USD debt exposure an Achilles’ heel for EMs right now, Fitch says

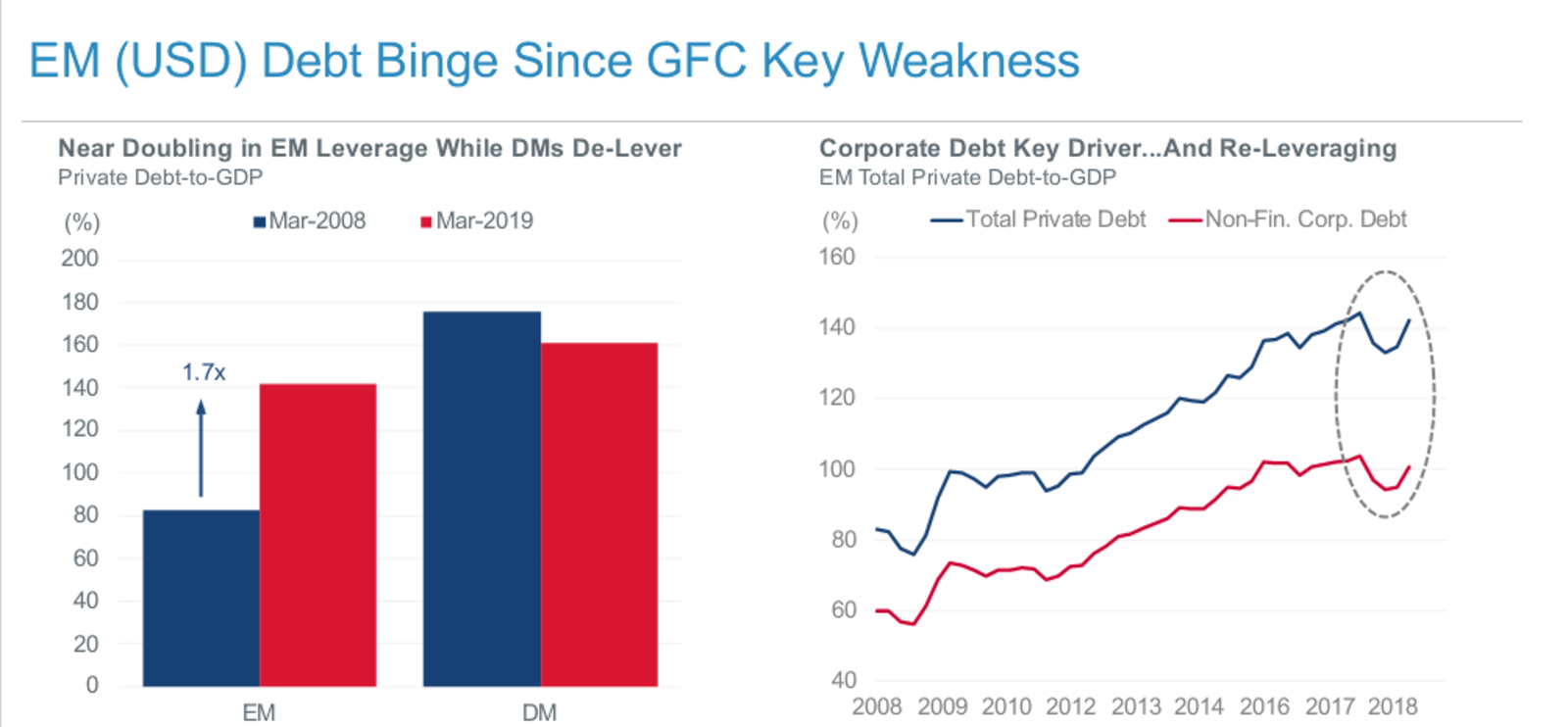

USD debt exposure an Achilles’ heel for EMs right now, Fitch says: Of all the macro issues emerging markets have to worry about, the biggest concern for them at the current moment is their exposure to USD-denominated external debt as the USD strengthens, Fitch Solutions’ Michael Larson said in a webinar we attended last week. In the wake of the 2008 global financial crisis, EMs went on a debt binge for nearly a decade, nearly doubling their private debt-to-GDP ratio between March 2008 and 2019. Now, as the USD is beginning to strengthen and EMs are required to service these debts, the latent effects of the debt binge are beginning to be felt.

To make matters worse, a recession is on its way, Larson said. The global and EM economist said that the risk of recession is rising globally, although it remains unclear exactly when it will hit. And while most like to point to the US-China trade war as being a key culprit behind the global economic slowdown, Larson pointed out that there are trade tensions all around the world fueling uncertainty, including Brexit and the trade issues between Japan and Korea. However, he says that the catalyst will likely be a US recession, which will set off a domino effect around the world.

And a recession is usually followed by a USD rally, which will further exacerbate EM debt struggles. The only question that remains at this point is when this perfect storm will manifest. Larson said his core view is that the recession won’t necessarily materialize in 2020, but stressed that there are plenty of recessionary indicators that all but confirm we’re well down that path.

What we would have liked him to clarify: To what extent can Fed easing stave off EM Zombie Apocalypse 2: Night of the Living Debt. He did say, however, that markets are pricing a Fed rate cut when it meets in a few days, and that Fed cuts usually propel a global monetary easing trend. However, any monetary policy action takes between 12 and 18 months to show their real effect on the economy, and whether the current easing binge will come into effect in time to shield EMs mostly depends on how other global headwinds proceed over the next year.