- CBE leaves interest rates on hold for the tenth consecutive meeting. (Economy)

- EBRD, VC firm Teklas back Swvl to the tune of USD 21.5 mn ahead of its SPAC merger + Anghami shares soar in market debut. (IPO Watch)

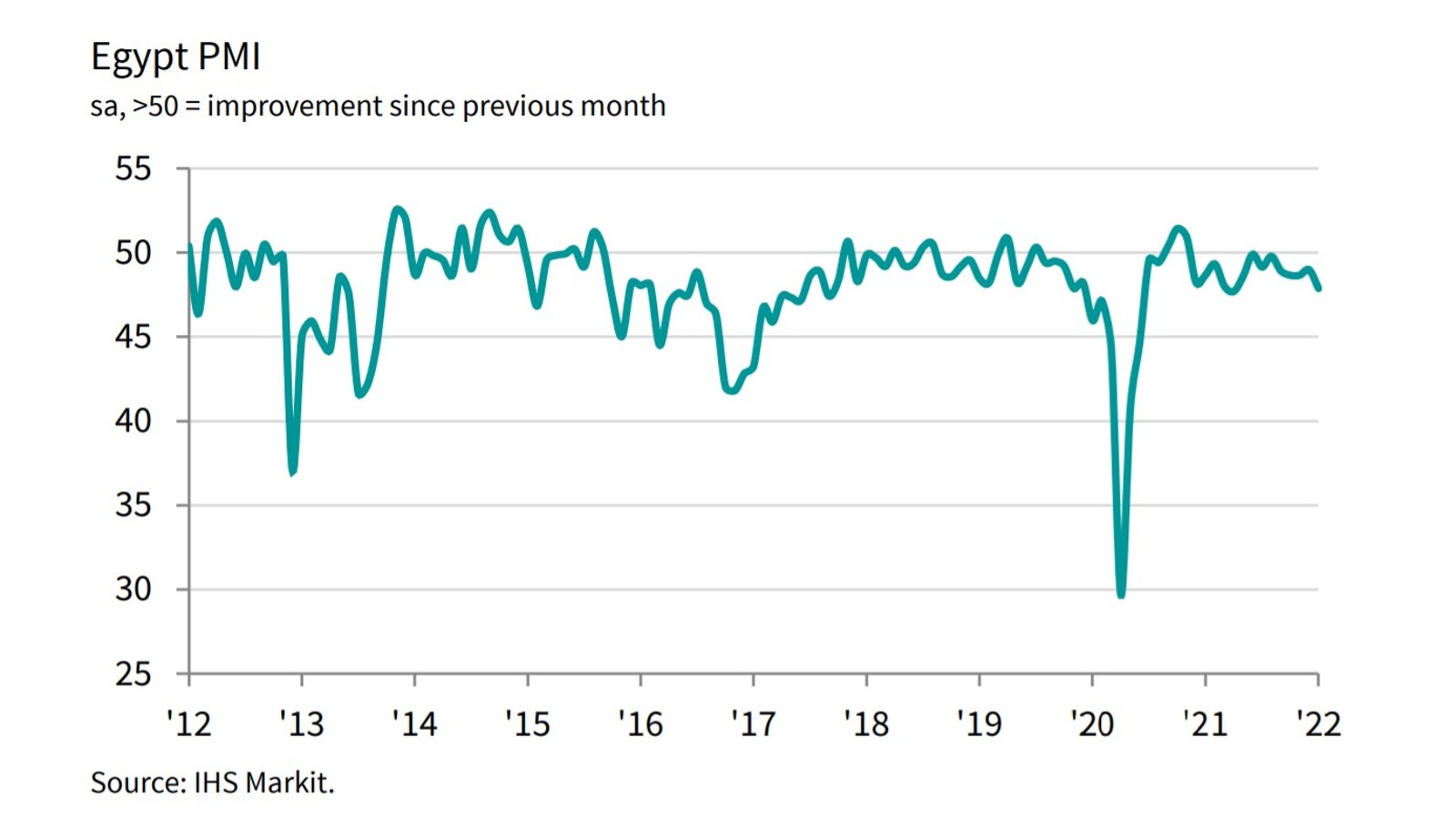

- Despite optimism about 2022, non-oil business activity contracted again in January. (Economy)

- Gov’t hikes fuel prices for the fourth time in less than a year. (Energy)

- Strong investor appetite for Macro ahead of its EGX debut at the end of this week. (IPO Watch)

- It’s Egypt v Senegal in tonight’s AFCON final. (What We’re Tracking Today)

- El Sisi, China’s Xi meet in Beijing amid flurry of Olympics diplomacy. (Diplomacy)

- The status of superapps in Egypt — Part 2: The challenges. (What’s Next)

- Aramco plots historic USD 50 bn listing + Turkish inflation soars to nearly 50%. (Planet Finance)

Sunday, 6 February 2022

AM — Central bank leaves interest rates on hold in its January policy meeting

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to another big news day.

Setting the tone this morning: The Central Bank of Egypt left rates on hold as it takes a wait-and-see approach on both inflation and the market impact of the US Federal Reserve’s plan to hike interest rates this year. The news comes as the state’s fuel price committee hiked prices at the pumps once again (oil prices are well ahead of the figure the Madbouly government has penciled into the budget)

ALSO- Macro Group’s shares are due to start trading by Thursday on the EGX under the ticker MCRO.CA, Swvl just raised money from EBRD and Teklas, and the PMI was down in January despite wide optimism about doing business in Egypt in 2022. We have the rundown on all of this and more in this morning’s news well, below.

WATCH THIS SPACE- The UAE’s biggest Islamic bank, Dubai Islamic Bank, is mulling a move into Egypt as well as Saudi Arabia and Turkey over the next five years as part of its international expansion strategy. “These are three markets that one cannot ignore,” CEO Adnan Chilwan told Bloomberg TV in an interview on Friday.

It’s AFCON finals night. The Pharaohs advanced to their first Afcon final in five years, edging out hosts Cameroon on Thursday night in another cagey goalless draw that was settled at the penalty spot. Having seen off Ivory Coast in a similar fashion in the quarter-finals, the Pharaohs were well prepped for a spot kick showdown against a Cameroon side who evidently hadn’t practiced their penalty kicks. Two saves by goalkeeper Gabaski and one meek shot blazed wide saw the tie go 3-1 to Egypt, setting up an Egypt v Senegal / Mohamed Salah v Sadio Mane showdown in Olembe.

The bad news: The Pharaohs will be without manager Carlos Queiroz on the touchline after he was sent off for arguing with the referee. His assistant Wael Gomaa will also be in absentia after receiving his second yellow card of the tournament.

Kick off: 9pm tonight.

PSA- All travelers to Saudi Arabia will have to present a negative PCR test taken within 48 hours before flying, regardless of their vaccination status, according to an EgyptAir statement. The new rules will come into effect at 10am CLT on Wednesday, 9 February.

HAPPENING THIS WEEK-

Is the automotive industry about to get a helping hand from government? It’s been six years, but we could finally see some details later this month on the long-awaited package of incentives to stimulate the local car assembly industry, according to statements made by Prime Minister Moustafa Madbouly on Thursday. The strategy, which has been in the works since 2016 and has seen years of delays, revisions and overhauls, aims to grow a car assembly industry that can compete with European Union, Moroccan and Turkish imports.

The House of Representatives is holding plenary sessions today through Tuesday to discuss a handful of laws and amendments, including changes to the Real Estate Registry Act, Al Shorouk and Youm7 report. The amendments, which received the green light from the House’s Legislative Committee last week, aim to simplify property registration procedures by significantly reducing the number of required documents, digitizing parts of the procedure, and putting a time ceiling on the process.

Also on the agenda:

- A draft law permitting landlords to evict organizations renting non-residential properties under the “old rent” law, which also received the Housing Committee’s nod in January.

- An overhauled Tourism and Hotels Act set to simplify licensing rules for hotels and tourism companies, which was given preliminary approval by the House at the end of January.

- Amendments to the Education Act that would see an EGP 500-1k fine imposed on parents whose children miss school without sufficient reason. The House will discuss a report from its Education Committee on why it struck down the amendments last week.

Foreign Minister Sameh Shoukry is in Addis Ababa for a two-day African Union (AU) summit, which kicked off yesterday, Cabinet said in a statement last night. Senegelese leader Macky Sall took over as AU president at the summit, which sees members discuss the ongoing pandemic, deteriorating security in Africa amid coups and insurgencies, and food insecurity. Shoukry has so far met with several diplomatic figures on the sidelines of the summit, including Palestinian Prime Minister Mohammad Shtayyeh.

|

THE BIG STORY ABROAD-

Ukraine crisis bubbles on: Though international coverage seems to have dropped a notch, most outlets are still carrying the requisite updates on just how imminent a Russian invasion of Ukraine might be. US intelligence says Putin could give the attack signal within days, according to the Washington Post, while Reuters says Russian forces are 70% assembled. The Financial Times, meanwhile, reports that the US believes “the optimum time for a Russian invasion” would be in the second half of February.

RELEVANT TO US– The Economist takes an in-depth look at what a Ukraine-induced disruption to global wheat supplies would mean for us here at home. The world’s largest wheat importer, Egypt is also the largest consumer of Ukrainian wheat, last year purchasing the equivalent of around 14% of its total wheat consumption from the eastern European country.

Wheat prices last year hit their highest level in nearly a decade, and the Economist notes that prices “spiked” the last time Russia invaded Ukraine (when it seized Crimea back in 2014).

SIGN OF THE TIMES- Canada has become the latest country to signal that it is shifting to “living with the virus” as death and hospitalization rates taper — and citizens grow fed up with pandemic-era restrictions.

For our fellow iSheep: Apple is looking at an early March event at which to unveil a new iPhone SE and an updated iPad, Bloomberg’s Mark Gurman reports. It will be the first event in a year that Gurman thinks will be a “record-setting” one for product launches.

MARKET WATCH-

Facebook Meta made history on the Nasdaq on Thursday for all the wrong reasons: Facebook parent Meta suffered a historic drop in its share price on Thursday after it forecast weaker-than-expected revenue growth for 2Q and admitted it had lost daily users for the first time ever in 4Q2021. The company lost more than USD 230 bn in market value as shares crashed 26%, making it the single-biggest one-day drop in the history of the US stock market and wiping USD 29 bn off Mark Zuckerberg’s net worth.

Daniel Ek isn’t smiling either: Spotify saw its shares fall as much as 18% ahead of Thursday’s trading session after its outlook for subscriber growth fell below analyst expectations, Reuters reports. The streaming platform has been catching heat in recent weeks after its flagship podcaster Joe Rogan was accused of spreading misinformation about covid.

On the other end of the Big Tech seesaw: Amazon set the record for the biggest single-day gain in Wall Street history on Friday, as its shares soared 14%, adding USD 191 bn to its market cap on the back of strong cloud growth, Bloomberg reports.

*** It’s What’s Next day: We have our weekly deep-dive into what makes and shapes pre-listed companies and startups in Egypt, the UAE and KSA, touching on investment trends, future sector insights and growth journeys.

In today’s issue: While Egypt is fertile ground for superapps due to its largely unbanked population, wide smartphone adoption, and compelling demographics, challenges and investor concerns remain. This week, we delve deeper into the performance of these apps and the challenges they face.

ECONOMY

CBE leaves rates unchanged in first meeting of 2022

The Central Bank of Egypt (CBE) left interest rates on hold for the tenth consecutive meeting on Thursday. The CBE left the overnight deposit rate at 8.25% and the lending rate at 9.25%, while the main operation and discount rates are still at 8.75%, it said in a statement (pdf) following the meeting.

The decision was in line with analyst expectations. All eight analysts and economists we polled last week expected the Monetary Policy Committee (MPC) to keep rates unchanged, telling us that the EGP carry trade is unlikely to face immediate pressure from the US Federal Reserve’s plan to raise rates this week.

Keeping rates unchanged was expected for many reasons, Al Ahly Pharos’ Radwa El Swaify told us. “We have to look cautiously at what is happening on the monetary policy front globally, especially in the US, as well as the expected rise in inflation due to the surge in global commodity prices,” she said. “Additionally, investors exiting from fixed income portfolios has been common among all emerging markets, and it’s related to EM strategy, not specific to Egypt. Meanwhile, locally, inflation is within the CBE’s range so there was no reason whatsoever to change the rates.”

Egypt continues to offer the highest real interest rates in the world, maintaining the attractiveness of our debt market to foreign investors. “We believe Egyptian treasuries will remain attractive, underpinned by EGP stability and maintained real interest rates,” Beltone Financial’s Alia Mamdouh wrote in a note following the CBE’s decision. “Among emerging markets with comparable yields, Egypt still stands out with a relatively less impacted economy from the repercussions of the covid-19 pandemic as it provides growth potential.” Egypt’s real return is currently around 4%, according to HC Securities’ Monette Doss, which compares favorably to rates in the US and other high-interest rate emerging markets.

Inflation is not a concern: The CBE expects price stability over the medium term, it said in its statement. Urban inflation rose to 5.9% in December from 5.6% in November, kicking off an expected upward trend in the coming months, largely due to an unfavorable base effect along with a global increase in consumer prices. However, the annual rate is expected to remain within the central bank’s target range of 7% (±2%) by 4Q2022.

Yet… Beltone expects inflation to average 9.6% through 2022, slightly above the CBE’s target range, due to the base effect and higher international commodity prices.

Expectations for a rate hike in 2022 are increasing: Some analysts are now expecting that the CBE will follow other central banks around the world and raise rates some time this year. Al Ahly Pharos’ is forecasting rates to rise 100 bps this year, “depending on the pressures from global monetary conditions, commodity prices, and inflation in general,” El Swaify told us. Beltone Financial also expects a 100bps hike through the year: “The need to maintain [the] lucrative carry trade in the fixed-income market, particularly with the rise in global rates posing a risk to inflows into emerging markets, backs our view,” Mamdouh wrote.

IPO WATCH

Swvl receives funding boost ahead of Nasdaq SPAC merger + Anghami starts trading

The EBRD is backing Swvl ahead of Nasdaq debut: Egypt-born, UAE-based mass transit app Swvl has new investors on board as it gears up to go public on the Nasdaq via a SPAC merger, the firm announced on Wednesday. The European Bank for Reconstruction and Development (EBRD) and Teklas Ventures, the venture capital arm of auto parts maker Teklas, will invest USD 21.5 mn in a private placement (PIPE), joining Agility, Luxor Capital, Chimera and Zain which agreed last year to commit USD 100 mn.

What’s a PIPE, again? Standing for private investment in public equity, PIPEs are simply the sale of publicly-traded shares to private investors. Check out our explainer here for more.

Swvl is expected to IPO on the Nasdaq this quarter via a merger with US female-led SPAC Queen’s Gambit Growth Capital.

The company will list 35% of its shares on the exchange (c. 50 mn shares) and hopes to go ahead with the listing before the end of March, CFO Youssef Salem told Enterprise, confirming a story first reported by Al Mal.

The latest investment takes Swvl’s expected PIPE finance to USD 121.5 mn, of which USD 66.5 mn has been pre-funded, the company said. Other PIPE investors include Agility, Luxor Capital Group, Chimera, and Zain Ventures.

Minus one investor: Queen’s Gambit announced in a filing last Sunday the termination of two agreements with Atalaya Capital Management that would have seen it invest up to USD 100 mn in SPAC shares and another USD 2 mn via a private placement.

What they said: “Swvl is a highly dynamic tech investor with a transformative business model that brings tangible benefits to travelers in Egypt and other countries of operation of the EBRD, benefiting female travelers in particular,” said Sue Barrett, the EBRD’s director of sustainable infrastructure for the Middle East, Turkey and Africa.

Swvl made its entrance to Europe and Latin America last year after acquiring controlling stakes in Barcelona-based transportation platform Shotl and South American firm Viapool, which operates in Argentina and Chile.

IPO to fund big investment plans: The company plans to invest USD 250-300 mn over the next three years to expand its global footprint after it goes public.

Advisors: Law firm Ibrachy & Dermarkar is Swvl’s legal advisor on the merger, while Vinson & Elkins and Shahid Law Firm are acting as advisors for Queen’s Gambit.

The Middle East’s first US tech listing soars on debut: Shares in Abu Dhabi-based music streaming platform Anghami rose as much as 82% on its Nasdaq trading debut on Friday following its merger with blank-check company Vistas Media Acquisition Company, which valued the company at around USD 220 mn, Bloomberg reports. Shares opened the session at USD 17.91 before falling back to close at USD 12.07.

But the company saw a wave of redemptions: Shareholders holding 9.8 mn of Vistas’ 10 mn shares traded them in for cash during the day, continuing a trend that has seen appetite for SPAC listings diminish. Redemption rates hit 75% last month, up from just 14% a year before.

Though Anghami isn’t too worried: “[Redemptions are] something that is recently expected but we were well-prepared with a solid PIPE to compensate for this,” Anghami CEO Eddy Maroun told Bloomberg Daybreak (watch, runtime: 4:53). “Of course this is something that has been happening lately, but we’re good with the funding that we have in place now.” The SPAC raised USD 40 mn in private investment from Shuaa Capital and Visas’ parent company.

About Anghami: The company says it has more than 70 mn registered users with some 1 bn streams each month. Revenues have jumped 80% since 2018 and are projected to rise five-fold over the coming three years.

ECONOMY

Business activity contracts at a faster pace in January

Non-oil business activity in Egypt contracted for the fourteenth consecutive month in January on the back of weaker demand and inflationary pressure, according to IHS Markit’s purchasing managers’ index survey (pdf). A “solid and faster deterioration in business conditions” pushed the gauge down to 47.9 in January from 49.0 in December, falling further below the 50.0 mark that separates expansion from contraction.

This is the lowest reading since April 2021, and below the series average of 48.2, which indicates “a solid decline in overall business conditions,” the report says. “Egypt’s non-oil economy had a disappointing start to the year, as weak demand conditions led to stronger declines in output and new business,” said David Owen, IHS Markit economist.

Construction, wholesale and retail have been hit particularly hard: January’s data points to “sharp falls in output” in construction, wholesale and retail, while the service and manufacturing sectors were “more stable” by comparison.

Weak demand driven by inflation: Inflationary pressures continued to weigh heavily on the non-oil sector throughout the month, with the prices of raw materials, components and transport all continuing to rise.

There’s been a continued decrease in purchasing activity, which fell at its fastest pace since April 2021, and businesses are trying to sustain sales by not fully passing on cost increases.

And we’re still seeing fewer jobs being created: Employment figures have fallen for the third consecutive month, with lower demand bringing stable backlogs and reduced workloads.

On the flipside, expectations for future growth are up: Hopes for strong growth in 2022 meant expectations for future output strengthened for the second consecutive month. But while “the degree of optimism picked up” in January, it still “remained lower than those seen through much of 2021,” said Owen.

REMEMBER- The Enterprise 2022 reader poll says you’re all quite optimistic about doing business in Egypt this year.

ELSEWHERE IN THE REGION- The UAE and Saudi Arabia’s non-oil private sector activity saw strong but slower growth in January, as a surge in covid-19 weakened demand. The UAE’s PMI (pdf) fell to 54.1 in January from 55.6 in December, off the back of rising covid cases, which led to increased uncertainty and stifled the rebound in tourism, said Owen. Meanwhile, the kingdom’s PMI (pdf) fell to 53.2 in January from 53.9 in December — its lowest level in 15 months.

ENERGY

Fuel prices rise by up to 3.5%

The government has hiked fuel prices for the fourth time in less than a year in response to rising oil prices. The fuel pricing committee decided to raise prices at the pump by another EGP 0.25 per liter for 95, 92 and 80 octane fuel at its latest meeting, the Oil Ministry said Friday, meaning motorists will now be paying up to 3.5% more per liter for fuel.

As of now:

- 95-octane is EGP 9.50 per liter, up 2.7% from EGP 9.25;

- 92-octane is EGP 8.50, up 3% from EGP 8.25;

- 80-octane is EGP 7.25, up 3.5% from EGP 7.00.

The price for diesel remained unchanged at EGP 6.75 per liter, the ministry said.

Fuel prices have now risen by 12-16% since April last year, when the government first hiked prices in response to an upswing in commodity prices. Additional EGP 0.25 increases came into effect in July and October.

These rates will remain fixed through to the end of 1Q when the committee next meets to set prices.

Oil prices hit seven-year highs last week: The price of international benchmark Brent crude hit its highest level since October 2014 last week, reaching highs of USD 93.70 per barrel on Friday before closing at USD 93.27. Brent has now risen 20% since the start of the year amid ongoing supply issues and concerns about rising geopolitical tensions between the US and Russia, the world’s second-largest oil exporter.

This is significantly higher than the benchmark price in the budget: The Finance Ministry expected the price of Brent to average USD 60 per barrel during FY2021-2022, but the price has remained above this for almost a year.

A limited impact on inflation? “We do not expect much of an impact on headline inflation from the implemented increase in prices given that the price of diesel, which is the main fuel used in the transportation of commodities, remains unchanged,” Alia Mamdouh, chief strategist at Beltone Financial, wrote in a note. Diesel prices have remained fixed since July 2019 even as the price of other fuels has risen, “to have a minimal impact on the prices of fuel and food,” the committee said in its October statement.

IPO WATCH

Macro Group sees strong demand from retail investors ahead of IPO

The retail component of Macro Group Pharma’s IPO was 6.49x oversubscribed at the close of Thursday’s trading session, Amwal Al Ghad reports, citing unnamed sources. Retail investors have requested some 85.9 mn shares so far, with subscription set to close at the end of tomorrow’s trading session. Macro wrapped up its private placement to institutional investors, which was 1.8x oversubscribed, last Wednesday.

Well on the way to an EGP 1.3 bn share sale: Shareholders are offering up to 45.8% of the company (c. 264.5 mn shares) in the IPO, with 95% (c. 251.3 mn shares) earmarked for institutional investors and 5% (c. 13.2 mn shares) are available in the retail offering. At the EGP 4.85 share price confirmed by Macro in a statement (pdf) last week, the IPO is worth some EGP 1.3 bn, valuing the company at around EGP 2.8 bn.

Shares should start trading “on or around” this Thursday under the stock ticker MCRO.CA, according to Macro’s statement.

About Macro: The company is a huge player in its segment, with a more than 23% share of the cosmeceutical market in 2020 and a portfolio of 112 shop-keeping units (or SKUs) and generates sales by targeting physicians and pharmacies nationwide. Macro turned in a top line of EGP 417 mn in 9M2021 (up 37% year-on-year) and EBITDA of EGP 172 mn (+30% y-o-y) in the same period.

Advisors: Our friends at EFG Hermes are quarterbacking the transaction as sole global coordinator. EFG Hermes and Renaissance Capital are acting as joint bookrunners, while White & Case is counsel to the issuer. Dechert and Zaki Hashem & Partners are counsel to the joint bookrunners, while PwC has been appointed external auditor. Inktank is investor relations advisor.

DIPLOMACY

President Abdel Fattah El Sisi met with his Chinese counterpart, Xi Jinping, on the sidelines of the Beijing Winter Olympics yesterday to discuss boosting economic, trade and industrial cooperation, according to an Ittihadiya statement.

On the agenda: The two leaders agreed to bolster cooperation on scientific research, the manufacture of pharmaceuticals including covid-19 vaccines as well as electric vehicles, health care, and IT, among other sectors. They also discussed the contribution of China’s Belt and Road Initiative to developing the Suez Canal Economic Zone, and recent developments in the Grand Ethiopian Renaissance Dam (GERD) dispute, the Palestinian cause, and crises in Libya, Syria, and Yemen.

Increasing China-Egypt ties: The “enhanced political trust” between the two countries comes as a model of “China-Arab, China-Africa and China-developing world solidarity,” the Associated Press cited Xi as saying, according to Chinese state media. Bilateral cooperation has seen Egypt manufacture China’s Sinopharm and Sinovac covid vaccines, and Chinese involvement in El Nasr Automotive’s plans to produce EVs with an international partner. The company is currently in “advanced talks” with two Chinese companies to replace Chinese company Dongfeng after talks fell through, and could sign an agreement sometime this quarter.

El Sisi also met with Qatar’s Tamim bin Hamad on the sidelines of the opening ceremony. It’s the third time the two leaders have met since the thawing of what had been icy relations between the two countries about a year ago.

China’s pivot toward Russia stole most of the headlines at the Olympics as Xi met with several heads of state yesterday, part of a diplomatic push by China to coincide with the opening ceremony amid rising tensions with the US. In a meeting with Russian President Vladimir Putin, Xi said China opposes further enlargement of Nato — tacitly backing Putin’s stance on the escalating Ukrainian crisis. The US has led a boycott of the games with several other, predominantly Western, countries over China’s human rights record. The story is everywhere today, from Reuters to the Financial Times and Bloomberg.

DEBT WATCH

EFG Hermes Corp-Solutions plans to take out EGP 2 bn in loans this year

EFG Hermes Corp-Solutions is negotiating with banks to borrow EGP 2 bn in 2022, CEO Talal Elayat told Al Mal last week. The funding will be directed at supporting the company’s leasing and factoring activities. Corp-Solutions lent around EGP 8 bn last year, swelling the company’s current portfolio to around EGP 10 bn, he said.

Securitized bonds worth EGP 1 bn are also in the works this year, Elayat told Al Mal, without putting a timeframe on the issuance. Elayat told the newspaper in October that the issuance would take place in early 2022. The firm closed its first EGP 790 mn securitized bond issuance in the last week of 2021.

M&A WATCH

Wintershall Dea exits Gulf of Suez oil concession

Wintershall Dea is now an ex-oil producer in Egypt: Wintershall Dea divested its stake in its Gulf of Suez oil concession to the Egyptian General Petroleum Corporation (EGPC) on 1 January, it said in a statement Thursday. The German oil and gas company operated the concession as part of a 50/50 joint venture with the state-owned company for almost 40 years. The transfer leaves EGPC as the sole owner of the concession. The statement did not put a figure on the value of the transaction.

Pivot to gas: The decision to divest from the concession coincides with Wintershall’s move to focus on natural gas, which now accounts for the majority of its global portfolio. The company has a 17% interest in BP’s large West Nile Delta gas project and operates the onshore Disouq gas concession as part of a 50/50 JV with EGPC.

LAST NIGHT’S TALK SHOWS

It was a mixed bag on last night’s talk shows, with President Abdel Fattah El Sisi’s visit to Beijing for the Winter Olympics, hikes to fuel prices, and the death of a Moroccan boy who was trapped in a well for five days all getting picked up by the talking heads.

El Sisi’s meeting with Chinese counterpart Xi Jinping on the sidelines of the Beijing Winter Olympics earned some airtime from Al Hayah Al Youm’s Loubna Assal (watch, runtime: 9:43), who discussed the diplomatic weight of the visit on a phone call with former assistant foreign minister Mohamed Hegazy. We have more on El Sisi and Xi’s meeting in this morning’s Diplomacy section, above.

Fuel price hikes also earned coverage from Assal (watch, runtime: 3:19), who noted the importance of Friday’s decision to keep diesel prices on hold to minimize the impact on inflation. We have more on the story in our Energy section, above.

The death in Morocco of a five-year-old boy who had fallen down a well was covered by Kelma Akhira’s Lamees El Hadidi (watch, runtime: 0:47) and El Hekaya’s Amr Adib (watch, runtime: 1:46). Rescuers spent five days tunneling a path through the hillside where Rayan Awram was trapped, but he passed away before they were able to reach him late last night.

COVID WATCH

Covid tally rises to fresh record after brief plateau

We’ve broken another record: The Health Ministry reported 2,298 new covid-19 infections yesterday, up from 2,291 the day before — setting a new all-time record for daily cases after two days of marginally lower tallies. Egypt has now disclosed a total of 437,350 confirmed cases of covid-19. The ministry also reported 58 new deaths, bringing the country’s total death toll to 22,877.

The vaccine tally: 27,081,735 people are now fully vaccinated against the virus, while some 10.8 mn people have received only their first shots and 629,087 people have received booster shots.

Germany sends 340k AstraZeneca jabs our way: The donation of 338k vaccine doses arrived on Friday evening, according to a Health Ministry statement. The donated jabs bring the total number of covid-19 vaccine doses sent to us from Germany to around 4 mn, including those sent through the Gavi / Covax program, Egyptian Ambassador to Berlin Khaled Galal said in a Foreign Ministry statement last week.

PLANET FINANCE

Aramco plots largest share sale ever: Saudi Aramco is in discussions to sell as much as a USD 50 bn stake to investors in a new share listing, the Wall Street Journal reports, citing unnamed sources. The sale, equivalent to a 2.5% stake at current prices, would be by far the largest-ever share sale in history, easily beating the company’s record USD 29.4 bn IPO on the Saudi stock exchange in 2019. Executives have held talks with advisors about a listing an additional stake on the Tadawul and are exploring the possibility of listing in London, Singapore or other exchanges, the sources said, with a tentative completion date set for late this year or early next year.

Turkey’s inflation soars to new heights: Surging energy prices combined with a weakened TRY saw Turkish inflation hit a near 20-year high in January, rising to 48.7%, Bloomberg reports. Turkey’s inflation-adjusted policy rate is now -35%, a record low across emerging markets.

|

|

EGX30 |

11,638 |

-0.5% (YTD: -2.6%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.75 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.75 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

12,142 |

-0.4% (YTD: +7.6%) |

|

|

ADX |

8,733 |

+0.1% (YTD: +2.9%) |

|

|

DFM |

3,171 |

+0.6% (YTD: -0.8%) |

|

|

S&P 500 |

4,501 |

+0.5% (YTD: -5.6%) |

|

|

FTSE 100 |

7,516 |

-0.2% (YTD: +1.8%) |

|

|

Brent crude |

USD 93.27 |

+2.4% |

|

|

Natural gas (Nymex) |

USD 4.57 |

-6.5% |

|

|

Gold |

USD 1,808 |

+0.2% |

|

|

BTC |

USD 41,699 |

+2.7% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 0.5% on Thursday on turnover of EGP 656 mn (39.5% below the 90-day average). Regional investors were net sellers. The index is down 2.6% YTD.

In the green: GB Auto (+2.0%), Qalaa Holdings (+1.7%) and Credit Agricole (+1.1%).

In the red: Madinet Nasr Housing (-4.1%), Sidi Kerir Petrochem (-2.1%) and e-Finance (-2.1%).

The status of superapps in Egypt — Part 2: the challenges: Last week, we looked into why superapps are on the rise, how they can accelerate financial inclusion, and what the Egyptian market is like. While Egypt is fertile ground for these apps due to the largely unbanked population, wide smartphone adoption and compelling demographics, there are challenges and investor concerns in the field. This week, we delve deeper into the performance of those apps and the challenges they face.

The big challenge: customer acquisition. While local superapps MNT-Halan, Yalla Super App, and MyFawry have been gaining traction in terms of users and volume of transactions, the main challenge they face is new customer adoption, their customer acquisition cost, as well as the underlying operations, company founders and executives tell us.

Superapps are being hampered by a lack of financial literacy and knowledge about … superapps. “There is a general lack of awareness amongst the population regarding financial products and the actual roles of financial institutions, service providers and so on,” PaySky founder Walid Sadek tells us. Founder and CEO of MNT-Halan Mounir Nakhla agrees, adding that his company has been doing a lot of face-to-face education across the country to help people understand what they can use the product for. “I believe our biggest challenges […] are customer and merchant adoption of digital financial solutions,” Fawry CMO Wael Wahby adds.

…which does not help with the cost of customer acquisition: Customer acquisition cost (CAC) — or the cost of acquiring a new customer via promotions and discounts or other tools — serves as an instrumental KPI for a company’s performance. Since a superapp competes with every other service out there, it needs to look at how much acquiring a customer is going to cost. It is only logical that the CAC increases, because adoption is low, managing director of Openner Ahmed Elsherif says. This can lead to superapps having to “subsidize” their customers, by giving out free products and services or discounts, which ramps up the cash burn and competition, he adds.

Selling at margin means selling at scale: At the core, superapps earn by selling several products at a margin. But this requires them to operate at mass scale to be profitable. “Typically, to compete with vertical-specific players, a superapp tends to be a multi-vertical low margin play, which means they will require tremendous volume or scale to flourish,” partner at Emirati VC firm Shorooq Partners Tamer Azer says.

One way around this is cross-selling and fintech services. E-commerce platforms, for example, suggest other products for customers to buy. And as many superapps are fintech plays, they offer financial products such as loans and payment services, or connect users to other fintech platforms.

But the backend can become an operational hassle. The backend of a superapp heavily depends on operations, since it tries to streamline the user experience across a number of services and products. The way you pay for your phone bill should be the same way you order your snacks and the same way you book a ride, for instance. The idea of a superapp is that the user gets the same experience across verticals starting from opening the app until the delivery of the service or product. “It is not just about the interface or idea, but rather about the execution behind it and […] operational excellence,” CEO and founder of delivery company Yalla Fel Sekka (YFS) Yasmine Abdelkarim tells us.

A shift from B2C to B2B2C may become beneficial to overcome the operational nightmare. YFS does not focus on acquiring customers, as much as it works on incorporating brands and facilitating how these brands interact with the customer, to organically attract new users. “People don’t use a superapp for its own brand, but rather because it helps them get the services from the brands they frequently use,” Abdelkarim says.

But despite these challenges, local superapps are seemingly doing well: For instance, EGP mns have been transferred via the MNT-Halan app in about eight months, with prime time being a day in January where EGP 10 mn of consumer finance products were sold, founder and CEO Mounir Nakhla tells us. The app boasts over 4 mn app installs and disbursed loans of over USD 2 mn to date, according to its website.

MyFawry follows suit: MyFawry was downloaded over 4.3 mn times with a value of transactions of around EGP 1.9 bn as of 2021. “Our biggest chance for growth […] is that Fawry itself has over 30 mn users on a monthly basis. […] They represent our potential pool to converge on the app and become MyFawry users,” Fawry CMO Wael Wahby tells us.

And Yalla Super App is on the same path. Sadek explains that current KPIs of Yalla Super App had surpassed multiples of the team’s forecast, adding that specific numbers will be widely announced “soon.” This includes the number of users and volume of transactions.

While YFS is fulfilling more than 10k deliveries a day. While it doesn’t call itself a superapp, it is on the path of naturally becoming one by virtue of offering a variety of services.

NEXT WEEK- So how are superapps gaining traction despite the challenges? We also speak to investors in the category on why they're still looking to invest.

Your top stories on future trends for the week:

- Cairo Angels Syndicate Fund (CASF) has made an undisclosed second investment in scientific research startup Nawah Scientific.

- Delivery startup Yalla Fel Sekka (YFS) has closed a USD 7 mn series A funding round led by Abu Dhabi-based VC DisruptAD.

- Social commerce startup Brimore has raised USD 25 mn in a series A funding round led by the International Finance Corporation and Silicon Valley VC Endure Capital.

CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

9 January – 6 February (Sunday-Sunday): 2021 Africa Cup of Nations, Cameroon.

Second half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

Second half of January: Regulations for installing EV charging stations will be published.

27 January-7 February (Thursday-Monday): Cairo International Book Fair, Egypt International Exhibition Center.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX this month.

February: Suez canal transit fees set to increase 6%, exempting cruise ships and LNG carriers.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

3 February (Thursday): European Central Bank monetary policy meeting.

3 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3 February (Thursday): January PMI figures for Egypt, Saudi Arabia, and the UAE will be released.

3 February (Thursday): Deadline to send in concept notes for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

11 February (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

14-19 February (Monday- Saturday): An art exhibition created by marginalized children will be held at Townhouse Gallery. The event is organized by the Sawiris Foundation for Social Development, AlexBank, Townhouse Gallery, Al Ismaelia for Real Estate Investment, and Ubuntu Art Gallery.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February- 1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers’ playoff.

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

29 March (Tuesday): The second leg of the 2022 FIFA World Cup qualifiers’ playoff between Egypt and Senegal.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.