- It’s official: Ramadan starts tomorrow. (What We’re Tracking Today)

- Is Cleopatra Hospitals throwing its hat in the ring for Alexandria Medical Services. (M&A Watch)

- Sinopharm, Sinovac aren’t stellar, China admits. (Covid Watch)

- MENA countries are going to need to borrow almost USD 1 tn over the next two years -IMF. (Economy)

- The effects of the Suez blockage on global supply chains could be felt for months. (Suez Canal)

- Hotel occupancy rates still weren’t great in 1Q. (Tourism)

- Gross negligence to blame for Sohag train crash, says public prosecution. (Also On Our Radar)

- What Egypt’s universities are doing to foster entrepreneurship. (Blackboard)

- Planet Finance — CEO pay surges during worst year for the global economy in decades

Monday, 12 April 2021

Is Cleopatra Hospitals throwing its hat in the ring for Alexandria Medical Services?

TL;DR

WHAT WE’RE TRACKING TODAY

Ramadan Kareem, y’all: Dar Al Ifta confirmed last night that Tuesday will be the first day of Ramadan. We wish all of you a fantastic, relaxing month with family and friends.

So, when do we eat? Maghreb prayers are at 6:21pm in the capital city tomorrow. You’ll have until 3:59am to finish sohour tonight.

As a reminder: Bank hours will run 9:30am-1:30pm through the holy month (9am to 2pm for staff), while the EGX is also on shorter hours, with the opening bell at 10am and last trades by 1:30pm.

***CATCH UP QUICK on the top stories from yesterday’s edition of EnterprisePM:

- Macro IPO postponed until fall: Macro Group has pushed back plans for an April IPO on the EGX despite strong appetite from international institutional investors, due to concerns about “the market’s capacity to absorb multiple offerings” following Taaleem’s debut on the bourse last week and as IDH plans to pull off the country’s first technical listing. The decision came after the company consulted regulatory authorities, it said.

- Economic reform program 2.0: Planning Minister Hala El Said has revealed more details about the second round of the government’s economic reform program.

- Operation Mogamma Facelift: The Sovereign Fund of Egypt expects to ink contracts by 3Q2021 with a private sector partner to repurpose the Mogamma Tahrir.

WHAT’S HAPPENING TODAY-

Russian Foreign Minister Sergey Lavrov is in town today for talks with President Abdel Fattah El Sisi to discuss the latest developments on the stalled GERD talks. Lavrov’s visit comes after expectations that Russian President Vladimir Putin would visit Egypt sometime in March did not materialize. The latest round of ministerial negotiations between Egypt, Sudan, and Ethiopia over the dam last week ended in yet another stalemate.

Resuming Russian flights to Red Sea resorts also high on the agenda: “We are looking forward to having flights from Russia to the Egyptian tourist areas resumed,” Shoukry told Russian news agency Tass ahead of the meeting. “We have done our utmost to reach the top security level at Egypt’s airports and in the resorts.” Russia has maintained a ban on direct flights to Red Sea resort towns since the Metrojet crash in the Sinai in 2015.

Meanwhile, Egypt and Sudan are getting closer on more levels: Finance Minister Mohamed Maait is in Khartoum for a second day. He’s meeting with central bank officials as well as the Sudanese ministers of transport, finance, and planning as part of Egypt’s efforts to strengthen bilateral relations and support Sudan’s economic development, according to a cabinet statement.

THE BIG STORY INTERNATIONALLY-

An Iranian nuclear facility has been sabotaged in an act Tehran has labelled “nuclear terrorism.” The head of the country’s nuclear authority said the underground Natanz enrichment facility had suffered a blackout, a day after the government announced it had begun tests on a new advanced centrifuge that could allow it to enrich uranium more quickly. This comes a few days after world powers met in Vienna for talks focused on bringing Iran back into compliance with the 2015 nuclear pact and persuading the US to drop the Trump administration's economic sanctions. Everyone from the NYT and the AP to Bloomberg and the BBC has the story.

|

CIRCLE YOUR CALENDAR-

Amendments to the VAT Act will be shipped back to the House Planning and Budgeting Committee in a few weeks after public consultations on the amendments wrap up, committee undersecretary Mostafa Salem told us. The Finance Ministry has been sitting down with industry players, including representatives from Coca Cola, PepsiCo, and Nestle for their comments on the amendments, including applying the 14% tax to the rent and purchase of commercial and administrative properties, imposing VAT on crackers and some sweets, and removing the tax on imports of strategic commodities.

Among the other deadlines and events you need to have your eye on this month:

- EBRD President Odile Renaud-Basso could visit Egypt later this month, Al Masry Al Youm reported this weekend following a meeting with Egypt’s ambassador to the UK Tarek Adel. This would be her first official visit to Egypt since she was appointed to head the bank in November.

- More information on the new construction licenses + building code will be made public by this Thursday, 15 April to explain the details of the new system that will hand out construction licenses.

- “Summer hours” will come into effect for retail stores and restaurants as of 17 April. This means retail shops can close at 11 pm (instead of 10 pm during the winter), while cafes and restaurants can stay open until 1 am (instead of midnight currently). We have more details on the winter vs. summer hours here.

- The Central Bank of Egypt will meet to discuss interest rates on Thursday, 29 April.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Egypt’s startup ecosystem ― like those throughout the world ― is closely linked to universities. Institutional support is a core factor driving our entrepreneurship movement. Since the first university-based startup incubator was founded in 2013, similar programs have been launched inside and outside Cairo, and more universities are leading general awareness-raising about entrepreneurship and teaching it as an academic discipline. Today we look at how university programs are fostering entrepreneurship and supporting students to launch their own startups.

M&A WATCH

Red hot

The bidding war for Alexandria Medical looks to be heating. EGX-listed Cleopatra Hospitals Group (CHG) is now reportedly throwing its hat in the ring for Abu Dhabi Commercial Bank’s (ADCB) 51.5% stake in Alexandria Medical Services, Al Mal reports, citing unnamed sources it says have direct knowledge of the transaction.

Ain’t nobody talking: Representatives of CHG as well as of the investment banks involved — EFG Hermes and CI Capital — were either unavailable or declined to comment. Alex Medical neither confirmed nor denied the news, saying in a regulatory filing (pdf) it has no information on CHG’s apparent intention to bid.

This isn’t the first time CHG has been linked with Alex Medical: Cleo publicly denied interest in Alex Medical last year after reports in the press claimed it was considering making a bid.

A bid would be wholly consistent with Cleo’s growth strategy: CHG has been on an acquisition tear in recent years, most recently announcing a mega-merger with Alameda Healthcare Group that will see CHG and Alameda’s Egypt assets merge to become the largest private-sector healthcare group by a wide margin. The agreement, which was announced in December, is expected to close in June. CHG also locked down a 60% stake in Bedaya Hospital with a business transfer agreement last September and acquired Queens and El Katib hospitals in 2019.

Speed Medical has put in a bid, confirming in a disclosure (pdf) yesterday that its consortium with Saudi’s Tawasol Holdings (already a 26% shareholder in Alex Medical) and Sharif El Akhdar’s LimeVest has made an offer to Alex Medical’s advisor, CI Capital. The consortium reportedly reached out to ADCB back in January to discuss a transaction. Alex Medical confirmed the consortium was interested in submitting an offer to purchase the company’s shares at EGP 38.09 apiece.

Who else is in the running? Reports in the local press last month suggested the Mabaret Al Asafra-Tana consortium would submit a bid to acquire 100% of the firm before the end of March. Alex Medical denied the news a week later, claiming that it was unaware of the potential takeover bid, but Al Mal’s sources yesterday seemed to confirm the existence of a bid, telling the newspaper that the consortium had valued Alex Medical at more than EGP 650 mn.

Advisors: EFG Hermes is acting as CHG’s financial advisor, while Arqaam Capital is advising the Mabaret Al Asafra-Tana consortium. Zilla Capital is advising Mabaret Al Asafra’s shareholders. Prime Capital is advising to the Tawasol-Speed Medical consortium. CI Capital is the sell-side advisor.

CORRECTION- 12 April 2021

An earlier version of this story incorrectly said Zilla Capital is advising the Mabaret Al Asafra-Tana consortium.

COVID WATCH

Questions about Sinovac, Sinopharm protection rates

Sinopharm and Sinovac — two vaccines Egypt is relying on in its inoculation drive — “don’t have very high protection rates” against the virus the causes covid-19, director of the China Centers for Disease Control Gao Fu said at a presser, according to the Associated Press reports. The country’s top disease control body is now considering the use of different vaccines with different “technical lines” and is also mulling mixing its existing jabs to make them more effective, Gao added.

The Sinovac shot, of which Egypt plans to produce 80 mn doses each year through state-owned Vacsera, is well below the Sinopharm jab's efficacy rate: Sinovac was reportedly found to be just 50.4% effective at preventing symptomatic infections in a Brazilian trial earlier this year — barely meeting the threshold for regulatory approval and much lower than the initially reported efficacy rate. Egypt has so far received 680k doses of Sinopharm and is expected to get its hands on an additional 900k-1 mn doses of the jab in the coming days. Sinopharm has claimed a 79% efficacy rate.

Next in line for jabs here at home: MPs, who are expected to get vaccinated this week after Prime Minister Moustafa Madbouly signed off on their eligibility, along with their immediate families, Parliamentary Affairs Minister Alaa Fouad said during a plenary session yesterday, Masrawy reports. Rep. Mostafa Bakry had previously proposed that the entire House of Representatives go on recess until members are inoculated, after 15 MPs were infected.

The Health Ministry reported 812 new covid-19 infections yesterday, up from 801 the day before. Egypt has now disclosed a total of 210,489 confirmed cases of covid-19. The ministry also reported 40 new deaths, bringing the country’s total death toll to 12,445.

Saudi Arabia will allow (limited) Ramadan-evening Taraweeh prayers in the two Grand Mosques in Mecca and Medina, according to a statement. The Taraweeh prayers in the two mosques will be capped to five Tasleemat, with strict precautionary measures in place to curb the spread of covid-19, the statement said.

Pfizer and BioNTech’s covid-19 vaccine could be less effective against the South Africa variant than previously thought, according to the real-world study in Israel that allowed the country to roll out its vaccination program at record speed. The study — the results of which may not be properly indicative because of the small sample size and other limitations — found the prevalence of the variant to be eight times higher in vaccinated than unvaccinated people, Reuters reports. “This means that the South African variant is able, to some extent, to break through the vaccine’s protection,” Tel Aviv University professor Adi Stern said.

ECONOMY

Egypt + MENA to face higher financing needs post-covid -IMF

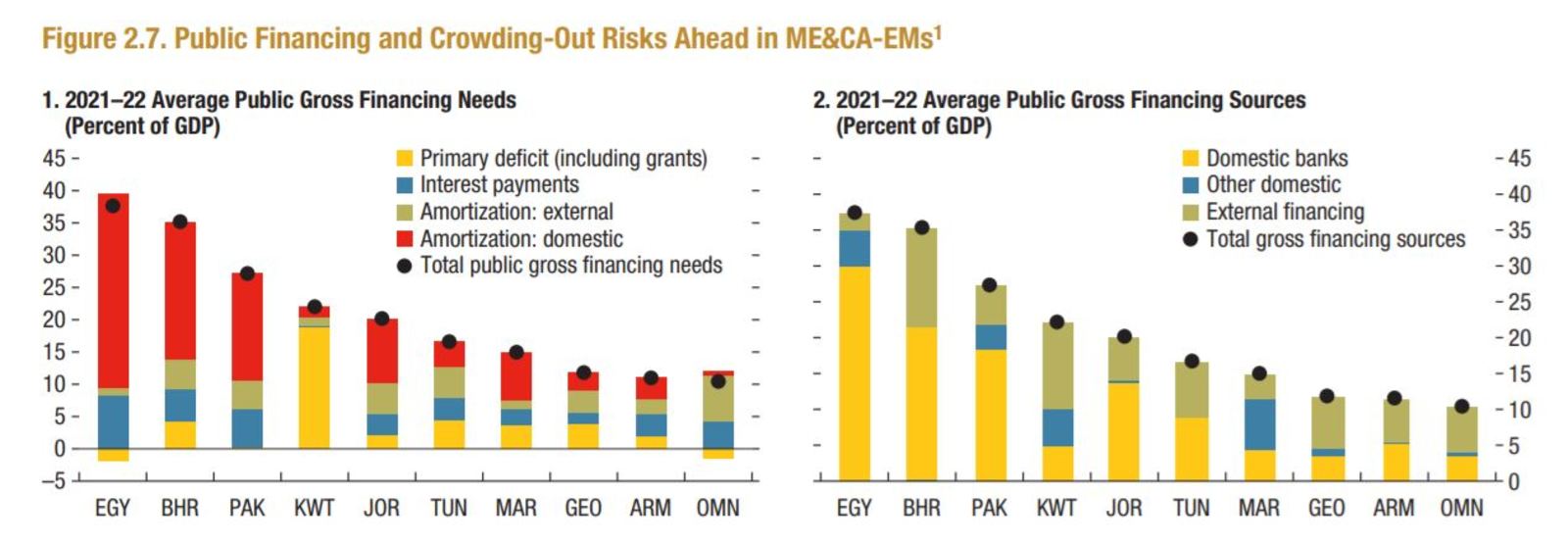

Rising financing needs in Egypt and MENA could threaten the post-covid recovery — and limit the scope for fiscal spending in a region scrambling to rebound from the pandemic, the IMF said in an update to its Regional Economic Outlook for the Middle East and Central Asia. Egypt is classified among the region’s emerging markets whose average public gross financing needs in 2021-2022 are expected to reach 37% of GDP. The IMF is concerned that this could cut into the ability of governments to fund programs designed to get their economies past covid — and that it could see the private sector have less access to credit as banks plow deposits into lower-risk state paper. Tap / click here to read the full report (pdf).

The IMF revised its 2021 growth expectations for MENA upwards to 4% from 3.1% previously, a sharp rebound from last year’s 3.4% contraction. The IMF last week cut slightly its growth expectations for Egypt this fiscal year to 2.5% from 2.8% but upped its FY2021-2022 projection to 5.7%from 5.5%. Egypt reports its GDP figures using the state’s fiscal year, which runs from July to June.

Financing needs for the region are forecast to hit USD 919 bn in 2021 and 2022, remaining above an average 15% of GDP for most emerging MENA economies, the fund added. For the wider MENA and Central Asia region, the IMF expects financing needs to come in at USD 1.1 tn in 2021 and 2022, which is at least USD 300 bn more than in 2018 and 2019.

Rollover and refinancing risks are higher in Egypt than elsewhere in the region, given that, at 37% of GDP, we have one of the highest public financing needs in the region and our higher-than-average rate of domestic amortization, the IMF says. External amortizations are at “manageable levels,” but the median domestic amortization is high at some 10% of GDP a year, and Egypt’s rate exceeds this median at 15% or higher, the lender adds.

The IMF also wishes Egyptian banks were lending more to the private sector, and less to the state: Egypt’s banks are highly exposed to the sovereign, with nearly 45% of bank lending going out to the government, and this has increased throughout the pandemic, the fund said. “Such an overexposure is detrimental for domestic debt market development, as well as for the government and the private sector to secure financing at the lowest possible cost among a diversified pool of creditors.” We had more on this last week.

Egypt has been able to push ahead with reform despite the pandemic. The country, along with others that have “kept the course,” now needs to shift its focus to “growth-friendly, medium-term fiscal frameworks through which everyone pays their fair share.”

How well a recovery pans out will largely depend on the vaccination program, which is slowly gathering pace in Egypt. The fund classifies us among the region’s “slow inoculators,” which rolled out programs but have had limited coverage and aren’t expected to vaccinate a significant portion of their populations before mid-2022. By contrast, “early inoculators” including the GCC and Morocco are racing ahead with vaccinations. “The recovery has started, but it has started on a divergent path,” Jihad Azour, the IMF’s regional director tells Bloomberg. “Our first message is countries need to accelerate vaccinations, give it the first priority. Regional cooperation is welcome.”

Region-wide, fiscal consolidation should help: “With the recovery underway, fiscal balances are expected to improve across the region, because of higher revenues and the expiration of pandemic-related measures,” the IMF said in the report. Recovering economies will also likely allow governments to resume fiscal consolidation programs in some countries with high debt levels including Egypt, Iraq, Jordan, Oman, and Pakistan, it added. Meanwhile, central banks in Egypt and other countries with flexible exchange rate regimes should remain accommodative in their policy approach, but only within “well-anchored inflation expectations,” it suggests.

Other key points made in the report:

- Fiscal deficits among MENA countries widened to 10.1% of GDP in 2020, up from 3.8% in 2019.

- Food prices will remain under pressure in 2021, with the IMF’s food price index forecast to rise by 14%.

- Public sector reforms are much-needed across the region to provide more scope for the private sector to grow and “ensure fiscal sustainability.”

- There’s room for governments to close up to one third of the gap in the region’s Human Development Index by working on improving the efficiency of their welfare spending, without needing to increase spending further.

The IMF’s regional outlook update comes a few days after the lender released its updated World Economic Outlook, which pointed out that advanced economies, where vaccine programs are generally faster, are mostly expected to rebound to pre-covid growth in 2022, while developing countries where those programs lag are unlikely to reach that point before “well into 2023.” We had coverage on last week’s report here.

OTHER ECONOMY NEWS-

Remittances from Egyptians living abroad dipped slightly in January 2021 to USD 2.54 bn, down from USD 2.65 bn during the same month last year, according to the Central Bank of Egypt (pdf). Remittances grew 11% y-o-y during the first seven months of the fiscal year to USD 18.1 bn, compared to USD 16.3 bn during the same period of FY2019-2020. Remittance inflows had increased 10.5% y-o-y in 2020, reaching USD 29.6 bn, despite the covid-19 induced shocks to many GCC economies where the majority of Egyptian expats are based.

Our covid-19 performance, in numbers: Egypt’s overall trade deficit narrowed 9% y-o-y to reach USD 42 bn in 2020, from USD 45.9 bn in 2019, according to an infographic Cabinet released yesterday recapping key economic figures and indicators in 2020. Exports fell almost 10% y-o-y to USD 27.6 bn last year from USD 30.5 bn in 2019, while imports slid almost 9% y-o-y to USD 69.6 bn. Fuel and oil exports accounted for the lion’s share of exports by value, totaling USD 4.4 bn.

SUEZ CANAL

The hangover

The Ever Given may have been dislodged in under a week, but the effects will be felt for months: The disruption caused to US and European supply chains by the blocking of the Suez Canal last month may not be resolved until 3Q2021, CEO of German shipping company Hapag-Lloyd Rolf Habben Jansen tells the Financial Times. Several shipping companies tell the salmon-colored paper that the blockage will have severe knock-on effects on international shipping and logistics, effects that will only be felt when Asian and European ports are faced with a sudden influx of ships in the coming days and weeks. The six-day blockage of the canal by the Ever Given left more than 400 container ships idled off the coast of Egypt. It took six days for all of the ships to pass when the canal was finally unblocked on 29 March.

The world’s largest shipping line isn’t quite so bearish — but it’s still forecasting several more weeks of disruption: We might need to wait until the middle of the second quarter before supply chains begin to normalize, according to Lars Mikael Jensen, head of global ocean network at Maersk. “We will see ripple effects continuing into the second half of May,” he tells the salmon-colored paper. “The best [case scenario] is we will see a normalization in Europe around the second quarter — towards the back end of the quarter,” with the US returning to normal after that.

Europe and Asia will feel the blow in different ways: In Asia, shippers are trying to contain the situation when the delayed vessels start hitting the next load ports. Maersk has reopened short-term cargo bookings from Asia after suspending them amid the closure. The situation in northern Europe is slightly more urgent, according to Jansen, who says that large ports such as Rotterdam and Southampton are feeling the bump more than other sea ports across Europe and Asia, with container terminals being stretched for space to store extra containers.

OTHER SUEZ CANAL NEWS- The Suez Canal Economic Zone (SCZone) has signed a long-term syndicated loan worth EGP 10 bn to finance infrastructure projects, it said in a statement. The 10-year loan, signed with a consortium led by the National Bank of Egypt (NBE), will fund projects at industrial zones and ports in the zone, and is divided into two tranches: one EGP 5 bn local currency portion and a USD-denominated tranche worth USD 320 mn (approx. EGP 5 bn). Some of the projects will be completed within two years, SCZone Chairman Yehia Zaki said.

Who else is involved? CIB, Banque du Caire, the Arab African International Bank and Suez Canal Bank are acting as lead managers, while the NBE and Banque Misr are managing and marketing the loan.

TOURISM

Hotel occupancy rates are slowly inching up

Occupancy rates at hotels across Egypt averaged between 40-45% in 1Q2021, but have been growing m-o-m as international travel picks up ever so slowly, Reuters reported, citing an unnamed Tourism Ministry official. Occupancy was at 25% in January, but rose to 30% in February and 45% in March, according to the official. Hotels across the country are still only allowed to operate at 50% capacity. Occupancy rates are now calculated out of that capacity limit, meaning that the real occupancy is around 25% for the three-month period.

Forecasts say things will get better: Occupancy rates are forecast to pick up this year with the roll-out of vaccines, which will help kickstart international travel. Some 2 mn tourists have visited the country in the nine months since flights restarted following the initial wave of covid-19.

BUDGET WATCH

Railway, media authorities are deeply in the red

The National Railway Authority (NRA) and the National Media Authority (NMA) posted the largest losses among all state institutions in FY2019-2020, according to a report by the House Planning and Budgeting Committee on last fiscal year’s budget picked up by Masrawy. Egypt’s 53 state authorities recorded a grand total of EGP 192 bn in losses. The NRA and NMA accounted for a combined 92% of the EGP 22 bn in losses 14 major state bodies incurred, with the railway operator making up over half of that figure. The committee presented its customary end-of-year report on the closing balances of individual government institutions to the House general assembly for review yesterday.

What’s the recourse? The report called for setting up committees to evaluate what went wrong, and look into whether the boards of directors of the two biggest loss-making authorities have been doing in the past three fiscal years. It also recommended setting up other committees with members from the Central Auditing Organization and the Financial Regulatory Authority to improve future performance and suggested some loss-making state bodies should be merged together or be subject to other rigorous structural changes.

It’s not particularly good news for Information Minister Osama Heikal, who is facing parliamentary scrutiny over how the ministry has been spending public money since it was reconstituted in 2019. Heikal is due to face MPs in the coming period to answer questions about how the ministry has allocated funds under his watch.

And the National Railway Authority’s losses have also widened significantly in recent years. According to the committee’s report, they were at least EGP 12 bn last fiscal year alone, which is around the same figure recorded in FY2018-2019. Besides consistently being in the red, the authority also owes at least EGP 100 bn to the central bank and EGP 150 bn in government dues. Reforming this crucial institution is one of the government’s most pressing priorities as Egypt’s rail network is suffering from years of neglect that routinely leads to tragic accidents — the most recent of which was last month’s Sohag train crash. The state has earmarked investments worth EGP 225 bn to revamp 10k kilometers of rail lines.

CUSTOMS

Shipping companies will need to file with Nafeza from July

Shipping companies will be required to send information about their cargo electronically to the Customs Authority’s new digital platform when the system goes live later this year, according to a recent decision by the Finance Ministry. Cargo data and documents such as the commercial invoice and bill of lading will have to be submitted to the new Advance Cargo Information (ACI) system, part of the National Single Window for Foreign Trade Facilitation (Nafeza), a digital customs system being rolled out by the Finance Ministry to speed up customs procedures and improve border security. The authority began trialling the ACI system at the start of April and plans to make it compulsory at all seaports in July before applying it to air and land ports at a later date.

ACI? ACI — otherwise known as a pre-registration system — is a World Customs Organization protocol that provides shipping lines, port operators and governments real-time information on shipments of incoming goods. Egyptian importers are required to file the paperwork at least 48 hours before the goods are shipped, after which they are given a unique ID known as an ACID. The shipping company must then submit documentation to Nafeza containing information such as the ACID and the bill of lading, which the ministry has now decided must be done at least 24 hours before the ship leaves port.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The dispute over the Grand Ethiopian Renaissance Dam continued to hog the limelight on the talk shows last night. The highlight of the night was provided by Hadeeth Al Kahira, which talked to Foreign Minister Sameh Shoukry about the current state of the negotiations and the potential for rapprochement with Turkey (watch, runtime: 10:38).

The red line remains: The minister reiterated previous statements made by the president that unilaterally reducing Egypt’s share of the Nile’s water is a red line for the government that would not be tolerated. Egypt regards filling the dam’s reservoir without an agreement as a “hostile act,” but the government is taking all diplomatic and political measures to try and resolve the issue, he said.

As does the possibility for an agreement: Egypt hopes Ethiopia reverses course and decides not to go ahead with the second phase of filling the dam’s reservoir this summer. A joint agreement between all three countries remains possible, should Ethiopia have the political will to negotiate, Shoukry said.

OTHER GERD UPDATES- Rising tensions over the dam amid Egypt and Sudan’s refusal of Ethiopia’s latest offer got coverage in Masaa DMC (watch, runtime 2:04), which also talked to Hani Sewilam, professor of water resources management at the RWTH Aachen University in Germany, about the latest developments (watch, runtime 9:03). The GERD’s impact on Egypt won’t be instant as the Aswan High Dam compensates for the shortage of water that will be stored by the GERD but this buffer will not last long, he said. The only solution is that Ethiopia bows to the international community and that’s why Egypt is asking for foreign mediators and facilitators, he added. Ala Mas’ouleety’ also featured an interview with Abbas Sharaky, professor of Water Resources at Cairo University, on the GERD (watch, runtime 5:51).

MEANWHILE: Turkey needs to walk the walk: Egypt appreciates Turkey’s recent gestures suggesting it is interested in resetting relations, but actions speak louder than words, Foreign Ministry Shoukry suggested last night (watch, runtime 4:36). The minister was speaking after two Egyptian Ikhwani mouthpieces at the Istanbul-based Al Sharq are now on indefinite leave after their shows were cancelled in the wake of Turkey's policy switch to tone down anti-Egypt rhetoric among the country’s media, Arab News reports.

The shutdown was a “positive development,” Shoukry said, urging Ankara to continue to crack down on “hostile elements” that attack Egypt — and tp avoid interfering in Egypt’s affairs. The minister also stressed that Egypt supports Lebanon to form a government that has the political will to embark on economic reforms and solve the ongoing financial crisis (watch, runtime 3:37).

ALSO LAST NIGHT- The public prosecution’s statement on the investigation into the Sohag train collision received widespread coverage: Kelma Akhira’s Lamees Al Hadidi (watch, runtime: 14:10 I 3:53), Al Hayah Al Youm (watch, runtime 3:03), and Ala Mas’ouleety (watch, runtime 12:15). We have more on this in this morning’s Also On Our Radar, below.

EGYPT IN THE NEWS

Dominating the conversation on Egypt in the foreign press this morning: 21-year-old Ahmed Bassam Zaki was sentenced yesterday to eight years in prison for assaulting and blackmailing three minors. The ex-AUC student, who in July confessed to serially abusing a number of women following his arrest, was sentenced to three years in prison for blackmailing and [redacted] harassing two women on social media, and was also facing separate charges of assaulting three minors. (AP | AFP | Reuters)

ALSO ON OUR RADAR

The public prosecution has found that gross negligence by railway staff was responsible for last month’s deadly train collision in Sohag, it said in a statement yesterday (watch, runtime: 10:32). The prosecution said that the incident, which killed 20 people and injured 200 others, was caused by the train driver, his assistant and a control tower guard, the latter two are alleged to have been under the influence of narcotics.

PLANET FINANCE

The median income of a CEO in the US kept climbing last year — and is on track to hit record highs, rising to USD 13.7 mn in 2020 from USD 12.8 mn in 2019, the Wall Street Journal reports, citing figures compiled from companies' regulatory filings. Of the 322 CEOs covered in the analysis, 206 saw a pay bump — some of which sit at the helm of firms that were battered (such as Exxon Mobil, Omnicom Group, and Norway’s Cruise Line Holdings).

|

|

EGX30 |

10,393 |

+0.9% (YTD: -4.2%) |

|

|

USD (CBE) |

Buy 15.63 |

Sell 15.73 |

|

|

USD at CIB |

Buy 15.64 |

Sell 15.74 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

9,938 |

-0.7% (YTD: +14.4%) |

|

|

ADX |

6,070 |

+0.2% (YTD: +20.3%) |

|

|

DFM |

2,593 |

+0.4% (YTD: +4.1%) |

|

|

S&P 500 |

4,128 |

+0.8% (YTD: +9.9%) |

|

|

FTSE 100 |

6,915 |

-0.4% (YTD: +7.1%) |

|

|

Brent crude |

USD 63.31 |

+0.6% |

|

|

Natural gas (Nymex) |

USD 2.56 |

+1.3% |

|

|

Gold |

USD 1,742.50 |

-0.1% |

|

|

BTC |

USD 59,800 |

-0.8% (as of midnight) |

The EGX30 rose 0.9% yesterday on turnover of EGP 749 mn (46.1% below the 90-day average). Foreign investors were net sellers. The index is down 4.2% YTD.

In the green: GB Auto (+8.6%), Fawry (+6.4%) and Export Development Bank (+3.9%).

In the red: Eastern Co. (-1.7%), Abu Qir Fertilizers (-1.2%) and EKH (-1.0%).

Asian markets are uniformly in the red this morning, and futures suggest that shares in Europe and North America will follow suits when markets open for the week later today.

AROUND THE WORLD

Jordan's King Abdullah II and his half brother Prince Hamza bin Hussein yesterday made their first joint public appearance since the latter was accused of plotting to undermine the government and placed under house arrest, the Associated Press reports. Marking the 100th year anniversary of the establishment of Transjordan by the British empire, the two were photographed together at the grave of the late King Hussein — a message seemingly designed to put a line under recent tensions in the royal family and put forward an image of unity. Abdullah said last Wednesday that the rift between himself and Hamza had been “nipped in the bud.”

Interim Libyan Prime Minister Abdul Hamid Dbeibah will pay a two-day visit to Turkey today for the first time since taking office earlier this year. Both countries are expected to discuss cooperation on energy and health as well as resumption of some projects by Turkish companies.

What Egypt’s universities are doing to foster entrepreneurship: Since the beginning of the global startup ecosystem, companies have been intimately tied to universities and the talents that come out of them. Just think of how many Silicon Valley founders and companies are associated with Stanford University. Egypt is no different, with one factor driving entrepreneurship being support from universities. Today, we take a look at how local university programs are doing this.

University entrepreneurship programs are growing, and producing more startups: After Egypt’s first university-based startup incubator was founded by AUC in 2013, at least 10 similar programs have been launched by other universities. Programs in Greater Cairo have supported at least 600 startups, with 270 formally graduating. University incubators have emerged outside of Cairo, including in Alexandria and Assiut, with some universities teaching entrepreneurship as an academic discipline. Public universities were issued a government mandate to teach entrepreneurship in 2017, NilePreneurs founder Nezar Sami tells Enterprise.

Incubators offer services to help students found startups, and then nurture them into full-fledged businesses: Generally, incubators give seed funding — anything from EGP 20k to EGP 250k, depending on the university and its resources — along with access to a lab or ideation space, technical and business mentorship, office space, marketing support, and connections to prospective investors. They’re university-run, funded through government and private sector partnerships. Unlike most non-university incubator models, they don’t take an equity stake in the startups they incubate.

What’s in it for the universities? Quite simply, startup programs attract students: Universities can leverage resources — academic knowledge, networks, reputation, and access to partnerships — and channel them into entrepreneurship programs. This helps with promotion and attracting the best students, says Sami. Programs that positively impact employability are a big pull, he adds.

AUC pioneered university startup incubator programs: AUC’s V-Lab has graduated over 200 startups since its 2013 founding, marketing and communication manager Nour Ibrahim tells Enterprise. “We usually get 400-500 applications every cycle, with cycles happening twice a year. And of these applications, we can only take about 25,” she says.

Other Greater Cairo universities have followed suit: Nile University-run NU Techspace lists 8 startups to which it has provided seed funding, branding, tech training, office space, networking, and legal support. NP Incubate falls within the NilePreneurs Initiative, a Nile University-Central Bank joint initiative to promote entrepreneurship, which has supported 74 startups in five sectors as of 2019. The Arab Academy for Science, Technology and Maritime Transport’s AASTMT Entrepreneurship Center, which has at least three distinct incubators, has “empowered” 250 startups since its 2015 founding.

Cairo University and BUE set up programs that graduate 8-12 startups per year on average: Cairo University’s FEPS BI has graduated 46 startups since its 2016 launch, and is currently incubating 9 more, executive director Heba Zaki tells Enterprise. The BUE’s business incubator has graduated 24 startups since it launched in late 2018, director Tamer Adel tells Enterprise.

We’re seeing more specialized university incubators, many of them beyond Cairo: Hemma Business Incubator at Assiut University, founded in 2014, supports startups focused on health, food, water and manufacturing. The Heliopolis University for Sustainable Development ESTEDAMA incubation program specializes in sustainable agriculture and food production. RWAQ Business Incubator run by Al Azhar University focuses on water, agricultural waste management, and renewable energy, while Alexandria University’s Artificial Intelligence Minds is Egypt's first AI-specialized incubator. It isn’t clear how many startups these programs have graduated.

Many university incubators have a sector-specific focus, NilePreneurs’ Sami says. Nile University’s incubator mainly focuses on tech startups, including those in ICT, manufacturing and supply chains. AASTMT’s multiple incubators focus on tourism, manufacturing and industry, technology and digital transformation, while one has a general scope. BUE’s program is a mix of generic and tech-based. “There are often thematic priorities, depending on the university, its strategy, and its competitive edge,” says Sami. AUC’s V-Labs has one specialized fintech incubator and one that is more general, says Ibrahim. Zaki maintains that FEPS BI is entirely sector agnostic, supporting startups in areas ranging from the green economy to edtech and health tech, e-commerce, and the creative industries.

Several universities — including Nile University, Cairo University and AUC — offer informal drop-in labs, where entrepreneurs can get startup advice: They’re designed to plug a gap, because incubator and accelerator services have to be selective, say sources. “We're always willing to help out with free consultations,” says Ibrahim.

Some universities also offer academic programs in entrepreneurship: Among private universities, AUC, BUE, Nile University, GUC, and the Knowledge Hub all offer academic entrepreneurship programs, says Sami. “These programs are designed to promote entrepreneurship as a formal discipline,” he says. Their aim is to foster entrepreneurial traits in students, but not necessarily produce startups, he adds.

Awareness-raising sessions — including student activities — can also help nurture entrepreneurial drive: Student unions run awareness-raising sessions including boot camps, startup weeks, and hosting guest speakers, says Sami. These sessions are more practical than academic and have some institutional support. The Academy of Scientific Research and Technology gives each entrepreneurship-focused student club EGP 250k per year to conduct its activities, he says. FEPS BI is also very active in the field of awareness-raising, says Zaki. “Over 6k have benefitted from our awareness program since 2016, and we’ve delivered 60 workshops, including 4 specialized training programs.”

According to concrete success metrics — like the number of startups graduated and jobs created — it’s V-Labs and FEPS BI leading the pack: V-Labs has graduated 200 startups, 80% of which have survived beyond their initial graduation period, and helped create over 8k jobs, says Ibrahim. FEPS BI has graduated 46 startups — 33 from its general incubation cycle, and 13 from “Her,” its incubation vehicle dedicated to female entrepreneurs, says Zaki. “Our startups have generated total revenue of EGP 23 mn, and we’ve created 133 jobs.”

Your top education stories for the week:

- Education IPO: Shares of higher education outfit Taaleem popped 6% in its first day of trading, ending the nation’s IPO drought.

- Scholarships: A new five-year joint scholarship program (pdf) funded by Cleopatra Hospitals Group and Nahda University in Beni Suef will offer eight medical students from low-income families the chance to study at the university’s Faculty of Medicine.

- Accreditation: International public schools that teach the IGCSE curriculum will be accredited by the British Council under a new mechanism being set with the Education Ministry.

- Scientific research cooperation: The American University in Cairo has inked two separate agreements with the Arab Academy for Science, Technology and Maritime Transport and Al Alamein International University to cooperate on scientific research.

- Entrepreneurship: A “1 mn entrepreneurs” initiative will make educational material for aspiring entrepreneurs available online as part of the state-backed Rowad 2030 entrepreneurship program — and is now accepting applicants.

CALENDAR

April: The government’s fuel pricing committee is scheduled to meet for its quarterly review of prices.

April: EBRD president Odile Renaud-Basso expected to visit Egypt.

12 April (Monday): Russian Foreign Minister Sergey Lavrov will visit Egypt for GERD talks (watch: runtime: 1:28).

13 April (Tuesday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Coptic Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday) : The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The 54th session of the Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday) Mediterranean Offshore Conference, Alexandria, Egypt

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.