- IMF gives initial nod to USD 5.2 bn in fresh funding to Egypt. (Speed Round)

- Parliament is back from its recess today with a stacked agenda. (What We’re Tracking Today)

- Egypt’s covid-19 deaths at 1,198 (+32); cases reach 32,612 (+1,497). (What We’re Tracking Today)

- Passenger car sales dropped 26% y-o-y in April. (Speed Round)

- Egypt’s construction sector is on track to be the region’s largest in 2029 -Fitch. (Speed Round)

- Emaar Misr is looking to build a new EGP 40 bn investment zone in the Greater Cairo area. (Speed Round)

- Egypt brokers ceasefire agreement in Libya, potentially setting up peace talks. (Speed Round)

- The Market Yesterday

Sunday, 7 June 2020

We’re one step closer to USD 5.2 bn in extra funding from the IMF

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to a largely “good news” issue to start the workweek, corona notwithstanding. Why are we so chipper this morning?

- We’ve reached a staff-level agreement with the IMF on USD 5.2 bn in fresh funding, as we note in this morning’s Speed Round, below.

- Cairo has brokered a breakthrough in the peace process between warring factions in Libya (again, more in Speed Round).

- Data from the US and Canada suggest that economies are rebounding quicker than expected from covid-19 shutdowns.

- And we’re really chuffed that Egypt is pushing ahead of mandatory vaccination programs despite the pandemic (see Diplomacy + Foreign Trade, below). Toz, anti-vaxxers.

On the jobs reports: The US economy added 2.5 mn jobs in May after two months of mass unemployment, bringing total unemployment to 13.3% from 14.7%. Now, there’s a good chance that problems with underlying data collection is partially at play here, but Canada also saw a substantial number of jobs created last month — to the tune of 289k positions vs. the loss of 500k jobs that many economists had projected. That’s leading pundits to proclaim that the covid-recovery has begun.

Why are job reports in the US and Canada important to Egypt? Beyond being positive indicators for the global economy, it’s where the jobs are coming from: “Job growth was concentrated in industries hit hardest early in the crisis, like leisure, hospitality and retail work. But manufacturing, health care and professional services added jobs as well, possibly signaling that the damage did not spread as deeply into the economy as many feared,” the New York Times’ Ben Casselman writes.

This is a shot in the arm for those among you who are optimistic about prospects for business in Egypt despite all the short-term pain caused by the lockdowns, as we reported in our Enterprise Reader Poll on Thursday.

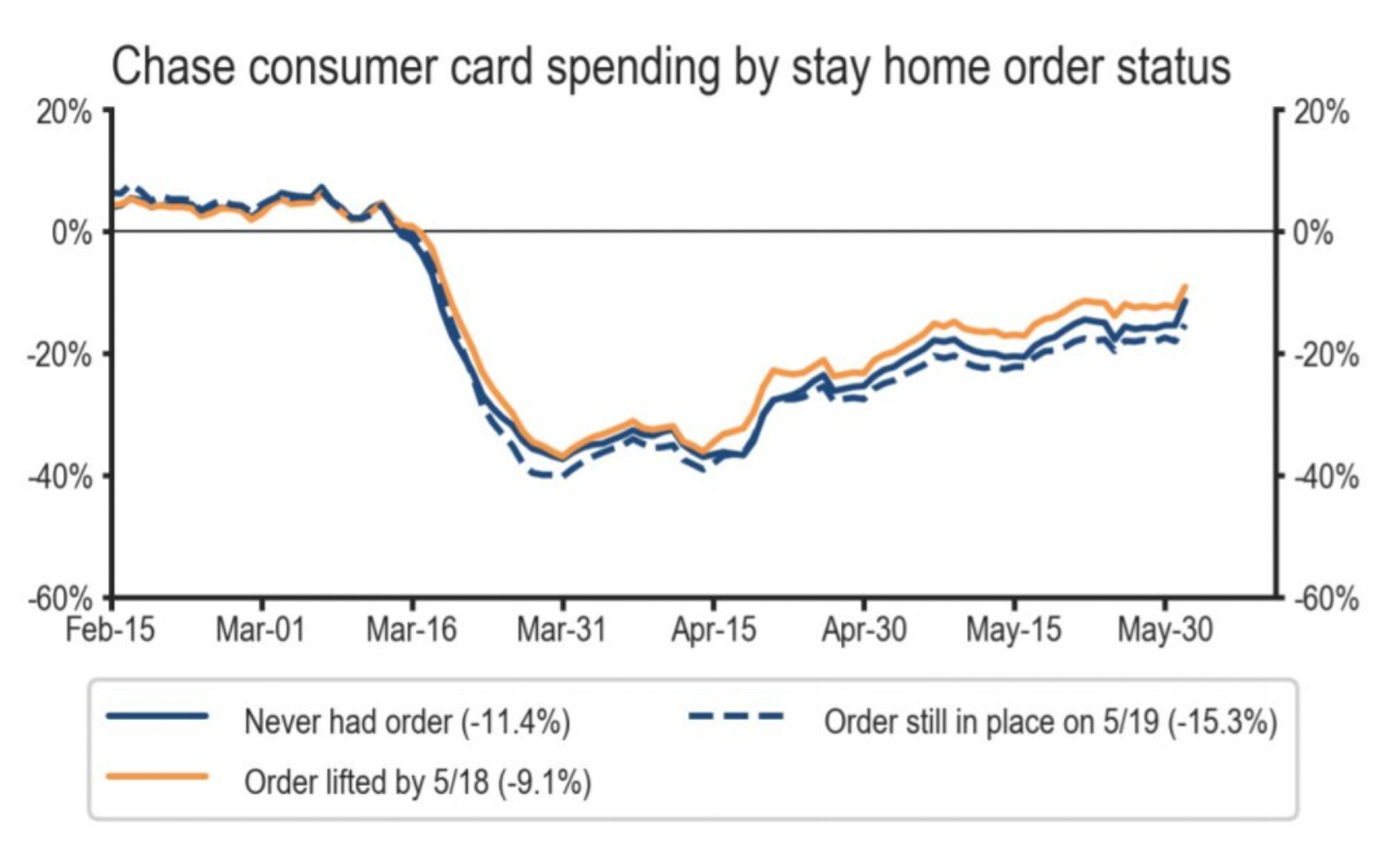

Oh, and one more thing: Don’t bet against the resilience of the consumer. Not in the US, and not in Egypt. Witness this graphic (below) from Bloomberg’s Joe Weisenthal, who notes that there is “almost no difference in spending activity between lockdown states and non-lockdown ones” — part of what’s getting economies through is that consumers keep on spending, even when they’re locked down.

And consumers can expect lots of sales ahead with retailers globally sitting on piles and piles of unsold inventory, the Financial Times adds, asking whether the end of lockdown will see the sale of the century.

It’s a big day for: The House of Representatives, which is back in session this morning with a very busy agenda that ranges from passage of the 2020-2021 state budget, the reconstitution of the upper house of parliament and a pile of other business-relevant bills. MPs are now in the home stretch preparing for summer vacation.

MPs will be wearing face masks in all sessions with six MPs having reported being infected with the virus that causes covid-19, Al Masry Al Youm reports. Rep. Hussein Ashmawi is the most recent. He’s being treated at a hospital in Giza, according to Youm7.

The creation of a new Senate is the big draw today with a draft bill on the subject due to be presented this morning, according to Masrawy. The bill, which parliamentary majority bloc the Support Egypt Coalition has drafted, would — if passed — set up a 300-member Senate, one-third of whom would be appointed by the president. The bill would also see the election of the remaining two thirds split equally between a list system and an individual basis. MP and former journalist Moustafa Bakry wrote on social media on Friday that “most” lawmakers prefer a 50/50 split between individual and closed lists.

Background: Parliamentary elections are scheduled for the end of this year. Constitutional amendments approved last year will bring back the upper house of parliament, with the Senate set to replace what was previously known as the Shura Council, which was abolished in the 2014 constitution.

Also on lawmakers’ agenda before they can go on summer break: Today should see MPs discussing the bills regulating the Sovereign Fund of Egypt and state-owned businesses. The final Banking Act needs to be passed. MPs will vote on the Central Depository Act and amendments to the Railway Act as well as discuss the bills regulating parking lots and amendments to both the Infectious Diseases Act and the Police Authority Act.

Key news triggers coming up:

- Foreign reserves figures for May should be out early this week.

- Inflation data for May will land on Wednesday, 10 June.

- The Central Bank of Egypt will meet to review interest rates on Thursday, 25 June.

- Founding members of the EastMed Gas Forum will meet this month to ink the Cairo-based energy organization’s charter.

COVID-19 IN EGYPT-

The Health Ministry confirmed 32 new deaths from covid-19 yesterday, bringing the country’s total death toll to 1,198. Egypt has now disclosed a total of 32,612 confirmed cases of covid-19, after the ministry reported 1,497 new infections yesterday, shy of the record 1,536 cases reported on 31 May. We now have a total of 9,603 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 8,538 have fully recovered.

The Health Ministry has reduced the need for ventilators and increased recovery rates by using convalescent plasma therapy, Minister Hala Zayed said. The ministry is calling for recovered patients to donate plasma to assist its efforts.

Restaurants and cafes will likely open their doors this month if they comply with new preventative measures to curb the spread of covid-19. The Chamber of Tourism Establishments circulated a checklist outlining those measures to its members, but the official announcement of the regs and the timetable to reopen will be revealed by the government soon, the Tourism Ministry said in a statement. The measures include rearranging seating to be at least two meters apart and in four-person tables, ensuring distancing in places where lineups or crowding are likely, and the usual practices of deep cleaning, and screening and sanitizing customers at the doors. An existing ban on shisha will remain in place.

Measures will also be mandated at tourist sites and landmarks, including limiting the number of people indoors, the ministry said. Egypt is expected to soon reopen six museums and landmarks, including the Baron Palace, after an almost three-month hiatus, as it moves toward a phased reopening of national attractions, we noted last week.

The news comes as Egypt continues reaching out to traditional tourism partners to discuss restarting flights and tourism flows as lockdown measures ease. The Tourism Ministry is also planning to kick off promotional campaigns targeting travelers in western and central Europe in mid-June, the local press reports, citing unnamed industry sources.

Egyptian economy “solid” -El Said: Egypt’s economic reform program has helped the economy to remain on a “solid” footing through the pandemic, Planning Minister Hala El Said said on Thursday (pdf). Despite the tourism, industrial and retail sectors suffering as a result of the government’s preventative measures, the Planning Ministry still expects the economy to grow at a 4% clip during the current fiscal year, down from the pre-corona forecast of 5.8%. The IMF predicted in April that Egypt would be the only country in the region to avoid a recession this year.

The Madbouly government is studying ways to assist Egyptians who have returned home from jobs abroad, including help with job placements and starting new businesses.

The African Development Bank (AfDB) could provide more funding to back Egypt’s battle against the pandemic, Country Manager Malinne Blomberg said, reports Al Mal. The lender last month approved a USD 500k emergency assistance grant to provide food relief and other forms of support to vulnerable communities.

CIB is waiving transfer fees on internet banking and hiking caps on transactions to encourage more customers to bank online. The move is designed to help curb footfall in branches amid the pandemic.

Public sector employees will receive their salaries starting 15 June over four days to avoid congestions at ATMs nationwide, the Finance Ministry said on Friday.

DONATIONS-

The National Bank of Egypt (NBE) is donating EGP 20 mn to Kasr El Ainy Hospital to support medical treatment for covid-19 patients, according to Masrawy.

AND THE REST OF THE WORLD-

Black Lives Matter protests are now a global phenomenon, according to the western press as people march in London, Paris, Toronto, Malbourne and beyond. Meanwhile, thousands across the United States continue to hit the streets in protest of racial inequality and police violence. The story leads the front pages of newspapers globally: Financial Times | WSJ | New York Times | CNBC | Business Insider.

US stocks continue to rally despite the widening of civil unrest. That’s not surprising, the Wall Street Journal and Fortune magazine suggest.

That floor under oil prices is looking increasingly solid: “OPEC and its allies finalized on Saturday an extension of their record oil-production curbs through July,” the Wall Street Journal reports this morning.

Qatar wants to end its riff with the rest of the Arab world. Qatar is “open to dialogue” on ending its longstanding isolation from Egypt and key Gulf countries, Qatar’s Foreign Minister Sheikh Mohammed bin Abdulrahman Al-Thani told state mouthpiece Al Jazeera (watch, runtime: 24:58). Egypt, Saudi Arabia, the UAE, and Bahrain — which together unilaterally cut diplomatic ties with Qatar in 2017 — had previously presented a list of demands to end their embargo on Doha, which they imposed as the statelet continued to back Islamists across the region. Kuwait is pushing the thaw and the United States is angling for Saudi and the UAE to start by re-opening their airspace to Qatari aircraft.

Your regularly scheduled reminder that US elections are still happening this fall: Presidential hopeful Joe Biden — and the sole Democratic contender — formally earned the Democratic Party nomination on Friday after securing the required number of delegates, Reuters reports. Biden has yet to tap a running mate, but has vowed to select a woman, and is coming under pressure to choose a black candidate amid ongoing protests in the US over the on-camera murder of an unarmed black man.

Egyptian film selected for the (canceled) 2020 Cannes Film Festival: Egyptian director Ayten Amin's new feature film ''Souad' was selected as one of 56 films of the Cannes Film Festival's Official Selection for 2020 edition. This year’s film festival has been cancelled due to covid-19, but the chosen films will receive an honorable mention award and may be screened in next year's festival.

What does a VC look for in a startup — and what makes them walk away from investing? Tarek Assaad and Karim Hussein, two of Cairo-based Algebra Ventures’ three managing partners, give us the lay of the land on how VC is done in this corner of the world in our latest episode of Making It.

Founded in 2015, Algebra is a USD 54 mn venture capital fund that focuses on early stage tech startups. The VC fund’s portfolio covers fintech, e-commerce, transport, and online food ordering, among other industries. Assaad and Hussein relay their experience being one in a handful of pioneers paving the way for bigger investment tickets in the region.

Tap or click here to listen to the episode on: Our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Enterprise+: Last Night’s Talk Shows

The Egypt-sponsored Libyan ceasefire agreement President Abdel Fattah El Sisi unveiled yesterday was the biggest talking point on the airwaves, with El Hekaya’s Amr Adib (watch, runtime: 2:41 and runtime: 2:37) and Masaa DMC’s Eman El Hosary (watch, runtime: 16:31) among those taking note. We have chapter and verse on the agreement in this morning’s Speed Round, below.

The new agreement is a marked improvement from previous attempts at reaching a peaceful settlement to the conflict, largely because it lays out a political roadmap that includes presidential elections and an equitable power-sharing structure between the country’s provinces, advisor to Libya’s parliamentary speaker Abdel Hamid Safi told Al Kahera Alaan’s Lamees El Hadidi. However, Safi said he expects UN-recognized Prime Minister Fayez Al Serraj to reject the initiative, which makes international mediation that much more important to reach a resolution (watch, runtime: 8:19).

Back at home: Private healthcare providers have not stopped providing covid-19 treatment to patients, despite their reported objections to the Health Ministry’s mandatory pricing scheme, according to the Federation of Egyptian Industries’ private sector healthcare division spokesman Ahmed Nazih. Private hospitals are still admitting patients as they come in and are looking to get ministry approval to conduct PCR testing through private laboratories, rather than continuing to rely on state-owned labs, Nazih told Adib (watch, runtime: 7:12). Nazih also had a similar conversation with Masaa DMC’s El Hosary (watch, runtime: 6:16).

The CIT Ministry will begin working on the second phase of its overhaul of Egypt’s telecoms infrastructure in 2H2020 to improve internet connectivity, Minister Amr Talaat told Al Tase’a Masa’an’s Wael Ebrashy. The ministry is also working on digitizing 80 government services, Talaat said (watch, runtime: 12:24).

Speed Round

Speed Round is presented in association with

IMF gives initial nod to USD 5.2 bn in fresh funding to Egypt: The IMF reached a staff-level agreement to provide Egypt with a one-year, USD 5.2 bn stand-by arrangement (SBA) to help the country withstand the economic fallout from the covid-19 pandemic, according to a statement on Friday. The funding will support healthcare and social programs, protect and advance structural reforms, and boost private sector growth and job creation, said Uma Ramakrishnan, who led the talks with Egypt.

Stand-by loan to boost investor confidence: “The agreement is important to continue to support the confidence of the markets and investors in the ability of the Egyptian economy to handle the effects of the coronavirus crisis,” the Finance Ministry said in a statement on Friday. Ramakrishnan said that the arrangement would “catalyze additional bilateral and multilateral financial support.” Egypt is reportedly seeking another USD 4 bn in financing on top of the SBA to see it through the crisis.

What’s next? The IMF’s executive board will make a final decision on whether to approve the funding “in the coming weeks,” Ramakrishnan said. You can check their meeting calendar here.

The first tranche of the loan could come this month, should the executive board give the green-light to disburse the funding, a Central Bank of Egypt official said last month.

Background: Egypt received last month a USD 2.8 bn rapid financing instrument from the IMF following talks in April. Egypt is seeking an additional USD4 b from undisclosed international lenders. Fitch Ratings said last month that fresh funds from the IMF will boost investor confidence in Egypt as portfolio outflows from emerging markets reverse. The funds may also help Egypt cut back on local borrowing to reduce the cost of servicing its debt, according to the Finance Ministry.

The story received wide coverage by the foreign press: Bloomberg | Associated Press | Reuters | AFP | the Guardian | the National.

EGP WATCH- EGP back where it was seven months ago against the greenback: The EGP is back to where it stood in December at 16.25 to the greenback, says Reuters. The EGP eased 2.2% last week and is down 3.5% from the 15.70 at which it had held steady throughout the covid-19 pandemic. Egypt’s key sources of foreign currency — tourism, remittances from Egyptians abroad, and foreign inflows into local debt — have been under increasing pressure over the past three months. Stil, the EGP has taken a much lighter beating than the hardest-hit EM currencies, such as the Brazilian real, which lost some 20% this year amid the covid-19 global risk off.

Passenger car sales dropped 26% y-o-y in April to 5,852 vehicles, according to figures from the Automotive Information Council (AMIC) picked up by Amwal Al Ghad. Truck sales dropped 41.7% y-o-y to 1,467 units.

The drop was expected, even after solid growth in 1Q2020: Egypt’s automotive companies saw business grind to a near-complete standstill when the government introduced lockdown measures towards the end of March, including the suspension of new vehicle licensing and reduction of working hours. Traffic police offices reopened for new car registration last month.

Egypt’s construction sector will become the largest in the region by 2029 in terms of value, Fitch Solutions’ BMI research said in a report summed up by cabinet’s Information and Decision Support Center (IDSC). The sector is projected to grow 9% on average between 2020 and 2024 after a short-term slowdown due to the pandemic. A large part of this will be driven by active public-private partnerships and an expansion of green building, BMI said.

The sector’s value will more than triple to USD 89 bn from a current USD 25 bn before the decade is out, and account for 30% of the entire region’s construction market, BMI expects. Egypt’s construction sector is currently ranked second in the MENA region, trailing only slightly behind the UAE, the IDSC said.

Enara to supply renewable energy to 1.5 mn feddans project under contract with ECDC: Enara Energy will generate and distribute 400 MW of renewable energy to farms and businesses in El Moghrah and westernmost Minya as part of the 1.5-mn feddans desert reclamation project, according to a company press release (pdf). Enara was awarded the contract last week by the company in charge of the project, the Egyptian Countryside Development Company (ECDC). Alongside greening the desert … “[the 1.5 mn feddans project] is also creating industrial clusters for food and beverage, packaging and oil, housing units, as well as health and education services,” Enara said.

Background: The 1.5 mn feddan project was announced by President Abdel Fattah El Sisi in 2015 as one of several national mega projects. The project involves tendering a vast expanse of land in the Western Desert to qualified investors and aims to increase the size of Egypt’s arable land by 20%. The ECDC is currently accepting bids for land in Al Farafra, El Moghrah, and further west from the western tip of Minya. So far, 150k feddans were awarded to agricultural investors, ECDC Chairman and CEO Ater Hanoura recently said, according to Amwal Al Ghad.

Correction (6/7/2020): A previous version of this article incorrectly stated that French energy company Total had been awarded the contract alongside Enara.

INVESTMENT WATCH- Saudi German Hospital seeking IFC loan for Egypt expansion: The Saudi German Hospital Group is seeking a loan from the International Finance Corporation to finance its expansion plans, the local press reports, citing sources familiar with the matter who did not disclose the loan’s value but added that the group was discussing selling the IFC a stake in Egypt. They said that the expansion plans include the three-phase Batterjee Medical City on the outskirts of Alexandria in which it is investing around EGP 10 bn. Vice Chairman Makarem Batterjee said last year that the group is looking to invest EGP 40-50 bn in Egypt over the next 15 years, including inaugurating a second hospital in Cairo and adding an outpatient clinics building to its Heliopolis facility.

INVESTMENT WATCH- Emaar Misr is looking to build a new EGP 40 bn investment zone in the Greater Cairo area, a cabinet statement said on Thursday. The 64-feddan development will feature commercial, residential, hotels and services facilities. The government is currently considering three other proposals to set up investment zones, the statement added without providing additional information.

Separately, Chinese garment firm Handa is looking to set up a factory worth USD 20 mn in Belbeis, Sharqiya, to produce clothes to export to Europe and the US, the statement added.

LEGISLATION WATCH- Sovereign fund law is up for plenary discussion in parliament today: Proposed amendments to the Sovereign Fund of Egypt (SFE) law, which the House Planning and Budget Committee approved in February, will be up for discussion in the House of Representatives’ general assembly today, Al Mal reports. The proposed amendments would, if passed, provide VAT refunds to any company that is more than 50% owned by the SFE and its sub-funds and limit the scope of legal action that can be taken against the fund (it’s effectively designed to shield the fund and its coinvestors from spurious third-party lawsuits that are common when the state partners with the private sector).

Background: The SFE is due to set up sub-funds to attract investment to key sectors including logistics, renewables and manufacturing. Extra legal protections for the fund, outlined in the amended legislation, would shield the SFE from third-party legal action. The Madbouly Cabinet had approved the amendments in December and the House Planning and Budget Committee gave the go ahead for tax breaks and legal immunity in February.

State banks sell EGP 170 bn of 15% savings certificates in just over two months: Banque Misr has so far sold EGP 49 bn-worth of its high-interest savings certificates as of the end of last week, Chairman Mohamed El Etreby tells Akhbar El Youm. The National Bank of Egypt (NBE) sold EGP 122 bn-worth of the certificates since their launch on 22 March, according to an informed source at the bank.

STARTUP WATCH- Vezeeta inks agreement with STC to provide telehealth to company employees: Digital healthcare startup Vezeeta has signed a partnership agreement with Saudi Telecom Company (STC) to provide all company employees with phone and video consultations at no charge, and discounted home check ups through Vezeeta’s app, according to Menabytes. No details were provided on the value of the agreement. Since launching in Cairo in 2012, the company has expanded its operations to 50 cities across Egypt, Saudi Arabia, Jordan and Lebanon.

Egypt brokers ceasefire agreement in Libya, potentially setting up peace talks: The Libyan National Army (LNA)’s General Khalifa Haftar and Libya’s Parliamentary Speaker Agila Saleh have agreed to a nationwide ceasefire due to come into effect tomorrow at 6am under an agreement brokered by President Abdel Fattah El Sisi, according to an SIS statement. The agreement requires all “foreign mercenaries” to withdraw from Libya and would see militias handing over their weapons to allow for a political resolution to the conflict, El Sisi said at a joint presser with Haftar and Saleh yesterday. Representatives of the UN-recognized Libyan Government of National Accord (GNA) were not present.

An end to conflict through LNA control and procedural representation: The peace agreement calls for UN sponsored talks with the 5+5 Libyan Joint Military Commission in Geneva to pave the way for the formation of an elected presidential council within 90 days. The council would include representatives from each of the country’s three provinces, who will be tasked with appointing a prime minister and transitional government. Tripoli would get to select four ministers, Cyrenaic with seven, and Fezzan would receive control of five. Saleh will form a legislative committee to draft a “constitutional declaration” to guide the country through the 18-month transitional period until elections are held.

The agreement has received international backing and praise from the US, Russia, Bahrain, UAE, Jordan and Saudi Arabia.

Background: Egypt and the UAE have repeatedly called for a political settlement in Libya, and Egypt also supported an initiative launched by Agila Salah, resisting Haftar’s move to take full political control of the east, according to Bloomberg. Haftar’s LNA said it would rejoin UN-sponsored ceasefire talks with Libya’s GNA, following a series of meetings in Cairo last week which came after forces loyal to the GNA took the last LNA stronghold near Tripoli on Friday. Turkish military support for the GNA was key to its recent successes, Reuters reports, but the LNA still held control of the south and east of the country, and its oil fields before yesterday’s announcement.

The story is topping coverage of Egypt in the foreign press this morning: The Guardian | Bloomberg | Reuters | The Jerusalem Post | Deutsche Welle.

Egypt in the News

It’s a reasonably busy morning for Egypt in the international press. The news cycle is led by President Abdel Fattah El Sisi’s brokering of a ceasefire between warring factions in Libya that sets up peace talks (see Speed Round, above). The news edged out coverage of Egypt’s new USD 5.2 bn standby funding agreement with the IMF, which had been dominating the conversation on Egypt (also in Speed Round).

Also getting lots of ink: A father will be prosecuted on charges of forcing his three young daughters to undergo FGM, the public prosecutor’s office said in a statement last week. The doctor involved will also go on trial. (Reuters | BBC | Guardian | AFP | Daily Mail | Gulf News).

Covid-19 is escalating in Egypt and other populous, low-income countries: Egypt and other densely populated low- and middle-income countries throughout the world are becoming the new epicenters of the covid-19 pandemic, Declan Walsh writes in the New York Times. Walsh notes there are concerns that Egypt may be following the US’ path, with people relaxing their behavior in the mistaken belief that fears about the virus are exaggerated. Meanwhile, Bloomberg looks at the acceleration of new cases in MENA post-lockdown.

Diplomacy + Foreign Trade

Egypt is pushing ahead with its mandatory vaccine program to curb the spread of preventable diseases, even with the ongoing pandemic, President Abdel Fattah El Sisi said in an address to a UK-hosted vaccine summit on Thursday, a cabinet statement said. The event helped raise funding to immunize 800 mn children worldwide against a handful of diseases over the next five years.

Egypt is banning the imports of white sugar for the coming three months, with the exception of imports for pharma manufacturing, a Trade and Industry Ministry statement said. Egypt currently has sufficient supplies of the white stuff to meet domestic consumption, Supply Minister Ali El Moselhy said.

Shoukry, Chinese FM talk GERD: Foreign Minister Sameh Shoukry gave his Chinese counterpart Wang Yi the latest on the Grand Ethiopian Renaissance Dam (GERD) negotiations between Egypt, Ethiopia, and Sudan in a phone call on Thursday. China is the latest to join Sudan, the EU, the UN, and the US in calling for a diplomatic settlement to end the GERD dispute, mounting international pressure on Ethiopia to return to the negotiation table. The negotiations reached a deadlock in February after Ethiopia’s unprompted decision to skip the final round of US-brokered talks in Washington and insistence on filling the dam as early as July.

Energy

New oil well discovered in Egypt’s Western Desert

Borg El-Arab Petroleum and Mineral Company — a JV between the EGPC and Kuwait Energy — has discovered a new oil well in the Western Desert’s Abu Sennan concession, the cabinet said yesterday. The Salmeya-5 well is estimated to hold 4k bbl/d of crude oil and 18 mn cf/d of gas. The JV made its most recent discovery in Abu Sennan last December, the ASH-2 well.

Electricity Ministry to add 145 MW to national grid in FY2020-21

The Electricity Ministry plans to increase the capacity of the national electricity grid by 145 MW in FY2020-21, to bring its total to 59.8 GW, Al Mal reports. Read our Hardhat story from yesterday for more on how the Madbouly government is handling Egypt’s energy oversupply issues.

Manufacturing

Katilo invests EGP 90 mn New Damietta City factory

Dairy products manufacturer Katilo will begin operations at its new EGP 90 mn factory in New Damietta City next month, according to the local press. The factory, which the company planned to bring online in March before the covid-19 pandemic, includes four new production lines that will help the company increase production and exports.

Infrastructure

Construction begins on new administrative capital’s EGP 2 bn Knowledge City

The CIT Ministry has begun working on the first phase of the new administrative capital’s EGP 2 bn Knowledge City, Minister Amr Talaat said, according to Al Masdar. The city will include an applied research center for technology, a technical training facility and the National Academy of Information Technology for individuals with special needs.

Banking + Finance

Elsewedy Electric eyes EGP 800 mn-1 bn loan for 6 October Dry port

Elsewedy Electric is in talks with local banks to arrange a loan between EGP 800 mn and EGP 1 bn to finance the first phase of the 6 October Dry port project, which it is constructing alongside 3A International and Schenker Egypt, according to Al Shorouk. The phase is expected to cost USD 176 mn, the newspaper says.

AfreximBank could give Egypt’s banks up to USD 750 mn of credit facilities

AfreximBank is looking at extending USD 500-750 mn worth of credit facilities to local state-owned and private banks to help them shore up their FX liquidity, Al Shorouk reports, citing unnamed sources with knowledge of the matter. Each bank would receive USD 200-300 mn, according to the sources.

The Market Yesterday

EGP / USD CBE market average: Buy 16.15 | Sell 16.25

EGP / USD at CIB: Buy 16.15 | Sell 16.25

EGP / USD at NBE: Buy 16.13 | Sell 16.23

EGX30 (Thursday): 10,621 (+1.9%)

Turnover: EGP 1.4 bn (91% above the 90-day average)

EGX 30 year-to-date: -23.9%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.9%. CIB, the index’s heaviest constituent, ended up 3.2%. EGX30’s top performing constituents were Credit Agricole up 7.5%, Orascom Development up 7.0%, and CIB up 3.2%. Thursday’s worst performing stocks were Juhayna down 4.0%, CIRA down 1.4% and AMOC down 0.4%. The market turnover was EGP 1.4 bn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -104.3 mn

Regional: Net Short | EGP -70.8 mn

Domestic: Net Long | EGP +175.1 mn

Retail: 52.4% of total trades | 49.4% of buyers | 55.4% of sellers

Institutions: 47.6% of total trades | 50.6% of buyers | 44.6% of sellers

WTI: USD 39.55 (+5.72%)

Brent: USD 42.30 (+5.78%)

Natural Gas (Nymex, futures prices) USD 1.78 MMBtu, (-2.20%, July 2020 contract)

Gold: USD 1,683.00 / troy ounce (-2.57%)

TASI: 7,207.78 (-0.20%) (YTD: -14.08%)

ADX: 4,303.14 (+0.43%) (YTD: -15.22%)

DFM: 2,039.48 (+1.99%) (YTD: -26.24%)

KSE Premier Market: 5,458.96 (+0.09%)

QE: 9,252.07 (+0.42%) (YTD: -11.26%)

MSM: 3,517.60 (-0.49%) (YTD: -11.64%)

BB: 1,273.34 (-0.16%) (YTD: -20.92%)

Calendar

7 June (Sunday): House of Representatives' general assembly is due to reconvene for its last sitting before summer recess.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

13 June (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

13 June (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 June (Tuesday): Anniversary of the June 2013 protests, national holiday.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.