- Inflation rises in November, ending six-month deceleration run. (Speed Round)

- Is the auto manufacturing incentives package finally going to emerge from hibernation? (Speed Round)

- Upcoming IPOs of BdC, e-Finance will be a boon for EGX liquidity, analysts say. (Speed Round)

- Rameda Pharma begins trading today as Saudi Aramco hits the Tadawul. (What We're Tracking Today)

- Manufacturers to gov't: Funding is not the only problem facing industries. (Speed Round)

- Al Nowais signs EGP 16 bn contract for solar, wind energy plants in Aswan, Ras Ghareb. (Speed Round)

- Why MAF’s Ahmed Ismail sees a bright future for retail, e-commerce or not. (Coffee With Enterprise)

- The Market Yesterday

Wednesday, 11 December 2019

Inflation rises in November for the first time since May

TL;DR

What We’re Tracking Today

Today will largely be shaped by how two IPOs will fare in their market debuts. Here at home, Rameda Pharma shares will begin trading under the ticker RMDA today, marking the second and last IPO for Egypt in 2019.

Meanwhile, the international press will be closely watching the long-awaited start of trading on Saudi Aramco. Crown Prince Mohammed bin Salman isn’t giving up on that USD 2 tn valuation, with the kingdom apparently still pushing Saudi’s wealthiest families and institutions to pile into Aramco’s shares once they hit the Tadawul, according to the Financial Times.

The Aswan Forum for Sustainable Peace and Development kicks off today. Government ministers, senior foreign officials and representatives from international institutions are gathering in Aswan for the two-day gathering, which will discuss ways to reduce conflict in Africa and help countries meet their sustainable development goals.

On legendary central banker Paul Volcker’s Cairo connection: Paul Volcker, the former US Fed boss who passed away earlier this week at age 92 (and who enshrined the role of central bank chairs as leaders who solve economic problems regardless of political considerations) had a Cairo connection that will surprise many readers: He was senior advisor to CIB’s board of directors for a three-year period ending in 2008.

CIB Chairman Hisham Ezz El Arab eulogized Volcker in an email to staff yesterday, a copy of which Enterprise obtained. Ezz El Arab, who said he counts Volcker as a friend and mentor, last saw the former Fed chairman turned global troubleshooter in March of this year. He noted in particular Volcker’s wise counsel to the CIB board and leadership in helping create the bank’s employee stock ownership program. You can read the full text of Ezz El Arab’s email here (pdf).

Jumia on the rocks: African e-commerce giant Jumia has announced it will close shop in Rwanda, only weeks after exiting Cameroon and Tanzania, the Financial Times reports. The company’s share price has plunged 90% from its peak in July as it struggles to cope with the realities of running an e-commerce business on a continent with limited infrastructure, a lack of trust of internet services, and weak logistics.

In global miscellany:

- US Democrats have officially filed two impeachment articles against The Donald, marking the fourth time this has happened in the country’s history, the Wall Street Journal reports. Trump could be impeached as early as next week, setting up a trial in the Senate early in January, the New York Times suggests.

- The US, Canada, and Mexico have agreed on a new trade pact to replace NAFTA, according to Reuters. The new agreement, which will be known as the United States, Mexico, Canada Trade Agreement (USMCA), would create new rules for e-commerce and add new intellectual property protection measures, among other stipulations. The Washington Post has the full rundown and a list of winners and losers.

- Qatar PM in Riyadh: Qatari Prime Minister Sheikh Abdullah Bin Nasser Al Thani attended an annual gathering of Gulf monarchs in Riyadh in what may be the latest sign that tensions between Saudi Arabia and the island state are thawing, Bloomberg reports.

- Voters in the UK are headed to the polls tomorrow in a general election and the Tories appear likely to form a government, a large poll suggests. (Guardian)

Merriam-Webster’s Word of the Year: “they.” Increasing awareness of nonbinary gender issues has sparked curiosity around use of the word, leading to a 313% y-o-y increase in look-ups on the dictionary’s website. Runner-ups included “quid pro quo,” “impeach,” "crawdad,” “snitty,” and the fantastic “tergiversation.”

Enterprise+: Last Night’s Talk Shows

Egypt’s role in Africa was the topic du jour on the airwaves last night as the Aswan Forum for Sustainable Peace and Development in the continent is set to begin today. The talking heads covered everything from President Abdel Fattah El Sisi’s meeting with South African President Cyril Ramaphosa to talk trade and investment, to Egypt’s activities during its year-long presidency of the African Union.

El Sisi and Ramaphosa discussed infrastructure development projects in Africa such as the Cairo-Cape Passage project, continental security and regional integration, Al Hayah Al Youm’s Lobna Assal (watch, runtime: 2:24), Min Masr’s Amr Khalil (watch, runtime: 1:57), and Masaa DMC reported (watch, runtime: 1:26). The projects are a particular priority due to this year’s launch of the African Continental Trade Area (AfCFTA).

The Aswan forum will bring together several African leaders and will see the formal inauguration of the Benban solar power park, Egypt’s ambassador to Ethiopia Osama Abdel Khalek told Masaa DMC (watch, runtime: 5:07 and runtime: 2:08).

Egypt will continue engaging with its partners on the continent after its presidency of the AU expires, but the government has worked to make the year-long leadership term fruitful, former diplomat Ahmed Hagag told Assal (watch, runtime: 3:42). (South Africa takes over the leadership of the African Union in 2020; the chair of the AU for 2021 is likely to be decided in February.)

Meanwhile, inflation figures earned some airtime on Masaa DMC, with finance professor Mostafa Badra saying that the overall deceleration this year has contributed to improving the country’s economic well-being (watch, runtime: 4:32). We have the full story in this morning’s Speed Round, below

Speed Round

Speed Round is presented in association with

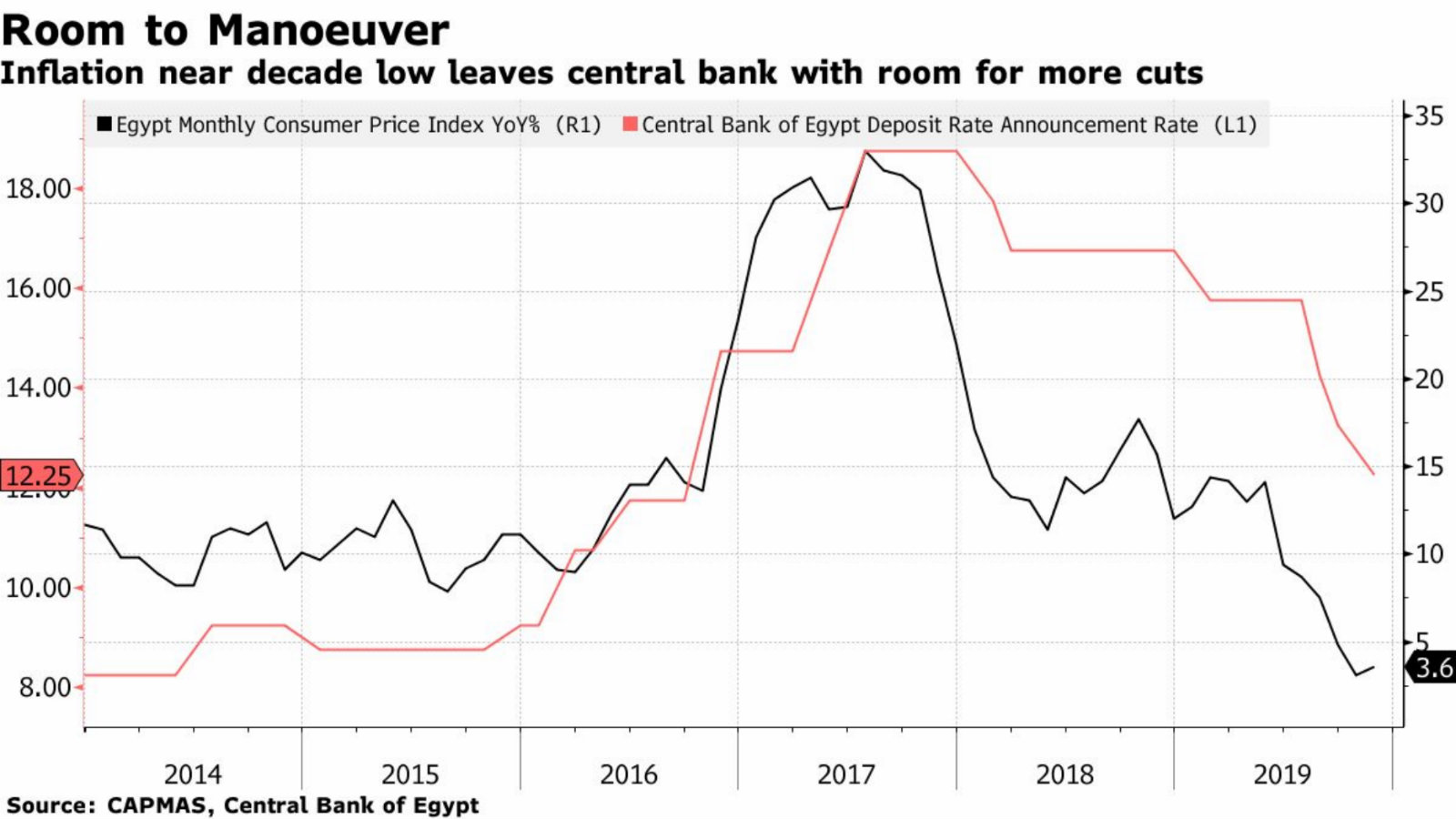

Inflation rises for the first time in six months in November: Annual urban inflation rose slightly to 3.6% in November from 3.1% in October, ending a six-month spell of disinflation, according to official data published yesterday by Capmas (pdf). Prices fell 0.3% on a monthly basis compared to 1% growth in October, led by a 4.6% decrease in food and beverage prices. Annual urban inflation had fallen more than 10% in the six months from May, when it measured 14.1%.

Core inflation continues to fall: Annual core inflation fell 60 bps to 2.1% in November, while on a monthly basis prices fell by 0.1% compared to 1.1% growth in October, the Central Bank of Egypt said (pdf).

What’s going on? The favorable base effect is coming to an end. Naeem Brokerage economist Yara Elkahky told Reuters that the rise, which is in line with the brokerage’s forecast, was due to “unfavorable base year impacts.”

Inflation forecast to rise again in December: Inflation will climb again to between 6-7% in December, Mohamed Abu Basha, head of macroeconomic analysis at EFG Hermes, told Bloomberg. Radwa El Swaify, meanwhile, forecasts inflation to reach 6.5-7.5% this month due to the fading base effect of food prices. Both of these estimations remain within the CBE’s 9% +/-3% target range.

CBE to play it safe in its final meeting of 2019? Abu Basha says that the central bank is unlikely to cut interest rates when its monetary policy committee meets on 26 December and will instead wait until the December and January inflation figures are released before possibly moving ahead with a 50-100 bps cut in 1Q2020. The CBE made its third consecutive rate cut last month in an easing cycle that has seen rates cut by 350 bps since August, and 450 bps over the course of the year.

But the CBE is still on track to cut rates in 2020: El Swaify told Bloomberg that the CBE is likely to agree to a 150 bps cut sometime during 1Q2020, with a similar sized cut coming towards the end of the year. Meanwhile, participants at a conference yesterday predicted that the CBE will cut rates by 100-200 bps during the course of the year. The National Bank of Kuwait is much more bullish, saying it expects the CBE to cut interest rates by 300-400 bps in 2020, assuming inflation remains in check, according to Al Mal.

LEGISLATION WATCH- Is the auto manufacturing incentives package finally going to emerge from months of hibernation? Proposed amendments to the Customs Act that will provide customs discounts to car manufacturers in return for increasing their use of local components will be sent to the House of Representatives “soon” for review and approval, head of the Industrial Development Authority’s domestic manufacturing department Alaa Salaheldin said yesterday, according to Hapi Journal. Salaheldin otherwise remained tight-lipped on the incentives package, saying only that the proposed incentives is “similar” to previous iterations of the program, by which we assume he means the scrapped automotive directive.

The proposed program has apparently been cleared with the European Union and will not violate any of Egypt’s trade agreements, Salaheldin told the local press. EU Mission Chief to Egypt Ivan Surkos had shot down the proposed automotive directive back in 2017, saying it would violate the terms of Egypt’s trade agreements with the EU.

What we’ve heard about the package so far: Two government officials had told us back in July that the Madbouly Cabinet had approved the Customs Act amendments in their final form. The updated amendments reportedly split customs breaks into three tiers according to the percentage of local content used, streamlining previous plans for a more complex five-tier system. The cabinet economic group had also reviewed in September a proposed package of incentives for auto manufacturers, but details were scant on what the package entails.

What the industry wants to see: Several members of the feeder industry called on the government to help provide raw materials for component manufacturing and lower customs rates on imported components, the local press reports. Speaking at the Egypt Automotive Summit yesterday, industry figures also urged the government to set a clear vision and implement policies that would attract foreign companies to the feeder industry.

Most of all, they just want to get the ball rolling: Fiat-Chrysler Automotive Egypt CEO Abdel Rahman Sultan said at the conference yesterday that time is of the essence in launching the incentives package, pointing out that it’s difficult to make plans as a business for the year ahead when a potentially groundbreaking policy move has remained in the shadows for so long, according to the local press. Sultan also warned that the prolonged process of bringing the package out of the woodworks is causing further strain to the auto industry. Any industry would struggle when faced with repeated changes in policy direction, he said. Meanwhile, customs on Turkish-origin cars will officially drop to zero as of next month, advisor to the finance minister for customs affairs Magdy Abdel Aziz said at the conference yesterday, according to the local press.

The upcoming IPOs of state-owned Banque du Caire (BdC) and e-Finance will be a boon for liquidity on the EGX, Bloomberg says. BdC, one of the country’s largest banks, is expected to attract investors from beyond the region, including from “mainstream global emerging market funds,” Tellimer’s head of equity strategy Hasnain Malik tells the news information service. “In 2019, Egypt has continued to be a consensus favorite among foreign investors, but this has been reflected in the performance of its biggest stock, CIB, not the rest, which are much less liquid,” Malik said.

Where do the IPOs stand? The government is expected to kick off next month a roadshow for the sale of a 30-40% stake in BdC, which is slated to hit the EGX in 1Q2020, majority shareholder Banque Misr’s Chairman Mohamed El Etreby said earlier this week. e-Finance could also make its stock market debut as early as 1Q2020, and is currently putting the final touches on the planned IPO, Chairman Ibrahim Sarhan said.

With cooling inflation and lower interest rates, the time is right to boost the market after the EGP float and reform program, including subsidy cuts, “pressured business activity, which was already struggling amid weak consumer demand.” As a result, these conditions put a damper on investor interest for Egyptian stocks, Naeem Holdings’ Allen Sandeep says. The EGX30 “has lagged behind peers in emerging markets” this year, Bloomberg says, rising only 3.5% in comparison to the 8.6% rise in the MSCI emerging markets index.

The EGP 100 bn subsidized loan initiative will help solve the funding problem for manufacturers, but other problems remain: Government efforts to help manufacturers access funding only address one problem facing industries, with shortcomings in the current income tax law, bureaucratic hurdles, and a shortage of skills continuing to hamper growth, a panel of private sector executives said at a conference on Monday. The execs welcomed the EGP 100 mn subsidized loan program announced by the government last week, but nonetheless pointed to other areas of concern for the sector.

What do they have against the tax code? Businesses could face additional uncertainty after the government scrapped a clause in the 2005 Income Tax Act that placed restrictions on retrospective tax audits, Saudi Egyptian Industrial Investment Company CEO Ahmed Ata said. The original legislation contained a provision that compelled the Tax Authority to sign off on returns within five years of submission. With the clause removed, businesses face the prospect of being hit with unexpected tax bills on returns that have not been audited by the authority.

Red tape: Factories will continue to struggle through lengthy bureaucratic processes when they need to increase capital, acquire a license to operate, or change their line of business, Ata said.

The skills shortage: Cairo Cotton Center Chairman Magdy Tolba said that the industry is suffering from an inadequate supply of technically-skilled workers and a lack of training programs that would go some way to redress this.

Background: The government and the CBE announced last week a EGP 100 bn initiative to boost manufacturing by allowing medium-sized privately-owned factories with annual sales revenues of less than EGP 1 bn to access subsidized loans at a declining 10% interest rate. The initiative was seen as a positive development for the private sector, but calls for more support — primarily in the form of government debt relief (here and here) — have been continuing to make headlines this week as factories say they’ve taken a heavy hit following the 2016 currency float.

CABINET WATCH- Foreigners can now acquire Egyptian citizenship for as little as USD 250k: The Madbouly Cabinet approved in its weekly meeting yesterday legislative amendments that will allow foreigners who hold assets in Egypt to buy citizenship, according to a statement. The cost of citizenship ranges between USD 250k-USD 1 mn depending how much money is invested and where. Under the new rules, foreigners can now officially become Egyptian by choosing one of the following options:

- Depositing a non-refundable USD 250k into a local account which goes directly to the government;

- Depositing USD 750k into a zero-interest bank account refundable after 5 years;

- Depositing USD 1 mn into a zero-interest bank account refundable after 3 years;

- Investing more than USD 400k in a minimum 40% stake in an investment project; or

- Purchasing a state-owned or private property for at least USD 500k.

The conditions: New Egyptians risk losing their passports if they sell their property or stake in a business within five years of acquiring them. If they choose to do so, they will only be allowed to retain their citizenship if they deposit the required amount of money into a local account. Bloomberg also had the story.

Background: The House of Representatives passed the amendments back in July. They gave the prime minister the legislative right to grant passports to asset-holding foreigners, and set up a cross-ministerial body to assess applications. The applications themselves cost around USD 10,000 or its EGP equivalent.

Feasibility study reveals new details on Egypt’s commodities exchange: The feasibility study for the planned Egyptian Commodity Exchange was leaked by Al Mal yesterday, revealing new details on fees, projected revenues and return on investment, as well as some information on what commodities will be traded on the market.

Fees: Traders will be charged a one-time EGP 1k registration fee and EGP 300 in annual membership fees. The study projects that the market will have around 5k active traders within the first year, attracting 2.5k more in each consecutive year through to 2030. The exchange expects to realize revenues of EGP 83.6 mn a year.

Rate of return: On current forecasts, the study calculated that merchants would see an internal rate of return of 39%, allowing them to fully recover their investment within three years.

Commodities: The study says that six commodities — wheat, rice, corn, potatoes, onions, and oranges — will initially be traded. This differs from what Internal Trade Development Authority head Ibrahim Ashmawy said earlier this year, when he announced that five commodities — flour, iron, oil, corn, and cement — would be traded.

What we already know: The EGP 100 mn company that will manage the exchange is scheduled to be set up before the end of the year, with the exchange opening its doors to traders 36 weeks thereafter. Ashmawy said last month that futures will not be offered on the market — at least not initially — meaning investors will be limited to trading spot contracts.

INVESTMENT WATCH- Al Nowais to build two wind, solar energy plants worth EGP 16 bn: Egypt yesterday signed an agreement with UAE’s Al Nowais Investments to build two renewable energy plants worth a combined EGP 16 bn, according to a cabinet statement. The company will build a 200 MW solar plant in Aswan and a 500 MW wind plant in Ras Ghareb. The plants will be built under a build-own-operate framework that will see Egypt pay 2.48 cents per KW of solar energy and 3.1 cents per KW of wind power. Al Nowais will begin work on the plants in 1Q2020, unnamed Electricity Ministry sources tell the local press. Reuters also had the story.

Background: Al Nowais bid in October to build USD 700 mn in renewable energy plants just two weeks after Egypt pulled the plug on the company’s USD 4 bn, 2.65 GW coal station in Oyoun Mousa. The ministry cited cost, the country’s electricity surplus and the government’s focus on renewables as reasons for killing the project, which had been through more than three years of planning and negotiations.

INVESTMENT WATCH- Tech fund A15 is making an undisclosed investment in mobile repair company iFix to help it launch Gadded, a platform for selling used mobile phones, according to an emailed statement (pdf). A15 CEO Fadi Antaki had said earlier this month that the fund plans to invest some EGP 250 mn in fintech, e-commerce, digital advertising technology, and digital development projects over the coming period.

Egypt to probe trade agreements: The government will form a ministerial committee headed by the Finance Ministry to assess the extent to which Egypt benefits from existing international trade agreements, Finance Minister Mohamed Maait said, according to Al Mal. The ministry is currently undertaking a preliminary study of the advantages and disadvantages of each agreement, and will present its findings to the cabinet’s economic committee within two months.

LEGISLATION WATCH- Central Depository Act gets committee-level nod at parliament: The House Economic Committee has approved the proposed Central Depository and Registration Act, according to Al Mal. The bill will now be referred to the House general assembly for plenary discussion “soon,” the newspaper says. The committee appears to have left unchanged the bill’s controversial Article 35, despite committee members previously voicing concerns that it could have a negative impact on the securities market. Under the article, the Financial Regulatory Authority would determine the ownership structure of companies licensed to provide clearing and depository services, set the conditions for board formation, and determine the minimum amounts of issued and paid-in capital, among other things. The committee had informally agreed to amend the article last month.

Egypt ranks 116 on 2019 Human Development Report: Egypt’s Human Development Index (HDI) score improved slightly from 0.696 in 2017 to 0.70 in 2018, placing the country in the “high human development” category. Our score is below the category average of 0.75, and also falls just short of the Arab states’ average of 0.703. Out of 189 countries and territories surveyed by the United Nations Development Program (UNDP), Egypt is ranked 116. Between 2013 and 2018, we dropped two spots in the ranking despite an improved score. Norway, Switzerland, and Ireland are still leading the charts globally, while the UAE, which ranks 35 globally, tops the Arab states’ ranking. You can read the report here (pdf).

MOVES- Madar CEO Maged Salah Al Din resigned earlier this month, and is currently looking at other potential c-suite posts at other real estate companies, he told the local press.. Salah (LinkedIn) joined Madar earlier this year. He had previously been vice president for portfolio management at Palm Hills for four years.

Our fourth episode of Making It is just two days away and we’ve got someone at the zenith of the Egyptian jewelry and design industry (have we given too much away?): How do you take something traditionally Arab, craft a beautiful item, and sell it across the globe under an easily recognizable and widely admired brand? Our next interviewee has the answers of how to do all of the above, and tells us how to take over and manage a family business.

Coffee With…

Coffee with Ahmed Ismail, CEO of Majid Al Futtaim Properties: Egypt is a country that has no public space to speak of — no urban parks or preserves in which to picnic, to allow the children to roam wild, or in which teens can kick a ball around. And even if we were so blessed, there are long stretches of the year in which the temperature dictates looking elsewhere for entertainment.

Perhaps more than anything else, that’s why the narrative on malls in MENA is so different from the one in Western markets. Across the pond, it’s about declining same-store sales and contracting gross leasable area. Blogs and haunting photography of dead malls are literally a thing. In our corner of the world, the story is growth — as anyone brave enough to venture near a shopping mall on “Black Friday” discovered.

Egypt’s newest mall is the USD 580 mn City Center Almaza, Majid Al Futtaim’s latest flagship, which opened last Thursday (see our past coverage here).

MAF prides itself on providing a regional platform for brands including Carrefour, Apple, Tods and Céline. MAF is unusual by any measure: A home-grown retail giant, it is privately held but both governed and managed independent of the founding family and has been an investment-grade company independently rated by Fitch for seven years now.

After expanding out of the Emirates, its top line is now north of USD 8 bn annually and it is on track to turn in EBITDA of more than USD 1.2 bn this year. With an asset base of some USD 13 bn, it has 26 shopping malls spanning from the UAE to Egypt, with a portfolio of own brands including Vox Cinemas and license agreements with global names including Carrefour. Some 7,000 of MAF’s 45,000 employees are in Egypt; there’s a big Egyptian presence in MAF’s top ranks, and 99% of the team in Egypt is Egyptian.

Among them is MAF Properties CEO Ahmed Ismail (bio), a 13-year MAF veteran tapped to lead Majid Al Futtaim Properties a year ago. Prior to his appointment as CEO, Ismail served as the CEO of Majid Al Futtaim Ventures for 10 years overseeing seven business verticals including fashion retail, leisure and entertainment, cinemas, financial services and facilities management. He was a principal with Booz Allen Hamilton in Dubai before joining MAF.

Edited excerpts of our conversation:

Enterprise: What’s Egypt to MAF?

Ahmed Ismail: We are long-term investors, full stop. Egypt was our first market outside the UAE, and we take a 30-year view on the investment. It’s how we think about growth. We’ve invested EGP 26 bn here, up from the EGP 22 bn we projected when we attended the Egypt Economic Development Conference in Sharm El Sheikh back in 2015. We invested in the run-up to the float of the EGP, and we invested afterward.

E: That kind of horizon is challenging for many businesses.

AI: Of course, but look at it this way: I read in Enterprise the other day that corporate earnings have now recovered to pre-devaluation levels in USD terms. That’s so fast. And it’s simple to see why: Look at the demographic trends. Look at the reform program. Look at the recovery in tourism. Our business in Egypt is growing in the double digits. Occupancy is north of 90% and we will have 37 mn visitors to our malls this year and are targeting 50 mn next year across our City Centers and flagships Almaza and Mall of Egypt. We have nearly 60 Carrefours in Egypt, and we are now aiming for 100.

That’s what we’ve gotten out of taking a long-term view, and we’ve sold that vision to our bondholders. We’ve tapped capital markets with hybrid, Islamic, and traditional issuances at competitive rates for 10-year periods. Global investors understand the potential of the retail story in Egypt and the wider MENA region.

E: The business model must be calibrated to allow that, right?

AI: Absolutely. As we expand into new markets, Carrefour is our beachhead. It’s capital-light and allows us to understand our customers and benchmark the quantum of demand. First we gather the data, then we roll out the more capital intensive businesses.

E: One of the theses popular in Cairo is that retail demand will soften because disposable incomes have been eroded and consumers are now struggling to seek finance. What accounts for the durability of consumer sentiment?

AI: We don’t offer consumer credit, so I can’t speak to that, but I do know that consumer debt as a fraction of GDP is very low. What we see is continual growth in traffic, and we’re seeing our tenants report growth in sales that’s beating inflation. The average basket is essentially keeping up with inflation, and the growth is being driven by more people coming in spending more time and purchasing. Getting the footfall is all about offering the right experience — then it becomes about conversion and average basket.

We expect traffic at north of 50 mn visitors this year, and we’ll see same-store growth of 12-15% this year. Store operators with great brands who take consumer experience seriously will do well, they’ll see double-digit growth. Those who are less up-to-date will see contraction.

We collect data — tenants offering high quality experience are doing double digits and those who focus less on customer experience and less up to date are contracting. Consumer demand is quite robust.

E: What are the global brands you do business with saying about Egypt right now?

AI: A lot of the global brands now see Egypt as a very good growth opportunity. The turnaround in the economy and consumer sentiment in three years has really encouraged them to invest again in growth — and many brands not already here are now considering moving in. Nike opened their first flagship store in Egypt at Almaza; Zara brought their new retail concept to Egypt for the first time. Armani Exchange and Hugo Boss are opening their own stores.

Brands on the luxury side are particularly encouraged by the turnaround in tourism, which is bringing a new type of visitor to Egypt who is spending more. Investing in retail and the infrastructure to support it isn’t just an investment in retail — it’s a critical part of Egypt’s tourism infrastructure that will have more and more impact the more it’s built out.

E: How does it feel to be in the brick and mortar business when e-commerce is coming for us all?

AI: There’s no question that online shopping is growing — it’s easier to do when the total penetration is in the single digits. Many of our own brands have robust online presences, including Carrefour, Crate & Barrel and Vox. But it’s a big question: How do we compete when anyone can order almost any piece of merchandise at a great price and have it delivered even the same day?

It’s simple: Customers in MENA don’t only want merchandise. They long for social and entertainment experiences — and an experience that goes beyond the value of a shoe or bag or shirt. It’s why we are a company that’s all about experiences — in entertainment, in food and beverage, in cinemas. It’s the same for our brand partners: When time-starved customers are looking to save time, they do it online. When they have time, it’s about the experience and social interaction. Retailers and brands that don’t understand that will find it difficult to compete.

E: Last question: Is it true you’ve brought self-checkout to Egypt?

AI: Yes, at Carrefour. Scan and go is now here and 10% of our sales are scan and go. The Egyptian consumer is hungry for the great retail experiences of the future.

Egypt in the News

Ancient Egyptian coneheads: The top story on Egypt in the foreign press this morning is an archaeological study that confirmed some Ancient Egyptian workers did, indeed, wear cup-sized cones on their heads, according to Science Magazine.

Elsewhere, Al Monitor breaks down the significance of the Grand Ethiopian Renaissance Dam talks held in Washington for Egypt, and reports that US Secretary of State Mike Pompeo nudged Foreign Minister Sameh Shoukry on a US citizen detained in Egypt.

Energy

NREA reviews Vestas’ bid for 250 MW Ras Ghareb wind plant

The New and Renewable Energy Authority (NREA) is reviewing the offer Denmark’s Vestas submitted in the tender to build a 250 MW wind energy plant in Ras Ghareb, and will make a decision within weeks, sources told the local press. Vestas is currently the only company bidding for the contract, after other bidders had either retracted their offers or were not notified of its new date. The plant is expected to cost EUR 260 mn and is being built for Lekela Egypt, which will operate it under a build-own-operate framework.

Infrastructure

Elsewedy subsidiary signs EGP 638.4 mn contract with Al Futtaim

Elsewedy Electric subsidiary Rowad Modern Engineering signed an EGP 638.4 mn contract with Al Futtaim Commercial and Administrative Centers to construct two Podium 2 office buildings, Elsewedy announced in a statement (pdf). The project is expected to be completed within 18 months.

Real Estate + Housing

SODIC unveils Vye neighborhood in Sheikh Zayed

SODIC has unveiled its Vye neighborhood in its new 500-acre development in Sheikh Zayed, it said in a statement (pdf). Vye is the second of four new projects in Zayed this year after the company launched The Estates in September.

Automotive + Transportation

Electric buses to be pilot tested in coming days -AOI

Twelve Egyptian and international consortiums setting up a smart transportation system of electric buses will begin a pilot test within days, said Mohamed Anis, advisor to the Chairman of the Arab Organization for Industrialization (AOI), according to the local press. The test period will be for three months and the government will use it to decide how many vehicles it needs to produce. The AOI is in talks with international companies including Volkswagen and Toyota to manufacture the buses, which will operate in the new administrative capital and other new cities under construction.

Banking + Finance

FRA could lower admission fees for new Federation for Securities

The Financial Regulatory Authority (FRA) is mulling reducing the EGP 25k admission fee for the newly-launched Federation for Securities to increase membership, according to a FRA source. Membership levels have so far fallen short of initial targets, the source said, adding that the regulator is looking to encourage more companies to become part of the organization. We noted in October that the FRA has received over 90 membership requests since it established the federation in March.

On Your Way Out

ITIDA, RiseUp announce winners of African App Launchpad Cup: The Information Technology Industry Development Agency (ITIDA) and RiseUp announced the winners of the African App Launchpad Cup on the last day of the RiseUp Summit, with USD 60k divided in cash prizes between six winners, Ahram Online reports. Agora, Bouita, Arcanium Studios, 247Medic, Find Me Football and Alkottab Game Studio were chosen from 28 finalists representing over nine countries across Africa.

The Market Yesterday

EGP / USD CBE market average: Buy 16.08 | Sell 16.20

EGP / USD at CIB: Buy 16.08 | Sell 16.18

EGP / USD at NBE: Buy 16.07 | Sell 16.17

EGX30 (Tuesday): 13,509 (+0.05%)

Turnover: EGP 1.2 bn (65% above the 90-day average)

EGX 30 year-to-date: +3.6%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.5%. CIB, the index’s heaviest constituent, ended up 0.7%. EGX30’s top performing constituents were CIRA up 4.0%, Egyptian Iron and Steel up 2.9%, and Ezz Steel up 2.2%. Yesterday’s worst performing stocks were Ibnsina Pharma down 1.3%, Egypt Kuwait Holding down 1.3% and Credit Agricole down 0.9%. The market turnover was EGP 1.2 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -54.4 mn

Regional: Net Long | EGP +1.7 mn

Domestic: Net Long | EGP +52.7 mn

Retail: 44.0% of total trades | 45.0% of buyers | 43.0% of sellers

Institutions: 56.0% of total trades | 55.0% of buyers | 57.0% of sellers

WTI: USD 59.12 (+0.17%)

Brent: USD 64.17 (-0.12%)

Natural Gas (Nymex, futures prices) USD 2.27 MMBtu (+1.48%, January 2020 contract)

Gold: USD 1,468.90 / troy ounce (+0.27%)

TASI: 8,066.42 (-0.66%) (YTD: +3.06%)

ADX: 5,020.13 (-0.06%) (YTD: +2.14%)

DFM: 2,687.61 (+0.12%) (YTD: +6.24%)

KSE Premier Market: 6,748.72 (+0.02%)

QE: 10,316.99 (+0.39%) (YTD: +0.17%)

MSM: 4,017.61 (-0.08%) (YTD: -7.08%)

BB: 1,549.77 (+0.02%) (YTD: +15.89%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

2-13 December (Monday- Friday) The COP25 Climate Change Conference, Madrid

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO.

11-12 December (Wednesday-Thursday): “Forum on peace and sustainability in Africa,” Aswan.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia.

12-14 December (Thursday-Saturday): AEEDC Education Cairo dentistry conference and exhibition, Royal Maxim Palace Kempinski Cairo.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.