- EBRD raises Egypt’s FY 2021-2022 growth outlook. (Economy)

- Suez Canal to hike transit fees next year. (Suez Canal)

- Egypt lays out 2030 renewable energy target. (Energy)

- Egypt receives offers for hydrogen production projects worth USD 2 bn. (Energy)

- FRA expands caps on margin trading. (Regulation Watch)

- Shoukry to hold high-level diplomatic talks in the US this week. Here’s what we expect to be on the table. (What We’re Tracking Today)

- Mosques are now banned from receiving cash donations. (Last Night’s Talk Shows)

- Another 3.5 mn Moderna jabs are here. (Covid Watch)

- Planet Finance — Emerging-market stocks haven’t kept pace with developed economies this year.

Sunday, 7 November 2021

AM — EBRD upgrades Egypt’s growth outlook for current fiscal year

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and happy Sunday. Our guts tell us it’s going to be a big week for business and investment news, but you can expect the next few days to be dominated by talk of our strategic relationship with the United States. Cairo and Washington are kicking off a two-day strategic dialogue in DC, and we have chapter and verse on what you can likely expect, below.

Washington also dominates global business headlines at the start of this workweek:

THE BIG STORY ABROAD- US Democrats passed a USD 1.2 tn infrastructure bill late on Friday in a major victory for US President Joe Biden after months of infighting over the bill among Democratic factions. The legislation will see the biggest upgrade of America’s roads, bridges, railways and internet infrastructure in more than a decade. It comes on the back of a USD 1.9 tn covid stimulus package back in March.

But lawmakers delayed a vote on the larger Build Back Better Act until later this month after several moderate Democrats refused to lend their votes until it had been independently costed. The bill would inject USD 1.75 tn into education and healthcare services, as well as more than USD 550 bn into green projects. Events on the Hill got plenty of ink from the global press. (Financial Times | Reuters | New York Times | Washington Post).

The civil war in Ethiopia is getting a lot of play in the global press as Tigrayan rebels advance on the nation’s capital. Rebels are reportedly within 200 miles of Addis Ababa and will be aided further after a coalition of opposition factions formed an alliance to bring down Abiy Ahmed’s government. (Reuters | Washington Post | CNN | Associated Press | The Guardian)

Someone tried (and failed) to assassinate the Iraqi PM in the early hours of this morning: Prime Minister Moustafa Al Kadhimi was targeted with a drone loaded with explosives which flew towards his house in Baghdad’s Green Zone early this morning, Bloomberg reports. Al Kadhimi tweeted that he was safe and called for calm.

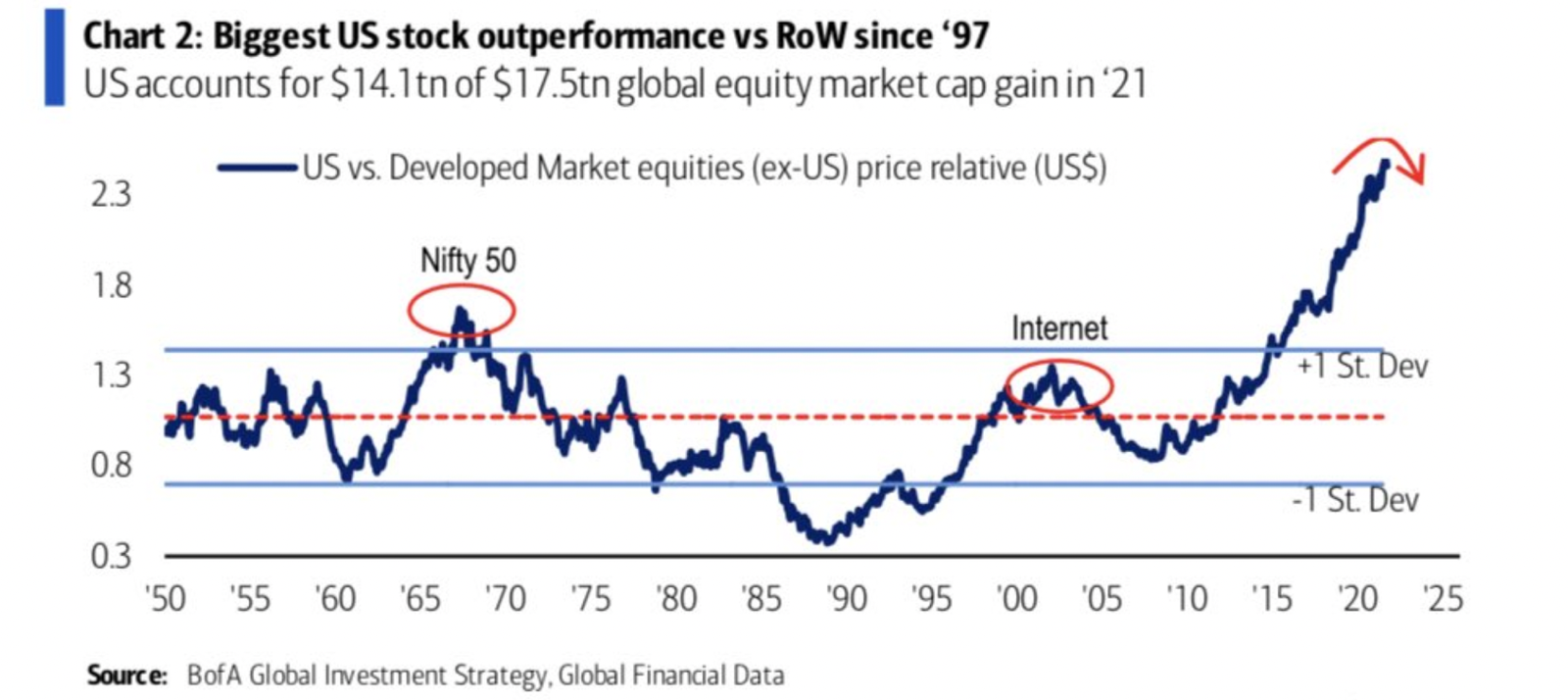

SIGN OF THE TIMES- US stocks are crushing the rest of the world’s equities in a way that we’ve never seen before, CNBC host Carl Quintanilla notes on his Twitter feed (he’s a great follow). US shares account for 80% of the world’s gain in market cap so far this year. Quintanilla was tweeting as traders pushed US shares to a new record high last week.

Really left behind? Emerging market shares, as we note in this morning’s Planet Finance (below).

WHAT’S HAPPENING TODAY-

Two conferences open their doors at the Egypt International Exhibition Center today: The four-day transport conference TransMea 2021, and the 2021 Cairo ICT exhibition, which also wraps on Wednesday.

PSA #1- Time changed in Canada and the United States as clocks in most (but not all) provinces and states “fell back” an hour with the end of daylight saving time. Egypt did away with the twice-annual change of the clocks a few years back after a ridiculous year in which we sprang forward, fell back for Ramadan, sprang forward again just in time for Eid, and then “fell back” in fall. Clocks changed in Ireland and the United Kingdom last Sunday.

PSA #2- All non-citizen, non-immigrant travelers to the US of A need to show proof of vaccination to board flights starting today. Fully-vaccinated travellers will still need to show a negative PCR test taken within 72 hours of departure and provide evidence of vaccination (this can be a QR code, a physical vaccination certificate or a digital copy of a certificate), the US embassy said Thursday. The US is now accepting Sinopharm and Sinovac vaccines (but still no Sputnik).

PSA #3- You have 10 more days to catch Art d’Egypte’s stunning Forever is Now exhibit at the Pyramids after the organizers extended its run. The site is open from 9am until 4pm daily, and all you need for admission is a ticket to enter the Pyramids. Catch some of the coolest public art we’ve seen in a long time on IG (watch, runtime: 1:33).

PSA #4- The fourth season of Stranger Things will make its debut in summer 2022, Netflix said yesterday at the end of the “titles teaser” (watch, runtime: 0:53) it released to drum up hype for the popular show on “Stranger Things Day.” The streamer also released yesterday the fourth of what pundits think are four short teasers before the drop of a “big” trailer. This one is titled “Welcome to California” and promises an action-packed season (watch, runtime: 1:13).

HAPPENING TOMORROW-

Shoukry in US for high-level talks tomorrow: Foreign Minister Sameh Shoukry will hold talks with US Secretary of State Antony Blinken during the two-day US-Egypt Strategic Dialogue, which kicks off tomorrow, the Egyptian Foreign Ministry and the US State Department said in separate statements over the weekend. The meetings, which will also be attended by senior officials from USAID and the Department of Defense, will cover “international, regional, human rights and bilateral cooperation on economic, judicial, security, educational and cultural issues,” the State Department said.

The meeting comes as relations continue to improve: After initially getting the cold shoulder from the Biden administration, Cairo earned credit for its work on the Israel-Palestine file and relations continue to improve. The US has gifted us mns of doses of mRNA covid-19 vaccines (8.25 mn jabs had arrived as of 30 October) and USAID recently unveiled some USD 125 mn in grants to fund projects in critical sectors including health and education. The State Department notice of the meeting described Egypt as “a vital partner for the United States.”

Here’s what we expect to be focusing minds over the two days:

#1- GERD: Persuading the US to become more actively involved in the intractable dispute with Ethiopia over its hydropower dam will be at or near Cairo’s top priority in the talks. The Sisi administration has been lobbying Washington for years on the issue, and though it had some limited success courting the Trump administration, the Biden White House has been more reluctant to take sides, refusing to co-sign the resolution Egypt brought to the UN Security Council earlier this year that called for international pressure on Addis Ababa. Progress here will be complicated given Tigrayan rebels’ march on Addis Ababa (above).

#2- Human rights: The Biden administration has put substantial importance on Egypt improving its rights record, including a decision to withhold a small amount of military aid until Cairo meets several conditions relating to its treatment of civil society workers and journalists. Egypt has wanted to show Washington that it is taking steps in this direction, dropping charges against several NGOs in the long-running foreign funding case and announcing a new human rights strategy. It has also lifted the state of emergency for the first time since 2017, though the effects of this remain uncertain after the House passed last week a raft of legislative amendments relating to national security.

#3- Israel-Palestine: Egypt has positioned itself as a vital partner for the US regarding Israel-Palestine issues, and demonstrated its value when it successfully mediated the ceasefire between Hamas and Tel Aviv that ended the 11-day war in May. The US and Egypt are working together to mediate Palestinian reconcilation talks, Cairo has recently hosted Jordanian and Palestinian leaders to discuss ways to restart peace negotiations, and in September Israeli PM Naftali Bennett became the first Israeli leader in a decade to make an official visit to Egypt.

#4- Sudan: Washington will want to get Egypt on the same page regarding the Sudanese military’s seizure of power in Khartoum last month, an act that threatens the democratic transition to a civilian administration in our southern neighbour. Though the US has been strong in its condemnation of the coup, Egypt has been less so, and has maintained close ties with military leader Abdel Fattah El Burhan, who according to the Wall Street Journal travelled to Cairo for talks the day before he seized power.

Less clear to us: What the two sides will discuss on the economic side of the ledger.

LATER THIS WEEK-

Inflation: Inflation figures for October will be released this Wednesday, 10 November;

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

|

MARKET WATCH-

THE LATEST IN THE ENERGY CRISIS- OPEC+ shrugs amid global energy crunch: The group of oil-exporting nations stuck to its plan of gradually increasing output by 400k bbl/d at its meeting on Thursday, ignoring calls by US president Joe Biden for the group to increase supply faster to ease soaring energy prices, Bloomberg reports. The Saudi and Russia-led cartel insisted that energy price hikes are the result of triple-digit spikes in the supply of gas and coal, and that producers do not need to act to hold down oil prices. “Oil is not the problem,” Saudi Energy Minister Prince Abdulaziz bin Salman told reporters. “The problem is the energy complex is going through havoc and hell.”

Saudi Aramco sharply upped the selling price of its crude to all buyers a day after the OPEC+ announcement.

The UK is turning to Qatar to plug its gas shortfall: UK officials have been in discussions with Qatar over a pact to make the Gulf state its “supplier of last resort” for liquefied natural gas, which would ensure the country can access gas even if supplies tighten, the Financial Times reports, citing informed sources.

Meanwhile, the wheat trade is on track for a record season despite soaring prices, amid high demand coming from the Middle East, according to Bloomberg. Egypt, as the world’s largest importer, is responsible for some of the boom, with authorities replenishing the country’s wheat supplies through recent tenders. Iraq, Iran, Turkey and Afghanistan are also piling in, after drought hit their harvests earlier this year. Iran is now Russia’s top wheat importer so far into the season, overtaking Egypt.

ECONOMY

EBRD raises Egypt’s FY 2021-2022 growth outlook

EBRD is more optimistic about Egypt’s growth outlook: Egypt’s economy is on track to grow 4.9% in FY2021-2022, the European Bank for Reconstruction and Development (EBRD) said in its latest Regional Economic Prospects report (pdf) on Thursday. This is an upwards revision of 0.4 percentage points from the bank’s June report, when it said Egypt would record 4.5% growth during the current fiscal year, but is still below the 5.4% the government has penciled in. The IMF and a Reuters poll of analysts also both recently predicted slightly faster growth rates than the EBRD report.

The EBRD’s forecast for the current calendar year is also stronger than it was in June, with the bank revising upwards its expectation to 5.3%, up 1.1 percentage points. Growth is then expected to cool off slightly in 2022 to 5.0% — a downward revision of 0.2 percentage points. Egypt is seen outperforming all of its peers in the Southern and Eastern Mediterranean (SEMED) region, as well as the mean growth for SEMED countries.

What’s underpinning Egypt’s expected growth? A pickup in the telecoms sector, coupled with a rebound in private consumption and investment, as well as recovering foreign direct investment flows, the report suggests.

The usual suspects are also still the biggest risks to our outlook, with the report pointing (again) to a slow vaccination rate and the “weak outlook in the tourism sector in view of a probable global delay in tourism recovery.”

Regional rebound is afoot: The SEMED region — which spans developing countries in the southern and eastern Mediterranean, emerging Europe, and central Asia — is seeing “a rebound of agriculture and telecommunication, as well as some growth in tourism and exports.” The report predicts SEMED economies to grow an average of 4.2% during the current calendar year and accelerate to 4.4% in 2022.

SUEZ CANAL

Suez Canal continues clawing back pandemic price cuts

Suez Canal transit fees are set to increase by 6% for most ships starting February 2022, as the Suez Canal Authority looks to capitalize on rising traffic, which it expects to increase by almost 7% next year, according to a statement on Thursday. The increase exempts LNG and cruise ships, which will continue paying the same discounted tariffs as now. The SCA will continue “to apply a balanced and flexible marketing and pricing strategy that fulfills the authority and its clients’ interests and takes into account the global economic conditions,” authority head Osama Rabie said.

The SCA is starting to dial back its pandemic discounts: The authority last month slashed discounts it had been giving LNG carriers to 15% from 25%. The SCA sees an opening to start restoring prices after cutting them to keep market share when the price of oil fell in the early days of the pandemic. The rise in oil to record highs to cross USD 85 a barrel for the first time since 2014 amid a global energy shortage is driving higher demand for natural gas and other fuels, while record high freight charges are also boosting income for shipping lines.

The authority had been offering reduced fees to boost traffic through the canal, slashing fees for tankers at the end of 2020 and some container ships at the beginning of July, and freezing transit fees for all ships at 2020 rates.

Canal revenues hit a record USD 5.84 bn during the last fiscal year, and receipts are expected to inch up further to an estimated USD 6.6 bn in FY2021-2022, and USD 7.6 bn by FY2024-2025.

ENERGY

Egypt lays out 2030 renewable energy targets

The Sisi administration wants to grow renewable energy capacity to cover 42% of the country’s electricity needs by 2030, Oil Minister Tarek El Molla announced at the UN’s COP26 climate summit in Glasgow on Thursday, according to a ministry statement. The new target apparently shortens the timeline for our clean energy transition by five years, after the government in 2016 announced that it was aiming to reach the 42%-mark by 2035.

We currently get about 10% of our electricity from renewable sources. In 2018, the International Renewable Energy Agency (IRENA) said it would be technically and economically feasible for Egypt to aim for 53% of power generation from renewable sources by 2030.

The minister’s comments came a day after the Environment Ministry launched its 2050 climate strategy on the sidelines of the conference. The announcement was light on policy specifics and targets.

COP is coming to Egypt in 2022: The next iteration of the global summit, COP27, will be held in Sharm El Sheikh next year. President Abdel Fattah El Sisi is aiming to fast-track infrastructure work in Sharm ahead of the gathering.

IN OTHER ENERGY NEWS- Egypt, EU talk natgas exports: El Molla held talks with EU officials about the prospect of exporting Egyptian natural gas to Europe as part of the Eastern Mediterranean Gas Forum, the ministry said in a statement. There is increasing talk in Europe about the need to diversify the continent’s energy supplies amid an ongoing gas supply crunch and fears that Russia, which provides half of Europe’s gas, is restricting shipments and driving up gas prices for political reasons.

ENERGY

Big global players eye hydrogen investment in Egypt

Eni, General Electric and ThyssenKrupp have all bid to establish hydrogen plants in Egypt, the Arabic-language energy website Attaqa reports, citing what it says are sources familiar with the matter. The bids are worth a collective USD 2 bn and concern facilities that would produce both green and blue forms of hydrogen, the sources said.

BP is not among the those bidding a company representative told Enterprise after the publication of an earlier version of this story in EnterpriseAM, our morning newsletter.

Some bids were accompanied by financing offers from European banks, including the German development bank KfW, the European Investment Bank and the International Finance Corporation, one senior government official told the website.

Policymakers in Egypt have been taking green hydrogen increasingly seriously over the past 12 months, holding talks with a number of international firms about establishing a local industry that has the potential to grow into a key part of the country’s energy mix. Siemens is already on board to set up a pilot green hydrogen production plant, while Norwegian renewable energy company Scatec announced last month that it will build a 50-100 MW green hydrogen facility in Ain Sokhna, in partnership with Nassef Sawiris-backed ammonia producer Fertiglobe and the Sovereign Fund of Egypt. Eni is working with state gas company Egas to produce feasibility studies for manufacturing blue and green hydrogen.

Green v blue: Green hydrogen is hydrogen produced via electrolysis of water, powered by renewable energy sources. In contrast, blue hydrogen is created using methane in natural gas, making it less environmentally-friendly because of its energy source and the CO2 emissions created during the production process.

What’s next? A ministerial committee tasked with overseeing the country’s hydrogen strategy will study each of the bids submitted, which will be followed by consultations regarding the technical and financial aspects of the projects.

** Check out our explainer on green hydrogen for more.

EDITOR’S NOTE: This story was corrected on 8 November 2021 to remove BP from the list of energy companies bidding on the hydrogen plants. BP has not placed a bid, company representatives told us.

REGULATION WATCH

FRA expands caps on margin trading

FRA expands caps on margin trading: The Financial Regulatory Authority (FRA) issued a decision on Thursday setting new caps on margin trading of shares of listed companies — and from what we’re seeing, it appears the authority has expanded them from its previous proposals. Newly released regulations would not permit any single investor or related party to purchase on margin more than 3% of a company’s market cap or 5% of its freefloat shares, whichever is higher.

No single company would be permitted to have over 15% of its outstanding shares held on margin, or 30% of its publicly-traded shares, whichever is higher. In its April proposal, the FRA had suggested that it would limit freefloat shares held on margin to 25%.

The FRA gave a bit more slack compared to what was previously proposed: In its previous proposal the FRA had wanted to limit a single investor’s margin trading cap at 1% of the company’s market cap or 2% of its freefloat shares. The proposal initially wanted to limit a single company to having a maximum of 15% of its outstanding shares held on margin or 25% of its publicly-traded shares, whichever is higher. Investors would also have had to limit margin trading to 1% of a company’s market cap or 2% of shares on freefloat.

Why is this happening? It’s all about risk management. While policymakers are encouraging margin lending, the steep increase in using borrowed funds has tripped a wire at the regulator. The latest decision aims to place limits on concentration risk while implementing measures designed to avoid a market crash thanks to back-to-back margin calls.

Still unsure of what margin trading is? Check out our explainer which took a deep dive into the topic earlier this year.

COVID WATCH

More Moderna jabs are here

We’ve received our largest yet batch of Moderna jabs: 3.5 mn doses of Moderna vaccines arrived at Cairo Airport through the Gavi / Covax program on Friday, according to a Health Ministry statement. The shipment follows our first ever batch of 784k Moderna doses donated by Canada last week. The Health Ministry announced earlier in October that Egypt would receive a total of 8 mn doses of Pfizer and Moderna vaccines from the US. As of the end of October, Egypt has received 8.25 mn Pfizer jabs through that program.

The Health Ministry reported 909 new covid-19 infections yesterday, down from 922 the day before. Egypt has now disclosed a total of 336,582 confirmed cases of covid-19. The ministry also reported 62 new deaths, bringing the country’s total death toll to 19,011.

IN GLOBAL COVID NEWS-

Pfizer will apply to have its antiviral covid pill approved for emergency use in the US, after a late-stage trial found it cut the risk of hospitalization or death in high-risk patients by 89% according to a company statement. A rival offering from Merck was approved for use in the UK last week.

Pfizer shares jumped 7% on the news, with travel and tourism companies also receiving a market boost, while shares in rivals Moderna and Merck plummeted 25% and 9%, respectively, the Financial Times reported.

Sinovac’s covid jab could be safe for children as young as 6 months old, according to preliminary data from experiments conducted by the company, it said in a statement. The first two phases of the clinical trial showed that the vaccine is safe for children between the age of 3 and 17. The company said that it will continue its research on vaccinating 6-month-olds in efforts to provide a stronger scientific basis for countries to safely start vaccinating young children.

(EDITOR‘S NOTE: This story was amended on 11 November, 2021 to reflect that Pfizer had not yet applied to the FDA for emergency approval of its antiviral covid pill at the time of publication.)

EARNINGS WATCH

Abu Dhabi Commercial Bank Egypt reported net income of EGP 379 mn in 3Q2021, up almost 3% from the same quarter last year, the bank said in a press release(pdf). The bank began operating under this name last year as a local Egyptian bank as a rebadge of Union National Bank Egypt, whose parent company in the UAE merged with ADCB and Sharia-compliant lender Al Hilal Bank.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Last night’s talk shows were a mixed bag, giving us a bit of everything:

First off: The government’s incredibly slow war on tuk-tuks just made another small advance: The Trade Ministry is preparing to issue a decision to stop importing the basic components needed for the local assembly of tuk-tuks — the base, the chassis and engine — according to Kelma Akhira’s Lamees El Hadidi (watch, runtime: 0:26). This comes following a previous decision to stop importing fully assembled tuk-tuks.

The fight against tuk-tuks has been ongoing for some time now: The government has for years been talking about cracking down on tuk-tuks but is yet to take decisive action. Over the summer, a Finance Ministry official said that the cabinet had decided to open up the scheme to increase the usage of natgas vehicles to tuk-tuk owners, allowing them trade in their vehicles for natgas microbuses. Since then, nothing has been heard.

NEXT UP- The government has banned mosques from receiving cash donations: Donation boxes will be removed from mosques across the country within the next 10 days after the Endowments Ministry announced a ban on cash donations.

Officials have offered a number of reasons for the move: Khaled El Jundi, a member of the Supreme Council for Islamic Affairs, claimed in an interview yesterday that donation boxes facilitate corruption and pose a threat to national security (watch, runtime: 3:49). Meanwhile, the head of the Ministry’s Religious Sector Hisham Abdel Aziz told Masaa DMC last night that the move will help reduce the use of cash and improve transparency (watch, runtime: 9:04).

How are people able to donate? Mosques will open their own bank accounts into which people will be required to transfer their donations, ministry undersecretary Ayman Abu Omar told El Hekaya last night (watch, runtime: 9:06). The ministry also has two accounts at the central bank — one for charitable donations and another for the Mosque Building Fund — into which people are able to donate, he said.

But how are people without bank accounts supposed to donate to their local mosques? The ministry hasn’t explicitly said.

Also receiving its fair share of screen time last night: The situation in Ethiopia, where Tigrayan forces are reportedly approaching the capital Addis Ababa. El Hekaya (watch, runtime: 8:14) and Ala Mas’ouleety (watch, runtime: 11:19) both covered the story.

Getting up close and personal with the UK’s new ambassador to Cairo, Gareth Bayley: Lamees El Hadidi sat down with the diplomat for a chat that covered everything from climate change and UK investments in Egypt to tourism (watch, runtime: 39:00).

EGYPT IN THE NEWS

It’s a mixed bag of nuts in the foreign press this morning: The Wall Street Journal reports that Sudanese military chief Abdel Fattah Al Burhan sought Egypt’s backing before launching the coup against civilian leaders last month. Three unnamed sources tell the newspaper that Al Burhan flew to Egypt for talks with President Abdel Fattah El Sisi the day before dissolving the joint civilian-military council governing the country and arresting the prime minister and several cabinet ministers.

Two reporters managed to briefly interview Egyptian intelligence chief Abbas Kamel on the sidelines of COP26, asking about Egypt-Israeli relations as well as ongoing negotiations for ceasefire and prisoner swap agreements between Palestine and Israel. Abbas, who rarely talks to the media, said he will visit Israel and the West Bank in the coming weeks for talks on restarting political dialogue between the two sides, according to Axios.

The state of emergency continues to get attention, this time from the UK Independent which criticizes the new national security powers passed by lawmakers last week, just a few days after the emergency law was lifted.

PLANET FINANCE

This year’s US-led equities boom has left emerging-market stocks behind, the Financial Times reports, with the expected monetary tightening in developed markets causing investors to anticipate a mass exit from EM assets. The gap between EM and developed-market equities hasn’t been wider since 2013’s taper tantrum, with MSCI’s EM index registering negligible gains so far this year, while its DM index has shot up more than 20%.

Egypt, India and Turkey are particularly vulnerable to a more hawkish turn from central banks, one analyst told the FT. Anticipated interest rate hikes to curb inflation in developed markets could see growth stall even as energy prices continue to rise. That scenario could squeeze our finances, as more risky EM stocks and bonds lose their appeal for investors, according to Danske Bank’s head of global macro research. Nevertheless, strong foreign reserves and a switch to longer-term debt — two points the Central Bank of Egypt (CBE) has been working on of late — should provide some protection from the brewing EM market storm.

It’s not just an emerging markets problem: US and UK hedge funds can’t keep up with changing central bank policies either. An intense sell-off in short-term government debt in anticipation of rate hikes has cost big players like London-based Rokos Capital and New York-based Alphadyne Asset Management bns of USD in recent months, the Financial Times reports. High volatility in government bonds has managers pointing fingers at the Fed and the Bank of England, as they argue that monetary tightening could throttle the economic recovery. “I think the markets are telling you that global central banks are careening into a pretty sizeable policy mistake,” one bond fund manager told the FT.

Dubai’s bourse gets a revamp as the city looks to catch up to neighbors: Sheikh Maktoum bin Mohammed bin Rashid replaced five of seven board members on the Dubai Stock Exchange on Wednesday, according to Bloomberg. The Dubai Financial Market jumped by 56% over the course of the week, bringing its weekly gains to a seven-year high of 9%. Earlier in the week, Bin Rashid announced plans to list the Dubai Electrical and Water Authority (DEWA) at a USD 25 bn valuation, in what is expected to be the first of many IPOs designed to breathe new life into the emirate’s bourse. Dubai’s bourse, previously the leading exchange by traded volume in the UAE, has taken a backseat to Abu Dhabi’s recently, which saw three IPOs this year alone. Last month, Nassef Sawiris’ OCI-backed Fertiglobe IPOed on the Abu Dhabi stock exchange in one of the city’s biggest IPOs to-date.

Boeing directors will pay USD 237.5 mn to settle a years-long lawsuit with shareholders over safety faults in the company’s 737 Max aircraft, which was involved in two fatal crashes in 2018 and 2019 which killed 346 people. The settlement, which is still pending court approval, will also see the company reshuffle its board and adopt a range of additional safety measures. (Reuters | Wall Street Journal | New York Times).

|

|

EGX30 |

11612.84 |

-0.6% (YTD: +7%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

11,752 |

+0.6% (YTD: +35.3%) |

|

|

ADX |

8,015 |

+6% (YTD: +58.9%) |

|

|

DFM |

3,108 |

-0.05% (YTD: +24.7%) |

|

|

S&P 500 |

4,698 |

+0.4% (YTD: +25%) |

|

|

FTSE 100 |

7,304 |

+0.3% (YTD: +13%) |

|

|

Brent crude |

USD 82.74 |

+2.7% |

|

|

Natural gas (Nymex) |

USD 5.52 |

-3.5% |

|

|

Gold |

USD 1,817 |

+1.3% |

|

|

BTC |

USD 61,457 |

+0.6% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 0.6% at Thursday’s close on turnover of EGP 1.05 bn (31.4% below the 90-day average). Local investors were net buyers. The index is up 7.1% YTD.

In the green: Orascom Development Egypt (+3.5%), Fawry (+2.1%) and Eastern Company (+1.6%).

In the red: Mopco (-5.1%), GB Auto (-4.2%) and Sidi Kerir Petrochem (-2.2%).

DIPLOMACY

The UK will try to encourage international financial institutions and investment funds to invest in Egypt, UK Chancellor of the Exchequer Rishi Sunak told Finance Minister Mohamed Maait on the sidelines of COP26 on Friday, the Finance Ministry said in a statement. Sunak said that Egypt has become more attractive to foreign investors thanks to its resilience through the covid pandemic and other external shocks.

The Foreign Ministry and the UN have launched a joint initiative to support migrants and refugees. The Joint Platform for Migrants and Refugees, led by the UN’s office in Egypt and the Egyptian government will bring together authorities, the UN, development institutions, donors and others in a bid to “to enhance coordination, ensure better delivery and mobilize resources to realize long term, sustainable development gains for migrants, refugees, asylum seekers and their host communities,” the UN Refugee Authority said in a statement.

AROUND THE WORLD

Lebanon doesn’t want to become the region’s new Qatar: Beirut is taking unspecified steps to try to resolve its diplomatic spat with Saudi Arabia, Reuters reports. Lebanon’s Prime Minister Najib Mikati has reportedly agreed with President Michel Aoun on a “roadmap” to patch up the row, according to a Lebanese presidency Twitter post made on Thursday.

Spat? What spat? Comments made in August by Lebanese Information Minister George Kurdahi about the Saudi-led war in Yemen struck a sour note throughout the GCC last week, with Riyadh expelling Lebanon's ambassador, banning all imports from Lebanon, and recalling its envoy for consultations. Bahrain and Kuwait also kicked out Lebanese diplomatic staff, while the UAE recalled its own diplomatic staff from Beirut.

Economic consequences ahead: Saudi state-owned companies have halted operations with Lebanese companies and the Head of the Federation of Saudi Chambers Ajlan Al Ajlan called on all Saudi companies to stop all commercial and economic activities with Lebanon.

Sudan’s military dissolved the boards of the country’s national companies and agricultural projects on Friday, Reuters reported, citing state-owned media, in military chief Abdel Fattah Al Burhan’s latest move to consolidate army rule following the 25 October coup.

International pressure is ramping up: The UN’s human rights council on Friday condemned the takeover. The ouster also has France reconsidering a plan to cancel some USD 5 bn in debt owed by the country, a French foreign ministry spokesperson told reporters on Friday.

ON YOUR WAY OUT

Alexandria is 4 degrees away from becoming the ‘long lost city of’: During his COP26 speech last week, British PM Boris Johnson’s comments about how our beloved Alexandria is at risk of drowning due to climate change has caused a stir in the Egyptian Twittersphere, according to BBC Trending (watch, runtime: 4:13). One Twitter user asked why the PM singles out Alexandria when lower countries like the Netherlands are at greater risk of submersion, while another user criticized the summit, saying that officials say something different every year.

CORRECTION- In Thursday’s edition of EnterpriseAM, we incorrectly said that BeFit opened its first gym in Obour, when in fact its first gym was in Shebein El Koum. We’ve updated the story on our website to reflect this correction.

CALENDAR

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

31 October – 12 November (Sunday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

7-10 November (Sunday-Wednesday): Cairo ICT 2021, Egypt International Exhibition Center, New Cairo.

7-10 November (Sunday-Wednesday): TransMea 2021, Egypt International Exhibition Center, New Cairo.

8 November (Monday): Egypt CSR Forum, International Citystars, Cairo.

8-9 (Monday-Tuesday): US-Egypt Strategic Dialogue kicks off in Washington, DC.

11 November (Thursday): Deadline for Anghami SPAC merger.

15 November (Monday): Unvaccinated public sector workers won’t be allowed into their workplaces.

15-21 November (Monday-Sunday): Intra-African Trade Fair 2021, Durban, KwaZulu-Natal, South Africa.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

18-19 November (Thursday-Friday): British royal family members Prince Charles and the Duchess of Cornwall visit Cairo.

25 November (Thursday): Rameda Pharma’s annual general meeting (pdf), at which it will decide on the sale of a 5% stake in the company from an individual shareholder to an unnamed foreign institutional investor.

25-27 November (Thursday-Saturday): RiseUp Summit, Cairo, Egypt.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

30 November (Tuesday): Launch of open call by GIZ and KfW for green project proposals in Egypt as part of their Investing for Employment facility (pdf).

1 December (Wednesday): Unvaccinated members of the public will be banned from government buildings from this date; unvaccinated students will be prevented from accessing university campuses.

1 December (Wednesday): Government departments will begin moving to offices in the new capital.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2022: Launch of the Egyptian Commodities Exchange.

7 January 2022 (Friday): Coptic Christmas.

27 January 2022 (Tuesday): National holiday in observance of 25 January revolution anniversary / Police Day.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

1H2022: The World Economic Forum annual meeting, location TBD.

2 April 2022 (Saturday): First day of Ramadan (TBC).

22-24 April 2022 (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April 2022 (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April 2022 (Monday): Sham El Nessim.

25 April 2022 (Monday): Sinai Liberation Day.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

2 May 2022 (Monday): Eid El Fitr (TBC).

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

30 June 2022 (Thursday): June 30 Revolution Day, national holiday.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

30 July (Saturday): Islamic New Year.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.