- E-Finance to IPO next month, could offer 10% stake. (IPO Watch)

- Cairn, Cheiron could replace Shell in the Western Desert before the month is out. (M&A Watch)

- IFC to support BCI Holding with USD 30 mn loan. (Investment Watch)

- CIB, SODIC to offer mortgage financing options with up to 20 year terms. (Real Estate)

- EGX trading sessions might be getting (slightly) longer. (What We’re Tracking Today)

- Egypt wants to issue more green bonds. (What We’re Tracking Today)

- Conference season continues: The Egypt-International Cooperation Forum opens today. (What We’re Tracking Today)

- El Salvador just crashed the crypto markets. (What We’re Tracking Today)

- The results of the Enterprise-Bupa Egypt Insurance poll are here. (Poll)

- How fiber optic cables are forming the bedrock of our digital infrastructure overhaul. (Hardhat)

- Planet Finance— US stocks fall as recovery concerns grow.

Wednesday, 8 September 2021

E-Finance to IPO next month, could offer 10% stake

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to a particularly busy Wednesday, packed with news about a long-awaited IPO, fresh investment, green bonds and the wellbeing of women employees.

Need more proof the summer slowdown is officially over? It’s been at leat a month and a half since our What’s Happening Today section (below) was as packed as it is this morning.

THE BIG STORY ABROAD this morning: The Wall Street Journal isn’t feeling that “new season, back-to-school” vibe, writing that the “US economy faces a slowdown just as it was set to take off. Covid seems it isn’t yet done with the world’s largest economy, and US stocks sank yesterday as a result. We have chapter and verse in this morning’s Planet Finance, below.

ALSO: The Taliban have named a government. It’s about as progressive as you might expect. Everyone from Reuters and the AP to the WSJ, the New York Times and the BBC have the news.

EGX trading sessions might be getting (slightly) longer — at least if Al Mal is to be believed. The newspaper reported last night that the Financial Regulatory Authority is considering making the trading day 30 minutes longer by opening the market at 9:30am instead of 10, and closing at 2:30pm.

WHAT’S HAPPENING TODAY-

The two-day Egypt-International Cooperation Forum (ICF) kicks off today at the Nile Ritz-Carlton in Cairo. Hosted by the International Cooperation Ministry, the conference will bring together representatives from African and Arab governments, leading Egyptian and international businesses and banks, multilateral lenders, and international institutions including the UN, World Bank, OECD to discuss international development issues such as climate change and the pandemic. Check out the agenda here (pdf)

On the sidelines: Foreign Minister Sameh Shoukry will hold talks with his counterparts from South Sudan and Namibia as well as the head of the UN agency responsible for Palestinian refugees, according to Al-Shorouk.

The GlobalCapital Sustainable and Responsible Capital Markets Forum 2021 wraps today. The two-day virtual event yesterday hosted Vice Minister of Finance Ahmed Kouchouk for a panel session on green bonds.

Egypt wants to start holding green bond sales more frequently, Kouchouck said during the session, according to Reuters. Egypt held the first sovereign green bond issuance in the MENA region last September, raising USD 750 mn from investors to channel into green projects.

Day two of the Egy Health Expo starts today at the Al Manara International Conference Center. The conference wraps up tomorrow.

It’s day four of the Arab Labor Conference, which is running through to 12 September at the InterContinental CityStars Hotel in Heliopolis. Government officials, ambassadors, trade union reps and business owners’ association delegates from 21 Arab countries are participating in the gathering.

Talks between Egypt and Turkey wrap up in Ankara later today as the two attempt to mend a near-decade-long rift. If things go well, the next step could be a reinstatement of ambassadors: “If we decide together after the meetings, we will take the necessary mutual steps to appoint an ambassador,” Turkish Foreign Minister Mevlut Cavusoglu told Turkish state TV yesterday. Egypt’s Foreign Ministry has not spoken publicly on the talks since they began yesterday.

The move comes amid attempts by Turkey to mend bridges in the region, embarking on talks with long-time rivals the UAE and Saudi Arabia in recent months. The Turkish FM also floated the possibility of an eastern Mediterranean maritime agreement with Egypt, calling for a multilateral summit to reconcile territorial disputes in the region.

LATER THIS WEEK AND NEXT-

EFG Hermes’ fourth Virtual Investor Conference runs 13-21 September with the theme of “After Reflation – FEMs in 2022.”

AmCham event: Environment Minister Yasmine Fouad will give a speech on strategies for generating green, private sector-led growth at AmCham’s virtual monthly event on Monday, 13 September. Register here.

ALSO:

- Inflation data for August will be out at the end of this week.

- New school year: International schools begin the 2021-2022 academic year on Sunday, 12 September.

- Sahara Expo: The four-day agricultural conference, the Sahara Expo, will start on Sunday at the Egypt International Exhibition Center.

- Interest rates: The Central Bank of Egypt will meet to review interest rates on Thursday, 16 September.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

|

*** IN CASE YOU MISSED IT-

- More listings for ADX: UAE company ADQ plans to list Abu Dhabi Ports on Abu Dhabi’s ADX before the end of the year.

- Public Investment Fund buys shares from Zain: Saudi Arabia’s Public Investment Fund made a USD 484 mn bid to buy a 60% stake in Zain Saudi Arabia’s towers infrastructure.

- Meet our analyst of the week – Yara El Kahky, economist and capital markets analyst at Banque Misr’s Market Intelligence Unit.

MORNING MUST READ- El Salvador became the first country yesterday to adopt BTC as legal tender alongside the USD. The country bought USD 20.9 mn worth of bitcoin a day ahead of the new currency’s rollout Tuesday, bringing its total holdings to 400 BTC, which can be used to make purchases nationwide, or exchanged for its equivalent in USD as of yesterday. But the rollout has already hit a minor snag yesterday when the government was forced to temporarily shut down its digital wallet, which was unable to cope with the surge in demand for the cryptocurrency.

And then crypto crashed: The price of BTC plunged more than 17% to USD 43k and Ethereum lost 12% during trading yesterday as crypto exchanges saw delays and trading platforms suffered outages, Reuters reports.

We’ll have more on what the daring move might mean for the country, and whether other developing nations could follow suit, in this afternoon’s EnterprisePM.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, and urban development, to social infrastructure such as health and education.

In today’s issue: We spotlight Egypt’s strategy to transition its broadband infrastructure from copper cables and wires to fiber optics, beginning with the 2012 EGP 37 bn plan. We look at how far we’ve come towards that transition, what the obstacles are to that, and why, despite all the effort done, are our internet speeds still falling short.

IPO WATCH

E-Finance to IPO next month, could offer 10%

E-Finance’s long awaited IPO could hit the market as soon as next month, unnamed government sources told Al Borsa (pdf). The state-owned e-payments company could offer around 10% for sale, according to the report said, though this is subject to change, the report says. The government’s IPO committee is expected to meet this month to consider the final stake to be put on offer.

The company’s IPO has been a long time coming: E-finance has been eying the EGX since 2019, when it first expressed its intention to IPO during 1Q2020. Its market debut was then postponed to April 2020, which was in turn derailed by the pandemic. In late 2020, the government pushed the company’s listing to the first quarter of 2021, and then the second quarter.

E-Finance’s IPO is one of five or six EGX debuts we were told to expect this year by EGX Chairman Mohamed Farid after a number of companies that were planning to list last year either postponed or cancelled their listings due to the pandemic. This year the EGX has already seen an IPO by education outfit Taaleem, as well as a technical listing by LSE-listed healthcare player IDH. Ebtikar’s share sale is expected to take place in 4Q2021. Meanwhile, cosmeceutical giant Macro Group is looking to pull the trigger on its IPO in the fall after postponing it in April.

Advisors: Renaissance Capital, CI Capital and Al Ahly Pharos are quarterbacking the transaction as joint coordinators and joint bookrunners. NI Capital is acting as the government consultant for the listing. Zaki Hashem & Partners were previously reported to have been retained as legal advisors. Inktank is investor relations advisor.

M&A WATCH

Cairn Energy expects to finalize Shell Egypt acquisition by end of September

Cairn, Cheiron could replace Shell in the Western Desert before the month is out: Cairn Energy and partner Cheiron expect to finalize its takeover of Shell Egypt’s onshore oil and gas assets by the end of September, Cairn said yesterday (pdf). The joint acquisition, which will see the assets split 50-50 between the UK-listed company and leading Egyptian independent player Cheiron Petroleum, is “advancing to completion” and should be complete before the end of the third quarter, the company said in its earnings release.

Shell announced in March it had agreed to sell its onshore portfolio to Cairn and Cheiron in a transaction that could be worth up to USD 926 mn. The companies will initially pay USD 646 mn for the assets, but a further USD 280 mn could be added between 2021 and 2024 depending on oil prices and exploration efforts. The portfolio includes 13 onshore concessions and Shell’s stake in Badr El-Din Petroleum (Bapetco) — a joint venture company established with the state-owned Egyptian General Petroleum Corporation.

The final hurdle: Cairn is waiting on approval from the Oil Ministry to move forward, according to a statement seen by Asharq.

Cairn plans to ramp up investment in the first half of 2022 after closing the acquisition, it said in the statement. There is “significant short-cycle potential” for further exploration and the company is planning to drill 10 wells and three “seismic acquisition programmes,” it said.

The company is funding the acquisition with a mixture of cash and debt: Cairn will borrow USD 181 mn across two loans and issue new shares worth USD 121 mn, according to the statement seen by Asharq. The remainder will be funded via existing cash balances, according to the report.

Cairn is playing up the strong financial feasibility of the takeover, pointing out that a USD 30 per-barrel price would see it break even on its investment, while Brent is currently trading above the USD 70 mark.

But some are questioning the transaction, pointing out that Shell had agreed to sell gas to the Egyptian government at a fixed price, meaning Cairn and Cheiron will not be able to capitalize on the recent surge in global gas prices. “Longer-term interest [in Cairn] depends upon investors’ appetite for [fixed price] Egyptian oil and gas and fossil fuels in general,” an analyst at RBC Capital Markets told the Financial Times.

Advisors: Rothschild & Co and Gaffney Cline & Associates acted as advisors on the acquisition.

INVESTMENT WATCH

IFC to support BCI Holding with USD 30 mn loan

Plastics raw material manufacturer BCI Holding will expand its production facility in Egypt through a USD 30 mn loan from the International Finance Corporation (IFC), which will also be used to establish new facilities in Algeria and Nigeria, the IFC announced in a press release (pdf). The statement does not say how much of the funding is earmarked for Egypt.

BCI Holding says it wants to create greener, circular economy systems using a technology that recycles scrap polyester into insulating materials. It also plans to use the funds to develop regional supply chains for polyurethane, which is used in the production packaging, footwear, and other purposes.

The company is a manufacturer and distributor of polyurethane raw materials, used in the production of plastics. BCI Holding has production facilities in Egypt, the UAE, Turkey and Italy, with distribution facilities in Algeria and Lebanon.

Other chemical production companies are looking to make Egypt their regional hub: Earlier this year, North American adhesive manufacturing company HB Fuller announced that it would be setting up a facility in Cairo and using Egypt as its ”gateway” to the region.

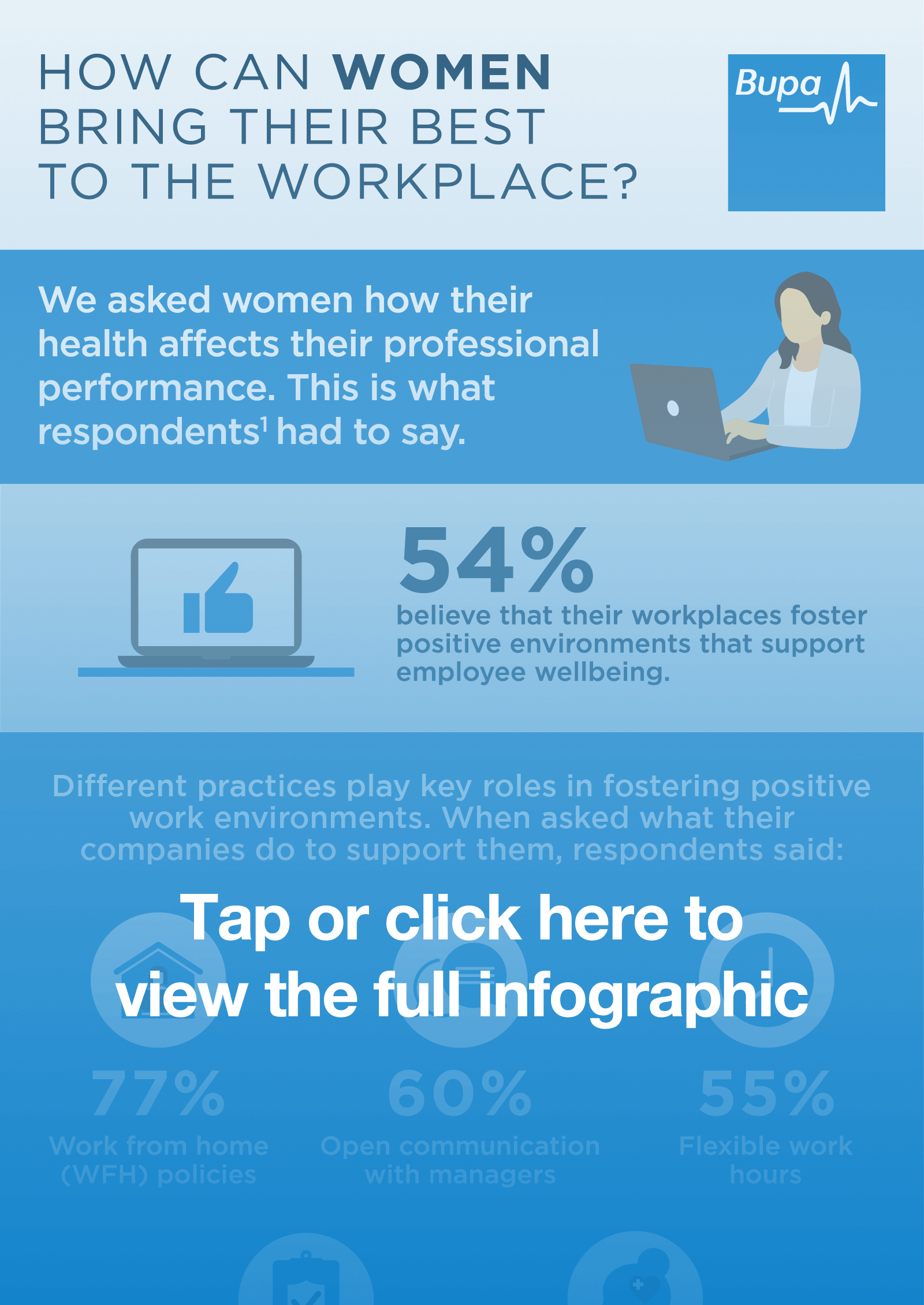

A MESSAGE FROM BUPA EGYPT INSURANCE

Women employees feel their wellbeing is supported in the workplace following the negative impact of covid-19, our survey in association with Bupa indicated. Many women leave the workplace due to issues surrounding their health, but covid-19 has brought women’s health and wellbeing into even sharper focus. While many of our respondents believe their workplaces foster positive environments to support employee wellbeing, many of them agree that there is room for improvement.

While a few of them say that the lines between work and home are blurred, those that strive to prioritize their professional successes admit that many factors continue to impact their mental health with regards to their jobs. Businesses must listen and reshape by making reasonable adjustments that can boost efficiency and satisfaction across their work environments.

Click here to access the survey results and understand how women can bring their best to the workplace.

REAL ESTATE

CIB to offer mortgage finance for SODIC units

CIB will now offer financing options with up to 20-year terms to home buyers purchasing property at SODIC-owned real estate developments, the upmarket real estate developer said in a press release (pdf). Under the cooperation protocol signed earlier this week, SODIC clients will be able to purchase ready-for-delivery homes with mortgage finance from CIB. Existing home owners offering their units for resale through the company platform will also be able to offer extended payment options to potential buyers.

Private sector players have been active in the real estate lending space this year: Contact Financial Holding and real estate marketplace Sakneen also joined forces earlier this year to offer a one-stop-shop for people searching for new homes and mortgage finance through 10-year loans of up to EGP 3 mn to Sakneen clients.

And the CBE is giving mortgage finance a leg up as well: The Central Bank of Egypt (CBE) launched its EGP 100 bn mortgage finance initiative for low- and middle-income earners this year which offers 30-year mortgages with a subsidized 3% interest rate for qualified home buyers. Under the program low-income buyers are required to pay a 10% down payment and can access financing for homes worth up to EGP 350k, while middle-income households would need to pay 15% for homes worth up to EGP 1.1 mn and 20% for homes valued at EGP 1.1 mn to EGP 1.4 mn. The initiative is expected to benefit 220k families, and cost some EGP 120 bn over 30 years.

The mortgage financing market has more than doubled to EGP 3.4 bn since 2017, driven by subsidized CBE lending initiatives in recent years, which has twice expanded upon an initial EGP 50 bn mortgage financing program for middle-income housing between 2014 and 2019 that offered homeowners long-term loans at a 5-7% interest rate. Real estate financing from private sector entities in 1H2021 grew to a total of EGP 3.1 bn, up from EGP 1.12 bn during the same period in the previous year, according to an FRA report (pdf).

INFRASTRUCTURE

Elsewedy snags EETC EGP 1.15 bn contract to build 3 electricity substations

Elsewedy Electric has signed two turnkey contracts worth a combined EGP 1.15 bn with the state-owned Egyptian Electricity Transmission Company (EETC) to establish three electricity substations in Central and North Sinai, according to a bourse disclosure (pdf) yesterday. The first contract, worth EGP 970 mn, will see the company set up two substations while the third will be established under a second, EGP 180 mn contract.

The substations will be up and running within 16 months, the disclosure read, adding that Elsewedy will design, supply and build the projects on a turnkey basis.

Elsewedy won the contracts in a bid round involving a number of local and international companies, Electricity Minister Mohamed Shaker said in a statement. He added that the projects come as part of government efforts to strengthen the electricity grid and improve infrastructure in the Sinai Peninsula.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Last night’s talk shows focused on President Abdel Fattah El Sisi’s tour of Alexandria Port, during which he inspected development work on a new multi-purpose logistics station, sea docks and storage warehouses, as well as new train carriages and the monorail. Alaa Mas’ouleety (watch, runtime: 13:16), Kelma Akhira (watch, runtime: 3:40 | 4:00) and Masaa DMC (watch, runtime: 3:37 | 22:47) all had the story.

Only goods that meet European standards will be allowed to enter the country, El Sisi said, adding that the state has invested bns of EGP in the new automated system for tax and customs procedures. He said that next March would mark the final deadline for the rollout of the new system.

Kelma Akhira’s Lamees El Hadidi invited FinMin advisor Mona Nasser (watch, runtime: 4:07 | 11:08) to explain the details of the new customs system and how it will facilitate imports and exports. She also spoke with Metta Beshay, a member of the importers division in the Federation of Egyptian Chambers of Commerce, on the system’s challenges and the extent to which traders are ready for its implementation (watch, runtime: 6:21).

On the development of Alexandria Port: Alexandria Port Authority Chairman Tarek Shahin spoke with Al Hayah Al Youm (watch, runtime: 9:50) on the implementation of the 22 new sea docks, which he said would allow the port to cater to the largest container ships.

Egypt will be a global center for trade and logistics by 2024, Transport Minister Kamel Al Wazir said in an interview on Ala Mas’ouleety (watch, runtime: 53:52 | 7:17), adding that 180 mn tons of goods are currently transported in Egypt every year. He added that the multi-purpose logistics station provided a chance to expand docking capacity at Alexandria Port.

The new monorail line will cost an estimated EGP 76 bn, National Authority for Tunnels (NAT) head Assem Waly said in a phone interview with Yahduth Fi Masr’s Sherif Amer (watch, runtime: 2:45 | 3:16), adding that construction on Cairo ‘s Metro Line 4 is now 15% complete.

The cost of garbage disposal in Cairo, including collection, transportation and safe disposal, is more than EGP 3 bn annually, Local Development Minister Mahmoud Sharaawy said during an inspection of the city’s garbage disposal companies, ahead of the implementation of contracts with two new firms, Irtiqaa and Enviromaster, to manage the city’s waste. Al Hayah Al Youm (watch, runtime: 2:49) and Yahduth Fi Masr (watch, runtime: 2:28) had the story.

EGYPT IN THE NEWS

Human rights is leading coverage in the foreign press this morning, in the wake of a Human Rights Watch report that is getting play everywhere from the BBC to the Washington Post.

Egypt has postponed the trial of activist Hossam Bahgat for tweeting criticism of alleged electoral fraud, AFP reports. The postponement comes after authorities in July released six activists and journalists from pre-trial detention.

On the other side of the human rights debate, an op-ed in The Hill by the former top Pentagon Middle East policy official argues against proposals by some Democratic lawmakers to partially withhold US security funding to Egypt on the basis of alleged human rights violations.

ALSO ON OUR RADAR

Fawry’s shareholders greenlit the acquisition of CIB and Banque Misr’s stakes in subsidiary Fawry Plus, the e-payments giant announced in a bourse filing (pdf). Fawry will buy each of the two bank’s 15% stakes in its subsidiary at EGP 1.15 per share, for a total of EGP 16.2 mn per acquisition. The acquisition is still subject to regulatory approval.

Egyptalum has hiked aluminum prices by between EGP 2k and 4.5k per tonne as global prices reach new multi-year highs,, a company spokesperson told Al Mal. A tonne of aluminium will now cost somewhere between EGP 51k to EGP 62k before tax. Global aluminium prices recently reached their highest level in a decade as a swell in post-lockdown demand and rising raw material costs cause inflation to rise. A recent coup in Guinea, of all places, hasn’t helped.

Other things we’re keeping an eye on this morning:

- The Cabinet has approved the executive regulations of the export subsidy program, which came into effect on 1 July for a period of three years, according to Al Borsa (pdf).

- President Abdel Fattah El Sisi ratified a law establishing an endowment fund to channel funds into educational, cultural, social, and healthcare organizations.

- General Electric and French cancer-research center Gustave Roussy will work with the Egyptian Health Ministry to improve cancer screening, treatment and research in Egypt, after Health Minister Hala Zayed signed an agreement earlier this week during her trip to Paris.

- Domty signed two contracts worth EUR 2.5 mn with AMF to establish a fourth bakery line, its first for the production of croissants.

COVID WATCH

Daily covid cases inch up again

The Health Ministry reported 378 new covid-19 infections yesterday, up from 368 the day before. Egypt has now disclosed a total of 290,773 confirmed cases of covid-19. The ministry also reported 10 new deaths, bringing the country’s total death toll to 16,811.

PLANET FINANCE

US stocks fall on recovery concerns: Fears that the US economic rebound from covid has peaked led shares to fall yesterday though tech stocks saw gains, according to Bloomberg. The S&P 500 fell 0.3% and the Dow lost 0.8% during trading yesterday as the greenback rose and bond yields climbed. The tech-heavy Nasdaq was the outlier, seeing a slightly 0.1% rise as investors bought into heavyweight tech companies.

The source of concern: Delta. The Wall Street Journal is already forecasting a slowdown in growth this month as the delta covid variant continues to spread around the country. Mask mandates and travel restrictions are back, hiring is slowing, consumer sentiment continues to fall, and Goldman Sachs has again reduced its 2021 growth forecast.

“The delta variant concerns are weighing down on overall third-quarter growth,” one fund manager told Bloomberg. “The next couple of weeks are going to be pretty rocky. We’re seeing investors become more picky with their stocks not only because of the delta concern but also because of fading fiscal stimulus, legislative policies and an overall slowing recovery in some sectors”

Global stocks recorded an eighth consecutive record high on Tuesday as expectations that the Federal Reserve will delay plans to unwind its stimulus program grew, Reuters reports. Weaker-than-expected US jobs data this week has heightened speculation that policymakers will rethink plans to begin reducing asset purchases later this year, helping MSCI’s global index to inch up 0.1% during trading.

In other global business news:

- Did Ford just land the coup de grace to Apple’s auto ambitions? The man appointed by Apple to helm its car project has defected to Ford, in a move the press is pitching as a heavy blow to the tech company’s auto ambitions. Doug Field joined Apple’s Titan project three years ago, which has goals of producing electric and autonomous vehicles in the coming years, but has now been hired by Ford where he will head up its advanced technology and embedded systems operations. (FT | Reuters | The Verge)

- German regulators join the Allianz pile-on: German authorities are the latest to launch an investigation into the country’s largest financial company, Allianz, which is facing a spate of lawsuits in the US after several of its funds tanked during the covid market sell-off last year. (Reuters)

|

|

EGX30 |

11,090 |

+0.2% (YTD: +2.3%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

11,414 |

+0.1% (YTD: +31.4%) |

|

|

ADX |

7,718 |

+1.2% (YTD: +53.0%) |

|

|

DFM |

2,909 |

+0.1% (YTD: +16.8%) |

|

|

S&P 500 |

4,520 |

-0.3% (YTD: +20.3%) |

|

|

FTSE 100 |

7,149 |

-0.5% (YTD: +10.7%) |

|

|

Brent crude |

USD 71.60 |

-0.9% |

|

|

Natural gas (Nymex) |

USD 4.57 |

-3.0% |

|

|

Gold |

USD 1,798.50 |

-1.9% |

|

|

BTC |

USD 46,352 |

-11.0% (as of midnight) |

THE CLOSING BELL-

The EGX30 rose 0.2% at yesterday’s close on turnover of EGP 1.4 bn (7.4% below the 90-day average). Regional investors were net buyers. The index is up 2.3% YTD.

In the green: Speed Medical (+9.8%), Egyptian for Tourism Resorts (+5.7%) and MM Group (+4.6%).

In the red: Credit Agricole (-2.2%), Ezz Steel (-1.5%) and Elsewedy Electric (-1.1%).

Asian markets are mixed in early trading this morning, with Chinese shares mostly in the green but exchanges in the rest of the region nursing losses. European shares look set to open in the red while shares on the other side of the Atlantic look to see early gains, according to US stock futures.

PROJECT PROFILE- Waiting for our high speed internet dreams to quit buffering: Since 2012 the government has set out on a major overhaul of our ailing digital infrastructure by replacing our traditional copper based internet cables with a more exhaustive high-speed fiber optic network. Telecom Egypt has been at the helm of this initiative to upgrade our current digital landscape, which has included expansions to our rural regions. In this issue we take a look at what Telecom Egypt has been up to on this front and why, despite almost completing the rollout of this plan, internet speeds remain stubbornly slow in Egypt.

So, why are we swapping out our copper network for fiber optic cables? Data travels over fiber optic cables at 20 times the speed regular copper can transmit, reaching up to 1 gbps up from the average 50 to 100 mbps speeds copper can offer, according to HP. The reason fiber optic is so much faster, and more reliable, than our traditional network is because copper wire heats up and picks up interference as it transmits internet signals. Fiber on the other hand breaks down files into data packets that are transmitted in beams of light over thin glass or plastic fibers contained within a protective encasing known as cladding. This also makes fiber less susceptible to internet service provider-induced slow downs during peak use.

The 2012 EGP 37 bn transition plan to connect c.34 mn homes was off to a slow start when it first launched but has recently picked up the pace. Telecom Egypt figures show that the company had transitioned some 9.7 mn households to fiber optic cables in 2016 and 12.6 mn households in 2017 before jumping considerably to 17.6 mn in 2018, and 27.7 mn in 2019, according to Telecom Egypt’s IR director Sarah Shabayek. By 2020 the total number of homes receiving internet service through TE’s fiber optic network went up by another 3 mn households, despite covid-related delays, which came to a total 30.8 mn by the end of the year.

Where does the project stand today: The company had completed 90% of its fiber optic connectivity target, which translated to 30.8 mn households being hooked up to the new network, Shabayek told Enterprise. “Telecom Egypt has basically finished working on the project. We covered about 90% of the target areas designated for a copper to fiber transition.The outstanding portion isn’t economically feasible to complete because of their remote location and low population density." By our own in-house calculations that amounts to some 4.22 mn homes waiting to be plugged into the fiber network.

One source of funding for the remaining homes could be the NTRA’s Universal Service Fund — which draws its revenues from a government-mandated fee on private sector companies operating in Egypt — could become another source of financing for a portion of the remaining households, according to Shabayek. The rest will come out of the state’s budget.

A separate initiative is in the works to bring 65 mn people fiber optic broadband: The government’s rural infrastructure development plan, Hayah Karima, will spend EGP 5.6 bn on installing fiber optic networks to some 1 mn residential buildings and 14k government buildings in 1.4k villages around the country, according to a CIT Ministry statement. Up to 65 mn people in rural regions are expected to see fiber optic powered broadband under the same Hayah Karima initiative, Ihab Said, head of the communications division of the Federation of Chambers of Commerce (FEDCOC), tells Al Dostor.

But results from Ookla’s Speedtest still show falling internet speeds this month: Average fixed internet speeds in Egypt fell to 41.45 Mbit/s in July, down from a reading of 42.42 Mbit/s in June, according to AMAY. Our global ranking of internet speed by Ookla also fell by one position in July putting us at the 92nd position globally, compared to 91st in June, when average speeds surpassed the 40 Mbit /s global average.

Egypt did however inch up to become the country with the third fastest average internet speed on the continent in June. The CIT Ministry said in 2019 it was targeting speeds of 40 mbps by the end of 2020, which at the time was still hovering at an average download speed of about 31.38 mbps.

So, why are we still falling short? It takes more than just fiber optic cables: It comes down to the wiring of existing buildings, which are outdated, Shabayek explains. “Electrical wires and internet cables need to be separated into different plastic tubes to avoid electrical interference with internet speeds,” which dampen the gains from our fiber optic network, Shabayek added.

Then there’s the old router problem: Routers have a lifespan of about five years and need to be swapped out every so often to keep up with the newest advancements in internet technology. Telecom Egypt was one company that shouldered a sizable portion of the costs of replacing old routers and launched an awareness campaign urging people to swap out their devices, Shabayek said.

The solution? Make all new buildings fiber optic-friendly: Fiber optic connectivity in April became a requirement for locking down licenses to build new properties much like all other required public utilities. The requirement has yet to be explicitly spelled out in the government’s new Unified Building Code but the new code is expected to be expansive and should see the light in the near future, suggesting that CIT infrastructure requirements could be included in the new regulations.

Beefing up our internet instructure has never been more crucial: Since the covid-19 pandemic hit and forced many crucial aspects of daily life to move online, demand for high speed internet access has skyrocketed here in Egypt. With Interest in online education, digital healthcare and e-commerce increasingly becoming part of the new norm established by the onset of the pandemic, an overhaul of our ailing internet infrastructure and wider access to our often forgotten rural regions is long overdue.

The challenge ahead remains bringing existing buildings to the fold to ensure that the heavy investment in upgrades are not for naught.

Your top infrastructure stories for the week:

- Hassan Allam Construction and Hassan Allam Roads and Bridges have been asked by the Transport Ministry to build stations and several bridges for the government's multi-bn high-speed rail network, the company said in a statement.

- Port Said could get a new EGP 3 bn logistics zone, with Head of the Internal Trade Development Authority (ITDA) Ibrahim Ashmawy and Port Said Governor Adel El Ghadban floating the idea in a meeting yesterday.

- French CMA CGM will operate and manage the Tahya Misr all-purpose terminal in the Alexandria port, after signing an agreement with the government.

- The Finance Ministry will guarantee an EGP 36.2 bn loan from the CBE for the National Authority for Tunnels, to finance planned projects during its current fiscal year, sources told Al Borsa (pdf).

CALENDAR

5-12 September (Sunday-Sunday): Arab Labor Conference, the InterContinental CityStars Hotel, Cairo, Egypt.

7-8 September (Tuesday-Wednesday): Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, featuring Vice Minister of Finance Minister Ahmed Kouchouk.

7-8 September (Tuesday-Wednesday): Egypt, Turkey hold diplomatic talks in Ankara.

7-9 September (Tuesday-Thursday): Egy Health Expo, Al Manara International Conference, Cairo, Egypt.

8-9 September (Wednesday-Thursday): Egypt-International Cooperation Forum (ICF), Cairo

11-12 September (Saturday-Sunday): International Conferences on Economics and Social Sciences, Cairo

12 September (Sunday): International schools begin 2021-2022 academic year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

13 September (Monday): Environment Minister Yasmine Fouad will give a guest speech at AmCham’s monthly virtual event,

13-21 September (Monday-Tuesday): EFG Hermes’ fourth Virtual Investor Conference.

14-30 September (Tuesday-Thursday): 76th session of the UN General Assembly, New York.

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 September (Saturday): Expiration of United Nations Investigative Team to Promote Accountability for Crimes Committed by Daesh/ISIL

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

29 September (Wednesday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins — must be held by the first Thursday of October.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.