- You may be able to register for your covid vaccine as soon as next week. (Covid Watch)

- Galina pushes on with EGP 600 mn stake sale, EGX debut. (IPO Watch)

- Landmark M&A: Hikma eyes GSK’s Egypt business + the first education M&A since foreign ownership limits were scrapped. (M&A Watch)

- Middle East M&A activity plunges 51% in 2020. (M&A Watch)

- Foreign direct investment into Egypt plunges thanks to covid, but we’re still the #1 destination in Africa. (Investment)

- Egypt’s economy will grow at a 2.8% clip this FY -Reuters poll. (Economy)

- Folks under the age of 21 can now open bank accounts without asking mum and dad. (Financial Inclusion)

- Egypt’s data landscape Part II: What’s driving data center growth? (Hardhat)

- Planet Finance

Wednesday, 27 January 2021

Landmark M&As in education, pharma + the inside track on Galina’s stake sale and IPO plans

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people. We made it through another workweek together — and our reward is a three-day weekend. Banks, the EGX and most private businesses are closed tomorrow. We’re also off and will be back in your inboxes at 6am on Sunday.

Make it count, everyone: This is our last day off until some time around 25 April (depending on the whole “Thursday holidays” rule), when we’ll observe Sinai Liberation Day in mid-Ramadan. The Holy Month is set to begin on 13 April.

Your holiday weather looks … brisk. Look for clear skies and a high of 22°C today in the capital today before the mercury plunges to 18°C and stays there until Sunday. Expect overnight lows in the single digits all weekend. The national weather service adds that we can expect high winds starting today, but they’re not calling for a sand storm.

BIG NEWS AT HOME- We have the inside track on food player Galina’s EGP 600 mn stake sale and plans to IPO on the EGX — and some big M&A news, including Hikma’s potential acquisition of pharma major GSK’s Egypt operations and the first acquisition in the education sector since the Education Ministry lifted a 20% foreign ownership cap last week.

WHAT’S HAPPENING TODAY-

The EU’s envoy for the Middle East peace process, Susanna Terstal, is in Cairo today for talks with Foreign Minister Sameh Shoukry, the Foreign Ministry said in a statement yesterday. Egypt has in recent weeks sought to inject new life into the Israel-Palestine peace process, inviting the French, German and Jordanian foreign ministers to Cairo earlier this month where they agreed to push for a revival of talks. President Abdel Fattah El Sisi also made a trip to Jordan to discuss the peace process with King Abdullah II, a few day after Egyptian intelligence officials visited Ramallah for talks with the Palestinian Authority.

A virtual roundtable titled “Competitive Advantages of Sukuk” will feature a headline discussion of a successful sukuk issuance, among other topics. Among the panelists: Our friends Bahaa Alieldean, managing partner at Alieldean Weshahi & Partners and Misr Capital CEO Khalil El Bawab as well as MERIS Ratings’ Amr Hassanein.

IT’S FED DAY: The Federal Open Markets Committee will announce their decision on interest rates / pandemic stimulus later today as the two-day meeting draws to a close. Expect plenty of dovish noises from Chairman Jerome Powell, whose main mission is to convince the markets that there are no plans to let the music stop.

The World Economic Forum’s virtual Davos forum continues today and wraps up tomorrow. Women’s empowerment was the subject of International Cooperation Minister Rania Al Mashat’s address to the gathering yesterday. The minister told attendees that gender parity is at the heart of Egypt’s development and reform agenda and spoke of a three-year public-private sector strategy to promote workplace equality.

The minister is also getting digital ink from Reuters, telling Patrick Werr and Aiden Lewis that affordable financing from development lenders will be used to boost the private sector, improve governance, and achieve a green recovery. “There are venues, very attractive venues, for such financing, not just for government projects but also for private sector projects,” she said.

Mashat’s “go green” message is getting through: The Financial Times notes that Egypt is one of a handful of EM economies that “are drawing up plans to ensure their economic recoveries are environmentally friendly.”

Speaking of development finance: The UAE is on the road to becoming a member of the European Bank for Reconstruction and Development after the board of governors yesterday approved its request to become a shareholder. The country will become a full member of the bank after its membership application has been finalized, though it remains unclear how long the process will take.

Davos in the Desert (yes, we know, we’re not supposed to call it that) kicks off at the Future Investment Initiative in Riyadh today. The gathering wraps up tomorrow.

Sunday is the deadline for employers and self-employed folks to file wage tax returns.

COMING SOON- A brand new building code: Officials are dotting the i’s and crossing the t’s on the new set of building regulations, which will soon be handed to Prime Minister Moustafa Madbouly for approval, cabinet said yesterday. The draft framework is being sent back to local governors over the next three days for a final round of consultations. The government temporarily halted construction permits last year in response to building code violations, and pledged to issue a new building code to prevent illegal construction.

*** Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

|

Egypt will take on defending world champions Denmark tonight at 6:30 pm CLT in the 2021 Men’s Handball World Championship quarter-finals. Egypt and Qatar are the only two non-European teams that made it to the final eight. Qatar faces off against Sweden tonight at 9:30 pm CLT. The remaining two quarter-final games will be Spain vs Norway and France vs Hungary (both of which will also kick off tonight at 9:30 pm CLT).

Remember the draw against Slovenia this week that took the Pharaohs to the quarter-finals? The Slovenes are claiming they got food poisoning right before the game. A Health Ministry medical team in charge of attending to the players denied the allegations.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: Work is underway to expand Egypt’s data center landscape and establish ourselves as a hub. Major developments include state-owned Telecom Egypt building the country’s first hyperscale data center. But what’s driving this growth? Geographic positioning, an abundance of subsea cables, surplus electricity and new data protection laws all have a role to play.

COVID WATCH

Form an orderly line

Members of the public may be able to register to get vaccinated as soon as next week, Mohamed Abdel Fattah, head of the Health Ministry’s Central Administration for Preventive Affairs, told Masaa DMC's Ramy Radwan last night (watch, runtime: 7:14). People will be able to register via a dedicated website that Abdel Fattah expects to go live next week.

But: There’s still no timeline for when the ministry will start distributing shots to the wider public. And we’re also looking for word on how (a) private sector companies and medical offices may be able to get involved in vaccine distribution and (b) how foreign residents can sign up for the jab.

Egypt kicked off its vaccine program on Monday: Citizens can line up for their jabs after the ministry is done inoculating 410k frontline medical staff working at isolation, chest and fever hospitals around the country. Those with underlying health conditions and the elderly will be at the head of the line. The Health Ministry won’t be vaccinating children (pending the results of clinical trials globally) or pregnant women.

The Health Ministry reported 643 new covid-19 infections yesterday, down from 669 the day before. The ministry also reported 55 new deaths, bringing the country’s total death toll to 9,067. Egypt has now disclosed a total of 163,129 confirmed cases of covid-19.

The politics of vaccine distribution are starting to get heated, after the EU blasted AstraZeneca for delaying deliveries and lashed out at the US’ export restrictions, reports Bloomberg. German Chancellor Angela Merkel is demanding Europe also block the export of vaccines as shortages threaten to disrupt national vaccination campaigns.

IPO WATCH

Galina pushes on with EGP 600 mn stake sale, EGX debut

Galina attracts local, international investor interest in EGP 600 mn stake sale, plans to offer 10% in EGX debut: Agrifoods player Galina Holding has lined up at least 10 foreign and local institutional investors interested in participating in a private placement that will see the company sell a 49% stake ahead of listing on the EGX, Chairman Abdel Wahed Soliman told Enterprise.

What’s the plan? The company will issue 161 mn new shares to investors, aiming to raise around EGP 600 mn to fund its expansion plans, Soliman told us. The sale will then be followed by an initial public offering in which the company will float at least 10% from both the new and existing shares on the EGX, he said.

Who’s interested? Prospective investors domiciled in the United States, UK and Germany, Soliman told us, without disclosing further details. Soliman previously said that unnamed private equity funds from France, the UAE, Kuwait, Egypt are also interested.

T-minus five months: The private placement is expected to close by June 2021 if ongoing due diligence wraps up before March, Soliman said. As soon as due diligence is complete, Galina will tap law firm Baker McKenzie’s Cairo office as legal advisor, and Baker Tilly will do the fair value report, Soliman says. The company has tapped Renaissance Capital to quarterback the transaction.

Galina had previously been hoping to complete the placement in 1Q2021. But the implications of covid-19 and travel restrictions in some of the countries where the prospective investors reside delayed the process, Soliman told us. The company had been looking at a way to raise capital for expansion, including a potential EGX listing, since 2018.

Galina will use the proceeds to finance the construction of its second factory in Alexandria, as well as set up storage spaces for exports to the US and Europe, Soliman told us. The planned factory, which will produce new products including a veggie burger, is expected to cost EGP 200 mn, and be up and running in 2023. Of the remaining 400 mn in proceeds from the sale, 150 mn will be added to share capital and 250 mn set aside to support liquidity and future investments.

Further down the line, the company has an eye for more exports and local expansion. It wants to grow exports to EGP 500 mn this year, from EGP 300 mn in 2020, and to EGP 1 bn by 2025, Soliman said. The company is owed upward of EGP 37 mn in export subsidies from the government, and has no plans to take out debt to finance its expansion plans. Locally, Galina is looking to set up a restaurant chain to serve plant-based meat alternatives, starting with branches in Alexandria then in Cairo, and partner with young entrepreneurs under a plan to eventually set up 1k retail franchises for its products.

Who else is plotting an upcoming listing (brought to you by the Enterprise IPO Tracker™)? CI Capital’s Taaleem and non-banking financial services firm Ebtikar are both considering a 1Q IPO, while consumer healthcare play IDH has hinted at a dual listing during the first six months of the year. State-owned payments platform e-Finance also has in store an IPO expected to hit the ground in 2Q2021.

M&A WATCH

Landmark M&A in pharma, education

The week ends with news of two landmark acquisitions, one each in pharma and education.

LSE-listed Hikma Pharma plans to buy a 91.2% stake in GlaxoSmithKline’s pharma and manufacturing business in Egypt, according to an EGX disclosure (pdf). The transaction would be subject to the completion of due diligence — which GSK’s board must now approve — as well as regulatory approvals, and would take place following Hikma’s submission of a mandatory purchase offer of 100% of GSK’s Egyptian arm. The non-binding term sheet signed by both companies also includes a potential acquisition of GSK’s Tunisia business. A timeline for the acquisition, or the potential value of the purchase were not disclosed. Reuters also took note of the story.

ALSO- We have the first education acquisition since the ministry lifted the 20% foreign ownership cap: Mauritius-based Olympus Victory has acquired Al Rowad International School for an undisclosed sum, advisors Matouk Bassiouny & Hennawy announced in a statement (pdf) yesterday. Olympus is the foreign shareholder and owner of Kaumeya Language Schools. Matouk Bassiouny’s Islam Saeed (partner and head of the education group) led the transaction with an assist from associate Yara Ghoneim.

WATCH THIS SPACE- SFE + ADQ announcing new investments this quarter: The USD 20 bn investment platform Egypt and the UAE set up back in 2019 through the Sovereign Fund of Egypt and ADQ (formerly known as Abu Dhabi Holding Company) will announce a number of new joint investments by the end of 1Q2021, Planning Minister Hala El Said in a statement yesterday. El Said discussed the platform with SFE boss Ayman Soliman and ADQ Egypt CEO Mohamed Al Suwaidi.

M&A WATCH

Mideast M&A activity picked up in 2H2020, Egypt is #2 for outbound transactions

The value of M&A activity in the Middle East nosedived 51% y-o-y to USD 58.7 bn in 2020 as M&A volume fell 13% y-o-y. Just 423 transactions were announced last year, according to a report from Baker McKenzie. The rate of decline in the region outpaced the global average, which saw transaction value dip 6% y-o-y and volumes drop 5%. In the Middle East, M&A picked up in the back half of the year (but the number of transactions still remained marginally lower than 2H2019 numbers), largely buoyed by a 56% y-o-y surge in agreements in November.

The majority of M&A in the region in 2H2020 was cross-border, which accounted for 147 agreements worth USD 9.9 bn compared to 157 agreements worth USD 10.4 bn for the same period in 2019. Meanwhile, a total of 73 domestic agreements worth USD 4.6 bn went through, up from 68 M&A totaling USD 3.7 bn.

Egypt ranked second for outbound transactions in both the full year as well as 2H2020. The US ranked first in both outbound and inbound cross-border M&A, with 19 inbound transactions worth USD 14.1 bn and 40 outbound agreements totaling USD 5.2 bn during the year..

The technology sector was the top target for inbound investments, followed by financial services, while energy and real estate topped the charts for the highest value of inbound investments.

The region could bounce back in 2021 as covid-19 subsides: “The megadeals we’ve seen in some sectors such as high technology, financial institutions, energy and power and real estate have shown that there is interest in the region” says Omar Momany, Partner and Head of the Corporate M&A Practice Group at Baker McKenzie Habib Al Mulla Dubai, adding that he expects the region to make a comeback and more M&A activity to occur.

INVESTMENT

Egypt is still Africa’s top FDI destination despite covid

Foreign direct investment into Egypt fell 39% in 2020 as fears over the coronavirus pandemic caused a historic drop in global investment flows, according to the United Nations Conference on Trade and Development’s (UNCTAD) most recent Investment Trends Monitor (pdf). Egypt attracted USD 5.5 bn of FDI last year, down from USD 8.5 bn in 2019, in what was a sharper drop than the 32% average among North African economies and 18% dip across Africa. Despite this, Egypt remained the top destination for FDI on the continent.

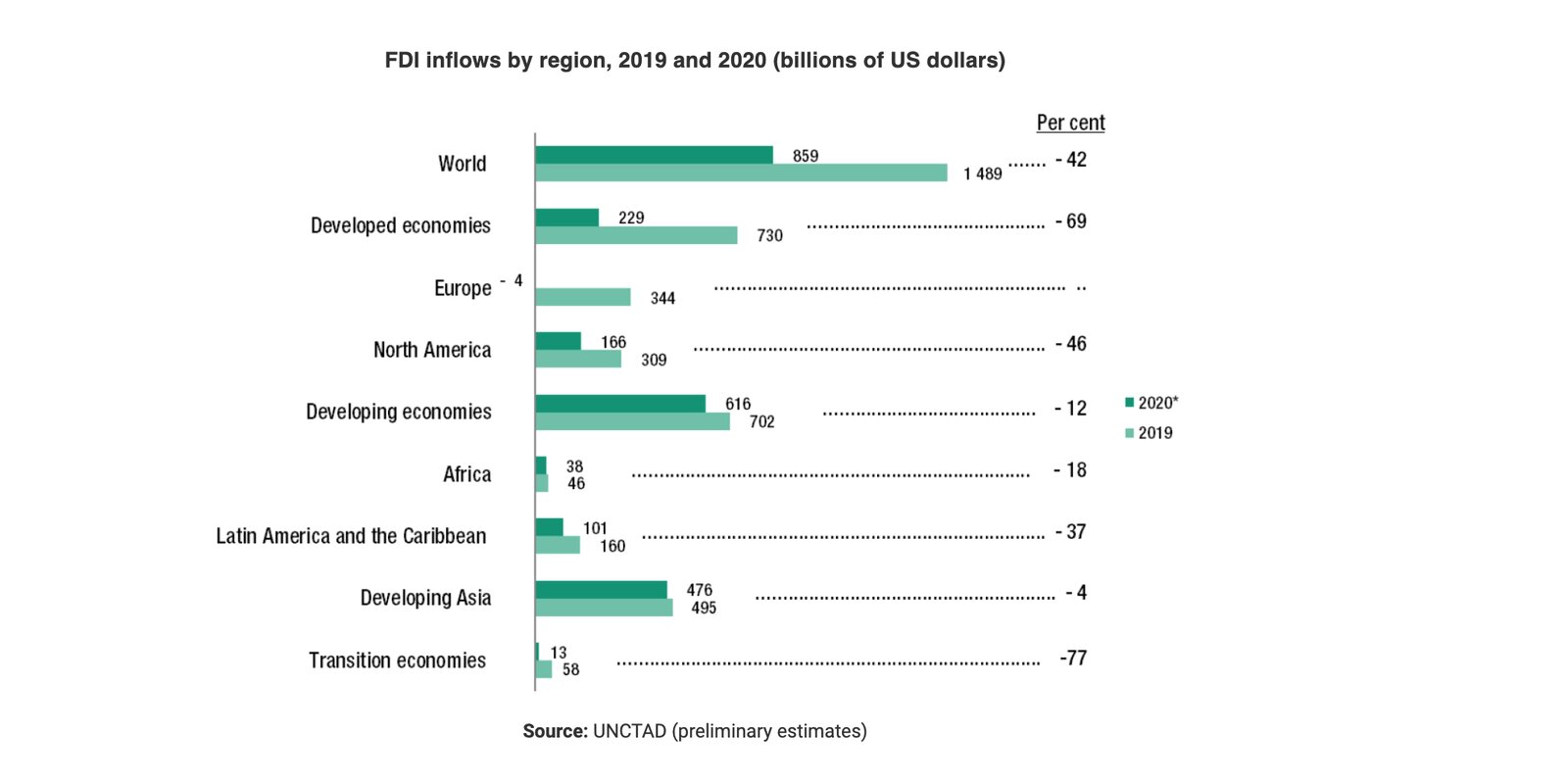

Developing economies got off fairly lightly, seeing a 12% fall in FDI during the year. This compares to the 42% decline in global flows (amounted to some USD 630 bn), which was slightly worse than UNCTAD’s projection for the year made in October. To put that in context: That’s 30% lower than the nadir seen in the aftermath of the global financial crisis.

The pain was felt most by advanced economies in Europe and the US, which saw a 69% plunge in inflows. Overall, developing economies still account for the bulk of global inflows, reaching a record 72%.

FDI will remain weak in 2021 due to low greenfield finance announcements last year—which fell by about 63% in Africa and 46% for developing economies — and continued uncertainty over the rollout of covid-19 vaccines. Growth in 2021 is expected to largely come from less productive cross border M&A — particularly in tech and healthcare — rather than new projects. And as for new industrial investment: the outlook “does not bode well,” the report says.

ECONOMY

Egypt’s GDP to grow 2.8% this FY + IMF is out with a more optimistic global forecast

Egypt’s economy will grow at a 2.8% clip in FY2020-2021, according to a Reuters poll of economists. This is a downwards revision from the 3.3% growth economists predicted in the last poll the newswire conducted in October. The forecast sits at the lower end of the Finance Ministry’s most recent GDP growth target range, which it set at 2.8-4.0%. The poll’s expectations are also on par with the IMF’s most recent growth outlook for Egypt.

The downgrade is attributed to the downturn in the tourism industry, which was also the key factor for muted growth economists cited in the October poll. HC Securities’ Monette Doss points to expectations of “weak tourism receipts” through the rest of the fiscal year as being “the main drag on the economy.” Some 3.7 mn tourists visited Egypt in 2020 — a 75% y-o-y drop from a record 13 mn in 2019.

A rebound in growth over the next two fiscal years is still in the cards, the economists predict, albeit at a slightly lower rate in FY2022-2023 than they previously expected. The economy is still on track to grow 5% in FY2021-2022, and will expand at a 5.4% clip the following fiscal year — down from the most recent forecast of 5.5%.

Private-sector investment will drive growth, spurred on by lower rates and higher public spending, Doss says. The economists predict that the central bank’s overnight lending rate will be cut 100 bps to sit at 8.25% by the end of June 2021, remaining steady until June 2023, when the central bank could raise rates by 25 bps to 8.50%.

Inflation is still expected to decelerate in FY2021-2022 before rising over the next two years: Economists now expect annual urban consumer price inflation to come in at 5.6%, two percentage points weaker than the last time around, but have held firm on their expectation that inflation will come in at 7% in FY2022-2023 and FY2023-2024.

And the EGP is seen sliding less than before: The currency is now expected to hover at EGP 16.11 to the greenback by December 2021, from its current EGP 15.67, rather than EGP 16.50 as in the previous poll. In 2022 economists see the currency weakening further to EGP 16.63, but this is also a more upbeat forecast than the previous poll.

And as for the rest of the world …

The IMF sees the global economy mounting a more rapid recovery this year after last year’s smaller-than-expected contraction. In its updated World Economic Outlook, the fund see the world economy growing 5.5% in 2021 — 0.3 percentage points higher than its expectations three months ago — “reflecting expectations of a vaccine-powered strengthening of activity later in the year and additional policy support in a few large economies.” Growth forecasts for next year are now at 4.2%.

Emerging markets will grow 6.3% in 2021, the fund says, up from its last forecast of 6.0%.

Thanks to a low base effect, we’re going to see EM-type growth from the US of A, with the Biden administration on track to claim 5.1% growth in 2021.

But we’re not out of the woods: The ongoing second wave of covid and the emergence of new strains of the virus will dampen many economies in 1Q2021. Tap / click here to read the full report (pdf).

ENERGY

A nice present for Valentine’s Day

The first test shipment out of Damietta’s LNG plant will be sent out on 14 February as Italy’s Eni takes over the plant’s operations from Spain’s Naturgy under the terms of an agreement between the two companies and the Egyptian government, S&P Global reports. Under the new agreement, Eni will hold a 50% stake in the Spanish Egyptian Gas Company (SEGAS) — owner of the Damietta plant — while state owned EGAS will hold 40%, with the remaining 10% held by the Egyptian Gas and Petroleum company (EGPC). The test shipment will be the first step towards adding Damietta’s exports to the Shell-operated Idku plant — Egypt’s sole LNG exporter — and boosting Egypt’s ability to export gas to European markets.

Exports at the Idku plant are up: Seven cargoes have been shipped from the Idku plant since the start of 2021, compared to 6 cargoes in 1Q2020, according to data obtained by S&P from trade flow software cFlow. Exports had already begun picking up in 4Q2020 with 17 cargoes shipped to mostly China, India and Turkey. Exports from Idku were halted in March 2020 as global gas prices plunged — with only one tanker leaving the facility between March and July — though exports resumed last October.

IN OTHER ENERGY NEWS- ADES SAE has signed a six-month drilling agreement in the Gulf of Suez with an unnamed “top tier” client, with the option of extending the contract for another six-month period.

FINANCIAL INCLUSION

Hey kids, want a bank account?

SMART POLICY- Folks under the age of 21 can now open bank accounts without their parents or guardians’ consent, the Central Bank of Egypt (CBE) said in a statement cited by state news agency MENA. Banks were directed to give those aged between 16 and 21 access to a limited number of banking services in a move the central bank hopes will increase the rate of financial inclusion.

Meanwhile, SMEs and agriculture players are being pushed further towards the digital light with a digital platform the Central Bank of Egypt (CBE) is working to set up to provide non-financial services, such as accounting, marketing, HR, and procurement support, CBE Governor Tarek Amer said. The platform could also help link different players in the agriculture industry to streamline their commercial operations, Amer said, without providing further information.

DEBT WATCH

Misr Italia, City Edge lining up securitized issuances worth a combined EGP 1.6 bn

Al Taamir for Securitization is gearing up to take to market securitized bonds for Misr Italia and City Edge worth a combined EGP 1.6 bn, Al Taamir Chairman Mazen Hassan tells Hapi Journal. City Edge is on track for an offering of about EGP 600 mn, backed by 200 units the company has sold in its Etapa project in Sheikh Zayed, as early as April. Misr Italia are eyeing a separate EGP 1 bn issuance backed by completed units at its Bosco and Cairo Business Park projects at the new administrative capital, Kai Sokhna development and the La Nova Vista Compound in New Cairo. Misr Italia hasn’t said anything about its timeline. Al Taamir is a special purpose vehicle set up by the New Urban Communities Authority.

ALSO FROM THE WORLD OF DEBT-

CIB signed a cooperation protocol with City Edge that will see the leader private sector bank provide up to EGP 1 bn for the developer’s mortgage scheme, CIB’s Assistant Vice President of Real Estate Ahmed Samaha told Enterprise. City Edge clients will be offered various mortgage finance options from CIB as part of the Central Bank of Egypt’s (CBE) EGP 50 bn mortgage finance program launched last year, City Edge Chairman Ashraf Salman said.

DIPLOMACY

And so it begins?

More pressure on human rights could be coming from the US Congress: Two members of Congress formed a “Egypt Human Rights Caucus” to mark the 10th anniversary of the 25 January Revolution. The lawmakers behind the group — ex State Department officials Don Beyer and Tom Malinowski — say they will work to build bipartisan support to increase pressure on the Egyptian government.

Biden concerns: US President Joe Biden talked up human rights on the campaign trail, raising concerns in the process about close ties Egypt enjoyed under Trump. These were heightened by the appointment of Anthony Blinken to the top foreign policy job in the new administration: Blinken has in the past been critical about Egypt’s human rights record, and US insiders have suggested that the White House could apply direct pressure on Egypt.

All of this was too much for Ala Mas’ouleety’s Ahmed Moussa, who attacked the Egyptian National Council for Human Rights for its silence towards the moves in the US and demanded that the Foreign Ministry mount a stronger response (watch, runtime: 3:05).

LEGISLATION WATCH

Tourism companies get legislative boost with new amendments

Proposed amendments to the Tourism Licensing Act are now out for public consultations, with Tourism Minister Khaled El Enany meeting earlier this week with the head of the Egyptian Tourism Federation and other industry stakeholders to discuss the bill, according to a cabinet statement. The amendments are designed to modernize tourism companies to bring them up to par with contemporary services, the statement says without providing further details.

ALSO FROM IN THE HOUSE–

- The creation of an online portal to reserve Umrah trips earned a preliminary nod from the House Tourism and Civil Aviation Committee, reports the local press.

- Ministries and state-affiliated bodies will soon need to remit 20% of their VAT dues and 100% of schedule taxes to the Tax Authority within 10 days of a transaction under legislative changes approved by the House Planning Committee yesterday, according to Al Mal.

- Draft amendments to a law that regulates committees that resolve disputes to which ministries and state-owned companies are party were approved by the House Legislative Committee yesterday. The changes restrict the work of those committees to disputes between a ministry or a state-owned firm and their employees.

- A bill to set up an authority to protect lakes and fisheries was also approved “in principle” by the House Irrigation and Agriculture Committee, reports Masrawy.

STARTUP WATCH

Isqan.com raises USD six-figure seed round

Egyptian real estate listings platform Isqan.com has raised a six-figure USD seed investment from Egygab Holding CEO Mohamed Gaballah, according to a statement (pdf). Isqan.com, which was founded four months ago, plans to use the investment to grow its team and product offerings. The company is looking to “digitize the entire real estate industry in Egypt” through a comprehensive database of listings that users can search through. Isqan is eyeing another financing round towards the end of the year to continue expanding, the statement says.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

GERD was top of Foreign Minister Sameh Shoukry’s agenda yesterday when we addressed MPs, telling them that finding a way through the stalemate is the country’s top foreign policy goal. The minister stressed the importance of reaching a binding legal agreement with Sudan and Ethiopia over the dam, laying the blame at Ethiopia’s doorstep for acting “unilaterally and intransigently.” Masaa DMC's Ramy Radwan phoned MP Tarik El Khouly, who praised Dhoukry for enhancing Egypt's position on the international stage (watch, runtime: 13:22).

Elsewhere on the airwaves last night:

- CMA CGM contender for Alex port project: French shipping company CMA CGM could be interested in taking charge of the new Alexandria port terminal, the CEO of the company told President Abd El Fattah El Sisi in a meeting yesterday (Al Hayah Al Youm | watch, runtime: 4:50).

- 25 January Revolution: Bibliotheca Alexandrina chief Mostafa El Feki discussed the changes in the Egyptian political scene 10 years after the revolution (Yahduth Fi Misr | watch, runtime: 3:58 | 3:46).

ALSO ON OUR RADAR

Former Tax Authority head Abdel Azim Hussein will be put on trial at a criminal court to face charges of corruption, reports Ahram Gate. An investigation into Hussein and five of his associates found evidence that he accepted bribes, leading the public prosecutor to refer him to trial. Hussein was arrested last year on what appeared to have been a sting operation.

The Egyptian Airports Company is planning a EGP 1 bn expansion project at Sphinx International Airport to boost its capacity to nine flights and 900 passengers per hour. Meanwhile: French renewables player Voltalia increased its solar-generated electricity production in Egypt fivefold to 76.5 GWh in 2020, it said in its earnings statement (pdf).

EGX-listed snackfoods giant Edita has launched its Molto Mini Magnum product as part of the company’s strategy “to migrate consumers towards higher price-points,” according to a company statement (pdf). Molto Mini Magnum is available in the chocolate and hazelnut cream flavor, and forms

PLANET FINANCE

The EGX30 rose 0.1% yesterday on turnover of EGP 1.7 bn (19.5% above the 90-day average). Foreign investors were net sellers. The index is up 6.3% YTD.

In the green: Dice (+6%), Pioneers (+4.1%) and Juhayna (+3.9%).

In the red: Orascom Development Egypt (-3%), Oriential Weavers (-1.2%) and Madinet Nasr Housing (-1.2%).

Asian markets are mostly in the red this morning following a steep sell-off on Tuesday. US and major European indices look to follow them later today ahead of the Federal Reserve meeting.

|

|

EGX30 |

11,527 |

+0.1% (YTD: +6.3%) |

|

|

USD (CBE) |

Buy 15.68 |

Sell 15.78 |

|

|

USD at CIB |

Buy 15.67 |

Sell 15.77 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,789 |

-0.65% (YTD: +1.15%) |

|

|

ADX |

5,582 |

-0.63% (YTD: +10.65%) |

|

Down |

DFM |

2,698 |

-0.93% (YTD: +8.27%) |

|

|

S&P 500 |

3,849 |

-0.15% (YTD: +2.49%) |

|

|

FTSE 100 |

6,654.01 |

+0.23% (YTD: +2.99%) |

|

|

Brent crude |

USD 55.91 |

+0.05% |

|

|

Natural gas (Nymex) |

USD 2.65 |

-0.19% |

|

|

Gold |

USD 1,853.30 |

-0.08% |

|

|

BTC |

USD 32,600.59 |

+0.65% |

Egypt’s data landscape Pt II: What’s driving data center growth? Late last year Hardhat looked at Egypt’s existing data infrastructure, and found that its current cluster of data centers is not enough to transform it into a regional — or even global — data hub. This could be changing though, with Telecom Egypt set to start work on Egypt’s largest center and several international firms establishing facilities of their own. Egypt itself is playing an important role in the African data center market, which is expected to grow at double the rate of the global average by 2025. But what is driving this growth?

We have major data centers under construction, including the New Capital facility being built by Orange — which is set to host over 400 servers — in cooperation with industry vendors including Dell EMC, Cisco, and Nokia, Orange Egypt’s Chief Enterprise Line of Business Officer Hisham Mahran tells Enterprise.

One of these — state-owned TE’s Smart Village data center — would be considered hyperscale, says one source speaking off the record, adding that it will be Egypt’s only hyperscale data center once it’s up and running. The data center is expected to be commissioned in early 2021, and will have access to all the global submarine cable systems that land in Egypt. It’s set to have 1600-2000 racks, but TE hasn’t disclosed how many servers it will house. Hyperscale facilities usually have a minimum of 5000 servers linked with an ultra-high speed, high fiber count network. They require at least 1000 racks (approximately four megawatts of electricity), another source previously told Enterprise.

More hyperscale data centers are exactly what Egypt needs to become a data hub, sources indicate. They’re essential for attracting Cloud Service Providers (CSPs) and OTTs (streaming media services offered directly to viewers via the internet).

Meanwhile, TE’s future plans span investment in infrastructure, and more international partnerships, the company says. TE is investing in new subsea landing stations and crossing routes, and new subsea stations, the company says, without giving details on the size of these investments. It plans to have 12 landing stations and 12 diversified routes by 2022 — up from the 10 stations and routes it already owns and operates — as well as setting up international nodes (connection points) in countries including Jordan, Singapore, Italy, and France.

And hosting content: TE plans to set up more colocation data centers, in addition to the six it currently owns and operates. And it intends to set up more partnerships with global organizations, similar to its existing partnership with Microsoft offering Egypt Azure cloud services, and sign more agreements like its existing ones with Subspace, Zenlayer, and Wangsu Science & Technology, to deliver online content.

Egypt already has some significant advantages driving overall data center growth, which could encourage more companies to set up hyperscale data centers here:

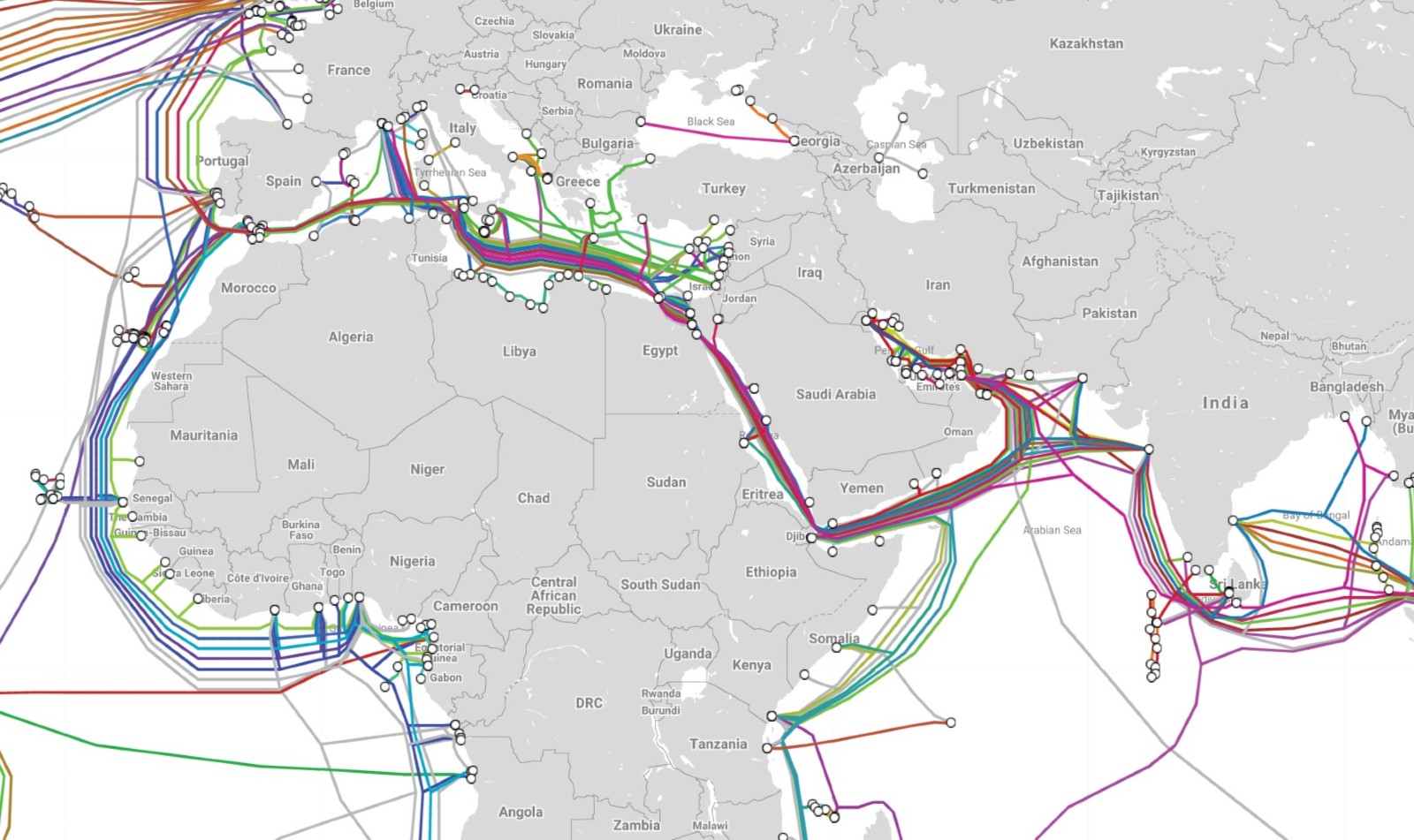

#1- “Ideal” geographic positioning: Egypt links Europe with Asia, so data traffic currently has to pass through us to get from one continent to the other. Under the right circumstances, this could make Egypt the Suez Canal of data traffic, say multiple sources, including former ICT Minister Khaled Negm. “Egypt is a prime location for potential hyperscale data centers,” says Sherif Elmasry, managing director of tech company Cornet Elevated.

#2- Our abundance of internet submarine cables: A total of 13 subsea cables land in Egypt, and data then crosses the country through the 10 subsea landing stations and 10 diversified land routes owned and operated by TE. As an internet subsea cable hub, Egypt is the natural conduit for data traffic, which could enable us to become a data hub, says Youssef Amin, market data director at Egypt for Information Dissemination (EGID), a joint venture between the Egyptian Exchange (EGX) and NASDAQ, which owns and operates one of Egypt’s 13 colocation centers. Subsea cables are usually owned by telecom operators, or sometimes by content providers like Facebook and Google, with smaller players renting bandwidth. The large number of subsea cables passing through Egypt should allow us to bolster capacity and bandwidth, we reported in July 2020.

#3- TE’s participation in projects like the 2Africa submarine cable project: TE is teaming up with seven other big-name parties to lay a giant 37k-km subsea cable — one of the world’s largest — linking Europe (via Egypt), the Middle East (via Saudi Arabia) and 16 countries in Africa. TE is present in over 60 countries, delivering “a complete range” of telecom services across continents, representatives tell Enterprise. In 2018, TE signed an agreement with Liquid Telecom to complete a fiber optic network to connect southern African countries with the rest of the world. It also signed an MoU to expand and service submerged fiber optic cables in the region. And a recent agreement between TE and Google (pdf) will grant Google capacity on TE’s Mediterranean submarine cable, TE North. The project is expected to go live in 1H2021.

#4- Surplus electricity and the relative affordability of data center construction: Egypt’s surplus electricity offers ample resources for energy-intensive operations like data centers, says Amr Farouk, who heads up the Future of Data Centers summit. Electricity generation capacity stands at around 58 GW, but peak demand ranges from 30-32 GW. Egypt can also provide cost-effective technical and operational support to data center construction, Farouk adds.

#5- New data protection laws: Laws covering data protection and cybercrime are important in attracting investors, and with the recent ratification of the Data Protection Act, Egypt now has that vital legal framework, Farouk believes.

But will this be enough to fulfil Egypt’s data hub ambitions? Not alone, say sources. So far, the landscape is still too small to be a hub. The only way to leverage our advantages is by making the infrastructure more cost-effective and reliable — in part, through private sector-government partnership, they argue. We discuss this in detail next week.

Your top infrastructure stories for the week:

- A project to locally assemble electric vehicles should be announced today with the Military Production Ministry teaming up with an unnamed international company.

- Greece’s Energean is planning to invest USD 235 mn to develop the North Amriya and North Idku concessions offshore Egypt.

- Egypt is getting a slice of CDC Group’s planned USD 1 bn investments in Africa in 2021, with the group eyeing infrastructure and finance investments.

- Egypt has recently added 28 GW to its electricity generation capacity, bringing surplus output to upward of 25%, Electricity Ministry spokesperson Ayman Hamza said on the airwaves this week (watch, runtime: 6:59).

- Hassan Allam Holding has landed contracts for seven projects in infrastructure, water and wastewater treatment that will be implemented in villages spanning five governorates.

- Egypt’s ADSL speed of 34.88 Mbps ranked us at 92 out of 176 countries, while our mobile internet speed was recorded at 20.42 Mbps, leaving us at 102 out of 139 countries.

CALENDAR

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship in four venues in Alexandria, Cairo, Giza and the New Capital.

25-29 January (Monday-Friday): The World Economic Forum’s Davos Agenda (virtual).

27-28 January (Wednesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

27 January (Wednesday): Roundtable on the “Competitive Advantages Of Sukuk.”

28 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

31 January (Sunday): The deadline for businesses to electronically submit their annual tax return to the Egyptian Tax Authority.

4 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 February (Friday): Deadline to reach a settlement with the Tax Authority on overdue income, value-added, or real estate taxes without all the late fees. Late taxpayers are still eligible for a 50% exemption on interest fees and late penalties until 12 February under a bill passed last year, Tax Authority boss Reda Abdel Kader said.

6-18 February (Saturday-Thursday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC)

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

31 May-2 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo.

30 May-15 June (Wednesday-Thursday): Cairo International Book Fair.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June (Wednesday): June 30 Revolution Day

1 July: (Thursday): National holiday in observance of 30 June Revolution

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday)

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday)

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 October (Friday): Expo 2020 Dubai opens

6 October (Wednesday): Armed Forces Day

7 October (Thursday): National holiday in observance of Armed Forces Day

18 October (Monday): Prophet’s Birthday

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.