- Egyptian equities join world’s top performers as EGX soars on CBE intervention. (Speed Round)

- House in recess until 12 April as Egypt reports a total of 366 covid-19 cases. (What We’re Tracking Today)

- CBE moves against dollarization amid signs the parallel market for greenbacks is trying to make a comeback. (Speed Round)

- Strong FX reserves, fiscal reform to mitigate short-term headwinds on Egypt’s external account -Fitch Ratings. (Speed Round)

- Endeavor to acquire Semafo in June, creating West Africa’s largest gold producer. (Speed Round)

- TE to make decision on Vodafone Egypt transaction next month. (Speed Round)

- Japan’s Trend Micro acquires SecureMisr cybersecurity company. (Speed Round)

- Federal Reserve goes all in to save the US economy. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 24 March 2020

EGX rebounds on CBE stimulus, but expect volatility to persist

TL;DR

What We’re Tracking Today

We’ll forgive you if it feels a little bit like you’re living in a remake of the Bill Murray classic Groundhog Day. And it seems unlikely to get better anytime soon, so we might as well settle in for the long haul, people. While a Nobel Laureate is suggesting that things could get better globally faster than we think, the consensus among scientists is that we could be living for some time with harsh measures to snuff out the coronavirus.

US politics will colour the debate over how long social distancing and more radical measures like business shutdowns should last. The Donald thinks the cure may be worse than the disease — and has said he believes businesses should reopen their doors in weeks, not months.

So, our two must-reads this morning: The epic The virus can be stopped, but only with harsh steps, experts say, in the New York Times. And this scientific paper (pdf) by the folks at Imperial College London, whose warning is US and UK-centric, but seems likely to apply globally.

Their bottom line: We may face on-again, off-again social distancing for a while to come. It’s worth reading in full: “Suppression will minimally require a combination of social distancing of the entire population, home isolation of cases and household quarantine of their family members. … The major challenge of suppression is that this type of intensive intervention package … will need to be maintained until a vaccine becomes available (potentially 18 months or more) — given that we predict that transmission will quickly rebound if interventions are relaxed. We show that intermittent social distancing — triggered by trends in disease surveillance — may allow interventions to be relaxed temporarily in relative short time windows, but measures will need to be reintroduced if or when case numbers rebound. Last, while experience in China and now South Korea show that suppression is possible in the short term, it remains to be seen whether it is possible long-term, and whether the social and economic costs of the interventions adopted thus far can be reduced.”

COVID-19 IN EGYPT –

Egypt has now reported 366 cases of covid-19 after confirming yesterday 39 new infections, all of them Egyptians, a Health Ministry statement said. The MoH also confirmed five new deaths from the disease, including four Egyptians and an Indian national, bringing the death toll to 19. A total of 68 patients are now reported to have fully recovered, while another 96 appear to be on the path to recovery after having tested negative for the virus that causes covid-19.

Among the dead: A second senior member of the Armed Forces, as the military mourned the passing of Maj. Gen. Shafee Daoud, who it said died after contracting the virus that causes covid-19 while participating in disinfection efforts, Al Shorouk reports. Daoud, who was head of the major infrastructure projects at the Armed Forces Engineering Authority, is the second senior military officer to pass away from the virus in the past two days, after Maj. Gen. Khaled Shaltout was reported to have died on Sunday. AFP also has the story.

The House of Representatives will stay in recess until 12 April as a precaution against the spread of covid-19, Al Shorouk reports. MPs were originally scheduled to reconvene for a general assembly session on 29 March.

The Housing Ministry will expedite payments to New Alamein contractors who want to furlough their workforces, the local press reports. Contractors will use the funding to meet payment obligations to subcontractors if they decide to stop work for a two-week period to help prevent the spread of the viruses. They will be required to pay workers 50% of their salaries while they’re off work.

The Finance Ministry has extended again the deadline for personal tax return filings to April 16 and is encouraging people to file online by waiving e-payment fees, according to Al Masry Al Youm. A support hotline, which can be reached at 16395, will help guide individuals through the Tax Authority’s online portal.

*** With businesses and auditors alike facing disruptions, the Tax Authority needs to push back filing deadlines for businesses, too. And with the need for stimulus increasingly clear, it needs to look at deferring tax payments, particularly for SMEs. The US is rolling out this type of relief, as has Canada at the federal and many provincial levels. At this point, it’s simply the right thing to do.

Arab Contractors has suspended its work on phase 4B of Cairo Metro Line 3 for one week to deep clean workspaces for the project, according to an internal memo carried by Al Shorouk. The suspension came into effect yesterday, and work is set to resume next Sunday, 29 March. Phase 4B includes three stations spanning 2.3 km.

The Federation of Chambers of Commerce is trying to convince members in some key market districts to voluntarily shut down for 10 days, according to a report in the domestic press. The districts are popular for their wood, building materials, home appliance and sanitaryware vendors and are in districts including El Sabtia, Darb Saadah, Hammam El Talat, El Mousky, the Jewish Quarter, Al Azhar, and El Ghouria and Abu El Nimros in Giza.

Some 40k street vendors have been ordered to clear out of Attaba and El Mousky’s outdoor souks as part of the government’s efforts to prevent the spread of covid-19 through reduced physical contact, Masrawy reports. Exceptions made for grocery stores in the two districts, which will also have to abide by nationwide closures from 7pm to 6am.

The Journalist’ Syndicate is shutting its head office for two weeks as a precautionary measure to help slow the spread of the disease, Youm7 reports. Reporters and photojournalists will continue to work, as they have in other countries, where media have been declared essential personnel and enjoyed freedom of movement on city streets even during lockdowns.

The Lawyer’s Syndicate will be closing its doors for two weeks after a board member was reported as a suspected case of covid-19 who fears he may also have passed it on to his family, Al Shorouk reports.

The Oil Ministry is setting up an online platform to allow foreign companies to participate in the ongoing gold exploration tender amid global travel restrictions caused by the outbreak of covid-19, Al-Mal reports citing an unnamed Ministry official. The Oil Ministry started accepting bids last Sunday, and will continue to do so through 15 July, for a 56k sq km exploration area in the Eastern Desert. Further licensing details were released yesterday. This is the first tender of its kind since amendments to the Mineral Resources Act were passed last year that permitted the issuance of new gold exploration tenders.

Cairo University has set up five research teams to conduct research on the covid-19 virus, with members from the faculties of science, medicine, pharmacy, and the National Cancer Institute, the local press reports.

EgyptAir will operate a weekly flight repatriate citizens from Kuwait starting on Wednesday, Hapi Journal reports, citing Kuwait’s Civil Aviation’s Administration.

PSA #1- The International Baccalaureate (IB) officially announced yesterday (pdf) that this year’s IB exams will be canceled. Graduating students will receive their diploma or certificates based on submitted coursework, which includes internal assessments and independent presentations. Read yesterday’s edition of Blackboard for a recap on how schools, universities, and international testing organizations are adapting to the covid-19 outbreak.

PSA #2- The virus that causes covid-19 wasn’t bioengineered by anyone. Not by the Chinese or US military. Not by a Canadian defense lab. Think we’ve been coopted by the conspiracy? Read this.

PSA #3- The WHO has launched a messaging service on WhatsApp to provide updates on the global covid-19 outbreak, which you can access using this link.

ON THE GLOBAL FRONT-

The Federal Reserve really is willing to do whatever it takes to save the market from melting down: Enter QE Infinity and corporate bond purchases. The US Federal Reserve yesterday pledged to buy government bonds and mortgage-backed securities “in the amounts needed” and announced new programs to buy corporate bonds in the primary and secondary markets and through exchange-traded funds. It will also provide USD 300 bn in new lending to consumers and businesses. The central bank has already slashed interest rates to zero, launched a new USD 700 bn bond-buying program and dumped tns of USD into the repo market in what seems to be a futile effort to provide liquidity to the system and return the markets to normalcy. (FT | Bloomberg | MarketWatch | CNBC)

But still the markets fell: US stocks finished in the red again yesterday despite the wave of fresh Fed stimulus. Despite a late rally, the S&P 500 was down more than 3% at the closing bell, and the Dow Jones fell 2.9%.

Point your fingers at Washington: Senate negotiations over a USD 1.6 tn economic rescue package remained at a standstill yesterday amid partisan disagreements over the GOP legislation. Democrats, who want to make the corporate bailout process more transparent and allocate more funds to workers and the healthcare sector, unveiled a rival USD 2.5 tn plan that would place more restrictions on the financial industry. Treasury Secretary Steve Mnuchin and Senate Minority Leader Chuck Schumer both gave optimistic statements, but the day ended without agreement. The Wall Street Journal has more.

Monetary policy can only do so much: “The Fed has really rallied to do as much as it can to extend its reach, but I think at the end of the day, the markets recognize this requires a fiscal response,” said Nela Richardson, an investment strategist at Edward Jones. “Every time the Fed takes a strong step forward there’s a kind of, ‘Oh no, this is worse than anyone thought’ reaction in the market.”

Sawiris’ gold gambit may be paying off: Gold futures posted their biggest single-day gain against the USD on record yesterday in response to the Fed’s pledge to flood the system with unlimited stimulus, MarketWatch reported. Goldman Sachs analysts now see prices rising above USD 1.8k. We have more on Naguib Sawiris’ comments on the gold market in this morning’s Speed Round, below.

Meanwhile in Europe: Can the ECB’s latest stimulus prevent a new sovereign debt crisis?

The European Bank’s EUR 750 bn nine month liquidity injection plan into European markets is set to soften the blow of spiraling economies and already showed promise as bond markets rallied after the announcement, but much of the recovery still falls upon the fiscal policies put in place by national governments, the FT says.

MUST READ: The world’s richest countries are going to have to step up to the plate and spare emerging markets the pain of corona, the Financial Times editorial board argues. “Supporting emerging markets is not just about the moral imperative of caring for the world’s poorer populations. For richer countries, it is also a matter of self-interest. Economic disaster that stokes pandemic in, say, India, Indonesia or sub-Saharan Africa could rebound on the developed world if travellers from those regions cause additional waves of infection. The chain of defence against coronavirus is only as strong as the weakest link. Investing to bolster weak links will be money very well spent.”

Covid-19 “accelerating” -WHO: The World Health Organization (WHO) has warned that the covid-19 pandemic is “accelerating” as the global toll has surpassed 350k cases and more than 15k deaths. Health systems worldwide could be overwhelmed in a few matter of weeks if the outbreak is not brought under control, WHO Director-General Tedros Adhanom Ghebreyesus said at a press briefing.

But in Italy there is actually some good news: The rate of new confirmed cases and deaths slowed on Sunday, perhaps providing a first sign that the country’s unprecedented shutdown could be beginning to deliver results. Italy has been the hardest hit country by the covid-19 outbreak in Europe, now considered the epicenter of the global pandemic, with a confirmed 59,138 cases.

The Olympics will be postponed until 2021 due to the virus, member of the International Olympic Committee Dick Pound has said.

Curfews, shut-downs, lock-downs, travel bans:

- The UK has become the latest European country to lock down: PM Boris Johnson yesterday announced strict new rules on when people can leave their homes. (BBC)

- Saudi Arabia officially imposed a curfew last night, ordering a shutdown across all non-essential services from 7 pm to 6 am for up to 21 days. (Saudi Press Agency)

- The UAE also suspended all flights, including transits, for two weeks, official state media announced. Etihad will only carry UAE citizens or diplomats from abroad whose final destination is Abu Dhabi, the airline said on Twitter.

- South Africa will enter into a 21-day lockdown from Friday as its covid-19 cases have spiked to 402, President Cyril Ramaphosa said on Monday. (Reuters)

YOUR MORNING DISTRACTION- Want to learn a new magic trick or feel a little better about doing absolutely nothing? The New York Times’ Smarter Living column has a list of recommended uplifting reads to help you from going crazy amid the downpour of stressful news. The round up includes articles that teach you how to be more optimistic, relax or perform a playful card trick for friends (post-social distancing) to get you through the rest of the week.

Enterprise+: Last Night’s Talk Shows

The talking heads were back on the air last night with all the latest on the covid-19 outbreak.

First up- the daily covid-19 update: Masaa DMC’s Eman El Hosary (watch, runtime: 1:47) and Min Masr’s Amr Khalil (watch, runtime: 2:00) both covered the latest statement from the Health Ministry on the covid-19 outbreak, which announced 39 new cases yesterday, bringing the total to 366. The ministry reported a further five deaths, bringing Egypt’s overall death toll to 19. A total of 68 people have now been discharged from hospital after 12 were released yesterday after making full recoveries.

Curfew not ruled out, but it won’t be a “magic solution”- Heikal: Information Minister Osama Heikal refused to rule out a curfew to stem the spread of covid-19 during an interview with Al Kahera Alaan’s Lamees El Hadidi, but the measure was not necessary yet. He added that a lockdown was not a “magic solution” to the crisis, as citizens would still be coming into close contact during the working day. The government could also move to shut down transportation, but it is trying to strike a balance to maintain normal life, he said. He called on Egyptians to be responsible, abide by the social interaction instructions coming from the World Health Organization and the government, and to stay at home where they can. He warned that if cases were to rise to over 1k, the outbreak would accelerate and become much harder to contain and monitor (watch, runtime: 17:25).

No shortage of equipment -Zayed: El Hadidi also interviewed Health Minister Hala Zayed who assured that the country was not facing a shortage of equipment necessary to combat the virus, and said that the government is importing new equipment to bolster existing supplies. She insisted that government planning for the outbreak remains in the control stage, despite new cases continuing to be reported each day (watch, runtime: 21:36). El Hekaya’s Amr Adib spoke with Health Ministry Spokesperson Khaled Megahed, who reiterated Zayed’s statements (watch, runtime: 2:44).

Second army official dies: Al Hayah Al Youm's Lobna Assal covered the day’s news that Maj. Gen. Shafee Dawood had died after being infected by the virus, the second death of a senior figure in the Armed FOrces in as many days (watch, runtime: 1:08).

Gov’t to support seasonal employment: Adib spoke with Social Solidarity Minister Nevin El-Kabbaj who said that the government would support people working temporary or seasonal jobs that have been impacted by the precautionary measures to confront covid-19. He said that the private sector and civil society also has a major role to play in assisting these workers without specifying how (watch, runtime: 2:28).

Speed Round

Speed Round is presented in association with

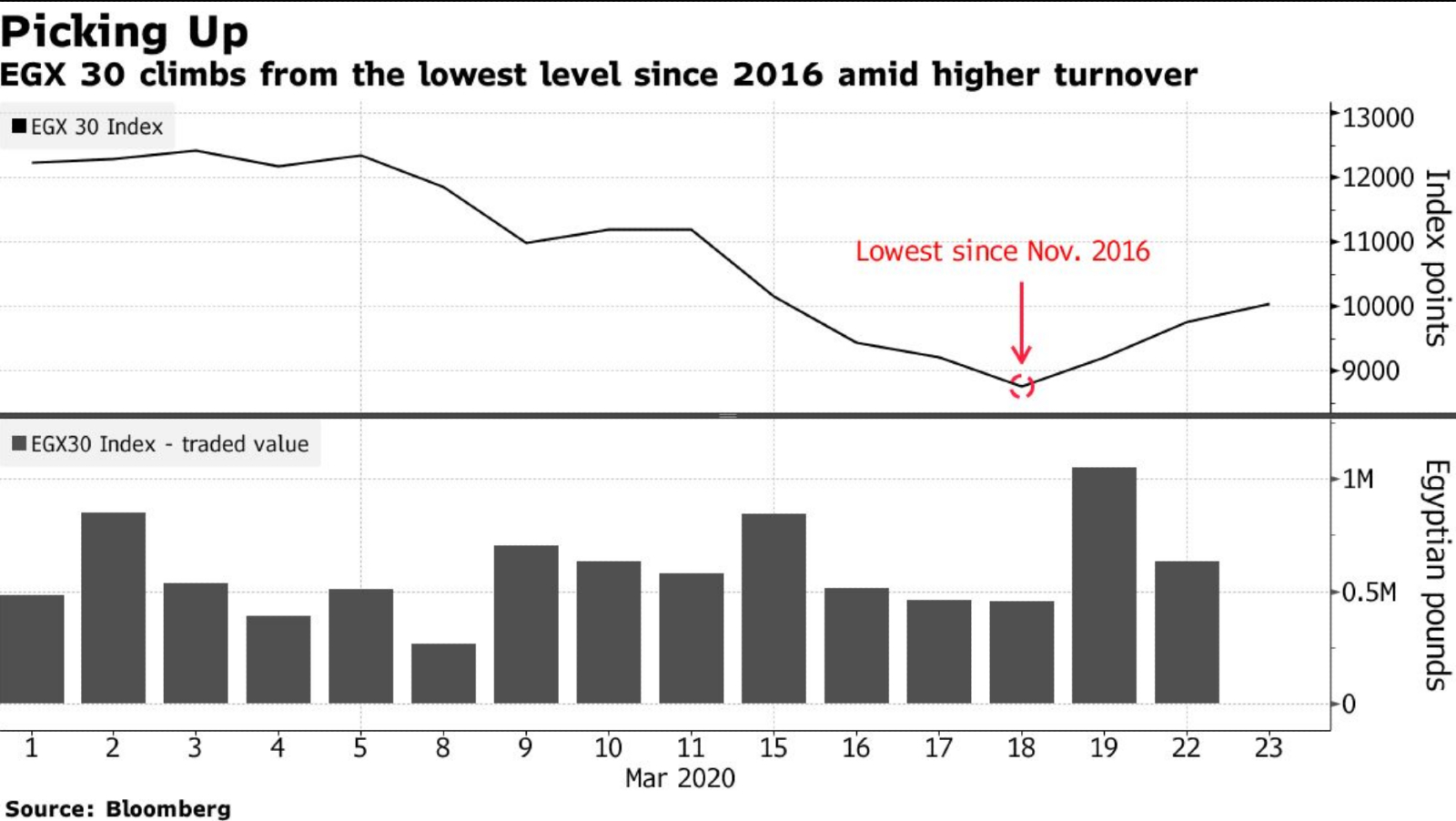

Egyptian equities join world’s top performers as EGX soars on CBE intervention: The benchmark EGX30 joined the ranks of the world’s best-performing indices yesterday, fueled by the announcement on Monday that the Central Bank of Egypt (CBE) would intervene to prop up share prices, Bloomberg reports. The EGX30 soared 6.8% during morning trading before falling back to 3.04% by the closing bell on an afternoon sell-off by foreign investors. Qalaa Holdings led the rally, rising 11.9% during the session. Elsewedy Electric and AMOC both gained 10.6%. Index heavyweight CIB ended the day up 0.4%.

This was the third-consecutive day of gains on the exchange, a winning streak that has seen the EGX climb more than 14% from Thursday’s three-year lows.

And the exchange is now besting the EM average: The EGX30’s performance since the beginning of the year is now better than the average across emerging markets. The index is down 28% YTD, compared to the 31% the MSCI EM Index has shed since the beginning of the year, according to Bloomberg.

EGX circuit breakers partially suspended: The Financial Regulatory Authority has approved an EGX proposal to suspend circuit breakers for upward moves on the wider EGX100, the exchange said in a statement. Yesterday trading was suspended for 30 minutes after the EGX100 index climbed more than 5%. The FRA decision means that from now on rallies will be allowed to continue uninterrupted, with circuit breakers only kicking in if the market falls by 5%.

CBE intervention fuels rally: The latest gains come a day after President Abdel Fattah El Sisi announced that the CBE would provide EGP 20 bn in support to the stock market. A CBE official later told Enterprise that the bank would intervene directly to purchase shares, without elaborating further.

With few details released so far, we’re still uncertain of exactly how the CBE is moving into the market. The CBE’s investment will likely be long term to “give it enough time to exit the market without rushing, make a profit (despite not being a profit-seeking entity), support the economy, and still maintain its stability in the long run,” said Pioneers Holding analyst Mohamed Gaballah.

Look for the CBE to effectively try to buy the EGX30 to stabilize the market — and with only one ETF, it will have to create its own approximation.

Brokerage companies are asking the CBE for soft loans to support the bourse, as many market players seek more funding to stabilize their positions, unnamed sources told Al Mal.

Meanwhile, the share buyback spree is showing no signs of abating. Among the companies saying yesterday they are planning or have completed buybacks: Eastern Company (pdf), Electro Cable Egypt (pdf), MNHD (pdf), and Odin Investments (pdf).

In other market news- Yields on EGP t-bills fall: The yield on the nine-month EGP treasury bill plunged almost 200 bps in the space of a week at an auction yesterday, falling to 13.367% from 15.273%. The rate on the three-month bill fell marginally, down to 12.61% from 12.892% last week.

CBE moves against dollarization amid signs the parallel market for greenbacks is trying to make a comeback. There are signs a parallel market for the USD has reappeared in recent days as the covid-19 outbreak places strain on Egypt’s sources of foreign currency, Reuters reports. While banks and currency exchanges were offering EGP 15.75 to the USD, some unofficial trades saw the greenback change hands for EGP 16.15, bankers and businessmen told the newswire.

Naeem Brokerage said that the USD was trading at EGP 16.10-16.15 in the parallel market, but that trade was slow as importers delay orders. “Banks have begun rationing their FX inventories (prioritizing on the imports of necessities) adjusting to the drop in inflows from tourism and hot money outflows,” it wrote in a note. “With interbank (foreign exchange) liquidity expected to dry up further in the coming months, we expect the CBE to intermittently plug the deficit by selling USD to the banks,” it said.

The coronavirus outbreak is putting pressure on Egypt’s key sources of foreign currency, including tourism, which brought in USD 12.5 bn last year. Covid-19 will also put pressure on remittances (the nation’s key source of FX) and Suez Canal revenues.

CBE acts against dollarization: The Central Bank of Egypt (CBE) has told commercial banks to cut interest on USD deposits to 1% above the London interbank rate (LIBOR) instead of 1.5%, Reuters reports, citing six bankers who spoke anonymously. The measure aims to limit dollarization on the back of the central bank’s decision last week to cut interest rates by 300 bps, one banker said. LIBOR is the rate of interest at which global banks lend to each other over short-term periods, and is also used as a benchmark for loans and savings across the world.

And banks are trying to deter people from putting their savings into USD certificates: The National Bank of Egypt (NBE) has reduced the return on three- and five-year USD savings certificates by 1.75-2.25%, and has launched alongside Banque Misr one-year savings certificates in EGP with a fixed 15% rate of return. The Federation of Egyptian Banks’ new chairman Mohamed El Etreby said in an interview on Sada El Balad on Sunday that Egyptians have so far bought EGP 4 bn worth of the certificates (watch, runtime: 20:10).

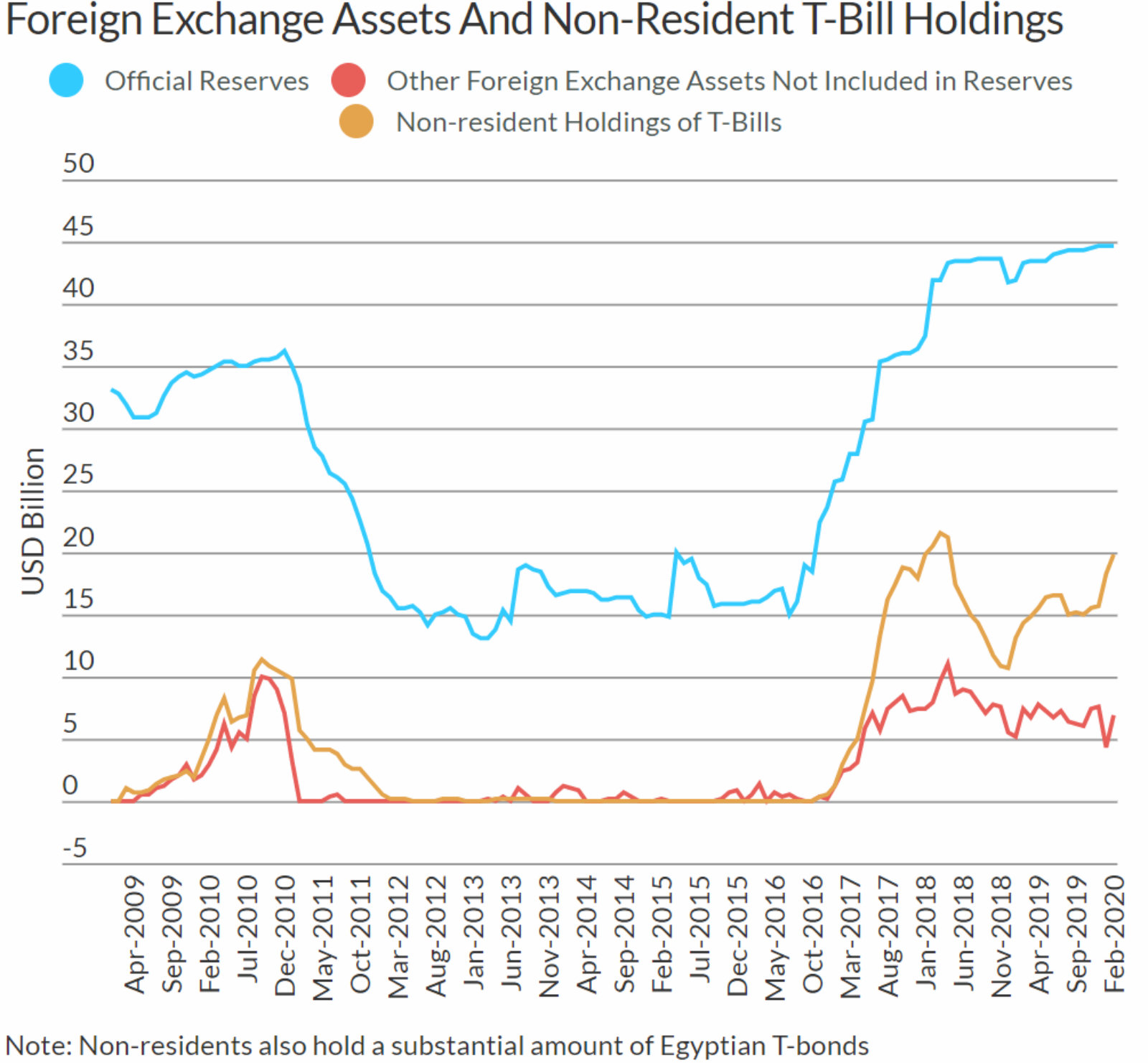

Strong FX reserves, fiscal reform to mitigate short-term headwinds on Egypt’s external account -Fitch Ratings: Strong international reserves and the government’s fiscal reforms will help to mitigate the impact of the covid-19 shock on Egypt’s credit position, but the fallout will nonetheless have a significant impact on the country’s GDP growth, external finances and fiscal position and will likely result in “substantial” portfolio outflows from EGP-denominated bonds, Fitch Ratings said yesterday. The ratings agency said the country’s USD 45.5 bn in international reserves and USD 7 bn in foreign-currency deposits should enable Egypt to weather capital outflows over a short-term period, but warned that they may be “rapidly eroded” if outflows persist.

Fiscal conservatism gives way to stimulus: “We expect the government’s fiscal consolidation efforts to falter in the near term, given weaker economic growth and revenue collection,” Fitch said. “We feel the [EGP 100 bn in fiscal stimulus measures] are modest, mostly temporary, and fairly easily reversible, but will add to pressures on the public finances.”

Egypt may be able to turn to the IMF if times get tough: Egypt’s successful completion of its IMF reform programme may allow it to access emergency funds from the international lender if its credit position becomes critical, Fitch said.

Meanwhile, Moody’s says Egypt is “particularly vulnerable” to outflows: Egypt is among a group of countries that are “particularly vulnerable to a lasting and sharp tightening in financing conditions,” Moody’s has said in a report. The surge in risk-off sentiment among investors that has followed the covid-19 outbreak and the collapse in oil prices will put the creditworthiness of countries dependent on external financing under increasing pressure the longer it persists, the ratings agency said.

Egypt’s comparatively high foreign reserves means it is less vulnerable than other emerging markets to a sudden stop in capital flows, it said, but we’re also among the most reliant on external borrowing, topped only by Lebanon and Pakistan. This has caused the country’s credit spreads to widen noticeably, with the monthly bond spread as measured by the EM Bond Index up more than 300 bps in March from its 2019 average.

M&A WATCH- Endeavor to acquire Semafo in June, creating West Africa’s largest gold producer: Canada’s Endeavour Mining will acquire Toronto-listed gold producer Semafo in a USD 690.7 mn agreement set to be completed in June, Reuters reports. Endeavour shareholders — which is 24.1% owned by the Sawiris family — will own around 70% of the combined company and Semafo shareholders the remainder. The group will be West Africa’s largest gold producer, based in Burkina Faso and Côte D’Ivoire, and one of the biggest 15 worldwide, with an output of 1 mn ounces a year. The acquisition comes just two months after Endeavour ended its bid to takeover Centamin.

Sawiris said earlier in the day that he was looking to up his stake in La Mancha: “I’m increasing my stake in my company because the cost of producing an ounce is much lesser than the gold price itself,” he told Bloomberg TV yesterday. Sawiris is currently in talks with the Egyptian government to acquire a 51% stake in state-owned Shalateen Mining, and has shown interest in bidding in the gold exploration tender, which got underway last week.

Gold has been on the slide since the covid-19 pandemic began to roil the markets, but Sawiris sees gold as king in a crisis: “I believe that when there is crisis, when people are done covering their margin cost, it’s gonna go up,” he said. “I’m still a buyer and I’m still increasing my position.”

Buy, sell or hold? Telecom Egypt on Vodafone Egypt transaction early next month. Telecom Egypt will decide early next month whether it will exercise its right of first refusal on Vodafone Group’s 55% stake in Vodafone Egypt, the local press reports, citing sources close to the matter. Saudi Telecom (STC) has already begun doing due diligence on Vodafone Egypt ahead of a possible USD 2.4 bn acquisition of Vodafone Group’s 55% stake in the company. The two sides signed an MoU in January. TE already owns a 45% take in VFE that carries with it a right of first refusal on the 55% it does not own.

TE could also sell its 45% stake in VFE to STC, as the Financial Regulatory Authority may compel STC to purchase the entire company, the sources added. STC is reportedly trying to find ways around the mandatory tender offer.

M&A WATCH- Japan’s Trend Micro acquires SecureMisr cybersecurity company: Japan’s Trend Micro has acquired Egyptian cybersecurity service provider Secure Misr through its Cysiv subsidiary, according to a press release. The value of the transaction was not announced. SecureMisr will continue the provision of all its services under Cysiv’s umbrella in Egypt and the Middle East.

M&A WATCH- New Smart purchases 18% stake in Egyptians for Housing and Development: New Smart for Industrial and Commercial Investments has purchased an 18.17% stake in Egyptians for Housing and Development (EHDR) for EGP 79.6 mn, according to an EGX disclosure (pdf). The company said it had purchased 20.62 mn shares in the company for EGP 3.86 per share.

EFG concludes advisory on IPO of Saudi healthcare company Sulaiman Al Habib: Our friends at EFG Hermes acted as joint bookrunner on a USD 700 mn initial public offering by Dr. Sulaiman Al Habib Medical Group on the Saudi stock exchange, it said in a statement. Shares in the company were up 10% in their debut despite “bearish sentiment” from the covid-19 outbreak, the firm said. Dr. Sulaiman Al Habib Group is one of the largest private sector healthcare players in Saudi and has operations in the UAE and Bahrain.

El Sisi ratifies Consumer Credit Act: President Abdel Fattah El Sisi has ratified the Consumer Credit Act, the local press reports, carrying a copy of the bill. The legislation, which received House approval late last month, introduces a new regulatory framework for consumer finance companies governing business creation and operations, as well as providing companies that finance purchases of consumer durables with more clarity regarding expanding their businesses.

MOVES- The Justice MInistry has appointed Counselor Tamer Farghani as head of the Illicit Gains Authority, Al Shorouk reports. Farghani previously worked in the public prosecution’s office and was appointed head of the Supreme State Security Prosecution’s office in July 2013. He succeeds Counselor Adel El Said who headed the department for five years.

Image of the Day

“The Great Empty” shows the world staying home: The New York Times has created a gallery of photographs depicting the new reality worldwide of ghost towns, abandoned public spaces, and people self-isolating from the covid-19 pandemic that has brought daily life across the planet to a screeching halt. The interactive gallery aptly named “The Great Empty” shows pictures from some of what used to be the biggest, most bustling cities in the world. The image above was taken in the metro of the German city Munich.

Worth Watching

What does it take to prevent a pandemic? Disease dynamics are extremely complex, and there’s no guarantee that they will stop doing what they do best — jumping from animals to humans. Such diseases are able to survive between species (such as SARS and the Plague, which originated in rodents in the medieval era but still exists today) and are nearly impossible to eradicate. With our current level of urbanization and industrial livestock farming, it seems we will always be running a risk of new variants of biological threats. Only if we take animal health and wellness more into consideration, and look at other factors such as our environmental footprint, will we be able to guard ourselves in the future, Robert Peckham, author on infectious disease, tells Bloomberg (watch, runtime: 7:11).

Banking + Finance

Marseilia Group to obtain EGP 1 bn loan from NBE to quickly finish projects

Marseilia Group is looking to arrange a EGP 1 bn loan from the National Bank of Egypt to accelerate the construction of ongoing and upcoming projects, Chairman Sherif Heliw said, according to Hapi Journal.

Al Ahly Sabbour to invest EGP 5 bn in Keeva project

Al Ahly Sabbour is planning to seek a EGP 1 bn loan from local banks to finance its planned EGP 5 bn investment in its Sixth of October compound, Keeva, Managing Director Ahmed Sabbour told the local press. Sabbour did not say whether the company has entered talks with banks yet.

CIAF Leasing delays EGP 50 mn sukuk issuance on covid-19 headwinds

Aviation leasing company CIAF has decided to postpone its EGP 50 mn sukuk issuance to 4Q2020 due to the current uncertainty caused by the covid-19 pandemic, the local press reported the company’s chairman as saying. The airline industry is coming under significant pressure as countries worldwide close airports and suspend passenger flights, causing the company to lose around USD 500k a month, Chairman Hassan Mohamed said. The company will review its plans to issue sukuk in the next three months, he said, adding that he expected the sale to go ahead in 4Q2020 to coincide with the receipt of new aircraft.

Egypt Politics + Economics

FRA orders Egypt’s NBFS associations to include at least one woman

The Financial Regulatory Authority approved a new rule committing all non-banking financial services associations to include at least one woman on their board of directors, according to an official statement. The FRA passed two similar decisions last year obliging listed companies and non-banking financial services firms to include one woman on their boards. A study by the International Finance Corporation found recently that only 25% of the 2k Egyptian businesses surveyed had women on their boards

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Monday): 10,047 (+3.0%)

Turnover: EGP 1.1 bn (83% above the 90-day average)

EGX 30 year-to-date: -28.0%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 3%. CIB, the index’s heaviest constituent, ended up 0.4%. EGX30’s top performing constituents were Qalaa Holding up 11.9%, Elsewedy Electric up 10.6%, and AMOC up 10.6%. Yesterday’s worst performing stock was CIRA down 0.1%. The market turnover was EGP 1.1 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -415.8 mn

Regional: Net short | EGP -65.5 mn

Domestic: Net long | EGP +481.3 mn

Retail: 43.5% of total trades | 41.8% of buyers | 45.1% of sellers

Institutions: 56.5% of total trades | 58.2% of buyers | 54.9% of sellers

WTI: USD 23.36 (+3.23%)

Brent: USD 27.52 (+2.00%)

Natural Gas (Nymex, futures prices) USD 1.60 MMBtu, (-0.12%, April 2020 contract)

Gold: USD 1568.50 / troy ounce (-0.27%)

TASI: 5,990 (-2.94%) (YTD: -28.60%)

ADX: 3,442 (-3.11%) (YTD: -32.19%)

DFM: 1,714 (-3.78%) (YTD: -37.99%)

KSE Premier Market: 4,947 (+0.93%)

QE: 8,258 (-3.85%) (YTD: -20.78%)

MSM: 3,567 (+0.0%) (YTD: -10.40%)

BB: 1,389 (-0.4%) (YTD: -13.72%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist-sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action,” new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.