- Egypt inflation nearly doubles to 7.1% in December. (Speed Round)

- CBE announces new MPC members, paving way for interest rate meeting this week. (Speed Round)

- Endeavour to make second bid for Centamin this week. (Speed Round)

- World Bank sees Egyptian economy growing 5.9% this year. (Speed Round)

- Rameda among “best-placed” to capitalize on Egyptian pharma sector’s growth potential. (Speed Round)

- Gov’t studying shifting to cash transfers for food subsidy recipients. (Speed Round)

- Deadline for GERD resolution looms as final round of talks kicks off in Washington. (What We’re Tracking Today)

- Libyan National Army agrees to Russia-Turkey ceasefire proposal. (Speed Round)

- The Market Yesterday — Pharos View: Inflation uptick rules out rate cut.

Sunday, 12 January 2020

Inflation accelerates, but it’s still in single digits as MPC confirms Thursday interest rate meeting

TL;DR

What We’re Tracking Today

It was a quiet weekend on the home front, with the new agenda being driven by a mix of ‘regional’ developments and diplomatic issues. We expect business news to pick up this week with the effective end of the winter holiday season, but look for foreign affairs to continue to enjoy an outsized position on the country’s news agenda this week.

Speaking of the end of winter holidays: You may want to leave a few minutes early for work this morning. Most private and international schools are back in session as of this morning, so expect a but more gridlock than last week.

Also worth noting: The EGP gained against the USD on Thursday, rising to EGP 15.93 after having fallen to EGP 16 on Wednesday, according to CBE figures. USD inflows into government debt instruments on Wednesday and Thursday were the key driver of the rally, Hapi Journal and Al Mal cite an unnamed Central Bank of Egypt source as saying. Foreign holdings of Egyptian treasuries stood at USD 15.5 bn as of the end of November.

Now, topping the regional news agenda:

Oman has sworn in a new leader following the death of Sultan Qaboos at age 79. The Arab world’s longest-serving ruler, who came to power almost half a century ago, died on Friday. An obituary in the New York Times calls him a “towering figure at home” who “transformed his … kingdom from an isolated enclave into a developed nation,” and an “essential diplomatic player” abroad who managed to bridge the region’s sectarianism and act as a peace broker between foes. Qaboos, who died without a direct heir, has been succeeded by his cousin and former culture minister Haitham bin Tariq Al Said, who was sworn in yesterday.

President Abdel Fattah El Sisi extended his condolences and announced three days of mourning in Egypt in a statement on social media.

Meanwhile, Iranian officials admitted this weekend to accidentally shooting down a passenger aircraft last Wednesday, hours after its armed forces launched attacks on US military bases in Iraq. Iranian President Hassan Rouhani wrote on social media that the government “deeply regrets this disastrous mistake” while Foreign Minister Javad Zarif blamed “human error at a time of crisis.” The government had previously denied that the crash, which resulted in the deaths of all 176 people on board, had been caused by a missile. The vast majority of those on board were Canadian or heading to Canada for school. The story dominates headlines worldwide this morning. See: Reuters | Wall Street Journal | AP | New York Times | Guardian | BBC | CNN.

Next round of GERD talks in Washington tomorrow: Foreign Minister Sameh Shoukry arrives in Washington this morning ahead of what are being billed as the final round of US-mediated talks between Egypt, Sudan, and Ethiopia over the Grand Ethiopian Renaissance Dam. The sides agreed last year to resolve the dispute by 15 January, but talks remain at an impasse, with the first three rounds having failed to produce a breakthrough. We have the latest in this morning’s Speed Round below.

Libya is also going to be prominent in the headlines this week: Shoukry left for DC straight from Algeria, where he met with his counterpart Sabri Boukadoum about the developing situation in Libya, the Foreign Ministry said in a statement. Egypt-backed military commander Khalifa Hafar and his rivals at the Government of National Accord announced overnight a temporary ceasefire in the country’s west, including Tripoli, Reuters reports.

That comes ahead of a visit to Cairo today by European Council President Charles Michel, who is set to meet with El Sisi. Given Michel’s meeting with Turkish President Recep Erdogan yesterday, we’ll hazard a guess that Libya will be the prime focus. We have more on Libya in this morning’s Speed Round, below.

The next steps in our bid to become the premier regional energy hub: Egypt and Sudan will launch the first phase of the electricity interconnection project today, which will see the two countries exchange 50 MW, according to Masrawy. The capacity will be increased to 150 MW in the second phase, which is expected to be ready within a year. The project has been in the works for several years, but was delayed by the political upheaval in Sudan last year and complications arising from the dispute over the Grand Ethiopian Renaissance Dam.

A similar agreement with Saudi Arabia is due to be signed by May and will see the two countries exchange power by 2022, while the USD 4 bn EuroAfrica project will connect the electricity grids of Egypt, Cyprus, and Greece by December 2021.

Are emerging markets falling into ‘secular stagnation’? Growth in emerging markets outside of China and India has failed to outperform developed markets since 2013 due to weak investment, putting them at risk of “secular stagnation,” the Institute of International Finance has said. ‘Secular stagnation’ — econospeak for protracted periods of low economic growth — has “important implications for markets, because the underlying value proposition of EM is predicated on higher growth, which in turn should translate into higher returns on foreign investment”, the Washington-based organization said.

US companies in bond-selling binge: Companies sold over USD 69 bn in low-interest high-grade bonds last week, making it the second-highest weekly issuance volume in history, according to BofA Securities, CNBC reports. The trend isn’t set to continue though: the investment bank is projecting a net fall in issuance over the course of the year due to a drop-off in M&A activity and de-leveraging among large companies.

Is telecom operator Orange looking at an IPO of its regional assets? The company has consolidated its operations in the Middle East and Africa into a single entity, which it is considering IPOing to finance overseas expansions, Reuters reports. Paris and London are potential homes for the listing, Bloomberg suggests. The stake sale, for which Orange has tapped BNP Paribas and Morgan Stanley as advisors, could go to market as early as 1H2020.

Fallout from Soleimani killing continues: The US has taken to threats in response to Iraq’s demands for troop withdrawal, warning yesterday that it would close the Iraqi central bank’s account at the Federal Reserve Bank of New York if it evicts the US military, the Wall Street Journal reports. The warning, which Iraqi officials said was conveyed directly to acting Prime Minister Adel Abdul Mahdi, would cut off the government’s access to important revenues and squeeze liquidity in the country’s financial system. Iraq’s parliament last week voted to remove all foreign troops from its territory after the US assassinated Iranian General Qassem Soleimani and a senior Iraqi paramilitary leader at Baghdad Airport.

US embassy in Egypt issues warning: The US embassy in Egypt has warned of increased security risks to US citizens abroad amid “heightened tension” in the region.

US bull market unfazed by #WW3: The S&P 500, Nasdaq and Dow Jones all shrugged off the geopolitical angst, closing near their all-time high at the end of last week, Bloomberg reports.

Other international news to note in brief:

- More progress on US, China trade: The US and China will hold biannual meetings to handle disputes arising from the phase one trade agreement, which is set to be signed on 15 January. (Wall Street Journal)

- Trump considers expanding travel ban: The Trump administration could propose to double the number of countries listed on its travel ban to 14 as it looks to make immigration a cornerstone of its 2020 election campaign. (AP)

Our podcast on building a great business in Egypt will return from its hiatus on Saturday. Want to catch up on season one in the meantime? Previous guests on Making It have included:

- Jalal Abugazaleh, founder of Gourmet Egypt

- Karim El Sahy and Abeer El Sisi from high-profile AI startup Elves

- Karim Awad, group CEO of EFG Hermes

- Fatma Ghali, Managing Director of Azza Fahmy

- Hazem Moussa, co-founder and CEO of Sarwa Capital

The episodes are available on our website | Apple Podcast | Google Podcast.

Enterprise+: Last Night’s Talk Shows

Business and econ news was once again relegated to footnote status on the airwaves last night, as regional politics continues to dominate the start to the new year.

The state of talks over the Grand Ethiopian Renaissance Dam took center stage on the talk shows last night. Al Hayah Al Youm’s Lobna Assal and Hossam Hadad repeated a statement from the Foreign Ministry accusing the Ethiopian government for making inaccurate statements and telling us that it’s all their fault that talks are still at an impasse. Hadad spoke to former assistant foreign minister for African affairs Mona Omar who said that no common ground has been reached and that Ethiopia will keep stalling and bringing negotiations to a standstill. (watch, runtime: 12:17). El Hekaya’s Amr Adib unsurprisingly heaped praise on the Egyptian negotiating team and delved into the technicalities of how much water Egypt is seeking (watch, runtime: 7:27).

The death of Sultan Qaboos got considerable airtime: Lobna Assal mentioned President Abdel Fattah El Sisi’s announcement of three days of mourning to mark the death of Omani Sultan Qaboos (watch, runtime: 4:51). Others also took note, including Amr Adib (watch, runtime: 6:47), Masaa DMC’s Eman El Hosary (watch, runtime: 5:05), and Min Masr’s Amr Khalil (watch, runtime: 0:48).

Impetus builds for Libyan political solution: Min Masr’s Amr Khalil noted the joint press conference held yesterday between Russian President Vladimir Putin and German Chancellor Angela Merkel to discuss the situation in Libya and the upcoming Berlin meetings (watch, runtime: 3:23). El Hekaya’s Amr Adib also covered the developments (watch, runtime: 3:54).

We’ll soon be using plastic money: Masaa DMC’s Eman El Hosary phoned economist Mohsen Adel to discuss a decision by the Central Bank of Egypt to start issuing polymer banknotes this year. Adel said that the CBE will phase in the new material starting with the EGP 10 note, which will help the government crack down on counterfeit currency (watch, runtime: 4:58).

Speed Round

Speed Round is presented in association with

Inflation nearly doubles m-o-m to 7.1% in December: Annual urban inflation jumped to 7.1% in December, up from 3.6% in November, the Central Bank of Egypt (CBE) calculated in its monthly CPI release (pdf) which is based on Capmas data (pdf). The increase is in line with expectations on the end of a favorable base effect that resulted in a six-month disinflation spell between May-October 2019. Overall inflation, which takes into account price changes in both rural and urban areas, stood at 6.8%. Reuters also took note of the story.

Month-on-month headline inflation came at -0.2%, falling for the second month in a row, led by a 6.8% decrease in the prices of sugar products and 6.3% in edible oil prices.

Core inflation rises slightly: Annual core inflation increased by 30 bps to 2.4% in December, while on a monthly basis it came at 0.2%, compared to -0.1% in November, according to the CPI release. Core inflation strips out volatile items such as food and fuel.

Still room for a rate cut? December’s figures increase the chances that the CBE will keep rates unchanged when its Monetary Policy Committee meets on Thursday. But given that the meeting was postponed from 26 December, prospects for more rate cuts remain, Mohamed Abu Basha, head of macroeconomic analysis at EFG Hermes, was quoted by Bloomberg as saying.

Inflation is still within the CBE’s 9% +/-3% target range, and “there’s easily room for a 150 bps cut,” Naeem Brokerage’s Allen Sandeep says, adding that the slowdown in food inflation, which accounts for one third of the basket, “confirms the state’s success in containing inflation.” The CBE made its third consecutive rate cut last month in an easing cycle that has seen rates cut by 350 bps since August, and 450 bps over the course of the year. Seven of 10 economists we polled in December expected rates to be left on hold.

RATE WATCH- Meet your new interest rate overlords: The Central Bank of Egypt (CBE) has formed its new Monetary Policy Committee and will convene its first meeting on Thursday 16 January, Hapi Journal said yesterday, citing MENA. The meeting was originally scheduled for the end of December 2019, but was postponed until the new committee is formed. The committee, chaired by CBE Governor Tarek Amer, includes his two deputies, Gamal Negm and Rami Abulnaga, and three CBE board members: Financial Regulatory Authority Chairman Mohamed Omran, former International Cooperation Minister Naglaa El Ahwany, and former Planning Minister Ashraf El Araby.

M&A WATCH- Endeavour to make new offer for Centamin within days, sources say: Canada’s Endeavour Mining is set to lodge in “a few days” a new, higher offer to acquire Egypt-focused Centamin, Al Mal reported, citing sources close to the matter. There’s also a possibility that we could be seeing a rival offer from another “major gold company.”

We already know that Endeavour’s last chance is Tuesday: Centamin received approval from a UK regulator late last month to give Endeavour an extension for a “put up or shut up” deadline that was triggered when Endeavour made an initial takeover offer, which Centamin had rejected. The new deadline is now Tuesday. The deadline extension came amid mounting pressure from major shareholders in both companies, including VanEck International Investors and US-based BlackRock. Naguib Sawiris’ La Mancha, the largest shareholder in Endeavour, has also urged Centamin to make the merger work.

This all comes as Centamin’s operations in Egypt are doing well: The London-listed gold miner reported a 51% y-o-y increase in 4Q2019 production at its Sukari gold mine in Egypt during 4Q2019, according to a press release. Centamin produced 148,387 ounces of gold from the mine during the quarter, marking the strongest performance since the end of 2017.

Egypt’s economy to grow 5.9% this year -World Bank: Egypt’s economy is expected to grow at a 5.9% clip in FY2020-2021, with the growth rate set to accelerate to 6% in FY2021-2022 and remain at that level throughout the following fiscal year, according to the World Bank’s Global Economic Prospects 2020 report released last week. With Egypt’s economy not heavily dependent on oil revenues, it has benefited from more stable growth than oil exporting countries in the region, according to the report. Economic growth has been fueled by an increase in exports and investment (both of which were facilitated by a “more accommodative” monetary stance, leading to a more stable EGP), the shifting of external debt maturity towards long-term instruments, and increased activity in the tourism sector. Flows into Egyptian equities and investor risk appetite have also been driven by developed market monetary easing, the report says.

Macro reforms get a nod: Egypt’s currency devaluation, energy subsidy and business climate reforms are all hailed as positive steps that have raised investor confidence and increased export and investment prospects, the report says. The Bankruptcy Act and new minority investor protection regulation are also cited as important measures, the former for facilitating debt resolution between creditors and debtors, and the latter for spurring investor confidence by requiring shareholder approval in issuing new shares.

Growth in MENA is projected to increase to 2.4% in FY2020-2021 (up from an estimated 0.1% in FY2019-2020) and then to 2.8% in 2021-22.

Labor productivity growth is a key challenge for MENA: Although MENA has the highest productivity level of any emerging market region, its productivity growth rate has been the weakest, averaging 0.3% between 2013-18 — well below the EM average. This is largely because of wide regional variation, with GCC economies displaying significantly higher productivity levels than energy importers such as Egypt. Productivity growth in Egypt has primarily been driven by “within-sector productivity gains,” the report says. The report stresses the need to develop the private sector across all MENA economies to reverse this trend, which would require loosening restrictions on the business climate and building human capital. The report also recommends more investment in renewable energy through public-private partnerships, among other things.

Emerging market growth as a whole remains muted: EM growth is projected to pick up to 4.1% in FY2020-2021 — 0.5% below previous forecasts — and stabilize at 4.4% in FY2021-2022, “with the pace of the recovery restrained by soft global demand and structural constraints, including subdued productivity growth,” the report says. The report also puts global growth in 2019 at 2.4% and is forecasting 2.5% for this year.

You can read the full report here (pdf) or check the press release here.

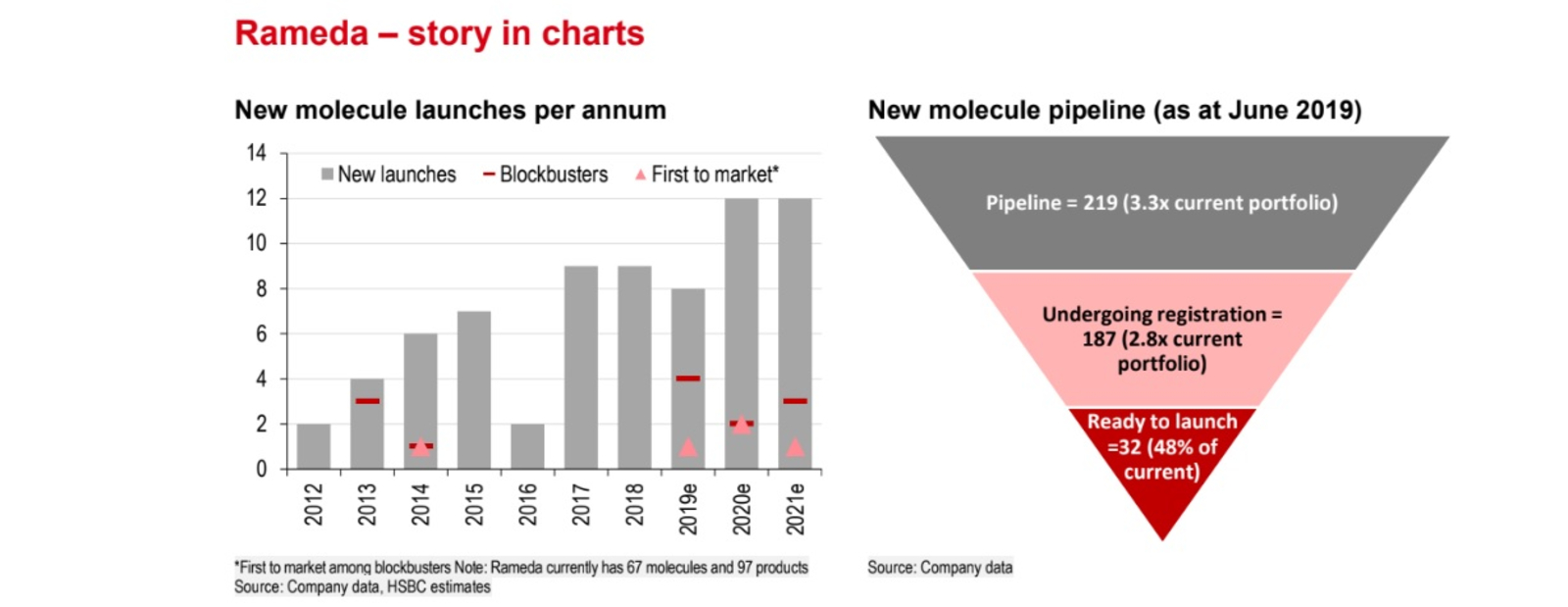

Rameda among “best-placed” to capitalize on Egyptian pharmasector’s growth potential, sees >50% upside to shares: Egypt’s pharmamarket has significant potential for structural growth, which Rameda is among the “best-placed” to capitalize on thanks to recent facility expansions and new formulas in the pipeline, HSBC said in a research note out at the end of last week.

Industry fundamentals: Egypt currently has a low median age (24) and sees relatively low spending in the sector, but HSBC expects that by 2025, more than 28% of the population will be above the age of 40 (up from a current 26.5%), while around 8.5% of the population is expected to be above 60 years of age (from around 8% currently). Per capita spending in Rameda’s industry will soon outpace the MENA and global growth rates on the back of the ageing population, helped in no small part by the government’s universal healthcare program.

HSBC sees 51% price upside on Rameda shares: HSBC has set a target price of EGP 6.40 per share for Rameda, implying a potential 51% upside in its current valuation. Rameda was the second and final company to IPO on the EGX last year, debuting under the ticker RMDA on 11 December. The shares dipped on the first day and lost a total of 9% of its value since going to market, but HSBC attributes the performance to the market “only focusing on the near-term performance,” with the pharmaco reporting 9M2019 revenue growth of only 8% y-o-y. “However, this weakness in its recent performance was due to delays in the completion of the capacity upgrade projects, which led to disruption in certain production lines,” the bank notes, saying that the company’s operational performance is expected to see a “sharp recovery” this year.

Rameda’s financials and strategy for the future give it a comfortable position going forward: Among regional peers, the pharmaco enjoys the highest EBITDA margins, and outperforms Egyptian peers as it benefits from scale and has a better product mix than other players in the market. “As Rameda has gained share its revenues are up 9.3x (2010-2018) compared to 3.9x for the overall market. Some of the factors that led to this strong growth at Rameda and form the bedrock of its strategy going forward are: new molecule launches with an increasing focus on higher unit price products,” HSBC says.

Latest GERD talks once again fail to yield an agreement: Egypt, Ethiopia and Sudan failed to reach an agreement on the Grand Ethiopian Renaissance Dam (GERD) during the latest round of talks that wrapped on Thursday in Addis Ababa, according to a Foreign Ministry statement. It appears the same sticking points have remained, with the statement blaming Ethiopia for having no “consideration of the water interests of the downstream countries, especially Egypt” in its reservoir-filling plans.

Ethiopia pointed the finger of blame right back at Egypt, saying Egyptian officials were “in no spirit of reaching an agreement,” according to the Associated Press. Egypt has proposed that Ethiopia extend the timeline for filling the reservoir to 21 years, from a currently planned 12, which Ethiopian Water and Energy Minister Sileshi Bekele said Addis Ababa would never accept. Ethiopia will continue as planned and start filling the dam in July 2020, Bekele said.

It all comes down to this week’s talks in Washington: Egyptian Irrigation Minister Mohamed Abdel Aty told Reuters that he hoped the situation would be solved in Washington, DC. by the agreed 15 January deadline. The US- and World Bank-brokered meetings begin tomorrow in the American capital. Abdel Aty appears to be optimistic, saying that despite failing to reach an agreement, Egypt “achieved clarity at least on all issues including the filling.” If the dispute is not resolved by the 15 January, the nations may resort to using an international mediator or involving the heads of states.

What are the chances of an extension? Al Masry Al Youm reported yesterday that sources familiar with the talks have said that the negotiations could be extended by an additional month or technical experts could be pushed into intensive two-week meetings in Washington if no solution is found this week. This would help avoid the politically problematic option of international mediation, which Ethiopia has made clear it would refuse.

Gov’t studying shifting to cash transfers for food subsidy recipients: The government is moving ahead with a plan to switch to doling out cash for food subsidy recipients in place of the current system of in-kind subsidies using ration cards, according to a cabinet statement. “A number of entities” are being consulted by authorities to study the feasibility of the move, and there’s a proposal on the table to launch the system on a trial basis in one of the country’s governorates, the statement notes without mentioning further details. The supply and finance ministries were in talks last summer over the planned shift, which would result in a new system that would see subsidy recipients receiving cash handouts, rather than points on their ration cards with which to purchase bread. Bloomberg also took note of the story.

What would this achieve? The obvious rationale behind this move is to hand out payments directly to commodity subsidy beneficiaries rather than subsidizing suppliers. The move could help streamline the system both in terms of state finances and fair access to the mns who rely on subsidies for basic needs.

Background: The Cash Subsidies Act, under which this new system would be governed, was sent to the House of Representatives back in July 2019. The act would revamp the country’s cash subsidy programs and provide the mechanism and basis for eligibility. Nivine Kabbag mentioned the legislation when she was sworn in as the new social solidarity minister as one of the items on her agenda.

Mixed messages on launch date for Egypt’s commodities exchange: Trading on the Egyptian Commodity Exchange will begin by January 2021, the Supply Ministry’s Internal Trade Development Authority head Ibrahim El Ashmawy said, according to Al Mal. Ashmawy is also quoted by Reuters as saying the launch date could be anytime between 36 or 48 weeks (8-11 months) from now. The ITDA boss provided a slightly wider timeframe after a senior source in the Supply Ministry said last week that trading should begin within 36 weeks, or roughly by September.

Background: The cabinet economic group last week approved the establishment of the exchange, which will be managed by a company whose shareholders include ITDA, the General Authority For Supply Commodities, the Holding Company for Silos and Storage, and the Egyptian Exchange. Six commodities — wheat, rice, corn, potatoes, onions, and oranges — will initially be traded.

Libyan National Army agrees to Russia-Turkey ceasefire proposal: General Khalifa Haftar’s Libyan National Army yesterday announced they would observe a ceasefire in the west of the country as of midnight last night, Reuters reported a spokesman as saying. Turkey and Russia issued a joint call on Thursday for a cessation of hostilities, which was initially rejected by the LNA. Haftar’s forces had been pushing to seize control of Tripoli and overthrow Fayez Al Serraj’s UN-recognized Government of National Accord.

A fragile truce: Al Serraj said during a meeting with Italian PM Giuseppe Conte that he welcomed “with pleasure” the ceasefire but that his government would only abide by the terms if Haftar’s forces withdrew from the outskirts of Tripoli, the Associated Press says.

International pressure has been growing for an end to the violence: Russian President Vladimir Putin and German Chancellor yesterday repeated calls for a ceasefire, a few days after Putin and Turkish President Recep Erdogan — who are backing opposite sides in the conflict — reached an agreement in Moscow. Putin also discussed the situation with President Abdel Fattah El Sisi yesterday, both of whom have provided support to the LNA. Meanwhile, European Council President Charles Michel was in Ankara yesterday for Libya talks and flies to Cairo today for talks with El Sisi.

Background: The conflict entered a more dangerous phase earlier this month when Turkey authorized the deployment of troops to the country to shore up Al Serraj’s forces, increasing the likelihood of a clash between regional powers in the war torn country. The move has intensified existing tensions surrounding Turkey’s gas exploration activities in the Mediterranean, leading Greece and Cyprus to join with Egypt and France — which both support Haftar — to condemn Turkish military adventurism.

MOVES- Ashraf Salman appointed City Edge chairman, Ahmed Wehashi joins board: The City Edge board has approved the appointment of former Investment Minister Ashraf Salman as the company's chairman, replacing Hassan Ghanem who had been selected for the post last month, according to Al Mal. Ahmed El Weshahi, Lobna Helal, Mohsen Adel, Ragaa Foaad, and Abdel Moteleb Omara have all joined the board of the company.

MOVES- Hisham Ramez continues as Arab International Bank chairman: Former central bank governor Hisham Ramez will continue as chairman and managing director of the Arab International Bank for a second three-year term, banking sources told Masrawy. Ramez, who chaired the Central Bank of Egypt from February 2013 to November 2015, was appointed as Arab International Bank chairman in May 2016.

CLARIFICATION- A local press report we picked up last week incorrectly said that Amr Eltazy would retain his position as CEO in Rich Foods after Ezdehar’s Egypt Mid-Cap Fund acquired a majority stake in the company. Eltazy will remain on the company’s board, but will no longer be CEO. Amr Farrag has been tapped to succeed Eltazy as CEO.

Egypt in the News

The Grand Egyptian Museum has earned us inclusion in the the New York Times’ influential “52 Places to Go” list for 2020. The Gray Lady also notes that the Sphinx International Airport and new hotels will make visiting Cairo “easier than ever.”

Alexandria synagogue reopened after renovations: Egypt reopened the Eliyahu Hanavi synagogue in Alexandria on Friday after it was renovated following a partial collapse in 2016. The Associated Press says that it will be used by few, as only a handful of Jews still remain in Egypt. Eliyahu Hanavi is one of several synagogues remaining in Alexandria. The story was widely noted over the weekend: Sky News | AFP | Xinhua | Haaretz.

Is Egypt in for a bargain on Israeli gas? Gas from Israel’s Leviathan natural gas field will be sold to Egypt and Jordan at a price lower than what the Israel Electric Corporation is currently paying, writes Eran Azran in a piece for Haaretz, questioning the status of the field as a national project for the Israelis. Egypt is due this month to start receiving Israeli gas under the landmark agreement signed by Alaa Arafa’s Dolphinus with Texas-based Noble Energy and Israel’s Delek Drilling.

Health + Education

GEMS Egypt to expand into textbook making, training as part of five-year plan

GEMS Egypt for Education Services plans to start producing textbooks and provide training to teachers as part of a five-year expansion plan, reports Al Mal. GEMS Egypt was established in 2018 as a joint fund between EFG Hermes’ Egypt Education Fund and UAE-based Gems Education. It is focused on K-12 education in Egypt and currently owns four private schools, all located to the east of Cairo. Its investments in Egypt’s education sector are expected to reach USD 300 mn by 2023.

EgyptAir resumes flights to Baghdad after three-day suspension

EgyptAir has resumed flights to Baghdad following a three-day hiatus it took to review the security situation in Iraq following the US’ assassination of Iranian General Qassem Soleimani, according to a statement picked up by the local press.

In related news, the private Iraqi airline Fly Baghdad made its first flight from Al Najaf Airport to Cairo on Saturday. The new route will operate one flight per week then gradually increase to four weekly flights by summer. The airliner is also now operating a flight to Sharm El Sheikh.

Nissan and Toyota seek customs exemption on imported components

Nissan and Toyota have requested that the government exempt them from paying customs duties on imported production parts, according to the local press. In a letter to the prime minister, the Japanese carmakers asked that they receive the same benefits provided to other companies from other countries by trade agreements. The Customs Authority last week began applying the 0% customs rate on imported Turkish cars as stipulated in the Egypt-Turkey Free Trade Agreement. Customs exemptions have been controversial among local auto companies, which have complained that they are unable to compete with the imported European vehicles.

Egypt’s OC close to securing contract to develop Banha-Port Said railway line

Orascom Construction (OC) is the frontrunner for a contract to overhaul the Banha-Port Said railway line at a cost of nearly EGP 5 bn, a source from the Transport Ministry tells Al Mal. The ministry is due to officially announce “within a few days” OC’s financial and technical offers as the winning bid from 11 other offers put forth by local and foreign companies. The government launched the tender to revamp the line last year as part of the ongoing EGP 56 bn plan to overhaul the nation’s railways by purchasing new railcars, improving junctions, and automating signaling systems.

Careem launches inter-city service in Egypt

Ride-hailing app Careem has launched a fixed-price inter-city travel service in Egypt. Customers can book any car type for now or later and pay in cash or via credit card.

Banking + Finance

Arab African Bank grants EGP 200 mn in credit facilities to Premium Int’l

The Arab African Bank granted credit facilities worth EGP 200 mn to Premium International for Credit Services to develop the company’s consumer finance portfolio, according to Al Mal. The bank acted as co-underwriter in Premium’s EGP 167 mn securitized bond issuance last October.

Other Business News of Note

Spinneys Egypt to open new branch in Nasr City in April

Spinneys will open a new branch in Nasr City’s Mercato Mall in April at an investment cost of EGP 40 mn, according to a local press report. The opening is part of a plan to inaugurate six new branches this year, bringing the total number of the supermarket chain’s branches to 20 across eight governorates, according to the newspaper. The next opening is due later this month in Sadat City. Spinneys said back in 2017 it planned to bring its total number of branches to 25 by 2019.

On Your Way Out

KUDOS- Eldib & Co. Partner Mohamed Eldib was awarded the International Trademark Association (INTA)’s 2019 service award for his work with the organization, according to an emailed statement. The accolade is given to INTA members who “[demonstrate] their combined passion for trademark and related intellectual property law and their commitment to INTA through exceptional efforts.”

Egyptian startup that brings furniture showrooms to your phone gets award at CES: Egyptian AI furniture showroom app Furnwish earned an award for the best plans of innovation for the future from the Trend Investment Fund at the Consumer Electronics Show (CES) in Las Vegas, the Information Technology Industry Development Authority said, according to Ahram Gate. The award was accompanied with a cash prize of USD 10k.

The Market Yesterday

EGP / USD CBE market average: Buy 15.93 | Sell 16.03

EGP / USD at CIB: Buy 15.93 | Sell 16.03

EGP / USD at NBE: Buy 15.95 | Sell 16.05

EGX30 (Thursday): 13,730 (+1.4%)

Turnover: EGP 747 mn (10% above the 90-day average)

EGX 30 year-to-date: -1.7%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.4%. CIB, the index’s heaviest constituent, ended up 0.8%. EGX30’s top performing constituents were Egyptian Iron & Steel up 6.6%, Egyptian Resorts up 5.5%, and Madinet Nasr Housing up 4.8%. Thursday’s worst performing stock was Cleopatra Hospital down 0.3%. The market turnover was EGP 747 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -71.1 mn

Regional: Net short | EGP -74.8 mn

Domestic: Net long | EGP +146.0 mn

Retail: 41.5% of total trades | 39.3% of buyers | 43.7% of sellers

Institutions: 58.5% of total trades | 60.7% of buyers | 56.3% of sellers

***

PHAROS VIEW

Inflation uptick rules out rate cut: Inflation in December was higher than anticipated, rising to 6.8% y-o-y for total Egypt (urban and rural), bringing the overall average for 2019 to 8.8%, which is slightly lower than a projected 9.0%. With the uptick in inflation rates, Pharos expects the Central Bank of Egypt’s Monetary Policy Committee to keep rates on hold when it meets this week “in order to assess the impact of the previous rate cuts, and in light of geopolitical unrest in the region.” Pharos expects a “less aggressive” easing cycle to resume throughout the rest of the year, with a total of 200-300 bps in rate cuts delivered throughout 2020. Tap or click here for the full report (pdf).

***

WTI: USD 59.04 (-0.9%)

Brent: USD 64.98 (-0.6%)

Natural Gas (Nymex, futures prices) USD 2.20 MMBtu, (+1.7%, February 2020 contract)

Gold: USD 1,560.10 / troy ounce (+0.4%)

TASI: 8,345 (+2.7%) (YTD: -0.5%)

ADX: 5,075 (+1.1%) (YTD: +0.0%)

DFM: 2,749 (+1.3%) (YTD: -0.6%)

KSE Premier Market: 6,929 (+1.9%)

QE: 10,444 (+1.0%) (YTD: +0.2%)

MSM: 3,977 (+0.8%) (YTD: -0.1%)

BB: 1,597 (+0.8%) (YTD: -0.8%)

Calendar

January: 1,000 artifacts to be displayed when Hurghada Museum opens.

January: UK-Africa Investment summit, London, United Kingdom.

9-12 January (Thursday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January (Monday): Egypt, Sudan, and Ethiopia move to Washington, DC, for a fourth (and final?) round of negotiations on GERD.

15 January (Wednesday): The Grievance Committee of the Financial Regulatory Authority will look into minority shareholder's complaints over Adeptio AD Investments' mandatory tender offer (MTO) for Americana Egypt.

16 January (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 January (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

27-29 January (Monday-Wednesday): African Private Equity and Venture Capital Association’s North African Fund Manager Masterclass, Sheraton Cairo Hotel, Galaa Square, Cairo.

February: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February: A delegation of Swiss businesses will visit Egypt to discuss investment.

February: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February: The Arab-African International Forum, Jeddah, Saudi Arabia

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

23 February (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot. It was previously postponed to 24 November 2019 and then to 5 January 2020, and now 23 February.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

12 April (Sunday): Easter Sunday

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

25 December (Friday): Western Christmas

1 January 2021 (Friday): New Year’s Day, national holiday

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.