- US election 2020: The first results are in and the race is far too close to call. (What We’re Tracking Today)

- Egypt’s private sector continues to expand in October. (Speed Round)

- Egypt adds USD 800 mn to foreign reserves in October. (Speed Round)

- New regulatory framework for SME lenders announced. (Speed Round)

- Mylerz and Softec to partner on AI-powered last mile delivery service. (Speed Round)

- Trucking logistics startup Illa raises USD six-figure seed round. (Speed Round)

- Smart meter startup Amjaad secures USD six-figure investment from Dhaman Group. (Speed Round)

- FinMin lays out the A-Z of green bond funding. (Hardhat)

- The Market Yesterday

Wednesday, 4 November 2020

Egypt celebrates the best PMI results in six years — and settles in to watch the US election nailbiter

TL;DR

What We’re Tracking Today

It is still early hours for US election results as we hit “send” on your morning read at 6am CLT, but here’s what we know after a peaceful day of voting to cap an election that seems set to see the highest turnout level in a century:

US ELECTION WATCH- The “blue wave” that so many had hoped for hasn’t yet materialized. Results at dispatch time paint a picture of an election that looks to be much a closer-run contest then many of the final polls indicated.

RACE FOR THE PRESIDENCY- Traditionally, the US public looks to CNN and the AP to call individual races. With polls in the West Coast still open:

- CNN is calling 94 electoral college votes for Biden and 72 for Trump.

- The AP, which takes a more aggressive approach to its predictions, has it at 131 for Biden and 108 for The Donald.

A candidate needs at least 270 electoral college votes to claim the win. Need a refresher on the electoral college system? CNN has a detailed explainer here.

SENATE- Democrats could still be on course to take the Senate, having so far won or being predicted to win 43 seats to the Republican’s 38. Republican senator of Kentucky and Speaker Mitch McConnell will sit for a seventh term after defeating Democratic challenger Amy McGrath. Democrat and former presidential candidate Corey Booker handily won re-election.

HOUSE OF REPRESENTATIVES- There’s a long way to go in the contest for the House but in the early stages Republicans have taken 76 seats to the Democrats’ 51. Republican Jeff Fortenberry, who has been a fairly steady supporter of Egypt, was trailing Democratic candidate Kate Bolz in Nebraska. The vote counts hadn’t started on the west coast, where outspoken Democratic senators Ro Khanna and Darrell Issa — both of whom have been vocal about Egypt — and House Speaker Nancy Pelosi are standing for reelection.

AND REMEMBER, FOLKS: It could still be days before we know the final outcome as mail-in ballots are counted and the results finally certified.

Here’s what we know from the battleground states at the time of dispatch:

- Trump is looking good in Florida, up 3 points with 93% of votes counted.

- Things are extremely close in Ohio: Although leaning Biden early on, Trump took the lead with 75% of votes counted.

- North Carolina is another toss-up: Both candidates were neck and neck with almost 90% of the votes counted.

- Trump was up 15 points in Georgia. We may not know the results for a day or two after a burst water pipe halted the count in Atlanta.

- Biden has a 9-point lead in Arizona.

- Pennsylvania — the state many politicos suggested could decide the election — was leaning Trump, though with only 25% of the votes counted.

- Wisconsin and Michigan — two Rust Belt states expected to go to Biden — were leaning Trump in the early vote count.

With the ballot counting underway, the Fed begins its two-day meeting today: The US Federal Reserve is primed to address any post-election market volatility that might arise during a two-day policy meeting that kicks off today and wraps up tomorrow, says the Financial Times. US policymakers could ramp up asset and debt purchases to contain any potential disruptions to Treasury and mortgage-backed security markets, two economists at advisory firm Evercore ISI said. The Fed would draw a line between commitment to a loose monetary policy, adopted in its latest meeting and keeping financial markets afloat through emergency response.

It was a sea of green in global stock markets yesterday as investors anticipated a Joe Biden win and fresh fiscal stimulus. US equities rallied for the second day running, with the S&P 500 jumping 1.8% and the Dow rising 2.1% in its biggest single-day gain since July. US treasuries and the USD Spot Index both fell as investors left safe haven assets, while oil prices rose on reports that OPEC+ will shelve plans to ease supply cuts. Bloomberg has the full market wrap.

But investors were more nervy this morning as the prospect of a so-called blue wave faded. Stock markets in Europe and the US were projected to fall in early trading.

The talking heads here at home are not praying for a Biden presidency: Cairo and Washington have in many respects become closer under the Trump administration after some post-2011 drift, and the talking heads last night were not looking forward to a Biden White House. Ala Mas’ouleety’s Ahmed Moussa claimed that House Speaker Nancy Pelosi and the Democratic Party are plotting a “constitutional coup” against Trump in the event he wins (watch, runtime: 5:08). Kelma Akhira’s Lamees El Hadidi, meanwhile, cast doubt on the recent polls showing Biden in the lead (watch, runtime: 2:34) and said that the Egyptian government would not change its approach to the Muslim Brotherhood if the Democrats won the White House, in reference to what many in Cairo see as the Obama administration’s softness on the Ikhwan in 2012 (watch, runtime: 1:42).

El Hadidi reviewed Trump and Biden’s most memorable statements from the campaign trail (watch, runtime: 2:11), while Al Hayah Al Youm’s Mohamed Sherdy talked through potential election outcomes (watch, runtime: 35:15). Masaa DMC’s Ramy Radwan interviewed Adel Al Adawi, an international relations professor at the American University in Cairo, who explained America’s electoral college system (watch, runtime: 16:23), while Yahduth Fi Misr’s Sherif Amer talked to Heba Al Qudsi, the Washington correspondent for Al Sharq Al Awsat newspaper, who discussed swing states and their role in determining the final results (watch: runtime: 9:59).

Beijing is also following the results closely: Trump-era barriers to Chinese investments in the US are likely to remain even if the president loses to Biden, pundits quoted by Reuters said. Anti-China sentiment, prompted by fears that China could abuse its tech “prowess” to misguide investors, seems to be shared by both Democrat and Republican lawmakers, suggests the newswire.

And because Egyptians have to put their touch on everything: Singer Wissam Magdy repurposed 1999 Egyptian operetta “Ekhtarnah” (We Chose Him), which was initially composed for late President Hosni Mubarak, into a pro-Donald Trump ballad that has garnered hundreds of thousands of views online, reports Al Monitor. Feel like cringing this morning? (watch, runtime: 04:42).

Netflix’s Paranormal premieres tomorrow: Reuters is taking note of tomorrow’s debut episode of Netflix’s Paranormal, the first Egyptian TV series to be released by the streaming giant. Based on books by Egyptian novelist Ahmed Khalid Tawfik, the series follows the paranormal experiences of doctor Refaat Ismail.

Egyptians abroad go to the polls today for the second phase of House elections. Casting their ballots are folks registered in Cairo, Dakalia, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai. Expats have until Friday to vote. Polls open for voters here at home on 7-8 November.

GERD meetings between the irrigation ministers of Egypt, Sudan and Ethiopia will take place today, ahead of Thursday’s ministerial committee meeting, the Egyptian Irrigation Ministry said in a statement. Legal and technical representatives of the three countries have been in discussions for several days on the framework for future negotiations on the dam project, as well as the role of external observers moving forward.

Defense Minister Mohamed Zaki is in Portugal to talk military cooperation with Portuguese officials over the course of several days, according to a ministry statement.

The government is preparing new incentives for consumers who want to convert their cars to run on natural gas instead of petrol, President Abdel Fattah El Sisi said during a meeting with the PM and oil minister. The incentives come as part of the government’s multi-year plan to transform 1.8 mn cars into dual-fuel vehicles announced earlier this year. Talk of incentives has so far included the idea of giving owners of cars over 20 years’ old access to subsidized loans to pay for new natural gas-powered vehicles, while those with younger cars could be made eligible for zero-interest finance to install dual-fuel engines.

Other news triggers to keep your eye on:

- Inflation data for October will be released on 10 November;

- The Central Bank of Egypt’s Monetary Policy Committee will meet to review rates on 12 November.

The Health Ministry reported 197 new covid-19 infections yesterday, up from 189 the day before. Egypt has now disclosed a total of 108,122 confirmed cases of covid-19. The ministry also reported 14 new deaths, bringing the country’s total death toll to 6,305. We now have a total of 99,765 confirmed cases that have fully recovered.

Europe is moving towards a “just test everyone” policy as new infections rise: Slovakia pushed through a massive nationwide testing campaign last week to test almost every person aged 10-65 in just two days fter a surge in covid-19 cases, the Wall Street Journal reports. The UK appears to be taking notes and is looking to test the entirety of Liverpool, but healthcare professionals maintain that testing without self-isolation is not enough to keep outbreaks at bay.

France could move to reimpose a nighttime curfew in the Greater Paris area as the surge in covid cases continues, Reuters reports.

UAE Prime Minister Sheikh Mohamed Bin Rashid Al Maktoum received a covid-19 vaccine on Tuesday. An Emirati company is working with China’s Sinopharm on phase 3 trials of its covid vaccine, and plans to begin manufacturing it next year. The country authorized the vaccine to be given to frontline health workers in September.

Bahrain also began administering Sinopharm’s vaccine to its frontline workers Tuesday, after the health ministry granted it emergency approval, Reuters reports. Bahrain is currently hosting phase 3 trials along with Egypt, the UAE, and Jordan.

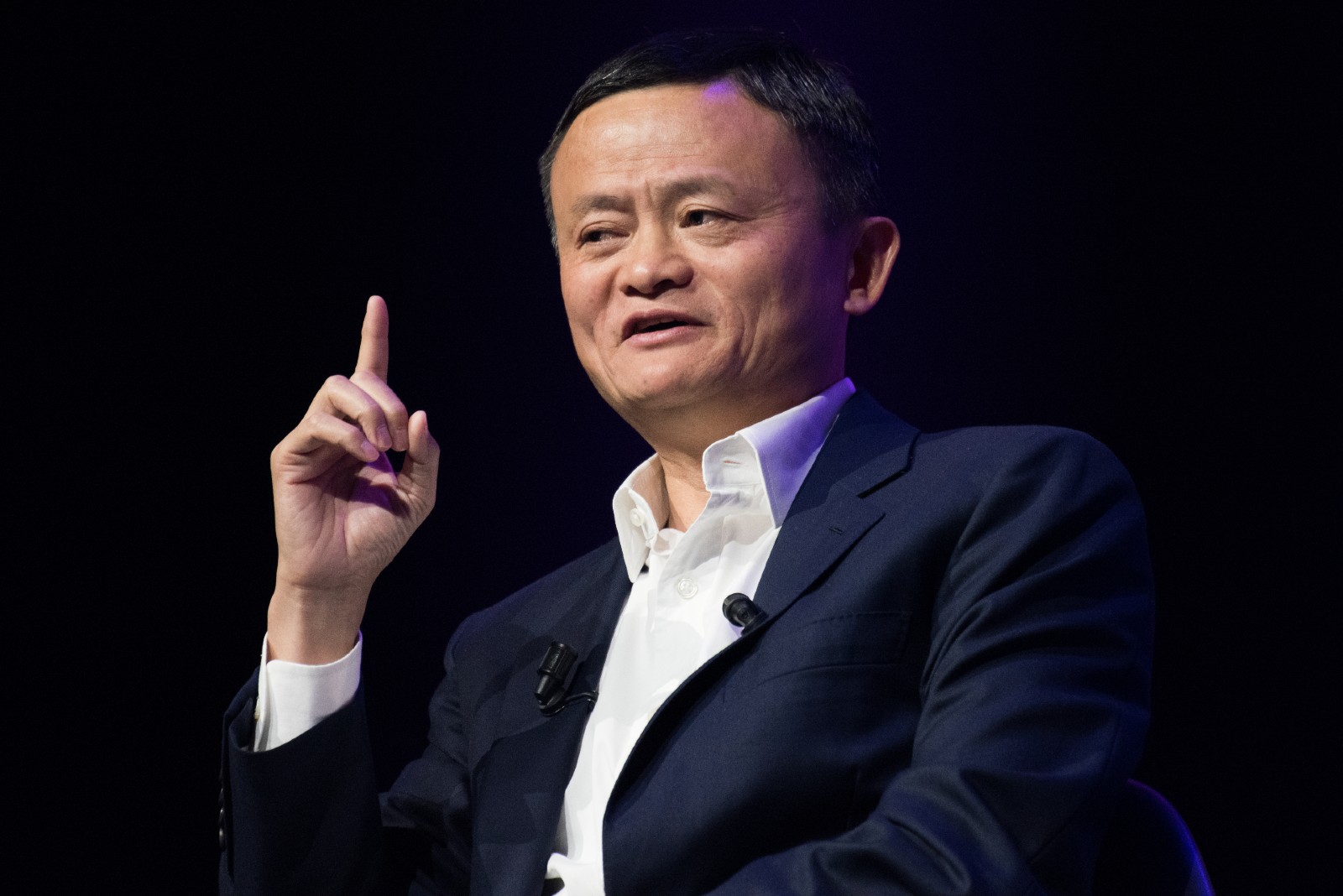

China slammed the brakes on Ant Group’s anticipated blockbuster USD 37 bn IPO two days before its stock market debut after financial regulators said the company may not meet listing qualifications or disclosure requirements in light of recent changes to the fintech regulatory environment. The Shanghai Stock Exchange said in a statement that it would suspend the listing citing “material matters” relating to “a change in the regulatory environment on financial technology,” a day after regulators called in company founder Jack Ma for a “supervisory interview.” New draft regulations issued by the central bank and regulators on Monday require online lenders to cap loans at one third of a borrower’s annual pay, a condition that could affect Ant’s profitability, the Financial Times says.

How will the economy escape the global liquidity trap? Not with further monetary easing, writes the IMF’s chief economist Gita Gopinath for the Financial Times. Gopinath hammers home the necessity for governments to step up to the plate with large spending programs — a recurring message from the IMF that seems to have fallen on deaf ears in some parts of the developed world. This fiscal support is essential in fighting an economic downturn during a liquidity trap, where interest rates are either near zero or in negative territory, and monetary policy has a weakened effect on spending. “Fiscal stimulus is not just economically sound policy but also the fiscally responsible thing to do,” writes Gopinath, who recommends cash transfers and large scale investments in job-generating projects as a potential antidote.

Some non-election headlines you may want to know about:

- Brexit talks between the EU and UK are going nowhere fast with less than two weeks before the deadline. (Reuters)

- Oil prices could further slump as Libya resumes of oil exports and Iraq and Nigeria exceed their production quotas. (Bloomberg)

- Saudi Aramco shareholders won’t be forgoing their 3Q payouts after the company decided to go ahead with plans to pay USD 18.8 bn in dividends despite not having enough cash to cover the costs, CEO Amin Nasser said as the company published its quarterly results. Aramco’s use of debt has soared this year in response to falling revenues, which “raises questions of sustainability,” the FT quotes an analyst at Bernstein as sayin.

- At least 54 Amhara people have been killed in Ethiopia’s Oromia region in a new bout of ethno-nationalist violence. (Guardian)

Introducing the new Mesca Beach: an exclusive slice of island paradise where you can slow down and sunbathe or simply live it up by engaging in exciting beachfront activities, offered in abundance above and below Somabay’s mesmerizing sea. Powered by top-class utilities and exceptional service, Mesca Beach is a heaven on earth.

Introducing the new Mesca Beach: an exclusive slice of island paradise where you can slow down and sunbathe or simply live it up by engaging in exciting beachfront activities, offered in abundance above and below Somabay’s mesmerizing sea. Powered by top-class utilities and exceptional service, Mesca Beach is a heaven on earth.

Covid-19 has pushed big companies to adopt tech at a blistering pace, a recent McKinsey & Company survey of executives (pdf) finds. Companies have sped up the digitization of internal operations and supplier and customer interactions by three to four years, while digital or “digitally enabled products” as a share of company portfolios has accelerated by “a shocking seven years” on average across regions. McKinsey said. Executives surveyed by the consultancy also expect those changes to be long-lasting and not just a passing fad.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: We explore the Finance Ministry’s Green Energy framework — the government’s manual for projects that stand to benefit from Egypt (and the region’s) first ever issuance of green bonds back in September.

Enterprise+: Last Night’s Talk Shows

It was all Trump-Biden, all the time on the airwaves last night, as we note in What We’re Tracking Today, above. The only business-relevant exception: Masaa DMC's Ramy Radwan interviewed Eric Ochelan, director of the International Labor Organization in Cairo, who said that the pandemic had led to an unprecedented crisis in the global labor market. Some 495 mn hours of work have been lost this quarter, with tourism companies, restaurants and exporters particularly hard hit. Ochelan said that the ILO is working with partners in Egypt to provide technical support specifically for women, who are more at risk of losing their jobs (watch, runtime: 21:15).

Speed Round

Egypt’s non-oil private sector grew in October at its strongest rate since December 2014 as rising output and new orders kept activity expanding for the second consecutive month, according to IHS Markit purchasing managers’ index (PMI) figures (pdf). The gauge rose to 51.4 from 50.4 in September, a level comfortably above the 50.0 mark that separates expansion from contraction. David Owen, economist at IHS Markit, described the figures as a “relatively strong upturn” but warned that continued weak employment would continue to pose problems for the economy in the coming months.

The non-oil private sector’s recovery since April has been uneven, with conditions first showing signs of improvement in July, but facing headwinds in August due to a sharp increase in job cuts and slowing output growth. The PMI gauge finally broke into growth territory in September, as the loosening of lockdown restrictions began to lift consumer demand.

Business activity expanded at the quickest pace since August 2014 last month as demand held up and looser covid-19 restrictions allowed firms to grow capacity. New orders hit the highest level in six years while new export business increased albeit at a slower rate than in September.

Many businesses don’t have the cashflows they need to hire new staff: “Weakness continues to lie on the employment side, as jobs decreased more quickly despite higher output,” Owen said. Employment fell for the twelfth consecutive month, with some businesses saying that they didn’t have enough money to replace workers due to lower revenues and higher expenses, and others laying off staff.

Fears of a second covid wave darkened sentiment: Employment was also hit by gloomy sentiment for the next 12 months, which hit its weakest level since May as firms feared that the economic recovery will stall if Egypt suffers a second wave of covid-19. “Growth could accelerate further if restrictions remain loose, although there are still enduring risks that may slow the recovery … firms noted that they are still struggling to raise the necessary funds to hire new staff, while also indicating weaker optimism as COVID-19 cases rise in nearby Europe,” Owen said.

Firms also reported the sixth successive increase in backlogs, “highlighting further pressure on business capacity.” They said they needed more inputs to handle the capacity constraints, resulting in the first increase in purchasing activity since December and input prices increasing at the fastest rate in 13 months.

PMI results were mixed in the GCC: Saudi Arabia’s gauge (pdf) hit an eight-month high of 51 in October (from 50.7 in September), but the UAE’s reading (pdf) fell into contraction territory amid further unemployment concerns and fears of a second spell of lockdowns. Bloomberg has more on the figures here.

Egypt adds USD 800 mn to foreign reserves in October: Egypt’s foreign reserves grew for the fifth consecutive month in October, climbing to USD 39.22 bn from USD 38.43 bn in September, according to central bank figures released yesterday. Reserves fell by some USD 10 bn between March and May this year as the central bank stepped in to cover the capital outflows as a risk-off swept global emerging markets. The CBE also funded imports of commodities and debt repayments. The country’s FX stockpile has been steadily rebounding since June, inching back toward its February peak of USD 45.5 bn.

REGULATION WATCH- SME lenders will need to be set up as joint-stock companies with a minimum capital of EGP 30 mn under a regulatory framework set out by the Financial Regulatory Authority (FRA) yesterday (pdf). Any company seeking an SME lending license must be at least 50% owned by juridical persons or legal entities, and financial institutions must hold no less than 25%, FRA boss Mohamed Omran said. Any given lender must also hire a chief executive with at least 10 years of experience in the banking or non-bank financial services sectors in managerial positions.

Background: Changes to the Microfinance Act signed into law last month made SME lenders subject to the legislation. The law, which has been previously only limited to microfinance companies, also brought the lenders under the FRA’s oversight. They introduced capital requirements for SME lenders, rules pertaining to lenders’ technical and risk management capabilities, and allowed lenders to be members of a rebranded Egyptian Microfinance Federation.

Mylerz and Softec to partner on AI-powered last mile delivery service: Parcel delivery service startup Mylerz has entered a long-term partnership agreement with tech solutions firm Softec, which will provide its Norma AI platform to boost efficiency and visibility of Mylerz’s last-mile delivery services, according the two said in a press release (pdf). The partnership should see Mylerz offer more reliable and time-sensitive deliveries to its customers through the new technology. Softec last month signed an agreement with Gourmet Egypt to provide its Norma AI services to optimize delivery and inventory.

STARTUP WATCH- Cairo-based FMCG trucking startup Illa has raised a USD six-figure investment in a seed funding round from Averroes Venture Capital, AUC Angels, and other local and regional angel investors, according to a press release (pdf). The startup plans to use the latest investment to expand in Egypt and explore other regional markets. Illa cooperates with freelance truck drivers to allow users seeking rentals to book a specific truck type and add pickup and dropoff details. Illa launched in March 2019 and was a part of Flat6Labs Cairo’s Spring 2019 cycle. Their clients currently include FMCG giants such as Coca-Cola, P&G, Nestle, and PepsiCo.

STARTUP WATCH- Egyptian smart meter startup Amjaad raised USD six-figure funding in a pre-Series A round from Bahrain-based Dhaman Group, Disrupt Africa reports. The company, which was founded in 2018, plans to use the funding to improve its bill payments platform and expand its consumer base. Applying smart metering services to gas and water utilities will also be on the group’s agenda with the new investment. Amjaad’s ioMeter platform allows users to remotely monitor and manage energy consumption through their web browser or mobile application and pay bills online. Dhaman wants to push Amjaad to grow its market share and impact within Egypt and begin cross-border expansion in the region, particularly the Gulf, said Dhaman CEO Mahmoud Al Hawary.

SMART POLICY- Tourism companies will be able to receive emergency funding to cover salaries for another three months after the central bank amended its subsidized loan program introduced in response to the covid-19 pandemic, according to a CBE circular (pdf) published Monday. Under the original terms of the initiative, tourism companies were only allowed to use the funding to cover three months of employee wages but under the changes announced this week can now pay wages for up to six months. Companies must also now allocate at least 40% of their loans to paying salaries, down from the 85% previously, and will be able to use the remainder to cover maintenance and operational costs.

Background: The CBE in March modified its EGP 50 bn program to support the tourism sector in response to the pandemic, providing low-interest loans to companies struggling to survive as international travel ground to a halt. The program offers two-year loans to companies which pay a reduced 5% interest rate following a six-month grace period.

WATCH THIS SPACE- Gov’t offers salary advance to Meeza card users on state payroll: Government employees using Meeza cards will be able to receive a 30% salary advance at no charge in the first six months of using the card, the Finance Ministry announced in a statement.

The catch? The advance can only be used for retail or online purchases and cannot be withdrawn from an ATM.

All government employees will receive their salaries via Meeza cards within a year, Maait said last week. The cards will allow users to withdraw cash through ATMs, make purchases online, and pay government fees through its e-payments portal. The government also plans to expand mobile payments through electronic wallets and QR codes.

The Takaful and Karama welfare programs will be getting their own dedicated investment fund after the prime minister approved a proposal during a meeting of the Social Justice Committee on Tuesday, according to a cabinet statement. The fund will invest pensions in the capital markets to maximize savings and expand the number of beneficiaries. The government has moved to bolster welfare programs in response to the pandemic, increasing budget allocations for pensions to EGP 170 bn and EGP 19 bn to social security and Takaful and Karama in the FY2020-2021 budget.

BACKGROUND: Takaful and Karam are very successful welfare programs that provide cash-based subsidies to eligible beneficiaries.

The government is banking on academic expertise in its push for better urban planning: Universities will serve as consultants to the government’s urban planning projects and will have the authority to issue construction licenses and approve building plans in Cairo, Alexandria and Giza, Prime Minister Moustafa Madbouly said during a meeting with the housing and local development ministers and the head of the General Authority for Urban Planning. The PM added that the government is working to set the building codes in each governorate, and approved the presentation of planning studies conducted by university staff to the Supreme Council for Planning and Urban Development.

Background: The government passed the Unified Building Code earlier this year, giving authorities the ability to clamp down on illegal construction, and introduced a six-month construction ban in May to allow for time to address building violations. The government has received more than 2.1 mn settlement requests, and has extended the deadline for payment until the end of November.

Brick and mortar retail needs to be an experience, not a commodity: As brick and mortar retail growth declines in the West in favor of online commerce, malls in emerging markets have to look at retail as an overall experience, Majid Al Futtaim Properties CEO Ahmed Galal Ismail tells us in this week’s episode of Making It, our podcast on how to build a great business in Egypt. The company has invested over EGP 40 bn since launching operations in Egypt in 2002, with further investments announced for the future.

You already have a podcast player on your iPhone, or you can listen to the episode through our website (no download required). We’re also on Google Podcasts | Anghami | Omny. Making It is on Spotify, but only for non-MENA accounts

You can get early access if you're subscribed to Making It: The new episode will drop into the podcast player of your choice this afternoon.

CORRECTION- We have a couple of mea culpas from yesterday’s issue: First, we incorrectly suggested that HSBC Egypt is providing the entirety of the USD 2.2 bn loan for China State Corporation Engineering Corporation’s work on the new administrative capital’s business district. HSBC is participating in the loan with other banks. We also incorrectly spelled the name of Cairo-based telecoms app Raseedy. Both errors have since been amended on our website.

Egypt in the News

It’s a mixed bag in the pages of the foreign press this morning…

How to invest like a b’naire, according to Egypt’s Mohamed Mansour: Egyptian b’naire Mohamed Mansour is staying away from banks, and has instead built a decade-old London-based investment to grow his family’s wealth, the 72-year-old Mansour Group chairman tells Bloomberg. “I used to leave my money with the banks, but I wasn’t pleased with the returns I was getting,” Mansour said. Man Capital — the investment arm of the USD 7 bn Mansour Group — led early investments in the likes of Facebook, Twitter, Uber, AirBnB, Snowflake, and Adyen. The firm now focuses on pouring investments into “the sectors of the future.” Man Capital has been sticking with its tech-focused investment strategy, especially with covid-19, Mansour said.

Gov’t releases 400 arrested in rare protests this year: A Giza terrorism court on Tuesday ordered the conditional release of 416 people arrested in connection with the 20 September anti-government protests this year, AFP reports. Over 2k people were arrested during demonstrations that demanded the removal of President El Sisi and followed the viral spread of videos by exiled businessman Mohamed Ali.

Egyptology is in the news: Egyptologist Toby Wilkinson’s new book, A World Beneath the Sands, is a “gripping tale of the archaeologists who raced to uncover dazzling ancient monuments,” the Financial Times’ Sue Gaisford writes. Elsewhere, CNN wonders if all of Egypt’s archaeological discoveries this year are enough to lure back tourists.

Asylum in South Korea? Egyptians came in second on a list of 164 asylum seekers accepted into South Korea this year, according to Reuters.

Diplomacy + Foreign Trade

USAID wants to focus its partnership with Egypt over the next five years on initiatives promoting women’s inclusion in the workforce, USAID Director Leslie Reed told International Cooperation Minister Rania Al Mashat in a meeting yesterday, according to a cabinet statement. Al Mashat and Reed’s meeting comes as USAID’s five-year partnership framework with Egypt is in the works.

Meanwhile, the European Bank for Reconstruction and Development (EBRD) is looking at potential investments in Egypt’s water projects, with Irrigation Minister Mohamed Abdel Aty meeting yesterday with bank representatives to discuss the projects underway, according to a cabinet statement. Abdel Aty invited the EBRD to participate in Cairo Water Week 2021 which will focus on the impact of Egypt’s population increase on water resources.

Italy is giving Egypt a USD 7.5 mn grant to support the Roubiki Leather City under an agreement Al Mashat signed with Italy’s ambassador to Egypt Giampaolo Cantini earlier this week, according to a ministry statement.

On the diplomatic front: James Heappey, the UK’s Minister for the Armed Forces, met with Egyptian Army Chief of Staff Mohamed Farid to discuss the Libyan crisis, counterterrorism efforts, and the possibility of staging joint military exercises, according to a statement by the British Embassy in Cairo.

FinMin lays out the A-Z of green bond funding: In September Egypt closed the region’s first ever issuance of green bonds, selling USD 750 mn of the climate-linked securities to investors before listing them on the London Stock Exchange. Now, the government has published its framework (pdf) for how it plans to use the proceeds, how it selects and evaluates the projects that receive funding, and how this information is publicly disclosed. Working in concert with the World Bank, the framework is the product of multiple ministries coming together to establish the ground rules for how the country will use green bonds over the coming months and years.

Green bonds — A refresher: A green bond is a type of fixed-income debt instrument that is deployed to raise money specifically for environmentally-friendly projects. Egypt’s maiden green bond issuance has been in the cards for at least two years, and form part of the government’s debt diversification strategy, marking a shift towards longer-term debt and unlocking finance for projects at a lower interest rate against traditional means of funding. September’s issuance of five-year securities was lapped up by investors, who submitted USD 3.7 bn in bids and accepted a payout 50 bps lower than the initial 5.75% yield.

Why green bonds? There are both economic and environmental incentives at play: The low interest rates attached to green bonds compared to standard fixed-income securities makes them very attractive, and they offer a way to diversify debt sources to hedge potential market risks, Finance Minister Mohamed Maait tells Enterprise. They will also attract new kinds of investors interested in financing sustainable, environmentally-friendly projects, and will drive the increase of these projects in the market, Maait adds.

There could hardly be a better time for it, as the pandemic appears to accelerate global interest in ethical investments. As the crisis in the oil and gas industry fuels speculation of a nearing post-hydrocarbon era and governments talk about a green-led recovery from the current economic downturn, asset managers have seen record inflows into ethical funds, putting total sustainable assets under management above USD 1 tn for the first time ever.

First things first: What actually classifies as a “green” investment? According to the ministry’s framework, the proceeds of green bonds and sukuk can be allocated to finance new projects — or refinance old ones — that are categorized as eligible green projects. These include clean transportation, like electric rail and its infrastructure; renewable energy facilities in solar, wind, hydro and biomass energy, along with the infrastructure for transmission and distribution; pollution prevention and control, including waste collection, recycling and composting; climate change adaptation, including agricultural and coastal zone management projects; energy efficiency; and water and wastewater management, including sewage treatment and desalination plants.

They can’t be used on projects that are detrimental to the environment: This includes burning fossil fuels, rail infrastructure dedicated to transport fossil fuels, nuclear power, waste incineration, landfill projects, waste-to-energy facilities that burn recyclable material, and renewable energy projects that use biomass from protected areas. The use of green bonds or sukuk to fund the alcohol, weapons, tobacco, gaming or palm oil industries is also a big no-no. And the proceeds can’t be used for state disbursements to any local authorities that raise financing through capital markets.

How will the proceeds be managed? The framework sets up a Green Financing Register (GFR) that will oversee and track the allocation of funding. It will contain information including the details of the green bond or sukuk (its ISIN, pricing date, maturity date and other information) and how its proceeds will be used (which eligible green projects they’ve been allocated to, the allocation amount, and what the impact is expected to be). The finance and planning ministries have been tasked with managing the register, and will conduct annual reviews of how the money is being used.

The finance and planning ministries won’t decide how the funding is actually allocated. That job has been given to a newly-created Green Finance Working Group. Representatives from both ministries are involved but will be joined by a host of other ministries and stakeholders, including the New and Renewable Energy Authority, Egyptian Electricity Transmission Company, and Construction Authority for Potable Water & Wastewater. The committee will evaluate projects to determine priority projects and review these allocations several times a year in case changes are needed.

And how will this information be made public? Each year the committee will publish a report outlining the amount allocated to projects, the amount given per project category, how much has been used for new financing versus refinancing, and how much of the proceeds are left to be spent. These reports will be made public within a year of the issuance.

We already have a pretty good idea about where the bulk of the proceeds from September’s issuance are going. A list obtained by Al Mal last month showed that the new capital and Sixth of October monorails, a desalination plant in El Dabaa, and wastewater treatment plants in Alexandria, Assiut Governorate and Giza will split USD 500 mn of the proceeds. Environment Minister Yasmine Fouad said that the projects were selected from a longlist of 41. It remains unclear how the remaining USD 250 mn will be spent.

A separate report disclosing the environmental performances of funded projects will also be published once a year — but only if the data exists. The framework lists a number of potential metrics the government is looking at, including emission reductions, energy saving, renewable energy production, and the quantity of waste recycled.

Meanwhile, Egypt has committed to external reviews of its Sovereign Green Financing Framework and the bond issuances themselves: Environmental, social and governance (ESG) rating and research agency Vigeo Eiris is set to review of the framework itself, and the government will hire an assurance provider to assess compliance.

Will more green bonds be issued this fiscal year? It’s still too early to tell, though the creation of a detailed framework belies an impetus to keep things moving in the coming months and years. The government has made clear that it intends to make green infrastructure an increasing priority, with Planning Minister Hala El Said stating that 30% of the government’s investment budget will be earmarked for green projects in FY2021-2022, up from 14% in the current fiscal year.

Your top infrastructure stories for the week include:

- Infrastructure projects: A host of infrastructure projects were officially inaugurated by President Abdel Fattah El Sisi over the weekend, including El Bardawil Airport in North Sinai, new museums, and a new sea water desalination plant in Sinai’s El Arish.

- Italian supermarkets in Egypt: Supply Ministry-affiliated Global Retail Gate (GRG) is planning to begin opening branches of an unnamed Italian supermarket chain in Egypt starting early 2021 in partnership with Italy’s Sopria Holding.

- SCZone ro-ro station: A draft law allowing the establishment of a roll-on roll-off station in the Suez Canal Economic Zone’s East Port Said Port got the green light this week.

- Cooperation with Iraq: Egypt and Iraq signed a flurry of agreements last week that cover everything from energy to boosting exports.

The Market Yesterday

EGP / USD CBE market average: Buy 15.66 | Sell 15.76

EGP / USD at CIB: Buy 15.66 | Sell 15.76

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Tuesday): 10,512 (+0.8%)

Turnover: EGP 833 mn (26% below the 90-day average)

EGX 30 year-to-date: -24.7%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.8%. CIB, the index’s heaviest constituent, ended up 1.7%. EGX30’s top performing constituents were SODIC up 6.7%, Cleopatra Hospital up 2.6%, and CIB up 1.7%. Yesterday’s worst performing stocks were Egyptian Iron & Steel down 4.4%, Sidi Kerir Petrochemical down 3.6% and CIRA down 2.6%. The market turnover was EGP 833 mn, and regional investors were the sole net buyers.

Foreigners: Net short | EGP -8.5 mn

Regional: Net long | EGP +19.5 mn

Domestic: Net short | EGP -11.0 mn

Retail: 79.2% of total trades | 81.9% of buyers | 76.5% of sellers

Institutions: 20.8% of total trades | 18.1% of buyers | 23.5% of sellers

WTI: USD 38.15 (+3.64%)

Brent: USD 39.94 (+2.49%)

Natural Gas: (Nymex, futures prices) USD 3.09 MMBtu, (-5.86%, December 2020 contract)

Gold: USD 1,910.50 / troy ounce (+0.95%)

TASI: 7,998 (-0.28%) (YTD: -4.66%)

ADX: 4,649 (+0.25%) (YTD: -8.40%)

DFM: 2,139 (-1.18%) (YTD: -22.61%)

KSE Premier Market: 6,042 (+2.36%)

QE: 9,701 (+0.64%) (YTD: -6.95%)

MSM: 3,538 (-0.28%) (YTD: -11.13%)

BB: 1,436 (+0.70%) (YTD: -10.80%)

Calendar

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Dakalia, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo.

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Dakalia, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

7-9 November (Saturday-Monday): Techne Summit 2020, Bibliotheca Alexandrina, Alexandria.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 November (Thursday): The African Private Equity and Venture Capital Association (AVCA) is organizing an online conference titled “State of African Private Equity & Venture Capital: Regional Perspectives.” You can sign up here.

13-15 November (Friday-Sunday): A conference on banking in the time of covid by the Union of Arab Banks, Sharm El Sheikh, Egypt.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

22-25 November (Sunday-Wednesday): Cairo ICT 2020, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 November (Monday-Tuesday): Runoffs for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December (date TBC): Egypt Economic Summit, Cairo, Egypt, venue TBD.

December: Fifth round of Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

5 December (Saturday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria.

7 December: Former Civil Aviation Minister Ahmed Shafik faces trial over embezzlement allegations.

7-8 December (Monday-Tuesday): Runoffs for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15 December (Tuesday): House of Representatives reconvenes from recess.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.