- CIB mounts a full acquisition of its Mayfair-CIB unit in Kenya. (M&A Watch)

- US Secretary of State Antony Blinken meets El Sisi, FM Shoukry this morning. (What’s Happening Today)

- House gives preliminary nod to tourism bill + crackdown coming on fake weather news. (Legislation Watch)

- EGX market cap hits fresh record as investors respond to EGP deval. (Last Night’s Talk Shows)

- EGP 460 bn poured into high-yield CDs at the NBE and Banque Misr ahead of tomorrow’s close. (Last Night’s Talk Shows)

- UAE accounting startup Wafeq to enter Egypt after USD 3 mn round. (Startup Watch)

- El Sisi talks trade and conflict in Armenia in first visit by an Egyptian president since breakup of USSR. (Diplomacy)

- Brace for a torrent of US earnings releases. (Planet Finance)

- Gaps in Egypt’s edtech leave room for private-public partnerships — and British companies have the appetite. (Blackboard)

Monday, 30 January 2023

AM — CIB to take full ownership of Kenya’s Mayfair bank in USD 40 mn stake buy

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, lovely people, and happy Monday.

Driving the conversation on Egypt in the global press this morning: US Secretary of State Antony Blinken is in town and will meet this morning with President Abdel Fattah El Sisi (9am CLT) and Foreign Minister Sameh Shoukry (10:30am CLT) and then hold a presser (11:40am) before he heads to Israel to speak with Israeli Prime Minister Benjamin Netanyahu and others later this afternoon, according to Blinken’s public schedule for today. Blinken arrived here yesterday afternoon.

On the agenda: The latest from Palestine and Israel alongside developments in Libya and Sudan, according to a statement.

How are ties now between the two sides? As warm as we can remember them being in during the Biden administration. The State Department’s rundown on “the US-Egypt relationship,” issued on the eve of Blinken’s departure for Cairo, notes our “historically strong and growing partnership” and dives deeper into areas including (in order of appearance, and thus emphasis): regional security, the economy, “people-to-people ties,” climate, defense, and then democracy and human rights.

Blinken kicked off his Cairo visit at AUC yesterday, holding a conversation with a group of young people at the Tahrir campus. “Enjoyed hearing from these young Egyptian leaders who are promoting our shared values and strengthening our important bilateral relationship — this makes me optimistic about our future,” he tweeted. He also met yesterday with staff and families at the US embassy.

Blinken has been reasonably quiet in the press since arriving: Only his opening remarks at AUC Tahrir were on the record for the press and his interview yesterday with Al Arabiya focused largely on Iran, followed by Iraq, Libya and Syria.

PSA- No fake weather news here: Winter will finally be upon us starting tomorrow. Look for the mercury to slide below 20°C for the coming two weeks, our favorite weather app suggests. Anyone else think we’ve so far had an unusually warm (and dry) winter?

**

We’re asking you to share your expectations on the EGP / USD rate in 2023, how you’re managing expenses amid the rising cost of living, where you see your industry as a whole heading, and whether you expect to make fresh investments — among a few other questions we ask our community on a regular basis. As is our custom, we’ll be sharing the results with all of you in a few weeks’ time to help you shape your view of the year.

You can take the Reader Survey here — it won’t take more than a few minutes to complete.

Want to have lunch with us? Leave your name, email, mobile number, and where you work in the box for “Is there anything else you want to tell us.” We’ll be inviting eight participating readers to breakfast at one of our favorite restaurants.

IN THE HOUSE-

Transport Minister Kamel El Wazir is in the hot seat, facing questions in the House on railway and metro upgrades, ports, and maritime transport, as well as what some reps are characterizing as his “excessive borrowing policies” and the high cost of our new Spanish Talgo passenger trains.

A busy day for the House Committees:

- The Economic Affairs Committee will resume discussion of the Unified Ins. Act, which the Senate approved last April. The bill would give the Financial Regulatory Authority (FRA) broad new powers to regulate the sector.

- The Defence and National Security Committee will begin discussing a new draft law that would give village mayors and sheikhs more security powers.

- The CIT Committee will resume discussion of a draft bill establishing the Digital Egypt Fund. The bill was approved by the Senate in December.

- The Education Committee will begin discussing a new bill establishing the Egyptian Intellectual Property Authority, which was approved by the cabinet in November.

RUMOR MILL IN THE HOUSE- Rumors of an imminent cabinet reshuffle swept the House yesterday. Opposition MPs loudly criticized the Madbouly government’s handling of the economy, sending representatives of the majority Mostaqbal Watan party to jump to cabinet’s defense. “We as majority, however, are keen to voice the concerns of the people in this House and are eager to use all of our powers to exercise supervision over the government in a way that is in the public interest,” said party spokesperson Rep. Ashraf Rashad.

HAPPENING TOMORROW-

Sayonara, CDs: The National Bank of Egypt and Banque Misr will pull their one-year 25% certificates of deposit from the market by the end of the working day tomorrow. The high-interest CDs were introduced earlier this month ahead of the devaluation of the EGP. CIB, QNB Alahli and Banque du Caire are yet to announce when they will follow suit, though we expect all the high-yield CDs to be pulled off the market in tandem.

HAPPENING THIS WEEK-

It’s interest rate week here at home… The Central Bank of Egypt (CBE) is likely to hike interest rates when it meets on Thursday as inflation continues to run high, according to our interest rate poll.

…And in the US: The Federal Reserve is expected to continue to slow the pace of its interest rate hikes when it holds its two-day policy meeting on Tuesday and Wednesday.

EBRD + EU + GCF are holding a green finance event tomorrow: The European Bank for Reconstruction and Development, the EU, the Green Economic Financing Facility, and the Green Climate Fund will hold a green finance event on Tuesday, 31 January at the Nile Ritz Carlton Hotel.

DATA POINT- What ‘normal’ means when it comes to imports waiting at ports: There are c. USD 4.8 bn worth of imported goods at our ports — the same level as before the now-scrapped rules that restricted imports were introduced a year ago, Alaa Ezz, secretary-general of the Federation of Egyptian Chambers of Commerce, told Salet El Tahrir (watch, runtime: 3:13). Imports worth USD 794.7 mn were released from the country’s ports between 24-28 January, Cabinet Spokesperson Nader Saad said in a statement, bringing the total value of goods released since 1 December to c. USD 16.2 bn by our math. PM Moustafa Madbouly said on Saturday that the backlog of imported goods at our ports has been cleared.

We ended the World Men’s Handball Championship in seventh place after our national team beat Hungary 36-35 in an action-packed game that saw the teams go through multiple rounds of extra time to break a tie. Denmark clinched victory at the tournament, beating France 34-29 in yesterday’s final and becoming the first team ever to rack up three consecutive world titles.

|

THE BIG BUSINESS STORY ABROAD: Adani hits back against fraud claims that sparked USD 50 bn stock rout: Indian conglomerate Adani Group has responded in a 413-page riposte to claims of fraud made by short seller Hindenburg Research that saw some USD 48 bn wiped off the company’s value, Bloomberg reports. Adani said Hindenburg’s report was “nothing short of calculated securities fraud,” and described the company’s claims as attacking India as a whole.

The Adani news is making waves among EM investors, Bloomberg says. While relatively expensive, Indian stocks are a favorite among emerging market investors thanks to the country’s high growth and strong governance standards. Indian equities make up more than 14% of MSCI’s emerging-market index — second only to China. But inflows could shift away to other EMs like Taiwan and South Korea in the fallout of the Adani ruckus, EM strategists told the business information service.

SIGNS OF THE TIMES-

#1- Google AI can turn text into music: MusicLM is an AI model developed by Google that turns descriptive text into “high-fidelity” music. Google’s research paper (pdf) claims that its platform can generate music at 24 KHz, which outperforms in audio quality compared to others. Check out MusicLM’s interpretation of Munch’s The Scream or its rendition of a reggae track here. The company has said it will not be releasing the tool (just yet) to the public anytime soon because of copyright concerns. Tech Crunch has more.

#2- It’s farewell to the Boeing 747 after more than five decades in production. The last of the original “jumbo jets” will be delivered tomorrow to Atlas Air, ending a reign that saw the aircraft revolutionize the aviation industry, Reuters reports.

#3- Commodity traders are seriously short on finance: The working capital needed to finance the global trade in commodities has more than doubled since 2020 and could rise by as much again by the end of 2024, sending traders on the hunt for an extra USD 300-500 bn to maintain the flow of goods, a report by consultant McKinsey shows. Price volatility, higher interest rates, and rising shipping costs on the back of an energy price boom are to blame, after the war in Ukraine sent a shock through the sector, the report reads.

ICYMI-

Missed this week’s Inside Industry? In our weekly vertical exploring all things industry and manufacturing, we looked at proposals to hand out silver and diamond licenses to industrial investors.

COME TO OUR NEXT ENTERPRISE FORUM-

We’re excited to unveil our next C-level event: The Enterprise FDI + Exports Forum, where we will take a deep dive into two of the most critical topics affecting our community.

Exports and foreign direct investment (FDI) have never been more important to our economy — or our businesses — than in the wake of the float of the EGP. We think we have a once-in-a-lifetime chance to build an export-led economy that makes us a magnet for FDI and all the benefits that will come with it for our nation.

CIRCLE YOUR CALENDAR-

NPH gets more time for Pachin takeover bid: The Financial Regulatory Authority (FRA) has granted a 60-day extension to Dubai-based National Paints Holdings’ (NPH) on its offer to acquire Paint and Chemical Industries (Pachin), according to a statement to the EGX (pdf).

REMEMBER– NPH’s offer of EGP 29 per share for 100% of Pachin is the second highest of five bids to take over the company in recent months. Pachin had been expected to respond to NPH’s offer this month but has not yet done so. The highest bidder at EGP 30 a share, Compass Capital, recently got the nod from Pachin to do due diligence.

We’re still waiting to hear what’s happening with fuel prices this quarter: The government’s fuel pricing committee was due to meet earlier this month to set fuel prices for 1Q 2023. The government has increased prices at the pump by 23-28% since April 2021, and decided on a rare fuel oil price hike last July.

Expect prices to rise: The government has committed to changing local fuel prices in line with movements in the global markets under the USD 3 bn loan agreement with the IMF.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed.

In today’s issue: We look at the British edtech firms who want to help bolster development in our education sector.

Experience a time of serenity and breathtaking views of the Red Sea where you get to enjoy life as it should be, only at Somabay. A gateway for the perfect winter vacation where you can combine all your vacation elements from one place. For more information, kindly contact us at 16390 or www.somabay.com

M&A WATCH

CIB and Kenya’s Mayfair Bank are now one

CIB now owns all of Kenya’s Mayfair: EGX mainstay CIB will acquire 49% of Mayfair CIB for USD 40 mn, giving it full ownership of the Kenyan bank, CIB said in a statement yesterday. Mayfair CIB has a focus on corporate and trade finance. The Egyptian and Kenyan central banks have approved the transaction, paving the way for Mayfair to become a fully-owned subsidiary of CIB, it said. The acquisition will close on 31 January, Asharq Business reported Friday, citing the Central Bank of Kenya.

Mayfair became Mayfair CIB in 2020: The Egyptian lender acquired 51% of Mayfair in April 2020 for USD 35.4 mn. CIB said that it would look to scale the lender, which at the time was Kenya’s fourth-smallest bank with only five branches.

A turnaround: Mayfair CIB has rebounded following a post-tax loss in 2020 due to the covid-19 pandemic, and last year reported positive net income of KSH 96.1 mn (USD 880.8k). Operating income jumped 64% y-o-y to KSH 891.5 mn (USD 8.2 mn) in 2021, according to the CIB statement.

LEGISLATION WATCH

More independence for tourism chambers + Hefty fines for fake weather news

House gives first nod to tourism bill: The House of Representatives yesterday gave its preliminary approval to a draft bill that will strip the power to form and regulate tourism chambers from the Tourism Minister and place it instead in the hands of the Egyptian Tourism Federation (ETF). The 72-article bill aims to make tourism chambers more democratic and independent and reinforce their role in promoting the industry, according to a report by the House Tourism and Aviation Committee.

Private sector to get a bigger say in tourism strategy? “The bill strengthens cooperation among private sector tourism companies in drawing up strategies for tourism promotion and marketing,” Tourism Minister Ahmed Issa told the House yesterday. It comes as the government looks to more than triple annual tourism revenues to reach USD 30 bn, he added.

REMEMBER- The government is pushing the tourism sector to up accommodation capacity and improve services as part of plans to boost the sector. Look out for a new tourism strategy later this quarter for details on how those goals will be achieved.

Also getting the greenlight: MPs gave their final approval yesterday to the country joining two multilateral agreements: one offering administrative assistance on tax matters, and the other to join the BRICS economic group’s New Development Bank.

Good news for de-dollarization? “Egypt joining the BRICS Group's New Development Bank will also help reduce demand for USD as bank members can use their national currencies in exchange of trade," Deputy Chairman of the House Economic Committee Mohamed Abdel Hamid said. Talk of the benefits of trading in currencies other than the USD has ramped up amid a hard currency shortage and in the wake of the most recent EGP devaluation, and after Russia’s central bank approved the EGP as a trade currency earlier this month.

AND- A crackdown on fake weather forecasts: The House has received a government-drafted bill that regulates the performance of the country’s Egyptian Meteorological Authority (EMA) and introduces hefty fines for fake news on weather forecasts. Under the legislation, anyone who uses social media or other media outlets to publish “fake news” on weather conditions could face a fine of between EGP 100k and EGP 5 mn. The same penalty would be imposed on those who buy weather forecasting equipment, set up meteorological stations, or release any kind of weather report without the prior approval of the EMA.

Weather privatization in the works? The bill would also allow the EMA to open the door to the private sector to enter the weather forecasting business.

STARTUP WATCH

Wafeq plans Egypt entry after raising USD 3 mn seed round

UAE accounting startup Wafeq has raised USD 3 mn in a seed round, the company said Wednesday. The round — led by Saudi VC Raed Ventures, with participation from Wamda Capital — will help fund Wafeq’s expansion into Egypt while scaling its services in the Gulf.

Not yet a household name here: Wafeq is a Dubai-headquartered accounting platform looking to address the “unmet finance and accounting needs of small and medium businesses in the Middle East.” Its platform enables SMEs to manage accounting, e-invoicing, payroll and taxation. It aims to help companies to stay compliant with tax law and will soon meet the requirements of the Egyptian Tax Authority, the statement reads. Businesses currently use Wafeq to create more than 630k invoices every month totalling over USD 117 mn, the company said.

MOVES

Our friend Salah Katamish (LinkedIn) is now full time at real estate developer MNHD as the company’s senior vice president for strategy and investments. He remains a member of the board of directors at MNHD, a post he has held since 2017. Katamish had been on staff at private equity investor BPE Partners, where he was director and head of placement, since 2008. He had been seconded to MNHD from 2012 onward as part-time director of investor relations. BPE is a significant long-term investor in MNHD.

Orascom Financial Holding has appointed Mohamed Gamal (LinkedIn) as its new IR head after our friend Tamer Darweesh stepped down, it said in a disclosure (pdf) to the bourse. Gamal was formerly senior finance manager at OFH and its fintech arm Klivvr.

Our friend Tarek Yehia (LinkedIn) has stepped down as head of IR at EK Holding. The department is now represented by the company’s head of corporate governance, Hany Azzam, and the group’s legal counsel, Khaled El Demerdash, according to a bourse filing (pdf).

LAST NIGHT’S TALK SHOWS

EGX gains, high-yield CDs, and rate hikes on the airwaves

It was another econ-heavy evening on the talk shows last night, with the talking heads cheering a good day for the EGX yesterday; totting up inflows to high-yield CDs ahead of the finish line tomorrow; and looking into their crystal balls to see whether a rate hike is in the cards when central bank policy makers meet on Thursday.

The EGX30’s market cap yesterday surpassed EGP 1.1 tn for the first time, rising 3.7% on turnover of EGP 2.5 bn (43.7% above the 90-day average). The index is now up 19.3% YTD.

Investors are excited about the listing pipeline: The blue-chip index’s strong performance was driven by PM Madbouly on Saturday saying that the government will soon reveal the details of the state-owned firms it plans to offer on the EGX this year, EGX board member Rania Yacoub told Kelma Akhira’s Lamees El Hadidi (watch, runtime: 8:45.) “Egyptian stocks are now becoming the best and cheapest alternative to lure investments by individual investors,” Yacoub said, as opposed to real estate or gold, which are more closely tied to inflation. The devaluation of the EGP and moves to clear the imports backlog have reflected positively on the bourse, Egyptian Capital Market Association (ECMA) chairman Mohamed Maher told Salet El Tahrir (watch, runtime: 5:54)

Savers have so far poured some EGP 460 bn into the record high-yield 25% CDs introduced earlier this month by the National Bank of Egypt (NBE) and Banque Misr, Banque Misr Chairman Mohamed El Etreby told El Hekaya (watch, runtime: 18:15). Some 30% of subscriptions at Banque Misr were fresh deposits, he said. “This reflects confidence by investors or institutions to invest again in treasury bills or the EGP,” he said, while stressing caution over part of the comeback “being hot money.” NBE Deputy Chairman Yehia Aboul Fotouh told Salet El Tahrir that savers invested some EGP 285 bn in CDs at his bank alone, with 50% of the money taken out of other CDs (watch, runtime: 3:47.) Both banks are set to pull the CDs from the market tomorrow.

More rate hike predictions: The CBE will likely raise interest rates by 150-200 basis points in its upcoming meeting on Thursday on the back of surging inflation, Yacoub told El Hadidi (watch, runtime: 1:15.) Ever the contrarian, Ahmed Moussa insisted economists are all forecasting the CBE to keep rates unchanged in its first meeting of the year (watch, runtime: 6:41.) Four of the seven analysts and economists we surveyed in our rate poll see the Monetary Policy Committee raising rates by 100-200 bps later this week.

EGYPT IN THE NEWS

More econ talk in the int’l press

It’s a mixed bag for mentions of Egypt in the foreign press this morning.

There’s still plenty of interest in our economy: Soaring book prices on the back of higher materials costs has led the Egyptian Publishers Association to offer customers payment plans of up to nine months with 1.5% interest to purchase books, the BBC reports. Meanwhile, the Economist is the latest to comment on the government’s commitments to reduce the military’s economic footprint under the recent IMF agreement, while Al Monitor looks at how price hikes continue to squeeze budgets for Egyptian households.

AND- More attention for Egyptian creatives: The New York Times is the latest to review Egyptian-Swedish filmmaker Tarik Saleh’s Cairo Conspiracy, while Deena Mohamed’s graphic novel Shubeik Lubeik is getting more ink in the Guardian.

Also making headlines:

- The war on trans fat: Egypt will place new limits on trans fat in foods this year in response to World Health Organization guidelines aiming to eliminate them globally by 2023. (The National)

- An unusual burial: The discovery of the remains of a child and 142 dogs in an ancient Egyptian necropolis in Fayoum has archaeologists puzzled. (The Daily Beast)

ALSO ON OUR RADAR

IFC, Tadamun partner to expand microfinance for women-led SMEs

DEVELOPMENT FINANCE-

IFC, Tadamun to boost women-led micro firms: The International Financial Corporation (IFC) has agreed to assist Tadamun Microfinance Foundation in digitizing and expanding its services, it said in a press release (pdf) last week. Tadamun is a local social enterprise focused on providing women micro entrepreneurs with access to finance and technical expertise. The project is being financed by the World Bank's Micro, Small and Medium Enterprises (MSME) facility, and will see the IFC design and pilot a program to help the lender expand its reach to the smallest women-run businesses across the country.

BANKING-

French cloud and managed security outfit Atos is stumping for more business in Egypt, with Egypt GM Ahmad Elharany quoted as telling Al Mal that the company is talking with National Bank of Egypt, CIB and aiBank about potential work. Atos is working on a digital banking project with Banque Misr, as we’ve previously reported.

COMMODITIES-

GASC announces int’l corn + veg oil tenders: State grains buyer GASC is seeking its second ever shipment of corn from overseas, it said in a statement, without specifying the amount it is looking to buy. Bid should be submitted on Wednesday, 1 February for delivery between 20 February and 10 March, with the shipment funded by the International Islamic Trade Finance Corporation. The authority is also seeking 30k tons of soybean oil and 10k tons of sunflower oil in an international tender tomorrow, for arrival from 25 February to 20 March, it said in a statement picked up by state-run MENA news agency.

INFRASTRUCTURE –

Qatari state utility company Kahramaa has awarded Elsewedy Cables Qatar a QAR 1.2 bn (USD 329.6 mn), 30-month contract to establish a new underground transmission line, Elsewedy Cables Qatar shareholder Aamal announced in a statement last week. Elsewedy Cables Qatar is 73.4% owned by Qatari industrial group Senyar Industries Qatar Holding, which is 50% owned by Aamal.

INVESTMENT WATCH-

Indian seed producer to boost Egypt ops: Indian seed producer Hytech Seed wants to expand its North African exports this year by upping production at its Egyptian facility Misr Hytech, Al Mal reports. This came following President Abdel Fattah El Sisi’s visit to India last week, during which he met with business leaders to discuss increasing investment in Egypt.

PHARMA-

Sandoz partners with Ibnsina Pharma to distribute OTC products: Ibnsina Pharma will distribute and market Sandoz’s over-the-counter pharma products in Egypt under a new agreement between the two firms, Ibnsina said in a statement (pdf). Sandoz is a division of Swiss pharma giant Novartis that sells generic pharma products and biosimilars.

TELECOMS-

Sawiris’ Italian webmail service provider suffers outage: Naguib Sawiris-majority owned Italian web firm ItaliaOnline suffered an outage last week, affecting 9 mn users, Reuters reports. The company resolved the issue and mailboxes were restored on Thursday, it said in a press release, but Italian authorities are still after answers over the outage.

M&A Watch? Orascom TMT Investments — a company whose majority owner is Naguib Sawiris — currently owns 72.5% of ItaliaOnline, and was reported last year to be considering selling its stake in the company.

PLANET FINANCE

Alphabet, Amazon, Apple, Meta: Incoming earnings avalanche

Keep an eye out for a torrent of earnings releases from leaders across various industries this week: More than 100 S&P 500 companies are set to release their 4Q and full-year 2022 financials this week, the Wall Street Journal reports citing financial data provider FactSet. Apple, Alphabet, Amazon, Meta and McDonald’s will all report this week, providing an indicator of the health of the US economy, which has been struck by proliferating layoffs, rising interest rates, and slowing growth.

What the forecasts say: Drawing on the financials of the 145 S&P 500 companies that have already reported their 4Q 2022 earnings, FactSet expects net earnings to drop some 5% y-o-y in the quarter — attributing the decline largely to information technology and communications companies. Net revenues are set to rise 3.9%.

A “historic collapse” at Intel following terrible earnings: Intel’s shares tumbled 6.4% on Friday after the company reported dismal 4Q results and projected further losses in 1Q 2023. The company suffered a net loss of USD 664 mn in 4Q, while revenues fell 32% y-o-y on the back of steep declines in the chipmaker’s client computing and data center businesses. “No words can portray or explain the historic collapse of Intel," one analyst told Reuters.

CLOSER TO HOME- Eni just signed a huge agreement with our neighbors to the west: Eni has signed a USD 8 bn agreement with Libya’s National Oil Corporation to increase offshore gas production, as part of Italy’s efforts to decrease its dependence on Russian fossil fuels. Production is expected to begin in 2026 and will peak at 750 mn cubic feet per day. (Company statement | Reuters)

|

|

EGX30 |

17,411 |

+3.7% (YTD: +19.3%) |

|

|

USD (CBE) |

Buy 29.83 |

Sell 29.92 |

|

|

USD at CIB |

Buy 29.84 |

Sell 29.94 |

|

|

Interest rates CBE |

16.25% deposit |

17.25% lending |

|

|

Tadawul |

10,839 |

+0.2% (YTD: +3.5%) |

|

|

ADX |

9,738 |

-2.6% (YTD: -4.6%) |

|

|

DFM |

3,329 |

-0.8% (YTD: -0.2%) |

|

|

S&P 500 |

4,071 |

+0.3% (YTD: +6.0%) |

|

|

FTSE 100 |

7,765 |

+0.1% (YTD: +4.2%) |

|

|

Euro Stoxx 50 |

4,178 |

+0.1% (YTD: +10.1%) |

|

|

Brent crude |

USD 86.66 |

-0.9% |

|

|

Natural gas (Nymex) |

USD 2.85 |

0.0 |

|

|

Gold |

USD 1,945.60 |

-0.1% |

|

|

BTC |

USD 23,871 |

+3.8% (YTD: +43.8%) |

THE CLOSING BELL-

The EGX30 rose 3.7% at yesterday’s close on turnover of EGP 2.5 bn (43.7% above the 90-day average). Local investors were net buyers. The index is up 19.3% YTD.

In the green: Telecom Egypt (+14.7%), Juhayna (+10.1%) and Ezz Steel (+7.4%).

In the red: Heliopolis Housing (-1.7%), Rameda Pharma (-1.4%) and CIRA Education (-0.6%).

DIPLOMACY

El Sisi talks trade and investment + conflict in Armenia

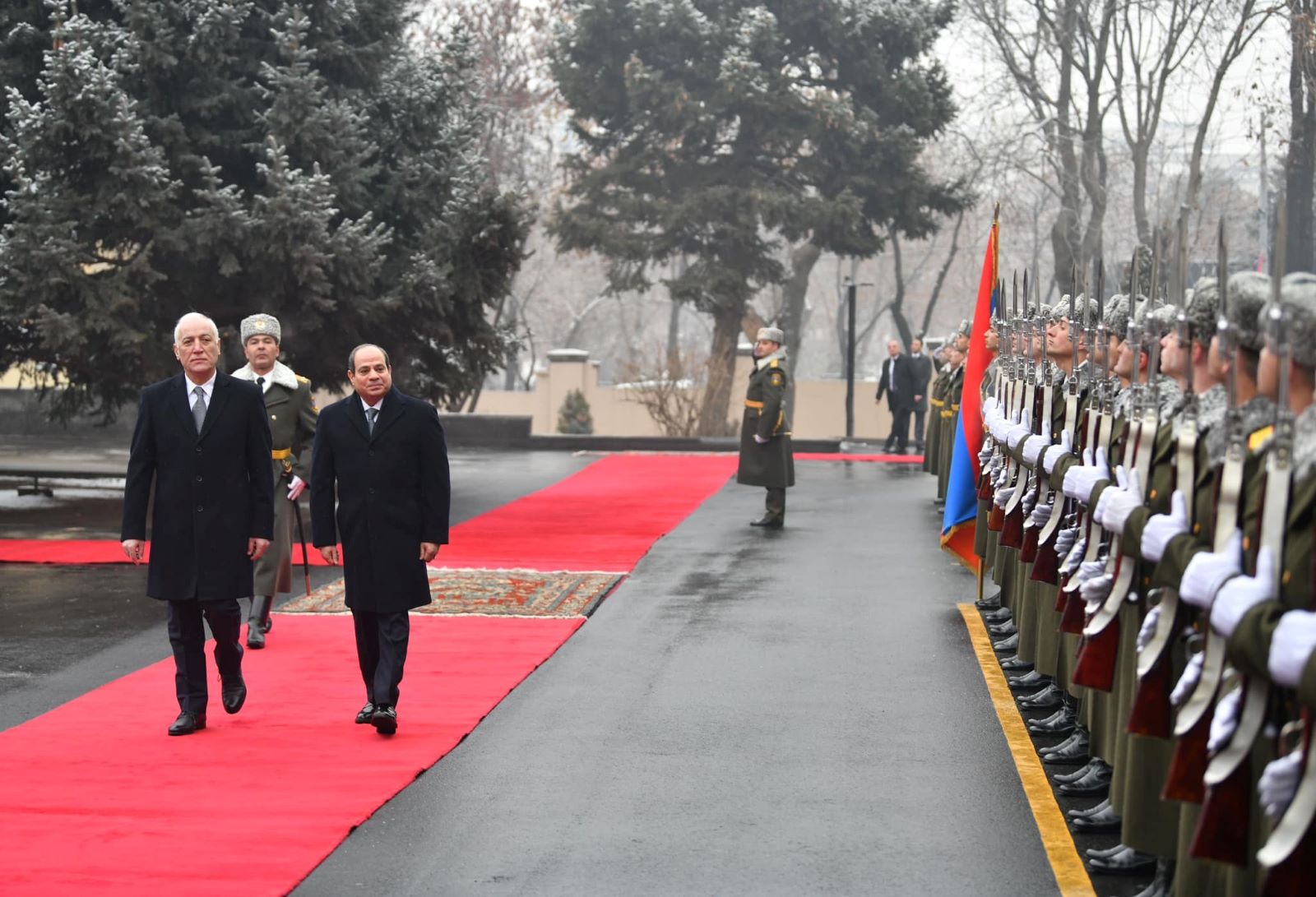

Russian-Ukraine conflict on the agenda as El Sisi makes first visit to Armenia: President Abdel Fattah El Sisi met his Armenian counterpart Vahagn Khachaturyan in Yerevan yesterday, where they spoke about strengthening bilateral relations, the fight against terrorism and extremism, and efforts to face the global economic fallout from the Russian-Ukrainian war, according to an Ittihadiya statement. El Sisi also held a separate meeting with Armenian PM Nikol Pashinyan, where they discussed mutual investment and agreed to intensify coordination and consultation over the war and its economic repercussions, according to a separate statement by Ittihadiya.

IT’S A BIG DEAL- The visit is the first by an Egyptian president since Armenia gained independence from the Soviet Union.

We’re looking to deepen ties with Armenia: The visit saw the two countries ink several MoUs and agreements in science, tech, sports, and investment. The two presidents also discussed boosting trade, opening regular direct flights between Cairo and Yerevan, and cooperation in the energy, infrastructure, agriculture, IT, food and pharma industries.

An offer to play peacekeeper between Armenia and Azerbaijan? President El Sisi said that Egypt maintains a neutral position over the Armenian-Azerbaijani crisis and could act as a mediator if needed, according to a readout by the Armenian presidency. “In this sense, if you accept our mediation and would like us to mediate or assume such a role, then we are ready,” El Sisi told Khachaturyan.

AROUND THE WORLD

Dismal voter turnout spells more trouble for Tunisian politics: Only 11.3% of Tunisians voted in yesterday’s parliamentary runoffs in Tunisia – around the same number who voted in the first round of elections in December, Reuters reports citing preliminary official data. Opponents of President Kais Saied said the low turnout was proof of growing contempt for his leadership. Saied has stripped much of the parliament’s power in a bid to consolidate his executive authority after a power grab in 2021, which saw him sack the government and suspend the legislative chamber.

Also worth knowing this morning:

- Bye to Jacinda, hi to Chris: New Zealand Labour leader Chris Hipkins was sworn in as the country’s prime minister on Wednesday, following the unexpected resignation of his predecessor Jacinda Ardern thanks to burnout, Reuters reports.

- A top US official is set to warn several countries in the region against attempts to evade sanctions imposed on Russia over its invasion of Ukraine. (Reuters).

Gaps in Egypt’s edtech leave room for private-public partnerships — and British companies have the appetite: Despite being largely nascent, education technology in Egypt has been gaining ground in the past few months, with nine investments made in edtech startups last year, according to our internal trackers. Local and international private sector companies operating in the edtech space see plenty of potential in the sector in Egypt, according to speakers at an edtech showcase hosted by the UK Embassy last week. However, edtech offerings and infrastructure within both our public and private sector schools need to be developed to build a system that can keep pace with tech developments and create a resilient and sustainable education system, speakers said.

First things first: What exactly is education technology? Edtech largely refers to tech used to promote and access education — not only can schools incorporating edtech make classroom teaching more engaging and innovative, but it enables education to be far-reaching. These tools are key to overcoming geographic inequalities and problems caused by distance-learning, which was a major issue during the height of the covid-19 pandemic, when schools moved classes online. Edtech can streamline school management systems, be used as a pedagogical tool, or be provided in the form of hardware and software.

British companies have already begun to make inroads in Egypt and are keen to do more: At last week’s showcase, 11 UK-based education companies presented their products to owners and C-suite executives of local British and international schools. All members of the British Educational Suppliers Association (BESA), the companies advertised a range of products from: Educational content, AI software tools, school resources, data and analytics tools, technical software support, teacher recruitment and training programs and assessment content and tools. Century Tech, an advanced machine learning platform that builds personalized learning paths for learners, has been in the Egyptian market since 2012 and has been working with international schools in Egypt for four years, International Schools Manager Ciara Morris told us previously. Century Tech has worked with international schools including Cairo English School (CES), the British International School of Cairo (BISC), and Kipling School.

These companies are looking to invest now: The companies at the showcase included CES Holdings, NetSupport Software, Planet Bofa, Everybody Counts, 2Simple, Renaissance, Oriel Square, Charanga, and Tes Institute. These companies were selected to join the showcase based on either their readiness to enter the Egyptian market or based on their prior experience in the market, BESA Deputy Director General Julia Garvey told Enterprise at the event. Many of these companies are now eyeing the Egyptian market as the government’s far-reaching educational reform program is looking to focus on driving the use of edtech in Egyptian schools, Garvey told Enterprise.

It’s not all robots and the metaverse: Education is about “human relationships and interaction,” education consultant John Collick told Enterprise at the showcase. Edtech should serve as a support for teachers, helping them to develop rapport with their students, Collick said. His thoughts were echoed by Ahmed Daher, deputy education minister for information technology, who said that there is a divide between Egyptian students and their education. Harnessing edtech to improve attendance levels and student engagement is key.

And there’s a window to branch out beyond student applications: Community Brands — which is new to the market — is also keen to partner with the Egyptian government and Education Ministry, using their data to bring value to educational policy as they have done in the UAE, Bahrain and KSA, Community Brands Vice President of Analytics and AI Matt Woodruff said at the showcase. Community Brands is an educational data and analytics aggregator that helps schools review their operations in a manner that makes sense for their tech ability. Moving schools from analog methods to use of the cloud or helping to prepare them to incorporate AI takes “stepping stones,” Woodruff said.

What’s driving the interest? We’re ripe for growth and development: For those entering the market for the first time, the room for growth and innovation in Egypt through well-targeted and priced products is appealing, according to company representatives Enterprise spoke with, while the old-hands cited the government’s commitment to developing and expanding the education sector. BESA is organizing similar showcase events in other markets, including China, Cambodia, and Saudi Arabia, Garvey told us. These countries are either in the early stages of edtech adoption, or have a strong vision for change. Egypt is among the countries where BESA sees a strong vision for change, with the adoption of its national reform strategy, she said.

That readiness for development was made evident — and accelerated — by none other than covid-19: At the outbreak of the pandemic, the closure of schools affected at least 24 mn pre-university education students, according to a Euro-Mediterranean Economists Association report citing CAPMAS data. The degrees of readiness varied between schools, in terms of communication and information technology infrastructure. In Egypt, only around 8 mn people are subscribed to ADSL services out of a population of 100+ mn and many children in rural areas don’t have access to a laptop or tablet to attend lectures. As a result, the 2020-21 academic year saw the beginning of a shift towards more edtech targeting learning rather than management systems. Among other measures, the government created and rolled out digital content to all grades through the Egyptian Knowledge Bank and live streaming. “Covid-19 accelerated the shift to edtech by five years,” Garvey told Enterprise.

Your top education stories for the week:

- CIRA Education sees higher revenues in 1Q 2022-2023 but lower bottomline due to rising rates: The company reported EGP 104.7 mn in adjusted net income in 1Q 2022-2023, down 3% y-o-y. Revenues rose 25% to EGP 536.1 mn on rising student enrollment rates.

- Palm Hill’s Badya compound is getting a GEMS school: The Egypt Education Platform (EEP) will open a GEMS-branded British school in Palm Hills Developments’ Badya development. The school is expected to open in September 2024.

- New licenses for teachers: Teachers may need to apply for licenses under new legislation being drafted by the Education Ministry. This comes as part of reforms meant to improve public schools and curb private tutoring.

CALENDAR

JANUARY

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

26 January-6 February (Thursday-Monday): Cairo International Book Fair, Egypt International Exhibition Center.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

31 January (Tuesday): The IMF will release its World Economic Outlook Update.

31 January (Tuesday): EBRD + EU + GCF will lay out their strategic plans to boost green finance in Egypt.

31 January-1 February (Tuesday-Wednesday): Federal Reserve interest rate meeting.

FEBRUARY

1 February (Wednesday): Capricorn Energy will hold a vote on its merger with Israel’s NewMed.

1 February (Wednesday): OPEC will hold a joint ministerial monitoring committee meeting.

2 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5 February (Sunday): The Senate reconvenes.

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH

March: 4Q2022 earnings season.

21-22 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

23 March (Thursday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

APRIL

April: GAFI to launch the country’s first integrated electronic platform to facilitate setting up a business.

1 April (Saturday): Deadline for banks to establish sustainability units.

10-16 April (Monday-Sunday): IMF / World Bank Spring Meetings, Marrakesh, Morocco.

16 April (Sunday): Coptic Easter

17 April (Monday): Sham El Nessim.

21 April (Friday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

30 April (Sunday): End of Mediterranean, Nile Delta oil + gas exploration tender.

Late April – 15 May: 1Q2023 earnings season.

MAY

1 May (Monday): Labor Day.

2-3 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

18 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE

7-10 (Wednesday-Saturday): The second edition of Africa Health Excon.

10 June (Saturday): Thanaweya Amma examinations begin.

13-14 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

22 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

25-26 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

AUGUST

3 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

19-20 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

31 October – 1 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

NOVEMBER

2 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

DECEMBER

12-13 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

EVENTS WITH NO SET DATE

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Egypt + Qatar to launch joint business forum.

1Q 2023: FRA to introduce new rules for short selling.

1Q 2023: Internal trade database to launch.

1Q 2023: The Madbouly government will choose which state-owned hotels will be merged into a new hotels company ahead of an offering to foreign and Gulf investors.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.