- Gov’t announces EGP 130 bn in tax incentives + expands social safety following rate hike and devaluation. (Economy)

- Gov’t agrees USD 2 bn asset sale with Abu Dhabi wealth fund, 18% of CIB + a stake in Fawry are among the five companies whose shares could be involved. (Investment Watch)

- More EGX incentives could be announced today –Cabinet spokesman. (What We’re Tracking Today)

- Gov’t announces price caps on unsubsidized bread. (Commodities)

- The Ukraine war is taking its toll on emerging debt. (What We’re Tracking Today)

- Gov’t settles cement dispute with Vicat. (Dispute Watch)

- El Sisi holds three-way talks with Israeli PM, MBZ in Sharm. (Diplomacy)

- Kremlin dismisses talk of progress in peace talks. (War Watch)

- Mandarin Oriental is coming to Egypt, Amazon is doubling delivery capacity, and Elevate Healthcare is linking up with Dar Al Handasah. (Also on our Radar)

- Coastal erosion could cost Egypt USD bns and wipe out half our beaches this century. Are we doing enough to mitigate it? (Going Green)

- A terrible day in the US bond market as Powell ups the ante on inflation. (Planet Finance)

Tuesday, 22 March 2022

AM — Policy blitz sees tax cuts, social spending + asset sales to shore up the economy following EGP deval, rate hike

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to a new reality. We’ve been saying for some weeks now that the Madbouly government has been deft in its management of the fallout from Russia’s war in Ukraine, but policymakers took it to 11 yesterday: The Central Bank of Egypt announced a surprise interest rate hike, let the EGP slip against the greenback, and canceled Thursday’s interest rate meeting. Cabinet then came in with the announcement of an EGP 130 bn stimulus plan and news that the Sovereign Fund of Egypt has lined up some USD 2 bn in fresh investment.

Oh, and more EGX incentives are expected to be announced today, cabinet spokesperson Nader Saad told Kelma Akhira’s Lamees El Hadidi last night (watch, runtime 3:04).

We went deep on the interest rate and FX decisions in yesterday’s EnterprisePM. We have a recap on that — and then chapter and verse on fresh investments and price caps on unsubsidized bread — in this morning’s news well, below.

Have fun re-working your business (and personal) 2022 budgets today, ladies and gentlemen.

MARKET WATCH-

The war in Ukraine is taking its toll on EM bonds: As worries mount over Russia and Belarus’ ability to make interest payments on their bonds, outflows from emerging markets have been increasing, reaching USD 14.3 bn since the beginning of the year, Bloomberg reports citing Bank of America and EPFR Global data. USD-denominated EM debt was not safe, with the amount of distressed bonds being traded reaching USD 500 bn — and that’s with yields being up 1000 bps over US treasury bonds. This comes as the cost of insuring against default in emerging markets has hit the highest level since May 2020.

Who’s on the chopping block? Some 14 emerging markets were identified as being most at risk of outflows and have seen yields on their bonds skyrocket. These included Belarus — whose bonds overtook those of Lebanon as the most distressed — along with Ukraine and ex-Soviet bloc member Tajikistan. Notable distressed EMs who are not directly connected to the conflict include Pakistan, Ethiopia and Tunisia.

Egypt is not on the bad list. We have for some time now boasted one of the highest inflation-adjusted interest rates in the world and have bucked the general trends that other EMs have seen over the years. Yesterday’s move by the Central Bank of Egypt will substantially shore up Egypt’s attractiveness.

Some investors are getting edgy about the long-term attractiveness of EM, with the Wall Street Journal running stats on how EM debt and equities have underperformed their developed markets counterparts over the past 10 years (including this horrible one obviously). “The call on emerging markets outperforming has been disappointing,” said Hayley Tran, co-head of equity research at Meketa Investment Group told the newspaper.

|

SMART POLICY- The SEC wants companies to disclose emissions: Proposals put forward by the US securities regulator yesterday would force hundreds of companies to disclose their greenhouse gas emissions and climate-related risks. The long-awaited rules would require companies to detail both direct and indirect emissions, as well as emissions generated by partners and suppliers. Investors have increasingly been requesting information on how climate change risks will likely affect businesses, prompting the regulator to take action, said SEC chair Gary Gensler.

CIRCLE YOUR CALENDAR-

There’s no MPC meeting this Thursday: The Central Bank of Egypt has canceled (pdf) Thursday’s regularly scheduled Monetary Policy Committee meeting after enacting a surprise 100 bps rate hike at a special meeting early yesterday morning.

Do you need to dive deeper into e-invoicing? Lynx Strategy Business Advisors are hosting a webinar on Wednesday, 23 March to discuss the system. The Arabic-language gathering will take place 12:00-1:30pm with speakers from the Finance Ministry and the Tax Authority and a panel discussion including the CFOs of PepsiCo, Talabat and Unilever. You can register for the event here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: Coastal erosion is a major issue for Egypt, one that could cost us USD bns and wipe out half our beaches this century. A recently-published World Bank report looks at just how acute the problem is, how it’s been put on fast-forward by climate change and heavy development, and how we need to put stronger mitigation measures in place to reduce damage from it.

Experience luxury in every thoughtful detail where prestige hospitality is rediscovered with genuine warmth and passion. Awaken forgotten desires and build unforgettable memories to fuel a lifetime of inspiration. Spend your winter break at Somabay with special rates and choose among five different hotels at one destination. Visit: www.Somabay.com/hotels/

ECONOMY

More than a spoonful sugar to help the medicine go down

Gov’t announces EGP 130 bn in tax incentives + brings forward social safety measures following rate hike and devaluation: Fresh off the heels of the Central Bank of Egypt’s (CBE) decision yesterday to raise interest rates and allow the EGP to devalue c. 16% against the USD, the Madbouly government announced (pdf) a package of incentives that would see EGP 130 bn in tax relief being doled out while moving up the timeline of already-planned social safety measures.

First up: The capital gains tax (CGT) on IPOs is being slashed by 50% for a two-year period, effectively bringing the CGT rate to 5% from 10%. The rate will then rise to 7.5% once the two-year period ends. There are also measures in place to exempt capital increases from the capital gains tax, while share-swaps between listed and unlisted companies will not be taxed.

Also exempt from the CGT: Investments in local debt and equity by institutional investors.

The government will also introduce amendments to the Income Tax Act designed to spur activity on the EGX, including setting an as-yet not revealed formula that would reduce the withholding tax on dividends.

Real estate tax relief: Manufacturers will receive a three-year real estate tax holiday, which is expected to cost the government some EGP 3.75 bn, according to the statement.

The fixed customs exchange rate is back: The government is re-introducing the monthly customs exchange rate, setting it at EGP 16 for imports of basic commodities and materials used for manufacturing. The rate will be fixed until the end of April. Egypt had scrapped the monthly system back in 2019, after initially introducing it in 2017 following the November 2016 EGP float, as an “exceptional measure” to stabilize the customs rate.

A tried and true formula: This package is similar in many respects to the stimulus and bailout measures introduced in March 2020 to manage the fallout from the covid-19 pandemic, but eclipses it in size: The 2020 package was worth a total of EGP 100 bn. These included similar real estate tax holidays to the industrial and tourism sectors. Cabinet had also announced last year a basket of measures designed to make trading on the EGX more attractive, including tweaking how the CGT is calculated.

The government is also looking to spend EGP 190.5 bn on expediting annual salary increases… Government employees covered by the Civil Service Act will get their regularly-scheduled 8% annual raise on their monthly gross salaries, at a minimum of EGP 100 per month and without a maximum, as of the beginning of April (instead of July). Civil servants not covered by the legislation will also be given a special 15% raise on their monthly gross salaries, equivalent to at least EGP 100 per month.

…and bonus and pension hikes: Meanwhile, monthly bonuses for state employees (both those covered by the Civil Service Act and those who are not) will increase by a minimum of EGP 175 and a maximum of EGP 400, depending on their rank. This bonus increase will only apply to employees hired after the package was announced. All of these salary and bonus raises will cost the government EGP 36 bn, the statement says. Pensions, meanwhile, will increase at least EGP 120. Both of these measures were already planned for July, at the start of the new fiscal year.

And the wage tax burden is getting lighter: The ceiling for exemption from income tax is being raised by 25% to EGP 30k, from EGP 24k previously. Those earning EGP 30k or less per year are now exempt from the wage tax, according to the anxiety-tab.com.

Separately, the government is also spending EGP 2.7 bn to bring 450k new families under the umbrella of the Takaful and Karama social security program in April, as well as bringing the 13% annual raise to pension payments into effect as of the beginning of next month. This was also supposed to come into effect in July but was moved up.

NEED A RECAP ON WHAT HAPPENED YESTERDAY MORNING?

Hit yesterday’s EnterprisePM for the full rundown — or just read on for a summary below on the Central Bank of Egypt’s snap decision to raise rates and allow the EGP to slip against the greenback:

The first rate hike in five years: The central bank raised interest rates by 100 bps at a special monetary policy meeting in a bid to combat the spillover effects of rising international commodity prices on domestic inflation, which rose to a 31-month high last month. This is the first time the central bank has raised rates since the end of its post-EGP float tightening cycle in mid-2017.

Where rates stand now: The overnight deposit rate now stands at 9.25%, and the lending rate is 10.25%, while the main operation and disc. rates are at 9.75%.

Egypt’s real interest rate is now positive: Until recently, Egypt boasted one of the highest inflation-adjusted interest rates in the world, which helped it attract bns of USD in portfolio flows into the local bond market. That advantage has been eroded in recent weeks as rising inflation pushed the real rate into negative territory. Following yesterday’s hike, the real rate is now 0.45%.

EGP devalued: The CBE also allowed the EGP to fall 16% against the USD yesterday as it looked to maintain foreign-currency liquidity. The FX rate settled at EGP 18.27 to the greenback by the end of the trading day yesterday, having fallen from around EGP 15.70 where it had traded since the beginning of 2021.

Amer holds rare presser: At a press conference yesterday (watch, runtime 29:29), CBE Governor Tarek Amer described change in FX rate as a “correction” and said that the “bold decisions” taken by policymakers would help maintain liquidity in the foreign exchange market, build confidence among foreign investors, and make the country’s exports more attractive.

Importantly: There are no signs of capital controls in place, according to three bankers with whom we spoke yesterday.

Producers began hiking prices yesterday in response to the devaluation: Cement companies raised prices by as much as 25% while feed prices jumped by up to EGP 1k a ton.

Banque Misr + NBE offer one-year, high-yield CDs: State-owned Banque Misr and the National Bank of Egypt brought to market one-year 18% certificates of deposit yesterday after the CBE’s decision to raise interest rates. Banque du Caire has yet to follow suit. Other banks are also reportedly repricing loans after the CBE interest rate hike, according to Masrawy. As we noted yesterday, we don’t expect most private banks to offer high-interest instruments.

The fact that NBE and Banque Misr are offering 12-month certificates and no longer-term instruments suggests that they believe the rate hike could be transient.

Yesterday’s moves will help boost inflows: “It will help catalyze fresh inflows into the market as investors perceive a reduced risk of further devaluations, and even the possibility of some appreciation in the coming months,” Goldman Sachs MENA economist Farouk Soussa wrote in a note picked up by Bloomberg.

A precursor to our signing up for an IMF package? Murmurs of fresh IMF financing to ease the pressure on state finances have been ongoing for several weeks as the ramifications of the Ukraine conflict became clearer. Though Egyptian officials and the Fund have both denied ongoing talks, sources told Bloomberg last week that there are discussions over a precautionary and liquidity line or and other forms of financial aid.

Analysts including at Goldman and Capital Economics say that yesterday’s moves by the CBE will make it easier for Egypt to agree a new program with the IMF, which in the past has demanded greater exchange rate flexibility before signing off on new financing. “A new program would not only offer important monetary support in the near term but also provide an important policy anchor for ongoing reforms, and help encourage inflows of both portfolio and fixed investment,” Daniel Richards, an economist at Emirates NBD wrote. “Some of the likely prerequisites of renewed financial support from the Fund — a meaningful rate hike and a cheaper currency — have now been met.”

INVESTMENT WATCH

Gov’t agrees USD 2 bn asset sale with Abu Dhabi wealth fund — and more GCC investments are probably in the pipeline

Accelerated sale of assets to Gulf investors will bring in fresh capital: We said yesterday that the Madbouly government would not be looking for handouts from the Gulf Cooperation Council countries, but rather would accelerate the process of offering attractive assets to Gulf buyers, including sovereign wealth funds.

Bloomberg is now reporting that the state has agreed to sell some of its holdings in five EGX-listed companies as it looks to bolster its finances strained by the fallout from the war in Ukraine. Abu Dhabi wealth fund ADQ will purchase the stakes from the government for around USD 2 bn, Mirette Magdy reported yesterday evening, citing people familiar with the matter.

What’s ADQ acquiring? Up to 18% of CIB, the nation’s largest private-sector bank, and an unspecified stake in fintech darling Fawry, alongside three other companies, Bloomberg reports. We expect one of those three will be significant stake in a brand-name infrastructure provider.

The ADQ news came as cabinet said yesterday the Sovereign Fund of Egypt has lined up investments for Egypt worth more than USD 2 bn, led by foreign and strategic private-sector investors. Some of the USD 2 bn would be deployed through the EGX while a portion would be invested directly, the statement added, saying only that further details would be made available “in the next few weeks.”

“These investments will contribute to enhancing the country's economic development and consolidating Egypt’s position as one of the world’s leading investment destinations,” Planning Minister Hala El Said said, according to the statement.

Don’t expect any of these companies to offer fresh capital, a source with direct knowledge of the government’s plans tells us — state institutions will sell existing stakes to ADQ. State institutions own at least 8.3% of CIB and 12.6% of Fawry, according to the most recent available filings for each institution (here and here, each in PDF). EGX-listed companies are required to disclose the names of shareholders they know own more 5% or more of their shares.

State institutions likely own far more shares in CIB. The Central Bank of Egypt said in March 2020 that it would buy up to EGP 20 bn worth of shares in EGX-listed companies to shore up the bourse as the pandemic drove a massive global risk-off from emerging markets. With CIB accounting for about 35% of the EGX 30 and assuming the funds were deployed to track the index, that implies a heck of a lot of that capital — invested through state-owned asset managers and other institutions — found its way into CIB.

The stake sales will happen through pre-agreed block trades on the EGX and do not need involvement from management or special regulatory approvals, we’re told, although anyone looking to take a stake of more than 10% in any Egyptian bank requires Central Bank of Egypt approval under the Central Bank and Banking Act. They would also need to have the CBE sign-off before taking a board seat and appointing someone to sit in that seat.

CIB and Fawry are very known quantities, and ADQ is no stranger to Egypt (as we note below). CIB’s management team has met a number of times with ADQ staff as part of its global-scale, award-winning investor relations program.

Expect Gulf investors to have appetite for IPOs — if market conditions this year allow them. Finance Minister Mohamed Maait’s EGP 130 bn stimulus package (above) smartly includes incentives that could make IPOs more attractive to global and local investors alike if international market conditions allow sales to go ahead. In early February, Prime Minister Moustafa Madbouly announced that his government planned to list “as many state companies as possible” before the end of this year. Misr Life and an additional stake in Heliopolis Housing are both up for sale this year.

And remember that Gulf investors have already expressed interest in sales of stakes in military-affiliated bottled-water maker Safi and filling station operator Wataniya.

Egypt needs to build up FX reserves as rising commodity prices caused by the Russia-Ukraine conflict put pressure on state finances. The Finance Ministry has estimated that soaring wheat prices will cost it an additional EGP 15 bn this fiscal year, while oil prices are now in three-figures — far above the USD 65 price assumed in the state budget.

Abu Dhabi has been a source of financial support in the past, including prior to the EGP float in 2016 when it provided USD 1 bn to the Central Bank of Egypt. In 2019, ADQ established a USD 20 bn joint investment fund with the Sovereign Fund of Egypt to channel funds into a variety of industries and assets.

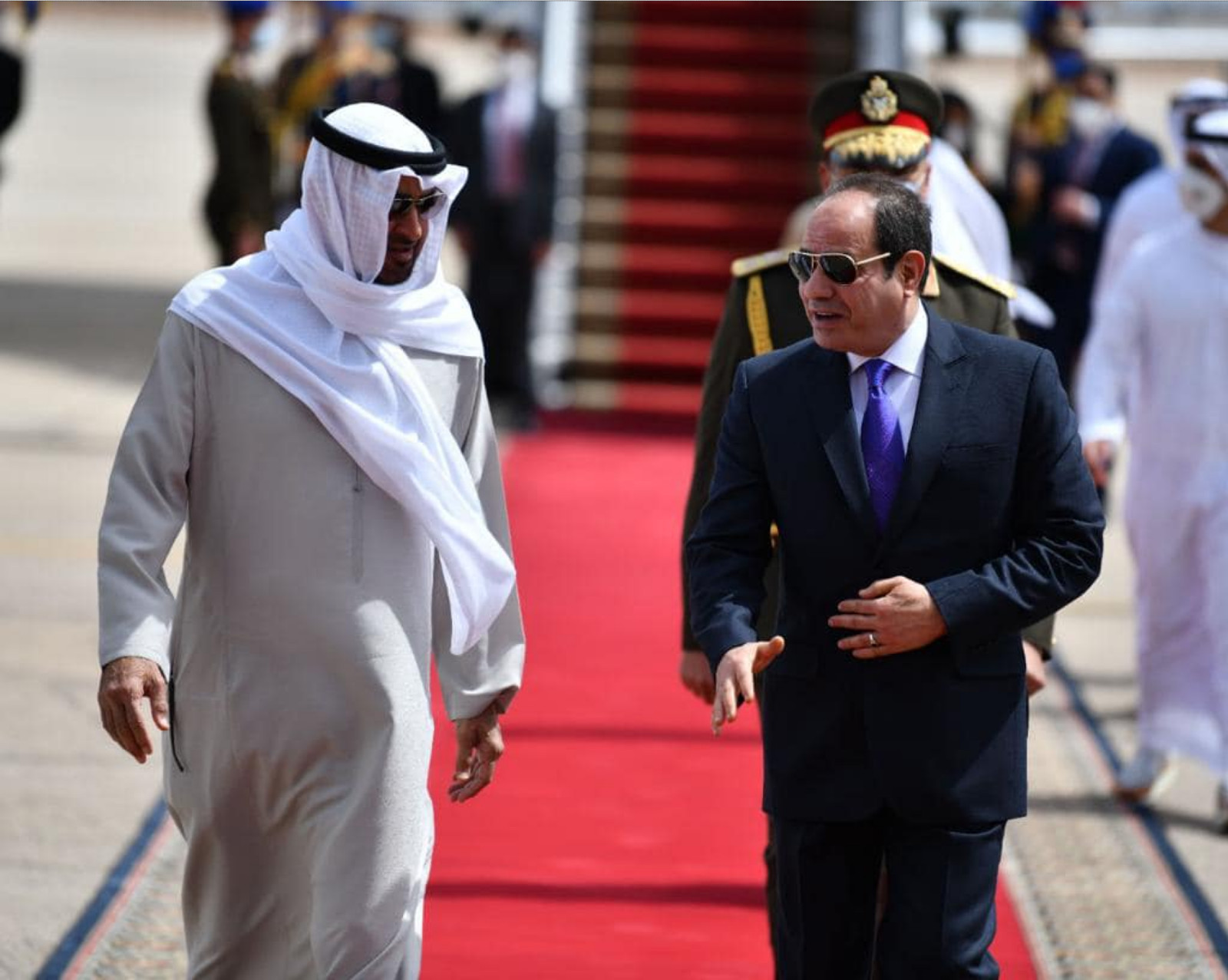

MBZ was in Egypt yesterday: The news came on the same day that President Abdel Fattah El Sisi held talks with UAE Crown Prince Mohamed bin Zayed in Sharm El Sheikh. An Ittihadiya statement provided few details on the discussions but said that they placed particular emphasis on the countries’ economic and investment ties.

ADQ is becoming an increasingly important player in the Egyptian economy, last year acquiring leading real estate developer SODIC alongside Aldar Properties, Bausch Health’s local pharma outfit Amoun Pharma, and Atyab brand owner Ismailia Agricultural and Industrial Investments. Agthia, the fund’s food subsidiary that acquired Ismailia, reiterated yesterday that it is pursuing further acquisitions in Egypt’s frozen meat and fast food industries, in an interview with Mubasher.

And other Emirati investors also have significant appetite for Egypt: Beyond Aldar / ADQ’s acquisition of SODIC, look no further than FAB’s bid this year for a majority stake in global financial services powerhouse EFG Hermes, UAE-based Gulf Capital saying it will invest some USD 250 mn here, and Alpha Dhabi Holding saying it was looking to make Egypt a priority market.

COMMODITIES

Gov’t announces price caps on unsubsidized bread

Price controls on unsubsidized bread are here: The Madbouly cabinet announced yesterday it is imposing price caps on unsubsidized baladi and fino bread for three months, according to a cabinet statement.

The breakdown: The decision imposed new price brackets for bread loaves based on their weight, setting the price of baladi bread at EGP 0.50 for 45-gram loaves, EGP 0.70 for 65-gram loaves, and EGP 1.00 for 90-gram loaves, according to a cabinet statement. A 1 kg package of bread is now priced at EGP 11.50. Prices for fino bread are now set between EGP 0.50 and EGP 1.00 for loaves weighing 40 to 80 grams.

Violators will face fines between EGP 100k and EGP 5 mn, according to the decree. Bakeries are also required to clearly mark their product prices.

The decision came as the rise in global wheat prices threatens to raise Egypt’s wheat spending by EGP 15 bn this fiscal year, after the government assumed an average price of USD 255 per ton in this year’s budget. A ton of wheat is currently trading at USD 368.75 per ton, according to market data. President Abdel Fattah El Sisi ordered his government to introduce the fixed pricing structure last week in a bid to hold down local prices amid surging global inflation, which led to local bread prices rising.

Meanwhile: Are we looking to India to fill the Ukraine- and Russia-shaped holes in our wheat import market mix? India, the world’s second-largest producer of wheat, is reportedly in “final” talks to begin exporting wheat to Egypt, among other countries, India’s Commerce Ministry said over the weekend, according to Bloomberg. India is also in talks to begin exporting its wheat to China, Turkey, Bosnia-Hercegovina, Sudan, Nigeria, and Iran.

Is India going to be able to plug the gap? India’s wheat exports rose fourfold to around 6 mn tons from April 2021-January 2022, the business information service says. And the country’s wheat production is expected to rise to a record 111.3 mn tons in the 2021-2022 agricultural season, from 109.6 mn tonnes during the previous season.

DISPUTE WATCH

Gov’t settles cement dispute with Vicat

French cement producer Vicat Group and the Egyptian government have reached a final settlement in a dispute over ownership of its Sinai-based subsidiary. An agreement was signed yesterday by Vicat CEO Guy Sidos and International Cooperation Minister Rania Al Mashat, the cabinet said in a statement. No details on the settlement were disclosed.

Background: Vicat filed an arbitration case against the government last year at the International Center for Settlement of Investment Disputes, alleging that it was trying to force it to sell its majority stake in Sinai Cement. The company said that there was a “a difference in interpretation of the legislation on foreign interests in the Sinai region” in its 2021 financial report (pdf). Ownership rules in Sinai are more restrictive than in other areas of the country, and prevent foreigners from owning land.

WAR WATCH

Kremlin dismisses talk of progress in peace talks

No progress in peace talks -Kremlin: Russia has thrown into doubt recent optimism surrounding the ongoing peace talks to end the war in Ukraine, with the Kremlin yesterday saying that negotiations have not made significant progress, according to Reuters. Several senior Turkish figures said at the weekend that the two sides are close to agreeing on most of the major issues. But Kremlin spokesperson Dmity Peskov has played down the chances of agreement, telling reporters yesterday that “there has been no significant progress so far.”

Another potential obstacle to an agreement: Ukrainian President Volodymyr Zelenskiy said yesterday that any peace agreement will need to be voted on by the Ukrainian people in a referendum, according to Reuters. Should the vote go ahead, people could be asked to vote on the key areas of dispute between the two nations, including Ukraine’s aspirations to join Nato and the future status of Crimea and the Donbas.

Russia tells US relations “on the verge of rupture” over Biden war criminal comment: Russia summoned the US ambassador in Moscow yesterday to tell him that President Joe Biden’s description of Russian President Vladimir Putin as a “war criminal” last week had pushed the bilateral relationship to breaking point, the Russian Foreign Ministry said yesterday.

ON THE GROUND-

Conditions are worsening in Mariupol — but surrender is still a no-go: Mariupol rejected yesterday Russia’s demands that its forces lay down their arms, in exchange for allowing food, medicine, and other humanitarian aid to enter the city, Bloomberg reported. The Russian ultimatum had also promised a humanitarian corridor to evacuate civilians, but these were shut down after Moscow’s demands were rejected. Conditions in the city are now “very difficult,” with food and medicine in short supply and frequent power outages, Ukrainian Deputy Prime Minister Iryna Vereshchuk said, according to Reuters.

Ukraine could lose USD 6 bn in grain revenues as Russia continues to blockade its Black Sea ports, a senior industry figure told Reuters. Around 100 vessels carrying tonnes of wheat and corn are currently stranded in the country's ports, according to maritime officials.

SPLINTERNET-

Russia has banned Facebook and Instagram for encouraging “extremist” activities, in the first use of the country’s draconian law targeting “extremism” against a foreign tech company, Bloomberg reported. Regulators had already blocked access to the two Meta-owned social media platforms earlier this month.

LAST NIGHT’S TALK SHOWS

Egypt’s airwaves were dominated by yesterday’s policy blitz (if you don’t know what we’re talking about here get out from underneath your rock — or just scroll to the top of the issue). Let’s jump right in.

New price caps on unsubsidized baladi bread and fino loaves have been introduced with immediate effect, head of the bakeries division at the Cairo Chamber of Commerce Attia Hamad told El Hekaya’s Amr Adib in a phone-in (watch, runtime 4:52). Awareness campaigns are currently underway to notify all bakery owners of the caps, which they have to abide by within the next three days or face criminal proceedings, he said. We have all the details on the price controls in this morning’s Commodities section, above.

Some 10.8 mn people stand to benefit from the hikes in pension payouts announced by the government yesterday, said Social Solidarity Minister Nevine El Kabbaj in a phone-in with Kelma Akhira’s Lamees El Hadidi (watch, runtime 11:06). The raises will take effect starting 1 April — three months earlier than initially planned, she said, which will cost the state around EGP 8 bn. Pensioners will see a 13% price hike, with a minimum of EGP 120, and no maximum amount, said National Council for Wages member Magdy El Badawy in a phone-in with Sada El Balad’s Salet El Tahrir (watch, runtime 5:05).

And around 28.5 mn workers will be made newly exempt from income tax after the government yesterday raised the threshold to EGP 30k, from EGP 24k previously, said Tax Authority advisor Ragab Mahrous, in a phone-in with Ala Mas’ouleety’s Ahmed Moussa (watch, runtime 6:58) You can read more about the newly announced packages and incentives in our Economy section above.

Banque Misr’s CDs are proving popular: Savers put EGP 4 bn into the state-owned bank’s

new 18% certificates of deposit, which were announced yesterday following the rate hike and EGP devaluation, Treasury and Financial Institutions Head Moustafa Gamal said in a phone-in with Ala Mas’ouleety’s Ahmed Moussa (watch, runtime 19:06).

And the winner of the EGP devaluation is… the EGX, which recorded the largest ever daily increase in market cap yesterday — around EGP 31 bn — following the central bank’s announcement, EGX boss Mohamed Farid told Taht El Shams’ Moataz Abdelfattah (watch, runtime 3:25).

In other news: More people are complaining about the Consumer Protection Agency’s recent decision to require companies to include expiration dates on product labels. On Sunday it was manufacturers, and last night it was the head of the electrical and home appliances division at the Cairo Chamber of Commerce, who called one companies in the sector to be exempt from the rule (watch, runtime 7:31).

EGYPT IN THE NEWS

Leading the conversation on Egypt in the foreign press: The Central Bank of Egypt’s decision to raise interest rates by 100 bps. The bold move is broadly being welcomed by investors and is seen by analysts as part of the fiscal and monetary response required to address the repercussions of the Russia-Ukraine war. Reuters, Bloomberg, and the Financial Times all had coverage.

The foreign press is also fixated on the war’s impact on our wheat supply: The Financial Times is out with a piece on Egypt’s moves to secure wheat supplies amid shortages caused by the Russia-Ukraine war, and the still-uncertain fate of the bread subsidies program, on which the government is still weighing a decision.

ALSO ON OUR RADAR

Mandarin Oriental to manage Shepheard Hotel: Hong Kong-based luxury hotelier Mandarin Oriental Hotel Group signed an agreement to manage Downtown Cairo’s historic Shepheard Hotel yesterday, the Public Enterprises Ministry said in a statement. This is the company’s first venture in Egypt, and comes more than a year after it was reported in the local press that it had agreed to manage the property. Saudi Arabia’s Al Sharif Group is refurbishing the hotel, which is slated to open in 2024.

Amazon is looking to double its delivery capacity in Egypt by scaling up its workforce (creating some 2k new jobs) and tech infrastructure in the country, the company said in a statement yesterday.

Elevate Healthcare and Dar Al Handasah Consultants could work together on healthcare, with a recent MoU (pdf) paving the way for Elevate to do business with Dar — and for Dar to potentially become a limited partner in Elevate’s new USD 380 mn healthcare fund.

Other things we’re keeping an eye on this morning:

- Misr Italia Properties is looking to issue securitized bonds worth EGP 800 mn during 4Q2022, up from a previously planned EGP 700 mn issuance.

- The China Construction Science and Industry Corporation will establish an iron foundry at China’s TEDA trade zone.

- Sharm El Sheikh-Baku flights resume: Weekly direct flights between the Azerbaijani capital Baku and Sharm El Sheikh resumed on Friday 18 March.

PLANET FINANCE

US treasuries experienced one of their biggest daily sell-offs in the past decade yesterday after Federal Reserve Chairman Jay Powell indicated that the central bank could hike interest rates more aggressively than expected, according to Bloomberg. Following last week’s policy meeting, the market had already priced in a further six 25-bps rate hikes this year. But in comments at a conference yesterday, Powell suggested that the central bank could resort to larger rate hikes to tame soaring inflation, which is expected to accelerate further in the coming months due to surging commodity prices caused by the war in Ukraine.

This drove yields across much of the curve to their highest levels in three years, and narrowed the spread between 5- and 30-year bonds to its slightest since 2007, a sign that the market is beginning to price in a recession.

Stocks weren’t as hard hit, with the S&P 500 closing marginally in the red, the Nasdaq falling 0.4% and the Dow down 0.6%.

And oil continued to climb: Brent crude is once again nearing the USD 120 a barrel handle after climbing almost 8% yesterday as peace talks between Russia and Ukraine showed no signs of progressing.

|

|

EGX30 |

11,511 |

+4.9% (YTD: -3.7%) |

|

|

USD (CBE) |

Buy 18.17 |

Sell 18.27 |

|

|

USD at CIB |

Buy 18.17 |

Sell 18.27 |

|

|

Interest rates CBE |

9.25% deposit |

10.25% lending |

|

|

Tadawul |

12,832 |

-0.3% (YTD: +13.7%) |

|

|

ADX |

9,563 |

-0.5% (YTD: +12.7%) |

|

|

DFM |

3,360 |

+0.3% (YTD: +5.1%) |

|

|

S&P 500 |

4,461 |

0.0% (YTD: -6.4%) |

|

|

FTSE 100 |

7,442 |

+0.5% (YTD: +0.8%) |

|

|

Brent crude |

USD 116.40 |

+7.9% |

|

|

Natural gas (Nymex) |

USD 4.90 |

+0.8% |

|

|

Gold |

USD 1,934.80 |

+0.1% |

|

|

BTC |

USD 41,357 |

+0.3% (as of midnight) |

THE CLOSING BELL-

The EGX30 rose 4.9% yesterday on turnover of EGP 2.2 bn (57.6% above the 90-day average). Local investors were net buyers. The index is down 3.7% YTD.

In the green: Alexandria Mineral Oils (+13.8%), TMG Holding (+11.8%) and Madinet Nasr Housing and Development (+10.1%).

In the red: Egyptian Kuwaiti Holding (-3.9%), and Fawry (-2.5%).

DIPLOMACY

El Sisi holds three-way talks with Israeli PM, MBZ: President Abdel Fattah El Sisi held trilateral talks with Israeli Prime Minister Naftali Bennett and Abu Dhabi Crown Prince Mohamed bin Zayed in Sharm El Sheikh yesterday. No official statements were issued following the talks, though diplomatic sources said discussions were had about “shared security interests”, the war in Ukraine, and the Iran nuclear talks. Ittihadiya said that El Sisi and MBZ discussed a number of issues in separate talks, including economic and investment ties.

AROUND THE WORLD

Tunisia is careening towards a default if it doesn’t course-correct its finances, strategists at Morgan Stanley warned yesterday, according to Reuters. The country is currently in talks with the IMF over financial assistance and a package of economic reforms, but unless this bears fruit the government will likely go into default next year, they said. Ratings agency Fitch downgraded the country’s sovereign debt deeper into junk territory last week, assigning it a B- rating.

Salameh charged: Lebanon has charged central bank governor Riad Salameh and his brother with money laundering and embezzling public funds, a judicial official told Bloomberg yesterday.

US anti missile batteries heading to Saudi Arabia amid Houthi attacks: The US has shipped a “significant” number of Patriot anti missile batteries to Saudi Arabia over the past month as the country tries to fend off drone and rocket attacks from Houthi rebels in Yemen, according to the Wall Street Journal.

Plane crash in China: A China East Airlines Boeing 737 jet carrying 132 people crashed in southern China yesterday, Reuters reported. There were no immediate signs of survivors.

Coastal erosion could cost Egypt USD bns and wipe out half our beaches this century. Are we doing enough to mitigate it? Coastal erosion is a major issue for Egypt, particularly in Alexandria and the Delta, heightening our vulnerability to rising sea levels and potentially inflicting severe economic losses in the years ahead. The issue was recently highlighted in a report (pdf) by the World Bank, which examines the potential implications of erosion on tourism, industrial infrastructure, and residential communities along Egypt’s coasts if it continues unchecked.

How bad is the problem? Data cited in the report suggest that between 1984 and 2016, Egypt’s coastlines have eroded by an average 0.1 meters every year. Compare that to Tunisia, which lost 0.6-0.7 meters each year over the same period, and it appears that the problem isn’t as acute as other areas of North Africa.

But one dataset tells only one part of the story: Some stretches of Egypt’s coastline are more vulnerable to erosion than others. The geological make-up of the sandy beaches and deltaic coasts that line the Mediterranean renders them particularly exposed to rising sea levels, with one study categorizing 72% of Egypt’s northern coastline as being highly or very highly vulnerable. Another study looking at shoreline changes along the Nile Delta found that between 1990 and 2014, some parts of the coastline eroded by an average 10-21 meters per year. The problem was particularly pronounced where the Nile meets the sea at Rosetta and Damietta, which lost 25-36 meters on average each year.

The erosion rate has increased rapidly since the turn of the millenium: The number of hectares lost to the sea every year almost doubled from 1984-2001 and 2001-2018, according to findings (pdf) based on satellite data published in the Alexandria Science Exchange Journal last year. The delta coastline lost an average 78 hectares of land each year between 2001 and 2018, up from the 41.7 average over the previous 17 years, with Dakahlia and Kafr El Sheikh governorates seeing particularly large jumps in the rate of erosion.

Coastal erosion is a natural process — but heavy development + climate change have put it on fast-forward. Storms, sea level rises, and sea currents slowly erode all coastlines over time. But heavy industrial, residential, and tourism-related development — which often involve damaging processes like dredging — has disrupted the sediment transport process that helps shape our coastlines, leaving them more vulnerable to erosion. Meanwhile, extreme weather events and global sea level rises caused by human-induced climate change are turbo-charging natural erosion.

Aswan’s High Dam is also one of the biggest culprits: The dam traps an estimated 90% of sediment, leaving downstream coasts and beaches “starved of replenishment by upstream construction,” the World Bank says.

Coastal cities are now at risk: Around 30% of Alexandria would flood should sea levels rise by just 0.3 meters (that’s marginally less than the current most optimistic scenario), according to the report. This would displace some 545k people and lead to 70.5k job losses. Port Said and other cities on the Delta coast are similarly at risk.

As are our beaches: One alarming 2020 study by the European Commission Research Center found that half of the world's beaches could disappear by 2100. When it comes to Egypt, that represents a best case scenario, according to the study’s lead author Michalis Vousdoukas.

All of this packs a substantial economic punch: Unchecked coastal erosion will likely bring significant costs in property damage, job losses, and lower tourism and tax revenues. The projected economic impact is difficult to measure on a nationwide scale, the World Bank notes. But it does say that coastal flooding in Alexandria alone — which hosts some 40% of Egypt’s industrial capacity, as well as being a tourism hub — could lead to annual losses of USD 504-581 mn by 2050. Meanwhile, sea level rises could hit beach tourism on the Red Sea’s Sahl Hasheesh and Makadi Bay with daily losses of USD 350k by mid-century, according to a study cited in the report.

Some concrete action has been taken: To defend against coastal erosion, Egypt has made use of both “hard” solutions, like widely-erected barriers or seawalls, and “soft” solutions like beach nourishment. In one example, five beaches near Alexandria were successfully “re-nourished” using desert sand, for instance.

Though not all of it has worked as intended: 15 groins were set up at the Rosetta promontory in the early 2000s, to mitigate erosion that had been accelerated by the Aswan Dam. But the groins inadvertently ended up accelerating sediment loss, with some segments of the area subsequently seeing erosion rates as high as 30.8 meters per year.

We need to make the jump from monitoring to mitigation: Egypt has been engaging stakeholders on integrated coastal zone management (ICZM) — which aims to collect data, conduct risk analyses, and plan comprehensive interventions to mitigate erosion — for decades. But while we have a strong record on data collection, we could be doing far more to take meaningful action, the report says. We need to scale up and enforce broad-based ICZM efforts — particularly when it comes to risk assessment and mitigation of erosion from development and infrastructure projects. We’re also one of 10 countries that isn’t yet enforcing a 2008 protocol (pdf), developed under the United Nations Environment Programme (UNEP) Regional Seas Programme, that calls on Mediterranean nations to enforce a regional ICZM plan.

There’s a big erosion defense project in the works for the Nile Delta: The Enhancing Climate Change Adaptation in the North Coast of Egypt project aims to develop 69 km of sand-dune dikes along the Nile Delta to protect from rising sea levels, as well as to establish a new, more comprehensive ICZM plan. Launched in 2017, some 70% of the project’s USD 105 mn cost will be shouldered by the Irrigation and Water Resources Ministry, with the rest to come from the Green Climate Fund. The United Nations Development Program is also a key partner. The seven-year project approved in 2017 is expected to directly benefit some 800k Nile Delta residents, and is an important pilot for ICZM schemes across the region, the report says.

And we’re exploring one interesting natural mitigation technique: Egypt launched a project in 2020 to plant mangrove nurseries over 200 hectares along the Red Sea coasts. The trees act as a natural coastal defense (pdf) by reducing storm damaging and trapping undersea sediment.

Your top climate stories for the week:

- New green ammonia plant? France’s EDF Renewables and Egypt’s ZeroWaste are among six international consortiums in talks to establish a USD 1 bn green ammonia plant in the SCZone that would produce green fuel for ships.

- Waste recycling: Intro Group subsidiary Intro Sustainable Resources is looking to invest some EGP 1 bn in waste recycling this year.

- Tax breaks to boost green economy: Companies working on a wider range of renewable energy and manufacturing projects will now be able to deduct 30-50% of their investment costs from their tax bills under a new decision to expand the Investment Act.

- Green diplomacy: Foreign Minister Sameh Shoukry and Malaysian environment minister Tuan Ibrahim Tuan Man held talks last week to discuss climate change adaptation and climate finance for developing countries.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

15 February-15 June (Tuesday-Wednesday): ITIDA’s Technology Innovation and Entrepreneurship Center is organizing the first Metaverse Hackathon.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

Mid-March: Bidding for the construction of Anchorage Investments’ petrochemical complex in the Suez Canal Economic Zone starts.

14 March-30 June: The “Escape to Egypt” exhibition at the Coptic Museum, in celebration of its 112th anniversary.

20-22 March: International Maritime and Logistics conference Marlog kicks off.

22 March (Tuesday): Egyptian German Green Energy Forum, 5:30-9:30pm CLT, InterContinental Cairo Semiramis.

24 March (Thursday): GB Auto Extraordinary General Assembly (pdf).

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

28 March (Monday): The court hearing for a case brought by Arabia Investments Holding (AIH) against Peugeot has been postponed until 28 March.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF Spring Meetings, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

Early July: Polish President to visit Egypt.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

4-6 November: The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.