- Are we in for an IPO-heavy second half of the year? (IPO Watch)

- Egypt’s GDP is on track to grow 4.2% in 2021 –RenCap. (Economy)

- Speed Medical to acquire 25% stake in software company + get in on consumer lending. (M&A Watch)

- Another AstraZeneca supply hiccup + UAE to administer third “supportive” Sinopharm shot. (Covid Watch)

- IDA exec regs are now the law of the land. (Legislation Watch)

- Ismailia court to consider appeal #2 to release the Ever Given. (Suez Canal)

- Israel + Hamas reject Egyptian proposal for ceasefire. (Around the World)

- Why MENA’s energy investments will grow in 2021-2025, according to Apicorp. (Hardhat)

- Planet Finance — The CEO succession race at JPMorgan is heating up.

Wednesday, 19 May 2021

Are we in for an IPO-heavy second half of the year?

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, everyone. The big news here at home this morning: We could see as many as five more companies offering shares on the Egyptian Exchange before the year is out. EGX boss Mohamed Farid did not specify yesterday how many of the transactions were likely to be initial public offerings vs. stake sales by already-listed firms or technical listings. Several state-owned companies that are already quoted on the EGX have been on deck to sell more shares in a process that has been stalled since before the pandemic.

First up on Farid’s list: Shares of LSE-listed Integrated Diagnostics Holding (IDH) are set to begin trading on the EGX tomorrow under the ticker IDHC. IDH’s technical listing will make it the second company to debut on the Egyptian bourse this year, after higher education outfit Taaleem, which ended nearly two-year-long IPO drought. We have more in this morning’s news well, below. IDH is the parent company of local giants Al Borg and Al Mokhtabar labs and operates in Egypt, Jordan, Sudan and Nigeria. The first-half IPO window is now starting to close and is unlikely to reopen before September.

We’re also keeping a close eye on the state of play in the nation’s vaccination drive after reports that the UAE is planning to offer third shots of Sinopharm’s jab in the form of boosters — raising fresh concerns about how reliable the Chinese jab is. This comes at the same time as there are signals Covax may be slowing delivery of AstraZeneca’s vaccine to countries like Egypt as India, a top supplier to the initiative, keeps shots at home. We have more on this, too, in the news well.

THE BIG STORY INTERNATIONALLY continues to be the elusiveness of a cease-fire between Israel and Hamas as the Israeli military continued to pummel the Gaza Strip with airstrikes. We have the latest updates in Around the World, below.

*** CATCH UP QUICK with the top stories from yesterday’s edition of EnterprisePM:

- The latest in the Alex Medical race: Nile Misr Healthcare plans to lower its bid for Alexandria Medical Services following Cleopatra Hospital Group’s offer.

- A bumper series A round: Egyptian furniture marketplace Homzmart has raised USD 15 mn in series A funding.

- A new e-payments player: Banque du Caire’s new e-payments arm Tally will launch before the end of the year.

WHAT’S HAPPENING TODAY-

Defense Minister Mohamed Zaki is in Nicosia today for talks with military officials from Greece and Cyprus, the Armed Forces said in a statement yesterday, without providing further information.

This comes ahead of Greek Foreign Minister Nikos Dendias’ visit to Cairo tomorrow. The minister will be sitting down with FM Sameh Shoukry after visiting Israel, Palestine and Jordan in a regional tour that takes place amid escalation between Israel and Hamas. Shoukry, Dendias and Dutch Foreign Minister Stef Blok discussed efforts to reach a ceasefire during a phone call on Monday.

Both HC Securities and RenCap’s investor conferences continue today and end tomorrow.

|

CIRCLE YOUR CALENDAR-

Africa-based startups have until 26 May to sign up for France’s AFD Digital Challenge, an annual startup competition (pdf) by the French Development Agency (AFD). This year, the competition involves startups finding solutions to curb the carbon impact of economic activities or promote sustainable economic activity and the use of natural resources. The 10 startups chosen will receive an “acceleration pack,” a package of technical and financial support worth EUR 20k.

An updated version of the government’s Egypt sustainable development strategy, Egypt Vision 2030, will be published next month, Planning Minister Hala El Said said yesterday. The strategy will be updated to account for the effects of covid-19, the minister said, without providing further details.

The IMF will complete by the end of June a second review of targets set under Egypt’s USD 5.2 bn standby facility. The facility was approved in June 2020.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development as well as social infrastructure such as health and education.

In today’s issue: We take a look at the Arab Petroleum Investments Corporation’s (Apicorp) outlook for the MENA region’s energy landscape, which the multilateral development bank expects will see a modest increase in net investment over the next five years as the global economy recovers from the pandemic.

IPO WATCH

Are we in for an IPO-heavy 2H2021?

The Egyptian Exchange could see as many as five more companies offer shares for sale before the year is out, EGX Chairman Mohamed Farid told CNBC Arabia, confirming a statement he made last month (watch, runtime: 1:23). According to Farid, two or three companies could offer their shares on the EGX in the back half of 2021, but the EGX boss did not specify whether they were private- or public-sector companies, whether the listings would be primary or secondary offerings, or whether he was including stake sales by already-listed companies in the tally.

The fresh listings in the pipeline are in addition to Macro Pharma, Farid noted. The company postponed its planned listing to the fall window, citing concern over the market’s capacity to absorb multiple offerings. Multibrand higher education outfit Taaleem started trading last month and London-listed consumer healthcare giant IDH is set to begin trading tomorrow.

Who else might be selling shares this year? Though Farid did not identify companies by name, analysts we spoke with earlier this year for our first EnterprisePM IPO Poll tapped the following as likely candidates for the 2H2021 IPO pipeline:

- NBFS player Ebtikar

- State-owned e-Finance

- State-owned Banque du Caire

What’s going on with transactions coming out of the state privatization program? Public Enterprises Minister Hisham Tawfik had said in April that the program could be revived with at least two stake sales in 3Q2021, while e-Finance Chairman Ibrahim Sarhan said the e-payments firm is expected to IPO in 2H2021. We could also see IPOs from the military’s National Service Products Organization this year, with the Sovereign Fund of Egypt currently studying a handful of companies to offer for co-investment.

ECONOMY

Egypt’s GDP is on track to grow 4.2% in 2021 –RenCap

Renaissance Capital revised upwards its projections for Egypt’s GDP growth to 4.2% in 2021, driven by growth in transport, tourism, and education, Renaissance Capital economists said yesterday during a webinar as part of RenCap’s annual MENA Investor Conference. This is an upward revision from the 2.8% RenCap had forecast for Egypt’s GDP growth in 2021 at the end of last year. The investment bank is maintaining its expectations that Egypt will manage to eke out growth this year, as GDP grew 2% y-o-y in 4Q2020.

GDP growth is picking up slowly but surely q-o-q: While 4Q2020’s growth rate “may be a slowdown” from the 5.7% y-o-y rate recorded one year earlier in 4Q2019, q-o-q growth was better, acting head of research in Africa Yvonne Mhango said. On a quarterly basis, GDP grew 1.3% in 4Q2020, “which implies a recovery is underway.” Egypt’s economy expanded at a 1.5% clip in 2020, down from 5.6% in 2019.

Inflation is expected to remain contained in the short term: RenCap sees annual urban headline inflation ending the year at 4.3% — a little over the 4.1% recorded in April when inflation slowed against expectations. “This implies inflation will remain contained, and well within the authorities’ target of 7% (+/- 2%) for 4Q2021,” Mhango said.

But the global rally in food and metal prices could soon directly hit consumers here at home, with analysts forecasting heightened inflation as a result of the year-long rally. Higher raw material prices could then increase the cost of local production and boost prices at the cash register as we head further into 2021, Pharos’ head of research Radwa El Swaify and Beltone’s Alia Mamdouh previously said. Domestic inflation, which has so far been shrugging off rising global commodity prices due to a favorable base effect, is seen as a potential “upside risk” from the recent boom in oil prices, which may reflect negatively on prices of non-food commodities.

What about changes to interest rates? Not this year — and not in 2021 if inflation remains contained within the “single-digit” limits in “the short term,” Mhango said. “Egypt’s low inflation implies it has relatively high real rates on its bonds relative to its [emerging market] peers, which should help sustain foreign investors interest in the local bond market,” she added. The Central Bank of Egypt (CBE) left rates on hold earlier this month for a fourth consecutive meeting as policymakers looked to maintain the attractiveness of Egypt’s carry trade, capitalizing on rising commodity prices and rising US interest rates.

And the EGP could come under a bit of pressure, RenCap said, suggesting it is as much as 13% overvalued against the USD. In the short-term, the EGP will remain “broadly stable” on the back of relatively high real rates, which have helped attract higher capital inflows to Egypt than its emerging-market peers.

MORE FROM THE CRYSTAL BALL SET– Egypt will likely reel in USD 7 bn in tourism revenues in FY2021-2022, but this figure will be contingent on the global vaccination rate, EFG Hermes’ Mohamed Abu Basha said, according to Al Mal. Abu Basha’s projection is on par with Bank of America’s forecasts for Egypt’s tourism revenues in calendar year 2022, but falls short of the USD 8 bn that Tourism Minister Khaled Enany said earlier this week the country is hoping to bring in during the current calendar year.

M&A WATCH

Speed Medical to acquire 25% stake in software company + get in on consumer lending

Speed Medical is planning to snap up a 25% stake in DG Well, a software company that owns the CareSquare healthcare app, the company said in a disclosure to the EGX (pdf) yesterday. The two sides have signed an MoU for the transaction, which would value the stake at EGP 22.5 mn, Speed said.

The company is also looking to get into the consumer finance game: Speed Medical will set up a consumer lending arm dubbed Speed Finance that will provide finance for medical and pharma services, the company said. Services provided by CareSquare, which acts as an online directory of medical professionals, will be combined with Speed Finance’s services should the acquisition go ahead, the company said. Speed Medical will own 50% of the company, which will launch with EGP 25 mn in capital. Sources told Al Mal that 40% will be offered to investors and 10% will be owned by DG Well.

COVID WATCH

We could see less AstraZeneca in Egypt just as fresh questions arise about Chinese vaccines

Vaccine producer the Serum Institute of India (SII) is planning to extend its suspension on exporting the Oxford / AstraZeneca vaccine until the end of the year, SII CEO Adar Poonawalla said yesterday, according to the Financial Times. The extension is meant to allow SII to better prioritize delivering vaccines to India, which is buckling under the weight of a third wave of covid-19. SII probably won’t resume “sizable exports” before October at the earliest, Reuters reports. Covax primarily depends on the AstraZeneca jabs SII manufactures.

What does this mean for Egypt? The fate of the rest of Egypt’s vaccine doses from the Gavi / Covax scheme is currently unclear. We received a 1.7 mn-dose shipment of the AstraZeneca vaccine from Covax earlier this month, bringing the total number of jabs Egypt has received from the program to around 2.55 mn doses.

We’re also expecting to receive another batch of 1.7 mn doses before the end of May, meaning we could have a clearer idea of how Egypt’s vaccine supply will be affected in the next couple of weeks. The uncertainty comes a few weeks before state-owned Vacsera is expected to churn out some 2 mn doses of China’s Sinovac vaccine, and suggests that plans to domestically produce other jabs (including Sputnik) will become all the more important.

That comes as new questions are being asked about the efficacy of China’s high-profile Sinopharm jab. The UAE will begin offering a third “supportive” dose of the Sinopharm vaccine — which has so far been administered as a two-shot jab — to individuals who received the second dose of the vaccine at least six months ago, the UAE’s National Emergency Crisis and Disaster Management Authority said yesterday. Sinopharm had been testing earlier this year whether a third booster shot would help increase the vaccine’s effectiveness. It is widely expected that annual boosters of covid-19 vaccines will be the norm to protect against mutations and variants.

US pledges to boost vaccine exports: President Joe Biden has promised to share at least 80 mn doses of covid-19 vaccines with other countries by the end of June, the Wall Street Journal reports. The government has faced international backlash over export restrictions that prioritized the vaccination of US citizens over other countries.

The Health Ministry reported 1,169 new covid-19 infections yesterday, down from 1,188 the day before. Egypt has now disclosed a total of 248,078 confirmed cases of covid-19. The ministry also reported 53 new deaths, bringing the country’s total death toll to 14,441.

LEGISLATION WATCH

IDA exec regs are the law of the land + sovereign sukuk inch closer to legislative clearance

The wait is over for industrial investors: The executive regulations to the law regulating the Industrial Development Authority (IDA) come into effect today after being published yesterday in the Official Gazette (pdf), the Trade and Industry Ministry said in a statement. The ministry approved the regulations earlier this month, setting rules for non-industrial developments within industrial zones as well as for how the IDA will price its services. This is in addition to the mechanism that controls rent, sale, and usufruct prices for lands in industrial zones.

Our sovereign sukuk are inching closer to legislative clearance: The House Economic Committee gave its final sign-off to the Sovereign Sukuk Act yesterday, after the Senate approved the law earlier this week, Masrawy reports. The bill sets the framework that will regulate Egypt’s sovereign sukuk issuances, including governing how the sharia-compliant debt is securitized and traded.

Didn’t the House Economic Committee already give its blessing? The committee had approved in February amendments to the Act, which included laying out the terms and processes for sukuk issuances, as well as setting up an oversight committee to assess how the sukuk are priced and where the funding will go. The act has since made its way through the Senate and the Council of State (Maglis El Dawla) for further review and suggestions. Yesterday’s approval is on the final text of the act.

What’s next: The House of Representatives’ general assembly needs to give the act its final rubber stamp before being sent to President Abdel Fattah El Sisi for ratification. The executive regulations to the law are expected to be issued within three months after that.

SUEZ CANAL

Shoei Kisen submits second appeal against Ever Given seizure

A new appeal from Ever Given owner Shoei Kisen will be on the agenda for an Ismailia court this Saturday, 22 May, after company lawyers submitted a second appeal yesterday against the seizure of the mega vessel, Youm7 reports. Earlier this month, the court had rejected Shoei Kisen’s first appeal against a decision allowing the Suez Canal Authority to seize the Ever Given until it receives payment of over USD 900 mn in compensation for losses incurred by the Ever Given’s week-long blockage of the Suez Canal in March. The court is also set to reassess on Saturday the Ever Given’s status. Negotiations for a settlement are ongoing as the ship continues to be held in the Great Bitter Lake.

EARNINGS WATCH

Sidpec rebounds from tumultuous 2020 in 1Q

Sidpec is beginning to recover from last year’s tumult in the energy markets: Sidi Kerir Petrochemicals (Sidpec) generated net income of EGP 151.7 mn in 1Q2021, against losses of EGP 31.3 mn during the same quarter a year earlier, the company said in its quarterly earnings release (pdf). Net sales jumped 38% during the quarter, hitting EGP 1.3 bn compared to EGP 951 mn in 1Q2020. The crash in energy prices last year hit the company hard, causing profits to plunge almost 20x to EGP 26 mn from EGP 487 mn in 2019.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

It was another humdrum evening on the airwaves last night. El Hekaya’s Amr Adib appears to still be basking in the sun on an extended Eid holiday, while Kelma Akhira’s Lamees El Hadidi had an extended sit-down with the stars and creative minds behind hit Ramadan mosalsal Le3bet Newton (watch, runtime: 5:57 and runtime: 9:02) and Ala Mas’ouleety’s Ahmed Moussa kept himself busy by debunking rumors about cancerous watermelons (watch, runtime: 6:00).

EGYPT IN THE NEWS

Egypt’s bid to mediate a ceasefire between Israel and Hamas is topping coverage in the foreign press this morning. The Biden administration’s reluctance to get involved in the process of brokering a truce means that Egypt is left with the burden of doing most of the work — but that this is also a window for Egypt to reaffirm its “centrality to the major matters of contention in the Middle East,” Bobby Ghosh writes for Bloomberg Opinion.

Also making headlines:

- Expats on living + working in Egypt: Expats ranked Egypt 55th out of 59 countries in a survey measuring their satisfaction with cost of living, job security, and quality of life. (Bloomberg)

- Human rights: Human Rights Watch is urging Egyptian authorities to release Hoda Abdel Hamid, who was reportedly detained after posting to Facebook a letter from her imprisoned son alleging he was subject to abuse behind bars. (Associated Press)

ALSO ON OUR RADAR

State-owned aluminum producer Egyptalum has hiked prices by EGP 4k-5k per tonne in response to a recent Trade Ministry decision to impose duties on imported raw materials, according to Al Mal. Aluminum producers and industry figures have been calling on authorities to review the decision, saying the duties are negatively impacting Egyptian producers.

Steel magnate Ahmed Ezz has increased holdings in his name in Ezz Steel to 32.9% after acquiring an additional 5.6% stake in the company, according to an EGX filing (pdf). Ezz acquired over 9 mn global depository receipts worth USD 2.1 mn each from affiliated holding company El Ezz Group Holding for Industry and Investment, whose holdings now stand at 33.45% following the transaction.

Also on our radar this morning: Tourism and Antiquities Minister Khaled El Enany inaugurated yesterday two museums inside Cairo International Airport housing artefacts that were stored in the Egyptian Museum in Tahrir and two other museums.

PLANET FINANCE

The CEO succession race at JPMorgan is heating up: Two contenders in line to succeed JPMorgan Chase CEO Jamie Dimon when he retires are being put in charge of jointly running the bank’s consumer and community bank, the bank said in a regulatory filing. Marianne Lake, the bank’s consumer lending chief, and CFO Jennifer Piepszak are both considered front-runners to replace Dimon upon his retirement, and the move to place them as co-heads of the consumer banking operation is seen as “the clearest sign yet that Dimon has in fact started the clock on the race to succeed him,” Bloomberg suggests.

|

|

EGX30 |

10,781 |

+1.0% (YTD: -0.6%) |

|

|

USD (CBE) |

Buy 15.63 |

Sell 15.73 |

|

|

USD at CIB |

Buy 15.62 |

Sell 15.72 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

10,424 |

+0.3% (YTD: +20.0%) |

|

|

ADX |

6,528 |

+0.8% (YTD: +29.4%) |

|

|

DFM |

2,705 |

+1.2% (YTD: +8.5%) |

|

|

S&P 500 |

4,128 |

-0.9% (YTD: +9.9%) |

|

|

FTSE 100 |

7,034 |

|

|

|

Brent crude |

USD 68.15 |

-0.8% |

|

|

Natural gas (Nymex) |

USD 3.00 |

-0.4% |

|

|

Gold |

USD 1,867.60 |

|

|

|

BTC |

USD 41,654.61 |

-7.3% |

THE CLOSING BELL-

The EGX30 rose 1.0% at yesterday’s close on turnover of EGP 1.67 bn (25.8% above the 90-day average). Foreign investors were net sellers. The index is down 0.6% YTD.

In the green: ElSewedy Electric (+6.5%), GB Auto (+6.2%) and EKH (+4.2%).

In the red: Export Development Bank (-1.8%), Ibnsina Pharma (-0.7%) and CIB (-0.5%).

Asian shares are mixed this morning, with major indexes down in Tokyo and Shanghai, but up in Seoul and Hong Kong. Futures suggest Wall Street and much of Europe will dip at the opening bell, with shares in Toronto on track to buck the trend.

AROUND THE WORLD

Israel + Hamas reject Egyptian proposal for ceasefire

Israel and Hamas both appear to have rejected an unconfirmed Egyptian proposal to bring a ceasefire into effect as of tomorrow morning, Israel’s N12 TV news reported yesterday, according to Reuters. EU foreign ministers added their voice to the chorus calling for an immediate cessation of violence against civilians in Gaza, according to a statement. Though the bloc called the high number of civilian deaths “unacceptable,” it also said it supported Israel’s right to self-defense in a proportionate manner.

Over 72k Palestinians have been displaced by Israel’s eight days of airstrikes on Gaza, according to a statement by the United Nations Office for the Coordination of Humanitarian Affairs, with Amnesty International calling on the International Criminal Court to investigate what it describes as “attacks that may amount to war crimes or crimes against humanity,” Reuters reports. The death toll of the past week’s violence as of Tuesday stood at 213 Palestinians, including 61 children, the Gaza Health Ministry said.

Among the destroyed infrastructure from the airstrikes: Six hospitals and nine healthcare centers as well as a desalination plant that will affect access of about 250k people to drinking water.

Egypt will contribute USD 500 mn to the rebuilding of property and infrastructure in Gaza, President Abdel Fattah El Sisi said yesterday.

The Tahya Misr fund has dedicated account number 037037 at all Egyptian banks to receive donations for Gaza, Hapi Journal reports. The donations will be put towards the delivery of meds and other supplies. The fund plans to launch a 100-container aid convoy to the Gaza Strip soon.

IN DIPLOMACY- The IMF is keen to continue developing Egypt’s “success story,” IMF head Kristalina Georgieva told President Abdel Fattah El Sisi during a meeting in Paris yesterday, according to an Ittihadiya statement. The efficacy of Egypt’s economic reforms and the resilience it has managed to achieve are an example the IMF hopes to replicate in other nations, Georgieva said.

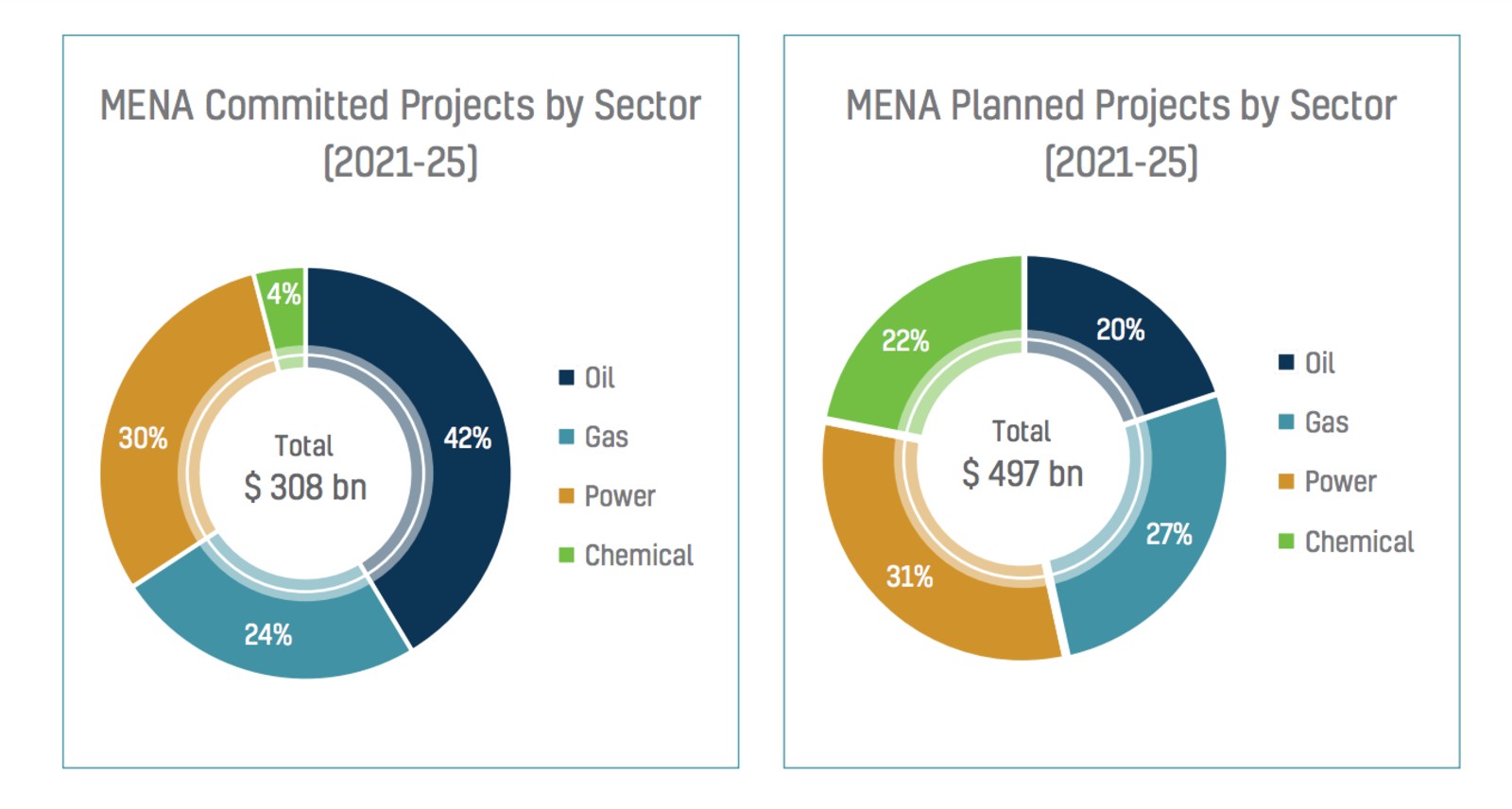

Why MENA’s energy investments will grow in 2021-2025, according to Apicorp: The MENA region is expected to see a combined USD 805 bn of investments in energy projects over the next five years, multilateral development bank Arab Petroleum Investments Corporation (Apicorp) says in its latest MENA Energy Investment Outlook. This forecast is a “modest” increase of USD 13 bn compared to Apicorp’s 2020-2024 outlook, which penciled in USD 792 bn of investment.

What’s behind the growth: The report attributes the uptick in energy investments in part to the recovery of the global economy as we could see “wide-scale access to vaccines” as early as 2021.

Remember that commodity supercycle we’ve been droning on about? It’s going to play into the recovery: Higher commodity prices and exports will help push regional GDP to grow 4% in 2021 and 3.7% in 2022, the report says, with commodity prices helping some countries — including Algeria and Iraq — more than others.

Also spurring more investments: Apicorp also points to the resumption of global energy demand, fast-paced growth in renewables in the region, and Libya reopening its energy projects after the country formed a unity government as key drivers of growth in regional energy investments.

The devil is in the details: Although total investments are up in absolute terms, signaling a certain degree of resilience in MENA’s energy sphere, the 2020 downturn makes its presence known through the ratio of committed to planned investments, which “fell to its lowest level over the past three five-year outlook periods,” the reports says.

Where does Egypt stand? Overall, Egypt has a “healthy pipeline” of energy investments as we make our way through 2021 on good fiscal footing, according to the report. This pipeline is underpinned by the creation of the East Med Gas Forum, resuming LNG exports from the Damietta liquefaction plant after eight years in hibernation, as well as “solidification of its energy transit/trade status with SUMED and Al-Hamra Port expansions, petrochemicals development ambitions … and new infrastructure megaprojects (high-speed rail and EV manufacturing).”

In terms of energy sectors, renewables are leading the pack in MENA: Power infrastructure will receive the largest share of energy financing, with planned and committed projects accounting for a total of USD 250 bn by 2025 (USD 175 bn of which is planned). Of that amount, some 40% will be funding renewable energy projects which are expected to add some 3 GW of solar energy across the region by the end of 2021, doubling last year’s production. Over the next five years, Apicorp sees 20 GW of solar energy coming online in the region. Although renewables still face “intermittency” and there is a “lack of utility-grade grid storage solutions,” meaning fossil fuels and nuclear power will continue to be staples in MENA’s energy mix, Jordan, Morocco, and Egypt (albeit “to a lesser extent”) are on track to meeting their renewables targets, Apicorp says.

In Egypt, our renewables ambitions “remain high” but the sector is being held back by regulatory issues, says Apicorp. Renewables in Egypt “still await the resolution of regulatory issues related to its stalled wheeling scheme and the unbundling of its power market.” Our total installed renewables (including solar and wind) capacity currently stands at 2.3 GW, with another “213 MW of solar PV IPP projects under construction, one 250 MW wind IPP project under construction, and 120 MW of wind capacity,” which the New and Renewable Energy Authority (NREA) is building. Further down the pipeline, Egypt has another 2 GW of wind and 1 GW of solar PV projects set to be added to our capacity.

Planned petrochemical investments are also on the up and up, with planned petrochem investments through 2025 coming in at USD 109 bn, up USD 14.2 bn from last year’s five-year outlook. On the flipside, committed investments are down by USD 7.7 bn to USD 12.5 bn, largely because several mega projects — including the Egyptian Refining Company’s Mostorod refinery — were closed out in 2020.

Egypt is the “regional leader” as far as committed petrochemical investments go, with Iran and Saudi Arabia in second and third places. Our placement, Apicorp says, is “owed to its drive to localize its specialty chemical industries and feedstocks import substitution.”

Natural gas isn’t doing as hot: Committed natural gas investments for 2021-2025 are a bit lower than the 2020-2024 period, coming in at USD 75 bn (down from USD 84.5 bn). Apicorp attributes this dip to caution stemming from natural gas oversupply and the completion of several natural gas megaprojects in its portfolio in 2020. The bank sees planned investments in the sub-sector remaining essentially stable at USD 133 bn over the next five years. Qatar, Saudi Arabia and Iraq-based projects will be receiving the bulk of the USD 208 bn allotment which is expected to help position Saudi Arabia as a blue hydrogen net-exporter.

You can read the full report here (pdf).

Your top infrastructure stories for the week:

- Avoiding Ever Given 2.0: Dredging work to expand the New Canal and the southern stretch of the waterway began this week.

- New logistics zones: French shipping company CMA CGM is in talks with Alexandria Port Authority to establish and operate two logistics areas at the port. The company will also operate and manage a new all-purpose terminal at the port that is planned for 2022.

- Bechtel wants in on more of Egypt’s megaprojects: US infrastructure giant Bechtel is looking to expand its business in Egypt, with an eye to get in on more of the country’s megaprojects, including managing new cities.

- Future flow securitization could be a boon for infrastructure: Utilities and public services companies may soon be able to raise capital by securitizing future cashflows, a move which could be used to finance infrastructure spending.

- IEA calls for halting new oil and gas exploration projects: The International Energy Agency (IEA) is calling for an end to new oil and gas exploration to achieve net zero carbon dioxide emissions by 2050 and meet the Paris climate goals.

CALENDAR

16-19 May (Sunday-Wednesday): The Arabian Travel Market (ATM) takes place in Dubai.

17-20 May (Monday-Thursday): Avior-HC Egypt Virtual Conference.

18-20 May (Tuesday-Thursday): Renaissance Capital’s annual MENA Investor Conference.

20 May (Thursday): Integrated Diagnostics Holding shares begin trading on the EGX.

20 May (Thursday): Greek Foreign Minister Nikos Dendias will be in Cairo for talks with FM Sameh Shoukry as part of a three-day regional tour amid the ongoing escalation of the Israeli-Palestinian conflict.

20-28 May (Thursday-Friday): Gouna International Squash Open 2021.

26 May (Wednesday): Final day for Africa-based startups to apply for the French government-sponsored AFD Digital Challenge (pdf).

27-29 May (Thursday-Saturday): Informa Markets’ Nextmove real estate exhibition, Cairo International Convention Center, Nasr City.

30 May (Sunday): Al Mal GTM is organizing the Portfolio Egypt conference under the theme ‘Growth under the weight of the pandemic.’

31 May (Monday): Egypt is hosting Trescon Global’s World AI Show with the support of ITIDA.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday) : The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

15 June (Saturday): EGX-listed will have to complete filing their financial disclosures for the period ended 31 March.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.