- Inflation accelerates to five-year high in November. (Economy)

- Vodacom reportedly closes acquisition of 55% stake in Vodafone Egypt. (M&A Watch)

- The IMF executive board is meeting this week to discuss our USD 3 bn loan. (What We’re Tracking Today)

- Hisham Ezz El Arab named non-executive chairman of CIB. (Moves)

- FinMin delays e-invoicing registration deadline for lawyers, doctors and others amid opposition. (Tax)

- Lawmakers to redraft labor bill following criticism from business. (Legislation Watch)

- Apex’s Tom Maher on why industries with a competitive advantage and added value should be our priority. (CEO Poll)

- El Rashidi El Mizan to embark on USD 150 mn expansion next year. (Investment Watch)

- Morocco makes history in Doha, becomes first ever Arab + African team to reach World Cup semis. (What We’re Tracking Today)

- Mubadala sells majority stake in Masdar to Taqa + Adnoc. (Planet Finance)

- The case for search funds in Egypt. (What’s Next)

Sunday, 11 December 2022

AM — Is our USD 3 bn IMF loan coming this week?

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to what we think is going to be a particularly busy workweek as 2022 races to the finish line. We can only hope to play out the final days of the year with as much heart as Morocco played the final minutes of last night’s match against Portugal.

HAPPENING TODAY-

The clock starts ticking for unlicensed shops: The Public Shops Law that will introduce new licensing requirements for shops across the nation goes into effect today, Local Development Minister Hesham Amna said yesterday. Under the bill, passed by the House in 2019, unlicensed shops will have one-year to acquire commercial licenses and become part of the formal economy. Shop owners will be required to apply to new licensing centers, which will process applications and grant licenses within 90 days, Amna said. The legislation also introduces a new inspection regime and specifies ins. requirements.

SOUND SMART- The law will impact as many as 80-90% of shops in Egypt, which remain outside of the formal economy.

LEGISLATION WATCH for the week:

- The Senate will discuss today and tomorrow a bill setting up the Digital Egypt Fund.

- Business will have its say during a meeting of the Senate Financial and Economic Affairs Committee to discuss a report by the pro-government Mostaqbal Watan party that aims to overhaul how we approach FDI.

- Housing Minister Assem Al Gazzar and Local Development Minister Hesham Amna are set to attend a meeting by the House Housing Committee to discuss legislation aiming to speed up the legalization of wildcat building.

THIS WEEK-

Will we finally close an IMF facility this week? The IMF’s executive board will discuss Egypt’s request for a new extended fund facility on Friday, 16 December. Past precedent suggests the board will likely make a decision on the USD 3 bn, 46-month facility during the meeting. Egypt and the Fund reached a staff-level agreement for a new loan program at the end of October.

What’s going to happen to the EGP? There’s plenty of chatter about the direction of the EGP ahead of the meeting, Reuters and Bloomberg reported over the weekend. Reuters focuses on the widening gap between the official exchange rate and the price on the (anemic) parallel market — where the EGP was changing hands at 32-33 to the USD — while Bloomberg notes that traders see the EGP weakening by as much as 20% to 30.90 over the next 12 months.

Analysts speaking to both news services were on the fence as to whether or not the EGP will weaken further ahead of the IMF meeting. The EGP closed at 24.66 on Thursday at banks, down 24.7% from the October devaluation and 56.3% from the start of the year.

WATCH THIS SPACE-

Egypt still plans to hold a fresh international tender for oil and gas exploration before the end of the year, Oil Minister Tarek El Molla told Bloomberg Asharq. The tender will cover concessions in the Mediterranean and the Western Desert, El Molla said. He suggested in November that the tender would also cover concessions in the Eastern Desert, where the ministry had also been planning to launch a second international tender for minerals other than gold before the end of the year.

WORLD CUP-

Morocco is making the Arab world proud in Doha: Morocco made history yesterday after defeating Portugal 1-0 to become the first ever Arab and African team to reach the World Cup semi-finals. A stunning header by Youssef En Nesyri before half time put the Atlas Lions ahead — and a crazily solid defensive performance in the second half kept the Portuguese at bay, sending Morocco through to the final four.

The end of the road for CR7? A substitute for the second game in a row, ineffectual when subbed on in the second half, and a swift, tearful exit after the final whistle — the game felt like Cristiano Ronaldo’s international swan song. At 37 years of age, this was always likely to be his final shot at hoisting aloft a World Cup — the only prize missing from his trophy cabinet — but his sub-par performances, tensions with the manager, and demotion to the bench show that the aging superstar’s powers are well and truly on the wane. Ronaldo at Euro 2024? We doubt it.

Morocco is now set for a clash with defending champion France, which beat England 2-1 after Harry Kane missed a late penalty.

Morocco wasn’t the only team to stage an upset in the quarter-finals: Croatia came from behind to dump tournament favorites Brazil out of the competition on penalties on Friday night. After equalizing with just a few minutes of extra time left on the clock, the Croatians coolly slotted home all four of their penalties while Brazilian forward Rodrygo and center-back Marquinhos failed to hit the target.

The Netherlands came close to repeating Croatia’s great escape: A dramatic comeback by the Netherlands against Argentina to a 2-2 draw was to no avail after La Albiceleste snatched a win in a 4-3 penalty shootout against the Oranje to keep Lionel Messi’s World Cup dream alive.

CIRCLE YOUR CALENDAR- This is how the semi-finals line up (all times CLT):

- Argentina v Croatia meet on Tuesday, 13 December at 21:00

- Morocco v France play on Wednesday, 14 December at 21:00.

|

CIRCLE YOUR CALENDAR-

The Egyptian Private Equity Association is hosting a healthcare summit tomorrow, 12 December at the Semiramis Intercontinental Cairo. The event will be held under the auspices of the finance and planning ministries. You can check out the agenda here (pdf) and register for the summit here.

Next week: The Central Bank of Egypt’s Monetary Policy Committee meets on Thursday, 22 December to review interest rates.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s What’s Next day: We have our weekly deep-dive into what makes and shapes pre-listed companies and startups in Egypt, the UAE and KSA, touching on investment trends, future sector insights and growth journeys.

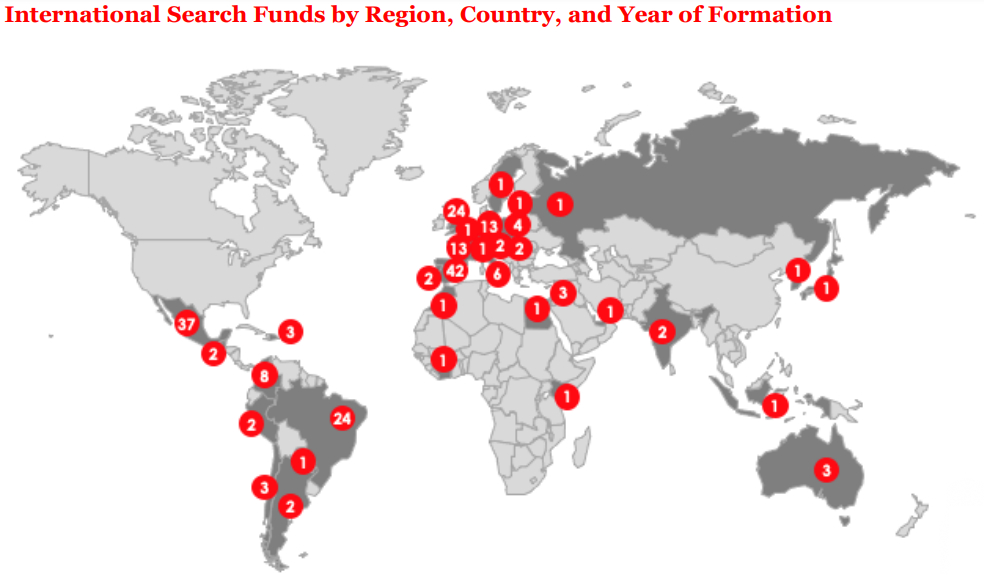

In today’s issue: Last week, we took a deep-dive into an alternative investment vehicle that lies somewhere in between VC and private equity funding — search funds. The exciting part: This year is the first time that Egypt was included in the map of global search funds by IESE Business School international search funds report (pdf). This week, we look at search fund activity in Egypt and the challenges that current and emerging players are facing.

Somabay brings out the best in majestic natural elements where raw beauty and endless activities reign supreme. Immerse yourself into a picturesque getaway all year long. This is simply Somabay. For more information, call 16390 or visit www.somabay.com.

ECONOMY

Inflation accelerates to five-year high in November

Deval drives inflation to five-year high: Urban annual inflation accelerated to 18.7% in November, up from 16.2% in October, according to figures from state statistics agency Capmas. November’s inflation figures are the highest in nearly five years, driven primarily by rising food and beverage prices. On a month-on-month basis, urban inflation came in at 2.3% in November, cooling off from 2.6% in October.

Food and beverage prices rose the fastest, climbing nearly 30% last month, from 23.8% in October. Food and beverage costs are the biggest single component of the basket of goods and services used to measure inflation.

We have the devaluation to blame for the uptick: November’s data is the first month that reflects the impact of the Central Bank of Egypt’s (CBE) decision to float the EGP at the end of October, leading the currency to lose c.25% of its value against the greenback. “We attribute the inflation reading to [the] effects of the devaluation at the end of October and the currency weakness and depreciation impact on restaurants and hotels, as well as recreation and culture,” our friends at CI Capital said in a note on Thursday.

Core inflation at a five-year high: Annual core inflation, which strips out volatile items such as fuel and food, rose to 21.5% in November from 19.0% a month earlier, according to central bank data (pdf). That’s the highest core inflation recorded since November 2017.

REMEMBER- We’re still waiting for the Central Bank of Egypt to announce a new target range for inflation, after it previously scrapped its 7% (±2%) target. The new target range will be “critical to direct the market towards the expected policy-rate trajectory,” our friends at EFG Hermes Research said in a note last week.

Fresh interest rate hikes coming this month? The figures might push the CBE to raise interest rates by 200 bps when it meets on 22 December, perhaps before the policy meeting scheduled for 22 December, Al Ahly Pharos analyst Esraa Ahmed wrote in a note Thursday. The central bank has raised rates by 500 bps so far this year, including a 200-bps hike when it devalued the EGP in October.

The news got attention internationally: Bloomberg | Reuters.

M&A WATCH

Vodacom closes acquisition of 55% stake in Vodafone Egypt

Vodacom is Vodafone Egypt’s new majority shareholder: Vodafone Plc’s South African subsidiary, Vodacom, has closed the acquisition of its parent company’s 55% stake in Vodafone Egypt, Al Mal reported on Thursday. The company reportedly acquired Vodafone’s 132 mn shares in Vodafone Egypt in a block trade transaction on the EGX on Thursday for EGP 59.7 bn (USD 2.4 bn). Enterprise did not hear back from representatives of the FRA or Vodafone Egypt in time for dispatch.

A long time coming: Vodafone shareholders approved plans to offload the company’s stake in Vodafone Egypt to Vodacom in January, after management greenlit the acquisition in November 2021. Vodafone had been expecting to close before the end of March, but the transaction stretched on as the two sides waited for approvals from Egyptian regulators. Vodafone Plc owns 60.5% of Vodacom, according to public data.

No official word yet from the regulators: There’s still been no word publicly from the Financial Regulatory Authority or the National Telecommunications Regulatory Authority on the sale. Last we heard, the two regulators were still deciding whether to approve the transaction, which was the subject of a national security review. Vodacom Group CEO Shameel Joosub was quoted in November by South African media as saying the company received regulatory approvals to go ahead with the acquisition.

Vodafone Egypt could welcome another new shareholder to the mix before the end of the year: The Qatar Investment Authority (QIA) is among three Arab sovereign funds reported to be in talks with Telecom Egypt over the purchase of a 20% stake in Vodafone Egypt, which sources have said could close before the end of the year. The EGX-listed telecoms giant holds the other 45% stake in Vodafone Egypt and the government owns 80% of TE.

And Vodacom already has big plans for Egypt: The South African telco plans to launch financial services products in Egypt through the Vodapay superapp it’s developing with Chinese tech giant Alibaba Group. Vodapay is modeled on Alibaba’s Alipay — the world’s largest digital wallet — and provides access to a suite of financial services including online shopping, loans, and mobile payments.

Advisors: EFG Hermes brokered the transaction, according to Al Mal.

TAXATION

E-invoicing registration deadline kicked back

FinMin extends e-invoicing registration deadline for the self-employed: Self-employed individuals — including doctors, pharmacists, and lawyers — now have until 30 April 2023 to register with the Tax Authority’s e-invoicing system, after the Finance Ministry extended the deadline from next Thursday, 15 December, according to a ministry statement out Thursday.

REMEMBER- There has been a chorus of opposition to the new system from self-employed professionals including doctors, engineers, lawyers and artists, with dentists the most recent to voice their concerns. Only 150k companies had signed up to the new system ahead of the previous deadline of 15 December, according to a tally from the Tax Authority at the end of November. That’s well below the 1 mn companies that will be required to register.

And we think they need to get with the system, literally. Industry associations for lawyers have pushed back for years against VAT and e-invoicing, while the doctors and pharmacists’ syndicates have resisted anything that would give the taxman clarity about their members’ finances.

BACKGROUND- What e-invoicing system? The Tax Authority has since late 2020 been rolling out a system that will see all B2B and B2C transactions captured via a state-controlled e-invoices portal. A business invoicing another business must use the portal to log its invoice, while retailers are required to integrate their point-of-sale software with the system to give the Tax Authority clarity on their sales. The system aims to clamp down on tax evasion and allow the Tax Authority to focus on undertaking tax audits on non-registered, non-compliant companies. You can check out our primer on the system here.

What’s going on now? Major retailers and just about all businesses are now enrolled in the system. Lawyers, engineers, doctors, pharmacists and artists were to have followed suit by this week.

CEO POLL

Apex’s Tom Maher on why industries with a competitive advantage and added value should be our priority

We recently had breakfast with 20 top CEOs to talk about why exports and FDI are key to our economy going forward. After reading our five-step recipe for turning Egypt into a global export hub and FDI magnet, participating CEOs agreed to answer two questions on the record for our latest CEO Poll.

We’ve already heard from: GSK’s Mohamed El Dababy | McKinsey’s Jalil Bensouda | Somabay’s Ibrahim El Missiri | ALC Alieldean Weshahi & Partners’ Bahaa Alieldean | HSBC Egypt’s Todd Wilcox | Actis’ Sherif El Kholy | Amazon’s Omar El Sahy | BII’s Sherine Shohdy | Mansour Automotive’s Ankush Arora.

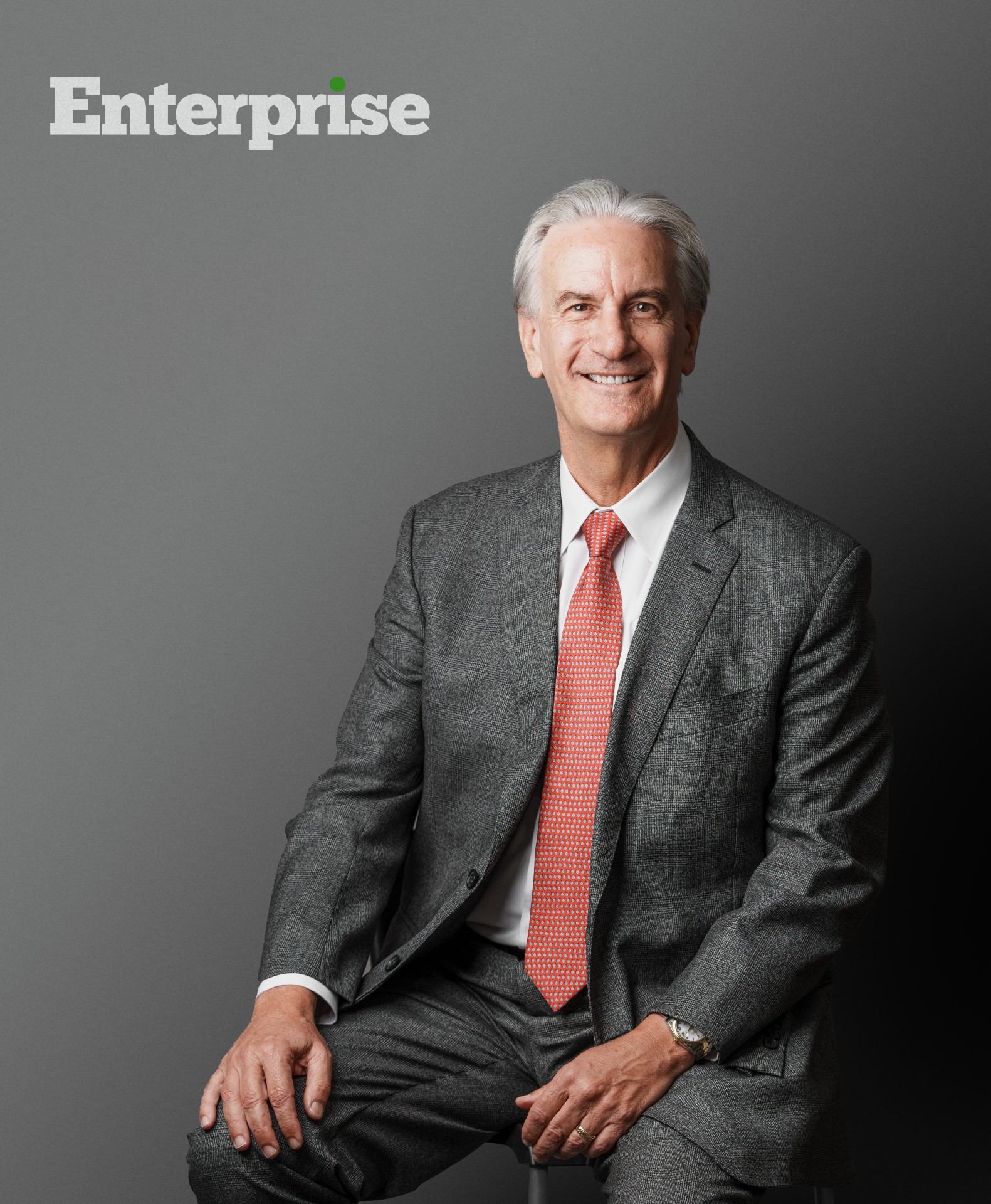

Thomas Maher (LinkedIn) is president and CEO of Apex International Energy, the newest producer in Egypt’s oil and gas industry after discovering and developing three oil discoveries in the Western Desert the past two years. Maher joined Apex in 2016 as president and COO, then became CEO in May of this year. Prior to joining Apex, he held several senior leadership positions in his thirty-year career with Apache Corporation in the US, Australia and Egypt.

ENTERPRISE- Which industry would you put on a focused short list — and why?

TOM MAHER- The first thing that comes to mind when hearing that question is: What are the criteria to look for in these focus industries? The first would be whether the industry has a competitive advantage in Egypt. The second would be the potential for significant export revenues, or at the very least, potential to minimize imports in that sector. Lastly, I would look to the sector that can create significant employment. When I put those three criteria together, the sector that comes on top of my list is energy — and I’m talking about broad energy, from oil and gas to renewables to nuclear energy. I believe Egypt will benefit from all of these.

Second to energy is the value-add that’s done with that energy, like liquefied natural gas. That’s recently been a significant provider of FX, more than most other sectors outside of remittances, which isn’t really a sector. Energy and its exports definitely have competitive advantages, with Egypt’s great location and the fact that it has two ocean transit routes on its borders. The infrastructure is all there; we have LNG plants running, so it ticks all the boxes. We have significantly more electricity generation capacity than we use, and this surplus is also being planned for export to neighboring countries who need it.

Then I would move to tourism as number two. Egypt sits in a great location, and tourism is already a very significant source of employment. I think there’s a lot of untapped potential in tourism, especially when you think of the size of the country, its geography bordered by two seas, and its rich history. Turkey is similar in size, location and history as Egypt, yet generates two to three times more revenue from tourism. I see great potential for Egypt to double or even triple revenues from tourism in the future.

Then I would look at textiles and clothing. This is a pretty well-established industry in Egypt. The natural resources, such as cotton, are here, as are the ports for distribution. The labor market is also strong, and it’s another large employment provider. Agriculture is also very important for several reasons, even if it does not currently generate significant export revenues. We need to focus on agriculture for food security reasons, especially after what we have seen with the Russian invasion of Ukraine and its impact on wheat and other grain markets. Egypt really needs to focus on building capacity in the agricultural sector to feed its growing population, but I also think it can go beyond that. We are already exporting a significant amount of citrus, and I think there are many other products within this sector that can be helpful to growing export revenues.

Lastly, I want to mention education, which is crucial for remittances — the largest provider of FX in Egypt, even more so than tourism or Suez Canal revenues. We should be capitalizing on our young talent pool by educating as many people as possible in those sectors that will lead the country into the future.

E- Why are exports and FDI the way forward?

TM- It’s hard for me to imagine anyone in the public and private sectors not buying into the five-point strategy in light of what has happened the past six years. We had to go to the IMF and our Gulf neighbors three times in six years; that says something. I’m sure the IMF and our Gulf allies would like to see Egypt implement a strategy to grow exports and increase FDI, and the government is doing that. The best way moving forward with this strategy is to look where it has been implemented elsewhere and has been successful, countries like Vietnam, Morocco, and India. All of them were hurt with the same current account and balance of payments issues Egypt has been facing yet have significantly improved their economies by increasing exports and attracting FDI.

What is needed is a focus on what we do well, and where we have a competitive advantage in exporting, and build on that. There are many examples out there that we can tap into — talk to those governments and business leaders and get some advice. The first step is identifying those five industries, putting together a group that can promote it, and then pursue it relentlessly.

LEGISLATION WATCH

Lawmakers to redraft labor bill following criticism from business

Business doesn’t like the look of the new Labor Act: Lawmakers will redraft the new labor bill following criticism from the business community, Parliamentary Affairs Minister Alaa El Din Fouad said last week. Nine business associations, as well as the trade union representatives, have voiced criticisms on key provisions in a series of hearings held by the House Manpower Committee, prompting lawmakers to redraft the legislation.

Refresher: The bill, approved by the Senate in February, would introduce new labor rights for workers, including legislating mandatory annual raises, caps on working hours, and longer maternity leave and notice periods, among other things.

Business isn’t happy: “We think that this draft law is unbalanced, giving workers a lot of rights at the expense of duties and this comes at a time the state is doing its best to raise productivity rates and boost exports,” said Hani Mahmoud, head of the Federation of Egyptian Industries’ labor committee. The FEI has voiced opposition to 17 articles in the bill, including those relating to strikes, holidays for women in the workplace, and salaries, employment contracts, bonuses, and membership of businessmen in the proposed rehabilitation and training fund.

Back to the drawing board: “The new labor bill will be redrafted to secure a balance between the rights of employers and employees and wins the satisfaction of all parties and achieve the public interest as much as possible,” Fouad said.

Trade unions aren’t happy either: The Egyptian Trade Union Federation has also expressed concern about a number of provisions, including those governing strikes, women in the workplace, paternity leave, workers' bonuses, child labor, VAT imposed on labor lawsuits, labor disputes and workers training and absence.

FACT CHECK- Unified Tax Act amendments won’t allow the taxman to snoop on your data: The Central Bank of Egypt, cabinet ministers and MPs are denying rumors circulating on social media that government-drafted amendments to the Unified Tax Act will allow the Tax Authority to access confidential financial information about individuals and businesses. An explanatory statement (pdf) published by the central bank said the exchange of data was limited to foreign tax authorities only, and not the local tax authority. Policymakers said the legislative amendment came to meet obligations required by the Global Forum for Transparency and Exchange of Information for Tax Purposes, which Egypt joined in 2016.

INVESTMENT WATCH

El Rashidi El Mizan to embark on USD 150 mn expansion next year

More halawa, please: Leading confectionery producer El Rashidi El Mizan, a subsidiary of Saudi-owned investment group Olayan, will invest USD 150 mn in 2H 2023 to expand production in Egypt, Sherif William, the company’s director of commercial sales, told Al Borsa. The company will add six new production lines during the six-month period, which is part of a broader five-year expansion plan, he said. El Rashidi El Mizan plans to produce new products, William said, without providing further details.

El Rashidi is one of the oldest confectionery manufacturers in Egypt and is famous particularly for its halawa and tahini products. El Rashidi’s products range has expanded in the past few years, introducing jams, tomato paste, honey, molasses, rice and a ready-to-eat range. The company currently produces 5k tons per month at its six factories in Sixth of October, which it hopes to double, William said.

MOVES

Hisham Ezz El Arab appointed CIB’s non-executive chairman

Hisham Ezz El Arab is once again chairman of CIB: Our friend Hisham Ezz El Arab (LinkedIn) was appointed non-executive chairman of cIB last week, the bank said in a disclosure (pdf) to the EGX on Thursday. He succeeds Sherif Samy (LinkedIn), who held the position since October 2020 and will remain on the bank’s board as a non-executive member. Hisham had been forced to step down by the previous governor. He returned to public life early this fall, initially as an advisor to new central bank boss Hassan Abdalla and now as non-executive chairman of the country’s largest private-sector financial institution, where he had enjoyed a 21-year run.

The comeback started last month when he rejoined CIB’s board as a non-executive director. Since the resignation of Tarek Amer as CBE governor earlier this year, Ezz Al Arab’s relationship with the central bank has taken a 180° turn — he was brought in to serve as an advisor to Governor Hassan Abdalla from late August until last month when he resigned to rejoin the CIB board.

MEANWHILE- Samih Amer was appointed advisor to the health minister on medical tourism, the Health Ministry said Saturday. Amer is a full time cardiothoracic surgery professor at Kasr El Einy Medical School.

LAST NIGHT’S TALK SHOWS

Morocco’s historic World Cup win + bread subsidies lead coverage on the talk shows

The airwaves were lit up red and green last night, with the talking heads dedicating much of the evening’s runtimes to covering Morocco’s famous win against Portugal in the World Cup quarter-final yesterday. Wearing a red blazer and a green scarf in a probable nod to the Moroccan flag, Kelma Akhira’s Lamees El Hadidi focused almost entirely on the game, declaring that “Morocco makes history again…dreams can come true through efforts, determination and [proper] planning. Impossible is nothing in football” (watch, runtime: 8:31). The historic victory also got applause from Masaa DMC (watch, runtime: 4:56) and Al Hayah Al Youm (watch, runtime: 2:25).

Supply Minister Ali El Moselhy didn’t rule out raising prices for subsidy card holders: In an interview with Masaa DMC’s Iman El Hosary, EL Moselhy said that the government is trying not to hike prices of commodities sold for subsidy card holders in a bid to protect the most vulnerable (watch, runtime: 4:47). “Subsidy card holders represent 65% of the population…that’s why we’re trying not to raise prices for them,” he said. El Moselhy highlighted the hefty expenses incurred by the government for its long standing bread subsidy program, revealing that the cost has risen from EGP 51 bn to EGP 76 bn. Loaves at below market prices under the system now cover 71 mn people, he said.

REMEMBER- The government wants to alleviate pressure caused by the program on the state budget, with the supply minister attempting in October to revive the possibility of reforming the massive program by calling on MPs to look into possible changes. Developments regarding the minister’s proposal remain unknown.

Also getting attention last night:

- Superstar Angham phoned in to Masaa DMC and Kelma Akhira to assure fans of her health after complications suffered following surgery last month. (watch, runtime: 7:42 | watch, runtime: 3:13).

- Don’t try this at home: The viral Throw your Friend TikTok challenge received coverage on Kelma Akhira (watch, runtime: 3:53) and Masaa DMC (watch, runtime: 2:22) after a 15-year old student suffered severe injuries.

EGYPT IN THE NEWS

It’s a slow morning in the pages of the international press. Among the stories worth your time this morning:

- Soaring inflation is forcing people to turn to BNPL: Quartz is out with a feature on how rising living costs are contributing to the growth of Egypt’s buy-now-pay-later market.

- Ancient artifacts coming home: An Irish university plans to return ancient Egyptian objects including mummified remains and a sarcophagus next year, following discussions between the university, the Egyptian and Irish governments, and the National Museum of Ireland. (BBC)

ALSO ON OUR RADAR

COMMODITIES-

State grains buyer GASC purchased 260k tons of Russian wheat directly from buyers at USD 354 per ton on a cost and freight basis, according to Agricensus. GASC made at least one other direct purchase of Russian wheat last month shortly after it canceled a tender due to high prices.

TRADE-

The government has disbursed 70% of the EGP 10 bn it plans to pay out in the fifth phase of its export subsidy program, according to a Finance Ministry statement. The Export Development Fund has so far paid EGP 40 bn in overdue subsidies to exporters under the program, which allows exporters to receive their subsidies in a single payment rather than in installments over four to five years, in return for a haircut. More than 1.4k exporters applied to join the fifth phase of the export subsidy program.

PLANET FINANCE

Mubadala sells majority stake in Masdar to Taqa + Adnoc: The UAE’s national oil company Adnoc and state energy firm Taqa have completed a transaction to take stakes in sovereign wealth fund Mubadala’s clean energy firm Masdar, according to a joint statement out Thursday. Taqa is the largest shareholder of the company’s renewables business with a 43% stake, Mubadala will retain 33% and Adnoc the remaining 24%. Meanwhile, Adnoc will lead green hydrogen operations with a 43% stake in that side of the business, with Mubadala holding 33% and Taqa the remaining 24%. Taqa paid more than USD 1 bn for its stake, according to the statement.

Americana Group will debut on both the Saudi and Abu Dhabi stock exchanges tomorrow, 12 December, according to statements from the two bourses (here and here, pdf). Americana, which operates KFC and Pizza Hut in MENA, is offering (pdf) a 30% stake (2.5 bn shares) in a dual listing in Riyadh and Abu Dhabi at SAR 2.68 apiece — the top end of its range, valuing the company at as much as USD 6 bn. Bookbuilding was oversubscribed within hours of opening last month.

|

|

EGX30 |

14,838 |

+0.4% (YTD: +24.2%) |

|

|

USD (CBE) |

Buy 24.59 |

Sell 24.66 |

|

|

USD at CIB |

Buy 24.58 |

Sell 24.64 |

|

|

Interest rates CBE |

13.25% deposit |

14.25% lending |

|

|

Tadawul |

10,247 |

+0.6% (YTD: -9.2%) |

|

|

ADX |

10,252 |

-0.2% (YTD: +20.1%) |

|

|

DFM |

3,325 |

+0.3% (YTD: +4.0%) |

|

|

S&P 500 |

3,934 |

-0.7% (YTD: -17.5%) |

|

|

FTSE 100 |

7,477 |

+0.1% (YTD: +1.3%) |

|

|

Euro Stoxx 50 |

3,943 |

+0.5% (YTD: -8.3%) |

|

|

Brent crude |

USD 76.10 |

-0.1% |

|

|

Natural gas (Nymex) |

USD 6.25 |

+4.8% |

|

|

Gold |

USD 1,810.70 |

+0.5% |

|

|

BTC |

USD 17,147 |

+0.2% (YTD: -62.9%) |

THE CLOSING BELL-

The EGX30 rose 0.4% at Thursday’s close on turnover of EGP 2.74 bn. International investors were net buyers. The index is up 24.2% YTD.

In the green: AMOC (+7.7%), Sidi Kerir Petrochemicals (+7.6%) and Elsewedy Electric (+6.0%).

In the red: Oriental Weavers (-3.9%), e-Finance (-2.6%) and Fawry (-2.3%).

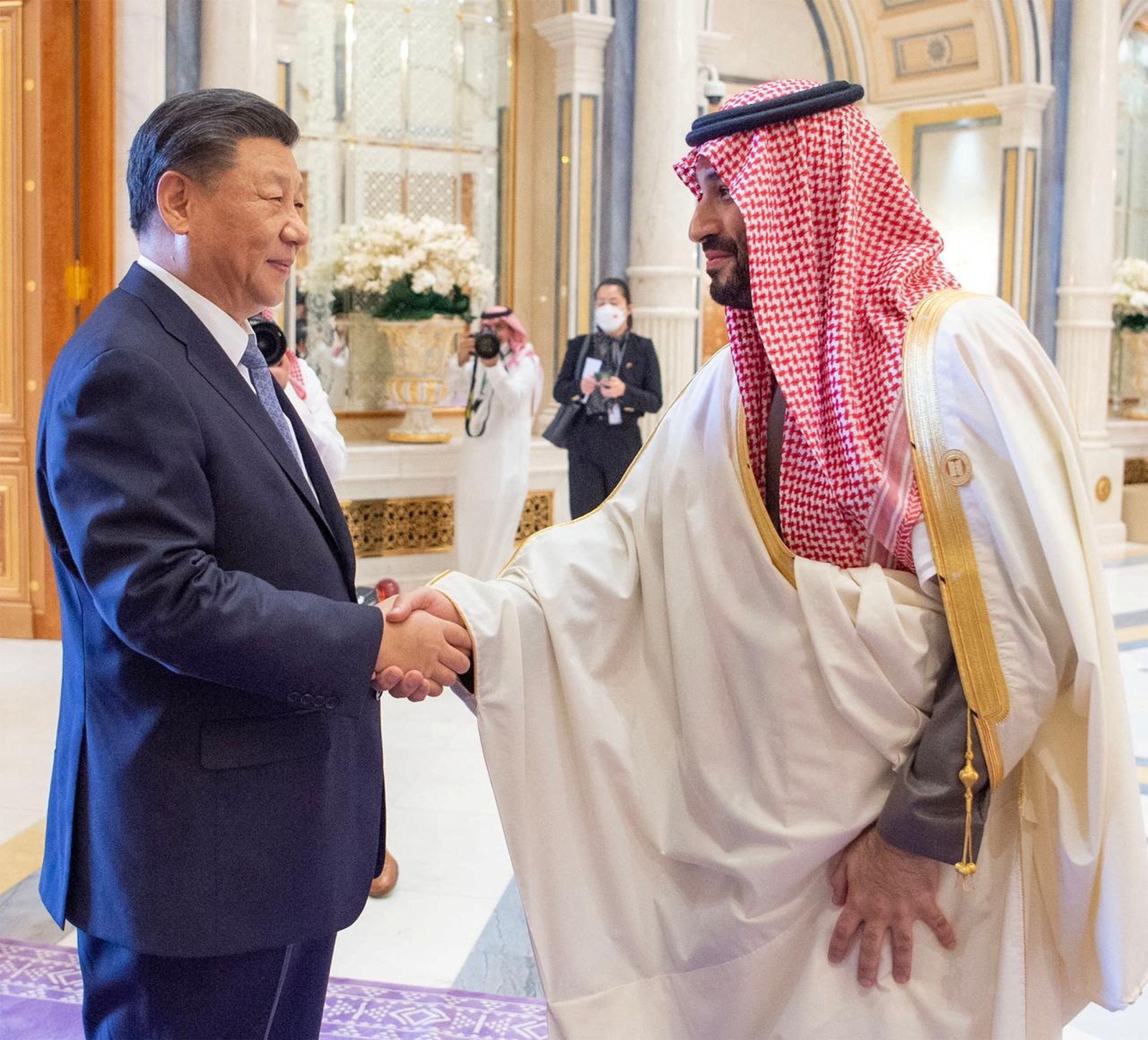

DIPLOMACY

El Sisi calls for close Arab-China ties: President Abdel Fattah El Sisi called on the Arab world and China to strengthen ties at a summit in Saudi Arabia attended by Chinese President Xi Jinping on Friday, according to an Ittihadiya statement. The president said that Arab nations and Beijing will need to work more closely to solve the problems caused by rising food insecurity, which he said was among the most dangerous threats in the world. The China-Arab summit capped a three-day visit to Riyadh by Xi which was hailed by Saudi Crown Prince Mohamed bin Salman as “launching a new historical era” of Saudi-China ties.

El Sisi met with: Sudan’s Abdel Fattah Al Burhan | Tunisian President Kais Saied | Iraqi Prime Minister Mohammed Shia Al Sudani.

Egypt, Jordan + Iraq to expand cross-border payment services: Bilateral trade could be added later to a joint initiative signed between the central banks of Egypt, Jordan and Iraq on cross-border payments last week, CBE governor Hassan Abdalla told CNBC Arabia in an interview (watch, runtime: 1:59). The three central banks announced a joint initiative to launch a cross-border payment service for pensioners in the Arab world through the Arab Monetary’s Fund Buna system. The first phase of the initiative will allow Iraqi pensioners residing in Egypt or Jordan to receive their monthly salaries easily after opening accounts in any of the banks under the initiative.

AROUND THE WORLD

Russia could respond to price cap by cutting production -Putin: Moscow will not sell oil to countries that impose the G7’s price cap and could cut production, Russian President Vladimir Putin said Friday, according to the Financial Times. Russia “would simply not sell to the countries” that imposed the cap or joined the EU ban on purchasing oil from Moscow, he told reporters following a summit in Kyrgyzstan. “We will possibly, if we have to, even think — I’m not saying that it’s a decision — about a possible cut in production,” he said, describing the price ceiling as a “non-market, harmful decision” that would be “stupid for everyone” to implement.

CALENDAR

NOVEMBER

20 November-18 December (Sunday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

10-12 December (Saturday-Monday): Nebu Expo for Gold and Jewelry, Egypt International Exhibitions Center.

12 December (Monday): The Egyptian Private Equity Association’s healthcare summit.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

16 December (Friday): IMF executive board to discuss Egypt’s EFF request.

19-20 December (Monday-Tuesday): The Arab Administrative Development Organization’s conference on Modern Methods in Hospital Management, Cairo.

20 December (Tuesday): EGX-listed Pachin will brief shareholders on offers received to acquire the company in an ordinary general assembly.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): President El Sisi will visit India as “chief guest” at celebrations to mark the 74th anniversary of Indian independence.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

End of December/early January: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q 2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Arabia’s Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.