- Israeli energy firms want to invest in Egypt’s renewables sector. (Energy)

- Foreign investors began to slowly return to the bond market in June. (Economy)

- Ukrainian officials could soon release 60k tons of wheat destined for Egypt. (Commodities)

- Saudi regulator approves STC takeover of Giza Systems. (M&A Watch)

- Unemployment rate flat at 7.2% in 2Q 2022. (Economy)

- e-Finance is working with the Saudi wealth fund’s Egypt arm. (Fintech)

- Yesterday saw the mother of all earnings dumps — and six of nine companies reporting turned in rising net income. (Earnings Watch)

- What a sustainable African energy sector could look like in 2030. (Going Green)

- Institutional investors aren’t giving up on crypto. (Planet Finance)

Tuesday, 16 August 2022

AM — 2Q earnings held up + a sign that foreign appetite for Egyptian debt may be returning

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to a big news morning.

There’s plenty of good news today, including the first tentative sign of renewed foreign appetite for Egyptian debt and another boost to our regional energy hub ambitions (from The Company Formerly Known As Delek and a compatriot).

Also notable: Six of the nine blue chips reporting 2Q earnings yesterday reported rising net income. It was a hell of an earnings dump, and we have the details for you, below.

WHAT’S HAPPENING TODAY-

Consensus in the market is that the Central Bank of Egypt will go for a rate hike on Thursday. We’re updating this morning our interest rate poll from earlier this week after hearing back from another analyst and their crystal ball. As of this morning, six of eight analysts and economists we surveyed see the CBE going for a rate hike: Four are calling a 100-bps hike, one is forecasting a 200-bps rise and another a more modest 50-bps increase. A Reuters poll out yesterday is also calling a rate hike, with the wire service saying the sweet spot is 50 bps.

MNHD shareholders will decide today whether to allow SODIC to do due diligence ahead of a potential takeover.

The Madbouly government will hold another two rounds of consultations on its privatizations strategy today and Thursday: Chemical producers are up today while players in the mining sector are in the spotlight on Thursday. Every Sunday, Tuesday, and Thursday see workshops on how privatization plans will affect specific industries. You can find more details on the schedule of the meetings here.

THE BIG STORY ABROAD-

Kenya elects new president amid vote rigging allegations: Kenya’s deputy president, William Ruto, will become the country’s new president after narrowly defeating his rival, Raila Odinga, in last week’s ballot taking 50.5% of the vote. Odinga’s campaign has accused Ruto of rigging the vote, and four of the seven members of the electoral commission refused to back the “opaque” result, raising fears that the contested results could trigger protests and unrest in a country with a long history of post-election violence.

The story was everywhere in the foreign press: BBC | The Guardian | CNN | New York Times | Reuters | Washington Post.

Getting attention in the global business press this morning: Activist investor Dan Loeb’s Third Point hedge fund is pushing for major changes at Disney after acquiring a stake in the entertainment giant. Loeb is calling on the company to refresh its board and consider spinning off ESPN to cut its debt. (Financial Times | CNBC | Bloomberg | Wall Street Journal | Reuters)

|

CLARIFICATION- In our Blackboard story of yesterday, our summary of tuition fees for Cairo American College (CAC) included the impact of a one-time USD 14,000 registration fee. This registration fee is charged to new students the first time they enroll at CAC regardless of grade level. Returning students do not pay that fee in subsequent years. We’ve updated the story to explain how that fee works and have stripped it out of the grade-level tuition figures we reported. The school remains the most expensive K-12 institution in the country: At the top end of the scale, CAC high school tuition comes in at the equivalent of EGP 548k, while the final two years at the British International School of Cairo come in at EGP 324k per year. CAC quotes tuition fees in USD, while BISC quotes them in EUR.

CIRCLE YOUR CALENDAR-

Expect more details on how gov’t plans to cut back on electricity: The Electricity Ministry will hold a press conference in the next few days to announce details of measures to curb electricity use that cabinet approved last week, Electricity Minister Mohamed Shaker reportedly told Al Mal.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

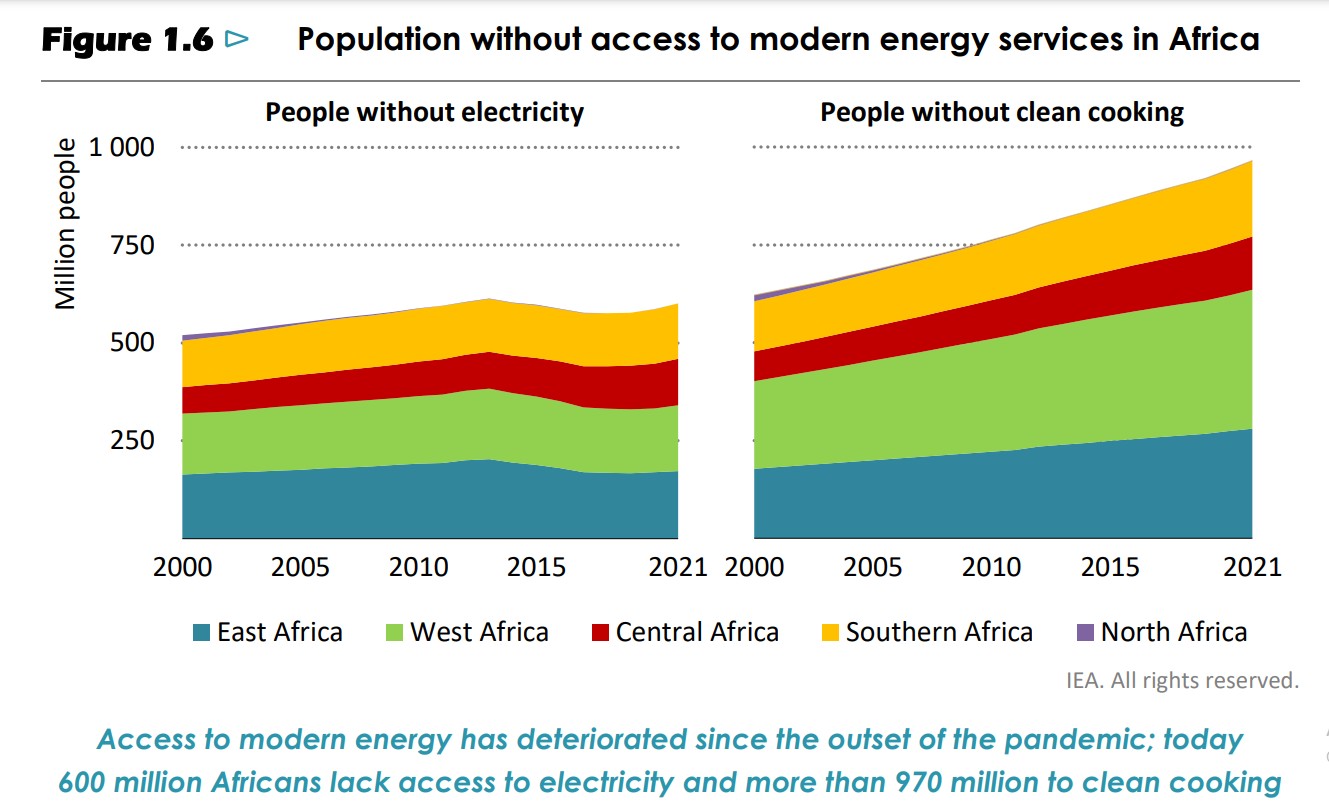

In today’s issue: How can African nations expand energy access and still meet climate goals? A new report from the International Energy Agency lays out what it will take to get all Africans access to modern energy by 2030, without compromising on climate. We take a look at what the report has to say on how the continent’s energy sector needs to change by the end of the decade — and what Egypt is already doing to get us there.

Solasi Wellbeing Festival at Somabay: Where wellbeing meets nature at this holistic yoga and healing festival set between mountains and sea. Solasi wellbeing festival is organized by Yes Yoga and Osana Family Wellness located in the beautiful Somabay. It is a place where yoga, movement, and holistic therapies meet play, relaxation, and music. Set in Somabay sunshine between the majestic mountains and the glittering sea, we are going to bring you sunrise yoga, sound healing, funky classes, morning runs, enlightening workshops, healing treatments, Tai Chi, meditation, kids’ treasure hunts, locally sourced food and lots of dancing. We have everything you need to run away with us for 4 days from 21 till 24 September at a magical destination. Book your one-day or three-day passes at solasifestival.com

ENERGY

Israeli energy players launch MENA-wide renewables venture

Israeli energy firms want to invest in the Egypt’s renewables sector: Israeli gas producer Delek Drilling NewMed Energy is lining up a joint venture with Tel Aviv-listed Enlight Renewable Energy to invest in renewables projects across the MENA region, the two companies said in separate disclosures to the Israeli stock exchange yesterday (NewMed, pdf | Enlight, pdf).

They plan to:

#1- Target Egypt + the wider region: The companies will pursue projects in Egypt, Jordan, Morocco, Oman, Bahrain, the UAE, and Saudi Arabia, the companies said.

#2- Invest in several types of renewables projects: The JV will target projects in solar, wind, energy storage and other renewables segments.

#3- And participate at every stage of a project’s life cycle, including initiation, development, financing, construction and operation.

But they won’t do it alone: The firms will work with local contractors to help them develop projects.

What they said: “The venture will exploit what we see as a very large opportunity in the region that began with natural gas, a development led to a large extent by NewMed,” Bloomberg reported Enlight CEO Gilad Yavetz as saying in a conference call.

NewMed is no newcomer to Egypt: NewMed — rebranded from Delek Drilling earlier this year — has been a key player in Egypt’s plans to become a natural gas hub for the Mediterranean region. These plans have recently seen us partner with Israel to up gas exports to Europe. Alongside Chevron, the company operates Israel’s two biggest offshore gas fields, Tamar and Leviathan, from which natgas is pumped our way for liquefaction and re-export to the EU. NewMed and Chevron are also developing Cyprus’ Aphrodite gas field, which is also set to be linked via a new pipeline to LNG facilities on Egypt’s north coast for re-export.

What’s next: NewMed will put the plan to its shareholders in an upcoming general assembly meeting, it said.

ECONOMY

Foreign investors are slowly coming back to the debt market

FROM THE DEPT. OF GOOD NEWS- Foreign flows have begun to trickle back into Egypt’s local debt market. Foreign holdings of Egyptian treasury bills rose for the first time in five months in June, a tentative sign that Egypt may have seen the worst of the 2022 emerging-market sell-off which has seen bns of USD leave the country. Foreign T-bill holdings registered USD USD 8.35 bn in June, according to central bank figures (pdf). Foreign T-bill holdings stood at USD 8.10 bn in May.

2022 hasn’t been kind to the capital account: Investors have pulled USD 20 bn of portfolio investment from Egypt this year amid a global emerging-market risk-off triggered by the conflict in Ukraine, surging commodity prices and rising interest rates. Official data shows that T-bill holdings fell 55% between February and May, with most of the outflows occurring in March following Russia’s invasion of Ukraine.

Egypt paid off more foreign debt than ever before in the first nine months of FY 2021-2022, the figures show. Foreign debt repayments between July and March came to almost USD 20 bn, up from USD 10.9 bn in the same period the year before and an all-time record for the nine-month period. Debt repayments in 3Q alone were more than double 3Q 2020-2021 due to higher principal and rising borrowing costs.

Remember: External debt is at an all-time high and rose 17% y-o-y to USD 157.8 bn in the January-March quarter.

COMMODITIES

Ukrainian wheat booked by Egypt last year is being held by Ukrainian officials

Ukrainian officials are trying to arrange the release of a 60k-ton shipment of wheat destined for Egypt after the ship carrying it was detained last month for investigation into its ownership, Ukraine's special envoy to the Middle East told reporters yesterday, Reuters reports. “We are working in coordination with all the responsible authorities in Ukraine and in Egypt to see that this ship is allowed to set sail as soon as possible,” Maksym Subkh said.

What’s the issue? The vessel, which has been stuck at the Ukrainian port of Chornomorsk since Russia invaded the country in late February, was supposed to depart the country last month, but was prevented from leaving because it is thought to belong to a Russian company that may have been involved in “financing action aimed at changing the boundaries of the territory or state border of Ukraine,” a court order seen by Reuters said.

The cargo’s chartering firm denies Russian links: “Emmakris III has been chartered by us to carry the wheat cargo in accordance with the terms of the GASC tender,” Dubai-based trading company GTCS said. "The vessel does not belong and has never belonged to a Russian company.” The court order shows that Dubai-based shipping company Greater Bloom is the registered owner of the ship, but Ukrainian authorities still believe that a Russian company is the ultimate owner.

The ship was one of many stranded in the country’s ports since Moscow’s invasion that is now finally able to leave due to the Turkey- and UN-brokered grain pact between the two countries that allowed Kyiv to resume wheat exports via the Black Sea last month. State grains buyer GASC terminated contracts for 240k tons of other stranded Ukrainian wheat after they remained stuck in the country for months due to Russia’s blockade of the country’s ports, with plans to sign new agreements with suppliers.

M&A WATCH

Saudi regulator approves STC takeover of Giza Systems

Giza Systems is one step closer to being Saudi-owned: Saudi Arabia’s competition watchdog has given the greenlight to Saudi Telecom’s internet subsidiary to acquire a controlling stake in Giza Systems, it announced on social media on Sunday. Shareholders agreed to sell 89.5% of the company to Solutions by STC in April in a transaction that values Giza at USD 145 mn. Inergia Technologies, which is majority owned by Egyptian private equity firm B Investments, agreed to sell its 65.7% stake in the firm.

ECONOMY

Unemployment rates holds steady in 2Q 2022

Egypt’s unemployment rate remained flat at 7.2% in 2Q 2022 from last quarter, according to data (pdf) from statistics agency Capmas out yesterday. The jobless rate is down by 0.1 percentage point in comparison with the corresponding quarter last year.

The jobless rate has been more or less steady since the summer of 2020, after retreating from a two-year high in 2Q 2020 caused by the partial lockdown of the economy during covid.

REMEMBER- The official unemployment rate only includes people who are looking for work. The labor force participation rate — which counts everyone aged 15-64 either in work or actively looking for work — recorded 42.6%, down 0.2 percentage points on last quarter. The figure is up from 41.9% in the same quarter of 2021.

Slightly fewer young people out of work: The number of jobless 15-29 year-olds accounted for 61.3% of all jobless people, down from 63.0% in 1Q — marking the second consecutive quarter of decline in youth unemployment recently peaking at 64.3% in 4Q 2021.

The jobless rate among women was down 0.2 percentage points q-o-q to 17.5%, while the rate among men rose 0.1 percentage point to 5.0%. The unemployment rate is consistently recorded as much higher among women than men.

The figures come on the back of a somewhat positive PMI reading on employment for the non-oil private sector. Employment rates remained steady in July, breaking an eight-month streak of job losses, according to S&P Global’s survey of non-oil business conditions.

FINTECH

e-Finance to provide financial services to the Saudi wealth fund’s Egypt arm

e-Finance is working with the PIF: e-Finance will provide financial and digital services to the Saudi sovereign wealth fund’s new Egypt investment arm, Chairman Ibrahim Sarhan told Bloomberg Asharq yesterday (watch, runtime 7:35).

The PIF now owns a chunk of the state-owned fintech player: The Saudi Egyptian Investment Company (SEIC), set up earlier this month by the Public Investment Fund to manage its investments in Egypt, acquired 25% of e-Finance. SEIC agreed to use its services as part of the negotiations for the acquisition, Sarhan told the business newswire.

EARNINGS WATCH

Enough earnings for you?

Yesterday was an earnings extravaganza, ladies and gentlemen. Among those reporting were (in alphabetical order):

Contact Financial Holding’s net income dipped 4% y-o-y to EGP 104.4 mn in 2Q 2022 amid challenging economic conditions, according to the company’s financial statements (pdf).The company recorded solid growth in its financing and ins. segments. On a 1H basis, the company’s net income is up 18% to EGP 258 mn thanks to a strong first quarter.

Net financing income for 1H2022 was up 22%, driven by 52% y-o-y growth in total new financing extended, which came in at EGP 5.1 bn. Big growth drivers included the company’s consumer finance, working capital, commercial trucks, and mortgage products.Total gross premiums written at the company’s ins. division came in 98% ahead of the first six months of last year at EGP 504 mn.

Looking ahead: “While the challenges faced during the first half of 2022 are likely to persist in the second part of the year, we are confident that we have in place a strong strategy to navigate the tough operating environment, and as such our priorities for the year remain unchanged,” the company said in the accompanying earnings release (pdf).

AMENDMENT- This story was updated on 16 August, 2022 to reflect that higher inflation, the EGP devaluation, and higher credit losses were not the cause of an increase in operating expenses at Contact Financial during 2Q, as we had stated in a previous version of the story.

Edita Food Industries’ net income more than doubled in 2Q 2022 to EGP 196 mn on the back of a round of price increases and bigger sales volumes, according to its earnings release (pdf). The company recorded a 37% increase in revenues to EGP 1.57 bn, with price increases in the range of 18% per pack easing pressure on the company’s profit margins, according to the release.

Driving growth: The company’s cake segment was the largest contributor to revenue growth, climbing 65% to EGP 477.9 mn and accounting for half of the company’s revenues during the quarter. The bakery segment, which accounted for 32% of revenues, saw a 15% increase, while revenues from the biscuits segment more than tripled.

Coping with inflation: WIth commodity prices skyrocketing and domestic inflation running high, Edita raised prices and reconfigured products twice in the reporting period, it said.

e-Finance doubles earnings y-o-y: e-Finance’s net income soared 104.8% y-o-y to EGP 279.3 mn in 2Q 2022, according to its earnings release (pdf). Revenues at the state-owned firm rose 59.3% during the quarter to record EGP 702.5 mn.

The breakdown: Growth was driven primarily by the company’s flagship business, e-Finance for Digital Operations, where revenues were up 42.9% to EGP 594.5 mn. E-commerce subsidiary eAswaaq also turned in a standout performance. The company’s card services business, eCards, saw a 39.7% decline in revenues to EGP 23.3 mn on the back of “foreign currency and worldwide sim card shortages which may extend into the coming quarters,” e-Finance said. Revenues were also down 17.6% to EGP 12. 5 mn at the firm’s digital payments arm eKhales.

What’s next: The company has gone to full rollout on its eTax and e-receipt systems and is now laying the groundwork to enter Libya, Tunisia and other African countries, Chairman Ibrahim Sarhan said.

First earnings with PIF on board: Sarhan noted that the earnings were the first with Saudi Arabia’s PIF on board as the company’s largest single shareholder.

Egypt Kuwait Holding (EKH) reported a second consecutive quarter of record earnings in 2Q 2022, the company said in its latest earnings release (pdf). Net income rose 60% y-o-y to USD 72.4 mn during the quarter, as the company continued to benefit from a tight global market for fertilizers and petrochemicals. Revenues also saw a significant boost, rising 53% y-o-y to USD 284.8 million.

EKH is still riding the commodities squeeze: The strong results were underpinned by growth in the firm’s fertilizers and petrochemicals segment, where revenues rose 86% y-o-y to USD 190.9 mn on higher urea prices at subsidiary AlexFert and higher sales volumes at subsidiary Sprea Misr.

E-payments giant Fawry’s net income eased 35% y-o-y in 2Q 2022 to EGP 24.15 mn, according to the company’s earnings release (pdf). This came despite revenues rising 35% y-o-y to register EGP 531.29 mn. The fintech giant’s bottom line was impacted by nonrecurring items, including a noncash expense of EGP 21.7 mn for its newly introduced employee stock ownership plan (ESOP). Setting aside those charges, net income would have dipped 14% y-on-y to EGP 41 mn.

What’s driving revenue growth: Banking services, which saw revenues at both its acceptance and agent banking segments double. The acceptance business “generated more than 20% of consolidated revenue growth for the six-month period,” the company said.

Big landmark: Fawry broke the EGP 1 bn mark for 1H 2022 revenues.

Looking ahead, it’s about growth and investment: The company says it is on track to introduce a range of new products this year, including its myFawry prepaid card, app-based financial solutions, and a full-fledged BNPL platform. Its earnings release name-checked its recent investments in Brimore and El Menus, the launch of Roaderz, and its partnership with Sudan’s Alsoug.

Housing and Development Bank’s (HDB) net income rose 48% y-o-y to EGP 564 mn in 2Q 2022, according to the bank’s earnings release (pdf). This came on the back of a 41% increase in the bank’s net interest income, which was driven by growth in its loan portfolio, treasury income and central bank deposits.

In detail: HDB’s gross loan book grew by 16% to EGP 31.3 bn during the first six months of the year as the bank focused on expanding its commercial banking operations. Deposits increased 25% to EGP 78.6 bn in the period, driven primarily by a 31% increase in corporate deposits.

What they said: “The bank’s positive results for the period reflect our modernized business model’s focus on continuously growing and generating revenue from core commercial banking activities across the retail, corporate, and SME fronts,” Chairman and Managing Director Hassan Ghanem said. “HDB’s corporate and retail loan portfolios have expanded significantly as more individual and corporate clients trust us with managing their business and day-to-day banking needs as well as leverage HDB’s attractive rates and wide range of services.”

CORRECTION- This story was updated on 16 August 2022 to correct a typo in the figure for HDB’s loan book, which was EGP 31.3 bn at the end of the reporting period, not EGP 31.3 mn.

Orascom Development Egypt’s (ODE) net income increased 28.9% y-o-y to record EGP 394.6 mn in 2Q 2022, according to its earnings release (pdf). Revenues were up 23.0% y-o-y to EGP 1.9 bn, up from EGP 1.5 bn in 1Q 2021. The company attributed the rise to accelerated construction at its developments and improved performance in its hotel and towen management sectors.

ODE saw strong real estate sales + a rebound in tourism: Net real estate sales in 2Q 2022 reached EGP 2.6 bn (up 39.4% y-o-y), closing the company’s best-ever first half for sales at a total EGP 4.7 bn. ODE hotel revenues jumped 132.1% y-o-y to EGP 372.6 million on the back of the continued recovery in tourism.

Oriental Weavers’ net income fell 29% y-o-y to EGP 211 mn, according to the company’s earnings release (pdf). The company’s revenues were up 14% y-o-y, reaching EGP 3.25 bn, on the back of price increases, an enhanced product mix and the impact of the EGP devaluation.

Export volumes cooled on demand worries: Softened demand led to a 14% y-o-y decrease in export volumes in 2Q 2022, as inflation hit discretionary spending abroad, though export revenues increased 8% y-o-y to EGP 2.1 bn due to the EGP devaluation and price increases. Revenue growth similarly outpaced volume growth in the local market, where revenues rose 27% to EGP 1.1 bn on just a 4% increase in sales volumes. Increased prices came to stop a 26% increase in raw materials costs for the company from eating further into margins.

Tenth of Ramadan for Pharma Industries and Diagnostic Reagents (Rameda) reported 65.8% y-o-y growth in net income to EGP 52.4 mn during 2Q 2022, according to a press release (pdf). The company’s topline for the quarter was up 38.0% y-o-y to EGP 368.4 mn, with the company attributing the growth to higher private sales and export volumes.

Private sales are driving revenue growth for Rameda: The company’s private sales volumes — meds sold to domestic distributors to stock local pharmacies — were up by roughly half in the first half of the year “on the back of solid growth of a number of Rameda’s top-selling products, coupled with the general post COVID-19 recovery in Egypt’s pharmaceutical retail segment,” according to the company’s earnings release (pdf). Private sales made up 70% of the company’s consolidated revenues and 75% of revenue growth in 1H 2022.

Rameda acquired two new molecules in 2Q 2022, good for four new products in the first half. The new additions were apixaban (an anticoagulant) and lacovimp (an anticonvulsant). CEO Amr Morsy said he is “confident that we can carry our strong momentum throughout the coming months to deliver consistent growth,” including through the growth of the company’s product portfolio.

MOVES

CI Capital has appointed Amr Helal (LinkedIn) as sell-side CEO of its investment bank, according to a press release (pdf). With over two decades of experience in the industry, Helal will oversee the group’s investment banking, securities brokerage and equity research business. Helal joins CI Capital from Renaissance Capital, where he served as North Africa CEO and worked to build the company's presence in Egypt.

CORRECTIONS– In yesterday’s edition, we carried a story from Al Mal that incorrectly reported Oriental Weavers is investing USD 200 mn in a new factory in Tenth of Ramadan. The factory will cost USD 50 mn, a company representative told Enterprise.

We also inaccurately reported that Edita’s new EGP 135 mn production line will increase its total baked goods production to 11 mn tons. This figure is the production increase.

LAST NIGHT’S TALK SHOWS

On the talk shows last night: The high-speed rail network was back in the conversation after President Abdel Fattah El Sisi met with representatives of the company that could snag the contract to operate the line, while time was made to discuss the new support going to ration card holders from next month.

President El Sisi urged the Transport Ministry to finalize contracts with German railway firm Deutsche Bahn which is lined up to operate and manage the first phase of the high-speed rail network, which will run 660 km between Ain Sokhna and Marsa Matrouh and will be finished during the second half of 2024. This came during a meeting between the president and company officials yesterday. Ala Mas’ouleety (watch, runtime: 3:51) spoke with head of the General Authority for Roads and Bridges Hossam El Din Moustafa, who discussed the importance of the railway for upgrading the country’s transport networks and facilitating freight shipping. DMC (watch, runtime: 1:16) and Al Hayah Al Youm (watch, runtime: 2:57) also took note of El Sisi’s sit-down.

Social security measures including the addition of five new key food staples to ration cards as of September also got some attention, with Adel Abdel Aziz, managing director of the General Company for Wholesale Trade, giving a rundown of the measures on Ala Mas’ouleety (watch, runtime: 3:34). We have more on this in this morning’s Radar section, below.

Also on the airwaves last night:

- A new list of political prisoners will be pardoned within days, presidential pardon committee member Kamal Abu Eita said. (Masaa DMC | watch, runtime: 7:14)

- Pope Tawadros II talked about the tragic fire at the Abu Sefein church in Imbaba. (Masaa DMC | watch, runtime: 1:23)

- A 280 km portion of the Egypt section of the Cairo-Cape Town highway has already been constructed, with the full 1150 km road set to be completed by 2024, General Authority for Roads and Bridges Hossam El Din Moustafa said. (Ala Mas’ouleety | watch, runtime: 6:05)

EGYPT IN THE NEWS

This morning in the international press: Sunday’s tragic fire at a church in Imbaba continues to generate headlines abroad from the Associated Press, the New York Times and the National. The incident led to the deaths of 41 people, 18 of whom were children. Meanwhile, Bloomberg leads its weekly Middle East newsletter with the EGP, reprising a piece published last week looking at how far international banks expect the currency to fall in the coming months.

ALSO ON OUR RADAR

Toyota Tsusho presented the results of its six-month study into producing blue ammonia in Egypt to the Oil Ministry, according to a ministry statement. In a preliminary study, the Japanese firm looked into installing carbon capture and storage (CCUS) tech at factories owned by Misr Fertilizers Production Company (Mopco) and Abu Qir Fertilizers to make blue ammonia and recommended that more detailed feasibility studies be conducted. (Blue ammonia is essentially your average ammonia + carbon capture.)

Five more food staples can be bought using ration cards starting September: The Supply Ministry has added ghee, flour, tahini, tuna and jam to its list of supplies eligible for purchase through ration cards, according to a Supply Ministry statement. Ration card holders will be able to purchase these staples at lower-than-market prices starting 1 September, when credit hikes for ration cards come into effect.

AND- The National Bank of Egypt (NBE) launched its Al Ahly Points Merchants program with Mastercard to promote the use of POS and other digital payment methods among traders. (Statement, pdf)

PLANET FINANCE

Institutional investors are making a comeback in the crypto world: BlackRock, the world’s biggest asset manager, has in recent days partnered with crypto exchange Coinbase to give its clients easy access to crypto and announced plans to launch its first BTC investment product. European fund manager Brevan Howard has raised more than USD 1 bn to set up a crypto fund, UK asset managers Abrdn and Schroders have both bought stakes in crypto firms, and US broker Charles Schwab last week launched a crypto ETF.

Crypto goes legit? In response to the spate of institutional involvement in the crypto space, Bloomberg and the Financial Times were both out with pieces yesterday suggesting that BTC and its ilk are becoming accepted by mainstream investors as legitimate assets. “Large asset managers are starting to consider this a real investment,” said one research analyst at investment banking firm DA Davidson. “I think it’s a major data point in terms of traditional asset management companies embracing what really for years has been almost ridiculed.”

The recent moves come as crypto prices recover from the car-crash 1H, thanks to cooler-than-expected US inflation data and optimism over a major upgrade from Ether. The rally may also be being driven by the revival of institutional attention in the market, BlockFi analysts wrote in a note.

Meanwhile, the SPAC kill list keeps growing: One pandemic-era bubble market that hasn’t seen a revival in fortunes as of late is the SPAC industry. At least four planned SPAC mergers looking to go public have pulled out since last week, bringing the year’s tally of failed acquisitions to 42, Bloomberg data shows. A raft of concerns has weighed on the SPAC market over the past year including market volatility, a crowded field of sponsors chasing mergers, increasing regulatory scrutiny and weak performances of the SPACs that did go through.

|

|

EGX30 |

9,915 |

-0.7% (YTD: -17.0%) |

|

|

USD (CBE) |

Buy 19.09 |

Sell 19.20 |

|

|

USD at CIB |

Buy 19.12 |

Sell 19.18 |

|

|

Interest rates CBE |

11.25% deposit |

12.25% lending |

|

|

Tadawul |

12,544 |

+0.2% (YTD: +11.2%) |

|

|

ADX |

10,200 |

-0.5% (YTD: +20.2%) |

|

|

DFM |

3,397 |

+0.1% (YTD: +6.3%) |

|

|

S&P 500 |

4,297 |

+0.4% (YTD: -9.8%) |

|

|

FTSE 100 |

7,509 |

+0.1% (YTD: +1.7%) |

|

|

Euro Stoxx 50 |

3,790 |

+0.3% (YTD: -11.8%) |

|

|

Brent crude |

USD 93.60 |

-4.6% |

|

|

Natural gas (Nymex) |

USD 8.73 |

-0.5% |

|

|

Gold |

USD 1,798.10 |

-1.0% |

|

|

BTC |

USD 23,996 |

-1.0% (YTD: -47.9%) |

THE CLOSING BELL-

The EGX30 fell 0.7% at yesterday’s close on turnover of EGP 1.52 bn (47.7% above the 90-day average). Local investors were net buyers. The index is down 17.0% YTD.

In the green: Egyptian Kuwaiti Holding-EGP (+1.0%), GB Auto (+0.9%) and Ibnsina Pharma (+0.9%).

In the red: Housing and Development Bank (-3.1%), Ezz Steel (-3.0%) and Rameda (-3.0%).

Asian markets are mainly in the green this morning. Shares in Europe look likely to follow suit later today. Shares in the US don’t.

What does Africa need to do to ensure universal access to energy by 2030 while still meeting climate goals? That’s the question posed by a recent report (pdf) from Paris-based multilateral energy organization the International Energy Agency (IEA). The report imagines what the continent’s energy mix will look like by the end of the decade in a so-called Sustainable Africa Scenario (SAS). In this scenario, African countries manage to grow their energy use, expand electricity access to everyone, and still achieve their Nationally Determined Contributions (NDCs) — emissions reduction targets pledged as part of the landmark global Paris Agreement on addressing climate change. (Remember: We just released our updated NDCs ahead of hosting COP27 this November.)

Some African countries still have a long way to go on “modern energy access:” Some 600 mn Africans — c. 43% of the continent’s total population — lacked access to electricity in 2021. The vast majority of those (some 590 mn people) live in sub-Saharan Africa. Meanwhile, nearly three in four people in Africa lack access to clean cooking fuels.

We’ve already secured universal modern energy access here at home: All Egyptians have had access to electricity and clean cooking fuels since at least 2016, according to World Bank data. We’re still working on expanding the coverage of our grid.

But that doesn’t mean we’ve got it all figured out: Energy access is just the first step — and we still have a long way to go on upping the renewable sources in our energy mix, improving efficiency, and winding down major electricity subsidies that could pressure state finances, the IEA report notes. Here are the report’s key points on what a sustainable energy sector could look like for us by 2030:

#1- Renewables like solar will account for most new capacity. Africa currently hosts 60% of potential solar resources but only 1% of PV solar capacity globally, according to the IEA. By 2030, solar power should lead the continent’s energy mix, while renewables (including solar, wind, geothermal, and hydropower) will account for more than 80% of new power generation capacity. Solar and wind power combined will make up 27% of overall power generation — eight times their present proportion in the continent’s energy mix.

We’re already leading the way on wind + solar: African solar PV generation peaked in 2019 on the back of the completion of our mega 1.65 GW Benban park, the IEA notes. By some measures, Egypt generates more wind and solar power than any other Arabic-speaking country, and our installed renewable capacity is set to rise by 68% or 4 GW in the coming five years (despite a road bump during the pandemic, when the government set limits on renewables generation to address our overcapacity issue). Meanwhile, African countries including Algeria and Morocco are building wind and solar capacity fast — so fast their capacity could eclipse ours by the end of the decade.

Phasing out coal will also be key to reaching the continent’s sustainable energy goals — something we have yet to do. Our latest NDCs do pledge to accelerate “the scale-up of on-grid renewable energy by reducing coal capacity in the generation mix,” including by expanding residential renewables generation with more rooftop PV panels and encouraging the use of LED lighting.

More African interconnection could allow us to solve our electricity glut: Electric grids that are heavily dependent on renewables need to be able to handle more variability (peaks and troughs in the level of generation due to weather conditions), the IEA notes. Strengthening domestic grid infrastructure is therefore key, as is linking the grids of neighboring countries, it says. Sharing more energy with our African neighbors could offer us a way to continue developing renewables despite our oversupply issue — and the government is already eyeing expanding regional interconnection projects (like those underway with Sudan, Greece, Cyprus, and Saudi Arabia) as well as shifting to a smart grid to improve efficiency.

#2- Now is the moment to capitalize on natgas: Egypt and Nigeria are set to drive a 15% expansion in natural gas production on the continent this decade, before output starts to fall from the mid-2020s as global demand drops off on the back of the transition away from fossil fuels, the IEA says. If African countries are able to position themselves as Europe’s replacement for even 20% of the gas it used to get from Russia, demand for African gas would increase by one-third by the end of this decade, the IEA says. But Africa’s ability to exploit its natural gas will hinge on its ability to attract investors fast to develop its resources, it adds, before other countries move in to fill the gap.

We don’t need to be told twice: We’ve been striking agreements left, right, and center on ramping up the exploitation of our natural gas and getting more of it exported to Europe. We’re cutting down on domestic electricity consumption to bump up exports to Europe and secure some extra FX liquidity, and we’re also boosting production capacity. The IEA report namechecks talks with Eni to ramp up gas imports from Egypt to Italy and the rest of Europe. We’ve also struck a landmark agreement that will see Israel send more gas to Egypt’s LNG facilities before exporting it on tankers to European shores.

#3- Green hydrogen is about to become competitive: Falling hydrogen production costs could mean that the continent will be able to deliver green hydrogen to the EU at “internationally competitive price points” by 2030. As the report acknowledges, we’re leading the continent when it comes to this nascent sector: The Madbouly government has signed more than USD 10 bn of preliminary agreements for projects with international partners, and is expected to announce more at COP27.

The price tag for a sustainably powered Africa? Securing modern energy access for all Africans by 2030 would require only USD 25 bn of investment a year — the equivalent of 1% of global energy investment or constructing one large liquefied natural gas (LNG) terminal, according to the IEA. But to do that while also achieving all the other sustainability goals in the SAS would take USD 190 bn annually from 2026 until 2030.

That means we need more finance: “Multilateral development banks must make increasing financial flows to Africa an absolute priority” by upping concessional finance, helping to double domestic financial markets, and using innovative financing methods like carbon credits (something we’re already exploring), the IEA says. Debt burdens in some African countries remain an investment risk, it adds.

Your top green economy stories for the week:

- Prime Minister Moustafa Madbouly has chosen a panel to oversee smart and green projects nationwide as part of an initiative that aims to connect national projects with financing institutions ahead of COP27.

- Each governorate and major city will establish a central park under the plan to plant 100 mn trees.

CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

AUGUST

August: Sharm El Sheikh will host the African Sumo Championship.

16 August (Tuesday): The government hosts public consultations on its state ownership policy document with chemical producers.

16 August (Tuesday): MNHD’s general assembly meeting to decide whether to allow SODIC to go ahead with due diligence on its takeover bid.

18 August (Thursday): The government hosts public consultations on its state ownership policy document with the mining sector.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

21 August (Sunday): The government hosts public consultations on its state ownership policy document with firms in the electricity sector.

23 August (Tuesday): The government hosts public consultations on its state ownership policy document with firms in the construction sector.

25 August (Thursday): Second Egypt and UN-led regional climate roundtable ahead of COP27, Bangkok, Thailand.

25 August (Thursday): The government hosts public consultations on its state ownership policy document with firms in the water sector.

25-27 August (Thursday-Saturday): Jackson Hole Economic Symposium.

27 August (Saturday): The National Dialogue board of trustees holds its fifth meeting, which will set the agenda for the dialogue and choose rapporteurs for the involved committees.

28 August (Sunday): Retail portion of Ghazl El Mahalla IPO ends.

28 August (Sunday): The government hosts public consultations on its state ownership policy document with mining and petroleum refining players.

30 August (Tuesday): The government hosts public consultations on its state ownership policy document with timber merchants.

31 August (Wednesday): Late tax payment deadline.

31 August (Wednesday): Deadline for qualifying companies to submit offers to manage and operate a soon-to-be-established state company for EV charging stations.

31 August (Wednesday): Submission deadline for fall 2022 cycle of EGBank’s Mint Incubator.

31 August (Wednesday): Beltone convenes its general assembly to restructure the board following the change of ownership.

SEPTEMBER

September: Naval Power, Egypt’s first naval defense expo

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

September: Egypt will host the second edition of the Egypt-International Cooperation Forum (ICF).

1 September (Thursday): Credit hikes for ration card holders will come into effect.

1 September: Madbouly government set to introduce new social protection measures.

1 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

1-2 September (Thursday-Friday): Third Egypt and UN-led regional climate roundtable ahead of COP27, Santiago, Chile.

4 September (Sunday): The government hosts public consultations on its state ownership policy document with electricity players.

5-8 September (Monday-Thursday): Gastech 2022, Milan, Italy.

6 September (Tuesday): The government hosts public consultations on its state ownership policy document with building and construction players.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Qubba Palace, Cairo.

7-9 September (Wednesday-Friday): African Finance Ministers to meet in Cairo to coordinate an African-led position during COP27.

8 September (Thursday): European Central Bank monetary policy meeting.

8 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

11 September (Sunday): The government hosts public consultations on its state ownership policy document with accommodation and food services players.

13 September (Tuesday): The government hosts public consultations on its state ownership policy document with sports industry players.

11-13 September (Tuesday-Thursday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

15 September (Thursday): The government hosts public consultations on its state ownership policy document with water and sewage utilities players.

15 September (Thursday): Fourth Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20 September (Tuesday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 September (Saturday): Start of 2022-2023 school year.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings chaired by CBE Governor Tarek Amer, Washington, DC.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.