- It’s official: We all have a full week off for Eid El Fitr as CBE, EGX weigh in. (What We’re Tracking Today)

- Egypt extends international flight ban indefinitely, citizen-facing services suspended for 15 days after Eid. (Speed Round)

- Egypt’s economic recovery will likely be U-shaped -El Said. (Speed Round)

- Egypt’s daily case toll rises to a record 720, topping Monday’s record by almost 200 cases. (What We’re Tracking Today)

- Energean’s acquisition of Edison’s Egypt assets faces delays. (Speed Round)

- CIB to push ahead with expansion plans -Hisham Ezz El Arab. (Speed Round)

- Egypt’s Nile Air shelves listing plans, scales back expansion due to covid-19. (Speed Round)

- Orascom, Bombardier start construction of USD 4.5 bn new capital-Nasr City monorail. (Speed Round)

- How will the oil shock impact Egypt’s renewable energy sector? (Hardhat)

- ** Today is the last day to tell us how covid-19 is impacting your business.

- The Market Yesterday

Wednesday, 20 May 2020

It’s official: Planet Finance will take the whole week off for the first time since 2011

TL;DR

What We’re Tracking Today

Well, it’s official: Planet Finance has a full week off for Eid El-Fitr, just like the rest of the private sector. The Central Bank of Egypt made the announcement overnight in a terse, single-sentence statement that says banks are closed Sunday-Thursday, inclusive, and will reopen on Sunday, 31 May. The EGX will also close for the full week, it said in a statement (pdf) last night.

It’s the longest shutdown of the banking sector that we can remember since 2011, when banks were closed for a week after the events of 28 January.

Also announced yesterday: Commercial flights are grounded “until further notice” and citizen-facing services will remain suspended for another 15 days after Eid, Cabinet said in a statement yesterday. Suspended services include the issuance and renewal of passports, visas and work permits.

We have the full rundown in this morning’s Speed Round, below.

The shutdown comes as the Health Ministry announced 720 new cases of covid-19 yesterday, a new single-day record. Among the measures in effect next week as the Madbouly government looks to flatten the curve:

- A 5pm-6am curfew from Sunday, moving to 8pm-6am on 30 May;

- The closure Sunday-Friday, inclusive, of all malls and retail outlets other than pharmacies and grocery stores.

Separately, the CBE sent a strong signal yesterday as Governor Tarek Amer told state news agency MENA that the central bank will guarantee 80% of each loan banks make under the CBE’s EGP 100 bn stimulus program for industry. Launched in December, the EGP 100 bn industry stimulus initiative provides subsidized loans with a declining 8% interest rate to medium-sized factories. The program was expanded to include agricultural companies in March and contractors last week.

NEED AN INCENTIVE? Five respondents will get an Enterprise mug and a bag of our own custom coffee from our friends at 30 North. Want to enter? Leave your name, title, company, email address and telephone number in the comments field at the end of the survey.

*** So, when do we eat? Maghrib prayers are at 6:45pm and you’ll have until 3:17am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

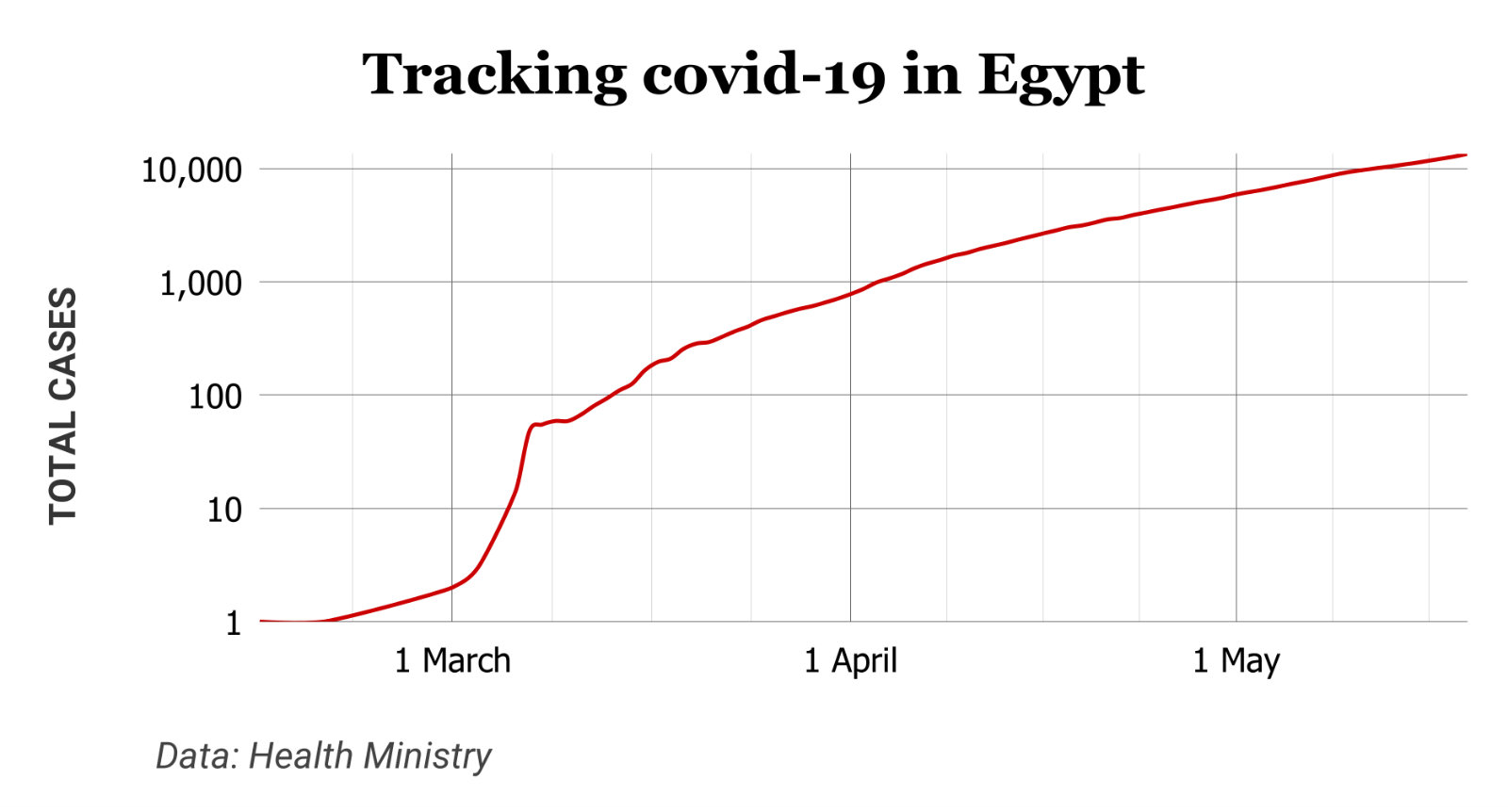

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 13,484 confirmed cases of covid-19 after the Health Ministry reported 720 new infections yesterday — topping yesterday’s record by almost 200 cases. The ministry also said that another 14 people had died from the virus, taking the death toll to 659. We now have a total of 4,275 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 3,742 have fully recovered. Reuters covered the story.

The latest high-profile cases: Former oil minister Sameh Fahmy has tested positive for covid-19, his brother said yesterday. Fahmy is currently receiving treatment at an isolation facility and his condition is said to be stable. Abdullah Montasser, head of the Supply Ministry’s weights and measures authority, also contracted the virus, the authority said, according to Masrawy.

The government has cut the mandatory quarantine for Egyptians returning from abroad to seven days from 14, Al Masry Al Youm says, citing unnamed government officials. Travellers who test negative after a week will reportedly be released from quarantine on the condition they self-isolate at home for another seven days.

Egypt’s courts will fully reopen on 13 June, the Justice Ministry said yesterday. Everyone in a court will be required to wear face masks and steps will be taken to ensure the headcount in court remains low, the ministry said in a circular to courts picked up by Al Shorouk. Some courts are currently convening only to issue final verdicts in major cases, while others are ruling on detention orders. Most are fully closed at present.

ON THE GLOBAL FRONT-

It’s the World Bank’s turn to bring the grim economic news this morning: World Bank president David Malpass warned yesterday that as many as 60 mn people will be forced into extreme poverty as a result of the global recession, the Financial Times reports. The bank is anticipating a 5% contraction in global output this year, significantly below the 3.8% forecast by the IMF last month.

There are early signs that Italy and Iran are already facing second waves of infections as each reported upticks in new infections.

What’s up with the Great Lockdown in our part of the world?

- The UAE will lengthen its curfew during Eid El Fitr by two hours to run from 8pm-6am instead of 10pm-6am, Bloomberg reports without citing a source for the news. Malls will be allowed to operate from 9am-7pm.

- Turkey is locking down the country for the full Eid vacation and schools will not be back in session his academic year, Bloomberg reports. Mosques, however, will reopen on 29 May.

- Pakistan is allowing retail outlets to reopen after a decision by its Supreme Court, the Wall Street Journal reports.

The Fed and the Treasury have different prognoses for the US economy: Fed chair Jay Powell and Treasury Secretary Steve Mnuchin yesterday offered competing visions for where the US economy is headed, disagreeing about whether fiscal stimulus will be necessary to prevent the country suffering an extended downturn. The story is leading the front pages of both the Financial Times and the Wall Street Journal this morning.

US President Donald Trump is threatening to “permanently” cut his country’s funding for the World Health Organization (WHO) and is threatening to pull, claiming the institution has failed in its covid-19 response. The Donald’s tantrum was promptly shut down by the other members of the organization, who decided instead to set up an “impartial, independent” investigation into the WHO’s response, the New York Times reports.

AND THE REST OF THE WORLD-

The EU is threatening to get tough on Zuck: Facebook will face more regulation if the company fails to ease concerns over market power and data collection, EU Industry Commissioner Thierry Breton told Facebook CEO Mark Zuckerberg during an online debate this week, Bloomberg reports.

And Zuck is signalling that he wants to go after Amazon, saying yesterday that the Evil Empire is going to launch an online shipping platform. Facebook Shops would add a checkout feature for in-app purchases through Facebook and Instagram, building on the recent launch of limited shopping functionality on Facebook-owned Instagram and WhatsApp.

Climate risks haven’t gone anywhere — the real question is how to price them into the market: Corporate green bonds marked record growth in 2019, reporting sales of over USD 217 bn but the figure is too small to address climate concerns on a global scale. Government-issued green bonds that account for future climate catastrophes may be a more effective way forward, Bloomberg suggests. Difficulties still stand in the way of appropriately pricing the cost of climate change through government debt instruments and “when markets find it difficult to price the risk, they just don’t price it at all,” said Shaun Roache, Asia-Pacific chief economist at S&P Global Ratings.

Saudi bn’aire businessman Sheikh Saleh Abdullah Kamel passed away at age 79, Al Arabiyah reported yesterday. Kamel was the owner of TV station Arab Radio and Television Network (ART) and a high-profile investor in Egypt. The longtime head of the Egyptian-Saudi Business Council, Kamel is perhaps best known for his Dallah Al Baraka Group, which invested across a wide range of sectors.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and even social infrastructure such as health and education.

In today’s issue: It’s part two of our three-part series examining how renewable energy in Egypt is likely to fare in these tumultuous times. This week: How will the oil shock impact investment in our renewables sector.

Enterprise+: Last Night’s Talk Shows

The airwaves gave us little to work with last night. We’ll be back with coverage as soon as something interesting catches our ears.

Speed Round

Speed Round is presented in association with

International flight ban extended indefinitely: Egypt is keeping its ban on international flights in place “until further notice,” Prime Minister Moustafa Madbouly confirmed yesterday, according to a cabinet statement. The flight ban was first imposed on 19 March and has since been extended multiple times. The latest extension was due to expire this coming Saturday, 23 May. The suspension only applies to international flights — domestic routes are still operating. Reuters also has the story.

The government has yet to decide when it will lift the suspension of flights, Civil Aviation Minister Mohamed Manar tells the local press. According to the minister, Egypt is currently waiting on recommendations from the International Air Transport Association.

You can’t book tickets on EgyptAir’s website anymore: We had found flights available earlier this week from Cairo to London, Washington, New York, Paris, Dubai, Jeddah, Montreal, Amsterdam, and Casablanca, among others, on national flag carrier EgyptAir’s online booking feature. Flights were available starting 1 June. These flights were no longer available yesterday.

Citizen-facing government services will be suspended for another 15 days post-Eid. According to the statement, this includes the authorities that issue work permits and passports well as the real estate registry (with some exceptions) and notary offices. The statement suggests that traffic police offices will provide “some services,” which we expect means the licensing of new vehicles and the renewal of car licenses.

Anyone not wearing a mask in “closed” spaces will be fined EGP 4k, Madbouly said. Starting 30 May, everyone will be required to wear a mask in banks, private offices, government buildings, malls, and retail outlets, and on all forms of mass transport.

Background: The extension of the flight ban and suspension of government services are part of the government’s planned return after the Eid El Fitr holidays to the same basic set of restrictions that were in place before Ramadan. This phase, which officially begins on Saturday, 30 May will run for 15 days. It will allow shops and malls to open from 6am-5pm and restaurants to operate as they did during Ramadan (with around-the-clock delivery + allowing customers to place takeaway orders in-store outside curfew hours). Beaches and public parks will remain closed.

Egypt’s economic recovery post-covid is most likely to be U-shaped, rather than V- or W-shaped, Planning and Economic Development Minister Hala El Said said during a webinar hosted yesterday by our friends at AmCham. El Said reiterated that the government has prepared multiple scenarios for the country’s economic outlook over the remainder of the year, but believes a U-shaped recovery is the most likely scenario when looking at Egypt’s demographics.

Growth will remain low for the rest of 2020: The government expects the majority of Egypt’s economic growth next fiscal year (3.5%) to be concentrated in its second half, with 1H2020-2021 expected to see “very low growth,” the minister said.

Egypt’s GDP growth in 3Q2019-2020 came in at around 5%, El Said said. The government is set to announce the official number today.

Unemployment figures in Egypt are also expected to end 2020 at around 10%, said El Said. Egypt’s unemployment rate rose to 9.2% in April from 7.5% in the second quarter of 2019 as the government’s precautionary measures to limit the spread of the novel coronavirus hit the economy.

Proposed IMF standby facility to support structural reforms: Any standby funding secured from the IMF will be used to implement pro-business structural reforms, El Said said. The standby facility, which could see Cairo receiving up to USD 5.5 bn on top of this month’s USD 2.8 bn covid-19 rapid financing instrument, will be used to plug payment gaps faced by businesses, she added.

The government has been working on reforms to boost private sector participation as part of the IMF-sanctioned program that came as a condition of the USD 12 bn extended fund facility we received in full last summer. Since the program kicked off in 2016, authorities identified six structural reform priorities, including digital transformation, industry, agriculture and logistics, the minister said yesterday. Reuters took note of El Said’s comments on the IMF plan.

M&A WATCH- Energean wants Edison to revalue its portfolio post-covid, slowing down its acquisition of assets in Egypt and beyond: Greece’s Energean has asked Edison to reassess the valuation of its oil and gas portfolio before moving ahead with a planned acquisition, Youm7 reports, citing an unnamed industry source. The Greek company wants Edison to account for the covid-19 pandemic and the nosedive in global oil prices in the final agreement pricing, according to the source. The process has pushed back the timeline for the two companies to close the acquisition, which was supposed to have happened by the end of 2019.

Background: Energean had been looking to buy Edison’s entire oil and gas portfolio for an initial USD 750 mn, with a further USD 100 mn due after gas production from the offshore Italian Cassiopeia field begins, which is expected to happen in 2022. The Oil Ministry had approved last year Energean’s purchase of Edison’s Egypt oil and gas assets — which make up 24% of the company’s portfolio — and include three producing concessions and six exploration concessions. Of the production assets, it owns a 100% stake in Abu Qir, a 60% stake in West Wadi El Rayan, and a 20% stake in Rosetta. It also has a 100% stake in three exploration assets, and shares ownership of the remaining three with state-owned companies EGAS and EGPC.

With ample liquidity, Egypt’s leading private-sector bank looks to push ahead with expansion plans: CIB is committed to pushing ahead with its expansion strategy once it finalizes its recent acquisition of a 51% stake in Kenya’s Mayfair Bank, Chairman Hisham Ezz El Arab told Bloomberg TV (watch, runtime: 8:08). The bank currently has ample capital and more local currency liquidity than required by the Central Bank of Egypt. “I don’t see any use for the excess capital we have, unless we carry on with our expansion policy,” the CIB chairman said. The bank is also “well-placed” to pay out dividends, but noted this isn’t on the corporate agenda until 1Q2021; CIB has declared dividends once per year since 2011.

Africa expansion plans still on course: CIB sees plenty of possibilities for Egypt in Africa, and believes that the country can provide benefits to its neighboring countries through cooperation, Ezz El Arab said. Africa has been at the heart of CIB’s expansion plans — in addition to its majority stake purchase in Mayfair Bank. CIB, Egypt’s largest private-sector bank, opened a representative office in Ethiopia last April.

M&A WATCH- Bank Audi will not be leaving Egypt anytime soon: Lebanon’s Bank Audi has postponed indefinitely its plans to exit Egypt after acquisition talks with First Abu Dhabi Bank (FAB) stalled earlier this week, Masrawy reported, quoting unnamed sources. Bank Audi had planned to leave Egypt in response to the recent banking crisis in Lebanon, but the knock-on effects of the covid-19 pandemic have forced it to abandon its plans, the sources said. FAB and Bank Audi agreed this week to pause negotiations that would have seen the former acquire the latter’s Egypt assets, citing “unprecedented circumstances and the uncertain outlook” caused by the covid-19 pandemic.

IPO WATCH- Nile Air shelves listing plans due to covid-19, long-term expansion plans in doubt: In another sign of the toll the coronavirus is exacting from the country’s aviation sector, Nile Air has abandoned plans to debut on the EGX this year and scaled back ambitions to upgrade the size of its fleet, the local press reports. A senior official painted a picture of a company in survival mode as it tries to support itself through a near two-month ban on international flights: “The company’s primary goal at the present time is to maintain continuity and remain in the aviation market,” they told the newspaper. The company, which is Egypt’s largest privately-owned airline, has delayed plans to add to its fleet, the official said, adding that its target of sizing up to 20 planes by 2023 is now in jeopardy. The revival of Egypt’s tourism sector in the years before the outbreak helped Nile Air turn a profit last year, and saw it operate some 20 regular flights to Egypt and neighbouring countries.

Gov’t support to the ailing aviation industry: The government has recently announced measures to support the hard-hit sector through the pandemic. This included a pledge earlier this month to doll out EGP 10 bn to aviation and other sectors from the administration’s EGP 100 bn covid-19 bailout package, tax relief, and a move by the central bank to allow airlines access to subsidized loans previously earmarked only for tourism companies.

Orascom, Bombardier, Arab Contractors begin construction of new capital-Nasr City monorail: Orascom Construction, Canada’s Bombardier Transportation, and Arab Contractors have broken ground on the USD 4.5 bn new administrative capital monorail project, which will connect East Cairo to the new capital, according to a company statement. The company did not disclose the expected timeline for completing the project.

Background: The Orascom-Bombardier-Arab Contractors consortium finalized last year the monorail agreement with the National Authority for Tunnels. The agreement will see the consortium design, build, supply and operate the lines, which will link Sixth of October City to Giza and Nasr City to the new administrative capital. The consortium will also be responsible for the operation and maintenance of both lines for 30 years and will design and build all infrastructure and civil works, including stations, guideway structures and new depot buildings.

Gold miners aren’t spooked by the coronavirus: Ten mining companies have taken out condition booklets for Egypt’s ongoing international gold and mineral exploration bid round, an industry source said, without naming the potential bidders. The Egyptian Mineral Resources Authority has been making it easier for foreign companies interested in purchasing booklets to make payments, the source said, without providing further details.

Background: The bid round began on 15 March and will end on 15 July with investors looking at a 56k sq km exploration area in the Eastern Desert. This will be the first time the industry tests legislative amendments passed last year that scrapped production sharing agreements in favor of a more investor-friendly tax, rent and royalty model.

STARTUP WATCH- Tribal Credit, a Silicon Valley-based fintech startup co-founded by two Egyptian entrepreneurs, has joined Visa’s Fintech Fast-Track program, which is designed to help fintech businesses scale up with support from Visa’s experts and resources, according to an emailed statement (pdf). The startup, founded by Amr Shady and Mohamed Elkasstawi, raised last December USD 5.5 mn in a seed funding round led by BECO Capital and Global Ventures. Tribal Credit uses “a proprietary AI-driven approval process and blockchain technology” to provide startups in emerging markets with instant access to credit and help remove financing hurdles. Tribal is seeing demand from startups in markets like Egypt, the UAE, Saudi Arabia, and Mexico, where they “struggle to access traditional financial services like opening bank accounts, issuing business credit cards and making cross-border payments.”

Edita Food Industries has entered the Egyptian biscuit market with the launch of its Oniro range of cookies, the company said in a statement (pdf). The Oniro Cookie Crisp Filled will retail at EGP 2 while the plain vanilla and chocolate biscuits will cost EGP 3. “Entering into new segments and creating new revenue streams for Edita is at the core of our growth strategy,” chairman and managing director Hani Berzi said. “Edita will continue to grow its biscuits portfolio in the coming months and build on its tradition of satisfying consumers’ tastes with great value-for-money propositions.”

EARNINGS WATCH- Gold miner Centamin reported a 13% y-o-y rise in profit after tax in 2019, which came in at USD 172.9 mn, according to its earnings report (pdf). The Sukari gold mine had one of its “strongest quarterly results” in 4Q2019, the report said. The mine’s gold production during the year will be disclosed later this month. Centamin reported USD 222.2 mn in gross revenues in 1Q2020, which the company generated from selling 139.8k ounces of gold, according to the company’s quarterly report (pdf).

MOVES- BP Egypt general manager Karim Alaa will succeed Hesham Mekawi as the company’s senior VP for North Africa, BP announced in a statement (pdf). Mekawi announced his resignation last month having spent 30 years at the company. Alaa will step into the role when Mekawi departs on 1 July.

Egypt in the News

It’s a quiet morning for Egypt in the international press.

- Egypt’s football league suspension squeezes small-time players’ pockets: The Associated Press profiles a professional football player from the Beni Suef Football Club who is now working as a street vendor to support his family while the league is suspended.

- An under-construction Giza bridge leaving a hair's breadth between it and the surrounding buildings is on Reuters’ radar after an uproar among area residents. The flyover is currently being investigated by a parliamentary committee.

Worth Watching

Forget the V: The US economic recovery is going to be a “series of W’s” -El Erian: The chances of the US economy staging a rapid recovery are slim to none due to the level of uncertainty surrounding the spread of the coronavirus and the development of a vaccine, Mohamed El Erian told Fox News’ Chris Wallace in an interview that aired on Sunday night (watch, runtime: 8:37). “It’s not going to be a neat V. It’s going to be more a series of W’s. Think of a pendulum swinging, and we don't know the magnitude of the swings, and we don't know the duration of the swings or the settling point. So it really is an uncertain outlook," El Erian said.

Diplomacy + Foreign Trade

UN chief urges settlement to GERD dispute: UN Secretary-General António Guterres has urged Egypt, Sudan, and Ethiopia to resume negotiations on the Grand Ethiopian Renaissance Dam towards “an amicable agreement in accordance with the spirit” of the 2015 Declaration of Principles. Ethiopia has reiterated in recent days its determination to begin filling the dam in July, despite failing to secure an agreement on its long-term operation during US-backed talks earlier this year.

Egypt and Sudan are trying to restart the talks: Sudanese prime minister Abdullah Hamdok will launch a last-ditch diplomatic effort to persuade the Ethiopian government to return to the negotiating table following a meeting with Prime Minister Moustafa Madbouly yesterday. Ethiopia refused to sign onto an agreement brokered by the US and the World Bank earlier this year, and has so far turned a deaf ear to pleas for it to reengage in negotiations.

Egypt, UAE call for political settlement in Libya: Egypt and the UAE have renewed their calls for a political settlement in Libya, a day after forces loyal to Libya’s UN-recognized government seized a key strategic base previously controlled by Egypt- and UAE-backed General Khalifa Haftar’s Libyan National Army (LNA). Speaking to African leaders, the president called for reconciliation between the rival factions following the major setback for Haftar’s advance on Tripoli. Emirati officials echoed the call, saying that the only course of action for the war-torn North African country is “an immediate, comprehensive ceasefire and a return to the political process,” Reuters reported.

How covid-19 and oil price volatility are impacting Egypt’s renewable energy sector — Part 2: The oil shock. Global experts and analysts have sounded the alarm that a combination of covid-19 and volatility in the oil market risks undermining the speed of the global transition to renewable energy. Some, including Fitch Solutions’ BMI Research, see Egypt’s renewable energy market as susceptible to those factors. We’ve been talking to experts, major renewable energy producers, and international funders about the impact of the lockdown and falling oil prices on Egypt’s renewable energy sector. In the first part of this three-part series, our sources told us that the temporary lockdown restrictions shouldn’t pose a serious threat to the long-term viability of the Egyptian renewable energy sector.

But what about the recent oil shock? We’ve seen this argued either way: some energy experts expect low oil prices to kill investment in green energy and others say the opposite. The people that we’ve spoken to fall into the latter category, arguing that the current volatility in the oil market is temporary and that renewables will remain competitive in the long-term.

Low energy prices could incentivize the continued reliance on fossil fuels: Hafez El Salmawy, professor of energy engineering at Zagazig University, tells us that low energy prices could disincentivize the government from phasing out fossil fuel-based infrastructure and ramping up renewables, which still only accounted for 3.4% of the country’s energy mix last year. Hatem Tawfik, managing director of Cairo Solar, sees the biggest risk coming from cheaper natural gas disincentivizing speedy subsidy removals, especially as industry looks to mitigate the economic impact of the crisis. We got a glimpse of that in March, when the government lowered the price of natural gas for the entire industrial sector in response to the crisis to USD 4.50 / mmBtu. This will mean a 25% price cut for cement companies which were paying USD 6.00 / mmBtu, and an 18% cut for metallurgy and ceramic manufacturers which were paying USD 5.50 / mmBtu.

This reduction has made natural gas more competitive than solar and wind in the short term. Solar and wind energy become competitive against natural gas once gas prices hit USD 5 / mmBtu, says Tawfik. Waste-to-energy company Empower’s chairman Hatem Elgamal says the price point for competitiveness is USD 6 / mmBtu.

This has already impacted global perception for Egypt’s renewable energy sector: These concerns have led to Egypt falling to 29th place from 12th in EY’s Renewable Energy Country Attractiveness Index May 2020 (pdf). “In addition to covid-19, Egypt has been hit hard by low industrial power price forecasts,” says the report, which focused on the impact the crisis has had on renewable energy globally. “Furthermore, its solar PV forecast has been reduced by 0.6 GW over the next five years.”

So why aren’t renewable energy providers scared?

#1 Oil and gas price lows are temporary: In a marked change from the doom-laden forecasts from last month, there are a growing chorus of voices calling the bottom of the market and issuing predictions for a gradual rebound. In response to Saudi Arabia’s abrupt change of course from its oil price war and the easing of lockdown restrictions in several major economies, the US Energy Information Administration now expects prices to average USD 32/bbl during the second half of this year and USD 48/bbl in 2021, while Morgan Stanley sees USD 35/bbl in 4Q2020. These prices are still well below the USD 60+ prices seen at the start of the year, but considering last month’s freak-out over negative prices a rise to USD 35 oil qualifies as a recovery albeit partial. Similarly, the EIA sees natural gas prices rising steadily throughout the rest of 2020 and into 2021.

#2 Renewable energy prices are more competitive for industry in the long run: “When compared to other sources of energy, PV offers huge savings for industry players in the long-term,” particularly as the cost of installing panels have decreased significantly, Menatalla Sadek, CEO of Hassan Allam Utilities, told us. “These savings could be as low as 10% to as high as 30% over 25 years, depending on the industry” she added.

… and more competitive for the government : A study conducted by the Fraunhofer Institute shows that the levelized cost of electricity from natural gas (the fair cost, by global standards) is substantially higher than that of solar, and also higher than what Egyptians — on average — are paying traditional energy providers for their electricity. Say, for example, the levelized cost of electricity from natural gas is EGP 1.5/ kWh. Egyptians are paying, on average, EGP 1/kWh, which is the equivalent of what solar generated electricity would cost. The government continues to incur a huge expense by subsidizing electricity to that degree, and it will have to put the prices up to their fair rate at some point, Tawfik argues. When that happens, the case for solar energy in particular will be all the stronger, he says.

…. and for consumers, too: Individual consumers could save up to EGP 320k in a lifetime by installing solar panels on their homes, rather than using traditional electricity sources, while business owners should expect a minimum of 10% savings compared to their current electricity bills, solar energy company Solarize says. Purchasing solar equipment is as much of an investment as buying a certificate of deposit or putting money in a savings account, says Tawfik, who argued that the money saved by not purchasing electricity from traditional providers is effectively money earned. “The internal rate of return (IRR) — which means how much money you get back for every EGP you invest in the solar station — is currently 25%, estimated very conservatively. Certificates of deposit offer interest rates between 10 and 15%. That’s where the appeal of solar energy is. But once the levelized cost of electricity from natural gas is fair, the IRR could reach 45%.” The IRR on a solar energy investment has increased by 60-70% since 2016 alone, he says.

#3 Egypt also benefits from its heavily regulated market, which offers a form of price stability: “Egypt generally benefits from fixed input prices for both renewable projects and thermal projects relying on domestic gas. As a result, the change in global oil prices should not impact the situation in the power sector too much,” says Walid Labadi, Egypt country manager at the International Finance Corporation (IFC). “If we compare the stability of oil prices with the stability of investments in renewable energy, renewables come off very well,” Alfredo Abad, head of Regional Representation in the European Investment Bank’s Cairo office told Enterprise.

The combination of competitive prices and price predictability has created significant consumer demand for renewables, says El Salmawy. Multiple sources agreed. This is especially the case among industrial and business consumers, who can access bank loans to pay for solar energy in installments, and who readily see the benefit in paying higher upfront costs for installing the system, and then entering into a 25-year fixed-price contract, says El Salmawy. “This is very important for industry planning and it is a fundamentally more stable mechanism than oil or gas. Even if oil is selling for USD 20/bbl today, it could be USD 60/bbl next week,” he told us In that sense, current oil market volatility actually strengthens the business case for renewables, proving their role as the dominant source of new power generation because they are affordable and have stable, predictable returns, argues IRENA’s Director-General Francesco La Camera, in a statement shared with Enterprise.

#4 We see no signs that the government is backing away from subsidy reforms: The Finance Ministry has allocated just EGP 28.1 bn to fuel subsidies in its draft budget for the coming fiscal year, down by nearly half from EGP 52.9 bn in FY2019-2020 forecasts.

Financial institutions remain committed to supporting renewable energy projects: The EBRD is exploring renewable energy projects to fund in 2020, Heike Harmgart, EBRD managing director for southern and eastern Mediterranean, told Enterprise. “We're looking at a number of smaller opportunities this year but they're a bit too early-stage to really put a number to it because a number of them are still under early discussion,“ she said. “Temporary drops in fossil fuel prices should not affect support to renewable energy projects in Egypt or elsewhere,” says Pierre Telep, Renewable Energy Senior Specialist at the Green Climate Fund, a fund established within the framework of the UNFCCC to help countries counter climate change. “The GCF will continue supporting renewable energy projects,” he adds.

If both the lockdown and low oil prices aren’t posing any long-term threats for renewables, what is? As with most industries, the covid-19 crisis has magnified structural problems in the sector that were there before the crisis. The most important of these problems is the massive overcapacity of our electricity generation. We dive deeper into this in Part 3 of our series on the impact of covid-19 on renewable energy in Egypt.

Your top infrastructure stories of the week:

- 2Africa project: Telecom Egypt is participating in a project to lay a 37k-km subsea cable between Europe, the Middle East and 16 countries in Africa to expand broadband and mobile networks on the continent. The cable will come online in 2023-2024.

- Port Said factory: The Transport Ministry will set up a new factory in Port Said to manufacture electric and monorail train cars as well as spare parts for the nation’s railways and metro lines.

- Marsa Alam power station: The Electricity Ministry inaugurated the Marsa Alam power transformer station, which was constructed by China’s State Grid Corporation, according to a cabinet statement.

- Delayed railcars delivery: A delivery of Russia’s Transmashholding railcars expected to arrive before 30 June will be delayed due to covid-19. No revised arrival date was given for the 100 railcars.

The Market Yesterday

EGP / USD CBE market average: Buy 15.74 | Sell 15.84

EGP / USD at CIB: Buy 15.74 | Sell 15.84

EGP / USD at NBE: Buy 15.72 | Sell 15.82

EGX30 (Tuesday): 10,357 (+0.8%)

Turnover: EGP 663 mn (5% below the 90-day average)

EGX 30 year-to-date: -25.8%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.8%. CIB, the index’s heaviest constituent, ended up 0.9%. EGX30’s top performing constituents were Porto Group up 2.8%, Qalaa Holding up 2.5%, and Telecom Egypt up 2.4%. Yesterday’s worst performing stocks were SODIC down 2.2%, CIRA down 1.4% and Orascom Development down 1.1%. The market turnover was EGP 663 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -61.1 mn

Regional: Net Short | EGP -27.5 mn

Domestic: Net Long | EGP +88.6 mn

Retail: 62.2% of total trades | 58.7% of buyers | 65.7% of sellers

Institutions: 37.8% of total trades | 41.3% of buyers | 34.3% of sellers

WTI: USD 32.50 (+2.14%)

Brent: USD 34.65 (-0.46%)

Natural Gas (Nymex, futures prices) USD 1.83 MMBtu, (-0.27%, Jun 2020 contract)

Gold: USD 1,749.00 / troy ounce (+0.19%)

TASI: 7,044.56 (+1.78%) (YTD: -16.03%)

ADX: 4,074.30 (+0.34%) (YTD: -19.73%)

DFM: 1,931.18 (+0.59%) (YTD: -30.15%)

KSE Premier Market: 5,287.34 (+1.75%)

QE: 8,802.14 (+0.43%) (YTD: -15.57%)

MSM: 3,393.50 (-0.98%) (YTD: -14.76%)

BB: 1,257.02 (+0.24%) (YTD: -21.93%)

Calendar

23 May (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

23 May (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

31 May (Sunday): A postponed court session for the lawsuit filed by Cairo Development and Auto Industry, a subsidiary of Arabia Investment Holding, against Peugeot Automotive to demand EUR 150 mn compensation.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): Anniversary of the June 2013 protests, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.