- Are we going to sign a new IMF agreement in March? (Speed Round)

- Egypt rises six spots in World Bank’s 2020 Doing Business report. (Speed Round)

- EGP hits its highest level since the spring of 2017 against the greenback. (Speed Round)

- The EGX has been lagging since last month’s protests, and the EGP is underperforming compared to EM peers, Bloomberg says. (Speed Round)

- Egypt to be the region’s “star performer” in 2020 -Capital Economics. (Speed Round)

- Egypt, Ethiopia agree to dial back GERD tensions, restart talks. (Speed Round)

- Eni acquires 70% of Edison block in North East Hapi Mediterranean concession. (Speed Round)

- Emerging markets’ Achilles heel: USD debt exposure. (Speed Round)

- The Market Yesterday

Sunday, 27 October 2019

The EGP has hit a fresh two-and-a-half year high, but can it last?

TL;DR

What We’re Tracking Today

We have a rather packed issue this morning as the Russia-Africa summit wrapped on Thursday and a flurry of economic analysis on Egypt hit the interwebs over the weekend.

Good news first: It looks like we’re not going to be taking up Abiy Ahmed on that war call. President Abdel Fattah El Sisi agreed with the Ethiopian prime minister to go back to the negotiating table over the Grand Ethiopian Renaissance Dam (GERD) during a sit-down in Sochi on Thursday.

Also good: Egypt’s ranking improved in the World Bank’s Ease of Doing Business Report.

Neutral: The EGP has continued to strengthen against the greenback, rising to the highest level since March 2017.

On a less welcome note: Domestic equities and bonds have not been doing great since last month’s protests. Investors, particularly foreign holders of government debt, have scaled back their bullish approach to Egypt over the past few weeks at the prospect of political unpredictability.

We have the rundown on all of the above in this morning’s Speed Round.

CIB kicked off the world’s biggest squash event at the Giza Pyramids on Thursday. The CIB PSA Women’s World Championship and the CIB Egyptian Squash Open Men’s Platinum, which are taking place simultaneously, bring together 64 women competitors and 48 men and run through Friday, 1 November.

The winner of the women’s world championship will earn more than will the men’s world champion at the Doha men’s world championship in November — something CNN lauds as a “potentially groundbreaking move” as the issue of gender pay equality continues to gain attention in the sports world. First prize in the CIB women’s tournament is nearly USD 49k out of a total purse of USD 430k. The men’s world champion will win nearly USD 46k out of a total purse of USD 335k.

Keep your fingers crossed for an all-Egyptian final — something not outside the realm of the possible given that squash is the one sport we absolutely dominate at the global level (as immodestly advertised all over Cairo International Airport in the run-up to the tournaments).

And join us in thanking our friends at CIB for having helped build Egyptian squash into a global powerhouse. Corporate backing can make a positive difference, and this is one of those cases in which it’s on display for the entire nation to see.

Egypt’s World No.2 Nour El Sherbini cruised past Hollie Naughton in three sets yesterday to enter the third round of the tournament. El Sherbini beat Naughton 13-11, 11-7 and 11-4 to keep her on course to retain her World Championship title.

German Foreign Minister Heiko Maas will arrive in Cairo tomorrow to discuss the situations in Syria and Libya with President Abdel Fattah El Sisi and Foreign Minister Sameh Shoukry, the German embassy in Cairo said in a statement.

King Tut’s multi-city exhibition is landing on Friday in London, where it will be on display at the Saatchi Gallery

Other dates to pencil into your agendas this week and next:

- The Munich Security Conference Core Group Meeting in Cairo kicked off yesterday and is set to wrap tomorrow, according to Ahram Online. The meeting will bring together senior foreign policy decision-makers from around the world to discuss regional security issues.

- A B2B conference for German and Egyptian companies will take place tomorrow in Cairo. Click or tap here to register.

- The US Federal Reserve will meet on 29-30 October to review key interest rates.

The Cairo International Film Festival will open on 20 November with Scorsese’s “The Irishman” (IMDb), which was selected as the Cairo International Film Festival’s (CIFF) opening title, the festival’s director Ahmed Hefzy said in a statement. The critically-acclaimed film sees Scorsese rekindle that classic Goodfellas feel, with oscar-winning legends Al Pacino, Robert de Niro and Joe Pesci bringing the fedoras, the Italian-American accents and the graphic violence. CIFF kicks off on 20 November.

Did Egypt really get hit by a ‘medicane’ over the weekend? A “Mediterranean tropical-like cyclone” (or ‘medicane,’ as some would have it) — a rare type of storm with tropical hurricane characteristics — hit Egypt and Israel over the weekend, according to CNN and the Washington Post. The UK Met Office says that these storms are a rarity at this end of the Med, particularly as the water temperatures are generally not warm enough to spawn a nontropical cyclone. But meteorologists says that climate change has pushed sea temperatures 1-3 degrees above average, and warn that this will likely become more common as they continue to rise. Egypt’s Meteorological Authority, meanwhile, says there’s “no way” for a tornado to form in the east Mediterranean.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag of nuts on the airwaves, with no particular coverage steering the conversation. Last night saw the talking heads tackle last week’s downpours, UK tourists in Egypt, and President Abdel Fattah El Sisi’s meeting with senior cabinet ministers. Oh, and it’s week two of Amr Adib’s version of open political debate.

The Irrigation Ministry declared a state of emergency after “irregular” weather patterns hit the nation last week and into the weekend, Homa Al Asema’s Reham Ibrahim reported (watch, runtime: 1:25). Teams will be commissioned in every governorate to respond to heavy rainfall and floods in the coming period.

El Hekaya’s Amr Adib phoned the acting head of the Meteorological Authority, Ashraf Saber, who said that a certain news outlet spread rumors that a medicane cyclone hit the country over the weekend (watch, runtime: 4:45). We recap this story in this morning’s What We’re Tracking Today, above.

Nearly half a mn Brits will visit Egypt this year -UK ambassador: Some 500k British tourists will come to Egypt this year to “enjoy [a] happy, trouble-free holiday,” the UK’s ambassador to Cairo Jeffrey Adams told El Hekaya’s Dina Abou El Fadl in an interview. Adams said that cooperation between British and Egyptian authorities was the key to last week’s decision by his government to lift its four-year ban on flights to Sharm El Sheikh (watch, runtime: 3:13). Abou El Fadl’s co-host Adib also showed a series of tweets from frequent British Sharm travellers excited to return to their happy place (watch, runtime: 0:31).

Egypt’s sovereign wealth fund now has a PPP investment mandate: El Sisi directed his top officials in a meeting yesterday to focus the EGP 200 bn sovereign wealth fund on partnerships with the private sector, whether in Egypt or abroad in the presence of the fund’s newly-appointed chief executive Ayman Soliman, Al Hayah Al Youm’s Lobna Assal reports (watch, runtime: 6:21). El Sisi, Prime Minister Moustafa Madbouly, Finance Minister Mohamed Maait, and Planning Minister Hala El Said also recapped macroeconomic indicators and discussed revamping Egypt’s tax collection mechanism during the meeting.

Adib gives the floor to “the opposition”: The host has lined up in the coming weeks interviews of political figures he says would give a counter view that is “critical” of the current state of affairs (watch Adib’s announcement: runtime: 1:28). Last week’s guest was urologist-turned-public intellectual Mohamed Ghoneim, who urged the government to go easy on taxing manufacturers and exporters, sort out its national priorities, and ease restrictions on civil society groups.

Next up: politician and intellectual Osama Al Ghazaly Harb, one of the co-founders of the pre-2011 opposition Democratic Front Party. Harb said that although Egypt is going in the right direction, there continue to be serious obstacles (watch, runtime: 0: 38). Harb echoed Ghoneim’s call for re-aligning priorities by saying that the money spent on the new capital and New Alamein could have been better spent to improve education (watch, runtime: 0:38). He also said that, despite its problems, the 2016 EGP float was “a great achievement” (watch, runtime: 1:15).

Harb also called for the release of his nephew, Shady El Ghazaly Harb, who has been a political detainee for a year-and-a-half (runtime: 1:49).

Miscellany from the interview: You can watch other snippets of the interview here (where he speaks of Egyptians civility), here (on the impact of social media), and here (where he likens the president to a homing missile).

Cabinet shows off its InDesign skills: The cabinet’s Information and Decision Support Center was out with an infographic yesterday highlighting unemployment hitting a 30-year-low in the second quarter of the year, Al Hayah Al Youm’s Lobna Assal reported (watch, runtime: 6:23). Capmas stats pinned down the number at 7.5% last August.

Speed Round

Speed Round is presented in association with

Egypt to sign IMF agreement in March? Egypt could reach a post-loan agreement with the IMF by March, Finance Minister Mohamed Maait told Euromoney. “We have already started talking with the IMF about a future engagement and we have been in informal discussion about what will be the coming engagement, and we have put a target to finish this discussion by end of March,” he said.

What we know so far: The Finance Ministry has telegraphed several times this year that it is eyeing up an agreement with the fund after the current three-year USD 12 bn extended fund facility ends in November. Maait told Bloomberg initially that the ministry was aiming to agree a two-year program by October, a plan that was swiftly put down by the fund, which declined to enter talks until the end of the current program. The IMF’s Middle East and Central Asia Director Jihad Azour said last week that any future engagement would likely focus on developing the private sector, strengthening welfare provisions, and increasing the transparency of state organizations. In a research note cited yesterday by the press, Bank of America said talks could produce a non-loan agreement with a mandatory reserve tranche.

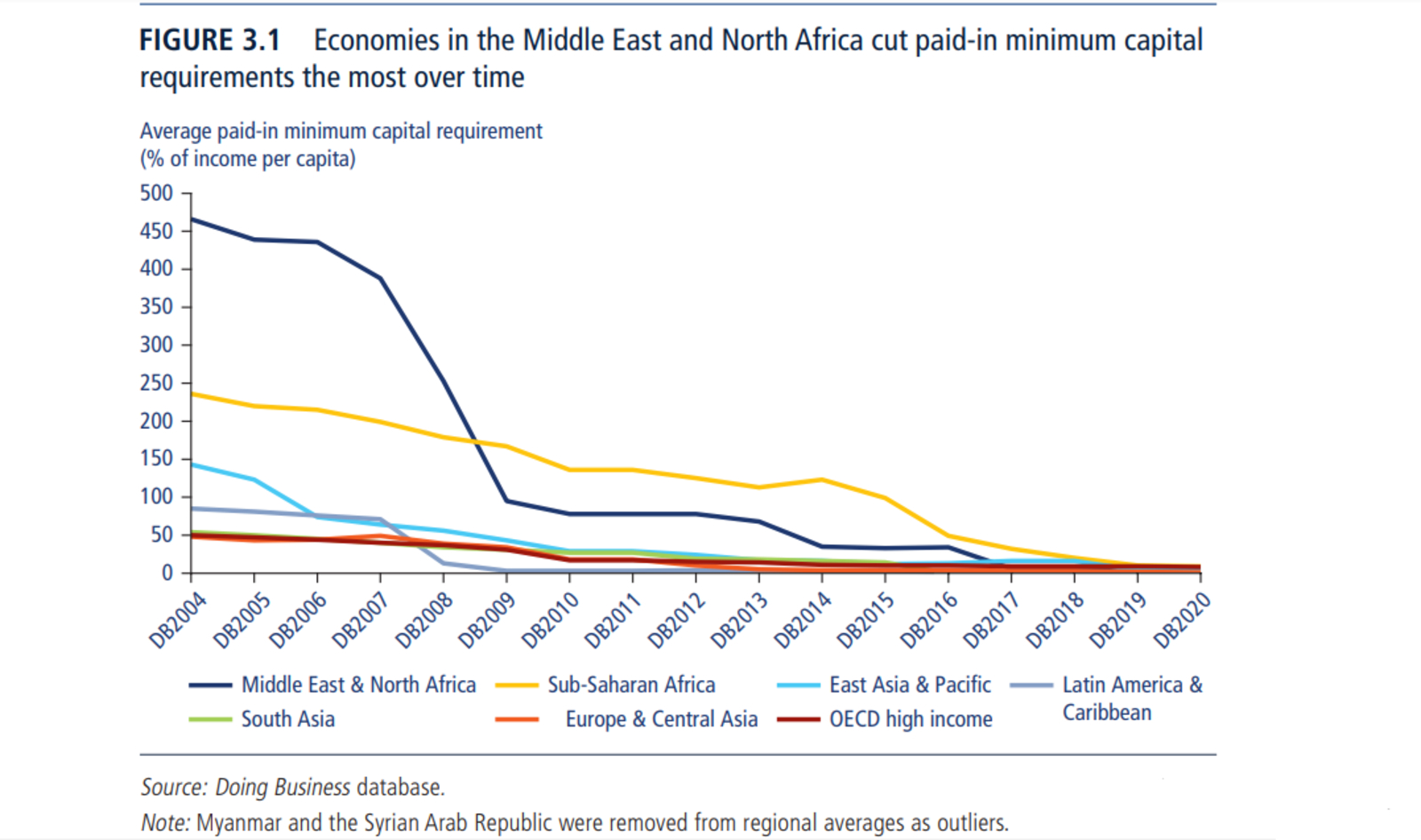

Egypt jumped six spots to rank 114th out of 190 countries in the World Bank Group’s 2020 Ease of Doing Business report (pdf), up from 120th last year. The country’s score rose to 60.1 from 58.56 and is among 42 countries to have implemented regulatory reforms that facilitated doing business in three or more of the 10 topics included in the report compared to last year. Egypt made changes in four key areas that improved our ranking:

- Starting a business: The process of starting a new business became easier over the past year with the improvement of our “one-stop shop” system. Egypt also scrapped a previous requirement for businesses to “obtain a certificate of nonconfusion,” the report notes.

- Tax payments: Paying taxes has also been made easier through the introduction of an online system that allows businesses to file and pay their corporate income and value added taxes.

- Egypt also stepped up protections for minority investors by creating new requirements for listed businesses to get shareholder approval when issuing new shares on the stock market.

- The report also pointed out an improvement in the reliability of electricity supply for companies in Egypt, which comes on the back of a new automated system that monitors and reports power outages.

How did we fare in comparison to others? New Zealand and Singapore once again landed in the top two spots of the global ranking, followed by Hong Kong, which rose one spot to edge out Denmark from third. Somalia retained its spot at the bottom of the chart, with its score actually falling slightly from last year’s report. The UAE remains the highest ranked MENA country, despite falling to the 16th spot from 11 last year. Saudi Arabia was also the most-improved economy this year, soaring to the 62nd spot from 92 last year.

EGP rallies to new two-and-a-half year high: The EGP rose to a new two-and-a-half year high against the greenback, hitting EGP 16.10 from EGP 16.12 on Wednesday, central bank data shows. The EGP has risen 9.9% against the USD since the beginning of the year, including a 2.4% gain in October, Reuters reports. This is the strongest the currency has been since 4 March, 2017.

USD inflows into government debt instruments are still driving the rally, analysts tell Reuters. Naeem Brokerage’s Allen Sandeep also points to the recovering tourism industry, higher expat remittances, and a narrower trade deficit as key sources of USD inflows. Tourism revenues have jumped 50% y-o-y this year to USD 11.4 bn, while foreign holdings of Egyptian treasuries climbed to USD 18.3 bn in August.

A strong EGP will help keep inflationary pressures contained, and could kickstart consumption, says EFG Hermes economist Mohamed Abu Basha. Inflation hit its lowest levels in seven years in September. Abu Basha doesn’t see the rally doing much for Egypt’s exports, but points out that exports are “a relatively much smaller part of the economy.”

The CBE could allow EGP to weaken slightly to counteract tight financial conditions, says Standard Chartered: The EGP rally may not necessarily be long-lived though, as the Central Bank of Egypt could decide to allow the currency to weaken slightly to turn around tight financial conditions, Standard Chartered’s senior economist for MENAP Bilal Khan tells Bloomberg TV (watch, runtime: 3:11). CI Capital and Sigma Capital had both released research notes last week predicting that the CBE will begin enacting a liquidity push in the Egyptian market in tandem with reduced interest rates, eventually kicking off the economic growth cycle as credit and private sector borrowing for investment begin to rise.

Expect 300 bps in rate cuts by the end of FY2019-2020: Egypt’s inflation outlook is giving the CBE’s Monetary Policy Committee the scope to cut interest rates by “at least” 100 bps when it meets in November or December, followed by another 200 bps during the course of 1H2020, Khan says.

The EGX has been underperforming for weeks, and however well they’re doing, EGP-denominated bonds are lagging the EM peers. Stocks on the EGX have been among “the world’s worst performers” and EGP-denominated bonds have underperformed emerging market peers since small-scale protests broke out in a few cities last month, Bloomberg says. The downturn “has reminded investors just how narrow the exit window can be in adverse conditions,” says Fidelity International money manager Paul Greer. Fidelity has cut back on its exposure to Egyptian t-bills in the past few weeks, Bloomberg notes.

Egypt’s strong macro performance is still an attraction… Although Egypt remains appealing for investors, particularly as rapidly cooling inflation has bumped up inflation-adjusted yields to around 10% and the economy is growing at a faster rate than the rest of its Arab peers, the news information service says. Coupled with the EGP rally, high yields have helped local bonds rise 39% in USD terms this year, which is higher than the average yield in EMs by a factor of seven, Bloomberg Barclays indexes show.

…but is it not enough to keep investors hooked? Investors are now wary of having to factor in political factors and “discontent that rapid growth is failing to reduce poverty,” Bloomberg claims. Fidelity’s Greer tells the business information service that he remains bullish on Egypt for the rest of 2019, but warns that bonds and the currency “would be hit” if we see another bout of political protests. The Financial Times’ Heba Saleh had suggested much of the same last week, saying that Egypt’s hot money inflows are largely contingent on investors remaining confident about the political climate.

It’s not just Egypt, though — markets are beginning to take notice of protests around the world, Reuters says. Money managers and risk analysts looking at several areas that have either recently witnessed or are in the midst of protests, including Beirut, Hong Kong, and Santiago, are concerned that the causes of unrest could be exacerbated if the world slips into recession. “Forced fiscal loosening in a world already swamped with debt and heading into another downturn may unnerve creditors and bondholders, especially those holding government debt as an insurance against recession and a haven from volatility,” the newswire says.

Egypt to be the region’s “star performer” in 2020 -Capital Economics: Egypt will be the MENA region’s “star performer” in 2020 as the central bank continues to cut interest rates and the government loosens fiscal policy, William Jackson, chief EM economist at Capital Economics, wrote on Thursday. GDP will grow at a 5.8% clip during the current calendar year, increasing to 6% in 2020 and falling back slightly to 5.3% in 2021.

Don’t expect the EGP to strengthen for much longer: Jackson sees the EGP falling back to around USD 18 by the end of next year — despite gaining 10% this year on the back of foreign inflows into Egyptian sovereign debt. The currency reached new two-and-a-half year highs against the greenback last week, finishing Thursday at 16.10/USD.

Inflation: Growth of consumer prices will remain slow, but is unlikely to dip much below September’s 4.3% rate.

More rate cuts ahead: An extended period of low inflation will clear the way for the central bank to push ahead with its easing cycle. Capital Economics is predicting 325 bps of cuts by the end of 2020, which would return the overnight deposit rate to pre-float levels of 10.00%. Businesses told us back in May that rates would need to be lowered to the 10-13% range before we would see a noticeable pick up in investment.

More room for fiscal stimulus: The falling debt-to-GDP ratio will allow the government to bump up its spending while keeping debt within sustainable levels. James Swanston, MENA economist at Capital Economics, suggests that the government could inject fiscal stimulus equal to 0.5% of GDP while keeping the debt-to-GDP ratio at a reasonable level. This appears to be just what the government has in mind: last month it reinstated subsidies for 1.8 mn people and the House of Representatives has signalled it will introduce draft legislation to double the value of ration cards to EGP 100 per person.

Political instability remains the key risk: Capital Economics sees the government “loosening fiscal policy aggressively” in the event of further unrest. “This would fuel a build-up of macro imbalances and lead to a sharp economic adjustment further ahead,” Jackson writes.

M&A WATCH- Eni has acquired 70% of Edison’s stake in Block 12 of its North East Hapi natural gas concession in the Mediterranean, an unnamed EGAS source said on Thursday, according to Reuters. The source did not disclose further details on the sale of the block, which Edison won in a 2015 bid round. The acquisition comes as Greek energy company Energean waits for final approval of its purchase of Edison’s entire oil and gas portfolio, including substantial assets in Egypt, for an initial USD 750 mn. Edison’s Egypt portfolio is a core part of its oil and gas unit and make up 24% of the company’s portfolio. They include three producing concessions and six exploration concessions.

The two companies began drilling the first exploratory well in the concession on Thursday, Al Shorouk cited an EGAS source as saying. Edison and Eni are expected to complete the drilling within two months, and will announce their findings shortly after, the source said. Edison had been looking for a partner to begin drilling the well since June 2017. An EGAS source said at the time that drilling costs could surpass USD 100 mn.

LEGISLATION WATCH- You can expect the executive regulations for the E-Payments Act no later than December: The executive regulations for the E-Payments Act, which the House approved last March, are expected to be issued before the end of the year, said Ehab Nosair, assistant to the deputy governor, according to Amwal Al Ghad. The law mandates government and private sector entities to make all payments to subsidiaries, suppliers, and contractors electronically. It is part of the government’s plan to gradually transition towards a cashless economy.

NGOs Act exec regs also out in December: The Social Solidarity Ministry will release the executive regulations for the recently-ratified NGOs Act at the end of the year, minister Ghada Wali told local reporters. The new law, which received House approval last month, replaces the controversial Law No. 70 of 2017, which generated considerable criticism both in Egypt and overseas for its restrictions on civil society. The new law received both praise and criticism from NGOs, with supporters applauding the removal of jail sentences for funding-related violations and detractors saying that it does not offer enough protections for civil society. We have a run-down of the key points of the new law here.

Egypt, Ethiopia agree to dial back GERD tensions, restart talks: President Abdel Fattah El Sisi and Ethiopian Prime Minister Abiy Ahmed agreed on Thursday to immediately resume technical negotiations over the contentious Grand Ethiopian Renaissance Dam (GERD), Ittihadiya said. The announcement came after the two met on the sidelines of a conference in Sochi, Russia.

What’s next: The technical committee tasked with reaching a settlement on the operations of the dam — including the all-important timeline for filling its reservoirs — will resume with greater openness and positivity, Ittihadiya said.

The statement is quite the departure from last week’s escalation, which saw Ahmed warning of military action against Egypt over the disagreements. He has since retracted his remarks and said they were taken out of context, according to the statement.

No mediation after all? Going into last week’s meeting at the Russia-Africa summit, one of the key question marks surrounded the issue of mediation: Would it be the US or Russia to take the initiative, and would Ethiopia accept? With the summit being held in Russia, President Vladimir Putin was in a prime position to cajole the two leaders into some form of modus vivendi. Foreign Minister Sameh Shoukry said as much a few days earlier when he called on Moscow to take the lead in the dispute. A few days later though, the US entered the fray with an offer to mediate talks in Washington, which Egypt accepted and Ethiopia — as far as we know — did not. Going by what we know from the Sochi meeting, mediation plans seem to have been put on the back burner while the three countries give direct talks another shot.

The Macro Picture

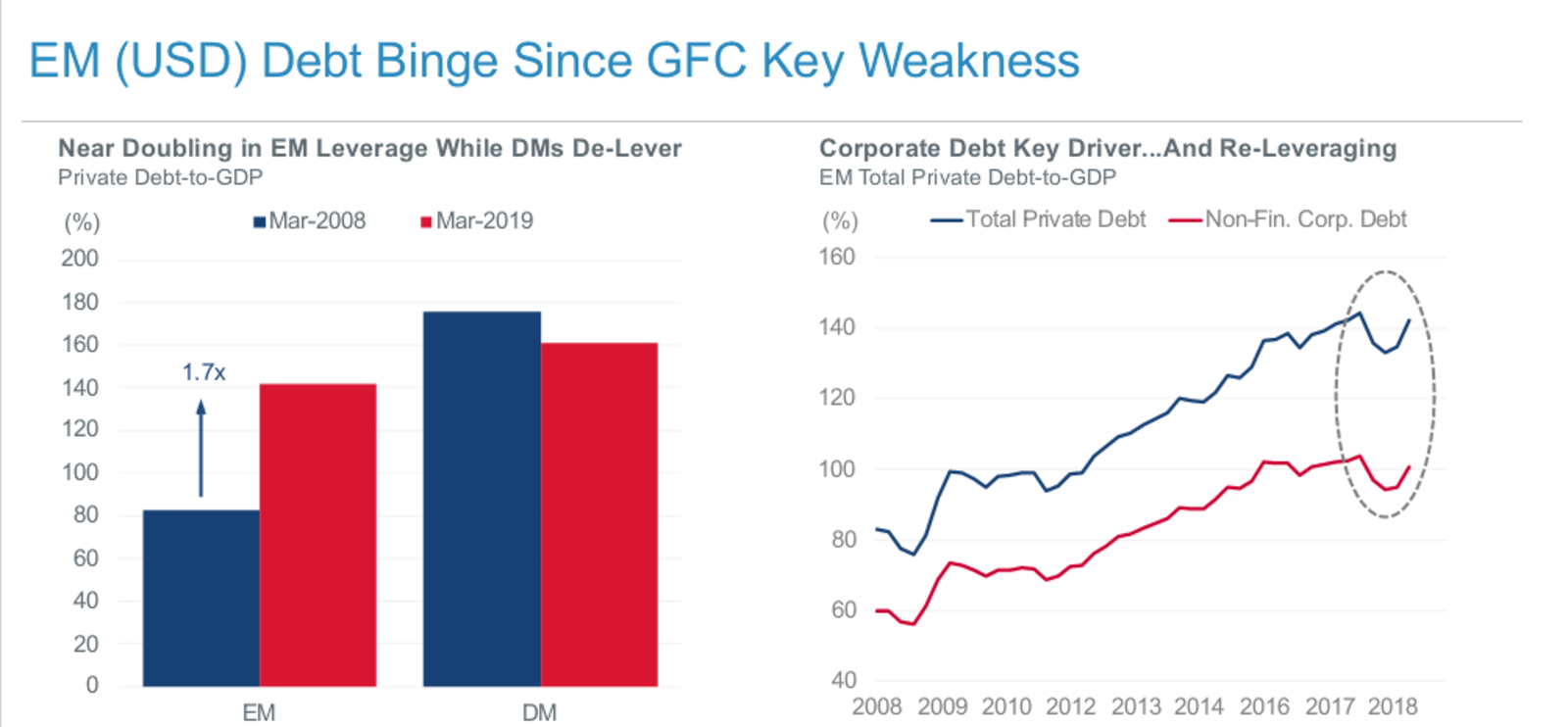

USD debt exposure an Achilles’ heel for EMs right now, Fitch says: Of all the macro issues emerging markets have to worry about, the biggest concern for them at the current moment is their exposure to USD-denominated external debt as the USD strengthens, Fitch Solutions’ Michael Larson said in a webinar we attended last week. In the wake of the 2008 global financial crisis, EMs went on a debt binge for nearly a decade, nearly doubling their private debt-to-GDP ratio between March 2008 and 2019. Now, as the USD is beginning to strengthen and EMs are required to service these debts, the latent effects of the debt binge are beginning to be felt.

To make matters worse, a recession is on its way, Larson said. The global and EM economist said that the risk of recession is rising globally, although it remains unclear exactly when it will hit. And while most like to point to the US-China trade war as being a key culprit behind the global economic slowdown, Larson pointed out that there are trade tensions all around the world fueling uncertainty, including Brexit and the trade issues between Japan and Korea. However, he says that the catalyst will likely be a US recession, which will set off a domino effect around the world.

And a recession is usually followed by a USD rally, which will further exacerbate EM debt struggles. The only question that remains at this point is when this perfect storm will manifest. Larson said his core view is that the recession won’t necessarily materialize in 2020, but stressed that there are plenty of recessionary indicators that all but confirm we’re well down that path.

What we would have liked him to clarify: To what extent can Fed easing stave off EM Zombie Apocalypse 2: Night of the Living Debt. He did say, however, that markets are pricing a Fed rate cut when it meets in a few days, and that Fed cuts usually propel a global monetary easing trend. However, any monetary policy action takes between 12 and 18 months to show their real effect on the economy, and whether the current easing binge will come into effect in time to shield EMs mostly depends on how other global headwinds proceed over the next year.

Egypt in the News

The foreign press is back to coverage of the fallout from last month’s protests. BuzzFeed is claiming that Twitter suspended “dozens of accounts” belonging to Egyptians and Egyptian-Americans critical of the government during the demonstrations that broke out in September. The social media platform apparently said that the accounts were erroneously suspended. The Wall Street Journal, meanwhile, notes the growing evidence of the use of torture by Egyptian security forces. Meanwhile, Mohamed Ali has done his fourth sit-down with the international press in as many days, adding AFP to the interviews he gave the BBC, New York Times and the Guardian last week.

Other headlines to keep your eyes on this morning:

- Egypt’s military ties with North Korea are back on the foreign press’ radar, with the Washington Post alleging that it has seen internal documents confirming the Egyptian military’s involvement in facilitating the passage of a shipment of North Korean weapons through Egypt in 2015.

- Calls to free Shawkan: The Committee to Protect Journalists is calling on the UN to push for the unconditional release of photojournalist Mahmoud “Shawkan” Abu Zeid, who spends the night at a police station everyday under the conditions of his release from prison.

- Syrian refugees detained: Dozens of Syrian refugees in Egypt have recently been arrested and are being held in “unacceptable” conditions, researchers tell Al Monitor.

- Climate change awareness through comedy: A comedy troupe is visiting farmers in Southern Egypt to teach them about climate change and sustainable farming through comedic skits, according to the Thomson Reuters Foundation.

Diplomacy + Foreign Trade

Parliament condemns EU resolution on human rights violations: The House of Representatives issued a statement slamming a European Parliament resolution that condemned Egypt for what it called a crackdown on protesters and restrictions on rights. The resolution accused Egyptian authorities of arresting more than 4.3k people in response to last month’s protests, and called for “an end to all acts of violence and intimidation, and the immediate release of all human rights defenders.” The House called the resolution an unacceptable interference in Egypt’s internal affairs, claiming the resolution is riddled with lies based on “false news” disseminated by NGOs with hidden agendas.

Russia’s EFKO, Egypt’s United Oil to set up USD 300 mn veg oil JV: Russian vegetable oil and mayonnaise producer EFKO and Egypt’s United Oil signed an MoU at the Russia-Africa summit on Thursday to set up a USD 300 mn joint venture to produce vegetable oils in Egypt, EFKO said in a statement. The JV aims to become the largest manufacturer of fat and oil products in North Africa, the statement said. The two sides also agreed to build a two mn tonne grain silo at an undisclosed location on Egypt’s Mediterranean coast.

Separately, the Russian Industrial Zone (RIZ) came up during a discussion between Trade and Industry Minister Amr Nassar and Russian Union of Industrialists and Entrepreneurs President Alexander Sokhin, with the two following up on investment projects in the USD 7 bn zone. Moscow recently committed up to USD 190 mn to develop infrastructure in the zone, which is expected to produce USD 3.6 bn worth of products by 2026.

Egypt’s new ambassador to Germany Galal Abdel Hamid presented his credentials to German President Frank Walter-Steinmeier on Thursday, a Foreign Ministry statement said.

Energy

Eni makes new oil discovery in Gulf of Suez

Eni has discovered new oil resources in the Abu Rudeis Sidri concession in Gulf of Suez, the company said on Friday. Petrobel, a JV between the state-owned Egyptian General Petroleum Corporation and Eni’s Egyptian subsidiary, IEOC, had begun drilling the Sidri South well in the concession last July. The well will begin production in the next few days with an expected initial output of around 5k bbl/d.

Vestas awarded tender for 250 MW Ras Ghareb wind plant

The New and Renewable Energy Authority (NREA) has awarded the tender to build a 250 MW wind energy plant in Ras Ghareb to Danish firm Vestas, sources familiar with the matter told the press. The two parties are expected to sign the contract before the end of the year after the European lenders on board to finance the project give the go ahead. Vestas’ offer was the only bid considered by the NREA after both Siemens Gamesa and Germany’s Senvion retracted their bids. The plant is expected to cost EUR 260 mn and is being built for Lekela Egypt, which will operate it under a build-own-operate framework. The project will be funded by Germany's KfW bank, the European Investment Bank, the French Agency for Development, and the EU.

EGAS resumes natgas exports to Jordan

EGAS resumed natural gas exports to Jordan at a rate of 290 mcf/d at the beginning of October, a source from the state-controlled company told the local press. The kingdom has been importing variable amounts since we resumed exporting natural gas to Jordan last September under a supply resumption agreement, which provides as much as 10% of Amman’s gas needs.

Basic Materials + Commodities

Falling wheat prices cut import bill by 13.7% in 9M 2019

Falling global wheat prices have knocked almost USD 20 bn off the government’s import bill this year, sources from the General Organization For Export and Import Control said. The government spent USD 1.04 bn in the first nine months of 2019, compared to USD 1.20 bn in 9M 2018, despite imports rising to 9.4 mn tonnes from 9.3 mn tonnes.

Tourism

Peak UK tourist numbers would increase GDP by 0.15% each year -Capital Economics

The Egyptian economy would receive a 0.15% GDP boost if the number of UK tourists returns to its pre-2011 peak, Capital Economics’ senior EM economist Jason Tuvey wrote in a note on Friday. Arrivals from the UK have remained 75% below their peak amid a four-year ban on flights to Sharm El Sheikh and continued political uncertainty. The UK’s decision to lift its flight restrictions last week is a “boon for the country’s tourism sector” that will contribute to increasing economic growth next year, Tuvey says. Red Sea Holidays announced hours after the ban was lifted that it would launch weekly charter flights from late December. TUI, meanwhile, is looking to start flights next summer and Easyjet is considering its options.

Automotive + Transportation

Hyundai Rotem to send first batch of air-conditioned metro cars in April

Egypt will begin receiving in April 32 new air-conditioned metro cars in batches from Hyundai Rotem for the Cairo Metro Line 3, Transport Minister Kamel El Wazir said, according to a ministry statement. This is two months earlier than expected: the National Tunnel Authority said last month that the cars would be delivered between June and December 2020 under a EUR 350 mn contract signed in 2017. The expansion of Metro Line 3 is also underway, the statement said. This will add three stops linking the Adly Mansour station to Cairo International Airport at a cost of EGP 1.5 bn.

Egypt Politics + Economics

NY art museum returns stolen artifact to Egypt

The Metropolitan Museum of Art in New York has returned a stolen artifact to Egyptian authorities after discovering it had been illegally smuggled out of the country, the State Department announced on its Share America website. The item is a golden coffin that contained the remains of high-ranking priest Nedjemankh, and is thought to be around 2,100 years’ old.

On Your Way Out

China wants our donkey skin: Efforts by a Chinese company to harvest the skin of our aging donkeys has been, quite rightly, met with ridicule on social media. Youm7 reports that the company has submitted proposals for a project that would export the hides and meat of Egyptian donkeys and horses, promising “huge” economic and environmental benefits. China the world’s largest importers of donkey hides. The practice has been widely condemned, and is increasingly promoting the mass slaughter of animals and putting entire developing communities at risk, says the Guardian.

The Market Yesterday

EGP / USD CBE market average: Buy 16.07 | Sell 16.20

EGP / USD at CIB: Buy 16.08 | Sell 16.18

EGP / USD at NBE: Buy 16.10 | Sell 16.20

EGX30 (Thursday): 14,206 (+0.6%)

Turnover: EGP 555 mn (21% below the 90-day average)

EGX 30 year-to-date: +9.0%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.6%. CIB, the index’s heaviest constituent, ended down 0.2%. EGX30’s top performing constituents were Eastern Co up 3.1%, Orascom Investment Holding up 3.1% and Qalaa Holding up 3.0%. Thursday’s worst performing stocks were Egyptian Resorts down 0.8%, CIB down 0.2% and Telecom Egypt down 0.1%. The market turnover was EGP 555 mn, and foreign investors were the sole net buyers.

Foreigners: Net long | EGP +13.4 mn

Regional: Net short | EGP -6.3 mn

Domestic: Net short | EGP -7.1 mn

Retail: 51.7% of total trades | 41.0% of buyers | 52.4% of sellers

Institutions: 48.3% of total trades | 49.0% of buyers | 47.6% of sellers

WTI: USD 56.66 (+0.8%)

Brent: USD 62.02 (+0.6%)

Natural Gas (Nymex, futures prices) USD 2.30 MMBtu, (-0.7%, November 2019 contract)

Gold: USD 1,505.30 / troy ounce (+0.0%)

TASI: 7,913 (+0.3%) (YTD: +1.1%)

ADX: 5,163 (+0.2%) (YTD: +5.0%)

DFM: 2,784 (+0.1%) (YTD: +10.1%)

KSE Premier Market: 6,284 (+0.0%)

QE: 10,377 (+0.2%) (YTD: +0.8%)

MSM: 3,989 (-0.2%) (YTD: -7.8%)

BB: 1,526 (+0.1%) (YTD: +14.2%)

Calendar

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt.

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October (Monday): B2B conference for German companies organized by the German-Arab Chamber of Industry and Commerce and the Bavarian Ministry of Economic Affairs, Regional Development and Energy, InterContinental Semiramis, Cairo.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

28 October- 22 November: World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review key interest rates.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

29-30 October (Tuesday- Wednesday): 10th African Food Day Conference, Cairo, Egypt

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

3 November (Sunday): Real Estate Debate 2019 Conference – Catalysts for Growth in 2020, Cairo Marriott Hotel.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

4-6 November (Monday-Wednesday): Egypt’s Chamber of Tourism Establishments will participate in the UK’s World Travel Market (WTM) event in London.

7 November (Thursday): AmCham will hold the Prosper Africa Event.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

12 November (Tuesday): Egypt Economic Summit, venue TBA.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.