- Clinical trials could start soon on Egypt’s first locally developed covid-19 vaccine. (Covid Watch)

- CBE leaves interest rates on hold. (Economy)

- Tender to manufacture tobacco could end Eastern Co’s decades-long monopoly, but would-be bidders have asks. (Competition Watch)

- Ebtikar now holds 80% of Bee + Rx Healthcare has a EGP 1 bn M&A pipeline. (M&A Watch)

- Turkey tells Ikhwani press to lay off Egypt in latest bid for reconciliation. (Politics)

- E-commerce platform zVendo closes six-figure USD investment in EFG EV-led round. (Startup Watch)

- Madbouly calls for effective GERD talks with int’l community’s participation. (Around the World)

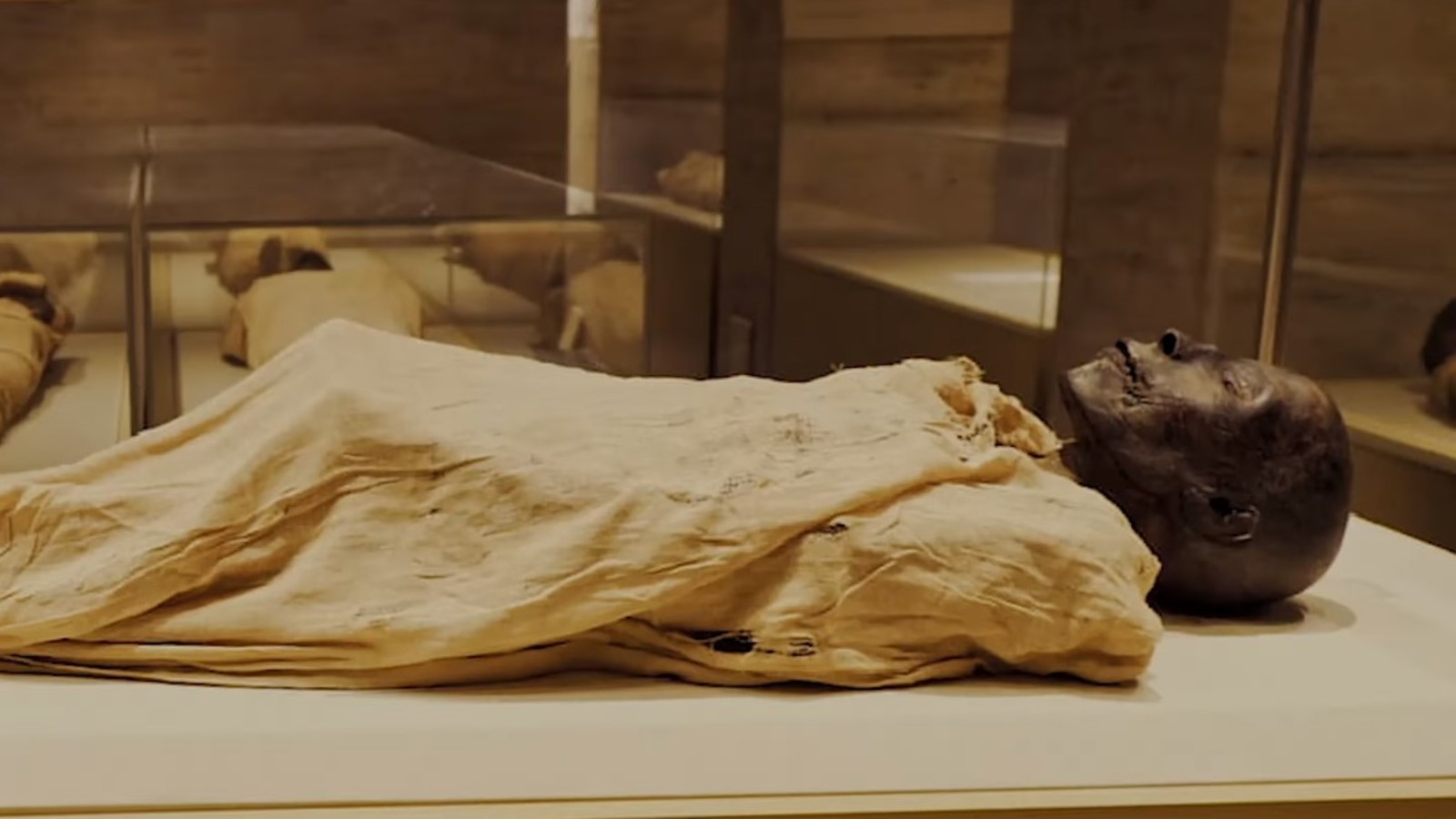

- Twenty-two mummies will be paraded to the National Museum of Egyptian Civilization in Fustat next month. (On Your Way Out)

- Planet Finance — BTC ownership could soon be on the menu for Morgan Stanley’s wealth management clients.

Sunday, 21 March 2021

Central bank leaves interest rates on hold

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to a new workweek — and the second day of Spring. The first quarter is over next week — and we have just 23 days until Ramadan.

THE BIG STORIES AT HOME- Egypt is one step closer to getting its own covid-19 vaccine out the door, after regulators signed off on the start of clinical trials for a jab developed by the National Research Center. And the central bank has left rates on hold. We have all the details in the news well, below.

THE BIG STORY INTERNATIONALLY- Only residents of Japan will be able to attend the delayed 2020 Tokyo Olympics and Paralympics this summer The move is part of a bid to contain the spread of covid-19, the organizers said in a statement yesterday. The organizers will refund the cost of 900k tickets snapped up by fans from outside Japan. CNBC has more. The Olympics, postponed by a year due to the pandemic, are now scheduled for 23 July to 8 August, and the Paralympics from 24 August to 5 September.

SIGNS OF THE TIMES for you to consider as this workweek gets underway:

- Egypt has tapped a former top congressional defense aide to help Cairo lobby policymakers in the US House and Senate. ForeignLobby.com has a full rundown on the hire, which is running through Brownstein Hyatt, Egypt’s lobby firm in DC (background here and here)

- China and the US had a “hostile encounter” at a sit-down in Alaska that saw top foreign policy officials on both sides trade recriminations. Two must-reads to get you up to speed on all the nuance are in the Economist and the New York Times.

- The US Securities and Exchange Commission is going to be tough on oil companies when it comes to climate issues, telling ConocoPhillips and Occidental that they need to hold shareholder votes on emissions targets, the Financial Times writes.

Thinking of a flexible WFH / work from the office policy? How are you going to cope with everyone wanting to work from home Sundays and Thursdays? How will you make sure folks still working from home feel included? And don’t get us started on whether you should have a mandatory vaccination policy. All of this and more is on the minds of corporate chieftains globally, the Wall Street Journal writes in Companies wrestle with hybrid work plans — awkward meetings and midweek crowding.

Goldman Sachs investment banking interns are getting plenty of attention for a deck they created (pdf) that says they’re working 105 hours a week, are sleeping five hours a night and routinely leave the office at 3am. The result? Their mental and physical health are cratering, they say in a presentation done in the style of a typical GS presentation, which concludes with a call for an 80-hour workweek.

PSA #1- Did you need us to tell you it’s warm out? Look for waves of dry, hot and dust-laden weather in the capital city and coastal areas continuing through Tuesday, before the mercury returns to a more seasonally appropriate range on Wednesday, the national weather service says. We’re looking at a daytime high of 36°C today, 35°C tomorrow and 32°C on Tuesday.

|

CIRCLE YOUR CALENDAR-

Talking sustainable manufacturing with BEBA: The British-Egyptian Business Association (BEBA) will host a virtual conference on how Egyptian and UK firms can work together on sustainable manufacturing projects in Africa in the post-Brexit environment on Tuesday, 23 March. Check out the agenda here (pdf).

The AUC’s Women on Boards Observatory will launch its 2020 annual monitoring report at an event on Tuesday, 23 March, with remarks from National Council for Women chief Maya Morsy, UN Women Egypt Office boss Christine Arab, and observatory founder Ghada Howaidy, among others. Check out the agenda here (pdf).

The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel this Tuesday 23 March, bringing together retail brands in Egypt and the region.

PSA #2- You have until 31 March to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

COVID WATCH

One step closer to an Egyptian covid jab

Clinical trials could start soon on Egypt’s first locally developed covid-19 vaccine after the jab got regulatory approval, Masaa DMC’s Ahmed Fayek said on Thursday (watch, runtime: 11:11). The vaccine — named Covi Vax — has already undergone lab and animal testing and is now moving onto the next step in the process, but will not be complete or available for at least six months, Fayek noted.

What we know about it so far: The two-dose jab will use inactive virus — the same technology used in standard vaccines for measles, mumps and rubella, as well as the Sinopharm covid-19 vaccine. Peer reviews of the vaccine indicate that it produces antibodies three weeks after administration, which remain active for 13 weeks, and was effective in preventing severe illness in the animals that were tested, and is 100% effective in preventing death.

It is unclear where the vaccines will be manufactured, but Health Minister Hala Zayed had said back in December that state-owned vaccine maker Vacsera had set up a production line to manufacture the Sinopharm jab here at home.

Speaking of Sinopharm: Our second gift shipment of 300k doses of the Chinese vaccine landed in Egypt in the early hours of Saturday, the Health Ministry said. The shipment brings the total number of Sinopharm doses Egypt has taken receipt of to 650k, including the first batch of 50k jabs we purchased in December and another 300k-dose batch Beijing gifted to us in February. We should have a total of 3 mn doses of the Sinopharm jab by the end of May, head of the Health Ministry’s preventive medicine department Alaa Eid told Hadith Al Kahera yesterday (watch, runtime: 13:28).

More vaccine shipments on the way, but the timeline is unclear: We should be getting another 1.5 mn vaccine doses by 30 March, followed by another 5.5 mn-dose shipment at the end of the first week of April, he said. Eid did not specify which vaccine he was referring to, but Zayed recently said that we should be taking receipt of the first 5 mn doses of an 8.6 mn shot order of AstraZeneca by March 30, which we’ve placed through the Gavi / Covax initiative.

As many as 250k people are eligible to be vaccinated in Egypt this week alone, Zayed said in a statement yesterday. Anyone living in Egypt who is 18 or older is now eligible and can register for the jab through the ministry’s website. The ministry has so far inoculated 25,500 individuals, Eid said.

The ministry could set up more vaccination centers to help speed up the process of administering jabs for everyone who has registered and alleviate some of the bottlenecks in the process, advisor to the minister Noha Assem told Kelma Akhira’s Lamees El Hadidi (watch, runtime: 14:22). Assem noted that part of the reason for the slow pace in vaccinating eligible individuals is incomplete data in the registration process.

Lamees called on the government to allow the private sector to import vaccines to help make the jabs more readily available for those who are willing to pay, pointing out that several companies want to inoculate their employees and that opening up this space would take some of the pressure off the Health Ministry (watch, runtime: 2:55).

The Health Ministry reported 644 new covid-19 infections yesterday, on par with 645 the day before. The ministry also reported 45 new deaths, bringing the country’s total death toll to 11,557. Egypt has now disclosed a total of 194,127 confirmed cases of covid-19.

European governments are set to resume the rollout of the Oxford-AstraZeneca vaccine after Europe’s pharma regulator on Thursday said the shot is “safe and effective” and not responsible for increasing the risk of blood clots, the BBC reports. Germany, France, Italy and Spain will all allow distribution to resume after last week suspending use of the vaccine after several batches were linked to blood clotting.

Egypt said it has no intention to halt the vaccine after receiving in January the first 50k doses of the 20 mn jabs the British firm will supply to Egypt (aside from the 40 mn we’re receiving from Gavi / Covax), the Wall Street Journal noted.

Meanwhile, Western “vaccine nationalism” is doing the world no favors:

US export controls are putting global vaccine production at risk, two of India’s biggest manufacturers have warned, the Financial Times reports. And the UK + EU are engaging in some post-Brexit vaccine-rattling: The EU has threatened to cut off exports of covid-19 vaccines to the UK amid delays in AstraZeneca vaccine deliveries that are causing what EU Commission head Ursula von der Leyen described as the “crisis of the century,” Reuters reports. Europe is aiming to vaccinate 70% of its adults by the end of summer, but has so far inoculated less than 10%, falling behind the US and UK as a third wave of the virus gathers pace.

But the US is looking to share the stock of vaccines it hasn’t approved for domestic use, saying on Thursday it will send 4 mn of its 7 mn-dose stockpile of AstraZeneca jabs to Mexico and Canada, according to a White House press briefing.

Pfizer wants to jack up the price of its jab when the emergency of the pandemic abates, Business Insider reports. Company execs told the Barclays Global Healthcare Conference last week that it is “increasingly likely” that governments will have to undertake mass vaccination every year but that there is “a significant opportunity” to raise prices when the virus shifts to an endemic state. People may also need a third jab to ensure immunity against new variants of the virus, they said.

ECONOMY

CBE leaves interest rates on hold

The Central Bank of Egypt’s (CBE) Monetary Policy Committee (MPC) decided to leave rates unchanged for a third consecutive time during its meeting on Thursday, accounting for the possibility of a further uptick of global commodity prices, the bank said in a statement (pdf). Overnight deposit and lending rates remain unchanged at 8.25% and 9.25% respectively, while main operation and discount rates remain at 8.75%.

The hold was expected by all 12 analysts we surveyed ahead of the meeting. They cited the possible impact of heightened commodity prices on domestic inflation and the potential for rising bond yields in the US to hit our all-important carry trade.

Holding rates is consistent with achieving the target inflation rate of 7% +/-2 by the end of next year, the CBE said in its statement. The country’s “leading indicators are gradually recovering to their pre-pandemic levels,” while “global economic and financial conditions are expected to remain accommodative and supportive of economic activity over the medium term,” despite a recent pickup in global bond yields.

The new highs recorded in global food and commodity prices including oil were a main driver of the CBE’s decision, EFG Hermes’ Head of Macro Mohamed Abu Basha and Beltone's head of research Alia Mamdouh told us, with the CBE expecting a possible pick up in the rate of inflation in the coming months. Annual urban inflation accelerated to 4.5% in February after a drop to 4.3% in January.

The seasonal increase in food prices accompanying Ramadan is likely to drive up inflation, Pharos’ head of research Radwa El Swaify told us. Over the second and third quarters of 2021, inflation will fluctuate between 5% and 7% on an annual basis, driven mainly by the base effect, she said. As for the full year, EFG Hermes’ Abu Basha forecasts inflation to average 6% amid expected increases in food and commodity prices, while Beltone’s Mamdouh sees inflation at an average of 7%, though it may cross this level if there is unexpected seasonality in prices or spending, he said.

But price growth could remain weaker until the end of the summer: Egypt is unlikely to see severe inflationary pressures due to increasing stockpiles of commodities to meet demand for eight months, said Mamdouh. Egypt said in January it had enough strategic wheat reserves for the next five months, sugar for the next eight months, and oil for the next four. This could change after the summer when the government has built up its stockpiles of key commodities, she said.

The carry trade remains attractive: Egypt’s real rates are still the highest in the world — and the country is in a better position to weather possible outflows than countries like Brazil and Turkey due to its positive growth rate in 2020, Abu Basha said, adding that Egypt has not witnessed outflows in the first two months of the year due to offering high real yields. Foreign holdings in local Egyptian debt hit its highest-ever level of USD 28.5 bn in February, reversing the 60% capital outflows prompted by covid-19 between March and May last year, Bloomberg notes.

Still, Egypt remains vulnerable to rising US treasury yields which threaten to tempt foreign investors away from emerging markets, El Swaify told us. Emerging-market bond funds saw their biggest outflows in almost a year earlier this month as investors lost their appetite for risk amid rising rates in the US while EM currencies are down 1% since February. “While portfolio flows and the pound have remained broadly stable in recent weeks, we believe Egypt is not immune to these developments,” said Goldman Sachs economist Farouk Soussa ahead of the meeting.

This is despite a raft of rate hikes in emerging markets last week: Russia, Brazil and Turkey all took action and hiked rates last week in what some are predicting to be the start of a tightening cycle to ward off stimulus-fueled inflation. Russia’s central bank unexpectedly increased rates for the first time since 2018 as inflation inches towards new five-year highs while Brazil went ahead with its first rate-hike in six years, raising them by 75 bps, higher than the 50 bps expected by economists.

And a reversal of the easing cycle could be in the cards if current trends accelerate: The CBE is in “wait-and-see” mode, but may raise interest rates if US treasury yields and commodity prices continue to rise at a rapid pace, according to Abu Basha. Meanwhile, Beltone’s Mamdouh notes that any higher rates are subject to global economic developments. Since 2018 the central bank has reduced its benchmark interest rate from 18.75%. It cut rates by a total of 400 bps last year, including an emergency 300-bps cut in March and two 50-bps cuts in September and November to support the economy through the pandemic.

SPEAKING OF TURKEY: President Recep Tayyip Erdogan sacked his third central bank governor since mid-2019. The move came two days after the central bank hiked rates a sharp 875 bps to 19% in a bid to stave off inflation. The new governor is a former MP from Erdogan’s AK Party who has publicly backed the president’s demand for lower rates. Reuters has more.

COMPETITION WATCH

Will Eastern’s monopoly go up in smoke?

Eastern Company’s tobacco monopoly could soon come to an end after the government put a license to manufacture regular and e-cigarettes up for grabs. Authorities have invited both companies with a local presence and new players to compete, the local press reported, citing government sources. Eastern — which has been the only licensed cigarette manufacturer for decades — would still own 24% of the company that will be set up by whoever gets the license, the report says. Big tobacco sellers aren’t too excited, it adds, and have formally asked the government to reconsider the tender’s terms.

The terms skew in Eastern’s favor: Besides owning 24% of the planned company, Eastern’s market share is unlikely to be affected thanks to a provision that would force the new company to sell any popular brands at a price 50% higher than Eastern.

Other conditions: The would-be manufacturer will need to fulfill a production quota of at least 15 bn cigarettes a year and have its factory, which has to have an annual production capacity of up to 50 bn cigarettes, up and running in no more than three years.

Eastern neither confirmed nor denied. The company doesn’t have “any official information regarding this decision [to issue the tender], and in the event of availability of official information or contacts, it will be dealt with, studied, and presented,” the EGX-listed company said in a regulatory filing (pdf). The company said it welcomes any prospect to “emphasize its ability to compete, expand, and raise operational profits,” and that it’s currently studying potential investments to “strengthen its position as leader in the field.”

The big four are less than overjoyed: Four major brand owners and distributors — JTI-Nakhla Tobacco, British American Tobacco Egypt, Imperial Tobacco, and Al Mansour International Distribution Company — that have been invited to bid have complained about the conditions asked the government to reconsider the terms, Reuters said, citing a letter to Prime Minister Moustafa Madbouly. The companies expressed concern that, because only one license is up for grabs, the winning company would gain an unfair advantage, and pointed out that the condition that limits rights to manufacture next-generation products including e-cigarettes and heated tobacco could create a new monopoly in the sub-sector.

Bidders have until 4 April to make an offer, as well as an initial EGP 30 mn deposit to the government (increasing to EGP 100 mn for any qualifying party). Authorities are due to start the formal selection process on 2 June. If the tender runs and wraps up under the current rules, no new manufacturers would be eligible for licenses for 10 years.

The status quo: Companies other than Eastern — which is 51% owned by the state’s Chemical Industries Holding — can only import and sell. This has been the case ever since the century-old company took over a nationalized industry to counteract the large influence of Greek immigrants in the sector before the 1952 Revolution. Now, Eastern holds a 70% market share with both products it owns and products it manufactures for global brand owners including Philip Morris International Japan Tobacco International. It’s the only licensed traditional cigarette manufacturer, but many other companies are allowed to produce “moassel,” the tobacco used in shisha (waterpipes).

M&A WATCH

Ebtikar now holds 80% of Bee + Rx Healthcare has a EGP 1 bn M&A pipeline

Ebtikar now holds 80% of Bee after acquiring an additional 20% stake in the company held by software services company Techno Beez. The EGP 40 mn transaction officially closed yesterday, Al Mal reports, citing unnamed sources. Ebtikar, which already held a 60% stake in Bee before the transaction, is now mulling a share swap with Techno Beez that would see the latter acquire a stake in Ebtikar, the sources said.

Background: Ebtikar’s acquisition follows Vodafone Egypt’s purchase of a 20% stake in each of Bee and Masary — both subsidiaries of Ebtikar — under the terms of an MoU between Vodafone and Ebtikar. Vodafone will acquire the stakes through a capital increase — a move that will open the door for Bee and Masary’s expansion in Africa. Ebtikar is a joint venture between B investments, BPE Partners and MM Group for Industry and International Trade.

OTHER M&A NEWS- EFG Hermes’ Rx Healthcare is either in talks over or due to wrap up EGP 1 bn worth of new acquisitions in the generic pharma and injectables industries, EFG said in its 2020 earnings release (pdf). The fund will look to expand its portfolio of pharma companies after having successfully closed an 80% stake purchase in manufacturer United Pharma in 2019.

POLITICS

Turkey tells Ikhwani press to lay off Egypt in latest bid for reconciliation

Turkish officials have told Ikhwani mouthpieces and other dissident media based in Turkey to tone down their criticism of Egypt, head of the Istanbul-based Al Sharq television station and former Egyptian MP Ayman Nour told Reuters, marking the country’s latest attempt to improve relations with Cairo. A member of staff at Al Sharq told the Associated Press the request was made during a meeting that also included broadcasters Mekameleen and Watan, on Thursday, in which all three channels were instructed to refrain from criticizing the Egyptian government so as not to affect ongoing talks. The officials said TV channels should not “attack” or “criticize” people and should practice objectivity.

Egypt’s pundits are happy: Information Minister Osama Heikal called the move a “good initiative” that would enable negotiations between Egypt and Turkey to move forward in an atmosphere more conducive to a positive outcome. Egyptian talkshows were silent on the issue last night.

The move is the latest in a series of olive branches offered by Ankara to Cairo in an apparent attempt to dial back tensions that have risen in recent months over gas exploration in the East Mediterranean and the conflict in Libya. Turkey suggested earlier this month that it could sign a maritime agreement with Egypt demarcating EastMed borders if relations improve, and Turkish Presidential spokesperson Ibrahim Kalin told Bloomberg Turkey hoped “a new page can be turned in [their] relationship with Egypt.”

But we’ll have to see whether this latest move is enough to curry Cairo’s favor: Despite Turkey’s keenness, Egyptian officials told MENA last week that the two countries had not resumed official diplomatic communication, and that Turkey should stop “meddling” in regional affairs.

Egypt and Turkey’s longstanding rift dates back to 2013 when Ankara backed the Ikhwan government Mohamed Morsi and grew even more tense last year, when Ankara refused to recognise an economic zone agreed between Egypt and Greece, and pressed ahead with its own gas surveys and naval exercises in disputed waters. Until the recent peace agreement, both countries were also backing opposite sides of the Libyan civil war, with Egypt supporting eastern Libyan forces and Turkey intervening on behalf of the western, Tripoli-based government.

The story is all over the foreign press: The Washington Post | VOA News | Haaretz | Arab News

ALSO IN DIPLOMACY-

Egypt and Saudi Arabia are pressing ahead with negotiations with Qatar following the end of a 3.5 year blockade, but Bahrain and the UAE seem to be dragging their feet, Reuters reports. Talks with the UAE have made little progress and Bahrain hasn’t yet arrived at the negotiating table, the newswire says.

But key differences remain: The quartet have demanded that Qatar rein in Al Jazeera and inflammatory social media accounts, as well as cut ties with the Muslim Brotherhood and move away from Iran, which Doha says it is unwilling to do. Egypt has reportedly asked for the extradition of a number of Brotherhood leaders from Qatar, though Qatari officials deny having received such a request.

What’s driving regional realignments? The increasingly close relationships between Arab states and Greece, Cyprus and Israel is being fueled partly by the common desire to curb Turkish and Iranian influence in the region, Seth J. Frantzman writes for Bloomberg.

STARTUP WATCH

zVendo closes six-figure USD investment from EFG EV, others

E-commerce platform zVendo has landed a six-figure USD investment in a funding round led by EFG EV Fintech and several undisclosed angel investors, according to Disrupt Africa. The Cairo-based startup operates a software-as-a-service platform that allows sellers to market their products online and access analytics, sales reports, and marketing tools. It recently expanded operations to support vendors across all industries and has recently launched in the UAE and Saudi Arabia, with plans to make further inroads internationally.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Aside from the latest on our vaccination program (see above), the Grand Ethiopian Renaissance Dam negotiations were at the top of the agenda for the talking heads last night.

Once Ethiopia moves ahead with the second filling of the dam’s reservoir in July, Egypt and Sudan will be forced into a position where Ethiopia has even more of an upper hand and will have the ability to impose whatever conditions it wants on its downstream neighbors, former Irrigation Minister Mohamed Nasr Allam told Kelma Akhira’s Lamees El Hadidi. Egypt’s water security won’t directly be affected by the second filling, particularly as the Aswan High Dam can cope with the influx of water from that phase, but the real danger is what this phase represents for us down the line (watch, runtime: 14:22).

Ethiopia is trying to use the GERD situation to position itself as an African power, African Affairs expert at Al Ahram Center for Political and Strategic Studies Amani El Tawil told Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 11:02). El Hekaya’s Amr Adib echoed El Tawil’s thoughts, saying that Ethiopia is taking a “selfish” approach to further its own interests (watch, runtime: 4:01).

The perspective from Sudan: Khartoum “doesn’t have any options” in the impasse with Ethiopia except for bringing in international mediators or resorting to an outright war, Sudanese pundit Shawky AbdelAzim told Lamees. Sudan’s position on the matter is also made more complicated because of the ongoing border dispute with Ethiopia, which AbdelAzim said Addis Ababa is “mixing” with the GERD issue. The ball is now in the international community’s court to interfere, after Ethiopia has “made it clear” that it has no desire to reach a binding agreement with Egypt and Sudan over the dam, he said (watch, runtime: 6:09).

EGYPT IN THE NEWS

Sanaa Seif’s prison sentence is still getting coverage in the foreign press this morning: The Times notes the activist and filmmaker’s 18-month sentence on charges of “disseminating false information” and defaming a public official.

Also making headlines:

- Port Fouad’s salt hills are reminiscent of Europe’s snowy mountains, making them a go-to destination for local holidaymakers. (CNN | Reuters)

- A call for spring breakers: Aswan is the world’s third sunniest city, coming in just behind Phoenix, Arizona. (Wall Street Journal)

ALSO ON OUR RADAR

Marakez has begun (pdf) construction of its mall in Mansoura, in which it will invest EGP 1 bn during the first phase.

Saipem is interested in taking part in the planned construction of Cairo Metro’s sixth line, which is expected to be led by US infrastructure giant Bechtel, the Transport Ministry said in a statement. The Italian contractor is currently bidding in the ministry’s tender to convert Alexandria’s Abu Qir railway into an underground metro, the statement said without providing further details.

Other things we’re keeping an eye on this morning:

- Tenders for four water desalination plant projects in El Hammam, El Quseir, Marsa Alam, and Safaga with a combined daily output capacity of 240 cbm will be launched shortly for private sector participation.

- Italian travel companies are looking to resume charter flights between Italy and some of Egypt’s tourist destinations, including Sharm El Sheikh, starting this summer.

- Telecom Egypt will establish a new fiber optic connection between the Red Sea and the Mediterranean under an agreement with the Suez Canal Authority and the Armed Forces’ Signal Corps.

- Car owners now only need to have owned their vehicles for two years to qualify for a replacement under the state’s natural gas transition plan, down from a minimum three years previously.

PLANET FINANCE

SIGN OF THE TIMES- Morgan Stanley’s wealth management clients could soon have access to three funds that enable BTC ownership, in a move that’s the first of its kind in the US, CNBC reported, citing unnamed sources in the know. The new funds grant BTC exposure to clients with “an aggressive risk tolerance,” who have a minimum of USD 2 mn-worth of assets held by the firm. Funds on offer include two from Galaxy Digital, and a third that’s a joint effort from NYDIG and FS Investments.

G7 backs plan to boost IMF support to poorer countries: G7 countries have agreed to bolster the IMF’s capital to provide post-covid relief to the developing world, the UK government — which is chairing the group this year — said in a statement following a meeting of G7 finance ministers on Friday. The plan, which will be tabled for final approval on the sidelines of the World Bank and IMF spring meetings next month, involves a “sizeable” new allocation of IMF special drawing rights, the fund’s reserve currency, the statement said, without disclosing further information. IMF Managing Director Kristalina Georgieva welcomed the news, saying that the meeting was “productive.”

As much as USD 650 bn in new SDRs is in the cards, say US sources familiar with the discussions. This would be just below the USD 679 bn bn threshold that would trigger a US congressional approval requirement, Reuters and the FT suggested. The move toward a new SDR allocation was backed by the Biden administration last month after having been opposed by Biden’s predecessor, Donald Trump. This is crucial because the US, as the IMF’s largest shareholder, has the right to veto new SDR rollouts. An SDRs allocation of this magnitude would be higher than the USD 500 bn originally proposed by the IMF earlier this year and the largest ever since USD 250 mn in new SDRs following the 2008-09 crisis.

Want more about SDRs and why they matter for EMs? We took a deeper dive into the story in our PM edition last week.

| EGX30 | 10,918 | -1.4% (YTD: +0.7%) | |

| USD (CBE) | Buy 15.65 | Sell 15.75 | |

| USD at CIB | Buy 15.65 | Sell 15.75 | |

| Interest rates CBE | 8.25% deposit | 9.25% lending | |

| Tadawul | 9,486 | -1.2% (YTD: +9.2%) | |

| ADX | 5,736 | -0.2% (YTD: +13.7%) | |

| DFM | 2,604 | +0.1% (YTD: +4.5%) | |

| S&P 500 | 3,913 | -0.1% (YTD: +4.2%) | |

| FTSE 100 | 6,709 | -1.1% (YTD: +3.8%) | |

| Brent crude | USD 64.53 | +2.0% | |

| Natural gas (Nymex) | USD 2.54 | +2.2% | |

| Gold | USD 1,743.90 | +0.5% | |

| BTC | USD 58,152.11 | -1.3% |

The EGX30 fell 1.4% on Thursday on turnover of EGP 1.0 bn (32.1% below the 90-day average). Local investors were net buyers. The index is up 0.7% YTD.

In the green: Export Development Bank (+1.2%), Sodic (+0.9%) and Elsewedy Electric (+0.6%).

In the red: Eastern Company (-9.9%), CI Capital (-9.5%) and MM Group (-4.4%).

AROUND THE WORLD

Egypt is “concerned” about the latest developments in the fraught negotiations over the Grand Ethiopian Renaissance Dam (GERD), Prime Minister Moustafa Madbouly said during the high-level meeting on water at the UN General Assembly on Thursday, two days after Ethiopia signaled readiness to return to the negotiating table — just not with international mediators. Madbouly called for effective negotiations sponsored by the African Union and an active participation from the international community to reach a binding agreement before the upcoming flood season. Egypt’s annual share of water is 560 cubic meters per person, well below the 1k cubic meter threshold for water scarcity, he noted.

The situation in Libya and the Grand Ethiopian Renaissance Dam were on the agenda for a phone call between President Abdel Fattah El Sisi and UK Prime Minister Boris Johnson, according to an Ittihadiya statement.

IN DIPLOMACY: Egypt and the US’ defense relationship is “critical” to the security of the Middle East, Centcom Strategy, Plans and Policy Director Major General Scott Benedict said during a three day visit to Egypt which concluded Friday, according to a US embassy statement. Benedict’s visit came during joint naval exercises in the Red Sea and a month after the US signed off on a USD 197 mn arms sale last month, despite a rhetorical escalation from the Biden administration over Egypt’s human rights record.

Also worth knowing this morning:

- Houthi rebels attacked Saudi Arabia’s Aramco refinery on Friday, the latest escalation in the group’s attempts to damage the kingdom’s energy infrastructure, Bloomberg reports.

- The UAE and Israel are having their first diplomatic rift since normalizing relations last year, with Emirati officials limiting formal contact with their Israeli counterparts and canceling a bilateral summit over Benjamin Netanyahu’s use of the Gulf state in his ongoing election campaign, the Times of Israel and the FT report.

ON YOUR WAY OUT

Twenty-two mummies will make their way to their new home in the National Museum of Egyptian Civilization in Fustat in a parade on 3 April, the Tourism Ministry said in a statement. This won’t be the first instance of a deceased Egyptian royal parading through Cairo: The transportation of the colossal statue of Ramses II from Ramses square to be displayed in the Egyptian Museum in 2006 drew large crowds.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

23 March (Tuesday): The British-Egyptian Business Association (BEBA) virtual conference on sustainable manufacturing in Africa.

23 March (Tuesday): AUC Women on Boards Observatory event to launch 2020 annual monitoring report.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

31 March (Wednesday): Income tax deadline for individuals. Real estate tax deadline.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

6 April (Tuesday): French Chamber of Commerce and Industry in Egypt working breakfast with Sovereign Fund of Egypt CEO Ayman Soliman.

7 April (Wednesday): British-Egyptian Business Association (BEBA) webinar on digital banking and fintech.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.