- Egypt’s maiden sovereign sukuk could be in the USD 500 mn range –Maait. (Debt Watch)

- Auto sales strengthen 15% y-o-y in August. (Auto)

- Telecom Egypt looks to secure USD 500 mn loan. (Debt Watch)

- Union for the Mediterranean ministers are in town for a climate action conference today (What We’re Tracking Today)

- Forget about boosters, BioNTech chief says we’ll need entirely new vaccines by next year. (Covid Watch)

- Crackdown on illegal private lessons + Will organ donation law amendments be back on the House’s agenda? (Last Night’s Talk Shows)

- What impact has covid-19 had on Egypt’s nascent microschooling movement? (Blackboard)

Monday, 4 October 2021

Egypt’s maiden sovereign sukuk could be in the USD 500 mn range + Pandora Papers land with a bang

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to Nobel Prize week. The festivities kick off today with the prize in physiology or medicine (expect an announcement around 11:30am CLT). Up next:

- Physics — Tuesday

- Chemistry — Wednesday

- Literature — Thursday

- Peace — Friday

- Economics — Monday, 11 October

You can track it all on the Nobel website here, if you’re so inclined.

WHAT’S HAPPENING TODAY-

The House Planning and Budgeting Committee is getting to work today, with two meetings scheduled. At least one will focus on the proposed Unified Budgeting Act. The House is settling into its new legislative season, having just yesterday (re-)elected committee heads. We have the full rundown on who’s running business-relevant committees in this morning’s Speed Round, below.

First Vice President of the European Commission Frans Timmermans is in town today for the Union for the Mediterranean ministerial climate conference. A side event on food security during the transition to green and circular economies will be livestreamed at 16:30. Lamees El Hadidi spoke to the Union’s secretary-general Nasser Kamel for a rundown of the event’s agenda (watch, runtime: 8:18).

Timmermans will also hold talks with a number of Egyptian ministers, the European Union Delegation to Egypt said in a press release (pdf). He will be joined by Carl Hallergard, the bloc’s co-director for the Middle East, and other EU officials. The release didn’t say which ministers Timmermans will be meeting.

Foreign Minister Sameh Shoukry took off to Moscow Sunday evening: Expect bilateral ties and regional issues to feature in talks with his Russian counterpart Sergey Lavrov, the foreign ministry said yesterday. Shoukry will also meet with Russian Security Council Secretary Nikolai Patrushev to discuss enhancing coordination in the upcoming period.

OPEC and its Russian-led allies will hold their output-setting meeting today. Expect a debate on how much oil to let loose into the bull market, where prices recently reached a three-year high of over USD 80 a barrel, as the world recovered from supply disruptions and weak demand. The cartel could consider adding more output that it had originally agreed in June, when it decided to boost supply by 400k barrels per day every month until at least April 2022, four unnamed insider sources told Reuters yesterday. Any potential increase would come into effect in November at the earliest, since output for October has already been set.

PSA- It’s official: You have a short workweek. The nation will take Thursday, 7 October off in observance of Armed Forces Day, the cabinet said yesterday in a statement. We can also expect to have a Thursday off later in the month thanks to the Prophet Muhammad’s Birthday, which is formally observed on Monday, 18 October.

HAPPENING THIS WEEK-

A preparatory conference for the Intra-African Trade Fair 2021 — which is scheduled to kick off in South Africa in mid-November — is being hosted tomorrow by the African Export-Import Bank (Afreximbank) at the Westin Cairo Golf Resort & Spa. Here’s the day’s agenda (pdf).

The Cairo International Fair continues today at the Cairo International Conference Center, running through 8 October.

It’s the final day of Techne Summit: The three-day investment and entrepreneurship event in Alexandria held under the auspices of the CIT ministry bringing together some 600 startups.

|

THE BIG STORY ABROAD- The Pandora Papers: One of history’s largest leaks of financial information has exposed the wealth of hundreds of rich and powerful people from across the globe — from the family of former UK Prime Minister Tony Blair to Jordan’s King Abdullah. The investigation — which focuses on how more than 330 politicians, 130 Forbes bn’aires, and others use offshore firms to stack wealth and avoid taxes — surpassed the 2016 Panama papers leak in size and scale, with more than 2.94 terabytes of data leaked from 14 offshore service providers.

This is but the tip of the iceberg: The Pandora Papers team have initially released data on 50 politicians, touching on Vladimir Putin’s secret assets in Monaco and Azerbaijani President Ilham Aliyev’s involvement in GBP 400 mn worth of property transactions in the UK. Kenyan President Uhuru Kenyatta and the inner circle of Pakistani Prime Minister Imran Khan, among others, are also alleged to have used offshore vehicles. There are still hundreds more implicated in the leak, and the folks who have control of the documents are trickling out stories in batches, often with global media partners. Look for this story to have legs in the weeks to come.

No Egyptian appears to be in the first batch of the papers: Unlike the Panama Papers — which had implicated members of former president Hosni Mubarak’s family and several other prominent local names — there don’t seem to have been any Egyptian politicians or business figures identified in this latest leak.

Wait, haven’t we heard this before? Nope. Those were the so-called Paradise Papers back in 2017.

You can read the Pandora Papers here, or you can check out one of the many outlets giving the story coverage: The Financial Times | Bloomberg | BBC | NPR.

RUNNING A CLOSE SECOND in competition for your reading attention: The whistleblower who made the WSJ’s Facebook Files possible has gone public. Former Facebook employee Frances Haugen says she “wants to fix the company, not harm it.” She went public in the Wall Street Journal and her account is getting lots of play on the front pages of the global business press: WSJ | FT | CNBC | Reuters.

SIGN OF THE THE TIMES- PwC has told some 40k staff in the United States that they can work remotely forever — but employees run the risk of pay cuts if they move to lower-cost areas. The news comes as CNBC says a growing number of US CEOs are going bonkers over not having staff in the office. The CEO of leading gaming company Electronic Arts says that while hybrid working is taking off, “people want to come back into our offices for the moments that matter.” Companies across North America are delaying return-to-office orders because of the spread of the delta variant.

***IN CASE YOU MISSED IT– Stories from yesterday’s edition of EnterprisePM:

- The global economy is going to face pressure as we close out the year: The delta variant, spiralling food and fuel prices, the supply-chain crisis, worker shortages, the China slowdown, and US budget could combine to form one serious headache for the global economy this quarter.

- EgyptAir flies to Tel Aviv: EgyptAir completed its maiden flight to Israel yesterday and will operate four weekly flights between Cairo and Tel Aviv.

- More oil: OPEC+ could decide to increase oil production at its meeting this week as prices continue to tick upwards amid fears of a global energy crunch.

CIRCLE YOUR CALENDAR-

The final quarter of 2021 is here. Get these dates in your diary:

- PMI: September’s purchasing managers’ indexes for Egypt, Saudi Arabia and the UAE will land on Tuesday, 5 October.

- The Senate will convene for its 2021-2022 legislative season on Tuesday.

- Foreign reserves: September’s foreign reserves figures will be out sometime during the first week of October.

- Public schools are back in session this coming Saturday, as are universities.

- Inflation: Inflation figures for September will be released on Sunday, 10 October.

- IMF + World Bank meetings: The IMF and the World Bank will hold their annual meetings during the week beginning 11 October.

- Interest rates: The Central Bank of Egypt will meet to review interest rates on Thursday, 28 October.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Microschooling — often defined as non-traditional education taking place at a very small scale, with a high instructor-to-student ratio — existed in Egypt before covid-19, but leading players say the movement was already fragmented because of structural issues. And while the pandemic has enhanced the appeal of microschooling for some families, it’s also compounded the challenges in keeping the schools afloat, they say.

DEBT WATCH

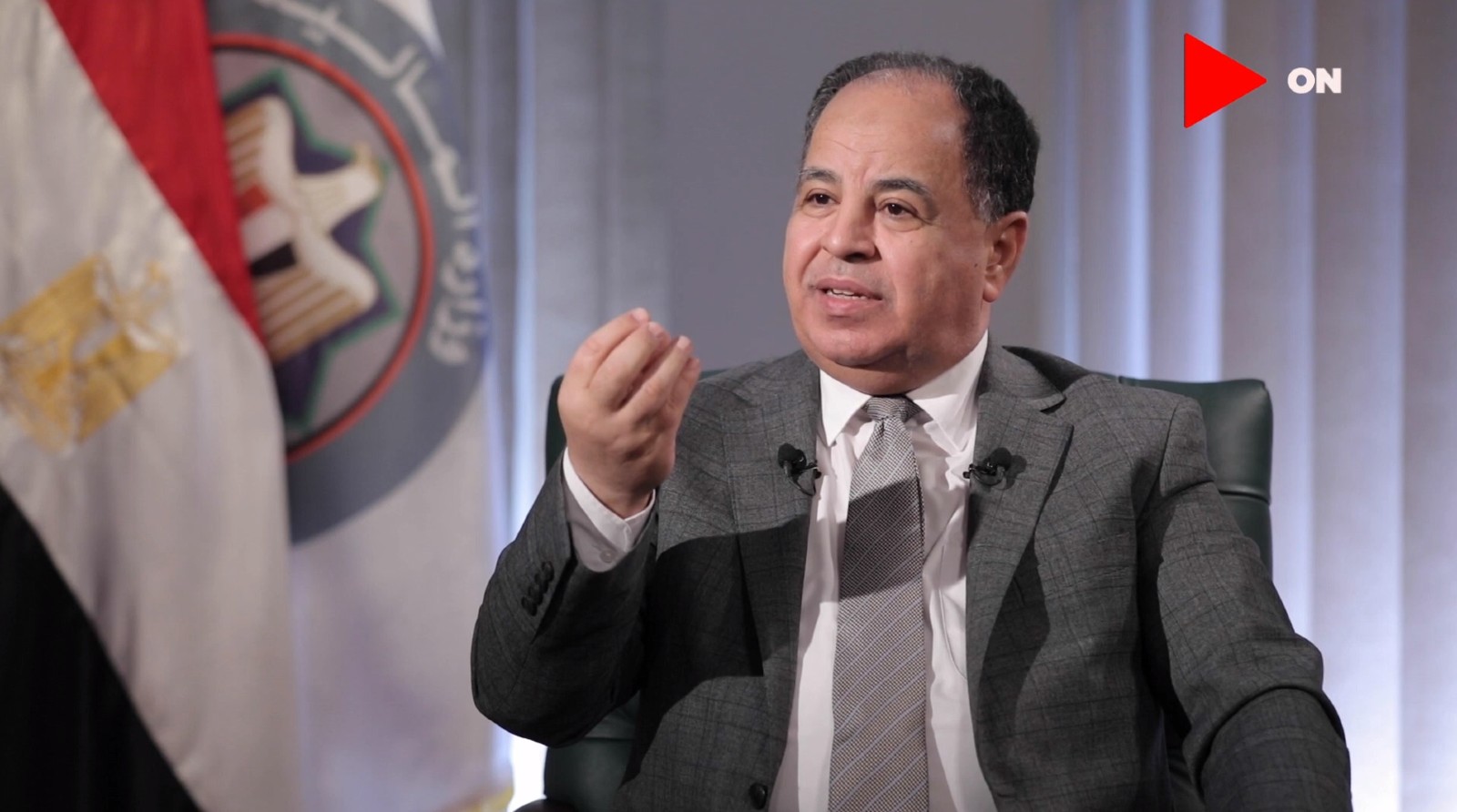

Egypt’s maiden sovereign sukuk could be in the USD 500 mn range

Egypt’s maiden sovereign sukuk offering could be in the range of USD 500 mn, Finance Minister Mohamed Maait told Al Mal. The paper quotes Maait as suggesting that the issuance would not be large and would be “similar in size” to Egypt’s first sovereign green bond issuance of USD 500 mn last year, which was almost 5x oversubscribed. Maait had said in June his ministry was looking to take to market up to USD 2 bn worth of sharia-compliant bonds, though he said then that the exact size and timing of the offering was still TBD.

What’s the status of the issuance? The government is still working on identifying the state assets that will be used to back the issuance, Maait said.

When will the ministry take the issuance to market? Possibly as early as 2022, the finance minister recently said. Al Mal quotes Maait as having said the executive regulations for the new Sovereign Sukuk Act would be enacted before the end of the year, paving the way for the sukuk issuance to follow. The act was signed into law this past August, setting up a regulatory framework allowing the state to issue a variety of sukuk in local and international debt markets. Maait had said in August that the executive regulations for the legislation would be issued within the next three months. The regulations will, when approved by the cabinet, set up a company to manage sukuk offerings as well as a regulatory body of experts.

This comes as part of the government’s wider debt reduction strategy which also entails a shift towards longer-term borrowing and increasing the average maturity of the country’s debt. The government is also looking to diversify its debts through selling new “floating rate” bonds.

What about “sustainable development bonds”? Don’t expect anything on that front till at least next year, the Finance Minister said, after having previously stated that Egypt was considering the possibility of beginning to issue the bonds, which would be linked to Sustainable Development Goals.

Need a refresher on the different types of sukuk? We’ve got you covered with this handy explainer.

AUTO

Auto sales strengthen in August

Passenger car sales continued to strengthen in August, rising 15% y-o-y during the month, according to industry figures released yesterday. Data from the Automotive Information Council (AMIC) showed that local distributors move some 18.3k units during the month, up from 15.9k in August 2020, while on a monthly basis sales rose 3% from the 17.8k in July.

August sales represent sustained growth, not a low base effect: Sales of all types of vehicles saw a dip in 2Q2020 on the back of a pandemic-induced slowdown. But passenger car sales had recovered by August last year, increasing nearly 50% y-o-y from 10.7k in August 2019. This August’s passenger car sales represent a 71% increase on August 2019, the summer before the pandemic hit.

Total vehicle sales were up 18% y-o-y to 24.5k units, compared with 20.8k in August 2020. Vehicle sales also increased slightly on a monthly basis, up 4% from the 23.5k units sold in July.

Sales of buses and trucks also posted growth in August: 1.9 k buses were sold in August, up 19% y-o-y from 1.6k in August 2020, and little changed from July. Truck sales were up by a hefty 32% y-o-y and 14% m-o-m to 4.2k.

AMIC data is self-reported by member distributors, who include the majority of (but not all) industry participants.

DEBT WATCH

Telecom Egypt looks to secure USD 500 mn loan

State-owned Telecom Egypt is looking for some USD 500 mn in financing from a syndicate of international banks, unnamed banking sources told CNBC Arabia. The company has appointed the First Abu Dhabi Bank and Mashreq Bank to arrange the facility, which is expected to have a six-year repayment term. We were unable yesterday to reach a company representative for comment.

This will be the first time the company taps international debt markets since 2018, when TE borrowed USD 500 mn from a syndicate of 14 Arab, Asian and British banks.

The funding will be used to refinance the company’s short-term debt and fund capital expenditure, CNBC suggests.

LEGISLATION WATCH

Who’s running which committee in the House?

Many of the same faces were re-elected to head the House of Representatives’ standing committees yesterday for the new legislative session. The full list was out following an internal vote.

Here’s the lineup of who’s running business-relevant committees, courtesy of Ahram Gate. The majority of the 25 committee heads are members of the majority Mostaqbal Watan, who control some 316 of the 596 seats in the House:

- Economic Committee: Ahmed Samir, who is also the deputy head of the Sixth of October Investors Association. (Re-elected)

- Industry Committee: Moataz Mohamed Mahmoud, the former head of the Housing Committee. (Re-elected)

- Planning and Budgeting Committee: Fakhry El Fiqi, the former IMF advisor and CBE board member (re-elected). El Fiqi’s deputies, Yasser Omar and Mostafa Salem, ran uncontested. Omar said that the committee’s work would start with two meetings scheduled for today on the government’s draft unified budget act.

- Transport and Communications Committee: Alaa Abed, the former chair of the Human Rights Committee, remains the committee boss. Reps. Waheed Qarqar and Mahmoud Al Dabaa were elected as deputy committee heads and Mohamed El Sayed was uncontested in his election as secretary.

- Education Committee: Sami Hashem. (Re-elected)

- Housing and Utilities Committee: Emad Saad Hammouda ran uncontested.

- Tourism and Civil Aviation Committee: Nora Ali, the former president of the Federation of Tourism Chambers, will serve as committee chair for the rest of the legislative session.

- Constitutional and Legislative Affairs Committee: Ibrahim El Heneidi, the former legal and parliamentary affairs minister. (Re-elected)

- Health Affairs Committee: Ashraf Hatem, the former health minister. (Re-elected)

The House was back in session yesterday after its summer recess. A raft of business relevant legislation is on the agenda, from the Unified Budget Act to VAT amendments and a bill that would regulate the fintech space, lawmakers told us last week.

COVID WATCH

The Health Ministry reported 768 new covid-19 infections yesterday, up from 761 the day before. Egypt has now disclosed a total of 306,798 confirmed cases of covid-19. The ministry also reported 37 new deaths, bringing the country’s total death toll to 17,436.

New covid vaccines will be needed by mid-2022 to protect against new variants of the virus, chief executive of BioNTech Ugur Sahin told the Financial Times. The current vaccines should remain effective for the rest of the year against the existing variants but companies will likely have to develop “tailored” shots for more heavily mutated strains that could crop up next year, he said.

LAST NIGHT’S TALK SHOWS

Education and healthcare were the two main themes on the airwaves last night with the imminent start of the 2021-2022 academic year. Kafr El Sheikh governor Gamal Nour El Din ordered seven unlicensed centers giving private lessons closed in a large-scale crackdown. Kelma Akhira’s Lamees El Hadidi (watch, runtime: 7:35) and Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 3:03) showed Nour El Din during a raid on one of the centers.

The Health Ministry is encouraging university students to get walk-in vaccinations at the newly established government walk-in centers ahead of the start of the academic year, Health Minister Hala Zayed told Al Hayah Al Youm’s Lobna Assal (watch, runtime: 6:01). Zayed confirmed that unvaccinated students will not be allowed on campuses this academic year, which starts on 9 October and runs through 3 February 2022. (Second term starts 19 February 2022.)

Draft amendments to a 2010 organ donation law were also a topic of discussion, with Ala Mas’ouleety’s Ahmed Moussa wondering whether the amendments would be on the legislative agenda this session. Moussa spoke to House Health Committee chair Ashraf Hatem, who was scant on details but said that the law is among the committee’s priorities (watch, runtime: 6:17). El Hadidi also took note of the proposed changes (watch, runtime: 9:01).

ALSO ON OUR RADAR

A few things we’re keeping an eye on this morning:

Talaat Moustafa Group is studying expanding its real estate business to Saudi Arabia and Iraq, with CEO Hisham Talaat telling reporters on the sideline of a visit by the Saudi housing minister that both countries are hot prospects for TMG.

Over 450 exporters have received some EGP 875 mn in overdue export subsidies during the first two phases of the government’s scheme to repay exporters overdue subsidies in a lump sum.

PLANET FINANCE

EM equities are looking very vulnerable to a spike in US treasury yields, with Bloomberg data showing the sensitivity of EM assets to fluctuations in US treasuries at its highest level since 2017 last week. For the first time in nearly half a decade, EM stocks and, similarly, bonds responded very aggressively to a brief spike in US two-year treasury yields — with stocks registering their biggest streak of weekly declines in over two years and bonds seeing some USD 28 bn in outflows last week. Driving all of this appears to be the spectre of rising inflation in the global economy as central banks become increasingly hawkish.

On the debt side of the house, Bloomberg thinks Egypt is well-positioned to avoid the worst of a potential EM selloff: Strong foreign reserves, a fast-growing economy, and a switch to longer-term maturities in recent years mean Egypt is best-placed among EM to weather a potential storm, Bloomberg wrote over the weekend. A reliance on foreign investors however means we’re vulnerable to volatility in fixed-income markets, while high debt service costs could get even higher if Egypt falls under pressure to pay out higher yields to stem potential outflows.

Adnoc Drilling shares rose 28% during its first day trading on the ADX yesterday, closing at AED 2.95 per share after opening at AED 2.30. The share price popped as much as 33% during trading, pushing the company’s market cap to AED 48 bn, before falling back slightly by the session’s close, according to Bloomberg. The IPO had been met with huge investor demand, allowing the company to increase the size of the institutional offering to USD 1 bn. EFG Hermes was joint bookrunner on the IPO, the leading EM investment bank said yesterday (pdf).

Speaking of going public: Carmaker Volvo, majority owned by China’s Geely, is getting ready to IPO in Sweden in a transaction that could value the company at up to USD 25 bn. The Wall Street Journal, which broke the news in an exclusive, says that if the transaction goes ahead, it would be “one of the car industry’s most dramatic turnarounds. Ford Motor Co, weakened by the global financial crisis, sold the Swedish company to Geely for USD 1.8 bn in 2010.”

The Emirati government is expected to start marketing its first federal USD bond this week, sources told Reuters. Although individual Emirates have issued sovereign bonds before (see: Dubai, Abu Dhabi), this will be the first time the federal government takes to the debt markets.

|

|

EGX30 |

10,366 |

-1.4% (YTD: -4.4%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

11,453 |

-0.4% (YTD: +31.8%) |

|

|

ADX |

7,719 |

+0.3% (YTD: +53.0%) |

|

|

DFM |

2,834 |

-0.4% (YTD: +13.7%) |

|

|

S&P 500 |

4,357 |

+1.2% (YTD: +16.0%) |

|

|

FTSE 100 |

7,027 |

-0.8% (YTD: +8.8%) |

|

|

Brent crude |

USD 79.28 |

+1.2% |

|

|

Natural gas (Nymex) |

USD 5.62 |

-4.2% |

|

|

Gold |

USD 1,758.40 |

+0.1% |

|

|

BTC |

USD 48,137.49 |

-0.11% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 1.4% at yesterday’s close on turnover of EGP 1.18 bn (24.7% below the 90-day average). Local investors were net buyers. The index is down 4.4% YTD

.

In the green: Abou Kir Fertilizers (+1.1%), Mopco (+0.9%) and Pioneers Holding (+0.4%).

In the red: MM Group (-3.3%), Telecom Egypt (-3%) and Ibnsina Pharma (-3%).

Major indexes in Asia are mostly in the red, with the Nikkei, Kospi and Hang Seng are all shedding early gains. All are down 1-2% at dispatch time, with only Shanghai bucking the trend (it’s up about 0.9%). Futures suggest most major European indexes will open in the green, as will the Dow, S&P and Nasdaq later today.

AROUND THE WORLD

Some foreign fighters have left Libya, as the unity government continues to call for international help to clear its land from the large number of mercenaries, Libyan Foreign Minister Najla Mangoush said yesterday, according to Reuters. The civil-war torn country is due to hold political elections as scheduled on 24 December after rivals agreed on a roadmap earlier in 2021. Mercenaries allied with both sides remain in the country, despite a ceasefire agreement signed a year ago calling for the withdrawal of all troops within three months.

What impact has covid-19 had on Egypt’s microschooling movement? Covid-19 presents a dilemma: how to protect children while they continue learning? Globally, 2020 saw the rise of “pandemic pods,” where children were homeschooled in small groups. Though the trend didn’t take off in Egypt as it did in the US, some parents began looking more closely at different forms of microschooling as potentially safer alternatives to traditional schools or nurseries.

But Egypt’s leading microschooling players say the movement — which existed pre-covid, but was already fragmented because of structural issues — has been buffeted by challenges during the pandemic. Most microschools seem unable to stay afloat in Egypt — and covid makes it harder, they add.

What exactly is microschooling? Precise definitions vary, but most agree that microschools are small… Microschooling is notoriously difficult to define. “Different people can have very different ideas of what microschooling is,” Nariman Moustafa, founder of Cairo-based self-directed learning center Mesahat, tells Enterprise. Moustafa characterizes microschools as generally having no more than 100 children, with the teacher:child ratio around 1:7 or 1:10. Homeschooling cooperatives — like pandemic pods — usually consist of five to 10 families, she adds.

…and sometimes unorthodox: ACT Microschools founder Deena Amiry defines a microschool as a small learning community not seeking to emulate a traditional schooling experience. A school of under 150 children with grade-segregated classrooms and set study times for particular subjects is simply a small traditional school, she tells Enterprise. “I wouldn’t consider that a microschool.” Different age groups often learn together, teachers facilitate rather than lecture, and experiential learning is highly valued, say Moustafa and Amiry, agreeing these are core microschooling traits.

“Microschooling in Egypt is very fragmented. It’s hard to understand what the landscape is,” says Amiry. She started Young Scholars of Egypt (YSE) — the Egypt wing of ACT Microschools — 10 years ago, when the only other alternative education provider she would have termed a microschool was Kompass. “Since then, I’ve heard of others popping up, but none with any kind of staying power,” she says. A sweep online reveals virtually no Egyptian providers calling themselves microschools, but both Amiry and Moustafa believe that many small-scale providers are likely operating without marketing themselves online.

Why is this? Legal limbo makes it difficult to go legit: Egypt’s legal framework doesn’t have provisions for alternative education, say Moustafa and Amiry. Alternative schools aren’t regulated by the Education Ministry, and don’t teach the national curriculum or award ministry-recognized certificates like the Thanaweya Amma or the IB, says Moustafa.

This presents challenges ranging from registration to growth: To register in Egypt as an international school, ACT would need to fulfill requirements that aren’t feasible for a microschool, including substantial capital investment, says Amiry. Registering as a community school would mean operating within a framework that precludes innovation, she notes. Instead, it’s registered in the US as a for-profit entity. “There's no way families or educators could form something different and progressive, and have it legalized within Egypt’s current framework,” she adds.

Even as market leaders, YSE and Mesahat operate on a very small scale: YSE currently serves around 70 children aged 3-18 in five mixed-age groups — kindergarten, lower elementary, upper elementary, middle school and high school — says Amiry. Since June 2020, it’s run on a hybrid model of outdoor schooling and online study, she says. Moustafa launched Mesahat in 2016. Until covid hit, it operated as an in-person self-directed learning space, and served 150 families during this time, with 25 long-term, regular learners, she adds.

One advantage of staying small? There’s wiggle room for experimentation: Alternative education movements like microschooling exist in a grey area where they aren’t directly overseen by the government, says Moustafa. This gives education providers space to experiment with different models of instruction and assessment, she adds.

But ultimately, the aim is to build a bigger movement: Mesahat has trained 200 teachers on its methodology, and mentors trainees wanting to launch their own community learning centers, says Moustafa. She has a map of 260 Cairo-based organizations with non-formal education models and content, she tells us.

Or establish regional links: Amiry intends ACT to serve as a network of connected microschools spanning Africa. Its shared tech platform and common vision would empower the region’s microschools, she believes, while a common core curriculum would be adapted to each local culture.

But covid compounds the practical challenges in keeping microschools like YSE and Mesahat afloat: Covid has forced some of the key education components of microschools like YSE and Mesahat to be put on hold, say Amiry and Moustafa. It’s harder to physically host other organizations, and go on field trips because of the need for social distancing, says Moustafa.

There’s been limited success transferring the microschooling model online: YSE was able to shift online quite effectively because the ACT platform was designed to be used that way. “I think ACT actually blossomed during covid, because they were able to do so many things online,” says Moustafa. But to adapt to covid, it let go of the building it had previously housed face-to-face classes in, instead doing all of its in-person learning outdoors. Social distancing impacted peer-to-peer learning, says Amiry. Mesahat, meanwhile, shifted online for a period of time, but has since had to suspend operations because it wasn’t sustainable long-term. “We worked hard and innovated, and I think we did a good job. But at some point, the children just didn’t want to sit in front of screens anymore,” Moustafa says.

And though covid enhances the appeal of microschooling for some parents, not everyone will stick with it: For safety reasons, covid pushed more parents to try forms of microschooling like the homeschooling cooperatives, says Moustafa. Some families will likely continue with this beyond covid, because of its benefits — namely the degree of individual attention the children receive. But others will probably revert to more traditional education models as soon as they can, she says. “This kind of microschooling is something only privileged families can really afford to do,” she notes.

Your top education stories for the week:

- Fast-track vaccinations: Uni students can now get jabbed within 24 hours of registering for an appointment.

- Education vaccine drive: More than 50% of public sector teachers and administrative staff have received at least one dose of a covid vaccine.

- M&A: Dubai-listed education and healthcare investment firm Amanat intends to acquire majority stakes in companies in Egypt, Saudi Arabia and the UAE, and could deploy AED 1 bn.

- Moves: The American University in Cairo appointed two new deans: Lotfi Gaafar will lead the School of Sciences and Engineering, and John Meloy will head the School of Humanities and Social Sciences.

CALENDAR

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

October: Romanian President Klaus Iohannis could visit Egypt mid this month to discuss ways to boost tourism cooperation between the two countries.

2-4 October (Saturday-Monday): Techne Summit, Bibliotheca Alexandrina, Alexandria, Egypt.

3-5 October (Sunday-Tuesday): Pharmaconex, Egypt International Exhibition Center, Cairo, Egypt.

4 October (Monday): Union for the Mediterranean ministerial climate conference, Cairo, Egypt.

5 October (Tuesday): Senate returns from recess; new legislative session begins.

5 October (Tuesday): Afreximbank will host a preparatory conference (pdf) for the intra-African Trade Fair 2021 at the Westin Cairo Golf Resort & Spa.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools and universities begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

15-21 October (Friday-Thursday): Intra-African Trade Fair 2021, Durban, KwaZulu-Natal, South Africa.

18 October (Monday): E-Finance begins trading on EGX.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28 October (Thursday): Second tranche of overdue subsidy payouts will be handed to eligible exporters.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

31 October (Saturday): World Cities Day, Luxor, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2022: Launch of the Egyptian Commodities Exchange.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.