 2.2% and shares in Qatar ended the day down 1.2%.

COUNTDOWN TO COP

Part 1 of our exclusive sitdown with Mahmoud Mohieldin, the UN Climate Change High-Level Champion for Egypt

Putting the climate crisis into perspective: As we near COP27 in November — seven years after the Paris Climate Agreement was signed — many of the fundamental issues are yet to be ironed out. The dust has yet to settle on everything from who bears responsibility, to who foots the bill for financing, to the debate about adaptation vs mitigation.

Perhaps there is no one better to help us get a sense of all of this than Egypt’s UN high-level climate champion, Mahmoud Mohieldin, whose work on these issues predates the Paris agreement, and will continue to drive the agenda for global climate action in the coming years. Prior to his selection as Egypt’s climate czar, Mohieldin — who is also a special envoy for the UN secretary-general and an executive director at the IMF — had been the World Bank’s senior vice president for the 2030 Development Agenda, where he helped shape the 17 sustainable development goals — the global metric for development.

In Part 1 of our two-part interview, Mohieldin explains the fundamental challenges when it comes to the climate crisis, and provides a sobering reality check on just how far off the mark we are.

KEY TAKEAWAYS-

- Emerging economies bear no real responsibility for climate change, but are the most impacted by it;

- Developed economies are falling far short of the USD 100 bn per year they’ve collectively pledged to help developing nations mitigate and adapt. The real gap, he says is in the USD tns, not USD bns;

- Reducing the climate change debate to “mitigation” suits the interests of developed economies;

- Mohieldin took the job as UN high-level climate champion because it meshes two of his passions: Crisis management and sustainable development.

ENTERPRISE: Let’s go back to the beginning. How did you wind up in this role?

MAHMOUD MOHIELDIN: This goes back to a process that started in Marrakesh a year after the Paris Agreement. Marrakesh is where the international community really recognized the importance of non-state actors — any entity or agency that is not part of the formal negotiation track. That includes the business community, civil society organizations, academic institutions, local and regional governing bodies, et cetera. So it’s a very broad tent of participants.

Within that, my focus is very much on the implementation side, on turning into reality everything the state actors agree on. I’m the seventh to hold this post, and there are two champions at a time. So I’m doing this work with the champion from COP26, Mr. Nigel Topping, and next year I should be doing this job with the climate champion selected by the UAE.

ENTERPRISE: Why was it the right challenge for you? Why was it appealing to you personally?

MM: Because it’s about a crisis and about development. It’s as simple as that.

I’ve been tackling crises and challenges throughout my professional life. Some of an economic nature, with challenges of development — challenges that were financial, economic and social — and now, climate.

And climate is the ultimate crisis. We do come across occasional short-term or midterm-crises — a financial crisis, a debt crisis, or even a pandemic — but the climate crisis is long-term. It is very deeply rooted in history, going back to the Industrial Revolution. And the stakes are so very high.

It also relates to my years at the World Bank, where I worked on the 17 sustainable development goals (SDGs). My focus has always been on implementation, on finance, on monitoring data systems and helping the work at the country level and globally. When I was offered the chance to do this work, I said, “This is a great chance to get into this area that had its own dynamics, but was very much integrated in the sustainable development framework that I had been working on.”

And it has many links with other problems. So while climate change is causing more poverty, more vulnerability, loss of economic potential, and negatively impacting social development … the solutions to the climate agenda are about investment, which I have been doing and implementing for many years.

Solutions to climate challenges are not just about massive investment in mitigation, in renewable energy, in tackling the impact of the crisis through adaptation. It requires more investment in human capital and resilience at large. Others take a much more narrow or “reductionist” approach to climate challenges.

ENTERPRISE: What do you mean by reductionist?

MM: Sustainability means handling different aspects of economic and social problems, including the political economy dynamics. This is the beauty of the structure of SDGs. You need to end poverty and you need to improve equity or equality in society. That will only happen through investment in health, education, infrastructure, digital infrastructure and resilience (including climate and biodiversity). If you take it this way, it’s about an inclusive and balanced approach to the challenges facing people and our planet.

A reductionist approach is telling you something completely different. It comes from a group of countries that have already benefited from their social and economic development. They have higher education levels, they have satisfactory health services, their economic progress and development brought them high living standards. These countries have hit the critical minimum of economic, social and human development. So, what’s left for them but the climate crisis?

That reductionist approach, reduces the whole discussion about sustainability to mean decarbonization and emissions and taking as well measures like carbon pricing as a guiding star for their activities. This fits nicely with their own priorities for economic development going forward.

ENTERPRISE: Who are these countries?

MM: Let’s just say the very advanced members of the OECD — the club of rich countries.

ENTERPRISE: So what’s a holistic approach, then?MM: Let’s start with Africa, Latin America or parts of East Asia. They haven’t really contributed to the mess we’re in, but they’re most exposed to the shocks. All of Africa is responsible for maybe 3-4% of global emissions, but water management systems are being compromised. Climate change has a severe impact on coastal areas. They’re exposed to severe weather. So when we talk about climate in developing economies, we need to do it in a comprehensive program. It needs to address a ‘typical’ African country that may suffer more from poverty, inequality, from the quality of education, and from inadequate health services and infrastructure.

Tap or click here to catch the rest of the interview in this morning’s Enterprise Climate here.

FINTECH

Global Ventures’ fintech fund reaches USD 105 mn second close

Nclude hits USD 105 mn second close: Local and international investors have committed around USD 20 mn to Global Ventures’ Nclude’s second funding round, bringing the fintech-focused VC fund’s total capital to some USD 105 mn, a source close to the matter told Enterprise. The source declined to name the contributing investors at this time.

About Nclude: Dubai-based Global Ventures partnered with state-owned banks and firms to reach a first close of USD 85 mn on the Nclude fund in March. Banque Misr is acting as an anchor investor, while NBE and Banque du Caire are on board as strategic investors, and e-Finance’s parent company e-Finance Investment Group also paid in to the initial raise. Nclude targets early- and growth-stage fintech startups based in Egypt, as well as regional firms looking to expand here. It has already invested in local startups including Khazna, Paymob, Lucky, and Mozare3.

A MESSAGE FROM HSBC

Enabling energy transition in the Middle East

By Zoe Knight

The arrival of COP27 and COP28 to the Middle East makes our region the focus of international efforts to implement energy transition as part of the shift to a net zero carbon global economy.

The example the Middle East sets will be a guiding light for others, because if the world’s most important region for traditional energy production can get the transition right, it means everyone can.

Access to capital on a global scale is critical, both to fund emerging green energy solutions, and to ensure that existing energy and industrial giants have the support needed to transition their own businesses to net zero.

Saudi Arabia plans to scale up the share of gas and renewables in its energy mix to 50% each by 2030. The UAE has pledged to improve energy efficiency by 40%, reduce emissions from the energy sector by 70%, and increase the share of renewables in the energy mix to 44%. And Egypt aims to make 42% of the country’s energy mix renewable by 2035 while cutting energy subsidies.

The good news is that investment in renewables across the region is gathering pace. The Benban solar power plant in Egypt — the largest in Africa and fourth-largest in the world — is an example of how we’ve supported a client, FAS Renewable Energy, in their commitment to support Egypt’s transition to a greener economy.

In addition, funding to decarbonize existing technology and industry, develop green hydrogen and its derivatives has enormous potential for the Middle East. Projects are already under way in Oman, UAE, and Egypt in the Suez Canal Economic Zone (SCZone).

Delivering a net-zero outcome is going to require significant progress and acceleration of carbon removal technologies, such as carbon capture, utilization and storage (CCUS). The UAE’s ADNOC has pioneered CCUS in the Middle East at its Al Reyadah plant in Abu Dhabi, the first in the world to capture carbon from the iron and steel industry. We hope more such facilities will follow across the region.

HSBC Egypt recently signed an agreement with other energy transition leaders to decarbonize existing oil and gas downstream facilities, with the ambition to provide execution, technology, and financing expertise to support the decarbonization of select downstream facilities across the country, aligning plans with Egypt’s leadership of COP27.

Designing and creating energy and industrial systems that offer both climate security and energy efficiency is complex, requiring intense collaboration. I believe that HSBC, with our global scale and the nature of our business — providing finance to enable economic and social development around the world — can deliver this convening power.

The hard truth about transition is that huge access to capital is required. The Energy Transitions Commission (ETC) estimates around USD 4 tn per annum average capital investment is needed in energy, built environment, and harder-to-abate sectors such as shipping, steel, and cement, to achieve net zero by 2050.

That capital must come from a variety of sources. So must the ideas for making transition real. HSBC’s net zero strategy is centered around supporting clients to make the transition, and I believe we can make the strongest impact by helping develop tailored solutions for reducing emissions, taking into account the unique needs of industries, businesses and geographies.

I invite you to join the conversation on what is needed to make this happen by registering for our Energy Transition Webinar series, which starts next week. Join us as we discuss the latest climate analysis, the global energy market and progress on transition to net zero. Hear from policymakers, industry experts, businesses and climate tech players, helping to facilitate the transition of the energy system and wider climate goals on the route to COP27 and beyond.

Zoe Knight (LinkedIn) is HSBC’s Group Head, Centre of Sustainable Finance and Head of Climate Change Middle East, North Africa and Turkey

ENERGY

Egypt gas revenues could rise more than 50% this fiscal year

Egypt wants to generate USD 8.5-10 bn in natural gas revenues in FY 2022-2023, up from USD 6.5 bn last year, Oil Minister Tarek El Molla told Al Arabiya (watch, runtime: 2:02).

El Molla cited the government’s electricity rationing strategy as being a key driver for the higher expected revenues, telling the broadcaster that Egypt was able to make additional shipments in August due to lower domestic consumption. “Temperatures dropping in September and October would raise our electricity rationing capabilities, and therefore [allow] for more gas to be sent to liquefaction plants [for exports],” he said. Egypt has made two additional gas shipments since the decision to ration electricity consumption came into force last month, Prime Minister Moustafa Madbouly said last week.

Higher spot prices are helping too: Bloomberg forecasts Egypt to export 8.2 mn tons of LNG this year due to higher spot prices in Europe. Gas prices in Europe have surged on the back of the war in Ukraine, which has seen Russia cut gas flows in response to financial and energy sanctions imposed by the EU and US.

REGULATION WATCH

Amendments to the PPP Act’s exec regs drop

Introducing the new and improved PPP Act: Prime Minister Moustafa Madbouly yesterday signed off on amendments to the executive regulations of the PPP Act aimed at making it easier for private sector firms to partner with the government on key projects. The regulations were published in the Official Gazette yesterday, after the cabinet greenlit them earlier this month.

Among the important changes:

- Going solo: Companies are no longer required to be part of a consortium to bid for projects and can bid individually;

- The right to appeal: Companies who have their pre-approvals rejected can now appeal the decision;

- Taking initiative: Companies can now propose new projects provided they handle the feasibility studies and the financing.

REMEMBER- The government’s plans to reduce state involvement in the economy are expected to see it sell down assets to private sector firms via PPPs. Industries including electric and gas utilities, pharma, and education have been pushing for more involvement through a more efficient and flexible PPP framework. Mobilizing private sector investment in state-funded mega-projects is also on the IMF’s wishlist amid ongoing talks with the government on an assistance loan.

INVESTMENT WATCH

Qatar eyes investment in Egypt’s container terminals

Qatar, Transport Ministry to conduct feasibility studies for Egypt port investment: Maha Capital, the investment arm of Qatar Investment Authority (QIA), has signed an MoU with the Transport Ministry to explore investment in Egypt’s container terminals, the ministry said in a statement yesterday. Under the agreement, the two sides will conduct feasibility studies for “joint projects in ports” such as the West Port Said container terminal, the statement said, without disclosing further information.

This is the second agreement of its kind in less than a week: The Sovereign Fund Egypt and QIA last week signed an agreement on ports during President Abdel Fattah El Sisi’s visit to Doha. Neither the Egyptian or Qatari governments have disclosed the details of the agreement. Qatar has pledged to invest USD 5 bn here to help shield us from the fallout from the war in Ukraine.

MOVES

Islam Mohamed Abdel Fattah has been appointed chairman of Alexandria Container and Cargo Handling (ACCH), according to an EGX disclosure (pdf).

ACCH is now majority-owned by Gulf sovereign funds: The EGX-listed firm recently saw a change in shareholders after the Saudi and Abu Dhabi sovereign funds acquired minority stakes as part of a USD multi-bn buying spree on the EGX. The Saudi Public Investment Fund (PIF) purchased a 20% stake in Alex Containers for EGP 3 bn, while Abu Dhabi fund ADQ snapped up a 32% stake for USD 186.1 mn. The Holding Company for Maritime and Land Transport was the reported seller to the PIF, while Alexandria Port Authority reportedly sold the stake to ADQ.

LAST NIGHT’S TALK SHOWS

Two of the big themes of 2022 — climate and the economy — featured on the airwaves last night following the deadline of the Smart Green Governorates initiative and ahead of the Central Bank of Egypt’s policy meeting later this week.

BUT FIRST- We’ll soon know which companies will be redeveloping the NDP HQ: The Sovereign Wealth Fund of Egypt (SFE) will announce the winner of the contract to redevelop the former National Democratic Party headquarters “in the coming weeks,” SFE head Ayman Soliman told Kelma Akhira’s Lamees El Hadidi last night (watch, runtime: 10:50). It remains unknown which companies are vying for the project, though Soliman said in December that five consortiums were interested in submitting bids. Bidding for the tender closed at the end of June.

More macro + policy analysis: Economist Medhat Nafea made his second appearance on the airwaves in two days, joining Ala Mas’ouleety to discuss central bank independence and the upcoming economic conference (watch, runtime: 3:06 | 3:30). The Central Bank of Egypt’s monetary policy “hasn’t been successful” in recent years due to “conflicting” decisions, Nafea said, stressing the importance of maintaining central bank independence. Meanwhile, former prime minister Hazem El Beblawy was back to warn about Egypt’s rising debt levels and called on policymakers to control it (watch, runtime: 7:16).

The expiration of yesterday’s deadline for the Planning Ministry’s Smart Green Governorates initiative got coverage from Kelma Akhira (watch, runtime: 1:39). The initiative, which will map green projects nationwide, gives prospective green projects a platform to raise investments at COP27 in November. The 5.4k submitted bids will be whittled down to 18, which will be presented at the summit in November, El Hadidi said. Emad El Din Adly, the head of the Egyptian Sustainable Development Forum (ESDF) and a member of the jury for the initiative, phoned in to the show to discuss the process (watch, runtime: 6:29).

EGYPT IN THE NEWS

It’s a mixed bag in the foreign press this morning, with no one story dominating the conversation. Here are some of the stories being picked up internationally:

- Our import woes are making headlines: Egypt and Tunisia are having a hard time filling the shelves as the FX shortage impacts the availability of certain foods and consumer goods. (The Economist)

- Controversy over rumored Egypt-KSA-Greece World Cup bid: Rumors that Egypt, Saudi Arabia and Greece will launch a bid to host the 2030 World Cup are already generating controversy, with Football Supporters Europe and Human Rights Watch criticizing the idea on human rights and logistics grounds. (Politico)

- Farmers embrace agtech: Government initiatives to boost food security and local startups like Mozare3 are introducing local farmers to new industry tech. (Quartz Africa)

ALSO ON OUR RADAR

The European Investment Bank (EIB) could lend EUR 100 mn to the Environmental Affairs Agency for on-lending to public and private industrial companies to green their manufacturing processes, according to the bank’s website.

Other things we’re keeping an eye on this morning:

- Egyptian Company for Pipes and Cement Products (Siegwart) is set to open an EUR 8 mn railway sleepers factory this October, with an annual production capacity of 500k high-speed railway sleepers. (Statement).

- The new Egyptian-British mint in the Suez Canal Economic Zone will cost EGP 2 bn to set up. The facility will produce 500 mn coins annually, with 50% directed for export. (Cabinet statement)

- Chinese chemical firm Tianyi Chemical will build a bromine plant in the Suez Canal Economic Zone that is set to eventually produce 30k tons of bromine a day. (Statement)

- Amazon Egypt head Omar Elsahy met with the head of the General Authority for Investment and Freezones to discuss increasing investment. (Statement)

- Forty-six pre-trial detainees were released over the weekend, including human rights lawyer Haitham Mohamadein. (Youm7 | AP)

PLANET FINANCE

The US tech IPO market hasn’t been doing this badly since the 1990s: The 2022 market sell-off is proving worse for US tech IPOs than either the 2008 financial crisis and the dot-com bust, according to Morgan Stanley research picked up by the Financial Times. Wednesday will be the 238th day without any tech listings worth more than USD 50 mn, surpassing the droughts seen during both of this century’s major market crashes. Following last year’s market boom, tech stocks have been particularly hard hit by this year’s sell-off, with the Nasdaq down almost 28% year-to-date compared to c.19% for the S&P 500.

And the broader IPO market? Volumes are down 94% y-o-y. Companies have raised just USD 7 bn so far this year, compared to the record-breaking USD 110 bn in the same period last year, according to Dealogic data.

Also worth noting:

- Arabian Drilling hired HSBC Saudi Arabia as lead manager on its upcoming Riyadh IPO: Goldman Sachs and SNB will also join HSBC as joint advisors, bookrunners, and underwriters. The Saudi firm will offer a 30% stake (26.7 mn shares) in the IPO, which could value the company at as much as USD 1.4 bn. Bookbuilding is set to run from 28 September to 5 October. (Intention to list, pdf)

- Chinese manufacturers struggle as US turns up the heat: The MSCI China index has fallen 7% this month amid investor concern about the Biden administration’s recent moves to isolate the country’s tech industry. (Bloomberg)

- Porsche could be Europe’s third-largest IPO ever: Volkswagen had valued iconic sports car brand Porsche at EUR 70-75 bn ahead of its IPO in Frankfurt. The company priced preferred shares at EUR 76.5 to 82.5 apiece, which would make it Germany’s second-largest IPO and Europe’s third-biggest ever at the upper end of the pricing range. (Statement | Reuters)

|

|

EGX30 |

9,763 |

-3.1% (YTD: -18.3%) |

|

|

USD (CBE) |

Buy 19.36 |

Sell 19.47 |

|

|

USD at CIB |

Buy 19.39 |

Sell 19.45 |

|

|

Interest rates CBE |

11.25% deposit |

12.25% lending |

|

|

Tadawul |

11,572 |

-2.2% (YTD: +2.6%) |

|

|

ADX |

10,202 |

+1.8% (YTD: +20.2%) |

|

|

DFM |

3,489 |

+0.8% (YTD: +9.2%) |

|

|

S&P 500 |

3,873 |

-0.7% (YTD: -18.7%) |

|

|

FTSE 100 |

7,236 |

-0.6% (YTD: -2.0%) |

|

|

Euro Stoxx 50 |

3,500 |

-1.2% (YTD: -18.6%) |

|

|

Brent crude |

USD 91.35 |

+0.6% |

|

|

Natural gas (Nymex) |

USD 7.76 |

-6.7% |

|

|

Gold |

USD 1,683.50 |

+0.4% |

|

|

BTC |

USD 19,395 |

-3.3% (YTD: -57.7%) |

THE CLOSING BELL-

The EGX30 fell 3.1% at yesterday’s close on turnover of EGP 1.27 bn (25.2% above the 90-day average). Local investors were net buyers. The index is down 18.3% YTD.

In the green: QNB Alahly (+7.0%), CIRA (+1.6%) and Oriental Weavers (+0.5%).

In the red: Fawry (-9.1%), GB Auto (-8.7%) and Heliopolis Housing and Development (-8.4%).

How do scholarship providers ensure that Egyptian scholarship recipients come back after completing their degrees? Several companies and organizations that offer scholarships to Egyptian students pursuing undergraduate and graduate degrees either abroad or here at home stipulate that scholarship recipients return to Egypt to work for a minimum two- or three-year period after completing their studies. Do students actually fulfill this requirement and return to Egypt? How do organizations implement this requirement? Enterprise spoke with several of these institutions providing scholarships, as well as previous scholarship recipients, all of whom confirmed that, while there isn’t a formalized or legal framework to implement the requirement, the broad majority of students do come home as part of a “social contract.”

Which scholarship providers have this requirement? The Sawiris Foundation for Social Development, Orascom Construction — which disburses its scholarships through the Sawiris Foundation, in cooperation with Amideast — the Qalaa Holdings Scholarship Foundation, Fulbright, and the UK government’s Chevening program each provide scholarships that require students to come back to work in Egypt for two or three years after the end of their degrees. The Sawiris Foundation offers scholarships for undergraduate and graduate students, Orascom Construction focuses on students looking to pursue graduate degrees in business administration or construction management, and Qalaa Holdings offers scholarships for graduate degrees, without specifying an area of study.

Why is this condition in place? Representatives we spoke with from different scholarship providers agree that the idea is to support the growth and development of high-caliber individuals who can contribute to Egypt’s development by pursuing quality education abroad and implementing their learnings here in the domestic market.

There are some exceptions, though: The foundation has recently added a condition in the contract between the foundation and the scholarship recipient that allows the student — after receiving explicit approval from the foundation and the university they are studying at — to remain in the country where they are studying for one year post-graduation, Senior Programs Officer Hadeer Mohamed told Enterprise. This is possible under the US’ Optional Practical Training (OPT) Program, which allows students on an international student visa to get temporary employment for 12 months as long as it is directly related to the student’s area of study. The foundation decided to allow for this scenario to better equip students to join the labor force, Mohamed said. The Chevening scholarship also allows for certain exceptions, including allowing students to spend two years in a third country in extenuating circumstances making their return to their home country impossible, such as open conflict.

Remember: The number of Egyptians studying abroad isn’t exactly negligible — and has been on the rise over the past two decades. As of 2018, there were nearly 39k Egyptian undergraduate and graduate students studying abroad, according to Statista data. Nearly half of those (16k) pursued their tertiary education degrees in Western Europe and North America. These figures have been growing steadily over the past two decades, nearly tripling from 8.8k students in 2000 to 34.9k in the 2017-2018 academic year, according to UNESCO data (pdf). These students would be a loss to the local market if they didn’t come back to contribute to the Egyptian market in some way, one scholarship provider representative who asked to remain anonymous told Enterprise.

So how do scholarship providers actually ensure students come back? For the Sawiris Foundation for Social Development, undergraduate students who receive a scholarship from the foundation are required to work in Egypt for three years after graduating, while graduate students need to work in Egypt for two years after completing their degrees. This requirement applies to all scholarship recipients, regardless of whether they pursue their studies in Egypt or abroad, and is stipulated in a written contract that all students must sign, Mohamed told Enterprise.

There is legal recourse — although it doesn’t appear to be popular: If a student appears to be circumventing the requirement to work in Egypt for the two- or three-year period required by the Sawiris Foundation, the foundation goes through a “long period” of warnings and negotiations with the student, Director Mays Abou Hegab told us. It is only once the foundation “has exhausted all options” that it pursues legal action against the student, she said. The scholarship provider representative who asked to remain anonymous said the same, noting that the provider can take legal action against students who violate the return condition, but typically pursues all other routes to avoid going to court. The provider instead tries to rely on emphasizing the “social contract” and social obligation aspect of the agreement to instill a sense of personal responsibility and make students return and contribute to the country’s economy willingly, our source said.

Some providers, such as Chevening, require students to reimburse the organization for the scholarship if they violate the terms of the contract, according to a copy of the 2019-2020 contract reviewed by Enterprise. Students who fail to return to their home country for two years after completing their degree are legally required through the contract by returning any financial support the organization provided, including tuition fees and stipends.

And in any case, the broad majority of students opt to return: Since the Sawiris Foundation started implementing the condition of return in 2018, more than 90% of students have obliged, Mohamed said. “There have been maybe two cases where the students did not return to Egypt,” Mohamed and Abou Hegab confirmed.

This partially goes back to that personal responsibility: “I wouldn’t have been able to pursue my studies abroad if it weren’t for Qalaa Holdings’ scholarship because business schools are extremely expensive,” Omar Taha, who recently completed his master’s degree at London Business School and returned to Egypt, told Enterprise. Although he doesn’t believe that Qalaa would have pursued legal proceedings against him if he hadn’t returned, Taha noted that there is a “social contract” between him and the foundation.

But there are outliers — and not all students agree with the condition in the first place: The condition is “not studied well, impractical, and not in the students’ interest,” one Chevening scholarship recipient who asked to remain anonymous told Enterprise. “The one-year master’s program is very work- and cost-intensive, and doesn’t give students a chance to apply their learnings,” she said. The source also tells us that there are other students she knows of who chose not to return to Egypt and instead pursued agreements with their universities to conduct research or gain other employment and remain in the UK. She is considering returning to the UK again after fulfilling her two-year employment term in Egypt, which she is fulfilling to make sure she is not in violation of her contract.

Your top education stories for the week:

- Court rules against university lecturer: Suez University lecturer Mona Prince has lost a legal battle against the university, which fired her after she shared a video of herself belly dancing online.

- Education financing is booming: Lamees El Hadidi discussed the growth of consumer finance providers in the education space with valU CCO Ahmed Hashem and Contact Financial Holding’s Tamer Samir.

- E-payments startup Klickit will add 122 private and international schools in the 30 June Schools group to its tuition payment platform. (Statement, pdf)

- Teradata Egypt signed two MoUs on training and capacity-building in big data analysis and AI for the state’s administrative sector employees and Egypt University of Informatics students.

CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 50 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

13-27 September (Tuesday-Tuesday): UN General Assembly, New York.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 September (Wednesday): The Egyptian Virtual Food Show (pdf).

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22 September (Thursday): Deadline to submit prequalification applications for companies interested in submitting a proposal for sea water desalination projects

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with potential investments in Egypt’s real estate sector.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

27-29 September (Tuesday-Thursday): HSBC Energy Transition Webinar series.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

30 September (Friday): Winter opening hours for shops and restaurants begin.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): Start of 2022-2023 public school year.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

4-8 October (Tuesday-Saturday): The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10 October (Monday): The CEO Women Conference

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.