- Non-oil private sector continues to shrink in August but inflation-inspired spending spree softens the decline. (Economy)

- Egypt’s high real interest rate could defend us against Taper Tantrum 2.0 when the Fed starts to pull back on stimulus. (Economy)

- Elsewedy Electric subsidiary signs EPC contract in Ghana. (Infrastructure)

- Four Egyptian startups secure USD 125k in seed funding from YC. (Startup Watch)

- Vacsera to produce 300k Sinovac vaccines per day from Wednesday. (Covid Watch)

- Chinese ride-hailing app DiDi launches in Egypt next week. (What We’re Tracking Today)

- Conference season is back with a vengeance. Here’s what’s coming up this week. (What We’re Tracking today)

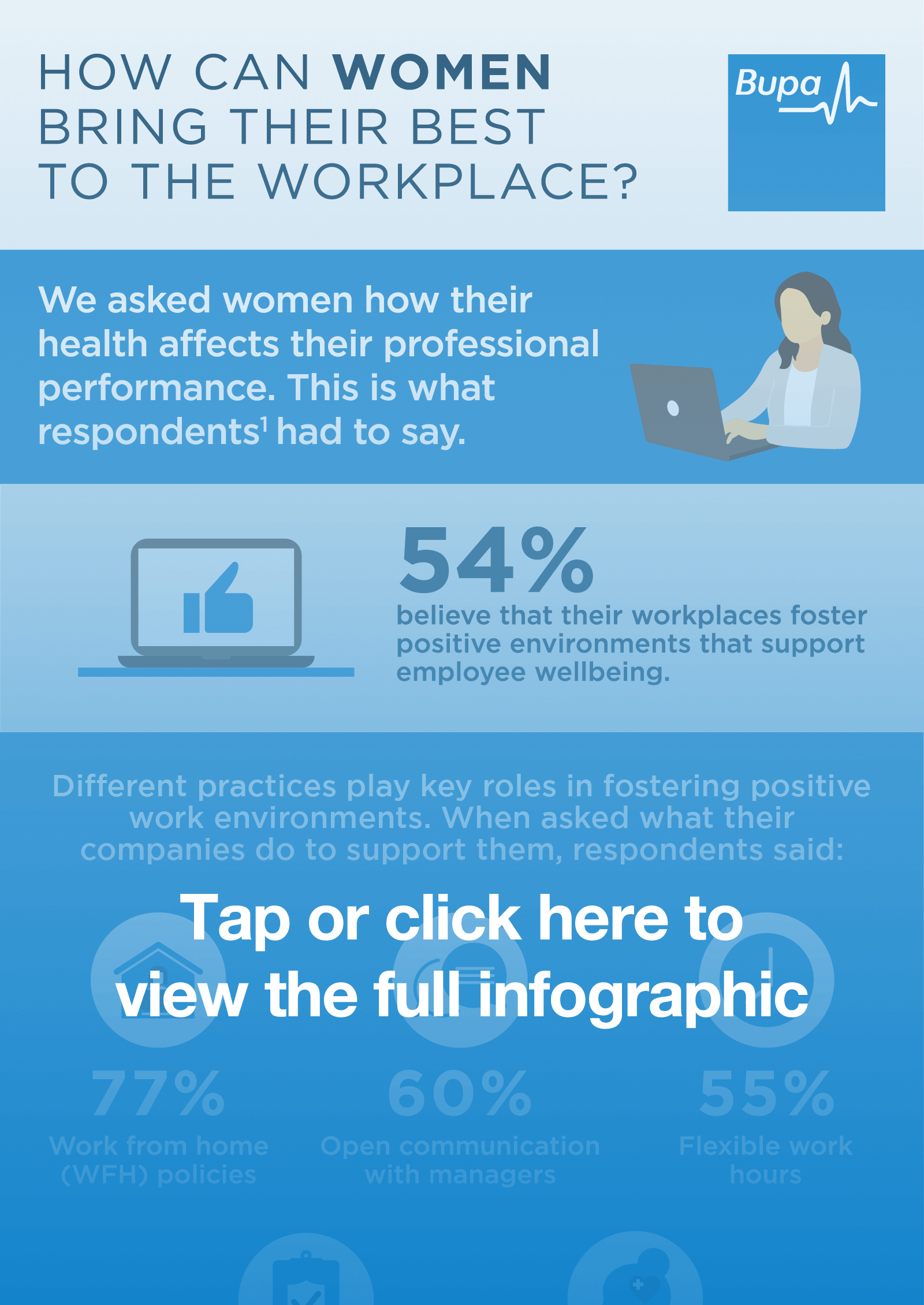

- The results of the Enterprise-Bupa Egypt Insurance poll are here. (Poll)

- Expanding private schools outside of Cairo is tough. So how are school operators doing it? (Blackboard)

- Planet Finance — Desperate for returns, bond investors are buying the junkiest junk they can find.

Monday, 6 September 2021

Private sector activity contracts in August despite surge in purchasing activity

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and happy Labor Day to our readers in Canada and the United States. It’s a really busy early fall morning here in Omm El Donia, so we’re going to jump right in:

WHAT’S HAPPENING TODAY-

Fall conference season is back with a bang this week, with many of the gatherings taking place in person:

It’s day two of the Arab Labor Conference, which is running through to 12 September at the InterContinental CityStars Hotel in Heliopolis. Government officials, ambassadors, trade union reps and business owners’ association delegates from 21 Arab countries are participating in the gathering.

It’s also the second day of the Arab Security Conference at the Nile Ritz-Carlton in Downtown Cairo. The cybersecurity conference will run until tomorrow.

Also taking place this week:

- Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, which kicks off tomorrow and features Vice Minister of Finance Minister Ahmed Kouchouk. The conference will run until Wednesday.

- The Egy Health Expo will also take place on Tuesday at the Al Manara International Conference Center.

- The International Cooperation Ministry is hosting its inaugural two-day Egypt-International Cooperation Forum (ICF) this Wednesday.

- DevOpsDays Cairo 2021, organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs, takes place this Thursday.

It’s Labor Day in the United States and Canada. Wall Street and Bay Street are closed today, but will be back to trading tomorrow.

NEXT WEEK-

Another new entrant to Egypt’s ride-hailing market will launch next week: Chinese ride-sharing app DiDi will start operating in Egypt next week, a company representative told Enterprise. The company will launch in Alexandria before expanding to other areas of the country. It is currently in the process of hiring drivers and is promising not to charge commission in their first month.

THE BIG STORIES INTERNATIONALLY-

The Taliban are still getting the front-page treatment: Reuters reports that a key opposition figure has agreed to enter talks to end fighting with the Taliban, while the Wall Street Journal takes a detailed look at the Biden administration’s thinking (or lack thereof) on the withdrawal from Afghanistan.

US covid job benefits expire: The Associated Press, Washington Post, and Bloomberg are both focusing on the expiry of covid-era jobless benefits for US workers.

*** IN CASE YOU MISSED IT-

- EGX has implemented its new closing share price calculation mechanism: The new “pre-close” auction system came into effect yesterday in a move designed to improve accuracy, increase trading volumes and boost foreign inflows into Egyptian shares.

- El Sisi talks vaccines for minors, covid-19 fourth wave: Egypt could start providing vaccines to children under the age of 18 at schools once the vaccine gets approved for use by minors in Egypt, the president said at a charity event yesterday.

- When whales walked on land: The new discovery of a four legged whale fossil in Egypt’s Western Desert could help us understand how the mammals evolved from living on land to the sea.

|

MORNING MUST READ-

M&A goes wild: Global transactions are booming and are on course to smash annual records with almost USD 4 tn agreed just eight months into the year, the Financial Times reports. August, generally a quiet month for M&A, saw agreements worth USD 500 bn, surging from USD 289 bn in the same month last year, and USD 275 bn in August 2019.

Fuelling the boom: The salmon-colored paper says that super-low interest rates, strong corporate earnings, and the “return of animal spirits to corporate boardrooms” are behind the bumper figures. The pickup in dealmaking has been evident across a broad range of sectors, with tech leading the way: M&As in the sector account for 21% of all transactions so far this year, marking a heyday not seen since the dot-com boom at the turn of the century. Bankers and lawyers are raking in the dough as a result.

Enter CNBC, with a word of caution: We may also be looking at a record-breaking fall IPO pipeline on Wall Street as companies line up to take advantage of current market conditions, the broadcaster says. The catch? “There’s a huge amount of froth in the marketplace right now much like we’ve seen in other important tops of the market that only became obvious in hindsight.”

CIRCLE YOUR CALENDAR-

Key news triggers remaining in the first two weeks of September:

- Foreign reserves: The central bank will release foreign reserves figures for August sometime this week.

- Inflation: Inflation data for August will drop at the end of this week.

- Interest rates: The Central Bank of Egypt will meet to review interest rates on Thursday, 16 September.

House Speaker Hanafi Gebali will head a parliamentary delegation to the Fifth World Conference of Speakers of Parliament, taking place on 7-8 September in Vienna. Topics on the agenda include gender equality, the effects of covid-19 on democracy, and terrorism.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Egypt is seeing soaring demand for K-12 private school education, but expansion remains heavily Cairo-focused. For many operators, expanding beyond the capital just isn’t worth it due to the high land costs and potentially lower revenues. But those that do venture into the governorates say there’s a strong business argument for doing so, including meeting substantial demand, facing low competition, and having the chance to develop Egypt’s education system. We talk to education providers about why they see expansion beyond Cairo as a smart move, and how they’re going about it.

ECONOMY

Egypt’s private sector is responding to rising inflation by buying. A lot.

Egypt’s non-oil private sector shrank again in August, but at a slower pace than in July: Business activity in Egypt’s non-oil private sector contracted for the ninth straight month in August — but a record surge in corporate spending and a pick-up in demand softened the decline, according to IHS Markit’s Purchasing Managers’ Index (pdf). The index rose to 49.8 in August, up slightly from 49.1 in July, but still below the 50 mark that separates contraction from expansion.

This was the first time purchasing activity expanded in nine months and grew at its quickest pace since the survey began in April 2011, IHS Markit said.

Output and new orders rose for only the second time since December, indicating that businesses are continuing to rebound from the pandemic, the report said. Both metrics remained above their long-run averages for the fourth consecutive month, suggesting that the private sector is in a “second phase of recovery,” said IHS Markit economist David Owen.

Fuelling the buying spree: A fear of inflation. Input cost inflation rose to its highest level in two years, leading purchasing managers to rush to build up stock in August ahead of an anticipated further price surge. Businesses pointed to the rise in commodities such as metals, plastics and timber — as well as anticipated shortages due to pandemic-induced supply chain disruptions — as factors affecting the uptick. Supply chain pressures also weighed on inventories, which saw a decrease for the first time in three months as firms leveraged their existing stocks in order to boost output.

Which led to a rise in end prices for consumers: A rise in transport costs and customs fees also led to a markup in prices that were passed on to end-consumers, as firms sought to improve margins.

Employment increased for the second month running, with survey participants attributing the growth in part to an increase in tourism and a rebound in market activity.

But growth rates were marginal, with all three indices hovering below the 50 mark and remaining in contraction territory, though more than half of firms surveyed expressed strong optimism that the growth would be sustained over the coming year.

The latest PMI figures got attention in the foreign press: Reuters | Bloomberg.

ELSEWHERE IN THE REGION- Saudi Arabia’s PMI reading (pdf) dropped for the second month running in August, recording 54.1 in August from 55.8 in July — the slowest growth recorded in five months. Businesses forecast subdued future output, leading to negligible growth and a slow-down in the pace of new stock purchases.

The UAE’s non-oil private sector saw a decline in its growth rate, with a PMI reading (pdf) of 53.8 in August, down from 54.0 in July. Though business activity in the UAE expanded at its fastest rate since July 2019, new covid variants cast a shadow of uncertainty over future demand. But businesses remain optimistic that Dubai’s Expo 2020 could provide the country with an investment boost.

ECONOMY

Can Egypt weather a taper tantrum 2.0?

Egypt’s world-beating real interest rate will help it weather an uptick in global rates, but the country faces some risk from capital outflows unless it acts to reduce its debt costs, S&P Global Ratings said in a report yesterday. Despite enjoying the highest real interest rate in the world, a rise in rates in the developed world could leave Egypt vulnerable to outflows if markets seen offering relatively lower risk start hiking rates.

Taper tantrum 2.0: We could be at risk of outflows if the Federal Reserve starts to unwind its bond-buying programme sooner than expected. Statements by Fed head Jerome Powell last month signalled that the central bank could begin rolling back its program as early as this year, which would be followed by an uptick in interest rates, potentially putting some pressure on the EGP carry trade. But a poor US jobs report out at the end of last week has pundits saying the Fed could wait a while longer.

Our high interest rates will help stem the tide: “Compared with some other emerging markets, we think Egypt may fare somewhat better in the event of US interest rate hikes, mainly due to high real interest rate,” Gupta wrote, citing the high returns, foreign reserve accumulation and the USD exchange rate, which has seen slight gains for the EGP. Egypt also has stronger policy credibility than other EMs and it’s positive growth outlook also counts in its favor.

Egypt has a sizable foreign reserves stockpile, which should help it avoid serious capital outflows. We have managed to recoup more than half of the almost USD 10 bn deployed in response to the initial wave of the pandemic last year, last month reaching nearly USD 40.6 bn. Reserves eased close to USD 35 bn during the peak of the covid-19-induced global pullback from emerging markets.

S&P is concerned about the possible impact of a sustained pullback in tourism: “We could see elevated balance-of-payment risks for Egypt if there were a sharp withdrawal of funds while current account receipts remained weak owing to pandemic-related damage to tourism and export receipts,” Gupta wrote. “This could result in a substantial decline in foreign exchange reserves and reduce Egypt’s ability to service its debt.”

Egypt’s high real rates are both a blessing… One of the key policy goals of the Central Bank of Egypt has been to maintain high real interest rates, which has enabled it to attract bns of USD in portfolio inflows and stockpile foreign reserves. Portfolio investment has been an important source of hard currency for Egypt since the onset of the pandemic, which caused tourism receipts to tank and heavily disrupted export and Suez Canal revenues.

…and a challenge: Egypt’s rates means that it currently has one of the highest debt service burdens among countries with B+ ratings and lower, while its interest payments as a proportion of GDP are among the highest in the world.

The government is working to lower its debt costs, embarking on a debt reduction strategy that includes decreasing reliance on short-term debt in favour of longer-term debt, and diversifying its funding sources to include eurobonds, sovereign sukuk and green bonds. The addition of passive flows via the inclusion in the new FTSE Russell bond index, and the possible addition of the JPMorgan index later this year will lower volatility.

Egypt could help bring down yields by increasing confidence in the economy: Investors will likely reduce the interest they demand on sovereign debt should the government deliver strong economic performance and policy credibility, Gupta wrote. This would allow the government to reduce its debt servicing costs without jeopardizing capital inflows.

A MESSAGE FROM BUPA EGYPT INSURANCE

INFRASTRUCTURE

Elsewedy Electric subsidiary signs EPC contract in Ghana

Elsewedy returns to Ghana: Elsewedy Electric for Transmission and Distribution of Energy signed a USD 16.7 mn EPC contract to build a substation for Ghana’s state-owned electricity company, it said in a bourse filing (pdf) last week. The company will be responsible for the design, supply and installation of the entire project, which it will deliver within a two-year period, it said.

Elsewedy Electric has been increasing its international footprint in recent months, earlier this year acquiring two power transformers companies in Pakistan and Indonesia. The company, as part of a joint venture with Arab Contractors, is also working to execute the Julius Nyerere Hydropower Project in Tanzania. Earlier this year, the Elsewedy’s Transmission and Distribution of Energy subsidiary also signed a USD 53.2 mn contract with the Kuwaiti Electricity and Water Ministry to supply and install overhead transmission lines.

IN OTHER INFRASTRUCTURE NEWS

State-owned, EGX-listed Alexandria Container and Cargo Handling Company signed a two-year contract with the French shipping company, CMA CGM, under which the company will anchor its ships on the holding company’s berths, according to a statement (pdf).

The news comes as Egypt has been working on upping its port infrastructure in efforts to attract more business with shipping companies. Gharably Integrated Engineering Company (GIECO) is set to receive an EGP 12 bn loan to develop Alexandria’s Abu Qir port, while earlier this summer the UAE’s National Marine Dredging Company was awarded a AED 290 mn contract for dredging work at Damietta Port to deepen the port’s basins and sea lanes.

STARTUP WATCH

4 Egyptian startups secure USD 125k seed funding

Four Egyptian startups secured USD 125k each in seed funding by US accelerator Y Combinator, Magnitt reports. The funding came either following the companies closing pre-seed rounds, or as boosters to companies that are looking to expand and complete acquisitions.

The startups: The Egyptian startups include Cairo-based delivery service ShipBlu, ins. marketplace Amenli, SaaS startup Pylon and online auto-marketplace Odiggo, which had secured USD 2.2 mn in seed financing from Y Combinator just last month. An additional two startups from Morocco, the B2B e-commerce platform for FMCG products, Chari, and supply-chain platform Freterium also received funding.

The funding came as part of Y Combinator’s second cycle of the year, which took place from June to August. The company runs two annual funding cycles over a period of three months, during which startup founders meet with partners and present their project to a group of investors. The seed accelerator company then takes small stakes in many of the startups. This year’s summer batch included 377 startups from 47 countries, with a record of 15 African companies.

Over the first half of the year Egyptian startups landed USD 194 mn in venture capital finance, which represented 26% of all MENA fundraising during the half. The 194 mn figure was led by a USD 42 mn contribution to Egyptian digital trucking platform Trella.

ALSO FROM PLANET STARTUP- Proptech startup Nawy will launch new rental services by 2022, as part of its plans to expand into the brokerage market, co-founder Mostafa El Beltagy told Hapi Journal. The company’s eventual expansion plans include entering Saudi Arabia, UAE, and South Africa. Nawy raised an undisclosed seven-figure seed round led by the Sawiris family in July, which it will use to improve its tech and expand its team.

COVID WATCH

Vacsera to increase vaccine production on Wednesday

Vacsera production to go up a gear on Wednesday: State-owned vaccine-maker Vacsera will ramp up production of Sinovac shots to 300k per day from Wednesday, health ministry spokesperson Khaled Megahed told El Hekaya’s Amr Adib (watch, runtime: 3:38 | 2:20).

By our maths this would give Vacsera a monthly production capacity of some 9 mn doses. The company eventually expects to raise capacity to produce 15-18.5 mn doses each month after the opening of its new facility in Sixth of October in November.

More vaccine shipments coming: The first shipment of Moderna vaccines should arrive in the country in the coming four days, Megahed said last night, without disclosing how many shots would be delivered. The following week some 3.2 mn doses of the Pfizer shot are set to arrive on 16 September, he said.

The Health Ministry reported 343 new covid-19 infections yesterday, up from 331 the day before. Egypt has now disclosed a total of 290,027 confirmed cases of covid-19. The ministry also reported 13 new deaths, bringing the country’s total death toll to 16,789.

LAST NIGHT’S TALK SHOWS

The big story on the airwaves last night: Health Ministry spokesperson Khaled Megahed dropped into El Hekaya to provide updates on all things vaccine. Check out this morning’s Covid Watch section for the details.

CBE governor Tarek Amer was all over the airwaves after he was named one of Global Finance Magazine’s 10 best central bank governors in the world in 2021. Ala Mas’ouleety (watch, runtime: 5:01), Al Hayah Al Youm (watch, runtime: 2:22), Masaa DMC (watch, runtime: 1:32) and Hadith El Qahera (watch, runtime 1:40) all had coverage of the story.

Also getting attention: Everyone and their mother had coverage of the Tahya Misr aid convoy that’s set to distribute goods to 5 mn Egyptian families around the country. El Hekaya (watch, runtime: 2:10), Masaa DMC (watch, runtime: 1:11), Al Hayah Al Youm (watch, runtime: 6:53) and Kelma Akhira (watch, runtime: 2:10) all had the details.

On another note, Kelma Akhira’s Lamees El Hadidi spotlighted the personal status law for non-Muslims that was recently approved by the cabinet. El Hadidi discussed the new law in a phone call with Andrea Zaki, president of Egypt’s Protestant community, who said that the law was currently with the justice ministry and that a decision has been made to send it on to the parliament (watch, runtime: 10:32 | 2:44). He added that churches had participated in drafting the law through expansive talks with the justice ministry, adding that 90% of churches are in agreement with it. Zaki said that the controversial articles relate to marriage, divorce and annulment, adding that the justice ministry had agreed with Egypt’s three Christian denominations that each one would see separate articles on these matters.

EGYPT IN THE NEWS

*Crickets*: Egypt is nowhere on the radar of the international press this morning.

ALSO ON OUR RADAR

Target Real Estate Investment has reduced its stake in EGX-listed Real Estate Egyptian Consortium from 13.2% to 11.5%, selling nearly 6.8 mn shares in the company for around EGP 51.9 mn at an average price of EGP 7.60 per share, according to a bourse disclosure (pdf). The transaction was managed by Arabeya Online, Beltone Securities, Arab African International Securities, and Blom Egypt Securities. Target’s direct and indirect shares in the company now amount to 17.6%.

Target in April more than halved its direct stake in the company from 24.5% to 11%, selling 5.3 mn shares to individual investors Aly Abdel Latif Mahgoub and Abdel Latif Mahgoub for EGP 84 mn, before again raising its stake in the company through a number of transactions in the intervening months.

Other things we’re keeping an eye on this morning:

- A EGP 650 mn aid package designed to support 5 mn families nationwide was launched by Prime Minister Mostafa Madbouly in the new capital yesterday.

- At least 12 people were killed and 30 injured when a bus overturned on the Cairo-Suez desert road late on Saturday, the Associated Press reports, citing the state-owned MENA agency. The accident was caused when the bus, which was on its way to Cairo from the coastal resort of Sharm El-Sheikh, hit a concrete barrier.

PLANET FINANCE

Ultra-low rates are driving investors hungry for yield into the riskiest types of debt, the Wall Street Journal reports. Faced with paltry returns on most speculative-grade debt and tightening spreads, fund managers are buying into corporate debt with the lowest credit ratings — and driving yields down even further in the process. Bonds rated triple-C or lower had offered an extra 2.79 percentage points of spread at the start of the year but thanks to the buying spree, this had dropped to a 20-year low of 1.51 percentage points in July.

Aramco slashes Asia crude prices as production ramps up: Saudi Aramco cut October prices for Asia by more than twice the expected amount in a sign that the world’s biggest oil exporter is looking to compete for a greater market share, Bloomberg reports. Arab Light crude, the company’s main oil grade, has been discounted by USD 1.30 a barrel to a premium of USD 1.70 more than the regional benchmark. With Brent crude up 40% this year and OPEC+ last week deciding to add another 400k bbl/d to the market in October, Aramco seems to be taking a more aggressive line on pricing as it fights to export as many barrels as possible before domestic demand likely drops off in the fall.

|

|

EGX30 |

11,096 |

-1.8% (YTD: +2.3%) |

|

|

USD (CBE) |

Buy 15.65 |

Sell 15.75 |

|

|

USD at CIB |

Buy 15.65 |

Sell 15.75 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

11,335 |

+0.1% (YTD: +30.5%) |

|

|

ADX |

7,636 |

-0.2% (YTD: +51.4%) |

|

|

DFM |

2,913 |

-% (YTD: +16.9%) |

|

|

S&P 500 |

4,535 |

-% (YTD: +20.8%) |

|

|

FTSE 100 |

7,138 |

-0.4% (YTD: +10.5%) |

|

|

Brent crude |

USD 72.61 |

-0.6% |

|

|

Natural gas (Nymex) |

USD 4.71 |

+1.5% |

|

|

Gold |

USD 1,833.70 |

+1.2% |

|

|

BTC |

USD 51,705 |

+3.0% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 1.8% at yesterday’s close on turnover of EGP 1.5 bn (0.2% above the 90-day average). Local investors were net sellers. The index is up 2.3% YTD.

In the green: EK Holding (+0.9%), CIRA (+0.2%).

In the red: Egyptian for Tourism Resorts (-11.9%), Orascom Development Egypt (-5.7%) and Pioneers Holding (-4.5%).

Asian markets are mostly in the green in early trading this morning. Futures in Europe suggest markets there will open largely in the red today. US and Canadian markets are closed in observance of Labor Day.

DIPLOMACY

President Abdel Fattah El Sisi called has Israeli counterpart, Isaac Herzog, on Sunday evening to congratulate him on becoming the president and wish him a happy Rosh Hashanah, according to an Ittihadiya statement. Herzog told El Sisi that he appreciated Egypt’s role in helping to achieve peace and stability in the region, while the two also discussed efforts to resume Israeli-Palestininan peace talks.

Rosh Hashanah is the Jewish new year and is observed this year from yesterday evening through Wednesday evening. Shanah tovah to readers who are observing.

The call comes amid reports that El Sisi is preparing a new roadmap to restart Israel-Palestine peace talks. Israeli, Palestinian, American, European and Arab representatives will soon visit Egypt to discuss restarting peace talks, the Times of Israel reports on the basis of a story from a London-based outlet that cites “high-ranking” Arab officials. The sources claim that Egyptian intelligence officials have been working on an initiative with European and Arab allies, and will unveil the proposal in the coming weeks.

Israeli PM is expected in Cairo soon: Naftali Bennett could soon become the first Israeli PM to make an official visit to Egypt in more than a decade after El Sisi extended an invite last month.

Egypt, PA, Jordan call for end to Israeli obstruction: Palestinian Authority president Mahmoud Abbas and Jordan’s King Abdullah II last week joined El Sisi for a trilateral summit in Cairo, where the three accused Israel of trying to undermine the possibility of a two-state solution, and reaffirmed their commitment to a Palestinian state based on June 1967 borders.

AROUND THE WORLD

The UAE is loosening residency rules to attract international talent to the country and has announced a new “green” visa that will remove the requirement for expats to be sponsored by an Emirati employer, Bloomberg and the Financial Times report. The changes will also allow individuals who lose their jobs to remain in the country for 180 days, as part of post-covid measures to retain wealthy residents, many of whom had to leave during after pandemic induced lockdowns and job cuts last year.

Given the challenges of private school expansion beyond Cairo, why and how are school operators doing it? Egypt’s demand for private school education is soaring, with K-12 private school enrollment growing at almost double the rate of public school enrollment. But private school expansion is heavily Cairo-focused. High land costs, low earning power, and the challenge of assessing demand means expansion in the governorates just isn’t worth the effort for many operators, sources told us last month.

But some operators say there’s a strong business case to expand into the governorates: Huge demand, low competition, and the chance to develop Egypt’s education system are great reasons to expand in the governorates, they believe. Cost-effective expansion is possible through targeted service provision and acquiring reasonably-priced land, they say. It could accelerate massively if the government provided land at no cost, through public-private partnerships, they argue.

This pool is pretty small, though. For CIRA and its subsidiary Eduhive, expansion beyond Cairo is a key strategic priority. By 2023, it will have over 25k seats in Upper Egypt alone at K-12 schools and higher education establishments, says CIRA CEO Mohamed El Kalla. And BalancED Education is eyeing country-wide expansion, chairman Ahmed El Bakry previously told Enterprise. It’s investing EGP 1.2 bn over three years to increase its portfolio of schools from the one it has now to a targeted 4-6.

So why do it if it’s hard? There’s substantial and growing demand: Expanding in the governorates means entering markets whose rapidly growing populations are underserved, says El Kalla. “You’re tapping markets at high demand points. You just have to be creative in how you respond to that demand. It can’t be a brick-and-mortar approach.”

Private school operators coming from Cairo have a competitive edge: Operators that successfully launched schools in Cairo’s fast-paced market are a step ahead of local operators, says Eduhive CEO Karim Mostafa. Competition in the governorates is far lower than in Cairo, and operators coming from the capital have the knowledge and resources to be tough competitors, he adds.

So how can expansion be cost-effective? By tailoring services by region: When CIRA assesses demand, it calculates how to deliver high-quality services needed in a particular location, and parents’ ability to pay for these services, says El Kalla. Some 20% of Cairo’s population might want so-called upper-middle class services, but this isn’t the case in the governorates. So operators need to tailor their service provision, he adds. “Every single element of your education supply chain — from the choice of land, to school construction, to the educational content and delivery cycle — needs to match the local dynamics of the community.”

This could mean allocating more resources to teacher training, and less to construction: While private schools in the governorates don’t need expensive buildings to attract students — as schools in Cairo do — more investment in content and education delivery may be needed, says El Kalla. Teachers in the governorates may need extra training, while students may need more remedial programs to be on a par with their Cairo peers, he says. Teacher training in the governorates is essential, but quite straightforward, believes BalancED Education managing director Salma El Bakry.

To assess which services are needed where, and at which price point, CIRA groups different locations in clusters. Locations are clustered according to their economic activity, resource availability, and growth prospects, says El Kalla. This could mean categorizing governorates based on their most prominent industries or the spending habits of their citizens, he adds. Clusters aren’t determined by geographical location. “A look at the poverty matrix and human development reports shows that it’s not about geography. We sometimes have Assiut and Mansoura in the same cluster.”

It uses this information to create brands: CIRA’s different brands provide services based on the needs of the clusters, says El Kalla. “Eduhive, ESI, Rising Stars — each focuses on educational clusters. They aren’t bound by geography.”

Another way to cover the cost of governorate expansion would be for schools to expand in groups, sharing CAPEX costs, Ahmed El Bakry previously told us.

But the land cost issue must still be resolved for expansion to be attractive: “As an operator, you don’t want to burden yourself with high land costs,” says Mostafa. “You have to be very careful with the price of land you choose.”

One approach? Selecting lower-priced land in the government’s new urban cities: CIRA launched the Regent British School in New Mansoura because costs in the new urban cities are much lower than elsewhere, says Mostafa. “Apartments in Mansoura cost more than apartments in Cairo, so to open a school there would be very expensive. Going to the new cities like New Assiut and New Alamein is a smart way to turn around the high price of land in the governorates.”

Prices in landlocked governorates remain outrageously expensive, say Salma El Bakry and BalancED Education executive manager Mahmoud Hamza. Locations that don’t have a desert background can’t expand to become new cities, meaning that land is scarce and very expensive, they add.

Widespread land provision to school operators at no cost, under the Education Ministry’s public-private partnership program, would be a better solution, sources argue. The government should provide land for school expansion without charge, so operators could build and operate schools at a reasonable price for residents — likely ranging from EGP 30k-60k depending on the governorate, says Salma El Bakry. “Excluding the price of the land is very important in the business formula.”

The problem with the current PPP process is that it’s too long and bureaucratic, says El Kalla. The only way education PPPs can work for now is with publicly-owned institutions, like public banks, he believes. “They operate with a private sector mindset.”

For now, a comprehensive PPP mechanism offering land to education providers at no cost doesn’t seem to be on the cards: “If government-owned land was going to be offered at a reduced rate or for nothing under a PPP framework, I’d be the first to sign up,” says Mostafa. “But I don't feel that's really on the table.”

YOUR TOP EDUCATION STORIES for the week:

- The fourth wave could disrupt back-to-school dates: Starting-dates for the new school year could be considered for review by the government, which is expected to ramp up preventative measures in the coming days as case numbers rise.

- All education staff will get at least one vaccine dose by mid-September, and are expected to have received two doses by mid-October, Health Minister Hala Zayed said in a cabinet meeting on Wednesday.

- Egyptian universities are among the fastest improving higher education institutions in the world, the Higher Education Ministry has claimed, citing newly-released Times Higher Education (THE) rankings for 2021. This year’s list saw the inclusion of 23 Egyptian higher-ed institutions, which on average climbed 11 positions in the table compared with last year.

- CIRA has teamed up with ed-tech start-up Orcas to launch a new hybrid tutoring scheme, which will see Orca’s online learning platform collaborate with CIRA’s 21-strong schools network to offer after-school support to students.

CALENDAR

5-12 September (Sunday-Sunday): Arab Labor Conference, the InterContinental CityStars Hotel, Cairo, Egypt.

5-7 September (Sunday-Tuesday): The Arab Security Conference, The Nile Ritz-Carlton, Cairo, Egypt.

7-8 September (Tuesday-Wednesday): Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, featuring Vice Minister of Finance Minister Ahmed Kouchouk.

8-9 September (Wednesday-Thursday): Egypt-International Cooperation Forum (ICF), Cairo

7-9 September (Tuesday-Thursday): Egy Health Expo, Al Manara International Conference, Cairo, Egypt.

9 September (Thursday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

11-12 September (Saturday-Sunday): International Conferences on Economics and Social Sciences, Cairo

12 September (Sunday): International schools begin 2021-2022 academic year

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

13-21 September (Monday-Tuesday): 76th session of the general assembly, New York

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 September (Saturday): Expiration of United Nations Investigative Team to Promote Accountability for Crimes Committed by Daesh/ISIL

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins — must be held by the first Thursday of October.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.