- Egypt closes places of worship for two weeks as covid-19 cases rise to 294. (What We’re Tracking Today)

- EGX30 ends in the green for the first time in two weeks. (Speed Round)

- US stocks suffer worst week since 2008 as global economic outlook darkens. (Speed Round)

- CBE cuts interest for three of its financing initiatives, raises ATM withdrawal cap. (Speed Round)

- The state privatization program has been put on ice. (Speed Round)

- Stamp, dividend tax breaks receive cabinet approval. (Speed Round)

- Remittances rise 5% in 2019. (Speed Round)

- EM economies are under stress as investors dump debt in favor of the USD. (The Macro Picture)

- The Market Yesterday

Sunday, 22 March 2020

Mosques, churches ordered closed; CBE hikes limits on ATMs, online transactions

TL;DR

What We’re Tracking Today

So, how was your first weekend on (near) lockdown? We spent it wondering not about what’s next in the immediate sense, but about how things are likely to develop a week, a month and a year out. We have no answers, but we have some things you might want to read as you shape your own thinking:

Among the questions that matter in the coming week: First, is the medicine worse than the cure? Are there other tools we could be using to deal with covid-19 that don’t strangle economies and risk speeding our flight into a depression? And second: What’s happening in global markets as we see simultaneous collapses in stocks and bonds?

In the next month (or two): Our must-read: The doctor who helped defeat smallpox explains what’s coming. How long will social distancing and other measures have to stay in place if we remain on our present policy response? Months and months, according to research out of the University of Toronto.

And one year out: What are the best and worst case outcomes? (Written from a very US-centric point of view, but the questions and the models hold just about no matter where you are.) And from reader favourite Yuval Noah Harari: The decisions we make today will change our lives for years to come in ways we haven’t fully thought through. What does all of this mean for globalization?

PSA- Tips from Egyptian MDs in London on how we can slow community spread — and how Egyptian docs should handle covid-19: London is probably a couple of weeks ahead of Egypt in how it’s dealing with covid-19. Two Egyptian medical doctors working in London — general surgeon Sherif Hakky and intensive care physician Ahmed El Haddad — put together one of the most rational and sensible videos we’ve seen on how we here in Egypt can avoid (and, if worst comes to worst, handle) a significant outbreak of covid-19 (watch, runtime: 9:05). Key takeaways:

- It is crucial to take social distancing seriously at this stage. The threat of community spread is real, and staying at home can make a significant difference in containing the virus;

- For hospitals and medical practitioners in Egypt, it’s time to plan for all scenarios. Stock up on equipment and supplies and use what you have as wisely as possible. Start training all your staff to be able to handle covid-19 cases as they come in, and think of how to optimize space inside hospitals.

COVID-19 HERE IN EGYPT-

Egypt has now reported 294 cases of covid-19, and 10 people have died of the disease, according to a Health Ministry statement, making 75 new cases over the weekend, the added (here and here). The two deaths announced yesterday were Giza residents, including a 68-year-old woman and a 75-year-old man. A total of 41 people have fully recovered and been discharged from hospital, and 73 people have tested negative after being treated in hospital and look to be on the path to release.

The Supreme Council of University Hospitals has ordered its facilities to cut non-emergency admission by 70% to free beds for potential covid-19 patients, according to a cabinet statement. University hospital outpatient clinics are to cut their patient intakes by 50% and create specific, isolated facilities for patients presenting with respiratory problems. University hospitals were told to each prepare 30-bed quarantine areas and to ensure they have six-month supplies of key equipment, meds and disposables.

Former Health Minister Mohamed Awad Tageldin, a familiar face to many Enterprise readers, is back in government services. Ittihadiya said President Abdel Fattah El Sisi had tapped the noted expert in pulmonary diseases as his advisor on health affairs.

Is a new stimulus package in the works? Planning and Economic Development Minister Hala El Said signaled the government is preparing a new stimulus package that will be similar to the EGP 30 bn approved by the government back in 2008 following the financial crisis, the ministry said.

Some MPs are calling for a curfew and others for a ban on non-essential travel between the governorates, Masrawy reports.

Places of worship are closed to prayers for the next two weeks. The Ministry of Religious Endowments’ ban includes a suspension of collective Friday prayers in mosques, a statement said, while the call to prayer has been revised to urge worshippers to pray from their homes. The Coptic Church has similarly suspended masses and other activities in churches and community halls for two weeks, the local press reports.

Shopping malls, sporting clubs, cafes and nightclubs are to close from 7pm and 6am daily until the end of the month, according to a cabinet statement issued Thursday. Grocery stores, pharmacies, bakeries and ba’els are exempt.

The central bank has raised limits on ATM withdrawals and electronic transfers as part of a move to ease the flow of funds in the banking system while cutting down on foot traffic to bank branches. We have more in this morning’s Speed Round, below.

Any business violating the restrictions will be shut down for a month and be slapped with a EGP 20k fine, Cairo Governorate said, according to a report in the domestic press. The governorate made the announcement after TV news reports showed establishments flouting the order to close.

The Tax Authority (TA) has pushed the deadline for individual taxpayers to file returns to 9 April from 31 March, TA boss Reda Abdel Kader said. The authority also lifted fees on online submission in a bid to encourage both companies and regular people to submit their returns electronically. The government began online tax filings at the start of the year as part of Egypt’s new unified digital tax payment system. Next up: We think the deadline for businesses needs to be pushed back, too.

End-of-term exams have been cancelled at universities and final exams could be postponed to after 30 May if the current shutdown lasts, the Ministry of Higher Education said. Final exams for primary and prep school students in the state education system have been cancelled, Education Minister Tarek Shawky said on Thursday evening.

Other measures now in place:

- Museums and archaeological sites are closed until the end of the month, the Tourism Ministry said in a statement, while sound and light shows have been suspended nationwide.

- Hotel restaurants and health clubs in the Greater Cairo Area are off-limits to anyone not staying at the hotel, the Tourism Ministry said. Also off-limits: Night clubs and swimming pools.

- Low-income earners will get some extra help as the Social Solidarity Ministry adds another 60k families to its Takaful and Karama benefit programs and hikes payments to women leaders in rural areas to EGP 900 per month from EGP 350. New beneficiaries will be those who have been impacted by the covid-19 outbreak and measures taken to contain it.

- The Army has deployed troops from its chemical warfare units to deep clean parts of the capital including metro stations and Mogamma Tahrir (watch, runtime: 2:56).

ON THE GLOBAL FRONT-

Thirty-nine interest rate cuts. In a single week. There are no words…

And there aren’t any for this either: The Trump administration is putting together a stimulus package that will total more than USD 2 tn, White House Economic Advisor Larry Kudlow said yesterday. To put that figure in context, the package would equal around 10% of US annual economic output and is double what the administration was talking about less than a week ago.

Jordan, Tunisia on lockdown: Jordan and Tunisia have both ordered their citizens to refrain from leaving their homes except for in cases of emergency.

New York, California, and Illinois residents have also been instructed to stay at home and cease all nonessential travel, according to the WSJ.

The UK has taken the unprecedented decision to step in and pay people’s wages in a bid to prevent the outbreak from causing mass unemployment. The government will pay up to GBP 2.5k per month to cover salaries of people who are at risk of losing their jobs. The BBC has more.

Italy is “shutting almost all industrial output” for 15 days as the outbreak continued to accelerate over the weekend despite the government-imposed lockdown, Bloomberg reports. The country announced 793 people new deaths and 6.6k new cases yesterday — the largest daily increase yet.

The US Federal Reserve has ramped up its purchases of mortgage bonds after the national average loan rate for mortgages spiked and the bonds came “under acute selling pressure.” The Fed’s New York branch buying USD 71 bn in the bonds between Monday and Friday, the Financial Times reports. The Fed had said last week it would restart its crisis-era bond-buying program with USD 700 bn in fresh asset purchases, and is looking now to expand the program to include short-term municipal bonds.

German fiscal conservatism finally caves: The German devotion to the balanced budget relented yesterday as the country’s finance minister announced that it would take on more than EUR 150 bn in new debt, the Financial Times reports.

SOMETHING TO MAKE YOUR SMILE: Rockhopper penguins go on a date at the aquarium. A pair of bonded rockhopper penguins (meaning they’re “together” for the nesting season) were allowed to roam around the Shedd Aquarium in Chicago, which has been closed to the public until next month (watch, runtime: 0:30).

Enterprise+: Last Night’s Talk Shows

All covid, all the time: The nation’s talking heads — like the rest of the world — continued to be squarely focused on the coronavirus last night.

The daily covid-19 update: Masaa DMC's Eman El Hosary (watch, runtime: 1:22) and Min Masr’s Amr Khalil (watch, runtime: 2:11) reviewed the latest covid-19 updates from the Health Ministry, noting an additional nine cases on Saturday have brought the total number of confirmed cases to 294. El Hekaya’s Amr Adib spoke by phone with ministry spokesman Khaled Megahed who said that the country’s containment efforts have so far been successful as they haven’t had to resort to the extreme measures prepared in the event that the case count tops 1k. He also noted that the rate of new cases has been decreasing in the past few days (watch, runtime: 2:47), (watch, runtime: 1:47).

Houses of worship closed: Al Hayah Al Youm’s Hossam Hadad covered the Endowments Ministry’s decision to close all mosques and suspend Friday prayers for two weeks, and the Coptic Orthodox Church’s decision to close all churches and suspend mass and other religious activities until further notice (watch, runtime: 6:56), (watch, runtime: 5:21). Adib also covered the news (watch, runtime: 5:53), as did El Hosary (watch, runtime: 0:47),(watch, runtime: 1:06), who also noted the Tourism Ministry’s decision to close museums and archeological sites (watch, runtime: 0:18).

University final exams postponed: Hadad covered the Higher Education Ministry’s announcement that end-of-term exams will be cancelled should the two-week onsite suspension of studies continue. Students will only sit for end of year exams, which have been postponed until after 30 May. (watch, runtime: 2:35). Masaa DMC’s Eman El Hosary (watch, runtime: 0:55) and Min Masr’s Amr Khalil (watch, runtime: 2:29) also had the report.

CBE hikes e-payment limit: Hosary noted the Central Bank of Egypt’s decision to raise the limits of electronic payments via mobile phones to EGP 30k pounds per day and EGP 100k per month (watch, runtime: 0:16). We have more on this in this morning’s Speed Round, below.

Pharma giant Sanofi will announce its potential covid-19 treatment within weeks, the company's chairman and managing director in Egypt and Sudan Christelle Saghbin told Adib on Friday night (watch: 5:14). The company has tested a rheumatoid medicine on 36 covid-19 patients and has shown results in 70% of the cases in under a week.

Speed Round

Speed Round is presented in association with

The EGX30 closed Thursday in the green for the first time in weeks: The benchmark EGX30 closed in the green on Thursday for the first time in two weeks, rising 5% by the closing bell. The index closed in the red since 10 March as investors fled equities amid a global sell-off prompted by covid-19. The Madbouly government’s cuts to energy prices as well as to stamp and dividend taxes only slowed the selloff. Thursday’s gains came as state-owned National Bank of Egypt and Banque Misr said they had pushed a combined EGP 3 bn into equities in a sign of confidence in the market.

Traders, EGX welcome the move: Pharos Head of Research Radwa El Swaify said traders welcomed the stimulus from NBE and Banque Misr, while EGX boss Mohamed Farid welcomed the move, saying the banking sector and CBE had sent the right signal to boos investor confidence, according to a local press report.

Investor protection fund to enter the market? Also on Thursday, Financial Regulatory Authority Chief Mohamed Omran said in a statement that the Investor Protection Fund could invest as much as 10% of its EGP 4 bn war chest in propping up the market. The proposal still needs cabinet signoff.

The EGX closed the week down nearly 18% and is now off just a hair over 34% since the start of the year.

EGX companies continued their wave of stock buybacks under the loosened rules on the practice. We count 10 companies that have executed buybacks in the past few sessions, including EK Holding (in two transactions here and here), Arabia Investments here and here), GB Auto here and here) and both Raya Holding and Raya Contact Center.

Bondholders sold EGP 23.1 bn of Egyptian debt in the secondary market from the second half of February to the end of last week, the local press reported, citing market data. That’s but a drop in the ocean: Foreign holdings of Egyptian bonds amounted to EGP 310 bn at the end of February.

Still, debt investors are getting edgy: The cost of insuring against losses on Egyptian bonds over five years (the Egypt 5Y credit default swap) doubled to 519.5 bps from the third week of February to the end of last week.

US equities suffered their worst week since 2008 last week as the financial and economic consequences of the covid-19 outbreak grew increasingly bleak. The S&P 500 index capped a torrid week’s trading with another 4.4% drop into the red, leaving it down 15% during the week to lows not seen since 2016. The Dow Jones fell 17% during the five days of trading and the Nasdaq fell 12%.

European stocks saw some respite from the frantic selling earlier in the week to finish Friday’s session in the green: The European Central Bank’s announcement that it would buy up to EUR 750 bn of securities this year helped Europe’s major indices rebound on Friday, leaving them only marginally down on the week. France’s CAC 40 gained 5%, the German DAX rose 3.5% and the Euro Stoxx 50 finished 3.85% in the green at the close of play on Friday.

Volatility is down but remains abnormally high: The VIX fell more than 16 points from its record high at the start of the week to 66. To put this in context: The so-called ‘fear index’ fluctuated between 10 and the lower 20s for much of the previous decade.

It was another disastrous week in the oil markets as Saudi Arabia and Russia doubled down in their war of attrition for oil supremacy: US crude plunged 28% during the week to trade at USD 23.66/bbl at market close on Friday and Brent fell 21% to USD 27.38/bbl. Prices on the two crude benchmarks have both collapsed since the start of the year after the Saudi-Russia price war aggravated an already serious demand slump caused by the covid-19 outbreak. WTI is now down more than 63% from its recent peak at the start of the year and Brent has lost more than 60%.

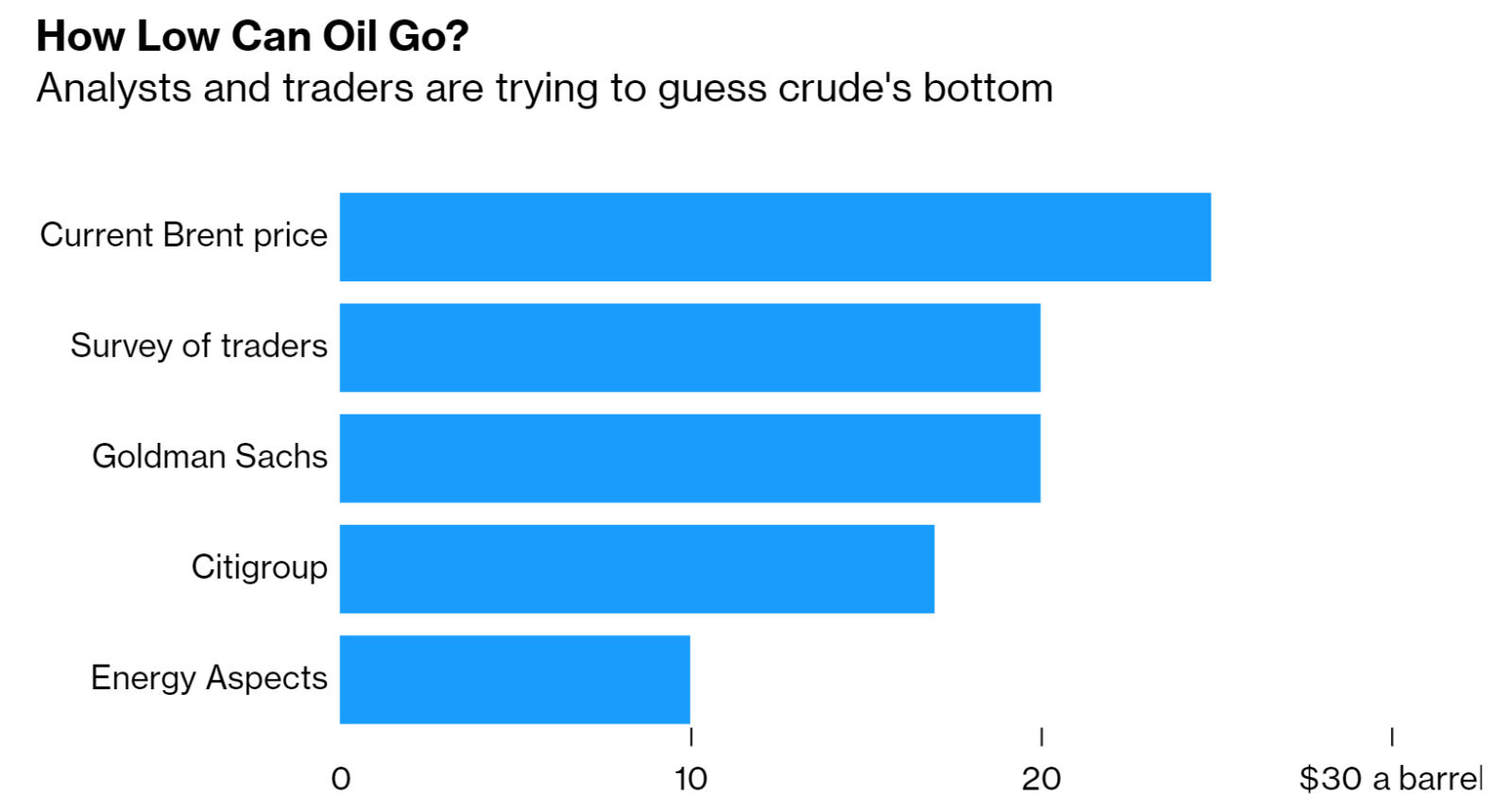

Prices are expected to plummet to lows unheard of in recent history, likely touching USD 20 per barrel or below, according to a Bloomberg survey. Out of 20 traders surveyed by the business information service, 18 expect the Brent index to hit or fall below the USD 20 mark, with WTI pinned at USD 3-5 lower. Goldman Sachs and Citigroup analysts also paint a gloomy picture, with some even warning of a rare occurrence of “negative physical prices in some areas,” forcing some producers to shut down.

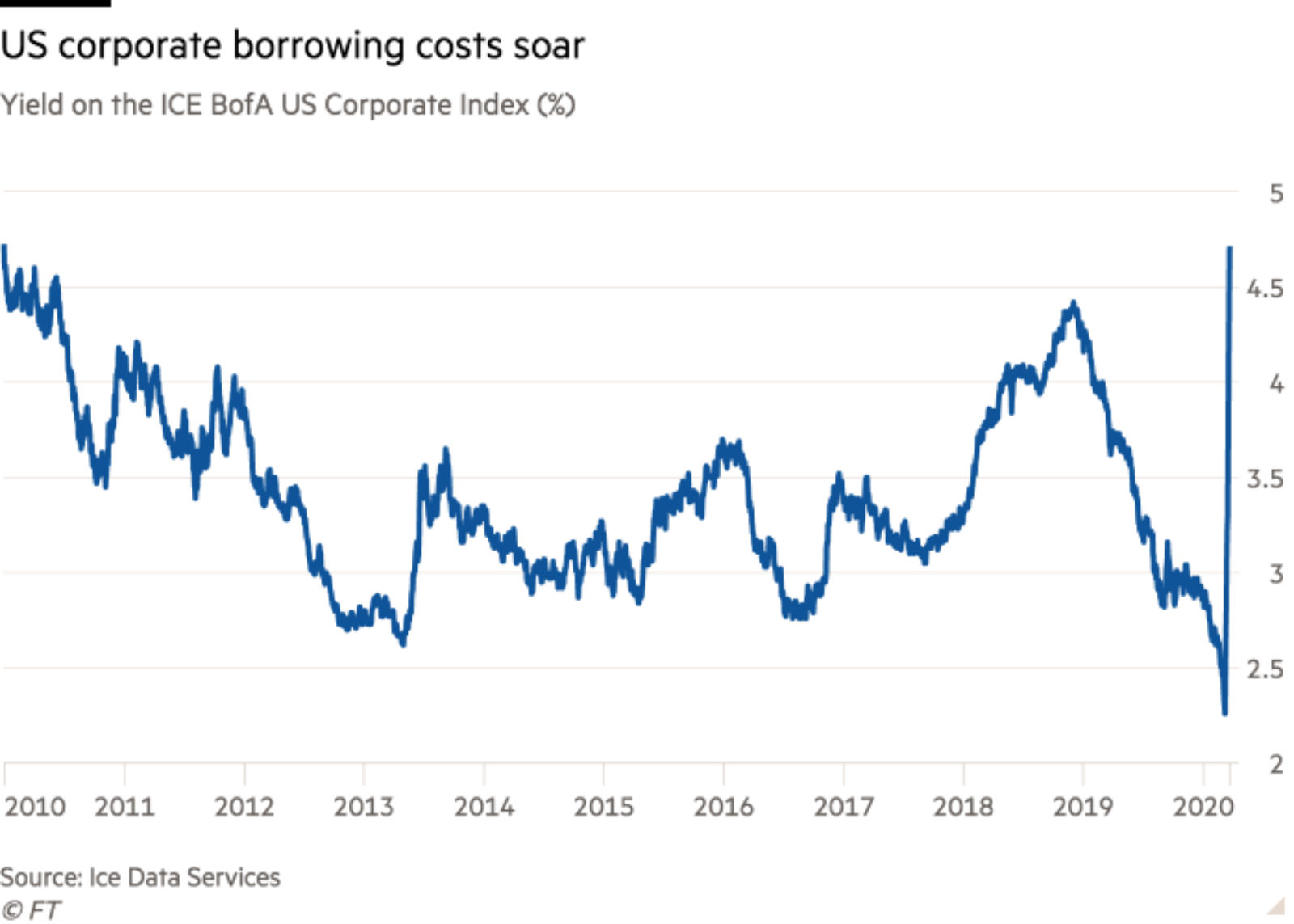

Even more worryingly, credit markets are trembling as investors sell off corporate debt at an unprecedented rate: The flood of central bank stimulus these past two weeks has failed to halt a corporate bond sell-off that has sent yields on investment and speculative-grade debt surging at an unprecedented rate, the Financial Times reports. Companies with investment-grade credit ratings have seen their borrowing costs double to an average of 4.7% as of Friday, yields on ‘junk-rated’ bonds have surged to more than 10%, according to Ice Data Services.

“Not like anything we have seen before”: The combination of the covid-19 virus and the collapse in oil prices are creating “a severe and extensive credit shock across regions, sectors and markets,” said Anne Van Praagh, a researcher at Moody’s. “The combined credit effects are unprecedented. This is not like anything we have seen before.”

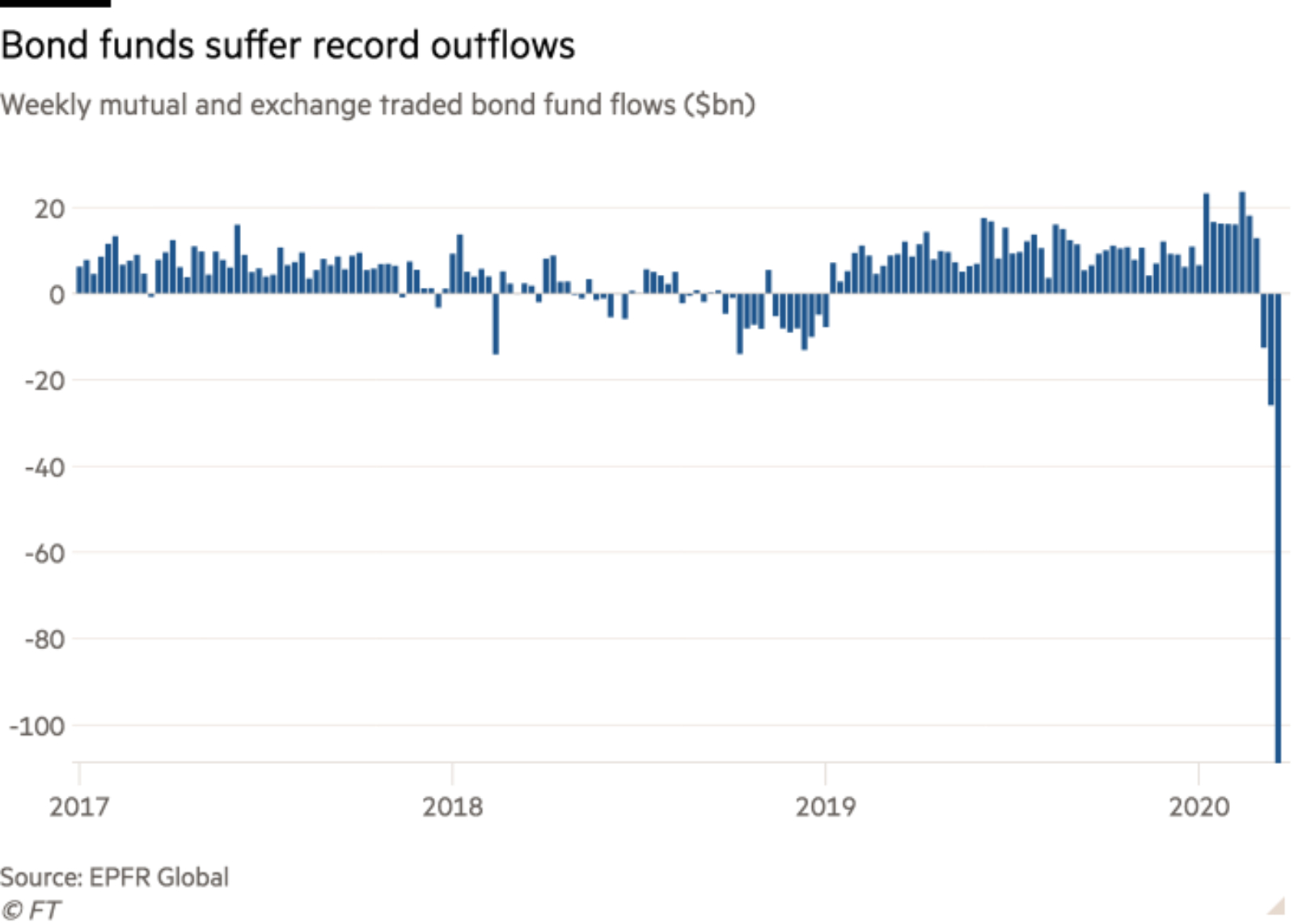

The “sell everything” mentality that took hold last week has analysts stunned: The sharp bond sell-off that took place last week in tandem with the cratering of the stock market is without precedent and has market watchers scratching their heads. The bond market, rather than providing a source of safety for investors, sold off in equal measure as asset classes of all stripes plunged into the red. “[It] was mind-boggling, said Bob Michele, CIO at JPMorgan Asset management. “I have been doing this now for almost 40 years, and this is the strangest market I have ever seen.”

REGULATION WATCH- CBE cuts interest for three of its financing initiatives: The Central Bank of Egypt (CBE) has reduced the discount interest rate offered under its support programs for factories, homebuyers and tourism companies to 8% following its emergency 300 bps rate cut last week, according to an official statement (pdf). The central bank originally offered a subsidized 10% interest rate on loans for qualifying businesses and homebuyers and is now cutting that to still provide an incentive to borrow.

Businesses and individuals who borrowed under the old program will benefit as their rates re-set to the new, lower price.

Background: The CBE last year increased funding to support the tourism sector to EGP 50 bn, allowing more companies in the sector to access soft loans to renovate and upgrade tourism infrastructure. It launched a EGP 50 bn mortgage finance program for middle-income housing last month to grant subsidized loans for middle-income homebuyers on houses valued at up to EGP 2.25 mn. Factories with annual sales of less than EGP 1 bn were also granted a EGP 100 bn initiative to boost domestic manufacturing by unlocking subsidized loans at a declining 10% interest rate.

ATM withdrawal, electronic payment limits increased: The CBE raised the daily limit on ATM withdrawals and electronic payments to EGP 30k for individuals and EGP 40k for companies, and the monthly limit to EGP 100k for individuals and EGP 200k for companies, according to a letter sent to banks (pdf), after announcing earlier it would relax credit limits and remove ATM and point-of-sale transaction fees and commissions. New bank cards will be issued for free for up to six months, the letter said.

Lending regs on supplier creditworthiness suspended: The CBE is suspending regulations it issued last December requiring banks to dig into the ownership and creditworthiness of a borrower’s suppliers, according to the local press. Under the rules, banks are required to obtain a full list of a borrower’s suppliers and run KYC, including obtaining copies of the supplier’s commercial registration document, before authorizing a loan.

FRA extends insurance premium deadlines: The Financial Regulatory Authority ordered insurance companies to extend the premium payment deadlines for their customers, it said in an official statement. Customers with life insurance will be granted a grace period of 60 days to pay their premiums without any fees, while medical and car insurance policies' premiums deadlines will be extended for 30 days. Companies will have an additional 30 days to pay collective life and property insurance.

PRIVATIZATION WATCH- The state privatization program is officially being put on ice as the covid-19 outbreak wreaks havoc on global equity markets, Public Enterprises Minister Hisham Tawfik told Ahram Online. The government will announce in two months the new plan for the privatization program, an unnamed official said. The program — which includes up to 23 companies scheduled to IPO or offer secondary stakes on the EGX — was previously expected to resume after several postponements next month with the long-anticipated IPO of Banque du Caire (BdC). Sources involved with the program had already signaled last week that BdC’s IPO was shelved.

Background: The state privatization program was announced in 2018 and is expected to reel in EGP 80 bn for state coffers, but has been postponed numerous times due to unstable market conditions. So, far only a single offering has come through — the 4.5% secondary stake offering of Eastern Tobacco in March of last year. Along with BdC, the other candidates for the state privatization program include Alexandria Container and Cargo Handling, Abu Qir Fertilizers, Sidi Kerir Petrochemicals, and e-Finance (which was pushed to 4Q2020 for other reasons).

CABINET WATCH- Cabinet greenlights EGX tax breaks: The Madbouly Cabinet has approved the emergency measures announced last week to cut stamp tax on EGX transactions and the withholding tax on dividends to reduce market volatility due to the covid-19 outbreak, according to a cabinet statement out following its weekly meeting on Thursday. The changes would cut the tax on dividend income to 5%, and lower the 0.15% stamp tax to 0.125% for foreign investors and 0.05% for residents. A capital gains tax that was due to be reintroduced this year would be postponed to 1 January 2022.

Other decisions from Thursday’s meeting:

- Approving changes to the executive regulations of a temporary law to settle building code violations to reflect legislative amendments ratified in January;

- Greenlighting a contract with Schneider Electric to build 10 new power transmission control centers; and

- Allocating a land plot in Zafarana to the Military Production Ministry to set up a plant to produce PV solar panels.

Remittances rise 5% in 2019: Remittances from Egyptians living abroad rose 5% to USD 26.8 bn in 2019 from USD 25.5 bn in 2018, according to preliminary central bank figures (pdf). The second half of the year in particular saw a notable pickup in inflows, which rose 13.5% on an annualized basis to USD 13.7 bn.

Inflows likely to take a hit this year: Remittances, a key source of foreign currency for Egypt, could witness downward pressure this year due to the crash in oil prices and the covid-19 outbreak. Transfers from workers in the oil-exporting GCC countries make up a large part of the country’s remittance inflows, but these will likely decline as companies come under pressure from the slump in oil prices to multi-decade lows.

Egypt taps HSBC as financial advisor on Siemens plant sale: State-owned Egyptian Electricity Holding has tapped HSBC as the financial advisor on the sale of a 70% stake in the first of three Siemens-built combined-cycle power plants, cabinet said in a statement. Citibank was previously said to have also been in the running.

Background: Six investors have already expressed interest in the 70% stake, which will be marketed to interested investors by the Sovereign Fund of Egypt (SFE). The acquisition is due to be completed this year, but we are yet to hear any updates on the timeline. The SFE is set to acquire the remaining 30% stake.

EARNINGS WATCH- Domty recorded EGP 156.2 mn in net profit in 2019, up from EGP 154.6 in the previous year, according to an EGX disclosure (pdf). Revenues rose 3% in the 12-month period, reaching EGP 2.67 bn from EGP 2.59 bn in 2019.

The Macro Picture

EM economies under stress as investors dump debt, flock to rising USD: Emerging market debt and equity outflows have hit USD 78 bn in the two months since the start of the covid-19 crisis in January, with investors rushing to snap up cash as a safe haven asset, Jonathan Wheatley writes for the Financial Times. The outflows recorded over the past two months are more than triple the amount seen in the three months following the beginning of the global financial crisis in September 2008, according to the International Institute of Finance (IIF). The sell-off “amounts to a ‘sudden stop’ in funding and will cause a sharp tightening in financial conditions, leaving households, businesses and governments starved of credit,” says IIF Chief Economist Robin Brooks.

EM currencies have also fallen against the greenback, while the yield premium on USD sovereign debt in EMs over US government bonds has spiked, Avantika Chilkoti writes for the Wall Street Journal. The yield spread has widened to more than five percentage points, from just above three percentage points four weeks ago. The difficulties in trading EM bonds is evident in a discount on the net asset value in the market, such as the JPMorgan USD emerging markets bond ETF, which was trading last week at 96% of net asset value. “Such a discount is unusual and indicates investors are selling the exchange-traded fund faster than the fund can unload its holdings,” Chilkoti writes.

But the bond market and debt burden may not be as big of a threat as the wider picture of overall economic damage from the covid-19 outbreak, says the FT’s influential Lex column. In comparison to 2013, when a rallying USD drove down EM bond prices as investors were concerned about defaults on USD-denominated debt, narrower current account deficits and stronger FX reserves mean EMs are better positioned today to handle the shock of falling bond prices. However, corporate earnings across EMs are expected to take a hit this year and JPMorgan has already said that EMs (excluding China) will slide into a recession in 1H2020.

On the bright side — the USD rally is losing steam (at least momentarily): The Bloomberg USD index slid significantly on Friday after California’s governor ordered all residents to stay at home as of Thursday evening. The slide comes after the index hit a record high on Wednesday amid bond and equity sell-offs. “The softer [USD] tone is giving some respite to many badly beaten-up currencies,” said a senior EM strategist at TD securities, but the USD is still in high demand and is likely to “get back on track.” Options pricing continues to indicate that investors are bullish on the greenback, according to the business information service.

Egypt in the News

Cairo is a city conflicted as it grapples with these early months of the global covid-19 outbreak. Not entirely on lockdown, it’s not far from approaching it either. Hamza Hendawi captures in the National this teeming metropolis as it tries to go about business as usual while contending with unfamiliar safety measures and a gut punch to the economy.

Also making the rounds of the international press was the release of 14 critics of the government on Thursday, including political activist Shady el-Ghazaly Harb, amid calls by activists and rights groups for action including release of those in pre-trial detention for non-violent offenses before covid-19 spreads in the nation’s jails.

Worth Watching

Clinical trials for experimental covid-19 vaccine finds no shortage of volunteers: An attempt to develop a covid-19 vaccine in a Seattle research facility has already attracted 45 human guinea pigs to test its efficacy.Inside Edition’s Lisa Guerrero spoke with Neal Browning, or ‘patient number two’, who says he’s taking a risk that could eventually lead to a cure for all of humanity (watch, runtime: 2:08). Browning is in a group of healthy individuals helping researchers determine whether the injection is safe and leads to the desired immune system response as a first phase of the vaccine trial, which began on Monday and will run for six weeks.

Diplomacy + Foreign Trade

El Sisi, Merkel talk covid-19, GERD, and Libya: President Abdel Fattah El Sisi and German Chancellor Angela Merkel agreed to exchange experience and coordinate healthcare strategies to curb the spread of the covid-19 virus in a phone call yesterday, an Ittihadiya statement said. The two sides also discussed the Grand Ethiopian Renaissance Dam dispute and the latest developments in Libya.

Energy

SDX begins drilling Sobhi well in Egypt’s South Disouq

SDX Energy has started drilling its Sobhi well in the South Disouq concession, which is expected to reach 2.3k meters by late April, according to a company statement. The USD 2.3 mn well is set to access the Kafr el Sheikh formation that SDX’s Ibn Yunus well is currently extracting from and should connect via pipeline to the South Disouq central processing facility upon completion.

Basic Materials + Commodities

Egypt wheat imports hold steady in 2020-2021

Egypt is expected to import 12.85 mn tonnes of wheat in marketing year (MY) 2020-2021, up a marginal 0.4% from 12.8 mn this MY, according to a report from the US Foreign Agricultural Service (pdf). Wheat grown at home is expected to record 8.9 mn tonnes in MY2020-2021, up 1.5% from MY2019-2020. Corn imports are expected to rise 1% to 10 mn tonnes and rice imports to come in at 200k tonnes. The MY in Egypt runs between July-June.

Tourism

EGOTH in talks with banks for EGP 400 mn loan to renovate Sofitel Winter Palace

The Egyptian General Company for Tourism and Hotels (EGOTH) is in talks with unnamed local banks for a EGP 400 mn loan to refurbish its Sofitel Winter Palace hotel in Luxor, EGOTH Chairman Sherif Bendary said. The company recently signed a loan agreement for the same amount with the National Bank of Egypt to renovate the historic palace adjacent to the Marriott Mena House hotel. Both loans will come from the EGP 50 bn set aside by local banks to support the tourism sector under a recently expanded central bank program.

On Your Way Out

In the UK, shoppers are being surprisingly selective with their panic buying (watch, runtime: 00:25).

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Thursday): 9,206 (+5.1%)

Turnover: EGP 1.2 bn (101% above the 90-day average)

EGX 30 year-to-date: -34.1%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 5.1%. CIB, the index’s heaviest constituent, ended up 7.4%. EGX30’s top performing constituents were TMG Holding up 8.9%%, SODIC up 8.1%, and Elsewedy Electric up 7.6%. Thursday’s worst performing stocks were Credit Agricole down 8.9%, GB Auto down 3.8% and Sidi Kerir Petrochemicals down 3.2%. The market turnover was EGP 1.2 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -335.6 mn

Regional: Net short | EGP -42.2 mn

Domestic: Net long | EGP +377.8 mn

Retail: 42.3% of total trades | 37.7% of buyers | 47.2% of sellers

Institutions: 57.7% of total trades | 62.7% of buyers | 52.8% of sellers

WTI: USD 22.63 (-12.66%)

Brent: USD 26.98 (-5.23%)

Natural Gas: (Nymex, futures prices) USD 1.60 MMBtu, (-3.02%, April 2020 contract)

Gold: USD 1,488 / troy ounce (+0.39%)

TASI: 6,267 (+1.83%) (YTD: -25.29%)

ADX: 3,685 (+8.41%) (YTD: -27.39%)

DFM: 1,819 (+2.85%) (YTD: -34.20%)

KSE Premier Market: 4,902 (+5.1%)

QE: 8,576 (-0.98%) (YTD: -17.73%)

MSM: 3,567 (-1.10%) (YTD: -10.39%)

BB: 1,408 (+2.45%) (YTD: -12.25%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist-sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.