- Our first covid vaccine shipment is here. (Covid Watch)

- Egypt’s natgas transition is in line for a boost. (Energy)

- With USD 6.6 mn, Egypt ranks third in November MENA startup funding -Wamda. (Startup Watch)

- Will 2021 be a boom year for IPOs on the EGX? (What We’re Tracking Today)

- Nassef Sawiris’ NNS Group wants a bigger piece of the New York Knicks + Rangers owner. (M&A Watch)

- Food prices drive inflation to a five-month high. (Economy)

- More changes coming to the new Customs Act? (Legislation Watch)

- Are investors finally seeing EMs as more than different shades of beige? (Planet Finance)

- Emerging markets will likely have a better 2021 than developed economies -Mark Mobius. (What We’re Tracking Today)

- Planet Finance

Sunday, 13 December 2020

Our first shipment of a covid vaccine has landed.

TL;DR

WHAT WE’RE TRACKING TODAY

We’ve got 19 days left until the end of 2020, and the end-of-year the news slowdown isn’t anywhere in sight as a dearth of corporate news over the weekend was more than made up for by news on the covid front and a looming deadline for a Brexit trade agreement that’s keeping things interesting with two of our largest trade and tourism partners.

Egypt became the first African nation with a ready-to-go vaccine for covid-19 after receiving the first shipment of China’s top jab late Thursday night, the Health Ministry announced. Egypt was among the countries participating in clinical trials for Sinopharm entry, which has shown to be 86% effective in fighting the disease. We have chapter and verse in this morning’s Covid Watch, below.

And it’s decision day for Brexit as both European Commission chief Ursula von der Leyen and UK PM Boris Johnson said it was unlikely the two would agree on a trade pact by today’s deadline. Business competition rules and fishing rights are the main sticking points.

CIRCLE YOUR CALENDAR- The legislative branch of government will wake from its slumber this week.

Up first: The final results for parliamentary elections held in Cairo and 11 other governorates will be announced tomorrow.

The current crop of MPs meets again on Tuesday when the House of Representatives reconvenes from its fall recess.

Also on Tuesday: The US Federal Open Market Committee kicks off its two-day policy meeting to review interest rates. Here at home, the Central Bank of Egypt will meet to do the same on Christmas Eve.

PSA- The weather is probably going to suck this week. There’s no more polite word for it. Look for sand and blowing dust across Cairo today and tomorrow, the Egyptian Meteorological Authority said, according to a cabinet statement, and for scattered rain along the North Coast.

Our favorite weather app is predicting a high today of 29°C in the capital city before the mercury eases to 20-21°C for much of the rest of the week. Look for a chance of a shower on Tuesday and up to 3mm of rain in Cairo on Wednesday.

|

ON THE GLOBAL FRONT, EM sage Mark Mobius sees good things for emerging markets in 2021: Developing countries are expected to outperform developed nations in 2021 as vaccines become more widely distributed early next year, veteran fund manager and EM investment guru Mark Mobius said at the Reuters Global Markets Forum in Dubai late last month. This will be the outcome of the positive knock-on effects of the vaccine, while developed markets are expected to continue to struggle to prop up their economies in 2021 as they had been in 2020, he said.

What’s top of mind for the man who literally invented EMs as an asset class?

- Top countries: “India and China are the big ones for us now, but a lot of these other countries like South Korea and Taiwan are very significant; and then if you go to Turkey and South Africa, prospects are very good in a year or two from now.”

- Top sectors: “Sectors, including healthcare and education, that use technology effectively will be among the best performing in 2021.”

- ESG investing to shine in 2021: Sustainable investing, especially corporate governance, will become even more critical in the context of a post-pandemic recovery.

Planet Startup saw its most lucrative year on record for IPOs. More than USD 157 bn has been raised in 2020 as of Thursday, with a third of that coming in the past 11 weeks, according to the Wall Street Journal. By number of listings, it was the biggest IPO year since 2000.

But wait, it’s 2020 — things could always take a turn for the worse. That’s the take-home message from the FT in Wall Street IPO bonanza stirs uneasy memories of 90s dotcom mania. The salmon-coloured paper thinks things are looking a bit frothy, but the head of global internet investment banking at Goldman Sachs thinks “the super cycle will continue,” saying there are more than 70 companies waiting in the wings that could be worth at least USD 5 bn apiece.

Extreme pops in first-day trading of DoorDash and Airbnb appear to have prompted at least two companies to postpone their IPOs, the WSJ reports, saying that point-of-sale lender Affirm and videogame outfit Roblox have both put their listings on hold.

Will 2021 be a boom year for IPOs on the EGX?

We hope just a tiny bit of that frothiness spills over into Egypt to fuel the resurgence of our IPO market in 2021. Among others, potential listings next year include CI Capital’s education platform Taaleem, NBFS player Ebtikar, and state-owned football club Ghazl El Mahalla, all of which could sell shares as early as 1Q2021. Perennial IPO candidates Banque du Caire and E-Finance are also waiting in the wings, and LSE-listed consumer healthcare company Integrated Diagnostics Holdings (IDH) said last month it is considering a dual listing of ordinary shares on the EGX. Agri outfit Galina Holding and Arabia Investment Holding’s financial services arm are also said to be considering tapping the market.

A new entrant in the IPO sweepstakes: Cottonil is considering going public next year, Chairman Basil Samakia told Masrawy, without disclosing any further details on the size or expected value of the offering. Samakia added that the company plans to open 50 new branches this coming year.

Not heading to IPO soon: Qalaa Holdings energy play TAQA Arabia, which had previously planned to list 30-40% of its shares. Qalaa is also unlikely to go ahead with its plan to take public ARC, the parent company of its Egyptian Refining Company, given where oil prices are right now.

Now THAT’S how you do a start-of-trading ad: A subtle entry from Airbnb to mark the debut of its shares (watch, runtime: 1:11).

COVID WATCH

We just got our first shipment of a covid vaccine

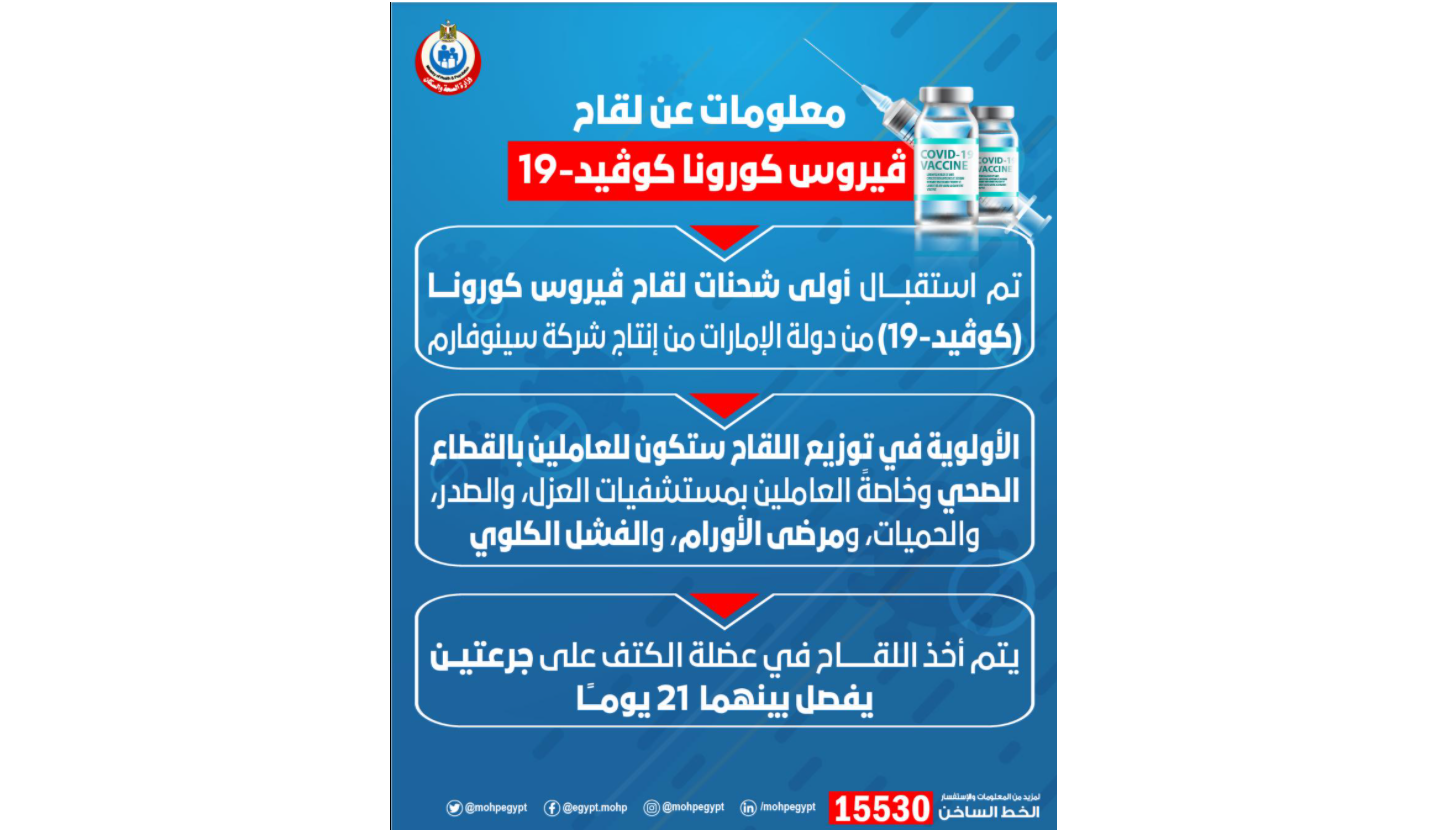

Egypt began receiving shipments of China’s Sinopharm vaccine on Thursday night by way of the UAE, Health Minister Hala Zayed announced at a presser. This is the first of several shipments that Egypt is due to receive of the Chinese vaccine, clinical trials for which showed an efficacy rate of 86%, Zayed said. Egypt and the UAE were among the nations that held clinical trials for the job, and Health Ministry scientists have signed off on the use of the vaccine. Its emergency use has been approved by the WHO, said Information Minister Osama Heikal in a statement on Friday.

Zayed herself was part of the clinical trials for the Sinopharm offering, rolling up her sleeve for the cameras to take the needle.

President Abdel Fattah El Sisi has ordered that the vaccine be distributed without charge to all Egyptians, Heikal’s statement added.

How will the vaccine be distributed? The vaccine will first be administered to frontline health workers, particularly in hospitals, isolation wards, and respiratory clinics, according to a Health Ministry statement on Friday. Next up on the priority list are those who are most at risk of severe covid symptoms, including cancer patients, and those suffering from organ failure, the statement noted. It did not give a timeline on when the vaccine will be distributed to the next tier of recipients or the wider population.

It’s a two-stage jab, just like AstraZeneca’s: The Sinopharm vaccine is administered in two jabs 21 days apart, each administered to the upper arm.

We could start making the vaccine ourselves, Zayed said in a phone-in to DMC on Friday. Financial negotiations over a production license are underway and Egypt has already established a production line for the vaccine at state-owned vaccine maker Vacsera, the minister said, with an eye to potentially exporting the vaccine to other African countries.

The government will also be launching a vaccine registration website in the coming days through which citizens can check the availability of and register for receiving the vaccine, Zayed told DMC, though no further details were provided on whether registration through the site would be mandatory or how exactly it would function.

Egypt is still lining up an arsenal of doses that includes jabs from AstraZeneca (the “Oxford” vaccine) as well as Russia’s Sputnik V.

AstraZeneca will combine its covid-19 vaccine with Russia’s Sputnik V in clinical trials that will determine whether they are more effective when mixed together, according to Bloomberg. The trials could begin before the end of the year. The AstraZeneca/Oxford University vaccine is between 62-90% effective, while Sputnik V has a reported 92% efficacy.

The news comes as the official covid-19 case count continues to rise. The Health Ministry reported 478 new covid-19 infections yesterday, up from 464 cases on Friday and 445 on Thursday. Egypt has now disclosed a total of 121,089 confirmed cases of covid-19. The ministry also reported 21 new deaths yesterday, 23 on Friday, and 22 on Thursday, bringing the country’s total death toll to 6,898.

Meanwhile, the EU will provide Egypt with an additional EUR 89 mn under the second phase of the Health Sector Policy Support Program (HSPSP) in efforts to support the country’s covid-19 response, according to an International Cooperation Ministry statement. HSPSP’s previous budget from 2010-2018 stood at EUR 110 mn to help the quality of the health services in Egypt.

Kuwait will soon resume flights with Egypt, and is coordinating with EgyptAir to announce a date in the coming days. Flights were suspended early during the pandemic.

Further afield, the US is one step closer to a vaccine rollout with the FDA granting emergency authorization for the Pfizer/BioNTech vaccine on Friday, according to Bloomberg.

Curious what the vaccine’s distribution journey across the US will look like? The WSJ has you covered with a step-by-step itinerary.

ENERGY

Egypt’s natgas transition is in line for a boost

Subsidized loans and more may be in the cards for those looking to convert petrol-powered cars to run on natural gas after President Abdel Fattah El Sisi called on the Central Bank of Egypt (CBE) and the Madbouly government to provide car owners with “appropriate” financial incentives. The president made the remarks at a meeting on Thursday, according to an Ittihadiya statement. El Sisi’s directive follows a decision by the Trade and Industry Ministry, the CBE, and the MSME Development Agency to allocate EGP 1.2 bn of low-interest financing for car owners to convert their vehicles to run on dual-fuel engines. The government will make the funding available for on-lending through banks. Owners of vehicles over 20 years old will be eligible for the financing, while owners of younger vehicles could have access to a separate, subsidized finance package.

El Sisi also called for setting up a car expo as a way to entice manufacturers to get in on the natural gas-transition plan, Ittihadiya said. Several foreign car makers have previously expressed interest in assembling natural-gas powered cars in Egypt, including Volkswagen and Japan’s Toyota Tsusho Corporation. Car owners looking to make the switch will be able to attend the expo and get the chance to fill in applications for financing.

Background: The Sisi administration earlier this year announced a multi-year plan to convert or replace 1.8 mn cars to run on natural gas in a bid to reduce dependence on petrol-fuel.

Want more? We took a deep dive this summer into the plan in our weekly infrastructure vertical Hardhat: Part 1 | Part 2 | Part 3.

OTHER ENERGY NEWS- TAQA PV for Solar Energy is receiving a USD 4.2 mn loan from the European Bank for Reconstruction and Development (EBRD) as part of a USD 10 mn credit line to fund private-to-private renewable energy projects, the EBRD said in a statement on Thursday. Proceeds from the initial tranche will be earmarked for a 6 MW photovoltaic solar plant that will see the TAQA Arabia subsidiary supply electricity to Qalaa Holdings’ Dina Farms. The plant will be located on Dina Farms’ premises in Beheira, enabling the dairy giant to “cover part of its energy consumption with clean energy” under a 25-year power purchase agreement (PPA).

The project is the first corporate PPA in Egypt financed by the EBRD in Egypt, the development bank said. It complements Egypt’s planned shift towards a greater proportion of renewables in the energy mix and bid to liberalize the renewables market.

STARTUP WATCH

Egypt ranks third in November startup funding league table -Wamda

Egyptian startups raised USD 6.6 mn in venture capital funding last month, putting them in third place in MENA behind the UAE and Saudi Arabia, Wamda said in a recent report. Egypt saw nine transactions in November (tying with the UAE in first place), that included creative tech startup Argineering, which raised USD 200k through crowdfunding during the month. Other transactions we’ve noted last month include ExpandCart’s USD 2.5 mn in series A funding, Wuilt’s USD 535k seed funding round and Brantu’s USD seven-figure series A round.

Across the region, startups brought in USD 37.1 mn, down 22% from October, according to Wamda’s findings. UAE- and Saudi-based companies accounted for the lion’s share, with Emirati startups raising USD 16.5 mn and Saudi companies raising USD 8.7 mn. In total, 30 MENA startups attracted investors in November.

Top industries: The leading industries were logistics (which reeled in USD 9.4 mn), e-commerce (USD 6.2 mn), gaming (USD 6 mn), SaaS (USD 4.1 mn) and fintech (USD 4 mn). At least 63% of the investments were early stage rounds.

Background: Startups in MENA raised USD 704 mn in 2019 after a record 564 transactions, startup platform Magnitt said this summer in its 2019 MENA Venture Investment Report.

M&A WATCH

Nassef wants a bigger piece of the Knicks + Rangers

Nassef Sawiris plans to up his stake in owner of New York Knicks, Rangers: Sawiris’ family office NNS Holding is aiming to increase their stake in Madison Square Garden Sports (MSGS) to 6.3% from a current 5%, NNS Holding revealed in a regulatory filing. In addition to the famed sports arena of the same name, MSGS owns the basketball team New York Knicks as well as hockey’s New York Rangers. The move will make Sawiris one of the three largest shareholders in the company, reports Bloomberg. This comes as MSGS saw their shares fall 15% this year as the pandemic forced the NBA and NHL to end their seasons with empty stadiums. Sawiris also has investments in sporting-goods maker Adidas and English football club Aston Villa.

ECONOMY

Food prices drive inflation rate to five-month high

Annual headline urban inflation accelerated for the second consecutive month to 5.7% in November from 4.6% in October, according to Capmas figures (pdf) released on Thursday. The increase was driven by higher food prices, which single-handedly brought annual inflation to its highest since May. Monthly headline figures remained muted at 0.8%, but higher than 0.3% in November 2019. The monthly rate was, however, lower than October’s 1.8%.

Food prices across the country edged up 3.2% on a monthly basis (and 4% y-o-y), Capmas said. Vegetable prices were the culprit, increasing over 25% on a monthly and annual basis, and offsetting a softer drop in the price of fruits.

Annual core inflation — which strips out volatile items such as food and fuel — rose marginally to 4% in November, from 3.9% last month, according to central bank figures (pdf). Monthly core inflation, meanwhile, fell to 0 from 1.7% in October.

The increase in the annual rate was higher than expected, Pharos head of research Radwa El Swaify said on Thursday. Pharos had forecast an annual headline rate of 5.1% in November and a monthly rate of 0.3%.

Inflation is expected to accelerate in the coming months as food prices are likely to increase further and as the price of Brent crude rebounds, Capital Economics said. The EGP is also forecast to weaken in the months ahead, adding pressure on the headline rate. However, inflation isn’t likely to exceed the mid-point of the CBE’s range, it added.

That hasn’t dampened hope for further rate cuts: Policymakers are expected to keep rates unchanged in their upcoming meeting, after having already lowered rates by 400 basis points so far into the year, El Swaify said. Beltone Financial echoed El Swaify, saying it expects rates to remain unchanged and that it holds the view “that the 400 bps policy rate cut to support domestic economic activity is still channeling its trickle down effect into the economy.” That said, “the door is open for interest rates to be lowered further over the next twelve months,” added Capital Economics, which expects 100 bps in cuts by the end of 2021. “With inflation likely to remain subdued and talks with the IMF set to result in the Fund giving the green light for further monetary easing,” the London-headquartered research house said.

The CBE cut interest rates at its most recent meeting by 50 bps earlier in November, its second consecutive rate cut and fourth since the pandemic struck in March. The CBE’s Monetary Policy Committee next meets on Thursday, 24 December to review interest rates.

EQUITIES

Suez Cement to delist from Egypt’s stock exchange

Suez Cement and its subsidiary Tourah Cement are planning to delist their shares on the EGX, after both companies’ board of directors approved the move during meetings last Wednesday, according to two separate regulatory filings (here and here — pdf). The companies will now need to seek regulatory approval to go private. This came after Suez’s German parent company, HeidelbergCement, lodged a mandatory tender offer to acquire 100% of its shares. In turn, Suez launched an MTO for Tourah Cement.

A sign of the times? The cement industry in Egypt has been suffering for years from a drawn out supply glut that has seen producers lose bns. As many as six players could be forced to exit the market by 2021, Lafarge Egypt's CEO Solomon Baumgartner Aviles said earlier this year. Tourah Cement suspended operations last year, and is currently struggling to turn move into the green. Suez Cement’s losses have also been widening in recent quarters, with sales struggling to pick up.

LEGISLATION WATCH

FinMin, industry groups to set up “working groups” to improve tax policy

The newly-passed Customs Act could be in for changes after Finance Minister Mohamed Maait agreed to conduct a broader review at the behest of industry representatives, according to Al Mal. Maait promised to address investor concerns in the act’s executive regulations, but could amend the legislation itself if needed. The decision to look into the law came after a recent dispute with customs brokers and shipping agencies on several sticking points which were addressed in a meeting on Friday between Maait and representatives from the Federation of Egyptian Chambers of Commerce.

The major points of contention: Brokers had complained about the strict new ins. requirements in the legislation, which force large companies to deposit EGP 100k and small companies EGP 50k, up from as little as EGP 5k before. The Customs Authority had earlier refused to budge from the figures, but according to a recent Finance Ministry directive, the authority will allow small firms to pay the amount in equal installments over five years. The government will also allow shippers to submit their cargo lists 24 hours before shipments arrive in the country, instead of the 48 hours in the legislation.

Meanwhile, a pre-registration system that aims to cut red tape and streamline customs procedures will be installed in Egypt’s ports in April, Maait said in a statement over the weekend. Using the system will be mandatory for exporters and importers as of the start of next fiscal year in July, he added. The new system, which would reduce customs procedures to a maximum of one day, would also create an online portal allowing customers to follow the status of their shipments. The launch of the system would come a few months after the ministry rolls out a parallel digitized tax filing system in January as part of a wider plan to overhaul tax collection.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The biggest story on the airwaves was, naturally, the arrival of Sinopharm’s vaccine in Egypt. Presidential health advisor Mohamed Awad Tag Eldin phoned in to Kelma Akhira to explain the process of testing and approving the Chinese vaccine, including allowing clinical trials to be held here in Egypt. Tag Eldin stressed to host Lamees El Hadidi that Egypt’s health authorities have studied the vaccine to ensure its efficacy and safety (watch, runtime: 22: 39).

The vaccine won’t be mandatory and citizens who opt into getting the jab can register through a website the Health Ministry has set up, Assistant Minister Noha Assem told Al Hayah Al Youm’s Lobna Assal. Assem reiterated that just because we have a vaccine, it doesn’t mean we get to forgo all precautionary and social distancing measures in the short term (watch, runtime: 19:45). Elsewhere, El Hekaya's Amr Adib had a chat with two doctors to ask whether or not they would take the vaccine (watch, runtime: 4:18 and runtime: 1:40).

Also on the airwaves last night:

- Tax progress: 100 out of 134 companies in the first phase of the Tax Authority’s electronic invoicing system are now integrated into the system, head of the authority’s research department Ragab Mahrous (Sarah Hazem, Masaa DMC | watch, runtime: 4:48).

- The Tourism Ministry has launched a promotional campaign in the Balkans to bring visitors to Egypt and reassure them of the covid-19 safety measures being implemented in tourist destinations, Deputy Minister Ghada Shalaby said (Sarah Hazem, Masaa DMC | watch, runtime: 3:14).

EGYPT IN THE NEWS

Human rights continues to dominate the conversation on Egypt in the international press after Italy charged four Egyptian security officials it alleges were involved in the death of PhD student Giulio Regeni with “aggravated kidnapping” with one official also being charged with grievous bodily harm, the Italian press reported on Thursday. The trial, likely to take place in absentia, will go ahead in Italy next year. The move comes a week after Egypt suspended its own investigation into Regeni’s death.

The story topped coverage of Egypt in the foreign press, with the Guardian talking to Regeni’s parents about the latest developments and looking at the number of people who died in Egyptian custody in separate articles, while Human Rights Watch deliberates whether Egypt will cooperate with Italy with no extradition treaty in place between the two countries. Also picking up the story, among others: The New York Times and Politico.

Meanwhile: NBC News looks at whether the incoming Biden administration will pressure Egypt on human rights and nine members of the police service have been sentenced to prison terms on charges of beating to death a street vendor in 2016.

ALSO ON OUR RADAR

The impact of covid on air travel is becoming clearer: EgyptAir Holding Company plans to restructure its EGP 10 bn in debt owed to foreign lenders, Chairman Roshdy Zakaria said. The company has also taken out a EGP 3 bn loan from the National Bank of Egypt as well as an EGP 2 bn loan from state coffers to contribute towards the debt repayments.

Other things we’re keeping an eye on this morning:

- French public transport operator Transdev plans to bid for the contract to manage the electric rail line lining Salam City, 10th of Ramadan and the new administrative capital, according to the company’s Egypt representatives.

- 1.1 mn more Egyptians subscribed to ADSL services in FY2019-2020, bringing the total number as of June 2020 to 7.99 mn, according to a CIT ministry report.

PLANET FINANCE

The EGX30 fell 0.3% on Thursday on turnover of EGP 1.4 bn (4% above the 90-day average). Foreign investors were net sellers. The index is down -21.3% YTD.

In the green: Eastern Company (+3.4%), Edita (+2.1%) and Credit Agricole (+1%).

In the red: Dice (-6.6%), Heliopolis Housing (-4.8%) and Juhayna (-3%).

|

|

EGX30 |

10,987 |

-0.3% (YTD: -21.3%) |

|

|

USD (CBE) |

Buy 15.65 |

Sell 15.75 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,644 |

-0.2% (YTD: 3%) |

|

|

ADX |

5,109 |

+0.6% (YTD: 0.6%) |

|

|

DFM |

2,547 |

+0.3% (YTD: -7.9%) |

|

|

S&P 500 |

3,663 |

-0.1% (YTD: 13.4%) |

|

|

FTSE 100 |

6,547 |

-0.8% (YTD: -13.2%) |

|

|

Brent crude |

USD 49.97 |

-0.6% |

|

|

Natural gas (Nymex) |

USD 2.59 |

+1.5% |

|

|

Gold |

USD 1,843.60 |

+0.3% |

|

|

BTC |

USD 18,452 |

+3.6% |

SIGN OF THE TIMES- Are investors finally seeing EMs as more than different shades of beige and giving China its due props? Some of the biggest asset managers appear to be shifting their strategies to give China the respect due to the second-largest economy in the world, according to Bloomberg. Amundi Asset Management (with AUM of USD 2 tn), and Robeco (with USD 190 bn AUM), are both rolling out new strategies focused on China amid a surge in demand from clients who had previously invested in the country through global developing-nation funds. Meanwhile, heavyweights such as BNY Mellon Investment Management and BlackRock are favoring splitting China off from EM, with the latter stating that they see China “as a distinct pole of global growth.”

Why now? China’s rapid recovery from the covid-19 pandemic and “increasingly domestic-driven growth model” have accentuated the differences between it and other emerging markets that came from its size, growth, and market depth. China’s economy is expected to expand 8.2% in 2021 after outpacing other EM, while Chinese equities have seen an increase of USD 10.4 bn this year compared to an outflow of USD 23.9 bn from other EM and FM funds. The widespread economic impact from the pandemic is also driving investors towards specific countries and away from regional funds.

Covid has certainly been good to Jumia: After receiving a boost from lockdown measures and short-sellers Citron eating humble pie, Jumia is now laying down the groundwork for the next phase of its growth, which the company hopes will finally get it to into the green, Jumia Co-CEO Sacha Poignonnec tells Bloomberg in an interview. The plan might see the company spin off key logistics and payments divisions operating in 11 African countries, including Egypt, in a bid to cut down on costs, Poignonnec said. Simultaneously, the company is looking to expand to Ethiopia. The plans come after covid-19 measures helped the Pan-African e-commerce giant reduce 3Q2020 operating losses 49% y-o-y, and boosted its stock price by over 500% YtD.

Hyundai has purchased 80% of US robotics group Boston Dynamics in a USD 1.1 bn transaction, the Financial Times reports. Japanese multinational SoftBank, which had bought Boston Dynamics for USD 100 mn in 2017, will retain 20% of the company through a subsidiary.

AROUND THE WORLD

The US Supreme Court has dismissed the latest challenge by supporters of Donald Trump hoping to undo Joe Biden’s presidential victory last month, throwing out a case brought by the state of Texas challenging the election results in four battleground states. The Supreme Court dismissed the case without a hearing Friday, saying Texas had no right to challenge election results in other states.

Morocco has become the latest MENA country to normalize relations with Israel in an agreement brokered by US president Donald Trump, according to a statement by the Moroccan Royal Office. Israel and Morocco will soon set up liaison offices and introduce direct flights between the two countries. Morocco is the fourth MENA country to kiss and make up with Israel, following the UAE, Bahrain, and Sudan, while Saudi Arabia seems likely to follow suit. President Abdel Fattah El Sisi praised the agreement, writing on Twitter that it will bring peace and stability to the region.

As part of the agreement the White House announced that it recognizes Moroccan sovereignty over the entire Western Sahara territory. Pro-independence fighters in Western Sahara have been battling the Moroccan government since 1975, but the two sides signed a peace treaty in 1991.

Also worth knowing this morning:

- Israelis are being warned against traveling to the Gulf as heightened tensions with Iran could potentially see travelers targeted, writes The Wall Street Journal.

- Algerian president Abdelmadjid Tebboune has been absent from the public sphere for more than six weeks since his evacuation to Germany for covid-19 treatment, missing the one year anniversary of his election, Bloomberg reports.

IN DIPLOMACY- Egyptian ministers and their Iraqi counterparts are moving forward with the “oil-for-reconstruction” agreement signed back in October and are holding meetings to outline the projects that will be part of the agreement. Egypt signed 15 MoUs that will see Egyptian companies work on development projects in Iraq in return for Iraqi oil. The ministers sat down on Thursday to discuss the specific projects covered in the agreements, which range from electricity, health, investment, infrastructure, mining, and road development, and will come up with a full list of projects soon. The potential areas of cooperation that were discussed included:

- Electricity: Iraq wants Egyptian energy firms to supply equipment and work on rebuilding Iraq’s electricity grid, according to a cabinet statement.

- Basic infrastructure development: Iraq is looking for Egyptian private sector involvement in social housing, construction of roads, agriculture, SME support, and infrastructure investment, International Cooperation Minister Rania Al Mashat said in a statement.

- Pharma: Health Minister Hala Zayed met with her Iraqi counterpart Hassan Al-Tamimi to discuss cooperation in developing and manufacturing meds as well as providing training for medical teams, according to a ministry statement.

- Mining: Egypt could begin training Iraqi employees in mining, geological surveying, Oil Minister Tarek El Molla said, according to a cabinet statement.

- Unified ticketing for road transport: The transport ministers of Egypt, Iraq and Jordan discussed the possibility of creating a unified ticketing system for road transportation between the three countries, according to a Transport Ministry statement.

WHO ELSE WAS TALKING- President Abdel Fattah El Sisi also met with Iraqi Deputy Prime Minister and Planning Minister Khaled Battal.

ON THE TRADE FRONT- Egyptian sheep and goat livestock can now be exported to the UAE after Emirati authorities gave their import formal approval.

ON YOUR WAY OUT

“Lift Like a Girl” lands three prizes at Cairo Film Fest: Egyptian filmmaker Mayye Zayed’s documentary, Lift Like a Girl, earned the prestigious Bronze Pyramid Award at the Cairo Film Festival last week as well as the USD 15k-worth Youssef Cherif Rizkallah audience award and the USD 10k-worth Isis Award for highlighting women’s issues in Egypt, according to Ahram Online. Zayed said the prize money will be used to develop the weightlifting ring shown in the movie. The documentary premiered at the Toronto International Film Festival in September and has since won an award at the International Leipzig Festival for Documentary and Animated Film. You can check out the trailer on the film’s website (watch, runtime: 01:40).

CALENDAR

December: Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: A meeting to finalize membership and trading rules governing Egypt’s Commodities Exchange (Egycomex).

December: The Egyptian-Iraqi Joint Higher Committee will meet.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15 December (Tuesday): House of Representatives reconvenes from recess.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

31 December (Thursday): Egypt-UK post-Brexit trade agreement to take effect.

31 December (Thursday): Deadline for car owners to comply with traffic regulations to install a RFID electronic sticker on their cars.

1Q2021: The Annual Egypt Automotive Summit will be held.

1H2021: Egypt’s Commodities Exchange (Egycomex) will begin trading.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

17 January 2021 (Sunday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria in case 445 of 2019.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

30 May-15 June 2021 (Wednesday-Thursday): Cairo International Book Fair.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June- 15 July 2021: National Book Fair.

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

13-17 December 2021: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.