- Egyptian banks could see interest income squeezed in FY2021-2022. (Banking)

- Jumia flags Egypt as a top investment destination. (Investment Watch)

- EGX could see four companies IPO in 2H2021. (IPO Watch)

- Are we over the third wave? (Covid Wave)

- Fatura raises USD 3 mn pre-series A round. (Startup Watch)

- More details on the Egypt-France financing agreement. (Diplomacy)

- Bye-bye, Bibi. (What We’re Tracking Today)

- Strong STEM representation for Egyptian women isn’t translating to the workplace. (Blackboard)

- Planet Finance — All is well in the US treasury market.

Monday, 14 June 2021

Good news on everything from IPOs to investment and the end of the third wave

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to the Good News Edition of Enterprise. From investment and the nation’s IPO pipeline to our deepening partnership with France, it’s bright blue skies for nearly as far as the eye can see this morning here at home. We have the full rundown in this morning’s news well, below. Meanwhile:

***CATCH UP QUICK on the top stories from yesterday’s edition of EnterprisePM:

- France wants to be among our top trading partners, French Finance Minister Bruno Le Maire told us in an exclusive sitdown as Cairo and Paris yesterday signed almost EUR 4 bn in bilateral agreements and contracts covering transport, social security and development.

- Could we see a USD 3-4 bn green hydrogen initiative soon? Studies for one of several planned green hydrogen plants are expected to be finalized and presented to the Sovereign Fund of Egypt and other state bodies including the oil and environment ministries as early as next week.

- Tobacco monopoly Eastern Company isn’t selling securitized bonds: CEO Hany Aman told us that issuing securitized bonds isn't in the company’s plans, denying a report by Al Shorouk we noted in yesterday’s EnterpriseAM.

THE BIG STORY ABROAD #1- Netanyahu is outta here: The Israeli parliament narrowly gave its blessing to a new coalition government last night, finally unseating Prime Minister Benjamin Netanyahu after 12 years in office. The vote brings to power a fragile group of disparate political parties — including the far right, Islamists and liberals — and brings to an end two years of paralysis that produced four indecisive elections.

So, who is the new man in charge? The Wall Street Journal has the rundown on far-right darling Naftali Bennett, who will serve as Israel’s prime minister for the next two years (if the coalition lasts that long…) before making way for liberal leader and coalition partner Yair Lapid.

The story is everywhere in the global press this morning from Reuters and the AP to the New York Times and the Washington Post.

THE BIG STORY ABROAD #2– The G7 wraps: The final day of the G7 Summit finished in Cornwall, the UK, yesterday. Here are the highlights from the final communique (pdf):

- Tax: Leaders reiterated their commitment to last month’s global tax pact and pledged to negotiate a solid agreement that will introduce a minimum 15% global corporate tax rate.

- Climate: Nations agreed to commit to “a set of concrete actions” to end state financing for unabated coal power by year-end and to “mostly decarbonize” electricity supplies in the 2030s.

- Covid vaccines: G7 countries will pay for 1 bn covid vaccines and share at least 870 mn more, half of which will be delivered by the end of the year.

- China: Leaders denounced China over human rights abuses in Xinjiang and called for a new investigation into the origins of covid-19, but held back from harshly criticizing its trade policies.

Not everyone’s happy: “This G-7 summit will live on in infamy,” the Associated Press quotes Max Lawson, the head of inequality policy at the international aid group Oxfam, as saying. “Faced with the biggest health emergency in a century and a climate catastrophe that is destroying our planet, they have completely failed to meet the challenges of our times.”

The global press is mainly focusing on divisions in the group about how to respond to China: Reuters | Bloomberg | FT.

|

HAPPENING TODAY-

Fintech bill to get committee approval today? The House’s CIT Committee yesterday greenlit yesterday five articles of the draft fintech bill and will continue discussing the remaining articles in a session today, according to Al Mal. The 30-article bill, which got the Committee’s preliminary nod last month, would regulate the use of technology to deliver non-banking financial services and grant the Financial Regulatory Authority (FRA) the power to license and regulate fintech businesses. The FRA had drafted and approved the bill last year, before earning the Cabinet’s sign-off in April.

Saudi Commerce Minister Majid Al Qasabi is in town for trade talks with Prime Minister Moustafa Madbouly and to attend a meeting of the Egyptian-Saudi Joint Business Council, the Trade Ministry said in a statement.

The Green Economy Forum takes place today at the Intercontinental Citystars in Heliopolis.

On the agenda: sustainable finance, waste management and supply chain risk. Look for participants to include speakers from multilateral lenders and global institutions, local and multinational businesses and investors, and Egyptian government officials. Check out the full event brochure here (pdf).

The first forum of the heads of African investment promotion agencies wraps up in Sharm El Sheikh today. Ministers, heads of investment agencies from 34 African countries and representatives of major financial institutions are in attendance.

HAPPENING THIS WEEK-

The Arab League will meet in Doha tomorrow for “emergency” GERD talks at the request of Egypt and Sudan. Foreign Minister Sameh Shoukry headed to the Qatari capital yesterday evening ahead of the meeting, carrying a letter from President Abdel Fattah El Sisi to Qatari Emir Tamim bin Hamad Al Thani on the latest “positive” developments in Egyptian-Qatari relations since the Al Ula declaration was signed earlier this year.

The Central Bank of Egypt will meet on Thursday, 17 June to review rates. All 11 analysts and economists surveyed in our poll are calling another hold as inflation hit its highest level all year in May as the global commodities boom began to hit the domestic economy.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Egypt is working hard to boost its science, technology, engineering and mathematics (STEM) education, an area where women are globally underrepresented. We’re doing better than average when it comes to women studying STEM, with almost equal numbers of male-female STEM university graduates. But this isn’t reflected in the workplace, where men far outnumber women in STEM careers. The discrepancy has nothing to do with academic ability, and everything to do with workplace inaccessibility and gender bias, the data shows. To change it, we need better policy implementation, funding and more flexible working conditions.

BANKING

Banks may face more pressure in the coming fiscal year

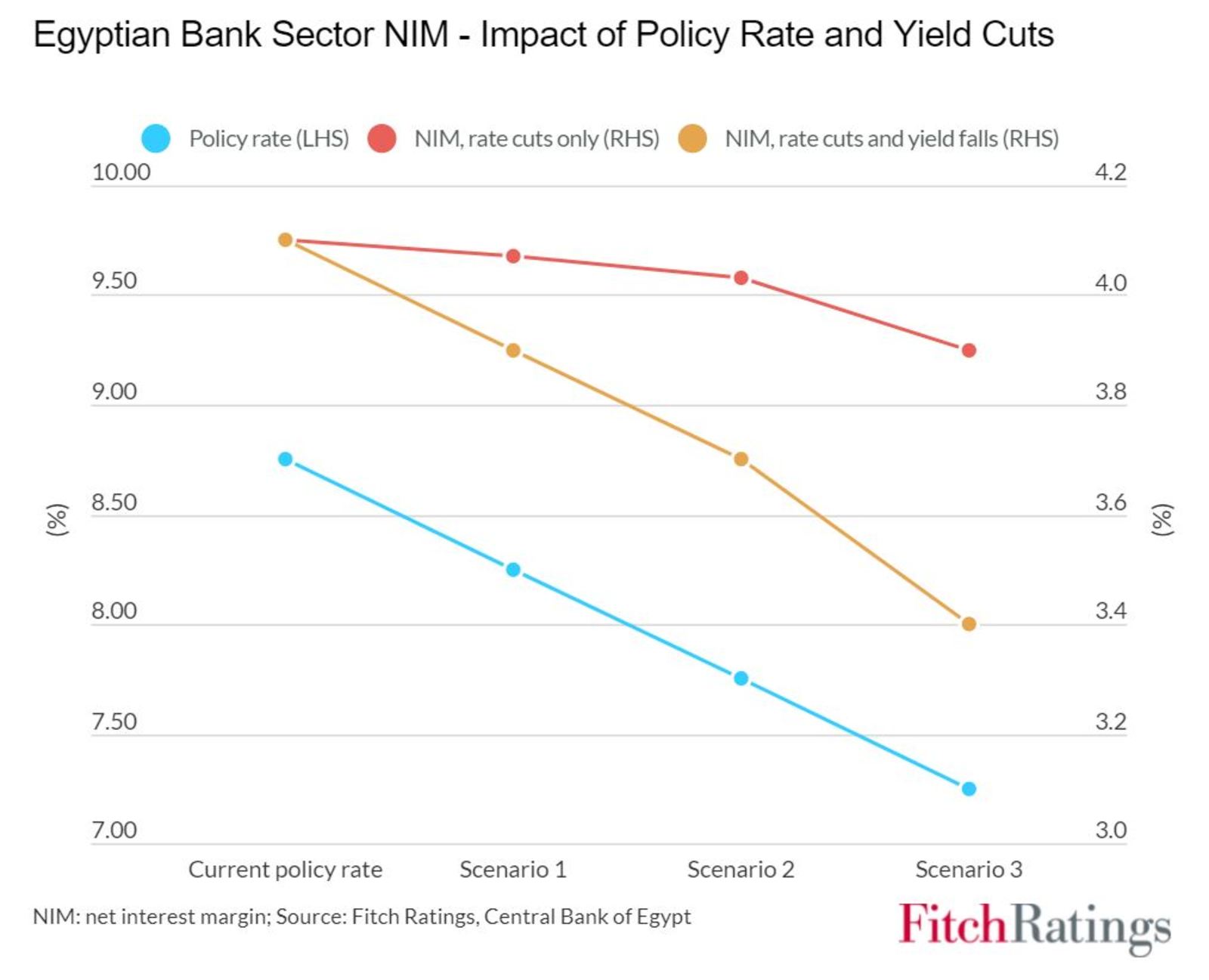

Egyptian banks could see their interest income squeezed during the coming state fiscal year due to lower interest rates and a potential dip in treasury yields, Fitch Ratings said in a report yesterday.

The sector’s average net interest-margin (NIM) held up remarkably well through 2020, coming in at 4.1% despite the central bank cutting rates by 400 bps last year in response to the pandemic, the ratings agency said. This was largely thanks to yields on sovereign bonds — from which banks derive around 65% of their income — remaining high throughout the year.

This won’t necessarily remain the status quo in the 12 months ending June 2022, though, under a few scenarios mapped out by the ratings agency yesterday.

Scenario #1: The central bank cuts rates by 50-150 bps in FY2021-2022 + yields remain unchanged. Banks are unlikely to feel much of an impact under this scenario, given their main source of interest income would remain unaffected. This doesn’t mean that every bank would feel the same impact though. Fitch says that the individual bank’s funding structure, and asset and liability pricing powers will determine how exposed it is to a lower interest rate environment.

Scenario #2: The central bank cuts rates by 50-150 bps in FY2021-2022 + yields fall with them. Under this scenario, the effects on NIMs will be “more significant,” the ratings agency says, estimating that a rate reduction of up to 150 bps will squeeze margins by as much as 70 bps.

The odds of aggressive rate cuts aren't exactly high: Most of the analysts we surveyed last week ahead of this Thursday’s MPC meeting expect the central bank to leave rates unchanged for most of the year, with a cut coming in the final quarter at the very earliest. The central bank has maintained rates for four consecutive meetings, largely to avoid putting pressure on real rates and dimming the attractiveness of the EGP carry trade — the most attractive of its kind in the world.

The direction of yields isn’t the only thing that could impact interest income: Lending to folks other than government matters, too. Corporate and consumer borrowing are set to grow over the next 18 months, according to Fitch, which predicts high single-digit loan growth through 2021 and low double-digit growth next year, helped by the CBE’s subsidized loan scheme and an increase in capex spending.

Scenario #3: Interest rates + yields remain the same, but bond holdings fall 5-15% due to increased lending. Should banks sell down some of their positions in high-yielding treasuries in favor of increasing lower-yielding personal and business loans, Fitch estimates that the average NIM could fall by up 90 bps.

Scenario #4: Interest rates + yields drop and bond holdings fall 5-15%. Combine a smaller treasury portfolio and lower yields, and the NIMs in the sector fall by up to 170 bps, the ratings agency says.

Banks remained financially sound throughout the pandemic, despite operating income from loans and core operations mostly decreasing. This is because a large part of bank income comes from government debt. Egyptian banks are also very conservative, with relatively low loan-to-deposit ratios by international standards.

Background: Fitch flagged in April that the profitability of banks may drop this year because of lower interest rates and a rise in default rates that may result from the central bank lifting its emergency support measures.

INVESTMENT WATCH

Jumia flags Egypt as a top investment destination, looking at everything from digital payments to last-mile delivery

Africa-focused e-commerce giant Jumia plans to invest over USD 590 mn in Egypt and other African countries over the upcoming years starting 2021, CEO Hesham Safwat told Enterprise. Safwat declined to reveal exactly what portion of the funds would be directed towards Egypt, but said that it is “one of the top countries we’re focusing on.”

The amount was raised over two phases from the sale of American depositary shares on the New York Stock Exchange: USD 243.2 mn (pdf) in December 2020 and USD 348.6 mn (pdf) in March this year, he said.

Where will Egypt’s investments be channeled? Jumia Egypt will focus its investments on digital payments and other e-services including Jumia Mall and Jumia Food, Safwat said.

Expansion plans: Jumia Egypt will increase its total number of pickup stations to 200 this July and increase its last-mile delivery stations by 40%, Thomas Maudet, managing director of Jumia Services Egypt, told us in May. The company also plans to expand Jumia Food — which launched in Egypt seven months ago — in Cairo and Alexandria. Other plans include increasing its warehouses and delivery capacity in the Delta to improve its next-day delivery service.

IN OTHER INVESTMENT NEWS-

Consumer healthcare giant Integrated Diagnostics Holding (IDH) will invest EGP 300 mn in Egypt this year in a plan that will allow the company to open 19 additional branches nationwide before the year is out, IDH CEO Hend El Sherbini tells Hapi Journal. The company, which plans to open 30-35 new branches annually, will inaugurate a third branch of Al Borg Scan in Heliopolis this month, in addition to opening three other sites of the scan centers across the country in 2H2022, she said.

IDH has invested EGP 35-40 mn in Egypt since the beginning of the year, opening 16 new branches of its Al Borg and Al Mokhtabar laboratory brands during the first five months of the year, according to El Sherbini. As of April, it had 429 branches in Egypt and a market share of more than 50% through its Al Borg and Al Mokhtabar brands.

IDH is armed with fresh funding from the International Finance Corporation, which last month signed off on a USD 45 mn loan, which it said it would use to finance expansion into new emerging markets. The LSE-listed company debuted 5% of its shares on the EGX last month, completing the exchange’s first-ever technical listing.

IPO WATCH

Four companies to IPO in 2H2021?

The EGX could see as many as four companies debut shares during the second half of the year, EGX Chairman Mohamed Farid told Reuters.

Want to know who? Farid is keeping us guessing. The EGX boss didn’t mention which companies could go public or when, only telling the newswire that they operate in the IT, agriculture and chemicals industries.

Is Banque du Caire among those in line to go public before the year is out? Farid brushed off questions about whether the state-owned bank will IPO this year, saying only that “state-owned offerings are under the purview of the relevant ministerial committee.”

BdC should, in theory, be one of the companies to IPO, after the Financial Regulatory Authority this week gave it — along with Sky Light Touristic Development, New Castle Sports Investment and City Trade Securities — a new deadline to complete its IPO by the end of the year. All of the companies have listed shares on the exchange but are yet to offer shares to the public.

But then again… A source told us that the FRA could extend the deadline again if the companies don’t manage to IPO by the end of the year.

Other likely contenders: State-owned e-payments company E-Finance, which was said earlier this year to be lining itself up for a 2H2021 IPO, and non-bank financial services player Ebtikar, which is planning to go public in the final quarter. Cosmeceutical giant Macro Group is looking ot the fall to pull the trigger on its IPO, having recently hired EFG Hermes to quarterback the transaction alongside Renaissance Capital, which had previously shared the mandate with CI Capital.

Earlier this year, it looked like ministers were about to brush the cobwebs off the state privatization program, when Public Enterprises Minister Hisham Tawfik told us that a government committee would meet to decide which companies would be chosen to IPO.

Since then, it has been radio silence: The minister said in April that two or three state companies could sell shares in 3Q but we still haven’t heard anything concrete as we head into the third quarter.

Conventional wisdom is that it will take new paper to spark the return of foreign institutional investors to the EGX. The EGX is now deep in the grip of retail traders and is down more than 8% YTD. Our regional rivals, meanwhile, are soaring: Saudi’s Tadawul is up more than 25% so far this year, the ADX has climbed nearly 33% and the DFM is up 14% since the start of the year.

COVID WATCH

Are we over wave #3? The dreaded third wave “has ended” here at home, with daily infection rates falling from their recent peak during Eid El Fitr, deputy health minister for intensive care affairs Sherif Wadea said in a phone-in to Al Hadath Al Youm (watch, runtime: 4:24). Bed occupancy rates and hospital-acquired infections decreased to 29% from the past week, while ICU occupancy dropped by as much as 56%, courtesy precautionary measures imposed by cabinet and a boost in the local vaccination campaign, she said.

Cases continued to decline yesterday, falling to 691, according to new figures from the Health Ministry. This is down 42% from the recent peak during the Eid break. Egypt has now disclosed a total of 273,182 confirmed cases of covid-19. The ministry also reported 41 new deaths, bringing the country’s total death toll to 15,623.

The US seems to have beaten the pandemic: Just 2% of covid-19 tests in the US are positive — the lowest since the pandemic broke out in the states in March 2020, compared with more than 13% during the winter, the Wall Street Journal reported, citing figures from Johns Hopkins University. The percentage of tests coming back positive have been falling dramatically in the US since April, along with declining hospitalization and death counts.

STARTUP WATCH

Fatura raises USD 3 mn pre-series A round

Egyptian B2B marketplace Fatura closed a USD 3 mn pre-series A funding round co-led by Sawari Ventures and Arzan VC, the company said in a press release (pdf). Egypt Ventures, EFG-EV, Cairo Angels, and Khwarizmi Ventures also participated in the round. The company will use the funds to extend its activities to provide further services to manufacturers, wholesalers and retailers in the B2B sector, the company said. These are likely to include digital payments on its platform — an endeavor it hinted at last year — as well as expanding into new regional markets.

Fatura’s marketplace was launched in 2019 to connect wholesalers and manufacturers with retailers in different industries, and mostly operates in the fast-moving consumer goods industry. Fatura’s first funding round in July 2020 saw the startup raise USD 1 mn in a round led by Disruptech.

EDUCATION

SFE, GEMS collaborate on Sixth of October schools

The Sovereign Fund of Egypt (SFE) and GEMS Egypt will establish at least two schools in Sixth of October City’s state-owned Cosmic Village, a source from GEMS told Enterprise on condition of anonymity. The schools will be open for admission starting September 2023, they added. Details on an expected cost for the project have not yet been confirmed.

This isn’t the first agreement of the sort: The SFE and GEMS signed an MoU in March to build and operate two national schools in west Cairo on SFE-owned land. The wealth fund also committed EGP 250 mn to the EFG Hermes Education Fund, established in 2018 as a 50/50 JV between EFG and GEMS.

Investment plans: GEMS CEO Ahmed Wahby said last year that the company has earmarked USD 300 mn to set up 30 schools across its footprint over 2.5 years.

DIPLOMACY

More details on the Egypt-France financing agreement

More details of the EUR 3.8 bn in agreements and contracts signed with France yesterday, courtesy of the cabinet.

Transport: Funding from the French government will go towards a raft of transport projects, including the supply of 55 new trains for Cairo Metro Line 1, the rehabilitation of the Mansoura-Damietta railway, the construction of the Aswan-Toshka rail line, and the Abu Qir metro conversion project, the cabinet said.

Energy + wastewater: Funding will also be earmarked for energy, electricity, housing and wastewater projects, the statement said. This includes wastewater plants in Helwan and Alexandria, a power control center in Alexandria, and the establishment of a wholesale market in Borg El Arab.

READ OUR FULL INTERVIEW WHEN IT COMES OUT THIS WEEK- In it, Le Maire tells us of his administration’s ambitions to make France among Egypt’s top three trading partners from a current eighth. He explains to us why France has been accelerating its economic cooperation with us over the past four years and where he wishes to see this cooperation go. We also talk about what the G7 tax agreement could mean for us. You don’t want to miss it.

ALSO IN DIPLOMACY-

Egypt, Pakistan talk defense: President Abdel Fattah El Sisi and Defense Minister Mohamed Zaki discussed military ties and organizing joint drills during a meeting in Cairo yesterday with the chairman of Pakistan’s Joint Chiefs of Staff, Ittihadiya said in a statement.

MOVES

Tamer Azer appointed Egypt partner for Shorooq Partners

Emirati VC firm Shorooq Partners has appointed Tamer Azer (LinkedIn) as a partner in its new Cairo office, according to a statement (pdf). Azer joins from Sawari Ventures where he served as a principal starting 2019.

Col. Gharib Abdel Hafez (bio) has been appointed the new spokesperson for the Egyptian Armed Forces to replace Brig.-Gen. Tamer Mohamed, according to a statement.

LAST NIGHT’S TALK SHOWS

It was a relatively quiet night on the nation’s airwaves last night, save for Tourism Minister Khaled El Enany’s extended interview on Ala Mas’ouleety to suggest that we could see direct Russian flights to Red Sea destinations return “in the coming few weeks,” (watch, runtime: 1:49). Plans to resume flights hinge on the all-clear from Russian authorities to lift the six-year flight ban imposed since 2015, as Russian President Vladimir Putin agreed with President Abdel Fattah El Sisi in April. You can watch the minister’s full interview here (runtime: 54:16).

Elsewhere: The talk shows were all over the latest on the treasure trove of historical artifacts which were recently discovered in an apartment in Zamalek. Teams formed by the Justice Ministry have confirmed that almost 2k archaeological pieces were found inside the apartment, Secretary-General of the Supreme Council of Antiquities Moustafa Waziri told Ala Mas’ouleety (watch, runtime: 1:10) last night. The place has been sealed by the Prosecutor’s Office as investigations continue, Waziri said in a phone-in to Kelma Akhira (watch, runtime: 6:41). Al Hayah Al Youm (watch, runtime: 30:10) and Masaa DMC (watch, runtime: 4:41) also had coverage.

The apartment’s owner, Hamad Abdel Fattah, who has lived outside Egypt for many years, has tried to explain the findings, stressing that he belongs to the royal family tree and that he had inherited the artifacts from them, though some pieces were purchased through public auctions, according to Sky News Arabia. However, the collection and possession of all the archaeological materials is unlawful and holders could face tough penalties and jail sentences, Kelma Akhira’s Lamees El Hadidi said (watch, runtime: 4:30).

EGYPT IN THE NEWS

The foreign press is zoning in on French Finance Minister Bruno Le Maire’s visit to Cairo, where he signed a number of contracts and agreements worth almost EUR 4 bn that will strengthen trade ties between the two countries. (Bloomberg | Reuters | The National)

ALSO ON OUR RADAR

Juhayna’s ex-chairman’s detention extended: The State Security Criminal Court has ordered that Juhayna’s former Chairman Safwan Thabet’s detention be extended for another 45 days while authorities investigate his alleged ties to the Ikhwan, Al Masry Al Youm reports. Thabet was arrested and ordered detained in December, initially for 15 days, a period which has been repeatedly extended. His son and Juhayna CEO, Seif Thabet, was also arrested on similar allegations in February and remains in detention. Both deny being a part of the outlawed group.

Contact Financial wants in on the central bank’s mortgage program: Contact Financial Holding is in talks with the government to take part in the CBE’s subsidized mortgage program, which offers 30-year loans at a 3% interest rate, CEO Saeed Zaatar tells Hapi Journal. The new program was launched in March to give low- and middle-income earners access to EGP 100 bn-worth of cheap mortgages. Contact thinks it can lend EGP 1.1-1.4 bn through the program, and expects to receive the terms for the initiative this week, Zaatar said.

AMENDED ON 14 June 2021

We would like to clarify that Safwan Thabet is Juhayna’s former Chairman and not their current one as a previous version of this story may have implied.

PLANET FINANCE

Investors appear (for now) to be going along with the Fed’s temporary-inflation mantra as US treasuries recorded last week their best week in a year despite further evidence of rising inflation, according to the Financial Times. Traders piled into the treasury market last week leaving 10-year yields with their biggest weekly decline since June 2020 — even as new data showed inflation hitting its highest level since 2008.

It was only a couple of months ago that the US bond market saw a serious sell-off and yields spike as investors positioned for an end to the Federal Reserve’s covid bond-buying programme and — perhaps — a rise in interest rates. The theory was that the oncoming inflation would soon force central bankers to turn off the liquidity taps. Instead, central banks seem perfectly happy to let inflation rise if it means keeping the post-covid economic recovery on track.

And this sentiment doesn’t seem to have changed all that much, according to a BMO client survey last week, which showed that a record 71% of investors expect the next major move in yields will be upwards.

|

|

EGX30 |

9,887 |

-0.9% (YTD: -8.1%) |

|

|

USD (CBE) |

Buy 15.60 |

Sell 15.70 |

|

|

USD at CIB |

Buy 15.60 |

Sell 15.70 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

10,897 |

+0.9% (YTD: +25.4%) |

|

|

ADX |

6,701 |

-0.2% (YTD: +32.8%) |

|

|

DFM |

2,842 |

-% (YTD: +14.1%) |

|

|

S&P 500 |

4,247 |

+0.2% (YTD: +13.1%) |

|

|

FTSE 100 |

7,134 |

+0.7% (YTD: +10.4%) |

|

|

Brent crude |

USD 72.80 |

+0.2% |

|

|

Natural gas (Nymex) |

USD 3.31 |

+0.5% |

|

|

Gold |

USD 1,878.70 |

-0.1% |

|

|

BTC |

USD 38,832 |

+7.9% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 0.9% at today’s close on turnover of EGP 1.24 bn (8.1% below the 90-day average). Local investors were net sellers. The index is down 8.8% YTD.

In the green: Eastern Company (+2.0%), Pioneers Holding (+1.6%) and Export Development Bank (+1.0%).

In the red: Orascom Financial Holding (-3.5%), MM Group (-3.3%) and Ezz Steel (-3.1%).

Why strong university-level STEM representation by Egyptian women isn’t translating to the workplace: Egypt’s science, technology, engineering and mathematics (STEM) education is seeing a boost. Since 2011, at least 15 Education Ministry-owned STEM high schools have been set up. Many degrees offered by international branch campuses are STEM-focused. And Egypt understands women are globally underrepresented in STEM, with International Cooperation Minister Rania Al Mashat a particular advocate for more female participation in STEM education programs.

The good news: Egypt’s doing better than the average when it comes to women studying STEM. 43% of Egypt’s university STEM students were women as of 2017, compared to only 35% in the UK, and globally.

Around 50% of Egypt’s STEM graduates are women: Women made up 47.2% of Egypt’s university science faculty student body in 2018-2019, according to CAPMAS (pdf). 48% of Egypt’s 2015 university STEM graduates were women, says a 2018 World Bank report (pdf). The 2021 UNESCO science report shows the percentage of female graduates by discipline using 2018 data: agriculture 49.4%; engineering 20.9%; health & welfare 56%; natural sciences 64.2%; ICT 36.8%;.

The bad news: this isn’t reflected in the workplace. Though almost equal numbers of women and men graduate with STEM degrees, many fewer women pursue STEM careers, says an April 2020 study (pdf) commissioned by the British Council Egypt and conducted by UK-based consultancy Pivot Global Education, released in May 2021. It used qualitative data from 22 women studying or employed in STEM fields, and quantitative online survey responses from another 63, supplemented by national and international reports and data.

Women with STEM degrees represent only 35.3% of Egypt’s scientific professionals, a CAPMAS 2017 bulletin shows. 67% of student participants in the British Council study said over half their counterparts were female, compared to only 45% of professionals. Female specialists working full-time in natural sciences, math and engineering make up only 18.44% of the public sector workforce, the report says.

Why the discrepancy? Workplace inaccessibility and gender bias, the study argues. Women are particularly unlikely to hold private sector STEM roles, as the long working hours expected are incompatible with other social expectations they face. They are most likely to hold academic positions, where working conditions are more compatible with family life. Supporting women to pursue STEM careers requires better policy implementation, funding and more flexible working conditions, the study argues. Concrete steps must be taken to advance female leadership, including clearer pathways to promotion and a pushback against rigid gender norms discouraging women from pursuing disciplines like engineering.

Egypt exceeds global averages for women in STEM research: 46% of Egypt’s total number of scientific researchers are women, according to 2018 UNESCO data. The global average percentage of female researchers is 33.3%, while in the Arab World it’s 42.6% and within the EU 33.8%.

But female researchers still miss out on state support: Women made up an estimated 54% of researchers in Egypt’s scientific research centers in 2018, but only 15% of them received state awards and only 13% registered patents, according to Mahmoud Sakr, president of Egypt’s Academy for Scientific Research and Technology (ASRT).

Ultimately, many Egyptian women wanting careers in STEM will enter academia. Most STEM professionals in the British Council study worked as lecturers and professors, with fewer than 10% working in industry or as researchers. Medicine, engineering and research are particularly competitive fields, where securing permanent positions is difficult, say interviewees. But even academia — more viable than other STEM fields — is difficult for women to find permanent, well-paid positions in, the study says.

Women in research hold leadership roles, but men are still at the top of the food chain. The UNESCO report breaks down the share of Egyptian female science researchers by seniority grade, using 2018 data: 51.2% PhD students or junior researchers; 46.2% assistant professors or post-doctoral Fellows; 39.4% senior researchers or associate professors; 35.5% directors of research or professors.

It’s clear: gender bias — not academic performance — prevents women from entering and progressing in STEM careers. Many fewer women work as STEM professionals than graduated with STEM degrees largely because of social norms and sector prejudice, the British Council study argues. Gender bias — including remarks by colleagues, being overlooked for promotion, inflexible hours, and deliberate exclusion — is a key feature of the respondents’ professional lives.

STEM gender norms are particularly rigid: Women in STEM are often discouraged from pursuing particular disciplines, like engineering or certain specializations within medicine and research. This applies especially to biology, petroleum engineering and certain medical fields, where women might be in close contact with people outside of their immediate family, the study notes.

This correlates with global gender indexing, where Egypt scores higher in education than economic participation: Egypt was ranked 129 in the Global Gender Gap Report 2021 (pdf), which benchmarks gender gaps in 156 countries according to four metrics. Egypt ranks 105 under educational attainment, but 146 under economic participation.

So how can academic STEM representation better translate to the workplace? Through more inclusive, better implemented policies. 60% of women interviewed believe institutional policies supporting women in STEM should be better implemented and more inclusive. They want more flexible hours, policies aligned with childcare, and more avenues for promotion.

And support for women to advance to senior leadership positions: This could involve professional development workshops and career support programs for women, interviewees say. Funding should be allocated to mentorship programs that help women advance in STEM fields, and to research that assesses the role of geographic location and economic background in women pursuing STEM studies and careers.

Let’s not forget more data: UNESCO terms the lack of comprehensive data on gender trends a “chronic problem,” impacting countries throughout the world. Measuring the scale of gender disparity in science is the first step to changing it, it notes.

The bottom line: The relatively high numbers of Egyptian women studying STEM subjects represent a chance to increase gender parity in STEM fields. But concrete support is needed to translate women’s academic engagement in STEM into participation in the workplace.

Your top education stories for the week:

- CIRA to set up new language school in New Rashid: The project will be located in the new city’s Bashayer El Kheir low-cost housing district, and has already received technical clearance.

- Henkel Egypt is taking part in GIZ’s ProGirls project to help girls explore new fields: The course, which will end on 11 October, will see elected participants, accompanied by a Henkel employee, trained online or in-person during the summer vacation to explore fields such as science, technology, engineering and mathematics.

- A new HQ for Francophone University Agency in Cairo University: The Higher Education Ministry has signed a contract with the Montreal-based association to open a new head office in Cairo University to improve students’ research and education skills.

- Tech upgrade at Zagazig University: A “digital creativity” center will be established in the public university to improve students’ tech skills under an agreement signed between the higher education and communications ministries.

CALENDAR

11-14 June (Friday-Monday): Egypt is hosting the first forum of the heads of African investment promotion agencies from under the theme Integration for Growth.

14 June (Monday): Egypt hosts the third edition of the Green Economy Forum (pdf).

15 June (Tuesday): Arab League meets to discuss the GERD in Doha.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday): The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

20 June (Sunday): Ismailia Economic Court to hold hearing on Ever Given compensation case.

20 June (Sunday): Deadline for Enpact + Tui + GIZ tourism recovery program (pdf).

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt. The Big 5 Egypt Impact Awards will also be taking place at the event on 27 June.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

15 June (Saturday): EGX-listed will have to complete filing their financial disclosures for the period ended 31 March.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

2-4 August (Monday-Wednesday): Egypt is hosting the Africa Food Manufacturing exhibition at the Egypt International Exhibition Center.

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.