Rameda among “best-placed” to capitalize on Egyptian pharma sector’s growth potential

Rameda among “best-placed” to capitalize on Egyptian pharmasector’s growth potential, sees >50% upside to shares: Egypt’s pharmamarket has significant potential for structural growth, which Rameda is among the “best-placed” to capitalize on thanks to recent facility expansions and new formulas in the pipeline, HSBC said in a research note out at the end of last week.

Industry fundamentals: Egypt currently has a low median age (24) and sees relatively low spending in the sector, but HSBC expects that by 2025, more than 28% of the population will be above the age of 40 (up from a current 26.5%), while around 8.5% of the population is expected to be above 60 years of age (from around 8% currently). Per capita spending in Rameda’s industry will soon outpace the MENA and global growth rates on the back of the ageing population, helped in no small part by the government’s universal healthcare program.

HSBC sees 51% price upside on Rameda shares: HSBC has set a target price of EGP 6.40 per share for Rameda, implying a potential 51% upside in its current valuation. Rameda was the second and final company to IPO on the EGX last year, debuting under the ticker RMDA on 11 December. The shares dipped on the first day and lost a total of 9% of its value since going to market, but HSBC attributes the performance to the market “only focusing on the near-term performance,” with the pharmaco reporting 9M2019 revenue growth of only 8% y-o-y. “However, this weakness in its recent performance was due to delays in the completion of the capacity upgrade projects, which led to disruption in certain production lines,” the bank notes, saying that the company’s operational performance is expected to see a “sharp recovery” this year.

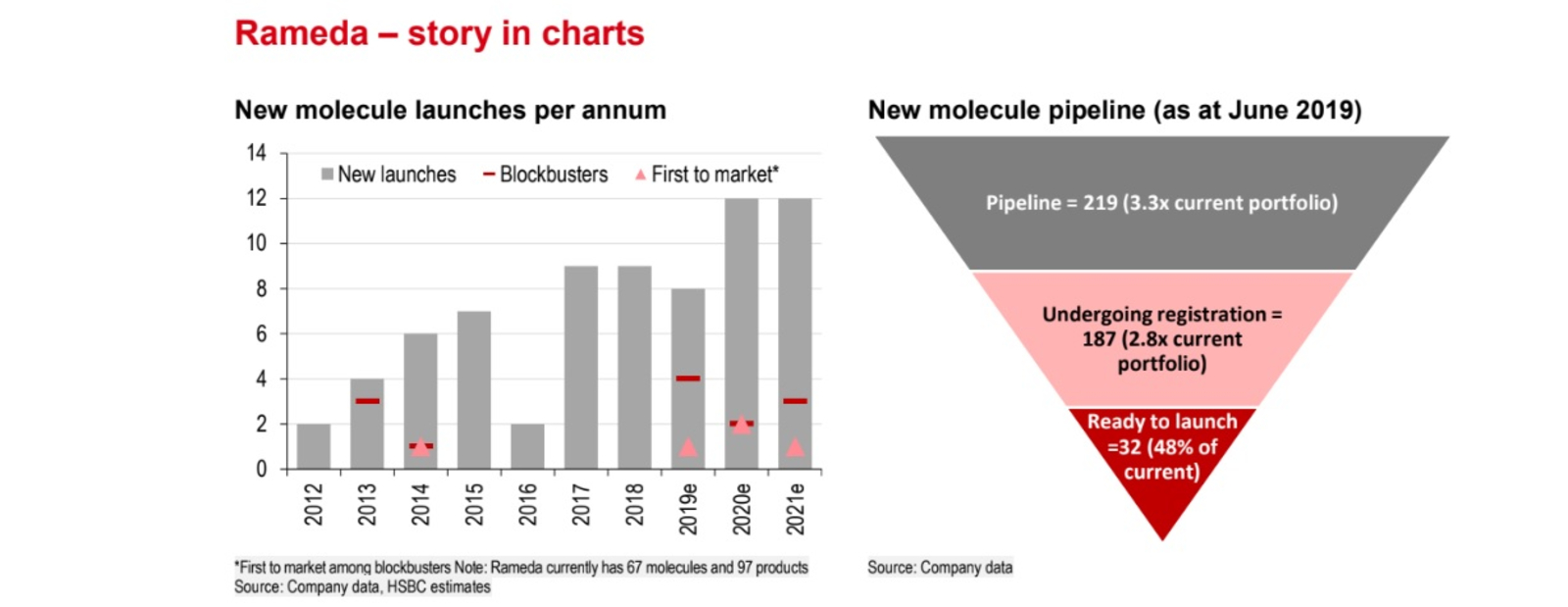

Rameda’s financials and strategy for the future give it a comfortable position going forward: Among regional peers, the pharmaco enjoys the highest EBITDA margins, and outperforms Egyptian peers as it benefits from scale and has a better product mix than other players in the market. “As Rameda has gained share its revenues are up 9.3x (2010-2018) compared to 3.9x for the overall market. Some of the factors that led to this strong growth at Rameda and form the bedrock of its strategy going forward are: new molecule launches with an increasing focus on higher unit price products,” HSBC says.