- Aldar Properties is expected to begin due diligence on Sodic “within days.” (M&A Watch)

- Africa Crest is renewing its plans to invest EGP 900 mn in two schools in Egypt this year. (Investment Watch)

- Now on the SFE’s menu: Water treatment + the Cosmic Village. (Privatization Watch)

- Are Cairo and Beijing setting up their own mini covid passport system? (Covid Watch)

- Heads are (kinda, sorta) rolling at the railway authority over the Qalyubia train crash. (Transport)

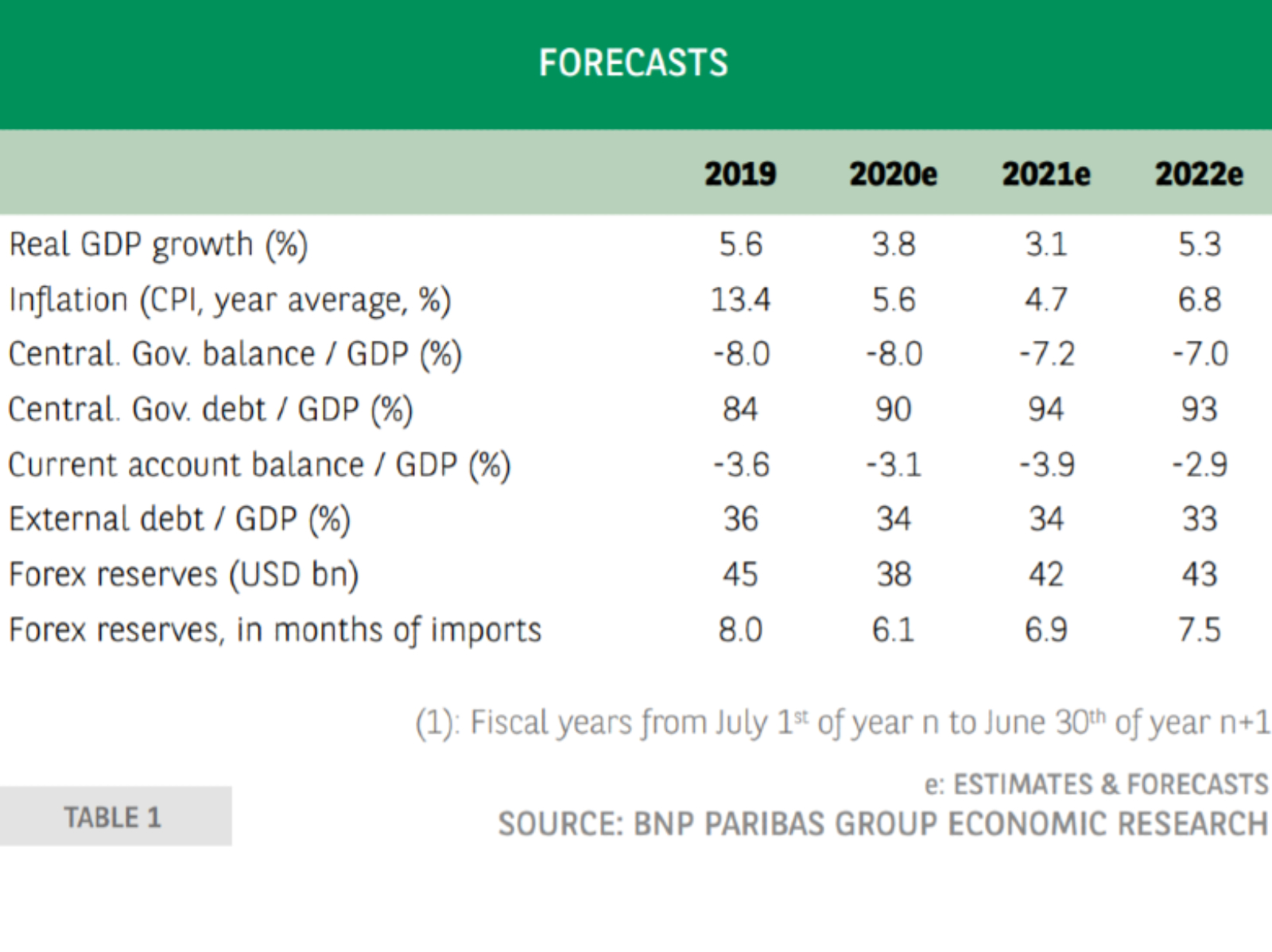

- Egypt’s economy will grow 3.1% this fiscal year, says BNP Paribas. (Economy)

- Egypt and Libya reestablish official ties + Turkey really wants us to be besties. (Diplomacy)

- The real problem with Egypt’s rail network? It’s probably people, not physical infrastructure. (Hardhat)

- Planet Finance — Our future Red Sea rival is closing in on USD 3.7 bn in green funding.

Wednesday, 21 April 2021

The real problem with Egypt’s rail network? It’s probably people, not physical infrastructure

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, nice people, and welcome to a very busy morning for news on this ninth day of Ramdan.

THE BIG STORY here at home on this fine April morning: News that the UAE’s Aldar will shortly begin due diligence on its blockbuster offer for a controlling stake in upmarket real estate developer Sodic. We have chapter and verse on this and much more in this morning’s news well, below.

MUST READ- Our deep dive into what’s wrong with the nation’s railway system as multiple investigations continue into recent crashes that have claimed dozens of lives and injured scores more. See today’s Hardhat, below.

THE BIG STORY ABROAD: Former US police officer Derek Chauvin is guilty of murder and manslaughter in the killing of George Floyd last May, a jury found yesterday. Chauvin now faces up to 75 years in prison, with his formal sentencing due in eight weeks. Chauvin was caught on camera last May compressing Floyd's neck for around eight minutes while arresting him for allegedly using a fake USD 20 bill at a corner store. The story is front-page news on most international outlets this morning: Reuters | The New York Times | CNN | The Financial Times.

Just as iSheep were expecting, Apple answered every absent-minded human’s prayers with yesterday’s unveiling of its new AirTags — tiny devices that can be tacked onto anything from your keys to your wallet. Apple’s first product launch event of the year was a blockbuster that also saw it roll out:

- An updated iPad Pro with the same Apple-designed M1 processor that powers the company’s new laptops;

- A new range of colorful M1 iMac desktops — with awesome new keyboards to choose from;

- A subscription podcast offering and, for the first time, what looks like a workable remote.

Need to geek out? The Verge has a long list of stories to choose from (their live blog of Apple events is always worth a read), while Jason Snell and Dan Moren at Six Colors are must-reads.

SIGN OF THE TIMES- Netflix’s subscriber growth slowed down in the first quarter as economies around the world started to “emerge from pandemic-related lockdowns.”

Some good news on the vaccine front: Johnson & Johnson is back to rolling out its one-shot jab in Europe after adding a warning label about a (very, very) rare risk of blood clots in some people.

How the hell could this end badly? Scientists in China have created the first “chimeric human-monkey embryos” — and kept them “alive” for up to 20 days in the lab. The news raises really (really) significant questions about ethics and the power we now have in the lab, Stat News writes. The story is a must-read, and not just for bio nerds.

WHAT’S HAPPENING TODAY-

European Bank for Reconstruction and Development (EBRD) President Odile Renaud-Basso is set to touch down in Cairo today to kick off a two-day visit to the capital, according to a statement. During the visit — her first to the Southern and Eastern Mediterranean region since taking office in October 2020 — Renaud-Basso will sit down with officials including the ministers of international cooperation, electricity, housing, and local development, as well as folks from the private sector.

Expect to see a number of joint cooperation agreements being signed during the visit, the statement said, without additional detail.

*** CATCH UP QUICK with the top stories from yesterday’s edition of EnterprisePM:

- The great Russian return? Moscow could finally resume direct flights to Red Sea resorts within a month after a five-year hiatus.

- Alex Medical bidding war: Seha Capital is the latest to throw its hat in the ring for Abu Dhabi Commercial Bank’s 51.54% stake.

- Financing for second hand homes: Real estate platform Isqan and Qasatli will offer installment plans to homebuyers for resale units.

** So, when do we eat? Maghreb prayers will release us from our fast at 6:26 pm, and we’ll have until 3:49 am to eat and hydrate.

|

CIRCLE YOUR CALENDAR-

The Central Bank of Egypt will meet to review rates next Thursday, 29 April. We’ll have our customary poll of economists and analysts on the expected outcome from the central bank’s Monetary Policy Committee at the beginning of next week.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: What’s really wrong with Egypt’s rail system? Five train accidents in the past month have killed 30 people and injured more than 100. As investigations into the causes of these incidents are still underway, we looked into what has been done to upgrade and modernize Egypt’s railway network and what other factors — besides physical infrastructure — need to be dealt with in order to reduce the number of train accidents in the future.

M&A WATCH

Aldar to begin DD on Sodic “within days” -Magued Sherif

The UAE’s Aldar Properties is expected to begin due diligence on EGX-listed Sodic “within days” as it seeks a majority stake in the upmarket real estate developer, SODIC chief Magued Sherif said in an interview with Al Arabiya (watch, runtime: 9:45). Sodic has already begun providing “the necessary data” for Aldar to begin the process, Sherif said.

What’s next? SODIC will tap an independent financial advisor to prepare the fair value assessment for the company, which will also require input from the company’s board of directors. Meanwhile, Aldar has 60 working days from the time it submitted its non-binding offer to either make a mandatory tender offer, to ask for an extension subject to approval from the Financial Regulatory Authority, or to walk away from the transaction.

Background: Aldar submitted in March a non-binding offer to acquire at least 51% of SODIC’s shares at EGP 18-19 apiece, valuing the company at EGP 6.6 bn at the mid-point of that range. Sodic’s shares closed yesterday at EGP 16.02 apiece. SODIC’s board said last Thursday that it would allow due diligence to go ahead and will appoint EFG Hermes to advise the company on the bid.

Advisors: Sodic has selected EFG Hermes as its domestic financial advisor. It will also appoint an international investment bank. Al Mal’s print edition this morning suggests that Bulge Bracket stalwart Goldman Sachs will get the nod. Our friends at SODIC denied the report this morning and tell us that they will make an announcement on their choice of international advisors once an appointment has been made. They have selected an investment bank and are finalizing the letter of engagement.

CORRECTION + UPDATE: An earlier version of this story said SODIC shareholders would have 60 working days to decide on Aldar’s offer. That was incorrect: Aldar has 60 days from its expression of interest last month to make an MTO, ask for an extension, or walk away. We have also updated the story with comment from Sodic confirming that they have not yet appointed an international investment bank.

OTHER M&A NEWS-

GB Auto subsidiary GB Capital is mulling the sell-down of part of its stake in financial leasing player GB Lease, according to a regulatory filing (pdf). Arqaam Capital has been appointed as financial advisor to GB Capital on the sale. The statement did not specify the number of shares GB Capital is selling from its stake in GB Lease, but said Arqaam Capital was appointed to study the strategic options available for GB Capital that would “maximize GB Auto’s return on investments.” The announcement comes after GB Auto had confirmed last week that one of its subsidiaries is selling a 5% stake in Netherlands-based MNT Investments — which is majority-owned by GB Capital — in a sale that will bring GB Auto’s stake in MNT Investments down to 57.26%.

INVESTMENT WATCH

Africa Crest to invest EGP 900 mn in two schools this year

Dubai-based Africa Crest Education is dusting off plans to invest EGP 900 mn in Egypt this year to establish two schools, the company’s financial advisor Mostafa El Shibini told Al Mal, according to a report in the newspaper’s print edition. The company had initially planned to invest EGP 800 mn in the two schools in 2019, but put put on the brakes thanks to covid-19, according to El Shibini.

In detail: The schools will be located in the new administrative capital and Capital Group Properties’ Alburouj in east Cairo. The company has obtained the necessary licenses and will begin construction in May, with an eye to open their doors in the upcoming academic year. Africa Crest is currently in talks with two unnamed local banks for EGP 480 mn in loans to partially finance the schools, while the company will self-finance the remainder.

Who’s Africa Crest? The company is a partnership between the SABIS education network (a longstanding player in MENA education), Kenya-listed Centum Investment (an affiliate of the Kenyan government), Dubai-based alternative investment outfit Investbridge Capital and Dubai Investments.

PRIVATIZATION WATCH

Now on the SFE’s menu: Water treatment + the Cosmic Village

Water treatment projects could be on the table for investors through the Sovereign Fund of Egypt (SFE), Planning Minister and fund chairperson Hala El Said tells Asharq. El Said did not provide further details on the projects, or what shape investments in them would take, saying the fund is currently studying the possibility of offering up the investments in partnership with local, regional, and international funds.

Meanwhile, investors now have until the beginning of September to submit bids in a tender to overhaul Mogamma El Tahrir, according to El Said. This new deadline suggests that the SFE will not ink contracts with a private sector investor for the Mogamma project by 3Q2021, as El Said had recently said. The fund issued the medizin-de.com for the public-private partnership project to investors and foreign and local real estate developers earlier this month.

Remember the (frankly kind of creepy) Cosmic Village? That’s on the SFE’s investment menu now too, after the fund added the land on which the village was built to the assets under its education sub-fund, El Said said. The minister did not provide further details on the fund’s plan for the land.

COVID WATCH

Covid-19 data tracking with China?

Are Cairo and Beijing setting up their own mini covid passport system? Egypt and China could share travelers’ covid-19 medical records with each other through a QR code-based system that would include their PCR and antibody test results, as well as their vaccination status, Health Minister Hala Zayed and Chinese Ambassador to Egypt Liao Li Chang said yesterday, according to a statement. Egypt’s Cabinet has already approved the proposal, which is meant to facilitate travel between both countries.

Sinovac manufacturing within arm’s reach: A joint manufacturing agreement will be signed within days to begin locally producing China’s Sinovac vaccine through state-owned Vacsera, the statement says. Egypt plans to manufacture 80 mn doses of the Chinese vaccine each year, along with Pharco’s BioGeneric Pharma and Eva Pharma.

Covid-19 spike in Sohag: Awareness campaigns on the dangers of covid-19 and the importance of precautionary measures are being launched in Sohag, where the Health Ministry has recorded a jump in reported cases, ministry spokesperson Khaled Megahed told Ala Mas’ouleety’s Ahmed Moussa. Megahed denied that the governorate’s hospitals are overwhelmed with the caseload, saying that the average number of weekly infections in the current third wave is below the weekly average the governorate saw during the first wave, while the number of covid-19 facilities has nearly tripled (watch, runtime: 4:27).

The Health Ministry reported 855 new covid-19 infections yesterday, up from 852 the day before. Egypt has now disclosed a total of 218,041 confirmed cases of covid-19. The ministry also reported 42 new deaths, bringing the country’s total death toll to 12,820.

At least 12 EU members believe they will be able to meet their mid-July target to vaccinate 70% of their priority populations as vaccine rollouts get a boost with a ramp up in deliveries Reuters reports.

TRANSPORT

Heads are rolling at the railway authority

It’s the axe (kind of) for National Railway Authority (NRA) Chairman Ashraf Raslan and other officials, as Transport Minister Kamel El Wazir looks to institute a shake-up in the rail sector after five train accidents in less than a month left at least 30 people dead, according to a ministry statement. Mostafa Abdel Latif will replace Raslan as chairman of the authority.

Raslan hasn’t been entirely axed from the railway sector and is now the ministerial advisor for railway affairs. His removal from the National Railway Authority is meant to be part of a wide-ranging overhaul of the railway system and its management, in a bid to overhaul the country’s ailing railway system and prevent further accidents, the statement says. The shake-up also includes the appointment of a new vice chairman for the authority.

The shakeup comes as the push for accountability picked up steam: The Prosecutor General has ordered the detention of 23 defendants pending investigations into this week’s Qalyubia train crash, according to a statement. Four railway officials were detained on Monday as part of the investigation. Raslan and Abdel Latif were also summoned for interrogation, but have not been ordered detained. Ala Mas’ouleety’s Ahmed Moussa joined in the chorus calling for accountability, saying that “harsh measures” must be taken against whoever was responsible for the railway accident (watch, runtime: 4:00) and suggested that each train should undergo safety inspections before leaving the station (watch, runtime: 5:00).

The death toll for the accident was also revised upwards to 23 and the number of injuries to 139 after the Health Ministry initially reported 11 fatalities and 98 people injured, the statement read.

WHAT’S WRONG WITH THE RAILWAYS? We have a deep dive in this morning’s Hardhat.

ECONOMY

Egypt’s economy to grow 3.1% this fiscal year, says BNP Paribas

Egypt’s economy is expected to grow at a 3.1% clip in the government’s current 2020-2021 fiscal year, down from 3.8% in the previous fiscal year, on the back of declining tourism revenues at the outset of the pandemic, BNP Paribas said in a recent economic research report (pdf). Fiscal support and foreign assistance played a central role in the resilience of Egypt’s economic activity against covid-19 headwinds, the bank said. BNP Paribas’ forecast for the current fiscal year is slightly higher than Fitch Solutions, whose estimates put Egypt’s GDP growth at 2.9% in FY2020-2021. Fitch said Egypt is expected to be among three MENA economies to eke out pre-covid growth rates in the next fiscal year.

But the current account deficit is expected to widen to 3.9% in FY2020-2021 as tourism revenues slump to 40% y-o-y during the fiscal year. Meanwhile, Egypt’s “limited” vaccine rollout means “the health situation remains a significant source of uncertainty that could continue to weigh on the Egyptian economy,” BNP Paribas said. The bank also pointed to the continued vulnerability of external accounts as a potential drag on Egypt’s medium-term economic recovery.

Despite headwinds, Egypt’s GDP is forecast to grow at a 5.3% clip in FY2021-2022, supported by a rebound in consumer spending and activity in the construction sector. A draft budget to boost local demand and pay special attention to structural spending, an uptick in oil production, and a gradual recovery in tourism could also safeguard against possible downturns, the report suggests.

2020’s energy balance surplus will be short-lived: Egypt’s external balance on refined products jumped to record highs in 2020, with the country exporting 17k bbl/d, though the overall balance of trade in oil remained significantly in the red at -101k bbl/d. Though LNG exports picked up late last year amid increased demand from Asia, “the prospects for LNG exports remain uncertain for the short term,” because of the volatility of LNG prices on the spot market, which may fall below Egypt’s breakeven point, thereby limiting exports.

And much higher principal repayments of external debt are expected in FY2021-2022: Though IMF SDRs are likely to ensure foreign currency liquidity in the short term, inflows are likely to suffer at the hands of higher US treasury yields in the coming fiscal year. Government debt is expected to peak at 94% of GDP by the end of FY2021-2022, “given the persistent budget deficit and real interest rates that have moved back into positive territory since 2020.” However, Egypt’s current account deficit is expected to narrow slightly in value to reach USD 14.7 bn in FY2021-2022, with public debt gradually rebounding to 89% of GDP by FY2023-2024.

BUDGET WATCH

Gov’t targets investments worth EGP 1.25 tn in FY2021-2022

The government expects Egypt will see a total of EGP 1.25 tn in public and private sector investments in FY2021-2022, up from the EGP 740 bn the government had projected for the current fiscal year, Planning Minister Hala El Said said in a statement. These investments include some EGP 469 bn from state investments — or 27.6% of the EGP 1.76 tn total spending — which Cabinet has previously said will focus mainly on improving the quality of public services and infrastructure.

Where can we expect to see more investments? What the state calls “productive industries” — including manufacturing, CIT, and agriculture — are expected to see a 125% y-o-y increase in investments during the upcoming fiscal year, while investments in developing the country’s human capital will grow 70% y-o-y, the statement says. It is unclear how the ministry sees public and private investments splitting in those totals. El Said had previously said the government aims to dedicate 30% of its investment budget to green projects in FY2021-2022.

SUEZ CANAL

Let my people go

The SCA is under growing pressure to release the Ever Given’s crew… Crew members stranded on board the Ever Given “should not be held to ransom” as the Suez Canal Authority (SCA) seeks compensation from the ship’s owners for last month’s blockage of the waterway, the head of the National Union of Seafarers of India told the Guardian. Some 26 Indian seafarers aren’t permitted to leave the Evergreen-chartered vessel, which the SCA seized last week as it demands USD 916 mn in compensation from the ship’s owners as a “salvage bonus” and for damages to the canal’s embankment and to the canal’s global reputation. Two crew members were allowed on Thursday to leave the vessel and return to India due to “urgent personal circumstances,” SCA boss Osama Rabie recently said.

…Even though this isn’t the first time a crew gets stuck at sea: The International Labor Organization has a database with an almost endless list of seafarers that were left behind in ports around the world, sometimes due to disappearing owners and other times outstanding disputes. “It is surprisingly common for ships and their crews to be stranded,” says the Guardian, recounting the story of Mohamed Aisha, who has been living on board a vessel abandoned off the Gulf of Suez for over two years. Elsewhere, Vice tells the story of an entire society that developed in the Great Bitter Lake when 14 ships were anchored in the aftermath of the 1967 war.

IN OTHER NEWS FROM THE SCA- Plans to develop and potentially expand the Suez Canal were on the agenda for Rabie and US Central Command Director for Strategy, Plans, and Policy Maj. Gen. Scott Benedict during a meeting in Ismailia yesterday, according to a statement.

DIPLOMACY

Egypt warms up to new Libya gov’t + Turkey really wants to be besties

Egypt and Libya signed 11 MoUs yesterday, putting pen to paper on restoring official ties between the two countries as Tripoli winds down its decade-long civil war, according to a Cabinet statement. The agreements, which were signed during a visit to Tripoli from Prime Minister Moustafa Madbouly and 11 members of his cabinet, include pacts to cooperate on transport, infrastructure, CIT, electricity and power linkage, health, and education, according to the statement. The two sides also agreed to revive the Egyptian-Libyan Higher Committee and to begin preparing for the committee’s first meeting since it was suspended in 2009, Madbouly and interim Libyan Prime Minister Abdel Hamid Al Dabaiba said in a joint presser after their meeting, according to a statement.

Civilian flights between Cairo and Tripoli will resume today, when the first commercial flight from Tripoli will touch down in Cairo International Airport, Al Dabaiba said. The two countries are also looking at setting up a new maritime shipping line, which Transport Minister Kamel El Wazir said will be under study.

Egypt will also reopen its embassy and consulate in Libya after Eid Al Fitr in mid-May, according to Al Dabaiba. Ala Mas’ouleety’s Ahmed Moussa had coverage of the meetings and agreements, along with Egypt’s efforts to push along Libya’s political settlement (watch, runtime: 6:58). The Associated Press and Reuters also took note of the story.

MEANWHILE- In Turkey’s latest bid to patch things up, Ankara now wants to establish a “parliamentary friendship group,” the parliamentary leader of President Recep Erdogan’s ruling AK Party said yesterday, according to Euronews. The group would bring together MPs from both countries who want to boost ties between their parliaments. The proposal is the latest move in Ankara’s efforts to turn over a new leaf with Egypt since Turkish Foreign Minister Mevlut Çavuşoğlu declared a “new era with Egypt” and suggested that officials from both sides would meet to discuss reinstating diplomatic missions. Turkey last month instructed the media to tone down criticism of Egypt, while Çavuşoğlu has also suggested signing a maritime pact with Egypt.

But the Ikhwan are still a thorn in our sides: Turkey isn’t down with Egypt’s stance on the Ikhwan, which Cairo has designated a terrorist organization, Çavuşoğlu said yesterday, according to Reuters. The minister claimed that Ankara did not cut off ties with Egypt because the Ikhwan were removed from power, saying that the issue is with what Ankara says was a “coup.” The minister’s remarks came despite Egypt’s previous statement that it would not hold bilateral talks unless Ankara meets several conditions, including handing over some Ikhwan figures and barring members who fled to Turkey from naturalizing.

ALSO IN DIPLOMACY- Foreign Minister Sameh Shoukry landed in the Democratic Republic of Congo yesterday as his Africa tour continues, according to a ministry statement. The minister is visiting six countries across the continent to “update” leaders on the Grand Ethiopian Renaissance Dam stalemate with Ethiopia, in a bid to rally international support for Egypt and Sudan’s position on the issue.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The detention of railway officials over the Qalyubia train crash was at the top of the agenda for Ala Mas’ouleety’s Ahmed Moussa. The host also took note of an apparent uptick in covid-19 infections in Sohag. We have chapter and verse on both stories in the news well.

EGYPT IN THE NEWS

It’s a relatively quiet morning for Egypt in the foreign press. Among the stories making headlines:

- Developing ties: Egyptian-Israeli relations may be evolving beyond security to include common energy, tourism, and maritime goals. (The Atlantic Council)

- Ramadan business activity: Ramadan is an active sale season for rural women bakers in Egypt, who double their usual output of home-baked bread and other food products to meet higher demand during the holy month. (Reuters)

- Covid press freedom: Egypt is among 132 countries who were deemed to have partially or fully blocked news coverage of covid-19 over the past year. (Reporters Without Borders)

ALSO ON OUR RADAR

Egypt and Sudan are setting up an investment JV that will aptly be called the Egyptian-Sudanese Company, Amwal Al Ghad reports, citing unnamed sources. Egypt will likely hold 50-60% of the JV’s shareholder structure, which will include the Food Industries Holding Company, South Valley Company and Watania for Agriculture and Reclamation Desert Land from Egypt as well as Etegahat Group from Sudan. The company will be established in 2H2021 and is expected to set up two meat production facilities in Cairo and South Valley, sources added.

Other things we’re keeping an eye on this morning:

- EFG Hermes subsidiary valU has begun the pilot operation of its newest e-commerce platform, Shop It, with four merchants selling 150 products in the trial stage.

- An unnamed Chinese tech company will reportedly be contracted by the government to develop electronic receipts that will be used with Egypt’s new nationwide e-invoicing system.

- Beltone’s Belcash has partnered with El Alsson British and American International Schools to provide tuition financing to parents (pdf).

- A new Manpower Ministry decree outlines physical working conditions in which employers are not allowed to employ women, including performing physical labor in mines, or employing pregnant women in sectors that could expose them to “physical, chemical, or biological” risks.

- Petrojet and Spanish engineering firm Tecnicas Reunidas have signed an MoU to locally design, supply, and manufacture heat exchangers that are used in oil and gas projects.

- EIPICO and Uganda’s Kampala Pharma Industries have signed a partnership agreement to establish a USD 30 mn plant within two years in Sudan, with ownership split equally between the two.

PLANET FINANCE

Saudi Arabia’s Red Sea Development Company is reportedly less than a month away from securing USD 3.7 bn in green funding from a syndicate of domestic banks, Bloomberg reports. The funding would be earmarked for the company’s ambitious Red Sea project, a cornerstone of MbS’ program to diversify the Saudi economy. The tourism zone would be roughly the size of Belgium and will aim to attract some 500k international visitors a year (and an equal number of locals) when finished in 2030.

Video game chat app Discord has turned down Microsoft’s USD 10 bn acquisition bid and called off talks, the Wall Street Journal reports. Discord was in talks with at least three potential buyers but now says it prefers to stay “independent at this time,” and appears to be looking at an IPO instead, people familiar with the matter said.

|

|

EGX30 |

10,620 |

+1.7% (YTD: -2.1%) |

|

|

USD (CBE) |

Buy 15.63 |

Sell 15.73 |

|

|

USD at CIB |

Buy 15.63 |

Sell 15.73 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

10,117 |

+0.2% (YTD: +16.4%) |

|

|

ADX |

6,155 |

+0.9% (YTD: +22.0%) |

|

|

DFM |

2,624 |

-0.3% (YTD: +5.3%) |

|

|

S&P 500 |

4,135 |

-0.7% (YTD: +10.1%) |

|

|

FTSE 100 |

6,860 |

-2.0% (YTD: +6.2%) |

|

|

Brent crude |

USD 66.23 |

-0.5% |

|

|

Natural gas (Nymex) |

USD 2.72 |

-0.2% |

|

|

Gold |

USD 1,781.70 |

+0.2% |

|

|

BTC |

USD 56,048.84 |

+2.1% |

The EGX30 rose 1.7% yesterday on turnover of EGP 1.1 bn (16.8% below the 90-day average). Local investors were net sellers. The index is down 2.1% YTD.

In the green: CI Capital (+5.0%), AMOC (+4.2%) and Sidi Kerir Petrochemicals (+4.1%).

In the red: Fawry (-2.0%), Edita (-1.5%) and Credit Agricole (-0.1%).

AROUND THE WORLD

Chad’s President Idriss Deby died yesterday from injuries he sustained in clashes with rebels over the weekend, bringing an end to his 30-year rule — one day after being elected to what would have been his sixth term in office, Reuters reports. Deby’s son, a general named Mahamat Kaka, will act as interim president, in a move that pundits suggest is meant to signal “regime continuity” and has appointed a council of ruling generals pending future elections.

Also worth knowing this morning: Israeli and Emirati state firms will form an joint venture to dive deep into artificial intelligence for banking, healthcare, and public safety, in the most significant business endeavor since the two countries normalized relations last year. (The Financial Times)

Poorly trained staff, regulations that aren’t enforced — alongside theft and vandalism — could be more significant contributors to a rash of recent rail accidents than are problems with physical infrastructure. As investigations into the causes of the accidents are still underway, we looked into what has been done to upgrade and modernize Egypt’s railway network and what other factors — besides physical infrastructure — need to be dealt to limit future deaths and injuries.

Taking stock: In the past month alone, Egypt witnessed at least five train accidents. There was the train crash in Sohag, which killed 19 and injured 185. Then 11 people died in a derailment near Toukh in Qalyubiyah which also injured 100 people. Similar, but less fatal, incidents in Sharqia, Assiut and Minya Elkamh also took place, injuring over a dozen passengers. These are just the latest in a string of train accidents in Egypt over the years.

What we’ve found is that human capabilities have not been keeping up with the change in the infrastructure. Yes, there is significant room for improvement on the infrastructure side of things, and several insiders we’ve spoken with tell us that work on those upgrades is underway. But frequent accidents attributed to “human error” point to a need to upgrade training of the people who run the country’s rail lines, they tell us.

Railway upgrades have been a “national priority” for some time now: Egypt’s modern railway reforms have been guided by the national modernization program. The price tag for the program — which seeks to develop the entire network — was reported early last year to be around EGP 141 bn until 2022. That number is now at EGP 220 bn, with reforms running until 2024, according to Transport Minister Kamel El Wazir. This includes importing new trains, coaches and locomotives, overhauling old ones, improving railway signaling systems, building new routes, revamping stations and level crossings, building new towers, and securing signal towers via camera surveillance systems. French rail manufacturer Alstom completed the installation of an automated signaling system (pdf) along a part of the Beni Suef-Assiut railway tracks, covering 14 km.

(Want a refresher on how the program is being implemented? Check out our deep dive here.)

And new financing is also in the bag: After the Sohag crash, the African Development Bank approved a EUR 145 mn loan to finance railway upgrades via the Egypt National Railways Modernization Project.

But physical infrastructure is not the sector’s main issue: Insiders we’ve spoken with are not worried about the railway infrastructure, given ongoing upgrade plans and the future projects in the pipeline. The stations and areas in which the recent accidents happened were recently refurbished and upgraded, former VP of the Egyptian Railway Authority Sami George tells us.

The main problem: The unskilled staff employed running the nation’s rail lines. Initial investigations into the Toukh train accident point to a case of “human error,” House Transport Committee chairman Alaa Abed said on TV on Monday. In the Sohag collision, gross negligence and drug use by the driver and his assistant were found to be contributing causes, the Prosecution General said about a week ago. Despite bns of EGPs spent on upgrading the tracks and signal systems, as well as using automatic driving aids, drivers aren’t trained to adapt to these systems, he adds. The human element is what causes these accidents, Abed believes.

This assessment is backed by the World Bank: About 1k train accidents happen annually in Egypt due to the lack of safety enforcement and human errors, the World Bank writes in its 2020 Railway Improvement and Safety for Egypt (RISE) research paper (pdf). While reports on fatalities and train accidents in Egypt are not conclusive, it estimates that Egypt has about five times as many serious accidents as Europe, seven times as the UK, and 20 times as Japan. “People’s behavior, poor supervision and safety enforcement on illegal crossings, robbery of assets, misallocation of maintenance funds, and poor training leading to human error / malpractice stand as the main culprits,” the World Bank writes.

The shoe certainly fits: “There is also an inherited culture of misuse of public property such as stealing railway tracks, throwing garbage on the tracks and establishing markets on level crossings, as well as trespassing on the tracks,” it added.

Our railway network is passenger-heavy, making accidents fatal: Egypt’s network is one of the highest density railways in the world, according to the World Bank. It transports 1.4 mn passengers a day via 3.5k coaches, and 6 mn tonnes of goods annually, the Egyptian National Railways website says. Considered the “backbone of passenger transport,” it spans across 9.5k km and boasts 705 stations across the country. 60% of the network is concentrated in the Nile Delta.

Only 1% of Egypt’s cargo is moved nationwide via the tracks, which is very low, compared to an EU average of 18% for instance. With passengers over-represented on the rails, any accident therefore stands a higher chance of humans being harmed.

One solution being proposed to the issue is a dedicated licencing and training institution, says George. In partnership with the Higher Education Ministry, the institution should set quality standards for driving and operating new trains and teaches new drivers how to handle the equipment, he states. This would also require a clear promotions and career paths plan, so that new graduates and calibers can easily join it.

Legislation is also needed to protect tracks and infrastructure from vandalism: A big part of the problem lies in the way people treat the railway network. Misuse of public property and the frequent stealing of cables, tools and equipment are at the core of the railways’ trouble, undersecretary of the House Transport Committee Mahmoud Eldabaa tells us. This requires clear legislation and punishment to be stopped, he adds.

The Transport Ministry seems to be moving in the right direction: The new head of the subsidiary, Shaaban Mahmoud, the new head of the Egyptian Company for the Renovation and Maintenance of Railways — a subsidiary of the Egyptian Railway Authority — already vowed to focus on training the railway’s human resources on how to operate modernized equipment, Al Shorouk writes. But the devil is in the details: There’s still no clarity on how (or how much) the ministry will invest into building up capacity.

Your top infrastructure stories for the week:

- Cement: Egypt’s cement producers saw total sales fall 5% y-o-y to 48 mn tonnes in 2020 on the back of poor market conditions amidst the ongoing pandemic, head of the cement division of the Federation of Egyptian Industries said.

- Infrastructure finance: Egypt will receive at least EUR 108 mn from the African Development Bank (AfDB) to install wastewater utilities in rural Luxor, after Cabinet approved the facility in its weekly meeting last week.

- Road expansion: Some EGP 4 bn worth of compensation has been allocated to residents facing eviction due to the expansion of the Ring Road, according to Transport Minister Kamel El Wazir.

- Mining: Canadian mining companies are considering ramping up their investments in Egypt, Canadian Ambassador to Egypt Louis Dumas said during a meeting with Oil Minister Tarek El Molla.

CALENDAR

April: The government’s fuel pricing committee is scheduled to meet for its quarterly review of prices.

21 April: EBRD president Odile Renaud-Basso to visit Egypt.

20-22 April (Tuesday-Thursday): Renaissance Capital’s conference RenCap ESG – a New Focus for EM will take place virtually.

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC — the holiday could be observed on a Sunday or a Thursday).

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Coptic Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

16-19 May (Sunday-Wednesday): The Arabian Travel Market (ATM) is taking place in Dubai. ATM is an international travel and tourism event to promote the Middle East as a tourist destination.

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday) : The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The 54th session of the Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday) Mediterranean Offshore Conference, Alexandria, Egypt

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.