- Strong FX inflows signal return of foreign investors after EGP deval. (What We’re Tracking Today)

- Are Gulf investors eyeing state-owned HCCD’s land bank? (M&A Watch)

- Subsidized bread could be accessible to all as a trial scheme launches tomorrow. (Last Night’s Talk Shows)

- Five consortiums are bidding for our three slated cooking oil complexes. (Infrastructure)

- Elsewedy Electric is building a 300-MW solar power station in the KSA. (Energy)

- The House gives its nod to development finance agreements + North Sinai oil exploration. (Legislation Watch)

- The state is plowing into corn with its first int’l tender. (Also On Our Radar)

- Most people globally are pessimistic about their future finances — though stagflation may not harm the jobs market as much as feared this year. (Planet Finance)

- The world is hotting up — and Egypt is no exception. (Going Green)

Tuesday, 17 January 2023

AM — USD 925 mn inflows to local FX market in three days -CBE

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and a very happy hump day.

THE BIG STORY here at home this morning is the central bank’s announcement of an upswing in foreign inflows to local banks through the local foreign exchange market and other sources in recent days, helping to clear the imports backlog at ports. Read on directly below for the full story.

Elsewhere, rumors are swirling of a potential Gulf purchase of land and assets belonging to the state-owned parent company of Heliopolis Housing. And we bring you several silos worth of commodities news on everything from wheat, to corn, to subsidized bread.

EGP WATCH- The EGP continued to hold more or less steady against the USD yesterday, falling 0.1% to settle at 29.66, down from 29.63 at Sunday’s close, according to the official central bank rate. The currency remains down nearly 20% from its 24.79/ USD level immediately before the central bank allowed it to slip further against the USD on 4 January, as authorities transition to a fully flexible exchange rate as agreed with the IMF.

Foreign investors poured some USD 925 mn into our local foreign exchange market in the three days since last Wednesday, 11 January, when the EGP fell more than 16% to an all time low of more than 32.00 to the USD before rebounding, according to a central bank press release. Interbank trading activity was up more than 20x on its recent daily average in the last three days, while FX inflows to banks were further boosted by local sources, remittances, and tourism, the central bank said, in what it called “positive indicators” for the local exchange market.

Not only hot money: Foreign investors are coming back to treasury bonds as well as short-term bills in a further sign of rising confidence abroad in our economy, Banque du Caire Chairman and CEO Tarek Fayed told El Hekaya’s Amr Adeeb in a phone call (watch, runtime: 10:20), noting that our credit default swaps and Eurobonds are performing better in the secondary market.

The USD inflows allowed local banks to cover more than USD 2 bn of importers’ requests since Wednesday, the CBE statement reads, in addition to requests from other clients. “Banque du Caire provided USD 150 mn to importers in the last three days and there’s currently very little demand for FX by importers,” BdC’s Fayed told El Hekaya. The story also got coverage from Bloomberg, Reuters, and Arab News

So where does that leave the imports backlog at ports? There are still some USD 5.4 bn worth of imports stuck at our ports, Alaa Ezz, secretary-general of the Federation of Egyptian Chambers of Commerce (FEDCOC), was quoted as saying by Masrawy yesterday. Some USD 3..4 bn of that is accounted for by bulk goods — oils, wheat, corn, and soy —- that have likely remained in port storage silos at the request of importers who don’t have the space to store them elsewhere, he added. Around USD 9.1 bn of goods were cleared from ports between 1 December at the end of last week.

Goodbye to 25% CDs from Banque Misr and the NBE? The two state-owned banks will withdraw within days the one-year, 25% certificates of deposit they introduced to the market on 4 January to helo curb inflation and dollarization, local media cites both banks as saying yesterday.

And hello to 25% CDs from Banque du Caire: The state-owned bank will soon introduce its own one-year, 25% CDs akin to those offered by the NBE and Banque Misr, BdC’s Tarek Fayed told El Hekaya.

Investors have so far poured more than EGP 300 bn into the record-high yield CDs: That includes some EGP 200 bn at the National Bank of Egypt, and EGP 104 bn at Banque Misr, Al Borsa reports, citing the heads of the two banks.

WATCH THIS SPACE- Hassan Allam is working with the UK’s export credit agency: Hassan Allam Holding and the UK’s export credit agency, UK Export Finance, have signed an MoU to “increase cooperation in a number of projects across Africa,” according to a joint statement (pdf) yesterday. The agreement aims to “secure inward investment into the UK and promote cooperation on financing projects and encourage trade between the UK and Africa as a whole,” the statement said. The company declined to provide further information about the arrangement when we reached out yesterday.

THE BIG STORY ABROAD- It’s all about China on the front pages of the international press this morning, as new data shows the country’s population fell for the first time in decades last year, while its GDP grew only 3% — its slowest pace since 1976, excluding the pandemic year of 2020.

WHAT’S HAPPENING TODAY-

Cairo is hosting an Egyptian-Jordanian-Palestinian summit today: Palestinian President Mahmoud Abbas arrived in Cairo yesterday ahead of talks today with President Abdel Fattah El Sisi and Jordan’s King Abdullah II.

The Egyptian Exporters Association is celebrating its 25th anniversary today in an event at the St. Regis Cairo Hotel from 6 pm, according to an invite sent to Enterprise.

IN THE HOUSE-

The House Economic Affairs Committee will today continue its discussion of the Unified Ins. Act, and Water and Irrigation Minister Hani Sewilam will face questions from MPs.

|

CIRCLE YOUR CALENDAR-

It’s that time of year again: The Cairo International Book Fair will open its doors to the public at the International Exhibition Center in New Cairo on 26 January, according to Youm7. The event, which runs until 6 February, is expected to draw mns of visitors during the two weeks.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: The world is hotting up — and Egypt is no exception.

Somabay brings out the best in majestic natural elements where raw beauty and endless activities reign supreme. Immerse yourself into a picturesque getaway all year long. This is simply Somabay. For more information, call 16390 or visit www.somabay.com.

M&A WATCH

HCCD reportedly in talks to sell land to Gulf investors

Gulf investors are reportedly interested in HCCD’s land bank, assets: The state-owned parent of Heliopolis Housing is in talks with Gulf investors to sell off land and other assets, Bloomberg Asharq reported Sunday, citing two sources familiar with the matter. The investors are negotiating with the Holding Company for Construction and Development (HCCD) to acquire land in several regions of the country and are interested in investing in Heliopolis Housing’s Heliopark project, one of the people said. A source at the company we spoke to yesterday denied that HCCD was considering selling land and characterized the arrangement as a partnership. The identities of the Gulf investors remain unknown.

Mountain View was supposed to be on board for Heliopark: Heliopolis Housing said in December 2021 that it had accepted an offer from Mountain View to co-develop the New Cairo project, which it anticipates to generate EGP 397 bn in revenues over a 23-25-year time period.

The state is fielding foreign offers to buy land for FX: The New Urban Communities Authority (NUCA) has received “many requests by Arab and foreign investors” to pay for state-owned land in USD, Walid Abbas, assistant housing minister and supervisor of planning and projects at NUCA, said last month. Abbas’s statements came days after the cabinet approved the sale of a state-owned plot in Sadat City to an unnamed Gulf investor to set up a housing project, setting a precedent to approve similar cases where foreign investors agree to pay for land in FX.

REMEMBER- The government has recently revamped its privatization strategy amid a foreign-currency shortage and the finalization of our loan agreement with the IMF, which saw policymakers pledge to reduce state involvement in the economy and move to a fully flexible exchange rate. Our Gulf neighbors last year pledged over USD 22 bn in total to support the economy amid the fallout from the crisis in Ukraine, with Gulf wealth funds investing a combined USD 3.1 bn in government-owned shares in EGX-listed companies. The Sovereign Fund of Egypt is now leading efforts to attract strategic investors into other state- and military-owned firms, with plans to raise as much as USD 6 bn.

INFRASTRUCTURE

Five consortiums bid to build three cooking oil complexes

Five local and international consortiums have submitted offers to establish three cooking oil complexes with investments of up to USD 321 mn, a Supply Ministry source told Enterprise, confirming comments attributed to Supply Minister Ali El Moselhy by local media. Our source declined to disclose the names of the bidding companies. The offers come amid state efforts to localize the industry in response to the war in Ukraine, which disrupted global food supply chains.

REMEMBER- News on the planned tenders first came in October with the state planning three cooking oil complexes in Alexandria, Sohag and Sadat City. The three complexes would be specialized in the extraction, pressing and packaging of vegetable oils, Holding Company for Food Industries board member Ahmed Abu El Yazid told us in November.

The current state of production: Egypt has four companies — all affiliated with the state-owned Holding Company for Food Industries — working in the production of edible oils with a refining capacity of about 40k tons per month. Egypt currently imports some 1.7 mn tons of raw vegetable oil annually, with palm oil accounting for two-thirds of that figure, while sunflower and corn oil make up the rest. We cover our domestic consumption needs for sunflower oil primarily through imports, with Ukraine typically accounting for 55% of Egypt’s sunflower imports, while Russia covers another 19%.

The push for localization: The government is looking to localize the vegetable oil industry as part of a push to boost food security and become less reliant on all types of imports amid uncertainty in global markets. It also wants to become a regional hub for producing and exporting Malaysian palm oil by signing trade agreements with Arab, African and European countries.

ENERGY

Elsewedy Electric to build 300 MW solar station in Saudi Arabia + Eni’s Descalzi sits down with El Sisi

Elsewedy Electric is upping its solar energy game: Elsewedy Electric for Transmission and Distribution, a subsidiary of Elsewedy Electric, signed a USD 176.1 mn turnkey contract to build a 300-MW solar power station for Saudi Arabia’s Al Ghazala Energy, according to a statement (pdf) by the company. Elsewedy “will mainly focus on the design, supply and installation of the entire project,” which will be implemented within 16.5 months, the statement said. Elsewedy will operate and maintain the facility for 29 months after its completion.

Elsewedy has been stepping up its involvement in Saudi lately: Yesterday’s announcement comes a few months after the company approved in November setting up one or more new companies in Saudi Arabia. The companies’ potential activities include the management of holding companies’ subsidiaries, investments, real estate ownership, lending, and leasing.

ENI BOSS MEETS EL SISI-

Eni CEO Claudio Descalzi was in Cairo for talks with President Abdel Fattah El Sisi yesterday, a day after the company announced a major gas discovery in the Eastern Mediterranean, according to separate statements by Eni and Ittihadiya. The two discussed the company’s current activities and future plans to drill for gas in Egypt, including its role in the country’s energy transition. Eni described its recent exploration efforts as “positive” and said that there is potential for it to increase exports “quickly.”

ICYMI- Chevron and Eni announced a “significant” gas discovery in the Mediterranean offshore Nargis block earlier this week. Neither party provided an estimate for how much gas is in place though unconfirmed reports last month suggested that it could hold 3.5 tn cubic feet of gas.

AND- Eni + EGAS sign gas flaring MoI: The Italian company will work with state gas company EGAS to identify areas to reduce CO2 emissions in the oil and gas sector under a memorandum of intent signed yesterday. The two sides will “collaborate on emission reduction technologies, including gas flaring reduction and gas valorization,” Eni said in the statement. The Oil Ministry was also out with a statement following the signing.

LEGISLATION WATCH

The House greenlights a batch of development loans, grants + a bill allowing fresh oil exploration in North Sinai

The House of Representatives approved a set of development loans and grants yesterday in food security, infrastructure, education, and healthcare.

- A USD 271 mn loan from the African Development Bank to boost food security and resilience this fiscal year in the wake of supply shocks brought on by the Russia-Ukraine conflict.

- A USD 13 mn grant from USAID to support family planning, birth control, and reproductive health services across the country, and a separate USD 5.7 mn USAID grant for primary education.

- An EUR 3 mn grant from the French Development Agency (AFD) to develop the infrastructure of four informal settlements in Cairo and Giza, and an EUR 2 mn grant from the AFD to finance the teaching of French in public schools.

Brenco, EGPC get the go-ahead for North Sinai oil exploration: The House also passed a law that allows Oil Minister Tarek El Molla to contract the Egyptian General Petroleum Corporation and Brenco to explore for oil offshore North Sinai.

AND- The House Economic Affairs Committee continued the discussion of the Unified Ins. Act it began on Sunday. Approved by the Senate last April, the bill has been more than four years in the making and would give the Financial Regulatory Authority (FRA) broad new powers to regulate the sector, make ins. compulsory for SMEs and freelancers, and set up new economic courts to mediate disputes.

LAST NIGHT’S TALK SHOWS

A new scheme offering subsidized bread to all is set to launch tomorrow: People not covered by the ration card system will be able to buy bread from bakeries at cost in a trial of the new scheme that will kick off on Wednesday, Supply Minister Ali El Moselhy was quoted as saying by Reuters yesterday. Under the program, citizens will be able to buy subsidized 90-gram loaves using prepaid cards, with the move expected to increase the amount of bread sold by the government by up to 10%, Moselhy reportedly said. The prepaid cards will be sold at post offices for around EGP 100, Moselhy said earlier this week.

The subsidized loaves will be sold for EGP 0.90 or slightly higher, Assistant Supply Minister Ibrahim Ashmawy told Kelma Akhira’s Lamees El Hadidi in a phone call (watch, runtime: 6:20.) The prepaid cards can be charged with any amount of money, Ashmawy said, adding that there is no limit on how much a person can buy per day.

AND- Authorities will soon release another 31 pretrial detainees who received pardons from the presidential pardon committee, Lobna Assal reports on Al Hayah Al Youm (watch, runtime: 1:08.)

EGYPT IN THE NEWS

The international press is focusing on the return of foreign inflows to our FX market following the latest devaluation of the EGP (get the full story in What We’re Tracking Today, above.) Bloomberg is also out with a recap on the recent movements in the EGP / USD rate as policymakers transition to a fully flexible exchange rate regime, part of our USD 3 bn loan agreement with the IMF.

Also making headlines:

- Is Sufism growing in Egypt? New generations are reportedly showing interest in mysticism and its rituals. (Qantara)

- Al-Monitor reports on the issue of child marriage as a draft law prohibiting the marriage of minors waits for a vote by the House of Representatives.

ALSO ON OUR RADAR

COMMODITIES-

State grain buyer GASC is set to launch its first-ever corn tender on 19 January to purchase supplies from international suppliers, according to a Supply Ministry statement. The tender will be financed by the International Islamic Trade Finance Corporation and the corn will be used for feed, the statement reads. How the grain will be distributed is unclear.

REMEMBER- While GASC assumes responsibility for wheat imports, feed grain stocks have typically been left to private firms. However, import restrictions amid the FX crunch have made it difficult for private players to bring feed into the country — with the supply constraints causing a rise in poultry prices in the local market. Egypt usually imports more than 1 mn metric tons of corn per month but bought just 924k tons in 4Q 2022, according to S&P Global. The requirement for importers to obtain letters of credit, which was partly to blame for the logjam at ports, was scrapped by the CBE at the beginning of January and the state has been working to get livestock feed released from ports.

GASC has sold some 300k tons of wheat through the Egyptian Mercantile Exchange (EMX) since it launched at the end of November, Reuters reports, citing EMX chairman Ibrahim Ashmawy. The wheat was sourced mainly from Russia and partially from Germany, he said.

A lot of wheat has been coming in from Russia: The majority of our wheat imports (57%) reportedly came from Russia in 2022, up from 50% in 2021. That trend looks set to continue this year, after GASC reportedly booked at least 60k tons of Russian wheat last Tuesday, with another 60k tons set to follow.

The EMX: Launched in November, the exchange aims to protect local farmers and producers against price distortions and to regulate trading. Suppliers to GASC are obliged to register with the exchange.

GASC plans to purchase less wheat from local farmers this year: The state will look to buy 4 mn tons of wheat this harvest season, which runs from April to August, Ahram Online reports Supply Minister Ali El Moselhy as saying. The government procured around 4.2 mn tons of wheat from local farmers during last year’s harvest, missing the ambitious 6 mn-ton target set after spiking food prices forced the state to increase its reliance on local production.

REMEMBER- The cabinet is tomorrow set to revise the state’s local wheat purchase price for this year in a bid to incentivize production, with Ala Masouleety’s Ahmed Moussa recently speculating that the price could rise to EGP 1.25K-1.35K per ardeb from the EGP 1k set previously for the 2023 season.

DEBT-

A syndicated loan for Qena industrial complex: An alliance comprising Emirati fertilizer company CFC Group’s Egyptian subsidiary CFC Feed and Chemicals and local fertilizer firm Evergrow is mulling three syndicated loan offers for its USD 400 mn industrial complex in Qena, Group CEO Ahmed Khalifa told Enterprise. A fourth offer is underway, Khalifa said, with the four bids set to be presented to the company’s board of directors meeting on 8 March.

Real estate developer Inertia has signed an EGP 850 mn loan agreement with Banque Misr and Banque du Caire (BdC) to fund its flagship North Coast project Jefaira, Managing Director Ahmed El Adawy reportedly told Hapi Journal yesterday. Inertia has previously inked an EGP 575 mn loan agreement with BdC and an EGP 1.1 bn eight-year Islamic financing agreement with Banque Misr to fund the project.

NBFS-

The Sovereign Fund of Egypt (SFE) and Etisalat Egypt have established Erada Microfinance, in a move designed to improve access to finance for micro and small businesses, according to a joint statement yesterday. Erada Microfinance is a non-banking financial services (NFBS) company that aims to provide “innovative financial products” for the expansion of small businesses. The statement did not disclose the shareholder structure of the company.

PLANET FINANCE

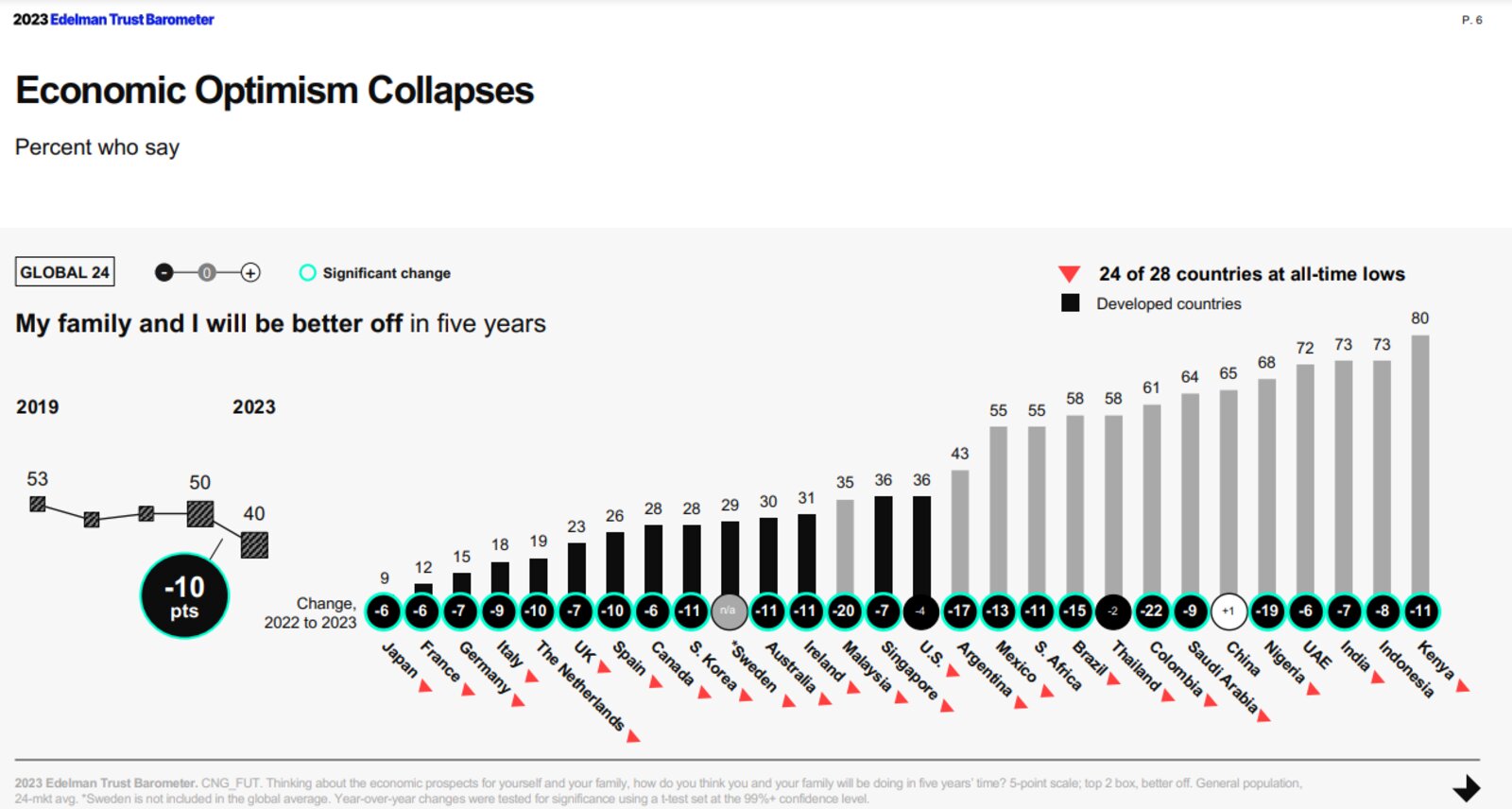

Most people globally feel pessimistic about their financial future: Only 40% of people surveyed in an annual global survey think their household finances will be better off in five years’ time — down a full 10 percentage points on last year’s reading, Reuters reports. Alongside pessimism on the economy fuelled by high inflation and the fear of job losses, the 2023 Edelman Trust Barometer (pdf) also measured a continued rise in distrust of key institutions, particularly among low-income families. The survey’s results are based on responses from more than 32k people in 28 countries in November last year.

When it comes to jobs at least, those worries could be misplaced: The global jobless rate is set to remain unchanged at 5.8% in 2023 even amid a slowdown in growth, the Wall Street Journal reports citing an International Labor Organization report (pdf). The UN agency expects the global economy to enter its first stagflationary period since the 1970s — but unemployment won’t rise in tandem, its says, as more older workers in countries with aging populations take retirement and young people stay in education for longer.

Is the global gold rally just getting started? Gold prices are projected to soar to record highs of more than USD 2k per ounce within months, as the US Federal Reserve slows the pace of its rate hikes, Reuters reports citing Bank of America analysts. Spot prices for gold are up 18% since November to more than USD 1.9k an ounce, as cooling inflation presages a slowdown on rates from the Fed, the news outlet reports.

REMEMBER- Gold took a beating last year as rising rates attracted investors to bonds and pushed the USD higher, making the precious metal more expensive in many markets, including Egypt. Local gold prices saw record highs on the back of the EGP’s depreciation with the price of 21-carat gold rising to EGP 1.8k in December.

|

|

EGX30 |

15,838 |

+1.8% (YTD: +8.5%) |

|

|

USD (CBE) |

Buy 29.57 |

Sell 29.66 |

|

|

USD at CIB |

Buy 29.57 |

Sell 29.67 |

|

|

Interest rates CBE |

16.25% deposit |

17.25% lending |

|

|

Tadawul |

10,728 |

0.0% (YTD: +2.4%) |

|

|

ADX |

10,264 |

+0.5% (YTD: +0.5%) |

|

|

DFM |

3,334 |

+0.3% (YTD: -0.1%) |

|

|

S&P 500 |

3,999 |

+0.4% (YTD: +4.2%) |

|

|

FTSE 100 |

7,860 |

+0.2% (YTD: +5.5%) |

|

|

Euro Stoxx 50 |

4,157 |

+0.2% (YTD: +9.6%) |

|

|

Brent crude |

USD 84.46 |

-1.0% |

|

|

Natural gas (Nymex) |

USD 3.67 |

+7.3% |

|

|

Gold |

USD 1,919.30 |

-0.1% |

|

|

BTC |

USD 21,186 |

+1.5% (YTD: +28.4%) |

THE CLOSING BELL-

The EGX30 rose 1.8% at yesterday’s close on turnover of EGP 2.78 bn (65.4% above the 90-day average). Local investors were net buyers. The index is up 8.5% YTD.

In the green: Fawry (+8.8%), Eastern Company (+6.7%) and Sidi Kerir Petrochemicals (+6.5%).

In the red: Alexandria Containers and Cargo (-3.9%), Heliopolis Housing (-1.5%) and Orascom Construction (-1.4%).

Asian markets are largely down in early trading this morning. Futures suggest a more mixed picture when European indices open, though Wall Street looks set to open in the red across the board later in the day.

The world just keeps getting hotter: 2022 was the fifth or sixth warmest year ever, according to research by the World Meteorological Authority (WMO). Six international datasets analyzed by the authority show that last year the average global temperature was around 1.15°C above pre-industrial levels, making 2022 the eighth consecutive year that the mercury has been at least 1°C above pre-1900 levels.

The last eight years were earth’s warmest years on record, the WMO said, warning that a “likelihood of – temporarily – breaching the 1.5°C limit of the Paris Agreement is increasing with time.”

Large parts of the world faced their hottest years ever: Large parts of western Europe, the Middle East, Central Asia and China, South Korea, New Zealand, north-western Africa and the Horn of Africa all recorded their hottest years ever, according to research by the EU’s Earth Observation Programme, Copernicus.

The last time CO2 levels were this high homosapiens weren’t yet a thing: CO2 levels reached their highest levels in 2 mn years in 2022, according to Copernicus. Initial analysis of satellite data indicates that CO2 concentrations rose by around 2.1 parts per mn (ppm) and methane was up by 12 ppb. This is the highest level of CO2 for more than 2 mn years while methane levels are at an 800k-year high, according to the EU’s Earth Observation Programme.

Saved by La Niña: Temperatures would have been higher in 2022 had it not been for La Niña, a climate pattern that produces cooler summers and has been estimated to lower global temperatures by about 0.2°C.

But only temporarily: “This cooling impact will be short-lived and will not reverse the long-term warming trend caused by record levels of heat-trapping greenhouse gases in our atmosphere,” the WMO said. La Niña is expected to weaken this year and be replaced by its warmer cousin El Niño.

2024 could be the year we fail to achieve an important climate goal: The UK Met Office said last week that global temperatures could rise beyond 1.5°C for the first time ever in 2024 should El Niño replace La Niña this year.

1.5°C is key: Under the terms of the 2015 Paris Agreement, countries agreed to reduce emissions in an attempt to limit global warming to 1.5°C. The UN Intergovernmental Panel on Climate Change (IPCC) has warned that exceeding this limit would significantly increase the risk of severe weather events and irreversible climate change.

Egypt isn’t exempt from any of this: As in other areas of the world, temperatures in Egypt have been on the rise. World Bank figures indicate that the country experienced its third hottest year on record in 2021, and the country recorded its highest-ever temperature in 2018 when the mercury reached 49°C in Kharga in June.

It was only slightly less hot last year: Temperatures went as high as 46°C in Aswan in June, while Luxor recorded a high of 45°C and Cairo reached 43°C.

Expect an even hotter summer this year: With La Niña in effect for the past three winters, Egypt has been spared even hotter summers since 2019. But with the transition to El Niño expected this year, expect summertime temperatures to go higher in the coming few years.

Where are we headed? Projections for future temperatures in Egypt depend on the extent of emissions reductions in the coming years. In its Sixth Assessment Report published in 2021, the IPCC charted five trajectories for the rest of the century according to how much CO2 is released into the atmosphere.

The best we can hope for: In the best case scenario — where emissions are cut to net zero by 2050 — the average highest temperature will measure 44.17°C between 2040 and 2059, before declining to 43.87°C in the final two decades of the century.

And the situation we really want to avoid: Should global emissions double by 2100, Egypt will be facing average maximum summer temperatures of 45.24°C between 2040 and 2059 and 47.74°C in 2080-2099.

Your top green economy stories for the week:

- HSBC part funds KarmSolar project: KarmSolar has received EGP 83 mn in funding from HSBC to build a second micro-solar grid in Farafra by 3Q 2023.

- FM and COP27 President Sameh Shoukry is in the UAE for Abu Dhabi Sustainability Week where he is giving a speech and participating in discussions about climate change.

- Aswan solar tender is taking longer than planned: The Electricity Ministry is still working on the forthcoming tender for six solar facilities in Aswan, which was expected to go live in 4Q 2022.

CALENDAR

JANUARY

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

January: Global Auto to restart BMW assembly in Egypt.

16-20 January (Monday-Friday): Davos 2023.

26 January-6 February (Thursday-Monday): Cairo International Book Fair, Egypt International Exhibition Center.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): President El Sisi will visit India as “chief guest” at celebrations to mark the 74th anniversary of Indian independence.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day (TBC).

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

31 January (Tuesday): The IMF will release its World Economic Outlook Update.

FEBRUARY

1 February (Wednesday): Capricorn Energy will hold a vote on its merger with Israel’s NewMed.

2 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

APRIL

1 April (Saturday): Deadline for banks to establish sustainability units.

10-16 April (Monday-Sunday): IMF / World Bank Spring Meetings, Marrakesh, Morocco.

16 April (Sunday): Coptic Easter

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

30 April (Sunday): End of Mediterranean, Nile Delta oil + gas exploration tender.

Late April – 15 May: 1Q2023 earnings season.

MAY

1 May (Monday): Labor Day.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

18 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE

10 June (Saturday): Thanaweya Amma examinations begin.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

22 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

AUGUST

3 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

21 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

NOVEMBER

2 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

DECEMBER

21 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

EVENTS WITH NO SET DATE

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Egypt + Qatar to launch joint business forum.

1Q 2023: FRA to introduce new rules for short selling.

1Q 2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.