- Ezdehar targets USD 100 mn first close for its next SME fund by mid-year, eyes potential impact fund. (Investment Watch)

- Covid has been a boon for Egypt’s startups, but we need regulatory overhauls to bring in more investment. (Startup Watch)

- The Damietta LNG plant is on track to finally come out of its eight-year slumber next week. (Energy)

- More natgas buses are a-comin’. (Green Economy)

- Another four companies signed gold exploration contracts worth a combined USD 11 mn. (Mining)

- Is family planning going to be regulated by law? (Legislation Watch)

- Catch up from Enterprise PM: The healthcare sector is still red-hot + OIH, OFH shares overshoot as they hit the EGX again. (What We’re Tracking Today)

- My WFH Routine: Catesby Langer-Paget, head of Savills Egypt.

- Planet Finance: Egypt could see (even more of) a swell of inflows debt investors as EMs heat up.

Thursday, 18 February 2021

SMEs and startups are getting plenty of love + lots of natgas news

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, nice people. We’ve made it through another workweek together.

THE BIG STORY here at home on this fine Thursday: What are the big investment stories in Egypt right now? Healthcare, education and infrastructure? Absolutely. But we’d add to that the quiet revolution in funding for SMEs and startups. Emad Barsoum tells us this morning that his Ezdehar is aiming for first close by mid-year on its next USD 180-200 mn SME fund — and is looking at raising an impact investing fund. Blue-chip limited partners are already on board. Meanwhile, last night’s Columbia webinar on venture capital and entrepreneurism in Egypt points out that as fast as our VC industry has grown, we have plenty of room left to run — and in which to innovate. We have chapter and verse on both stories in this morning’s news well.

*** CATCH UP QUICK- The top stories from yesterday’s edition of EnterprisePM:

- There appears to be a bidding war in the red-hot healthcare sector, with Tawasol Holdings seeking full ownership of Alexandria Medical Services, in which it already owns a 25.92% stake.

- Mitsubishi Motors is reportedly planning to start assembling cars in Egypt using a Nissan-owned plant.

- Orascom Investment Holding was overbought and Orascom Financial Holding was oversold as their shares resumed trading after their horizontal demerger.

NICE NEWS on which to end the week: Egypt had the third-fastest rate of improvement in digital inclusion last year, rising two spots to 50 (from 52 in 2017) in management consultancy Roland Berger’s Digital Inclusion Index (pdf). Our score jumped eight points thanks to “significant infrastructure improvements in mobile data availability and coverage,” the report says. The two top improvers were Myanmar and Vietnam.

CLARIFICATION on a story we picked up on Tuesday afternoon: The former owners of Adwia Pharma are getting into toll manufacturing, not fully re-entering the market, as we reported. A toll manufacturer typically takes in raw material or semi-finished goods from a third party and uses its facilities to make a product on contract. Toll manufacturers typically do not make own-brand products, engage in sales and marketing, or carry out research and development. An industry source tells us that Dawana is 18 months or more out from obtaining licenses and starting production. The story has been updated on our website.

THE BIG STORY ABROAD this morning: “Facebook has defied Australia’s push to make Big Tech pay for news by banning the sharing of content on its platform in the country, the most far-reaching restrictions it has ever placed on publishers in any part of the world,” the Financial Times reports. Reuters is also leading with the story, while the Wall Street Journal trumpets that the economic recovery is broadening in the US as retail spending rebounds. Meanwhile, mns are still without power as another winter storm sweeps into parts of the US. France’s Figaro, meanwhile, notes that Biden is pursuing “iron fist” diplomacy toward Beijing in a clear break with his predecessor.

PSA- The weather is looking much better today after heavy winds died down overnight. It’s chilly out there right now and the most we can hope for is a daytime high of 15°C. With largely cloudy skies in the afternoon, it’s going to feel a bit colder, our favorite weather app suggests.

|

WATCH THIS SPACE- Saudi Arabia could be getting in on GERD talks in the near future with a special summit bringing together the eight nations of the Red Sea Council — of which Egypt and Sudan are members — to discuss the issue of the dam. The announcement came from African Affairs Minister (and Saudi’s former ambassador to Egypt) Ahmed Abdul-Aziz Al-Qattan after a meeting with Sudanese Prime Minister Abdalla Hamdok, although Al-Qattan did not specify when the summit might take place, according to Sky News Arabia. Our trilateral talks with Sudan and Ethiopia last month failed to make any headway and ended without an agreement on how to proceed with discussions.

CIRCLE YOUR CALENDAR-

HAPPENING TODAY- Join a discussion on how to get innovation out of labs and into the hands of businesses just like yours. The Zoom webinar runs today starting at 1pm and will include a dive into the incentives business needs to establish joint ventures with universities to commercialize research. The talk is being organized by the USAID-funded Sustainable Services Activity for MSMEs in collaboration with the Academy of Scientific Research and Technology (ASRT) at the Higher Education Ministry. Sign up here.

ESG investing for Egyptian businesses: AmCham is hosting a webinar on investing for social and environmental impact next Monday, 22 February. Guest speakers include Qalaa Holdings’ Chief Sustainability and Marketing Officer Ghada Hammouda, Catalyst Partners co-founder Abdelaziz Abdel Nabi, executive advisor to the chairman of Egyptian Arab Land Bank Hanaa Al Hilaly, and Investia Capital Group Chairman Samir Al Alayli.

Madbouly to chat with the business community. AmCham and the Egypt-US Business Council will host a webinar headlined "Egypt: 2021 and Beyond" next Thursday, 25 February. The original date was today. Guest speaker Prime Minister Moustafa Madbouly will talk about Egypt’s strategy to mitigate the effects of the global downturn as well as the country’s future plans to maintain economic growth.

The second edition of the Egypt International Art Fair will be held from 26-28 February, and will showcase the work of 120 regional artists at Dusit Thani Lakeview.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

INVESTMENT WATCH

Ezdehar targets USD 100 mn first close for its next SME fund by mid-year, mulls separate impact investing vehicle

Private equity firm Ezdehar is targeting a first close of USD 100 mn on its second fund by the middle of 2021, founder and Managing Director Emad Barsoum tells Enterprise. A second and final close of the fund — dubbed Ezdehar Egypt Mid-Cap Fund II — will come before the end of the year, raising USD 80-100 mn, he said. The company previously planned to reach first close on the midcap-focused fund in late 2020, but like everything else in the world was delayed due to covid-19.

Blue-chip investors are already in: Barsoum confirmed that the European Bank for Reconstruction and Development, the European Investment Bank, the Sawiris family’s Gemini Holding, the UK's CDC and the Netherlands’ FMO have all committed capital to the fund. Negotiations are ongoing with the International Finance Corporation and the Egyptian American Enterprise Fund.

What does Ezdehar have appetite for? The new fund will focus on manufacturing, pharma, healthcare, consumer goods, F&B and education, Barsoum told us. He told the local press last year that the new vehicle will mainly target Egypt-based companies with single-transaction ticket sizes of USD 10-30 mn.

A third fund in the pipeline? The firm is presently looking at the potential launch of an impact investing fund later this year or next, he told us. Impact investing is when the folks committing capital do so in the expectation that their investment will have a positive environmental and social impact at the same time as it generates a financial return. (Want more? Go have a look at the Global Impact Investing Network’s page here.)

Ezdehar will exit two high-growth companies this year as it nears the end of its five-year holding period, Barsoum confirmed, without providing further details. The subsidiaries are delivering annual top line growth of 30-40% per year, the local press reported yesterday. The company said last October that it was moving towards exiting from three investments and went on to sell its full 22.5% stake in loyalty services provider Dsquares to Lorax Capital Partners.

Background: The company launched its first USD 100 mn investment vehicle, Ezdehar Mid-Cap Fund I, in 2016 to invest in mid-cap companies. Its portfolio is online here.

IN OTHER INVESTMENT NEWS-

Elsewedy Electric is interested in investing in Pakistan and is sending a team there to kick the tires on potential transactions, CEO Ahmed El Sewedy told Pakistan’s Foreign Minister Shah Mahmood Qureshi during a visit to Cairo earlier this week, according to a statement. Qureshi met with a group of Egyptian investors yesterday to discuss potential openings for Egyptian firms in the Pakistani energy, construction, pharma, tourism, IT and logistics sectors.

STARTUP WATCH

Egypt’s startups got a covid boost

Covid has been a boon for Egypt’s startups, but there’s still much to be done by way of legislative and regulatory changes to bring in more investment. That was the key takeaway from a webinar on entrepreneurship and venture capital in MENA, hosted by the Columbia Entrepreneurs Organization.

Tech startups in particular have been having their day in the sun over the past year, with the pandemic pushing them “out of their comfort zones” to come up with innovative services and solutions when other businesses were faced with covid-related limitations, HOF Capital Managing Partner Onsi Naguib Sawiris said. This innovation push helped young businesses to better position themselves for investment from the local and regional venture capital market, Sawiris said.

The numbers don’t lie: Our super-high-tech internal trackers tell us that fintech and e-commerce startups accounted for the lion’s share of VC investment landed by startups last year (by volume, at least), with 12 and 11 transactions apiece. And tech-related firms together accounted for another six investments, putting the tech space as a whole way ahead of other sectors. Overall, our data suggests that Egyptian startups raised substantially more in 2020 than they did the year before: USD 100 mn, compared to over USD 88 mn in 2019, with the average transaction being about 2x larger than the previous year.

And while we’re on the topic of innovation, a word of advice for budding entrepreneurs: Don’t blindly mirror a business that found success in a western market. Startups are most successful when they cater to specific local or regional needs and have a deep understanding of our neck of the woods, AUC Venture Lab founder and director Ayman Ismail said.

With a “hot venture capital market and strong talent,” we have the market fundamentals. But there’s a catch, says Global Ventures Managing Director Amal Enan: Startups need to navigate a maze of regulatory unknowns, which are challenging enough for more established businesses. “You need to get your hands dirty to do it right,” she says. Reworking Egypt’s legislative and regulatory landscape for startups and venture capital funding would go a long way in putting Egypt ahead of the rest of the region in terms of attracting investments, Sawiris says.

Even though it is picking up steam in Egypt, we don’t have a “sophisticated” venture capital market, says AAF Management General Partner and CFO Omar Darwazah. In a more advanced VC market, we would see more corporate venture capital (outfits like CIB’s CVentures), angel investors, pre-IPO investors, and fewer seed accelerators or incubators. Egypt isn’t at that stage yet in large part because of an ambiguous regulatory environment, Darwazah said.

ENERGY

Wakey, wakey

The Damietta LNG plant is on track to finally come out of its eight-year slumber next week: The terminal will export a 150-160k cbm shipment of natural gas during the final week of February, Youm7 reports, citing an oil industry source. The source confirms the timeline laid out last month from Oil Minister Tarek El Molla, who had said that the plant will process some 4.5 mn tonnes of natural gas per year once it goes live. The plant’s first test shipment was scheduled to go out earlier this week, S&P Global had said.

The shipment going out next week will be the plant’s first commercial-scale delivery since late 2012, when it was idled after the government redirected its gas supply to the local market. Operator Eni last year reached an agreement with the government and its former partner Naturgy to settle the eight-year dispute, paving the way for the reopening of the facility.

It comes at a good time: Global demand for natural gas is beginning to pick up following a collapse in prices year caused the covid-19 pandemic, driven by rising demand as the world transitions from oil and coal to cleaner energy including solar, wind and natural gas. Qatar got ink on this subject yesterday, with Bloomberg reporting that the country is committing to an ambitious investment program to make sure that it remains “the world’s biggest producer of liquefied natural gas for at least the next two decades.” Egypt only exported a couple of shipments between March and October as lockdowns around the world caused demand to tank.

ALSO FROM THE WORLD OF ENERGY-

- Siemens Energy and Turboden have begun (pdf) constructing a “first-of-its-kind” high-efficiency gas compressor station at a facility belonging to state-owned natural gas operator GASCO in Dahshour.

- TechnipFMC will carry out work on four subsea wells and install a subsea tie-back to a processing plant for Energean / EGPC’s Abu Qir joint venture, Energean said in a press release (pdf).

GREEN ECONOMY

More natgas buses are a-comin’

IT systems provider Select International is looking to work with an unnamed Chinese partner to manufacture and assemble natural gas-powered buses in Egypt next year, Select International President Shady Samir told reporters yesterday, according to Masrawy. The companies appear to be planning to set up a joint venture with the government, in which the government would hold a 60% stake, Samir said without providing further details.

Is the mystery company Brilliance Auto? The Chinese company was reportedly in talks about participating in Egypt’s natural gas conversion scheme late last year. Other candidates include China’s Foton and Jinbei, who are also expected to begin locally assembling natgas vehicles in 2021, Khaled Saad, the secretary-general of the Egyptian Association of Automobile Manufacturers, told Enterprise in December.

Background: The government is in talks with nine companies to locally produce 12 models of natgas cars, microbuses, and taxis, Trade Minister Nevine Gamea said last month. Toyota struck an agreement with the Arab Organization for Industrialization in 2019 to manufacture 240k nat-gas minibuses, and agreed this year to convert its entire 100k microbus fleet in Egypt to nat-gas in the coming four to six years. The government has been rolling out an ambitious multi-year natural gas transition plan, which kicked off at the start of the year.

MINING

Signed, sealed, and delivered

Another four mining companies signed yesterday 10 new gold exploration contracts worth a combined USD 11 mn with the Oil Ministry, after being awarded concessions in the Eastern Desert in a tender issued last year, according to a ministry statement. Yesterday’s contracts bring the grand total to 15, after the ministry had previously signed five agreements worth USD 13 mn.

Who now has keys to their concessions? Naguib Sawiris-backed Akh Gold signed contracts to explore nine concessions worth USD 4.1 mn, Red Sea Resources was awarded five concessions worth USD 5.5 mn, the North Africa Mining and Petroleum Company (NAMC) landed two concessions worth USD 1 mn, and Al Abadi Mining received one concession worth USD 636k.

Who’s already inked a contract? Canadian miner Lotus Gold and local firms Mining and Manufacturing Company (MEDAF) and Ebdaa Gold Mining inked their agreements last month.

Who’s still left: Canada’s Barrick Gold and B2Gold, British firm SRK, and Australian gold miner and Sukkari operator Centamin also received exploration awards from the tender, but have yet to sign their contracts.

With the exploration sale now closed, Naguib was the latest to pile on praise for the amended Mineral Resources Act passed in 2019, saying the changes gave local and international firms a significant push to participate in the latest bid round, the statement notes. Launched last year, the tender was the first of its kind since the amendments became the law of the land. The new legislation — which met with praise from industry leaders — gives investors more favorable terms, including doing away with production sharing agreements and introducing a more attractive model. Bloomberg also took note of Naguib’s nice words.

LOOKING AHEAD- Bidders in the second round of the gold exploration tender now have an extra two months to submit their paperwork, after the Egyptian Mineral Resources Authority extended the deadline to 15 May from 15 March previously. The extension is meant to allow investors more time to submit bids, Reuters reports. The tender was issued in November.

LEGISLATION WATCH

Are we about to take family planning notes from China?

Family planning could become law: A draft law to address Egypt’s overpopulation problem by enforcing family planning could be on the House of Representatives’ agenda soon, Rep. Rania El Gazayerli said (watch, runtime: 6:09). The MP didn’t delve into the details of what the legislation would entail, but did note that religious institutions such as Al Azhar and Dar Al Iftaa would weigh in on the legislation to ensure it meshes with religious norms. We’re guessing the legislation won’t be met with much opposition from Dar Al Iftaa, which started a hashtag campaign yesterday declaring family planning is permissible.

The legislative proposal comes after President Abdel Fattah El Sisi touched on the importance of family planning and birth control twice this month, most recently during the inauguration of the Ismailia Integrated Healthcare Complex this week. The president had said earlier this month, however, that the government isn’t looking to introduce “aggressive” measures to push family planning on the population. The Social Solidarity Ministry’s “Two is Enough” program — launched in 2018 — is hoped to bring down the birthrate to 2.4 children on average per woman by 2030.

CABINET WATCH

Of peddlers and a syndicate for tech bros…

Egypt to criminalize peddling: Unlicensed vendors who sell goods on trains and in stations would face prison sentences of 1-2 years or fines of EGP 1-10k under a draft law approved by cabinet in its weekly meeting yesterday. The bill will make its way to the House of Representatives for approval.

A new syndicate for tech bros: Cabinet separately greenlit a bill to set up a labor syndicate for ICT professionals, it said following the meeting. The body would take part in developing curricula and training programs to help keep university education up to pace with domestic and global labor market trends, cabinet noted.

Also approved yesterday: A decision to place some healthcare facilities in Ismaila and Luxor under the supervision of the General Authority for Healthcare (GAH), which was also put in charge of renovating state hospitals as Egypt gradually rolls out the universal healthcare scheme. Under the decision, GAH needs to overhaul the facilities within three years of this week’s rollout of the scheme on a trial basis in both governorates. The universal healthcare scheme, first piloted in Port Said in July 2019, will also see the state contract out the delivery of healthcare services to private sector hospitals.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

It was a somewhat insipid night on the airwaves last night, with no single story leading the conversation.

The Real Estate Registry Act is coming into effect as of 6 March. As of that date, citizens will need to get their sale and purchase agreements validated by their local ma’moreya before registering their property at a real estate registry office, spokesperson of the Real Estate Registry Club Ashraf Fleifel told Yahduth fi Misr’s Sherif Amer (watch, runtime: 3:42). The law has been in the works since early 2020, when former House Speaker Ali Abdel Aal hounded the government to better regulate the offices and expedite registry procedures.

Covid-19 vaccine distribution and shoring up healthcare infrastructure across Africa were key talking points during an African Union meeting President Abdel Fattah El Sisi attended alongside France’s Emmanuel Macron, Al Hayah Al Youm’s Mohamed Sherdy noted (watch, runtime: 2:00).

Also on the airwaves last night:

- The US State Department’s approval of an arms sale to Egypt confirms our standing as a strategic ally in the Middle East, pundit Khaled Okasha said. (Mohamed Sherdy on Al Hayah Al Youm | watch, runtime: 4:24)

- The Arish Port is now up and running after undergoing upgrades as part of a plan to develop several ports in Egypt, Suez Canal Authority boss Yehia Zaki said. (Mohamed Sherdy on Al Hayah Al Youm | watch, runtime: 8:53)

EGYPT IN THE NEWS

Human rights is on the international press’ agenda for the second day running: The Wall Street Journal is running an opinion piece by a human rights lawyer calling on the Biden administration to ramp up pressure on Egypt in response to our treatment of US citizens. A suspension of aid, targeted sanctions and visa restrictions are all on Jared Genser’s list of ideas. The piece comes after relatives of Egyptian-American activist Mohamed Soltan, whose father was a senior Ikhwan official, were reportedly detained this week by authorities.

The Middle East is still (mostly) getting the “silent treatment” from Biden: The FT’s David Gardner points out that we’re with Saudi Arabia on the list of Mideast countries that have yet to get calls from the Biden White House. Israeli leader Benjamin Netanyahu only received his call yesterday, Reuters reports, after much speculation that the delay could point to Israel’s fall from grace following the end of the Trump administration.

Also making the international press:

- Regional diplomacy: Egypt will likely reach across the aisle and attempt to mend ties to forces in western Libya after its preferred candidates Aguila Saleh and Fathi Bashagha weren’t appointed to the country’s newly-formed transitional authority. (Arab Weekly)

- FGM: An Egyptian woman who survived FGM and a plastic surgeon dedicated to helping victims talk about the outlawed practice. (France24)

- Ancient Egypt: Ancient Egyptian ruler Seqenenre Taa II may have been killed in a ritual execution ceremony after being captured in battle, a new study relying on CT scans and x-ray imaging of his mummified corpse suggests. (The Guardian | Live Science | Daily Mail)

ALSO ON OUR RADAR

Other stories we’re keeping an eye on this morning:

- US web hosting company GoDaddy is partnering with Startups Without Borders to train some 500 entrepreneurs in the MENA region on how to use its services to take their businesses online, the company said in a statement (pdf) on Tuesday.

- UAE budget airliner Air Arabia will launch two weekly flights between Sharjah and Luxor starting 23 February.

- Elsewedy Electric has signed (pdf) a KWD 16.1 mn agreement with Kuwait to supply and install 400 kV overhead lines at the Gulf country’s Boubyan electric transmission station.

- Emirates NBD Egypt yesterday launched its online SMARTtrade platform which allows companies to submit trade finance requests, file accompanying documents, and complete trade finance transactions.

- The Egyptian Exporters Association will run four new rounds of its export incubation program along with the Trade Ministry’s Foreign Trade Training Center from March to November.

COVID WATCH

Supply chain problems are slowing down vaccines everywhere

The Health Ministry reported 618 new covid-19 infections yesterday, down from 633 the day before. The ministry also reported 49 new deaths, bringing the country’s total death toll to 10,150. Egypt has now disclosed a total of 175,677 confirmed cases of covid-19.

Kuwait’s central bank has reportedly decided to extend its virus relief program until June 2021, after originally scheduling the program to end in 2020, Bloomberg reports. Kuwait follows Saudi Arabia, Bahrain, and the UAE in extending its stimulus measures following the combined economic pressures of covid-19 and lower oil prices that have left Gulf economies reeling.

Japan is trying to get the 2021 Olympic games back on track: Japan kicked off its covid-19 inoculation drive and administered the first shots of the Pfizer-BioNTech vaccine to 40k Tokyo hospital workers, Prime Minister Yoshihide Suga said at a presser yesterday.

Global vaccine roadblocks, thanks to supply chain issues: Russia’s outsourcing of the production of its Sputnik V vaccine to countries like India, Brazil, and South Korea due to its limited manufacturing capacity means it is likely to face supply chain hurdles that could undermine its output, the Financial Times reports. Meanwhile, vaccine rollouts could be significantly delayed as a result of a shortage of sterile bioreactor liners — effectively giant plastic bags — which are used to mix the ingredients to make covid-19 vaccines, the salmon-colored newspaper reports. German supplier MilliporeSigma has been unable to keep up with soaring demand.

PLANET FINANCE

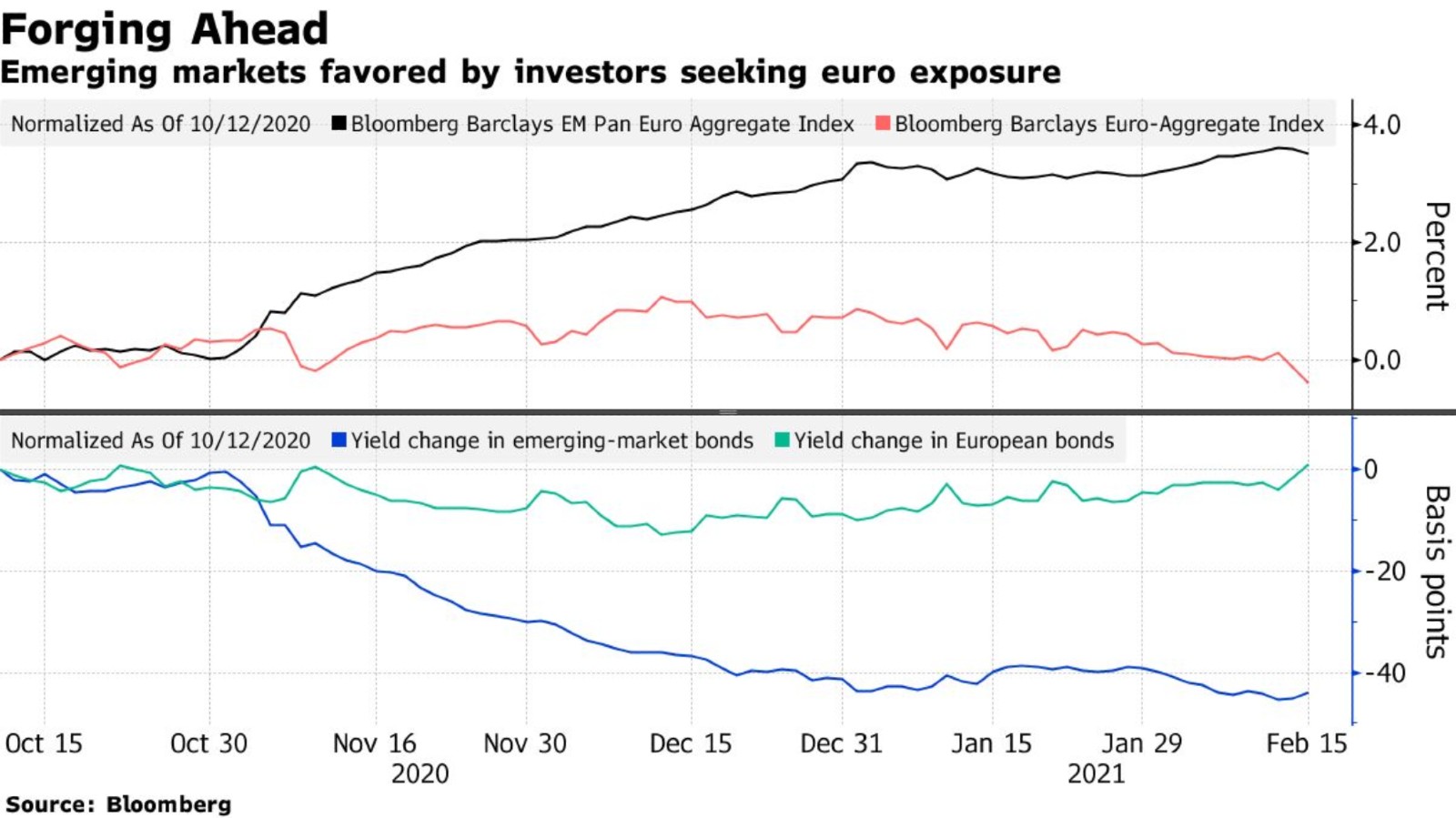

Egypt to see a swell of inflows from eurobond traders? Emerging markets are becoming a “sweet spot” for eurobond investors amid negative yields in Europe and concerns about incoming inflation, Bloomberg reported. Inflows into EM bonds have pushed their yield to a 27-month low relative to Europe, suggesting that investors are turning to higher-yielding debt in anticipation of an uptick in inflation. Egypt is already setting the tone for the asset class, with the issuance of USD 3.75 bn of eurobonds in a sale that was c. 4x oversubscribed earlier this month.

And while we’re on the topic of debt: Global debt reached a record USD 281 tn at the end of 2020 as governments and individuals around the world borrowed nearly USD 24 tn to offset the economic effects of covid-19. The borrowing spree has already pushed debt to almost 355% of global GDP, but shows no signs of abating as governments are set to continue borrowing a further USD 10 tn by the end of this year to support stimulus measures, according to Bloomberg.

Emerging markets funds’ focus on ESG is “paramount” in the upcoming five years, International Investment quoted John Malloy, co-head of emerging and frontier markets at RWC Partners.

Saudi Arabia could reverse its oil output cuts as of April after agreeing to slash its daily output by 1 mn bbl in February and March in an attempt to buoy prices, the Wall Street Journal reports. Oil prices dropped on the news ahead of the OPEC+ meeting next month, when the kingdom is expected to announce its plans, after staging a recovery in recent months on hopes of a successful vaccine rollout.

|

|

EGX30 |

11,413 |

-1.1% (YTD: +5.2%) |

|

|

USD (CBE) |

Buy 15.59 |

Sell 15.69 |

|

|

USD at CIB |

Buy 15.59 |

Sell 15.69 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

9,084 |

-0.2% (YTD: +4.5%) |

|

|

ADX |

5,636 |

-0.5% (YTD: +11.7%) |

|

|

DFM |

2,595 |

-0.6% (YTD: +4.1%) |

|

|

S&P 500 |

3,931 |

– (YTD: +4.7%) |

|

|

FTSE 100 |

6,711 |

-0.6% (YTD: +3.9%) |

|

|

Brent crude |

USD 65.25 |

+1.4% |

|

|

Natural gas (Nymex) |

USD 3.27 |

+1.7% |

|

|

Gold |

USD 1,777.30 |

+0.3% |

|

|

BTC |

USD 52,179.97 |

+5.8% |

The EGX30 fell 1.1% yesterday on turnover of EGP 1.4 bn (3% below the 90-day average). Foreign investors were net buyers. The index is up 5.24% YTD.

In the green: Orascom Investment Holding (+51.5%), CI Capital (+0.9%) and Sodic (+0.6%).

In the red: Orascom Financial Holding (-15.5%), Pioneers Holding (-3.3%) and MM Group (-2.5%).

Asian markets are mixed this morning, with the Nikkei and Shanghai in the green and the Kospi and Hong Kong’s Hang Seng in the red. Futures suggest the Down and S&P will open in the green, while the tech-heavy Nasdaq is trending toward red at dispatch time. We’re also looking at a mixed open in Europe this morning.

MY MORNING ROUTINE

Catesby Langer-Paget, head of Savills Egypt: My Morning / WFH Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Catesby Langer-Paget (LinkedIn). Edited excerpts from our conversation:

I’m Catesby Langer-Paget and I head up the Egypt office of Savills. I first started working for the company in 2007. I started in the UK, and then moved to the UAE in October 2008 — just in time to watch the recession taking hold and see property prices in Dubai nosedive by 30-40% in the space of a few weeks. After the UAE, I followed my previous boss to Bahrain, where I met my wife — who is half Bahraini, half American — and spent the better part of seven years there before moving back to the UK.

My wife and I missed the Middle East, so we moved back to Bahrain, which is when the chance came up for me to start up the Egypt office of Savills. So, Egypt is now the fourth country I’ve lived in while working for the company, and since moving here, we have never looked back.

That was two years ago. There was one employee here when I started, and now we’re just past the 50 mark, and should be up to about 70 by mid-year. We started with a small office in Maadi and now we’ve moved into a new office in Sheikh Zayed and are planning to open another office in New Cairo this year.

Savills is one of the five largest real estate consultancies in the world, with 600 offices globally. As head of the Egypt office, I oversee all of our service lines, including property and facilities management, strategic consultancy, marketing, sales, and leasing. That's on both commercial and residential, and also project management, which is overseeing construction work.

I've got three young kids aged between one and six and, and they're early risers. So I'm lucky if I'm not up before 6am, to be honest. My wife's quite a keen runner, so she generally leaves me in the morning and goes for a long run, while I'm in charge of getting the kids ready and making breakfast.

Then it’s a quick check at emails, which obviously includes reading Enterprise to see what’s going on in Egypt. Then we put the kids on the bus at around 7:40am and I head straight to the office. If I’m working from Maadi — which is usually twice a week — I’ll be in the office by 8am since it’s a five-minute walk from my house. The drive to Sheikh Zayed is longer, so I’ll usually be in by 8:45.

My days at the office don’t follow a set schedule, but there are a lot of meetings — online and in-person — with clients, prospective clients and typically an interview or two since we are on a hiring spree at the moment. I normally finish work around 5pm and can usually catch my kids before they go to bed if I’m in the Maadi office, but probably not if I’ve been working from Sheikh Zayed.

Our job is generally difficult to do from home, so we’ve been working from the office but we’re lucky to have moved to a new office and a lot of us are often on site, so our staff is dotted around in a few different locations. We obviously have precautions in place and we make concessions for employees who are, or live with, high-risk individuals. That being said, I have a lot more online meetings with clients, which has really cut down on the amount of time I’ve wasted travelling to in-person meetings. Before covid, I typically had three meetings outside the office every single day.

We have big ambitions to grow the business but when covid struck we just paused for a little bit before really going for it again after last summer. The team actually did amazingly well. We have a great leadership team in place with lots of people stepping up. All the Savills offices globally are also a lot more joined up now and we are all learning from each other’s experiences.

The most difficult part of WFH is employing and onboarding people, and imparting the company culture on them. It was a little bit challenging bringing on new employees, teaching them what they need to know, and getting the teams to properly cross-sell and collaborate if they’ve never even met in person.

I don’t know how people manage to wake up at the crack of dawn and fit in all that exercise before they go about their day. I’ll blame it on my kids being really young, because if I worked all day and ran all morning, I think my wife would kill me. The morning run is her chance to spend a little bit of time on the road by herself. Check in with me in 10 years’ time — I’ll let you know then if my kids getting older allowed me to become a triathlete.

My evenings aren’t hugely exciting: It’s usually dinner with my wife, followed by more emails, a book, or TV. At the moment, I’m reading Crisis by Frank Gardner, a BBC correspondent who lived in the Middle East, including Cairo, for a long time. I just finished Game of Thrones season eight. The ending was a big disappointment.

When things go back to normal, I’m most looking forward to traveling with ease. My wife’s family is spread between the US and Bahrain and most of my family is in the UK. My youngest son, who was born here in Cairo, is just over a year old — and nobody from my wife’s family has even met him.

But I’m still pretty happy to be where I am at the moment. I’m thankful that we have plenty of domestic travel options, and we’ve been able to visit Sharm El Sheikh, El Gouna, Somabay, and the North Coast. I wouldn’t wish to be anywhere else.

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

6-27 February (Saturday-Saturday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

17 February (Wednesday): MENA x CEO MENA Entrepreneurship & VC Panel: Investor Perspectives from New York to North Africa will be hosted by the Columbia Entrepreneurs Organization.

20 February (Saturday): Final results of applications for private university places will be announced on the Higher Education Ministry’s electronic university admissions site

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually.

26-28 February (Thursday-Saturday): The second edition of the Egypt International Art Fair will be held at Dusit Thani Lakeview Cairo.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

1 March: Eastern Mediterranean Gas Forum comes into effect.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.