Egypt + MENA to face higher financing needs post-covid -IMF

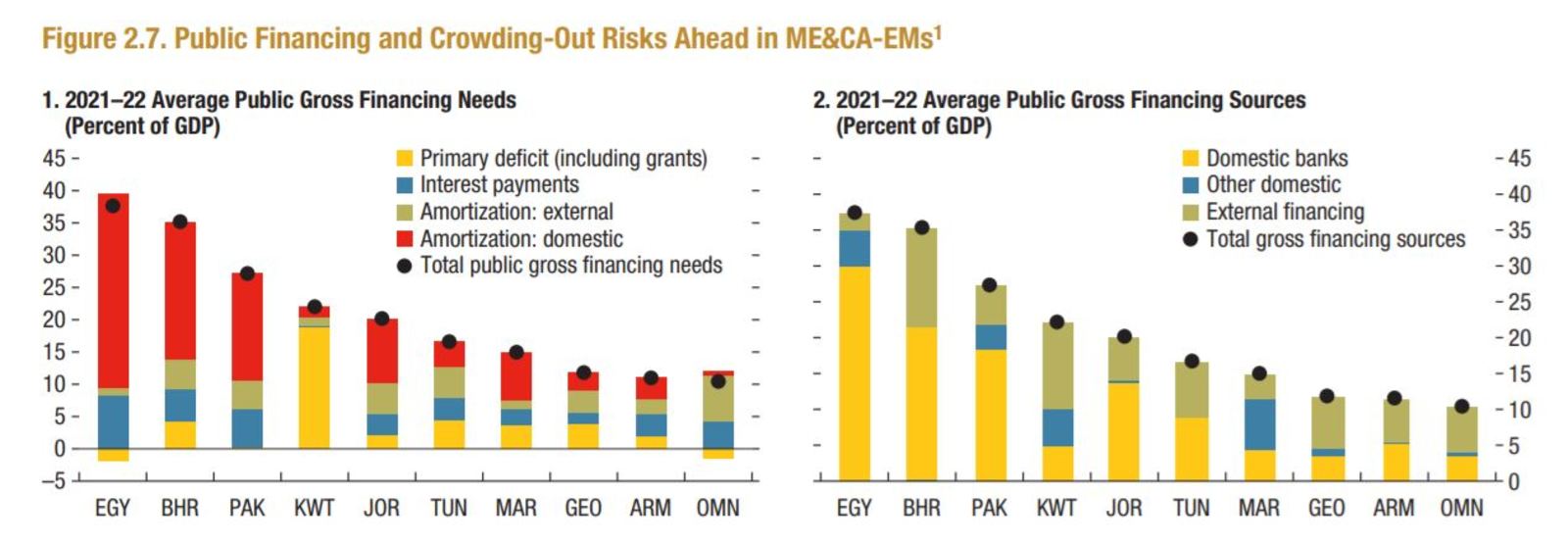

Rising financing needs in Egypt and MENA could threaten the post-covid recovery — and limit the scope for fiscal spending in a region scrambling to rebound from the pandemic, the IMF said in an update to its Regional Economic Outlook for the Middle East and Central Asia. Egypt is classified among the region’s emerging markets whose average public gross financing needs in 2021-2022 are expected to reach 37% of GDP. The IMF is concerned that this could cut into the ability of governments to fund programs designed to get their economies past covid — and that it could see the private sector have less access to credit as banks plow deposits into lower-risk state paper. Tap / click here to read the full report (pdf).

The IMF revised its 2021 growth expectations for MENA upwards to 4% from 3.1% previously, a sharp rebound from last year’s 3.4% contraction. The IMF last week cut slightly its growth expectations for Egypt this fiscal year to 2.5% from 2.8% but upped its FY2021-2022 projection to 5.7%from 5.5%. Egypt reports its GDP figures using the state’s fiscal year, which runs from July to June.

Financing needs for the region are forecast to hit USD 919 bn in 2021 and 2022, remaining above an average 15% of GDP for most emerging MENA economies, the fund added. For the wider MENA and Central Asia region, the IMF expects financing needs to come in at USD 1.1 tn in 2021 and 2022, which is at least USD 300 bn more than in 2018 and 2019.

Rollover and refinancing risks are higher in Egypt than elsewhere in the region, given that, at 37% of GDP, we have one of the highest public financing needs in the region and our higher-than-average rate of domestic amortization, the IMF says. External amortizations are at “manageable levels,” but the median domestic amortization is high at some 10% of GDP a year, and Egypt’s rate exceeds this median at 15% or higher, the lender adds.

The IMF also wishes Egyptian banks were lending more to the private sector, and less to the state: Egypt’s banks are highly exposed to the sovereign, with nearly 45% of bank lending going out to the government, and this has increased throughout the pandemic, the fund said. “Such an overexposure is detrimental for domestic debt market development, as well as for the government and the private sector to secure financing at the lowest possible cost among a diversified pool of creditors.” We had more on this last week.

Egypt has been able to push ahead with reform despite the pandemic. The country, along with others that have “kept the course,” now needs to shift its focus to “growth-friendly, medium-term fiscal frameworks through which everyone pays their fair share.”

How well a recovery pans out will largely depend on the vaccination program, which is slowly gathering pace in Egypt. The fund classifies us among the region’s “slow inoculators,” which rolled out programs but have had limited coverage and aren’t expected to vaccinate a significant portion of their populations before mid-2022. By contrast, “early inoculators” including the GCC and Morocco are racing ahead with vaccinations. “The recovery has started, but it has started on a divergent path,” Jihad Azour, the IMF’s regional director tells Bloomberg. “Our first message is countries need to accelerate vaccinations, give it the first priority. Regional cooperation is welcome.”

Region-wide, fiscal consolidation should help: “With the recovery underway, fiscal balances are expected to improve across the region, because of higher revenues and the expiration of pandemic-related measures,” the IMF said in the report. Recovering economies will also likely allow governments to resume fiscal consolidation programs in some countries with high debt levels including Egypt, Iraq, Jordan, Oman, and Pakistan, it added. Meanwhile, central banks in Egypt and other countries with flexible exchange rate regimes should remain accommodative in their policy approach, but only within “well-anchored inflation expectations,” it suggests.

Other key points made in the report:

- Fiscal deficits among MENA countries widened to 10.1% of GDP in 2020, up from 3.8% in 2019.

- Food prices will remain under pressure in 2021, with the IMF’s food price index forecast to rise by 14%.

- Public sector reforms are much-needed across the region to provide more scope for the private sector to grow and “ensure fiscal sustainability.”

- There’s room for governments to close up to one third of the gap in the region’s Human Development Index by working on improving the efficiency of their welfare spending, without needing to increase spending further.

The IMF’s regional outlook update comes a few days after the lender released its updated World Economic Outlook, which pointed out that advanced economies, where vaccine programs are generally faster, are mostly expected to rebound to pre-covid growth in 2022, while developing countries where those programs lag are unlikely to reach that point before “well into 2023.” We had coverage on last week’s report here.

OTHER ECONOMY NEWS-

Remittances from Egyptians living abroad dipped slightly in January 2021 to USD 2.54 bn, down from USD 2.65 bn during the same month last year, according to the Central Bank of Egypt (pdf). Remittances grew 11% y-o-y during the first seven months of the fiscal year to USD 18.1 bn, compared to USD 16.3 bn during the same period of FY2019-2020. Remittance inflows had increased 10.5% y-o-y in 2020, reaching USD 29.6 bn, despite the covid-19 induced shocks to many GCC economies where the majority of Egyptian expats are based.

Our covid-19 performance, in numbers: Egypt’s overall trade deficit narrowed 9% y-o-y to reach USD 42 bn in 2020, from USD 45.9 bn in 2019, according to an infographic Cabinet released yesterday recapping key economic figures and indicators in 2020. Exports fell almost 10% y-o-y to USD 27.6 bn last year from USD 30.5 bn in 2019, while imports slid almost 9% y-o-y to USD 69.6 bn. Fuel and oil exports accounted for the lion’s share of exports by value, totaling USD 4.4 bn.