- Amazon mulls Egypt as manufacturing and export hub, Fine says it will double its investment here. (Speed Round)

- Ebtikar is fielding interest in its potential sale of stakes in e-payments firms Bee, Masary. (Speed Round)

- At least a quarter of Egyptians will have access to Russia’s Sputnik V covid vaccine. (What We’re Tracking Today)

- Why are Gulf banks targeting Lebanese banks’ Egypt units? (Speed Round)

- World Bank green-lights USD 200 mn loan for “green recovery” project. (Speed Round)

- EIB mulls EUR 78 mn loan for Helwan wastewater plant expansion. (Speed Round)

- Tourism support, flight incentives programs extended until the end of the year. (Speed Round)

- My WFH Routine: Jude Benhalim, co-founder of Jude Benhalim jewelry.

- The Market Yesterday

Thursday, 1 October 2020

Is Amazon eyeing Egypt as a regional hub?

TL;DR

What We’re Tracking Today

Welcome to the first day of the fourth quarter of this annus horribilis, ladies and gentlemen — we can think of no better day on which 4Q could begin than a Thursday, which is demonstrably the best day of the week. Just a few hours of work left ahead of you, followed by a relaxing evening in which contemplate the potential of two days full days in which to recharge your batteries. Enjoy, folks.

The House of Representatives is back in session today, ending what may have been its shortest-ever recess (and our shortest break from the avalanche of legislative news). Our elected representatives adjourned for just over a month after pushing through a mountain of legislation, including the Banking and Central Bank Act, a bill to impose a 1% “corona tax” on salaries, the Customs Act, and the Eminent Domain Act … just to name a few.

The House has a pretty stacked agenda to get through before a new class of MPs is seated following elections that kick off later this month and end in November. Among the more significant bills before MPs:

- The Unified Tax Act, which received a preliminary nod from parliament right before the recess;

- Two pieces of water-related legislation: The Drinking Water and Wastewater Act, and the new Water Resources Act, both of which have been languishing in parliament for years;

- The law that will establish the Egyptian Commodity Exchange;

- Changes to the criminal code designed to protect the personal data of victims of [redacted] harassment and assault. This received preliminary approval from parliament in August.

It’s the final day of EFG Hermes’ virtual investor conference. You can visit the conference website here.

People will be able to pay government dues of more than EGP 10k at some 4k post office branches and 18 banks starting today, the Finance Ministry said in a statement yesterday. The move is designed to simplify payments for people living in remote villages and increase e-collections.

Private sector companies will discuss transitioning to the government’s electronic invoicing system today at a Finance Ministry-organized conference at which representatives from the ministry and the Tax Authority will be in attendance, Mubasher reports. The meeting comes as the Tax Authority prepares to roll out the system to 134 companies on 15 November.

Key news triggers as we enter a new month tomorrow:

- PMI figures for September are due out for Egypt, Saudi Arabia, and the UAE next Monday, 5 October.

- Foreign reserve figures for September should be out next week.

- Inflation data for September will land on Saturday, 10 October (the next central bank meeting isn’t until mid-November).

Remember: You have a long weekend next week. Thursday, 8 October is off in observance of Armed Forces Day, which is formally marked on 6 October.

The Health Ministry reported 119 new covid-19 infections yesterday, down from 124 the day before. Egypt has now disclosed a total of 103,198 confirmed cases of covid-19. The ministry also reported 16 new deaths, bringing the country’s total death toll to 5,930. We now have a total of 96,494 confirmed cases that have fully recovered.

Around a quarter of the population will have access to Russia’s Sputnik V covid-19 vaccine under an agreement between Russia’s sovereign wealth fund and Egyptian pharma company Pharco, according to a statement. The fund agreed to distribute some 25 mn doses of the vaccine through Pharco’s local subsidiary Biogeneric Pharma, but has yet to make a timeline clear. Russia has been criticized for a rushed testing process but the fund said yesterday that no participants have exhibited adverse effects.

Moderna won’t have its vaccine ready before the US presidential election on 3 November, undermining President Donald Trump’s claim during Tuesday evening’s presidential debate that the jab could be available by 1 November, the Financial Times reports. CEO Stéphane Bancel told the salmon-colored newspaper that 25 November is the earliest the company could submit the vaccine to the FDA for approval.

Could Egypt get a slice of USD 12 bn in World Bank funding to pay for the vaccine doses? The World Bank is looking at dishing out USD 12 bn in loans or grants to developing countries to help them access doses of covid-19 vaccines for healthcare and essential workers, World Bank President David Malpass told Reuters. Malpass did not specify which countries would be eligible for the funding, saying only it would be geared towards “poor and middle-income countries.” The financing is currently awaiting board approval, Malpass said.

Europe will have access by the end of October to a “game-changing” 15-minute covid-19 antigen test, according to Bloomberg.

Demand for microfinance seems to have held up through the worst of the pandemic after figures yesterday showed the number of micro borrowers fell just 1.4% to 3.9 mn during 2Q2020, Masrawy reports. The data, published by the Egyptian Microfinance Federation (EMF), shows that the balance of micro loans fell 3.2% to EGP 39.9 bn during the three-month period. EMF chairman Mona Zulfikar said the figure shows that the sector is resilient and was able to withstand the fallout from the covid-19 pandemic. More than 75% of borrowers during the quarter were unbanked.

Global M&A activity surged to a record high in 3Q2020 as bankers scrambled to push through a backlog of transactions that piled up after the onset of the pandemic, according to the Financial Times. In value terms, the quarter saw USD 456 bn-worth of transactions above USD 5 bn apiece, making it the busiest third quarter of any year on record, Refinitiv data showed. Tech and pharma companies were in particularly high demand, with tech accounting for nearly a half of all high-value transactions.

Palantir closed it’s debut session on the NYSE yesterday valued at around USD 21 bn. The data-mining company surpassed the exchange’s reference price of USD 7.25 by 31% to close the day at USD 9.50, the Wall Street Journal reports. Both Palantir and Asana — which also listed yesterday — were the first companies this year to opt for a direct listing over a traditional IPO.

Hit by lower oil revenues and aggressive lockdowns, Saudi and the UK saw their economies contract sharply in 2Q2020. The UK’s GDP collapsed 20% during the quarter — more than any other developed country — in what is its biggest quarterly drop in activity on record, reports Reuters. Meanwhile, unemployment in Saudi soared to a record high of 15.4% in 2Q2020, as its oil and non-oil sectors were both hurt deeply by lower global crude demand, the newswire says.

Activity in China’s services sector continued rebounding in September as new export orders grew at their fastest pace in three years, according to the Caixin/Markit PMI (pdf).

An “Arthur Andersen moment”: Is this one scandal too far for Ernst & Young? EY could be facing a slew of lawsuits from investors and politicians in Germany after it was revealed that an ex-employee told the company of potential fraud at Wirecard four years before it collapsed, the Financial Times reports. For over a decade, EY had without reservation signed off the financials of Wirecard, which this summer crashed into insolvency after admitting that it was missing some EUR 1.9 bn in cash. “In a worst-case scenario, EY could face its Arthur Andersen moment.” said leftwing Die Linke party MP Fabio De Masi, referring to the auditor of fraudulent energy group Enron, which collapsed in 2001.

From Big Tech:

- Amazon is rolling out new biometric technology that will allow shoppers to pay just by swiping their palms, Vox reports. The payment technology, Amazon One, links shoppers’ palm prints with their credit card on the Amazon One database, allowing a simple wave of the hand when exiting Amazon’s physical retail stores.

- Netflix is still struggling to get a footing in Africa, where its subscribers are concentrated in the wealthiest segments and piracy remains rampant, according to Bloomberg.

- TikTok will be shut down in the US if an agreement for its operations there fails to meet the country’s security requirements, warned Treasury Secretary Steven Mnuchin, Reuters reports.

For the gadget nerds among us: Google’s half-hour hardware event featured the Pixel 5, notable more for its use of a lower-end processor than for pushing hardware boundaries, the Verge says. Meanwhile, Nikon will unveil its new Z6 II and Z7 II mirrorless cameras on 14 October. The generally quite reliable Nikon Rumors has a rundown on the expected specs, which it says will include dual card slots, two processors to help with faster / more accurate AF, and new video features.

US ELECTION WATCH- The wreckage left by the US presidential debate has commentators and citizens alike begging for the end. “My group of undecided voters are telling me this is like reality TV … Except it’s the destruction of America that we’re watching,” political pundit Frank Luntz wrote in a painful / hilarious Twitter thread during the debate. In the foreign press: “A national humiliation,” “Cacophonique,” and this gem of a Deutsche Welle tweet. Trump’s refusal to denounce far-right militias (NYT | Washington Post | AP | FT) and plans to prevent a recurrence of Tuesday night’s disaster (Reuters | Bloomberg | CNN | Politico | WSJ) are grabbing headlines this morning.

Libya’s warring sides will meet next week to resume face-to-face talks on security, oil production, as well as prisoner swaps and resuming air traffic. The decision was made as one of the recommendations after delegations from the Tripoli-based Government of National Accord and the Libyan National Army concluded on Tuesday two days of UN-backed talks in Hurghada. It’s unclear when or where the next round of talks will be held.

Enterprise+: Last Night’s Talk Shows

Green bonds ran the show last night: Vice Minister of Finance Ahmed Kouchouk phoned in to Masaa DMC and (watch, runtime: 10:59) Yahduth Fi Misr (watch, runtime: 4:35) to discuss the country’s maiden green bond issuance, which took place on Tuesday. Kouchouk said the offering sends a signal to local and international investors that Egypt is committed to financing sustainable and environmentally-friendly projects. Kouchouk stressed that 100 investors participated in the offering, including 17 who have not invested before in the Middle East. The USD 3.3 bn in bids received has allowed the ministry to allocate these funds to the most serious and long-term investors. The country’s USD 1.9 bn portfolio of green projects includes renewable energy, waste management, sanitation, clean transportation projects as well as new cities and other projects designed to reduce pollution and emissions, he said. Al Hayah Al Youm's Mohamed Sherdy phoned Iman Abdel Azim, the director of international bonds at the Finance Ministry, to talk about the issuance (watch, runtime: 10:19).

El Sisi participates in UN biodiversity summit: Masaa DMC’s Ramy Radwan highlighted President Abdel Fattah El Sisi’s participation in the biodiversity summit at the United Nations General Assembly. El Sisi said that Egypt is keen to support the efforts of the African continent in preserving biological diversity and stopping the degradation of nature. He added that Egypt launched a comprehensive initiative to integrate biodiversity into various specific sectors. (watch, runtime: 1: 34). Al Hayah Al Youm's Mohamed Sherdy (watch, runtime: 3:59) and Yahduth Fi Misr’s Sherif Amer (watch, runtime: 3:30) also covered the story. You can catch part of this speech here (watch, runtime: 2:50).

Gov’t support for tourism: Amer spoke with Tourism Minister Khaled El Enany, who praised the government’s decision to extend covid-19 support measures for tourism companies to the end of the year (more on this in this morning’s Speed Round, below). El Enany said the Red Sea has seen some 600k tourists since flights resumed on 1 July, and looked forward to Upper Egypt opening up to foreign visitors (watch, runtime: 11:23).

The Russkis are coming, vaccine in hand: Sherdy (watch, runtime: 4:22) and Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 12:34) also discussed Russia’s decision to distribute 25 mn doses of its Sputnik-V covid-19 vaccine in Egypt through Pharco. More on this in this morning’s What We’re Tracking Today, above.

Health insurance across Egypt: Moussa spoke with Assistant to the Health Minister, Ahmed Al Sobky, who discussed the implementation of the health insurance system and its cost in Port said (EGP 8 bn), Ismailia (EGP 12 bn), and Luxor (EGP 10 bn), where some 800k citizens have joined the system, out of of a total 2.8 mn citizens registered nationwide so far (watch, runtime: 10:34).

Speed Round

INVESTMENT WATCH- Amazon might be looking to set up shop in Egypt: Amazon is looking at whether Egypt could be a hub for the manufacture of its own-brand products — and for exports to the wider region, Amazon MENA Head of Public Policy Dalia Seif El Nasr said during a meeting with Trade Minister Nevine Gamea, according to a cabinet statement. Amazon contracts for the manufacture of goods include apparel and houseware under brands including Amazon Basics as well as electronics such as its Kindle readers and Alexa smart speaker. The company is also looking to have more local manufacturers sell their products via Amazon’s marketplace, according to Seif El Nasr. Amazon currently operates in Egypt under the Souq brand, which it acquired in early 2017.

OTHER INVESTMENT NEWS- Tissue and sanitary products manufacturer Fine is planning to almost double its investments in Egypt through 2021. The company is earmarking USD 35 mn to “diversify its portfolio of hygienic products in Egypt,” the company said in a statement (pdf) yesterday, which CEO James Michael Lafferty told Ahram Online would bring its total investments to USD 63 mn.

M&A WATCH- Foreign, local investors eye stakes in fintech players Bee, Masary: Non-banking financial services outfit Ebtikar has received “several” offers from unnamed local and foreign investors for stakes in two of its subsidiaries, Bee smart payment solutions and Masary smart payment services, the local press reported, citing sources with knowledge of the matter. The sources did not provide further information on the offers. Ebtikar is a joint venture between B investments, BPE Partners and MM Group for Industry and International Trade, and is expected to IPO in 1Q2021. The company has tapped EFG Hermes as financial advisor on the transactions.

Background: Earlier this year, MM Group said that Bee and Masary would be merged and brought under the fold of an unnamed e-payments company, though no further details were given. Ebtikar acquired a 33% stake in Masary in 2018 and continued to up its stake through 2019. Ebtikar now holds 72% of the company, with the remainder held by Bahrain’s Sadad. The company also acquired a 60% stake in Bee in October 2017, with the remaining 40% held by two other investors.

In related news: Ebtikar and B Investments-owned financial services provider Tamweel Holding is planning to launch a new securitization arm in 4Q2020, Managing Director Mohamed El Kahki told Al Mal. The company is looking to issue some EGP 500 mn in securitized bonds backed by some of its real estate portfolio and will soon submit its licensing request to the Financial Regulatory Authority, El Kahki added.

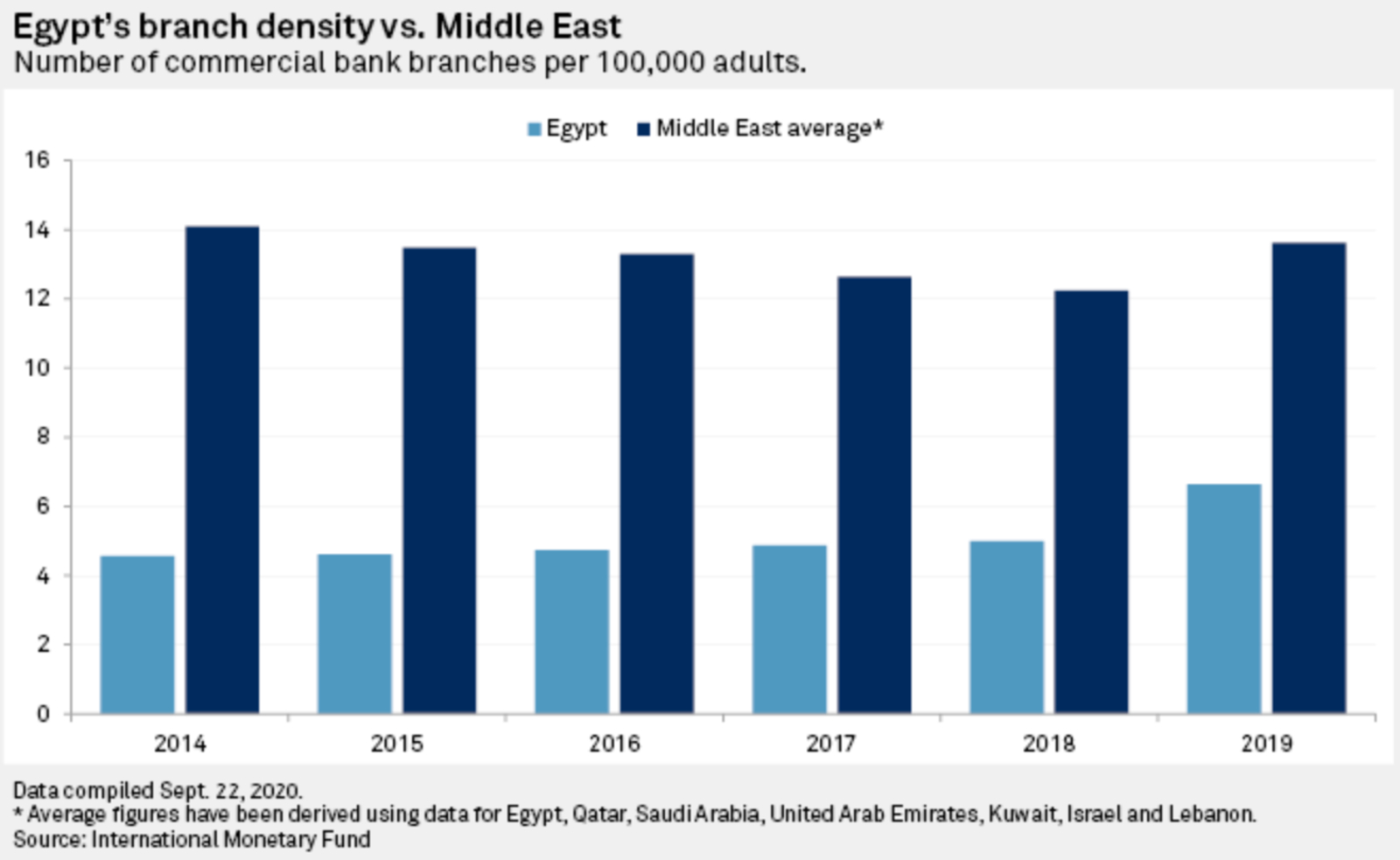

Why are Gulf banks looking to snap up the Lebanese banks leaving Egypt? Egypt’s large population, the low penetration of banking services throughout the country, and the unexplored potential of SME lending spell out an attractive market for expansion for GCC banks, and the slew of Lebanese banks currently on sale provide a window into it, writes S&P Global Market Intelligence. As Lebanese banks face insolvency after a mounting financial crisis that has been exacerbated by covid-19 and civil unrest in the country, Gulf banks looking to expand in Egypt are eyeing Lebanon’s Blom Bank and Bank Audi. "GCC banks have long targeted Egypt because it offers things the Gulf lacks aside from in Saudi — a large population and structural opportunity for growth," EFG Hermes’ head of MENA financials Elena Sanchez-Cabezudo told S&P. According to data compiled by S&P, only one in three Egyptians has access to banking or mobile financial services, lower than the region’s average of one in two.

Who wants a piece of the action? Though Blom Bank denied it was looking to sell its Egypt unit earlier this year, it has now confirmed its upcoming Egypt exit, and is in early discussions with Bahrain’s Arab Banking Corp (ABC), though “there is no certainty any translation will be completed,” according to a statement by the bank. ABC is competing with Dubai's Emirates NBD Bank — which entered Egypt in 2013 through the purchase of BNP Paribas — and which is also interested in Blom’s Egypt unit. First Abu Dhabi Bank (FAB) — the UAE’s largest bank — had planned to submit an offer for Bank Audi’s Egypt branch earlier this year, but halted the transaction in May because of the economic uncertainty caused by covid-19. The potential purchase — which could have a value of up to USD 700 mn — seems to be back on the table now.

Why M&A? Acquisitions are currently the only way into Egypt’s banking sector, as the CBE has for years denied new banking licenses and has told new entrants to see whether any of the country’s 38 licensed banks might be for sale. Though Egypt’s banks are considered desirable M&A targets, they were rarely up for sale before the recent M&A wave. The country’s banks capitalized on the high interest rate environment that followed the 2016 EGP float by piling into high-yield treasury bonds and bills, resulting in “excessively strong balance sheets” that have made the banks highly attractive acquisition targets.

World Bank green-lights USD 200 mn loan to tackle air pollution: The World Bank has approved a USD 200 mn loan to improve Greater Cairo’s air quality, reduce emissions and improve solid waste management as part of what is being named a “green recovery” project, International Cooperation Minister Rania Al Mashat said on Wednesday. The project aims to modernize air quality monitoring systems, establish safe landfills in Tenth of Ramadan City, safely eliminate dumps in Abu Zaabal, set up charging stations for electric vehicles, and support other green initiatives.

The World Bank is also providing Egypt with technical assistance on how to best allocate the proceeds from our maiden USD 750 mn sovereign green bond issuance, which went to market on Tuesday, said Vice Minister of Finance Minister Ahmed Kouchouk. The agreement between the Finance Ministry and the World Bank will see the international lender help in preparing annual reports on the use of funds and ensure projects are in step with the International Capital Markets Association’s (ICMA) Green Bond protocols.

Egypt earlier this week held the MENA region’s first-ever sovereign green bond offering, which saw the government raise some USD 750 mn. The five-year bonds, which were 5x oversubscribed and sold at a 5.25% yield, will be used to finance Egypt’s USD 1.9 bn portfolio of green projects. The inaugural issuance also comes as part of the government’s debt diversification strategy, which entails a shift towards longer-term debt, that the government hopes will constitute some 52% of borrowing by June 2022.

The European Investment Bank (EIB) mulling a EUR 78 mn loan to finance the EUR 200 mn expansion of the Helwan wastewater treatment plant, according to the bank’s website. The project aims to improve the disposal and utilization of effluent and sludge at the facility, improving the quality of water and lowering pollution in the area, the bank said. The government has reached out to other undisclosed international lenders to secure the remaining financing for the project, the local press reports, citing government sources.

M&A WATCH- Packaging group Mondi has acquired Amreyah Cement’s industrial bag plant, the local press reported, quoting unnamed sources close to the matter. The sources didn’t disclose the exact value of the transaction, only describing it as “medium-sized.” Amreyah, reeling from the drawn out supply glut crippling the industry, made the decision to cut its running costs, the sources said. Mondi, meanwhile, plans to create a large paper business in Egypt, having acquired Suez Bags and the National Company for Paper Products in 2018.

CABINET WATCH- Tourism support, flight incentives programs extended until the end of the year: The debt, utilities and real estate tax payment holiday introduced in April to support companies reliant on tourism through the covid-19 pandemic has been extended until the end of the year, cabinet said yesterday following its weekly meeting. The charter flight incentives program, which was previously extended from the end of April to 28 October, will also run through to the end of 2020. The cabinet also decided to extend the visa-exemption period for tourists arriving to South Sinai, Luxor, Aswan and the Red Sea governorates until 30 April 2021. Ministers also approved the extension of stipends from the Manpower Ministry’s emergency fund, which will continue to be paid out till December 2020.

Also approved during the meeting:

- The Industrial Development Authority will have new powers to issue licenses and allocate land to heavy industry;

- Setting up a private freezone for textile manufacturer Tianpei Egypt in the Tenth of Ramadan City industrial zone;

- Amending a financing agreement between Egypt and the Saudi Fund for Development for a branch of the Salman bin Abdulaziz University in South Sinai to increase the loan amount to EGP 465.8 mn;

- Approving the offering of six new specializations at the bachelor’s level to be offered by Coventry University’s planned branch in Egypt.

STARTUP WATCH- Stock trading app Thndr has completed its registration with the EGX, the company announced on its website. The no-commission equities trading platform last month became Egypt’s first company to obtain a new brokerage license since 2008. Thndr secured an undisclosed pre-seed funding round last December from Y-Combinator, 4DX Ventures, Endure Capital, the Raba Partnership, and MSA Capital, co-founder and CEO Ahmad Hammouda (Uber Egypt’s former general manager) said at the time.

EFG Hermes topped the EGX’s brokerage league table in September with a market share of 19.5%, according to EGX figures (pdf). CI Capital came in second with a 9.6% share, followed by Beltone (8.5%), Pioneers (4.9%) and Mubasher (3.2%).

EARNINGS WATCH- Qalaa Holdings reported a net loss of EGP 712.1 mn in 2Q2020 compared to EGP 224.5 mn in the same period last year, according to the company's earnings release (pdf), on the back of low fuel prices and the covid-19 pandemic. The losses were driven primarily by the Egyptian Refining Company (ERC) “on account of covid-19 and overall soft oil markets with consequent pressure on heavy fuel oil and diesel spreads,” the company said. This comes despite Qalaa more than doubling its quarterly revenues to EGP 7.4 bn from EGP 3.5 bn in 2Q2019.

Top line growth was driven by the ERC, which brought in EGP 4 bn during the quarter. ERC began operations at its Mostorod petrochemical complex last year and inaugurated the facility earlier this week. Removing the ERC from the equation, Qalaa’s revenue would have fallen 4% on 2Q2019. “Whilst our top-line witnessed significant growth on account of the ERC’s maiden contribution, our revenue excluding the refinery’s share recorded only a marginal 4% decline which, in management’s view, is a commendable achievement given the unprecedented global challenges,” Chairman Ahmed Heikal said. “This was supported by the breadth of our diversified portfolio and ability to unlock value from strategic sectors.”

MOVES- 500 Falcons managing partners Sharif El Badawi and Hasan Haider will leave the firm to start a new fund focused on late-stage seed rounds, Menabytes report, citing a company statement. El Badawi and Haider will announce the details for their new venture in coming weeks, the site said, adding that the two will continue to support 500 Falcons over the next 18 months.

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

- A full-time copy editor to enforce house style, police facts and generally make us sound smarter than we really are.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

Egypt in the News

It’s a mixed bag in the foreign press this morning: Israel Hayom is claiming that Egypt’s diplomatic clout vis-a-vis Israel is under threat by the recent normalization accord Tel Aviv signed with the UAE, and the National says Ethiopian Prime Minister Abiy Ahmed is facing a “diplomatic tightrope” in securing an agreement with Egypt and Sudan over the Grand Ethiopian Renaissance Dam. Meanwhile, an op-ed in the National Interest says Turkey’s recent nonsense in the eastern Mediterreanean has more to do with Erdogan’s “pan-Islamist, Neo-Ottoman inspired ideology” than securing energy supplies.

Diplomacy + Foreign Trade

Topping trade news this morning: QIZ exports fall in 1H2020: The value of goods exported from Egyptian qualifying industrial zones (QIZs) fell almost 25% during the first half of the year compared to 1H2019, according to Trade Ministry figures. Some USD 357 mn of goods were exported during 1H2020, down from USD 472 mn in the same period last year, head of the Trade Ministry’s QIZ unit Ashraf Rabie said yesterday. Readymade garments and textiles made up 97% of the exports, while the export of glass products increased by 137.5%, from 1.6 mn to 3.8 mn y-o-y. Egypt signed the QIZ agreement with Israel and the US in 2004, allowing participating companies to enjoy access to the US market without tariffs provided their products meet a minimum required amount of Israeli content.

Jumia and Talaat Moustafa Group, along with a number of British retailers, participated in the first retail webinar organized by the UK Department for International Trade and Egyptian British Chamber of Commerce, the British Embassy in Cairo said in a statement yesterday.

SCZone customs rules published: The General Authority of the Suez Canal Economic Zone has published customs rules and procedures for companies operating in the zone, Al Masdar reports, carrying a copy of the regulations as reported in the Official Gazette on Monday.

Energy

Six companies to bid for wind plant O&M contract

Six foreign and local companies are planning to bid for a five-year operation and maintenance contract for the New and Renewable Energy Authority’s (NREA) 220 MW wind plant in the Gabal El Zeit complex in the Gulf of Suez, the local press reports, quoting unnamed sources. The companies include Denmark’s Vestas, Siemens Gamesa, Voltalia, China Energy, and Orascom Construction, according to the sources. NREA is expected to review the technical offers on 11 October, and the company awarded the contract is expected to begin operating the plant within two weeks and one month thereafter, the sources added.

Tourism

New tender for pyramids sound and light show

The Sound and Light Cinema Company (SLCC) has issued a global tender to develop and manage the sound and light show at the pyramids, according to Masrawy. SLCC has set a 5 November deadline for the submission of bids. SLCC had annulled in 2018 its EGP 10 mn contract with a JV between Orascom Investment Holding and Prism International, saying Orascom breached the terms of the contract by failing to carry out the required work. SLCC has since raised the minimum value of its annual tender to develop and manage the sound and light show to USD 2.5 mn.

In related news: Orascom Pyramids Entertainment has borrowed EGP 230 mn from SAIB Bank to develop the Giza Plateau, Hapi Journal reports.

Banking + Finance

Banque du Caire receives USD 15 mn from Sanad for onlending to SMEs

Banque du Caire has received USD 15 mn from German development bank KfW’s Sanad Fund for on-lending to SMEs, a joint statement (pdf) said on Wednesday. Chairman Tarek Fayed said the funding will be aimed at low-income and village residents, providing needed liquidity for farmers, small agricultural enterprises and micro-financing institutions.

Who’s got licenses for what?

CI Capital’s consumer finance arm Souhoola has been awarded a consumer finance license by the Financial Regulatory Authority, the company announced in a statement (pdf).

Bank Audi’s Egypt arm has obtained a license to set up online payment gateways for its client vendors and businesses after gaining central bank approval, the Lebanese bank said in a statement carried by Al Mal.

Egypt Politics + Economics

Two female TikTok users given six-year jail terms for “inciting prostitution”

Two female TikTok users were sentenced to six years in prison and fined 100k each for violating family values and principles and inciting prostitution, Al Dostour reports.

My WFH Routine

Jude Benhalim, co-founder of Jude Benhalim jewelry: Each week, my Morning / WFH Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Jude Benhalim, the co-founder of her namesake jewelry brand, Jude Benhalim.

My name is Jude Benhalim and I’m a jewelry designer and business owner. My title at the company is designer and marketing manager — but that only actually occupies around 20% of my time. The rest of my time is dedicated to managing the team, resolving problems that come up, working on product development and brand expansion — and inevitably getting sucked into every little bit of the business.

Thankfully, I have my mom as my business partner and CEO to handle the operational management. Even with these titles, we both still find it almost impossible to stick to our job descriptions. It’s a huge learning process for me and I love the challenges and finding ways to tackle them. It’s very experimental and I guess that’s what excites me most.

I wake up at 8 am everyday. Each day has to start with a cup of coffee in complete peace and quiet. I head to the office at 9am and am immediately set up in front of my screen, jumping on calls, and catching up on work. Throughout the day, my work really differs on a day-to-day basis, depending on the projects we have in the pipeline. Right now, we’re preparing to launch a new collection, but when we’re in the designing phase, I spend a large amount of time on research and working out problems with each department.

My work days generally end at 5pm. Granted, there are a lot of distractions — I sometimes unwind in the middle of the day with a quick episode of a favorite show (New Girl is my go-to) and while working from home, I also have to account for time that’s lost to household needs like cooking. To be honest, I don’t spend much time reading up on the news or on social media. I’ve found it gets very overwhelming, so I’ve deactivated my social media profiles. My husband still reads the news and reads Enterprise religiously in the mornings.

On a personal level, I handled the shift to WFH pretty well. I like to work from home and actually manage to be quite productive. But I had to set up my environment to be conducive to that — I change into a comfortable yet work-appropriate outfit (pajamas are a no-go during work hours, even at home) and set up a space in my house dedicated to work. I do not recommend working out of your bed.

It was very challenging to adapt to the change as a team, given that we are a small team of 10 people who are very reliant on each other and on face-to-face communication. I implemented a task-based system where each department is assigned a set of tasks at the start of every week, and we meet over Zoom on Thursdays to discuss the progress and what’s been done. Obviously we also have a lot more smaller calls during the week just to discuss quick things. But this system was actually really helpful in getting things organized for us and I am still implementing parts of it now that we’re back at the office. The shift also encouraged the team to communicate together through email, which made things so much more efficient.

This experience taught me that I tend to take things too seriously sometimes. I’ve been taking time to actively slow down sometimes and reflect on things better. Professionally, I learned how to create a killer marketing campaign with a very small marketing budget — it seemed impossible but I’m proud of what we’ve been able to do. I also learned that my team was just too dependent on physical presence, but thankfully that has now changed.

During my time off, I like to watch TV shows — I watched a great series called Little Fires Everywhere and really recommend it. Recently, I’ve been hooked on New Girl. Hilarious. I also really recommend Maybe You Should Talk to Someone. I found it to be a beautiful read. Otherwise, I like to wind down with an interesting documentary if I have the energy for it and I like to do yoga when I have time.

The Market Yesterday

EGP / USD CBE market average: Buy 15.70 | Sell 15.80

EGP / USD at CIB: Buy 15.71 | Sell 15.81

EGP / USD at NBE: Buy 15.70 | Sell 15.80

EGX30 (Wednesday): 10,989 (+0.02%)

Turnover: EGP 1 bn (11% below the 90-day average)

EGX 30 year-to-date: -21.3%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.02%. CIB, the index’s heaviest constituent, ended flat. EGX30’s top performing constituents were CIRA up 4.0%, Ibnsina Pharma up 3.8%, and Madinet Nasr Housing up 2.9%. Yesterday’s worst performing stocks were GB Auto down 2.4%, Palm Hills down 2.4% and Juhayna down 2.3%. The market turnover was EGP 1 bn, and regional investors were the sole net buyers.

Foreigners: Net short | EGP -27.5 mn

Regional: Net long | EGP +35.2 mn

Domestic: Net short | EGP -7.7 mn

Retail: 75.0% of total trades | 74.4% of buyers | 75.6% of sellers

Institutions: 25.0% of total trades | 25.6% of buyers | 24.4% of sellers

WTI: USD 39.86 (+1.45%)

Brent: USD 40.95 (-0.19%)

Natural Gas: (Nymex, futures prices) USD 2.55 MMBtu, (-0.62%, November 2020 contract)

Gold: USD 1,890.90 / troy ounce (-0.65%)

TASI: 8,299 (+0.18%) (YTD: -1.07%)

ADX: 4,518 (+0.52%) (YTD: -10.99%)

DFM: 2,273 (+0.91%) (YTD: -17.77%)

KSE Premier Market: 6,020 (-2.19%)

QE: 9,990 (+0.80%) (YTD: -4.17%)

MSM: 3,614 (-0.19%) (YTD: -9.21%)

BB: 1,434 (+0.26%) (YTD: -10.91%)

Calendar

October: Trade and Industry Ministry allocates SMEs seven industrial complexes.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

1 October (Thursday): Deadline for students to transfer between schools.

1-10 October (Thursday-Saturday): Alexandria Book Fair, Kouta, Alexandria.

4 October (Sunday): Senate convenes for its first session.

5 October (Monday): Libyan peace talks in Hurghada bringing together political figures and tribal representatives from the Libyan National Army (LNA) and Government of National Accord (GNA).

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

12 October (Monday): The Egyptian Iron and Steel company general assembly would discuss demerging its mining and quarrying unit and restructure the company’s board of directors

10-17 October (Saturday-Saturday): CIB Egyptian Squash Open, New Giza Sporting Club / Pyramids of Giza.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities.

18-22 October (Sunday-Thursday): The annual Cairo Water Week event — which will be semi- virtual this year — will be held under the slogan “Water Security for Peace and Development in Arid Regions”

21-23 October (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

24-25 October (Saturday – Sunday) Polls open for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

End of October: Last chance to settle building code violations for illegal buildings.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

December: IMF delegation visits Egypt to in first of two reviews ahead of disbursement of second tranche of USD 5.2 bn SBA.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.