- Inflation slows to 5.3% in February, but will covid-19 give it a bump? (Speed Round)

- EGX boss expects fresh IPOs this year despite global flight from equities. (Speed Round)

- Oil Ministry slashes rental fees on gold exploration blocks in a bid to lure investors. (Speed Round)

- Suez Cement to offload stake in Kuwait’s Hilal Cement after reporting EGP 1.2 bn loss. (Speed Round)

- AT Lease plans EGP 1 bn securitized bond offering in 3Q2020. (Speed Round)

- How China is using big data to tackle the spread of covid-19. (Worth Watching)

- Why Egypt looks set to be a regional leader in electricity for the next nine years -BMI Research. (Hardhat)

- Schools are closed tomorrow because of weather, not corona.

- The Market Yesterday

Wednesday, 11 March 2020

Inflation slows in February, but will covid-19 give it a bump?

TL;DR

What We’re Tracking Today

PSA- Schools are off tomorrow, but not because of El Corona: Schools and universities are off nationwide on Thursday after the national weather service forecast that sandstorms and heavy rains accompanied by thunder and lightning are expected to hit the country, the cabinet announced in a statement. Showers are expected to continue through the weekend.

GOOD NEWS OF THE DAY #1: Nearly half Egypt’s covid-19 cases have recovered: Twenty-six of Egypt’s 59 confirmed covid-19 cases appear to have recovered, turning out negative tests after receiving medical care, the Health Ministry announced yesterday. Meanwhile, 48 foreign tourists held in quarantine from a Nile cruise boat in Luxor were released and travelled back to their countries yesterday after testing negative for the virus, while another 35 have been cleared for travel today, it added. Egypt reported no new cases yesterday.

GOOD NEWS OF THE DAY #2: There was actually some green on trading screens yesterday. The EGX30 is back out of bear territory after the index finished yesterday’s session up 2%. Trading was moderately heavy at EGP 774 mn (30% above the trailing 90-day average) as investors seemed to buy the dip after a torrid sell-off on on Monday that saw stocks plunge more than 7%. Index heavyweight CIB closed more than 3% in the green.

Don’t expect a return to normalcy just yet: Asian stocks were mixed and US equity futures were all at least 2% in the red at the time of dispatch, signalling another turbulent day on Wall Street.

Sporting events on hold: The Sports Ministry is putting on hold all sports events and “youth gatherings” after the government suspended large public gatherings earlier this week to curb the growing number of infections, the cabinet announced yesterday.

AmCham has postponed its monthly luncheon due to take place this Thursday as a precautionary measure against the covid-19 outbreak.

Schools have not been cancelled for the rest of the year, the Education Ministry said yesterday, and if classes were to be suspended, students will have to finish their coursework from home. A cabinet spokesman hit the airwaves last night to underscore that while the government is closely monitoring the situation, suggestions classes were being cancelled are just rumours.

The effects of covid-19 on Egypt’s tourism industry is leading the conversation in the foreign press this morning: Pieces in the New York Times and AFP ask what we can expect the impact on Egypt’s tourism industry to be and whether enough is being done to contain the health risk in the face of promoting Egypt as a tourist destination. Meanwhile, the Associated Press talks to a Florida family who were among those quarantined on the Nile cruise ship in Luxor over the weekend.

Tourism companies told to monitor symptoms: The Egyptian Travel Agents Association is also taking measures of its own and has required its members to report tourists that show any symptoms of rising fever, the local press reports.

In miscellaneous Egypt-related covid-19 news:

- Jordan has closed its seaports to ships coming from Egypt, Reuters reports.

- Oman’s Health Ministry is requiring travellers returning from Egypt to be quarantined for two weeks, a decision that started on Sunday, according to the Times of Oman. Travellers that returned from Egypt after 22 February must now quarantine themselves at home, wear a mask if they visit any health facility, and avoid using public transport.

- First Lebanon covid-19 death has Egypt tie: A Lebanese man who returned from Egypt a week ago yesterday became the country’s first person to die from covid-19, Reuters reports.

- EgyptAir flights brought Egyptians back from Saudi Arabia yesterday after the kingdom decided on Sunday to suspend travel between the countries, according to a cabinet statement. An Egyptian citizen transiting through Saudi Arabia on his way back from New York to Cairo has tested positive for covid-19, Saudi state media reports.

The one thing we’re reading on covid-19 this morning: Top coronavirus doctor in Wuhan says high blood pressure is major death risk in Bloomberg, which is full of sensible advice and findings.

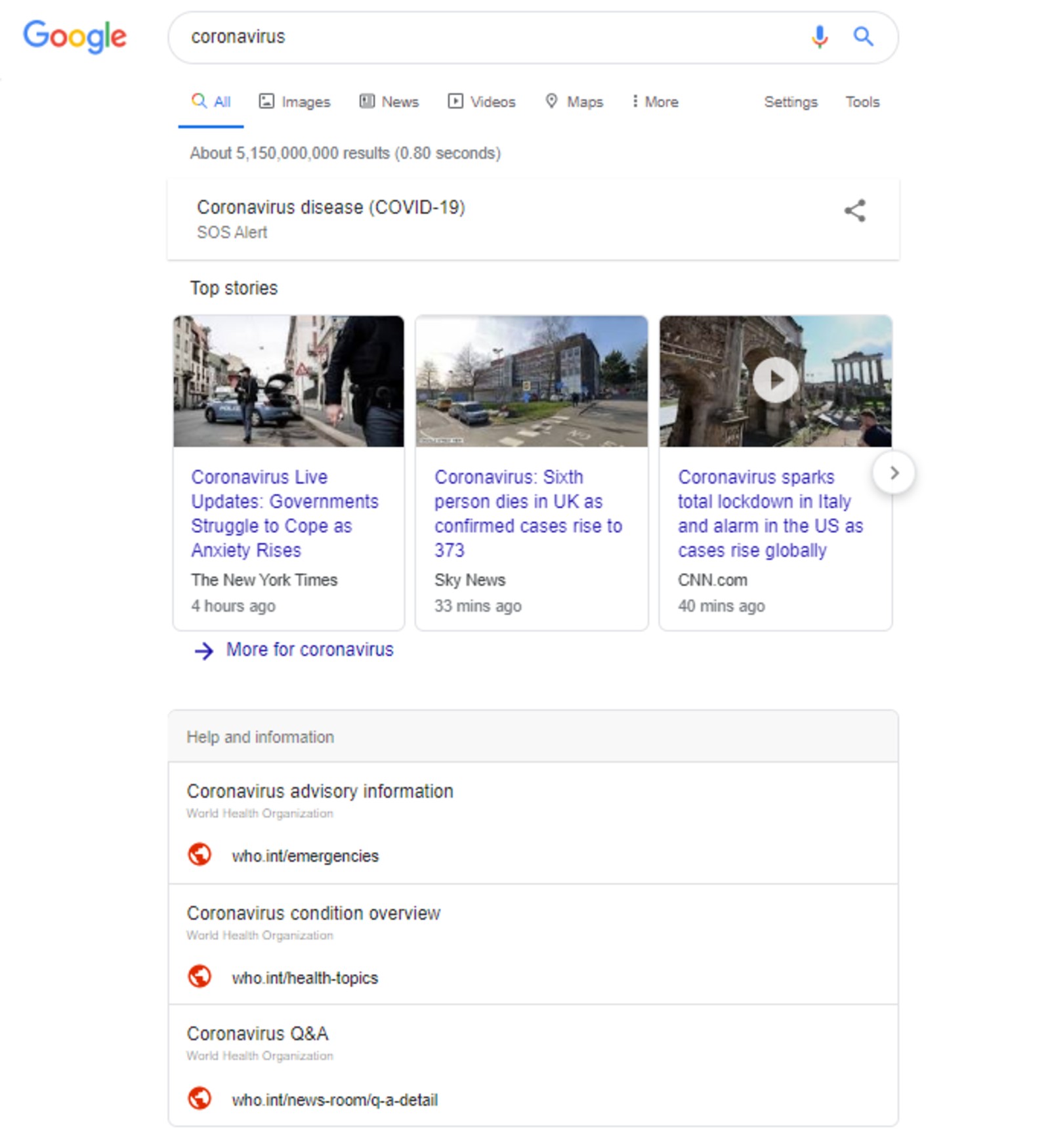

Google is aggressively cleaning up coronavirus misinformation on its platforms: Google has altered what appears when users search something related to the virus, now showing an “SOS Alert,” with news from mainstream publications followed by information from the US Centers for Disease Control and Prevention and the World Health Organization, according to Bloomberg. YouTube has also had a covid-19 facelift with videos claiming to prevent the virus and ads discussing the virus both banned, while instead governments and NGOs have been given free ad space on the video service.

Investors still demanding higher yields at CBE bond auction: The Central Bank of Egypt (CBE) sold less than a third of its bond offering in yesterday’s auction amid pressure from investors for higher yields. Official data shows that investors bought EGP 2.28 bn worth of five-year and 10-year treasury bonds out of the EGP 7.5 bn on offer. Demand for the 10-year tranche was particularly poor, with investors snapping up just EGP 77 mn of the EGP 3.5 bn offering after the central bank accepted yield of 14.033%, almost 60 bps beneath the rate targeted by investors. The EGP 4 bn five-year tranche was undersubscribed by almost half, with the CBE selling EGP 2.2 bn at a 14.458% yield, against the 14.591% sought by investors.

US stocks bounce back after madness of ‘Black Monday’: US stocks staged a recovery yesterday after suffering the worst sell-off since the 2008 financial crash. All three major indices staged a late rally on news that President Trump is considering a multi-bn payroll tax cut in response to covid-19 and as traders regained their buy-the-dip mentality.

European equities didn’t fare as well, with all indices finishing in the red, albeit to a far lesser extent than they did on Monday.

Oil prices staged a slight recovery yesterday following Monday’s Saddam levels of carnage: US crude rose 10.4% to USD 34.36/bbl and Brent crude was up 8.3% to USD 37.22/bbl.

This probably isn’t going to become a trend: Saudi Arabia doubled down on its mission to upend the oil markets yesterday, signalling that it is quite happy to shred its budget targets if it means one-upping Russia and the US in the oil trade. Saudi Aramco announced that it would increase production to a record 12.3 mn bbl/d, placing further pressure on a market already suffering a demand slump and teetering on the news that Riyadh would slash prices to lows not seen in 20 years. Bloomberg has more.

Russia signalled a comparatively concessionary tone, reportedly refusing to rule out further OPEC talks, according to CNBC.

Biden takes a huge step towards the Democratic nomination: Democratic presidential candidate Joe Biden looks increasingly likely to claim the Democratic nomination after winning big in yesterday’s round of primaries. The former vice president as expected won the southern states of Missouri and Mississippi but crucially also took Michigan, a state that rival candidate Bernie Sanders was pinning his hopes on winning. The states of Washington and North Dakota were leaning towards Sanders at the time of dispatch and Idaho looked to be going to Biden. The New York Times and Washington Post have live updates on the results as they come in.

Are securities analysts a thing of the past? Heightened regulation, automation and the rise of index funds paint a grim picture for the continued viability of the profession but a Financial Times video (watch, runtime: 3:08) suggests that humans won’t lose their place at the table anytime soon. Much like any profession, failure to adapt to a changing market will be costly, but the need for people to interpret the numbers behind investments remains very clear. While hiring for securities analysts in the US and UK is falling, demand for CFA certification is steady and even rising among Asian countries.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and even social infrastructure such as health and education.

In today’s issue: We shine a spotlight on Fitch Solution’s BMI Research report on Egypt’s electricity sector which forecasts robust growth over the next nine years.

Enterprise+: Last Night’s Talk Shows

Wall-to-wall coverage of the covid-19 outbreak continued on the airwaves last night: Al Hayah Al Youm’s Lobna Assal covered the joint press conference held by the ministers of health, tourism and telecommunications on Egypt’s covid-19 cases. Health Minister Hala Zayed said that the positive cases remained at 59 and no new ones had been discovered. She said the ministry had expanded its testing activities to cover all Nile cruise boats and hotels in Luxor and Aswan, where 558 random samples were collected, all of which tested negative. She added that Egypt was among the first countries in the region to purchase PCR detection systems being used in ports nationwide (watch, runtime: 5:03), (watch, runtime 3:03). Min Masr’s Amr Khalil also covered the press conference (watch, runtime: 2:12).

Rapid virus detectors en route: Yahduth Fi Misr’s Sherif Amer spoke by phone with Zayed, who pointed out that Egypt still has a low rate of confirmed cases compared to some European countries. She covered the precautionary measures being taken in ports and said that Egypt had purchased rapid detection systems — which deliver results in 30 minutes compared to the six hours taken by PCR tests — saying they would be deployed in airports to help the initial screening of passengers arriving from high-risk countries (watch, runtime: 12:10). PCR tests will remain the gold standard, she suggested, noting their 98% accuracy rate.

Football behind closed doors: Masaa DMC’s Ramy Radwan covered the Sports Ministry’s announcement that it will cancel most games in line with the government’s recent ban on large gatherings. He also took note of the Football Association’s announcement that it will hold upcoming matches behind closed doors. (watch, runtime: 2:07).

Gov’t issues warning on online fake news: Radwan also spoke by phone with cabinet spokesman Nader Saad who stressed the harsh measures that would be taken against those who spread false information about covid-19 on social media. He added that the country had not reached a stage that necessitated suspending schools, but the issue was being monitored on an “hourly basis.” (watch, runtime: 6:50). An “anti-rumor law” is currently working its way through the House that would impose a prison sentence of up to three years, and fines of up to EGP 100k, for those convicted of spreading disinformation. Al Hayah Al Youm’s Hossam Hadad (watch, runtime: 3:37), and Khalil (watch, runtime: 2:21) also ran reports warning of the hazards of covid-19 rumormongering.

Speed Round

Speed Round is presented in association with

Annual urban inflation fell in February following three months of back-to-back acceleration, according to Capmas figures out yesterday. The reading came in at 5.3%, down from 7.2% in January. On a monthly basis, prices remained constant after having risen 0.7% in January.

Once again, food prices were primarily responsible: Food prices, which account for a third of the basket of goods, took 1.1 percentage points off the headline rate, falling by 2.3% on an annual basis.

Core inflation falls slightly: Annual core inflation fell to 1.9% in February from 2.7% the month before, according to figures released by the Central Bank of Egypt (pdf). On a monthly basis, core inflation fell to 0.2% from 1%.

Will slowing inflation persuade the CBE to resume its easing cycle? Yes, says Capital Economics, which now expects a 50 bps rate cate when the MPC meets on 2 April. Both inflation — which is now well below the central bank’s 9% (+/-3%) target range — and the EGP — which is up 2% against the greenback so far this year — gives policymakers additional room to make further cuts to interest rates. It also suggests that the central bank will make protecting economic activity its priority and cut rates to try to mitigate the negative effects of the covid-19 outbreak.

No, says Pharos’ head of research Radwa El Swaify, who told us that the CBE will not risk dampening foreign appetite for Egyptian debt. She forecasts the MPC will leave rates unchanged when it meets at the beginning of next month. “We expect the CBE to maintain rates in light of the expected pressure on Egypt’s three key sources of foreign currency (foreign portfolio investments, tourism, and remittances). This is obvious from the witnessed weakness in the EGP/USD exchange rate over the previous 2-3 weeks,” she said. Mohamed Abu Basha, EFG Hermes’s head of research, concurred, telling Bloomberg that the central bank will probably hold rates due to the negative effects of covid-19 on Egypt’s external balance.

Will covid-19 give inflation an upward nudge? Local manufacturers reliant on covid-19 ridden China are struggling to find alternative source markets for their raw materials and will likely see (or have already seen) their costs edge up as a result. This could lead to cost-push inflation and reflect in the inflation figures of subsequent months, perhaps prompting the CBE to hold off on easing.

The central bank had lowered interest rates four times over the course of 2019, delivering a total 450 bps in cuts between February and November. It left rates on hold at its two last meetings to contain inflationary pressures and in light of global headwinds.

The overnight deposit rate currently stands at 12.25% and the lending rate is at 13.25%. The main operation and discount rates are 12.75%.

EGX boss expects fresh IPOs this year despite market turmoil: The current market volatility will not prevent new companies listing on the Egyptian Exchange, according to EGX boss Mohamed Farid, who said yesterday that two or three IPOs will go ahead before the end of the year. Egyptian equities have come under pressure over the past two weeks as fears of the impact of the covid-19 virus on the economy and an oil price war being waged by Saudi Arabia and Russia caused investors to dump equities all around the world in search of safe-haven assets. But speaking during the Capital Markets Summit yesterday, Farid said that conditions on the EGX were stabilizing.

Farid echoed Public Enterprises Minister Hisham Tawfik, who told El Kahera Alaan’s Lamees El Hadidi on Monday night that the IPOs of Banque du Caire (BdC) and E-Finance will in the coming months, as would a stake sale by Alexandria Containers. State-owned BdC is the closest to go to market and kickstart the stalled state privatization program. BdC Chairman Tarek Fayed reiterated earlier this week that the bank will continue with its plans to offer a 20-30% stake in April while cautioning that this could be delayed if the global selloff saps investor sentiment.

Private-sector IPOs in the pipeline: Qalaa Holdings has previously said it will IPO its Taqa Arabia and Arab Refining Company units this year, and Farid told El Hadidi that an unnamed financial company is also heading to market. Taqa had been scheduled for late April, while ARC and the financial company were due to make their offerings this fall.

Oil Min slashes rental fees on gold exploration blocks in a bid to lure investors: The Oil Ministry will cut rental fees on gold exploration blocks by 80% as it tries to persuade international investors to bid in its upcoming mining tender, the local press reported citing unnamed sources. Investors will pay just EGP 5k per sq km in rental fees, down from the EGP 25k written in the newly-amended Mineral Resources Act. Bidding for the first gold exploration tender since 2017 will open on 15 March for a four-month period, and will cover a 56k sq km area in the Eastern Desert.

The new tender will be the first tender of its kind since amending the Mineral Resources Act, which the government hopes to stimulate investment in the sector. Under the new regulations, gold mine operators will pay the minimum 5% royalty and income tax of 22.5% once production starts.

Several foreign companies have expressed interest in participating in the tender: Canada’s Forbes & Manhattan Group and Franco-Nevada Corporation and US-based giants Newmont Corporation and Barrick Gold recently joined a growing list of potential investors including Centamin, Sprott and Kinross Gold. Aton Resources in February was awarded Egypt’s first new gold exploration license in 15 years, and will explore the Eastern Desert’s Hamama region under a 20-year license.

M&A WATCH- Suez Cement to offload stake in Kuwait’s Hilal Cement after reporting EGP 1.2 bn loss: Cement producer Suez Cement is looking to offload its 51% stake in Kuwait’s Hilal Cement, according to a regulatory filing (pdf). Hilal Cement is the third largest producer in Kuwait and operates two cement import terminals. Suez Cement has been the majority shareholder in the company since 2007.

The decision to sell the stake as the industry continues to struggle. Suez saw its Tourah plant suspend production amid a sustained supply glut and a race-to-the-bottom price war. Annual financial statements released yesterday (pdf) showed the company remains in the red, turning in a net less of EGP 1.2 bn, on par with last year, “mainly due to additional restructuring one-off expenses and impairment due to the closure of Tourah plant.” Revenues fell 13% to EGP 6.5 bn during the year due to the intensifying supply gap in the market.

“2019 was perhaps the worst year the cement industry has witnessed in its recent years, deepening the downturn of Egypt’s cement sector as excessive oversupply and very intense competition, coupled with a continuous slowdown in demand for cement during the last three years have put the industry into an official recession,” CEO Jose Maria Magrina said. “We expect the market to remain challenging in 2020 as the new capacities added to the market in the past two years continues to put downward pressure on an already uneconomical cement sector.”

The company’s board also approved a three-year USD 125 mn loan from parent company HeidelbergCement at a 6.5% interest rate. The loan will be used to offset the current local overdue payments denominated in EGP.

DEBT WATCH- AT Lease plans EGP 1 bn securitized bond offering in 3Q: AT Lease is planning to issue EGP 1 bn in securitized bonds in 3Q2020, CEO Tarek Fahmy told the local press. The offering will feature one-year, three-year and five-year tranches, and the company will not begin negotiations with advisors until the third quarter, he said.

AT Lease will start providing factoring services to SMEs in the second half of the year after recently receiving its license from the Financial Regulatory Authority. Fahmy had originally expected to begin factoring in the first quarter.

Misr Capital Investments plans bond, sukuk sales: Misr Capital Investments, Banque Misr’s investment arm, is also planning to offer securitized bonds and sukuk worth EGP 8 bn this year, CEO and Managing Director Khalil El Bawab said during a conference. This is a slight drop from last year when the fund issued EGP 9.8 bn in securitized bonds.

MOVES- Hani Sarie-Eldin has stepped down as chairman and non-executive member of Sodic’s board of directors, the company said in a statement (pdf). “During his tenure SODIC has added over 7 million sqm to its land bank and has solidified its position at the forefront of the real estate market, having almost tripled its sales since his appointment,” the statement said.

Veteran economist and former investment minister Osama Saleh has been appointed to the board, the company said. Saleh has also served as chairman of the General Authority for Investment and of the Egyptian Mortgage Finance Authority.

Image of the Day

The covid-19 outbreak mapped: Masrawy has created an interactive map showing how the virus has spread, as well as all the countries that now have the virus, how many cases, and how many deaths.

Egypt in the News

The dispute over the Grand Ethiopian Renaissance Dam is again getting ink in the pages of the foreign press this morning: An op-ed in The Independent leans heavily on the proposition that war between Egypt and Ethiopia is a growing possibility, reminding readers that both former President Anwar El Sadat and former UN Sec-Gen Boutros Boutros-Ghali warned that water was the only issue that could drag Egypt into conflict. It also noted that it’s an election year for Ethiopia, and no political contenders can afford to be soft on the issue. “Ethiopia is isolated, Egypt is cornered,” the piece says, and suggests an agreement may only be reached by US President Donald Trump intervening in a hunt for a Nobel Peace Prize. A report in Gulf News said that a measured diplomatic effort will inform talks in the near future, quoting Al Ahram Centre for Strategic and Political Studies analyst Hany Raslan as saying that Egypt will stay committed to “cooperation and partnership” provided its interests aren’t harmed.

The sentencing of human rights lawyer Ziyad El Elaimy also made international headlines: The Associated Press reports that El Elaimy yesterday received a one-year jail sentence and a EGP 20k fine for disseminating fake news during an interview with BBC Arabic in 2017. Amnesty International responded to the court’s decision by calling for his immediate release and calling him a “prisoner of conscience” punished for speaking to the media.

Worth Watching

China is harvesting all the data it can to counter covid-19, but extreme surveillance methods worries rights activists: China’s antivirus strategy utilizes massive surveillance that tracks the entire population through cameras with facial recognition and drones that follow people around barking orders, according to a Wall Street Journal video (watch, runtime: 06:35). The surveillance reached the extent that they were able to create the “Close Contact Detector” a mobile application with over 200 mn users that could tell you if you came into contact with someone who tested positive for the virus. As China’s technology usage is on the rise, so are human rights concerns over civil liberties. Now South Korea seems to be following the same model citing health concerns.

Why Egypt looks set to be a regional leader in electricity for the next nine years: We’re setting aside our covid-19 talk of last week to look beyond the current crisis in the infrastructure, where Fitch Solutions’ BMI Research Egypt Power report (paywall) on Egypt’s electricity sector is on track to generate an exportable surplus. The report sees Egypt increasing power generation to 265 terawatt hours (TWh) by 2023 from 231.5 TWh this year. This will allow it to generate a surplus even as domestic demand rises to 234.9 TWh by 2023.

Electricity sector growth driven by gas-fired power plants: Egypt will remain heavily dependent on fossil fuels through to 2028, with gas and coal-fired plants producing 85% of the country’s electricity. Most of this will be powered by the country’s large natural gas resources, with gas-fired plants — like the Siemens / Orascom Construction / Elsewedy Electric combined cycle power plants — expected to account for 75% of total power generation.

Coal among the biggest losers in the sector: The report is bearish on coal and expects it to become increasingly marginalized as the use of gas-fired plants increases. “Coal-fired power has lost favor in Egypt once again, following the discovery of robust domestic gas reserves,” the report says, pointing to the number of high profile projects that have either stalled or cancelled altogether. These include the 2.65 GW Al Nowais plant that was scrapped last October, and the 6.6 GW Hamrawein project, which looks to have been relegated to “zombie” status.

Renewables will be the fastest growing segment through to 2028: “Egypt will be one of the fastest growing non-hydropower renewables market in the region over our 10-year forecast period, with capacity expanding by more than 8.5 GW at an average rate of 22.1% y-o-y between 2019 and 2028,” the report says. This rate boils down to a number of key factors, including the availability of solar and wind potential, and the decreasing costs of harnessing solar and wind energy. “Falling equipment costs will make such facilities increasingly profitable while offering cost-competitive electricity tariffs relative to average thermal power rates,” it says. This in particular will help to bring in private sector investment, which BMI Research sees as crucial to growing the sector.

Continued foreign funding and private sector involvement are driving growth in renewables: The number of renewable energy projects in the pipeline has been growing with an influx of foreign funding and increasing private sector activity. Other key projects in the pipeline include: the Orascom Construction-led 500 MW wind farm in Ras Gharib, ACWA Power’s 200 MW Kom Ombo solar plant, Lekela Power’s USD 325 mn 250 MW West Bakr wind farm, and Smart Energy solutions 250 MW solar power complex, whose first phase is expected to cost USD 1.2 bn. That’s not forgetting the USD 4 bn Benban solar park that was officially completed last October.

Still, the gov’t looks unlikely to meet its 2022 target of 20% renewables: Despite the rapid growth in the sector, BMI Research does not think the government will meet its target to generate 20% of its power from renewable energy by 2022, calling it “an unrealistic target, especially given the hefty investment registered in gas-fired thermal power projects.”

Ditto nuclear: “We remain downbeat on the prospect of the Dabaa nuclear power plant project reaching completion and entering commercial operations within our forecast period to 2028,” BMI says, citing the high costs and steady growth of generation from other sources. The report does note, however, that Egypt’s strategic ties with Russia might provide it with the impetus to continue with the project. You can check out our starter pack on the Dabaa nuclear power plant here.

Other “weaknesses” in the sector: In addition to coal and nuclear, the report highlights a number of issues that it feels are “weaknesses” in the sector. These include:

- The continued overdependence on fossil fuels;

- Difficulties in securing financing for larger scale projects;

- The dominance of the state-owned Egyptian Electricity Holding Company in the sector;

- Ageing grid infrastructure;

- “A poor track record in developing projects cost-efficiently.”

But with the growth in capacity and a robust export market, Egypt looks set to be a regional leader in electricity: “New capacity in Egypt and the UAE will account for almost 65% of the region’s total net growth in renewables capacity, spurred on by high-volume private sector investment and increasingly competitive renewables auctions expected over our forecast period to 2028,” the report says. Egypt’s plans to export surplus to other countries in the region will also contribute to the country becoming a regional power hub, with agreements with Saudi Arabia, Sudan, Cyprus and Greece set to see it send electricity in almost all directions.

Top infrastructure news of the week:

- Transport Minister Kamel al-Wazir met Thales International head Patrice Caine to talk railway modernization and improving electrical signaling systems on Cairo-Alexandria and Assiut-Nag Hammadi railways.

- A EGP 2 bn sludge digestion plant will be constructed in Alexandria to reduce sludge produced by the Eastern Wastewater Treatment Plant and generate electricity.

- Korean infrastructure company CGN is being considered to manage the dry port at Borg El Arab after submitting a bid.

- Some 250k thermal scanners have been purchased for deployment at ports nationwide to detect covid-19 infections.

- Trade Minister Nevine Gamea and Environment Minister Yasmine Fouad met to discuss importing scrap materials for an industrial waste to energy program and promoting environmentally-friendly industrial production.

The Market Yesterday

EGP / USD CBE market average: Buy 15.66 | Sell 15.78

EGP / USD at CIB: Buy 15.67 | Sell 15.77

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Tuesday): 11,200 (+2.0%)

Turnover: EGP 774 mn (30% above the 90-day average)

EGX 30 year-to-date: -19.80%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 2.0%. CIB, the index’s heaviest constituent, ended up 3.1%. EGX30’s top performing constituents were Egypt Kuwait Holding up 4.8%, Elsewedy Electric up 4.5%, and Cleopatra Hospital up 4.0%. Yesterday’s worst performing stocks were Pioneers Holding down 8.0%, Qalaa Holdings down 6.5% and Egyptian Resorts down 5.3%. The market turnover was EGP 774 mn, and regional investors were the sole net sellers.

Foreigners: Net long | EGP +1.2 mn

Regional: Net short | EGP -8.3 mn

Domestic: Net long | EGP +7.2 mn

Retail: 57.0% of total trades | 58.6% of buyers | 55.3% of sellers

Institutions: 43.0% of total trades | 41.4% of buyers | 44.7% of sellers

WTI: USD 35.46 (+3.20%)

Brent: USD 38.65 (+3.84%)

Natural Gas (Nymex, futures prices) USD 1.93 MMBtu, (-0.21%, April contract)

Gold: USD 1,657.20 / troy ounce (-0.19%)

TASI: 6,762 (+7.07%) (YTD: -19.40%)

ADX: 4,262 (+5.52%) (YTD: -16.02%)

DFM: 2,231 (+7.32%) (YTD: -19.31%)

KSE Premier Market: 5,174 (+0.3%)

QE: 8,433 (+3.34%) (YTD: -19.11%)

MSM: 3,797 (+0.68%) (YTD: -4.61%)

BB: 1,493 (+1.47%) (YTD: -7.26%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 March (Tuesday): The Annual Export Summit, Nile Ritz Carlton, Cairo, Egypt.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.