- Sinopharm jab gets ‘okay’, scientists think current wave could peak in late January. (Covid Watch)

- Agrium dispute is over as successor sells its full 26% stake in Mopco. (Dispute Watch)

- Enara Energy inks pact with Chinese PV solar panel maker Chint Electric — is it the mothballed USD 2 bn solar panels planet? (Investment Watch)

- Debt market shows no signs of slowing down in the last week of the year. (Debt Watch)

- Everything you never wanted to know about last night’s talkshows.

- 2020 in Review: Many tech startups were won big in 2020 — thanks to covid

- 2020 in Review: The year in macro.

- Planet Finance: Wall Street highs new high as covid relief bill is signed.

Tuesday, 29 December 2020

Sinopharm Jab gets Okay. Plus: The year in startups + macro.

TL;DR

WHAT WE’RE TRACKING TODAY

End-of-year news slowdown? What news slowdown? In what is traditionally the slowest period for news outside of the month of August, we have another packed news day for you today.

The big story at home and abroad: Corna, Corona and still more corona. Have we mentioned there are just three days left until 2021? Yeah, yeah, we know — we’re gonna be the same people on 1 January as we are today. But still, it’s a mental barrier we want to break.

PSA #1- Look for fog on highways into and out of Cairo today and for the rest of the week, particularly out in October and on the Cairo-Alex Desert Highway, the national weather service is warning. There’s also a chance of light showers in coastal areas and in the capital city on Friday. (Our favourite weather app puts the odds of a sprinkly at just 20%, so don’t hold your breath on that front.)

PSA #2- We have yet to hear from the CBE on whether Thursday will be a bank holiday. Banks with December-January fiscal years are typically shuttered on 1 January to close their books, but this year New Year’s falls on a Friday. If banks close, the EGX will follow suit.

SMART POLICY- The central bank has extended its ban on transaction fees for withdrawals from ATMs outside your bank’s network until 30 June 2021, the CBE said in a statement (pdf) on Monday. EGP-denominated bank transfers will also be exempt from transaction fees until mid-next year, as well fees on contactless payment cards, mobile wallets and e-payments.

Pity the poor bank shareholders: That’s a lot of fee and commission income up in smoke, but look at it this way: Once you train them to use ATMs…

More from our TBR pile:

- Score one for the couch potatoes: There’s nothing natural about exercise, the WSJ notes in its promo for Harvard evolutionary biologist Daniel E. Lieberman’s forthcoming Exercised: Why something we never evolved to do is healthy and rewarding. The book is out 5 January and we’ve got it on pre-order.

- The best time to go to bed is 8:45pm, writes New York magazine in a nice, short piece. Sounds about right to us, but our schedule is … weird.

- Consumer brands think working from home is here to stay — it’s why everyone from coffee companies to makers of paper towels are “investing in factories, new products aimed at remote workers post-pandemic,” the Journal suggests. Is there a similar trend you’re working on in Egypt?

WATCH THIS SPACE-

Is the”automotive directive” coming back? The Madbouly Cabinet appears to be formulating (or reformulating, if you’ve been keeping count) a strategy to make locally-assembled cars more competitive for export markets, according to a cabinet statement. While the statement lacked detail on what strategies the government is exploring, it did note that the Trade Ministry was exploring a series of new incentives for the auto industry.

Foreign automakers have the ear of gov’t, so unlikely: This is starting to sound eerily similar to conversations we’ve been hearing five years ago on the so-called “automotive directive,” especially when the statement says the ministry is studying proposals by an unnamed foreign automaker. It was these players, who benefit from fully-assembled, imported cars being sold at zero-customs domestically, who lobbied to kill the automotive directive.

This could be related of course to our natgas transition plan: The automotive industry could be getting a boost from a fund the government is mulling to encourage local manufacturing, especially automotive components and vehicle assembly, Trade Minister Nevine Gamea said earlier this month. The fund is linked with the launch of the government’s campaign to convert existing vehicles to natural gas engines, which will kick off at the start of 2021.

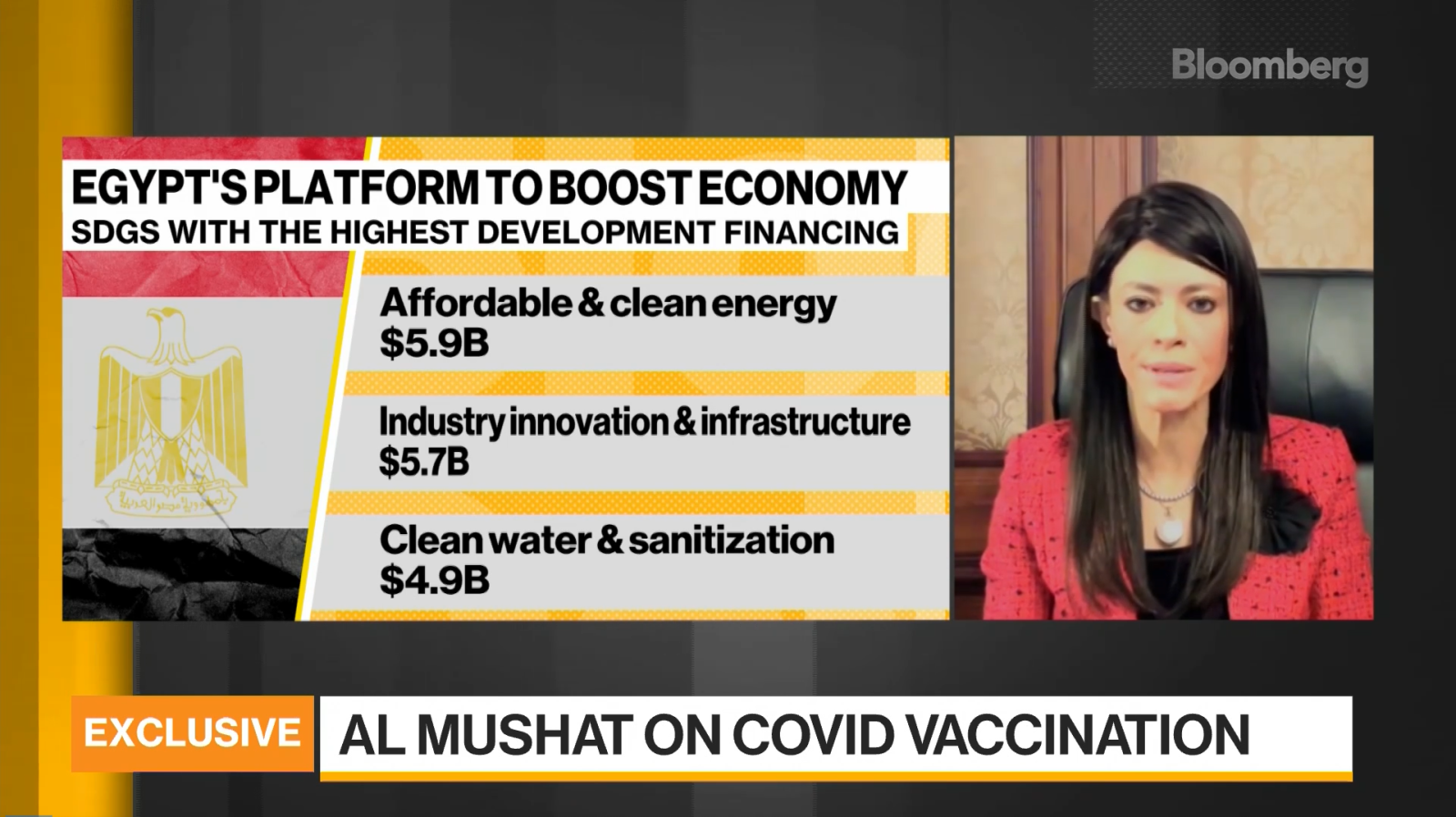

Gov’t will show the private sector lots of love in 2021: That’s our paraphrase of International Cooperation Minister Rania Al Mashat’s sit-down yesterday with Bloomberg TV (watch, runtime: 10:52). Engagement will be based around ESG principles, Al Mashat said, adding that green growth and environmental initiatives have recently become a top priority, “which aligns global and national priorities, and in return reinforces Egypt’s commitment to deepen its engagement with the private sector to encourage innovation and growth.” Al Mashat also recapped the ministry’s 2020 annual report, the highlights of which you can catch here.

|

BORING, BUT REALLY IMPORTANT–

The Finance Ministry wants to remind everyone that it’s launching the pilot phase of its unified tax platform on 1 January. The launch, which will see some 11k of Egypt’s largest taxpayers begin filing taxes through the electronic platform, will be accompanied by a series of workshops where Tax Authority officials will explain to these companies how to use the system and what the benefits are, authority head Reda Abdel Kader told the press on Monday.

What is happening? The new system, which was made possible through the recently-passed Unified Tax Act, integrates some 64 previously-separate tax services into a single core taxation system. The platform will allow users to file returns and pay taxes, register as taxpayers, enquire about electronic payments, and settle unpaid taxes. The authority will also be able to issue fines for late payment and monitor taxpayer accounts.

This is different from the e-invoicing system — a platform that allows companies to log their invoices electronically to the Finance Ministry’s database. Large taxpayers that don’t sign on to this system by 1 July 2021 will risk losing benefits and see government services and businesses dry up, the ministry warned on Sunday.

For a primer on Unified tax platform, click here. To catch up on the e-invoicing system, check here.

COVID WATCH

The Health Ministry has okayed the use of Sinopharm’s covid-19 vaccine yesterday, Health Minister Hala Zayed told Al Arabiya. A working group at the Egyptian Meds Authority held its final review meeting yesterday and an official announcement is expected today, she added. Egypt had been receiving shipments of the Sinopharm jab over the past few weeks, after it had been cleared by UAE regulators, but questions arose earlier this week over potential supply chain delays out of China.

This would pave the way for the government to announce a detailed distribution plan next week, Zayed tells the channel. The Health Ministry is setting up an operations room to oversee the rollout of the vaccine, a cabinet statement said last week.

It’s still unclear how many people will be covered in the first phase of the rollout after Cabinet Spokesperson Nader Saad said Sunday night that kinks in Sinopharm’s supply chain would see us get the full 500k initial doses later than expected.

Egypt is still building its war chest of covid vaccines. We’re in in talks with AstraZeneca and Pfizer, Saad said, and hope to get about 20 mn doses of a vaccine from Gavi, the global vaccine alliance, some time in May 2021. Also important: We’re in talks to obtain local manufacturing at Vacsera’s highly regarded facilities. (You can catch more of Saad’s remarks here and here.)

The approval of the jab was all over the airwaves last night, with Ala Mas’ouleety’s Ahmed Moussa beating the drum particularly hard (watch, runtime: 3:00).

The current covid wave could peak in the third week of January, a top government scientist told Kelma Akhira’s Lamees El Hadidi last night, adding that Sinopharm is not the only vaccine the government is now studying (watch, runtime: 7:59).

CASE COUNT- This comes as the Health Ministry reported 1,359 new covid-19 infections yesterday, up from 1,226 the day before. The ministry also reported 61 new deaths, bringing the country’s total death toll to 7466. Egypt has now disclosed a total of 133,900 confirmed cases of covid-19.

And the reality on the ground is that these numbers are higher, Zayed said, adding that this happens everywhere and that inaccurate real time data is a reality of the pandemic. December and January typically see the highest number of respiratory disease-related deaths in Egypt due to their prevalence and people staying at home more due to the cold weather, which makes it difficult to log.

WATCH- You can catch Zayed’s full interview here (watch, runtime: 8:09).

NOT A BAD IDEA- Manufacturers want to run their own vaccination programs for workers. The Association of Industrial Investors is petitioning the Madbouly government to allow private companies to import the vaccine on their own dime and vaccinate their employees, the association’s head Sobhy Nasr told the local press yesterday. The proposal reportedly received the endorsement of the Federation for Investors Associations as well.

Saudi Arabia’s vaccine rollout has begun with the first round targeting individuals with obesity and multiple underlying health conditions such as high blood pressure, diabetes and heart disease. We know two people who got the call yesterday after registering online for the jab.

ALSO YESTERDAY- A law to regulate clinical research was ratified by President Abdel Fattah El Sisi, Al Masry Al Youm reports. The law is being widely touted in the local press as possibly playing a role in expediting the roll out of vaccines by setting up clinical trial testing procedures and frameworks that allow for safe testing on humans.

DISPUTE WATCH

Neo’s got nothing on us

Canadian fertilizer producer Nutrien has sold its entire 26% stake in state-owned Misr Fertilizers Production Company (Mopco) in a USD 540 mn transaction, according to regulatory by both companies (pdf) yesterday. Mopco bought some 59.57 mn shares at a price of EGP 2.9 bn, according to the filings. It is unclear if the payment was made in USD, as Nutrien had said last week.

Nutrien = Agrium, for readers who hadn’t caught the rebranding of the Canadian outfit after it merged with the very inventively named Potash Corp. in January 2018. The Agrium case was a perennial thorn in the side of Egyptian governments looking to drum up FDI after very loud public opposition in 2008 to the construction of a fertilizers plant on the Mediterranean coast near Damietta forced the government to back out of a JV to build the USD 1.4 bn EAgrium nitrogen fertilizer plant. For the better part of a decade, local communities tagging a proposed investment as “Agrium” was a powerful epithet.

The sale came as part of a settlement agreement that would see Nutrien drop a USD 140 mn arbitration case filed against Mopco subsidiary the Egyptian Nitrogen Products Company (ENPC) in the International Court of Arbitration last year. Nutrien predecessor Agrium was seeking damages for what it said was ENPC’s failure to stick to a marketing agreement. The agreement is being widely touted by the oil and finance ministries as a success in protecting the interests of foreign investors.

Advisers: Sarie Eldin and Partners acted as legal advisers to the Finance Ministry on the sale.

New arbitration commission behind the settlement: While the oil and finance ministries helped broker it, the settlement came under the supervision of the technical committee of the Supreme Commission for Arbitration and International Disputes, which is headed by Deputy Justice Minister for Arbitration and International Disputes Judge Moustafa El Bahabety. The Madbouly Cabinet had granted the commission significant supervisory powers over government contracts and agreements last month, while granting it the authority to handle all of Egypt’s arbitration cases. The move was made as a means for the government to streamline its handling of international arbitration cases and stave off future and potentially damaging arbitration suits.

Under its new authority, all government contracts must receive its final approval and sign offs. The commission also has the power to appoint legal representatives and sign off on all arbitration fees. The commission had previously existed as an advisory role, but would now hold sign off powers.

INVESTMENT WATCH

A USD 2 bn zombie project revived?

Enara Energy has signed an agreement with Chinese PV solar panel maker Chint Electric to partner on developing a sand-to-cell PV panel factory in Egypt, Enara’s head of project development Mohamed Adel reportedly told the local press. Adel provides no detail on the project, its size or costs. Enara and Chint representatives had reportedly met with Military Production Minister Mohamed Ahmed Morsi last month to discuss moving forward with the project.

It seems likely this is the Armed Forces’ USD 2 bn integrated solar panel factory, talks for which had broken down a little over two years now. Negotiations between the Military Production Ministry and China’s Golden Concord Group (GCL) over the factory had halted after GCL wanted the ministry to sign an offtake agreement to purchase the factory’s full output.

DEBT WATCH

TMG, Sarwa, and CIRA makes three

The Financial Regulatory Authority (FRA) has signed off on EGX-listed private education outfit CIRA’s EGP 600 mn sukuk issuance, FRA chief Mohamed Omran announced in a statement yesterday (pdf). Proceeds from the offering will fund CIRA’s expansion plans in K-12 and higher education. The sukuks will carry a tenor of 84 months and the offering will be open to private institutional and high-net-worth investors, Omran noted in the statement. The sukuk will be backed by four of CIRA’s K-12 schools, the company noted in a bourse filing last week.

This brings the total number of corporate sukuks offered this year to EGP 5.1 bn, Omran said. CIRA’s offering will be the third issuance of corporate sukuk in Egypt, following Talaat Moustafa Group’s EGP 2 bn offering in April and Sarwa Capital’s EGP 2.5 bn sale in November, Omran emphasized. While CIRA has yet to comment, Omran’s statement and CIRA’s own initial closing timetable of the 27 December would indicate that we should expect an announcement on the sale this week.

EGP 10 bn in corporate sukuks are expected to be on offer in 2021, Omran added, echoing statements by other FRA officials last month. We’re hearing of a potential EGP 2.5 bn Amer Group issuance in 1Q2021. The Sarwa-managed offering could be Egypt’s first hybrid sukuk issuance with a mix of ijara and mudaraba bonds on offer. We’ve also heard that an unnamed financial services company is working on a EGP 500 mn mudaraba sukuk issuance, and that an agriculture company is looking at a EGP 250 mn “istizraa” issuance. Both are reportedly eyeing a 1Q2021 date.

Advisors: EFG Hermes Investment Banking is sole financial advisor, lead arranger and bookrunner for the transaction, while EFG Hermes Sukuk Co. will be the issuer for the EGP-denominated sukuk. Ahli United Bank, Suez Canal Bank and Banque du Caire are underwriters. Prime Capital as independent financial advisor. Zulficar & Partners is providing counsel, and Meris will provide the credit rating.

ON THE SECURITIZATION FRONT- TMG appears to be edging ahead with the issuance of EGP 885 mn in securitized bonds, according to a company bourse filing (pdf) yesterday. The disclosure simply notes that such an issuance is in-line with its business practices, so more of a non-denial than an actual confirmation. Earlier this week, reports had emerged that TMG subsidiary Al Rehab Securitization was planning the issuance with EFG Hermes acting as financial advisor and managing the issuance, while two other unnamed banks will also play a role.

TMG is also in talks with banks for a EGP 1.2 bn loan to fund projects in the New Administrative Capital, the statement says.

ALSO IN DEBT- The European Bank for Reconstruction and Development is reportedly interested in funding as much as 50% of the 6th of October drydock, sources close to the matter tell Al Mal.

Want to catch up on what happened with debt in 2020, read our Year in Review on the subject here.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

A quick and dirty rundown on talkshows for you wonderful people as we push past this mid-week hump and look forward to a very quiet New Year’s Eve:

The Order of Covid with Clouds, Banners, Crossed Swords and Diamonds goes to: Khaled Kassem, spokesperson for the Local Development Ministry, who found the energy to make the (telephonic) rounds of last night’s talk shows despite being home sick with the ‘rona. Highlights:

- Some 11.6k shops, malls and cafes have been fined after inspectors found them in violation of new winter-summer opening hours.

- Cairo, naturally enough, headed the list of “violators” with exactly 2,821 sanctions having been handed out.

- There was also some muttering about a forthcoming statement on “violations” and “shisha” in shuttered cafes, but we tuned out — we haven’t spent years getting off tobacco to imagine, once more, the sweet sting of shisha going down our windpipes…

Catch Kassem chatting with Lamees (watch: runtime: 7:35) or Al Hayah Al Youm’s Lobna Assal (watch, runtime: 7:58).

Don’t worry: If the bubble fails, our covid invincibility shield will do the trick: Egypt is ready for any emergency during the 2021 Mens’ Handball World Championship, Youth and Sports Minister Ashraf Sobhy told the gentleman who hosts Ala Mas’ouleety (watch, runtime: 12:20). Apparently the ministry isn’t listening to Lamees’ better half: As we noted yesterday, Amr Adib hit the nail on the head when he suggested the Men’s Handball World Championship 2021 should take place without spectators — NBA-style bubble system or not — when it is hosted in cities across Egypt from 13-31 January. (Then again, maybe we need not worry — who watches handball?)

Yo, Zamalek — you got your water back yet? Cairo Water Company chief Mostafa El-Shimi says so, telling Ala Mas'ouleety's Ahmed Moussa that a key water line damaged during the Metro buildout has been fixed (watch, runtime: 4:09).

EGYPT IN THE NEWS

One place the end-of-year news slowdown is real: Egypt in the international press, where it’s largely crickets. Egypt gets a walk-on role in Which developing economies will rise after the pandemic? by Morgan Stanley’s Ruchir Sharma. The otherwise fairly unremarkable piece notes us as having mounted pretty successful covid responses alongside Saudi Arabia, the UAE and Indonesia.

YEAR IN REVIEW: STARTUPS

Many tech startups won big in 2020 — thanks to covid

More startups raised more funding in 2020 than the year before, despite covid-19. If there was one segment of the economy to which 2020 was, if not kind, then at least “temperate,” it was Planet Startup, home to many of the “winners” of an accelerated transition to both online commerce and financial inclusion.

…Or rather, because of covid? Digital payments, fintech and e-commerce have thrived across all metrics this year thanks to the pandemic. Ceilings on contactless transactions have doubled since the start of the pandemic. Between the beginning of the outbreak and June, e-commerce sales in Egypt shot up 80%, while 15% of businesses in Egypt reported more online sales now than before the pandemic.

Meanwhile, the number of mobile wallets in Egypt has jumped at least 17% to 14.4 mn between March and October as the pandemic boosted digital payments, as the number of e-payment cards in use also rose 7% in the first six months of 2020, rising to 39.6 mn from 36.7 mn at the end of December.

All that led to ICT becoming Egypt’s fastest growing sector in FY2019-2020 seeing 15.2% y-o-y growth, according to a CIT Ministry statement. With an output of EGP 108 bn, compared to EGP 93.5 bn in FY2018-2019, the sector’s contribution to Egypt's GDP was approximately 4.4% in FY2019-2020, up from 3.8% in FY2018-2019. Investments in the sector rose 35% y-o-y to EGP 48.1 bn, up from EGP 35.4 bn, while exports increased 13% to EGP 4.1 bn from EGP 3.6 bn.

Our internal trackers count 49 investments in Egyptian startups in 2020, a nearly 50% increase from 33 in 2019. Most of the arm-twisting in negotiations and due diligence took place in the first nine months of the year: Startups announced they had raised funds every month in 2020, but fall was prime time to announce your big raise.

Egypt’s startups raised well over USD 100 mn this year compared to over USD 88 mn last year, according to our data. Note that these numbers are — at best — approximations. The modal answer to the question “How much did you raise?” was “more than USD 100k” or “six figures USD” both this year and last. Fifteen startups reported having raised “more than USD 100k” and four said they had raised “more than USD 1 mn.”

Setting aside clear outliers, the average transaction raised about 2x this year compared to last. Of those who disclosed a precise figure (not “more than 100k”), the average raised this year per transaction was USD 2.38 mn, up from USD 1.12 mn in 2019.

Local investors took the lead this year, with only 53% of investments in local startups having international involvement. Last year, 82% of all transactions announced involved a non-Egyptian investor at some level. That reflects a rising number of early-stage investments made by angels (individually or in groups) as well as the growing confidence of Egyptian VCs, one local VC told us. Also playing a part, he says: “Global players didn’t travel as much in 2020 for obvious reasons, and they had their own problems at home.”

Egyptian VCs also provided bridge finance in some cases until companies closed their next round, a partner at a top VC outfit told us. “A number of the international players were initially cautious, but they came in eventually when they saw how the companies were performing, so we provided bridge finance to keep them going.”

Fintech and e-commerce were the hot sectors this year at 12 and 11 transactions apiece, followed by six investments in a mix of tech-related firms. Last year, investments were more evenly divided across personal services (five transactions), followed by education, fintech, healthcare, and transportation / logistics with four each.

Half of all announcements in 2020 avoided specifying which “round” a startup was raising. Eight companies said they had raised seed rounds, four announced pre-seed rounds, five announced series “A”s and four announced pre-A rounds. Angel, pre-B, series “B” and series “D” made up the rest at one each, and many of the unspecified rounds look to us like seed, angel or otherwise very early stage fundraising.

A watershed year: We generally enjoy talking with partners at venture capital firms, who tend to be bright (intellectually) and sunny (in disposition). The year just ended was a watershed for many of them: While their portfolio companies sailed through earlier macro headwinds such as the float of the EGP — it helps to be a super-young business with USD-backed investors and LCY costs — the pandemic was the first acid test for many of them.

In terms of operational performance, the winners this year were predictable: Digital transactions, efficiency plays, and any form of marketplace that allowed e-commerce, payments and matching did phenomenally well in 2020, insiders agree.

The losers: Travel and any marketplace that facilitated physical interactions (think personal services such as home cleaning and face-to-face education).

In numbers: “The winners did 2x their expected budget for 2020,” one of the country’s top venture capital partners told us, “and those that crashed did 0-50% of projections.” The top beneficiaries are growing double-digits every quarter.

May and June were particularly tough months for VCs and startup founders alike as businesses were either scrambling to staff up — or to learn, for the first time, how to handle salary cuts and firing.

WHAT TO LOOK FOR IN 2021- Fintech bros will be everywhere. Covid telescoped three years of digitalization into three months — and the Sisi administration’s financial inclusion drive just added fuel to the fire. Expect to see lots of interest in providing financial services enabled by tech, as well as infrastructure plays (think: Fawry) and embedded fintech (taking what you know about a market and using it to make a buck facilitating access to financial services).

Also: Marketplaces. We’re a nation of >100 mn, and if there’s one thing we love, it’s to eat — followed closely by shopping. You do the math.

The big play in 2021: Jockeying to see who is going to become the first “challenger” bank (provided, of course, the Central Bank of Egypt ever lets that happen).

The sleeper plays of 2021: Agriculture, healthcare and the windows created by the government’s move away from conventional petrol-powered engines.

Also: Look for international VCs to make moves on Egypt, with one local VC noting that funds in the UAE in particular are being priced out of Saudi Arabia and so are redoubling efforts to get a piece of the action in Omm El Donia.

YEAR IN REVIEW: MACRO

2020: The year the sky fell — but then didn’t

How covid brought on a liquidity-charged global monetary order, and with it, an investing enlightenment: Just three months into what was largely an optimistic macro outlook for 2020, the world was staring down the barrel of the worst global recession. Unprecedented movements in international capital flows, selloffs and the biggest oil crash in decades would go on to define the first half of the year. But despite a crumbling world trade order that marked the coming of the Trump administration, central bankers across the world (with memories of 2008 firmly on their mind) took a unified monetary policy stance and unleashed a wave of historic stimulus packages.

Keep calm, and invest on: Not only did this reverse selloffs and spark an IPO boom, but it served to spur a wave of sovereign and corporate debt, and the emergence of new vehicles such as SPACs and PIPEs. But perhaps the year’s most enduring legacy, is how it finally got investors thinking seriously about the climate and ESGs in general. That or the mother of all debt bubbles.

Just how bad did it get before we were staring into the abyss? The financial markets entered full-on crash mode in March as investors sold anything and everything that wasn’t the greenback and USTs, with equity markets seeing historic daily plunges, corporate bond yields spiking, and the volatility index reaching Chernobyl levels.

Emerging economies were treated to the mother of all sell-offs as investors pulled a monthly record of USD 83.3 bn in March. The US and Europe, the countries worst hit by the initial wave, saw truly staggering falls in economic output, private sector activity, and employment. Forecasting in April a 3% contraction in global output (then 4.9% in June, then 4.4% in October), the IMF — long the arbiter of structural adjustments and debt sustainability — was begging governments to do anything and everything they could to soften the economic blow of the “Great Lockdown.”

Turbulence in the oil markets defined life across much of the Middle East: Oil exporters in the Gulf found themselves faced with not only the pandemic but the historic crash in international oil prices, which threatened to do serious damage to their petro economies and public finances alike. To plug the gaps, governments resorted to austerity measures and record debt issuance.

Next year probably isn’t going to offer much respite to the Middle East’s oil exporters, whose public finances are expected to come under further pressure as the pandemic continues to suppress oil demand. After a huge year of debt sales in the Gulf, Deutsche Bank expects even more in 2021 with USD 107-110 bn of issuance.

Remember those illuminati members conspiracy theorists love to hate? You know, central bankers? Consider sending yours a New Year’s card this year: That the financial system didn’t suffer a heart attack is due to the world’s central banks, whose swift actions only served to strengthen the idea that in modern day policymaking the monetary supersedes the fiscal. To maintain flows of liquidity into the system and prop up asset prices, the world’s four systemic central banks — the US Fed, the European Central Bank, the Bank of Japan and the Bank of England — bought more than USD 6 tn of bonds this year alone. The Federal Reserve slashed rates to zero and reintroduced the alphabet soup of crisis-era emergency programs, which saw it purchase USTs, commercial paper, assets from mutual funds, and for the first time investment grade corporate debt and bond ETFs.

2020 was the year that some EM central banks finally threw caution to the wind and resorted to buying government bonds. At least 18 central banks purchased assets this year, either because interest rates were already on the floor or to finance government spending, and — so far — economists’ warnings of fiscal irresponsibility and uncontrollable inflation have not come to pass. Developing countries were able to keep bond yields down without undermining their currencies, proving that quantitative easing can be an additional tool in the EM central bank’s toolkit going forward, providing the program and the bank are credible.

Pandemic who? The waves of monetary and fiscal stimulus unleashed during those first months of the outbreak helped investors to forget about the dire state of the economy. Global stocks roared back to record levels, capital poured back into emerging markets, and junk bond yields fell to record lows. It ended up being a record year for IPOs and corporate issuance while bns were thrown at celebrity-owned SPACs. Meanwhile, sovereign and corporate debt levels have soared this year, and according to the Institute of International Finance will reach an eye-watering USD 277 tn by the end of the year.

But will all this debt come home to roost? Fiscal stimulus measures and spending programs by governments and a surge in corporate bond issuance will leave the global economy more leveraged than ever by the time the virus has finally been neutralized, when the inevitable questions of how to restore stability to state finances and resuscitate the raft of newly-zombified companies will arise. With USD 15 tn in new debt issued in the first nine months of 2020 alone, global debt-to-GDP hit 365%, with developed economies surging to 432% from 380% at the end of 2019 and emerging markets hitting 250%.

INVESTOR NIRVANA- How investors finally caught on to climate: Say what you want about its unhealthy influence over global capital markets, BlackRock’s coming out in favor of green-led finance was somewhat of a watershed moment for those who want the global investor class to start thinking a little more about the environmental impacts when pulling the trigger on an investment. 2020 was certainly the year that investors began to take climate risk seriously. Records were smashed as investors plowed USD 7.1 bn into ESG funds in the first nine months of the year — almost four times more than inflows seen in the equivalent period in 2019. And the amount of assets under management in responsible funds topped USD 1 tn for the first time ever.

There are a couple of caveats though: Firstly, though these figures might seem big, investments in ESG funds make up just 3% of total AUM. Secondly, whether these record inflows indicate a genuine shift in investor sentiment, or are a product of the central bank-fuelled ‘buy everything’ post-April market melt-up, remains to be seen. And lastly: we cannot understate the difference between statements and actions. Despite Larry Fink’s encouraging rhetoric in January, his company’s decisions this year relegate them, for the moment at least, to mere virtue signalling. Whether the ESG trend continues into 2021 will depend, in part, on whether the titans of global finance match their words with actions.

2021 in EM and FM Land: Investment, fiscal outlooks and policy turns in emerging markets will hinge on the trajectory of the pandemic and the rollout of vaccines — and right now no-one knows how this is going to play out. Analysts are split on how long the late-year rally can continue for into next year: some predict a huge year of inflows but Societe Generale and HSBC have warned that uncertainties over vaccine distribution, the economic recovery and surging debt will make for another volatile 12 months. The more adventurous central banks will likely come under pressure to reverse their bond-buying programs if global vaccine rollout is smooth, but after a swathe of credit downgrades this year, mounting debts will continue to pose problems and some countries will continue to dance with default.

MAKING IT

Making It Season Two: How did the business community react to Covid

How did the business community react to Covid-19? In season two of Making It, we spoke to the founders and CEOs of great businesses in Egypt about how they’ve reacted and adapted to the Covid-19 pandemic. Lockdowns forced many sectors to a complete standstill, while others were pushed into an accelerated growth plan. Guests in season two cover industries directly impacted by the pandemic, like education and logistics, as well as sectors that have seen exponential growth, like digital infrastructure and fintech.

Not sure if you want to commit to a full episode? Try these short trailers — scroll down and use the player in the black bar at the bottom of the page.

- How 30k students shifted to e-learning, with CIRA CEO Mohamed El Kalla

- How to survive food trends, with NOLA co-founders Laila and Adel Sedky

- Starting private microfinance, with Tanmeyah Managing Director Amro Abouesh

- Putting Egypt on the mobile commerce map, with TPay Mobile CEO Sahar Salama

- What is a successful tech startup? with Tarek Assad and Karim Hussein of Algebra Ventures

- Creating a digital safety net for businesses, with SAP Egypt Managing Director Hoda Mansour

- The evolution of the supply chain, with Trella CEO Omar Hagrass

You can also listen on Apple Podcasts | Google Podcasts | Omny | Anghami.

PLANET FINANCE

The EGX30 rose 0.7% yesterday on turnover of EGP 979 mn (27.5% below the 90-day average). Foreign investors were net sellers. The index is down 23.7% YTD.

In the green: Sidi Kerir Petrochemicals (+5.5%), Ezz Steel (+4.0%) and Egyptian Iron & Steel (+3.2%).

In the red: Sodic (-0.7%), Export Development Bank (-0.2%) and Telecom Egypt (-0.2%).

Asian markets are solidly in the green this morning and futures suggest Europe and Wall Street will follow suit, thanks in part of optimism about a vaccine rollout and approval in the US House of Representatives of a new covid aid bill. Stocks jumped to record highs on Wall Street yesterday on news that Trump had signed the bill, averting a government shutdown in the process.

|

|

EGX30 |

10,659 |

+0.7% (YTD: -23.7%) |

|

|

USD (CBE) |

Buy 15.67 |

Sell 15.77 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,715.38 |

-0.3% (YTD: +7.5%) |

|

|

ADX |

5,106.31 |

+0.2% (YTD: +7.1%) |

|

|

DFM |

2,514.60 |

-0.04% (YTD: -4.1%) |

|

|

S&P 500 |

3,739.89 |

+1% (YTD: +17.5%) |

|

|

FTSE 100 |

6,502.11 |

+0.1% (YTD: -12.1%) |

|

|

Brent crude |

USD 50.89 |

-0.8% |

|

|

Natural gas (Nymex) |

USD 2.32 |

-7.7% |

|

|

Gold |

USD 1,879.60 |

-0.2% |

|

|

BTC |

USD 27,011.58 |

+0.5% |

CALENDAR

31 December (Thursday): Egypt-UK post-Brexit trade agreement to take effect.

31 December (Thursday): Deadline for car owners to comply with traffic regulations to install a RFID electronic sticker on their cars.

31 December (Thursday): Deadline for EGX-listed companies to comply with regulations requiring at least one member of their boards of directors be a woman.

1 January 2021 (Friday): New Year’s Day, national holiday.

1 January 2021 (Friday): 11k of Egypt’s largest taxpayers begin filing taxes through the electronic unified tax platform.

January 2021: US Treasury Secretary Steven Mnuchin is set to visit Egypt.

5 January 2021 (Saturday): The annual GCC summit will be held in Riyadh, Saudi Arabia. The agenda includes potential resolution of the three-year-old spat with Qatar.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship in four venues in Alexandria, Cairo, Giza and the New Capital.

Mid-January: Local expo to display natural gas-powered and dual-engine vehicles for Egypt’s car replacement program.

17 January 2021 (Sunday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria in case 445 of 2019.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February 2021 (Saturday-Thursday): Mid-year school break.

20 February 2021 (Saturday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2021: The Annual Egypt Automotive Summit will be held.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

30 May-15 June 2021 (Wednesday-Thursday): Cairo International Book Fair.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June- 15 July 2021: National Book Fair.

2H2021: Egypt’s Commodities Exchange (Egycomex) will begin trading.

1 July 2021 (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

5 August 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

16 September 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 October 2021-31: March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

28 October 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December 2021: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.