- Egypt’s economy to grow by 3.3% in FY2020-21 -Reuters poll. (Speed Round)

- CIB’s shares begin recovering as the bank addresses concerns raised by regulatory probe. (Speed Round)

- Egycomex to begin trading in wheat in 1H2021. (Speed Round)

- Egypt, Ethiopia, and Sudan could have a draft agreement on filling + operating GERD within a week. (Diplomacy + Foreign Trade)

- Smart Policy- As many as 1 mn additional students are lined up for state support to fund their education. (Speed Round)

- Global foreign direct investment fell 49% y-o-y in 1H2020. (The Macro Picture)

- Ahli United Bank purchases 30 mn shares in AUB Egypt. (Speed Round)

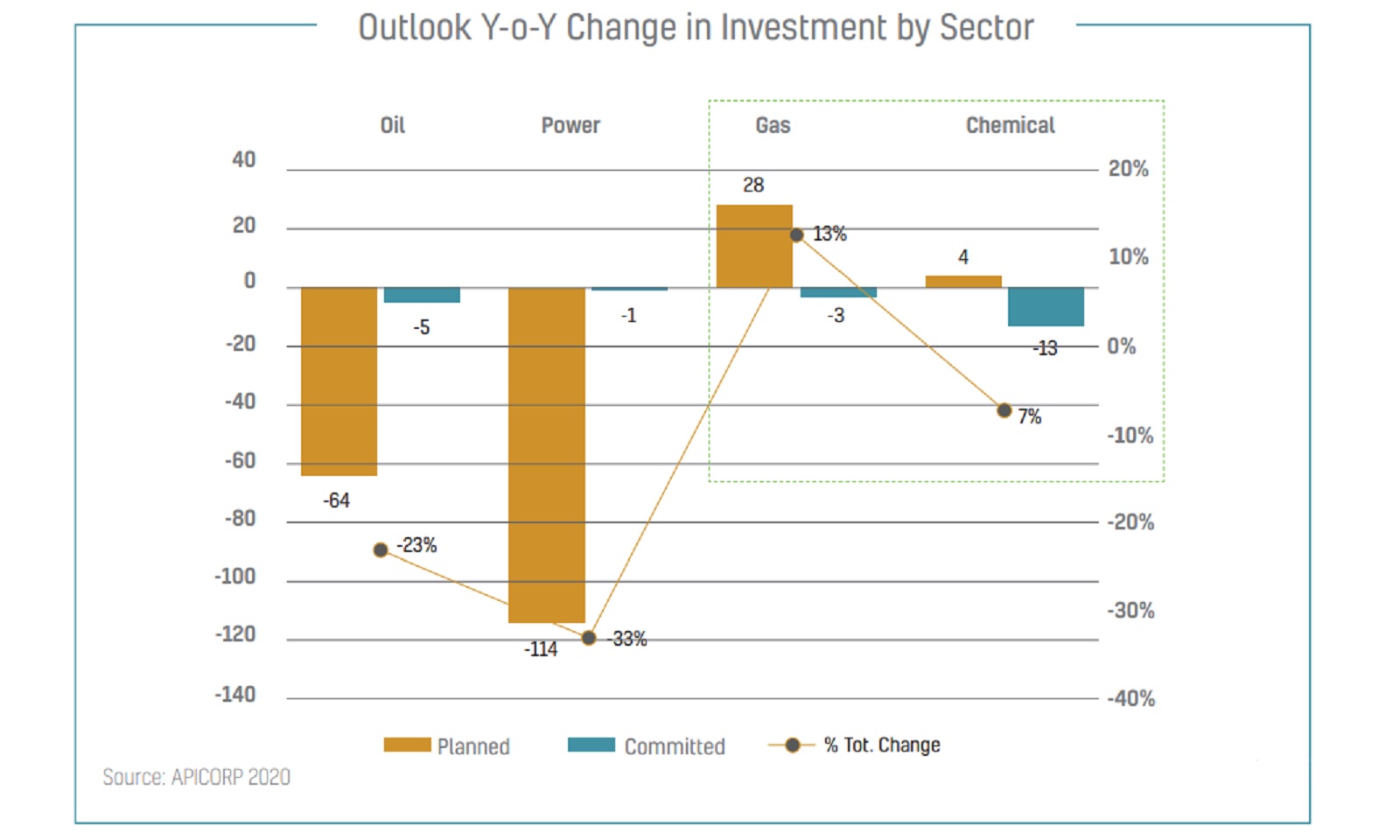

- The MENA region is planning more gas + petrochems investments in 2020-2024, despite covid-19. (Hardhat)

- The Market Yesterday

Wednesday, 28 October 2020

Happy long weekend, everyone.

Plus: Egypt’s GDP growth could hover at 3.3%

TL;DR

What We’re Tracking Today

Good morning, friends. Are you looking forward to the long weekend as much as we are? We are always grateful to write to you every morning, but we sometimes wish a four-day workweek would become standard practice…

Banks and the EGX will close their doors tomorrow in observance of the Prophet’s Birthday, and the rest of the business community is also taking the day off.

Enterprise is off tomorrow, too, but keep an eye on your inbox for a fresh episode from season three of Making It, our podcast on how to build a great business in Egypt. We’ll send a special email with the new episode to keep you entertained as you kick off the three-day weekend, but you can get early access if you're subscribed to Making It: The episode will drop into the podcast player of your choice this afternoon.

After a short-lived drama over the weekend, the dust is already settled over at CIB, which is wasting no time in addressing concerns found in a regulatory probe. The leading private sector bank saw its share price inch up again on the EGX yesterday, helping the EGX30 end the day in the green after two days of losses. We have the full story in this morning’s Speed Round, below.

Foreign Minister Sameh Shoukry is in Moscow today to talk about Libya, Syria, Lebanon, Yemen, and other regional issues with Russian officials, Al Shorouk reports. Shoukry is also set to meet with Russian Trade and Industry Minister Denis Manturov and Secretary of the Security Council of Russia Nikolai Patrushev.

The Health Ministry reported 170 new covid-19 infections yesterday, up from 167 the day before. Egypt has now disclosed a total of 106,877 confirmed cases of covid-19. The ministry also reported 11 new deaths, bringing the country’s total death toll to 6,222. We now have a total of 99,084 confirmed cases that have fully recovered.

Travelers heading to the UK from Egypt could be exempt from a requirement to self-isolate upon arriving in the kingdom, the Sun reports. The UK is currently changing its criteria for its “travel corridor” list, which determines whether travelers are required to quarantine based on the risk level of the countries from which they are traveling. Previously, countries with more than 20 new cases per 100k people over a seven-day period would face quarantine restrictions. This has now been increased to 100 new cases, meaning Egypt falls in the “green zone.”

The Middle East is seeing a “dangerous increase” in covid-19 cases, the World Health Organization’s regional programme director Rana Hajjeh told Yahduth fi Misr’s Sherif Amer yesterday. Hajjeh also poured cold water on the idea that the virus that causes covid-19 is getting weaker (watch, runtime: 3:53).

Don’t expect a vaccine to be a cure-all that will automatically reset the global economy and return us to our normal lives, warn scientists. A return to pre-covid growth could still take over a year — even with a successful vaccine, Bloomberg reports. The efficacy and global distribution of any vaccine are still huge variables, which will have a major impact on consumer behavior and global economic recovery. And though the US and eurozone may have seen their downturns ease in 3Q, and while there’s reason to hope vaccines may be available to protect the most vulnerable by spring 2021, uncertainty and adverse economic effects could persist until well into 2022, say experts.

Meanwhile, pressure to adopt any vaccine that shows even moderate results could reduce the chances of creating more effective versions, especially for vulnerable groups like the elderly, the Guardian reports. Some 198 covid-19 vaccines are currently under development, with four in final phase 3 trials, and results are expected within the coming weeks and months. But experimental vaccines that appear first may not be as effective as those developed using slower methods, scientists say.

Pfizer is not yet ready to release data from its late stage vaccine trials, after previously saying it could announce whether its vaccine works as early as this month, Reuters reports. Pfizer is developing its vaccine with German BioNTech and hopes to be the first US pharma company to announce successful results from the vaccine trial it began in July.

“Overwhelming” demand for Ant IPO sees book-building close early: The private placement for the Hong Kong portion of Ant Financial’s upcoming blockbuster IPO has closed a day early due to strong demand from investors, Reuters reports, citing sources familiar with the matter. The USD 17.2 bn Hong Kong listing was oversubscribed after just an hour of launching on Monday, signaling a high level of investor appetite for China’s largest fintech company. The USD 34.4 bn listing will comfortably set a new record for the world’s largest ever IPO, eclipsing Saudi Aramco, and values the company at around USD 312 bn.

Is there any wonder why Wall Street bigwigs are wining and dining in Shanghai? Major US investors have been in China attending two summits, eager to hear Beijing’s plans to open its financial markets as it prepares its next five-year plan. The China-US Financial Roundtable and the Bund Summit attracted big-name delegates from the world of Western finance, a signal that some of the most important people in the American business community have no intention of slowing investment in the face of rising political tensions.

Advanced Micro Devices is looking to acquire rival chipmaker Xilinx in a USD 35 bn all-stock transaction, the latest in a series of transactions in the semiconductor industry fueled by an increased demand for electronics during covid-19, the Wall Street Journal reports. The purchase follows Nvidia Corp’s proposed USD 40 bn acquisition of Arm Holding, and the USD 20 bn purchase of Maxim Integrated Products by Analog Devices.

A handful of third quarter earnings released yesterday:

- BP beat expectations, reporting a slender USD 100 mn profit after its heavy USD 6.7 bn loss in the previous quarter, according to the company’s earnings release (pdf). Analysts had forecast the company to report a loss of USD 120 mn.

- HSBC’s net profit fell 46% to USD 2 bn, after lower interest income caused revenues to decline by 11% to USD 11.9 bn, according to the company’s earnings release (pdf).

- The pandemic-fueled demand for cloud computing and video gaming gave Microsoft a solid quarter. The company reported USD 13.9 bn in net profit in between 1 July and 30 September, up by 30% y-o-y.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: We take a look at the Arab Petroleum Investment Corporation’s (Apicorp) outlook for the MENA region’s gas and petrochemicals industries, which the multilateral development bank says will see an uptick in investments over the next five years — but will face some headwinds because of the pandemic.

Enterprise+: Last Night’s Talk Shows

The fresh round of tripartite negotiations on the Grand Ethiopian Renaissance Dam was at the top of the talking heads’ agenda last night, with former Irrigation Minister Mohamed Nasr Allam phoning into Kelma Akhira (watch, runtime: 5:55) and Yahduth fi Misr (watch, runtime: 3:28) to provide color commentary. We have chapter and verse on yesterday’s meeting between officials from Egypt, Sudan, and Ethiopia in this morning’s Diplomacy + Foreign Trade, below.

Education was also in the limelight on the airwaves yesterday: Education Minister Tarek Shawki had a chat with Kelma Akhira’s Lamees El Hadidi about planned regulations the ministry will begin implementing at private schools to ensure parents make good on tuition fee payments in a timely manner. The regulations would also penalize schools that try to impose any changes to their tuition fees at any point during the academic year, Shawki said (watch, runtime: 16:52). Lamees also discussed the government’s plan to financially support an additional 1 mn students to be able to attend school with Social Solidarity Minister Nevine Kabbaj (watch, runtime: 5:43). We have the full story in this morning’s Speed Round, below.

Speed Round

Egypt’s economy will grow at a 3.3% clip during the current fiscal year, according to a Reuters poll of economists. This is a slight upwards revision from the 3.1% growth economists had penciled in for FY2020-2021 in a similar poll in July. The economists’ forecast is more optimistic than the Planning Ministry’s projection in May that we would only see 2% growth if the pandemic continues into December — but more or less matches expectations from the IMF, Fitch, and Deutsche Bank. The figure falls below the Finance Ministry’s forecast, which said in June it sees GDP growth for FY2020-2021 coming in at 5%.

Chalk up the muted growth to a tourism downturn: HC Securities’ assumption for the current fiscal year is based on its expectation that tourism revenue will plunge 50% y-o-y, driving down employment levels and potentially also leading to “muted real growth in household consumption,” HC’s head of macro and financials Monette Doss tells the newswire.

Growth is expected to accelerate over the next two fiscal years, the Reuters poll indicated. Economists expect the economy to expand 5% in FY2021-2022 and 5.5% in FY2022-2023.

Inflation to spike in coming years… Annual urban consumer price inflation will slow to 5.8% in FY2020-21 before rising to 7% in each of FY2021-22 and FY2022-23, according to the economists. Annual inflation came in at 3.7% in September and 3.4% in August, close to its lowest levels in 14 years, the report notes. “We expect inflation to trend higher over the medium term as the exchange rate weakens and global commodity prices tick higher amid a recovery in global demand,” said Callee Davis, an economist at NKC African Economics.

…and the EGP will weaken against the USD: The currency will weaken to EGP 15.8 against the USD by the end of the year from its current rate of about 15.65, the economists predicted. According to the economists, the exchange rate could be at EGP 16.5 / USD by December 2021 and EGP 17 / USD 1 by December 2022. The economists predicted that the central bank’s overnight lending rate would slide to 9.25% by the end of June 2021, from the current 9.75%, then again to 8.5% by June 2022 and 8% by June 2023.

Growth in other major African economies, meanwhile, is seen as subdued and mixed, a separate Reuters poll showed. The continent’s two largest economies, Nigeria and South Africa, are expected to eke out positive rates of 2% and 3.5% in 2021 after taking a beating this year and shrinking 4% and 8.5%, according to the poll. This is “partly because many African countries’ fiscal positions will be a constraint on growth,” Jacques Nel, head of macroeconomic research at NKC African economics said. “Most of the fastest-growing countries will be in East Africa” as the region is one of the most diversified, Nel said.

As for the MENA region, economies are seeing a disproportionate amount of economic pain because of structural issues that long pre-date covid-19, AUC’s Amr Adly argues in Bloomberg Opinion. Weaknesses in MENA economies mean the impact of covid-19 on the US and EU has hit us hard in terms of trade, investment and reduced fuel exports, while a lack of intra-regional trade integration has stopped us tapping into the purchasing power on our doorsteps, he says. The IMF is predicting MENA economies to shrink 5.4% in FY2020-2021 — a level of contraction that seems unaligned with the scale of the public health crisis in the region. The average number of covid-19 deaths in MENA stands at 79.46 per mn — lower in the most populous nations, including Egypt, at 62.21 per mn — compared to 673.80, 360.45 and 661.29 in the US, EU and South America.

CIB is working with auditors to address issues detected by a recent regulatory probe that found “regulatory, compliance, and governance concerns,” according to an EGX disclosure (pdf). Representatives of the country’s leading private sector bank sat down with Central Bank of Egypt (CBE) officials on Monday to look into the violations found in the audit. The CBE made a number of recommendations to strengthen compliance and internal controls. Several CIB teams will study the central bank’s guidance and make the necessary corrections over the coming days, the bank said.

The bank’s share price is rebounding following two days of losses: CIB shares rose 0.4% yesterday after shedding a total of 9.4% over the course of Sunday and Monday. Research houses have affirmed their confidence in the bank, with HSBC, Arqaam Capital and Arab African Bank all maintaining “buy” ratings. HSBC’s Aybek Islamov wrote in a research note that the bank believes that “the market has overreacted to the sudden news of the chairman’s departure” and “continues to view CIB as a financially sound bank.”

Background: Hisham Ezz Al Arab stepped down from his position as CIB chairman last week after the central bank said it found “gross violations” of banking regulations during an audit of the bank. Ezz Al Arab has been succeeded by former regulator, consultant and entrepreneur Sherif Samy as the bank’s non-executive chairman.

Meanwhile, other banks across the country got a nudge from the CBE to ensure their boards of directors are kept up to date with the CBE’s regulations and correspondences to ensure they are able to perform their duties, according to a circular (pdf)

M&A WATCH- Bahrain’s Ahli United Bank (AUB) has purchased more than 30 mn shares in its Egypt unit alongside Misr Strategia for EGP 913.1 mn, it said in an announcement posted on EGX screens yesterday. The bank, which controlled 85.5% of its Egypt subsidiary before the transaction, purchased 30.6 mn shares from foreign shareholders and 68.7k shares held by Egyptian shareholders. The Financial Regulatory Authority, which approved the purchase offer last month, said the bank would buy all 43.5 mn of the remaining shares at EGP 29.783 apiece, and that the International Finance Corporation would be offloading a 10% in the bank while Qatar National Bank would sell its 4% stake.

Background: Bahrain’s AUB signaled last month that it was seeking 100% ownership of its Egypt unit by snapping up the shares it didn’t already hold from undisclosed parties. The bank’s 2018 annual report suggests that the bank had already owned 85.5% of its Egyptian subsidiary. The purchase marks a reversal by the parent bank after local press reports earlier this year suggested that it was looking to sell its Egypt unit, or it could be AUB clearing out minority shareholders to streamline ahead of a divestment. Kuwait Finance House has been in the process of acquiring AUB since 2019 but the potential USD 8.8 bn transaction was postponed until December earlier this year due to the covid-19 pandemic.

M&A WATCH- Bahrain’s Arab Banking Corporation (Bank ABC) will wrap up due diligence on Blom Bank Egypt in mid-November, ahead of a potential offer to acquire the Lebanese bank’s Egypt assets, Masrawy reports, citing banking sources. Blom has reportedly nudged Bank ABC to complete the process and present an offer as soon as possible, the sources say. Bank ABC showed interest earlier this month after announcing it had entered early-stage talks. Blom confirmed in August it is looking to sell its Egypt assets as its home country suffers its worst economic crisis in decades. The sale could wrap up as soon as next month, familiar sources recently said.

Bank ABC isn’t alone in the running: The bank is competing with fellow GCC lender Emirates NBD, which wrapped up its due diligence this month. Sources previously said that Emirate NBD has valued Blom Egypt at EGP 6.5-7 bn, around 1.5x the bank’s total shareholder equity. An unnamed non-banking financial services firm is also considering submitting an offer for the bank, unnamed sources said last month.

Advisors: Blom has hired CI Capital to advise on the sale, while HSBC is providing financial advice to Bank ABC.

Egypt’s Commodities Exchange (Egycomex) will begin trading in the first half of 2021 and will launch with only wheat as a tradeable commodity, newly-appointed chairman Ibrahim Ashmawy told the local press. Ashmawy previously told us that traders would be able to buy and sell wheat, oil, sugar, and rice when the exchange launches next year, and said in a separate interview that gold, steel and cotton would be added later. The company aims to have the exchange up and running by 1Q2021 but this could be pushed to the second quarter, he said yesterday. Egycomex will be headquartered in New Cairo. The long-awaited commodities exchange has been in the works since February 2018, when it was made possible after amendments made to the Capital Markets Act.

The Egycomex board: EGX head Mohamed Farid will serve as deputy chairman of the exchange, whose board also includes representatives from EFG Hermes, the National Bank of Egypt (NBE), the Agricultural Bank of Egypt, the General Authority for Supply Commodities, the Egyptian Holding Company for Silos and Storage, and three other members of the EGX.

The ownership structure of the company managing Egycomex: Beltone and CI Capital join EFG as the three private sector players to own part of a 49% stake in the company that will be shared with the NBE, Banque Misr and the Agricultural Bank of Egypt. The ِEGX, Misr Holding Insurance, and Misr for Central Clearing, Depository and Registry, as well a number of Supply Ministry companies, will split the remaining 51% stake.

In related news, shareholders in the forthcoming futures exchange will likely receive equal stakes of between 10-20%, Al Mal reports, citing sources in the know. Sources added that the Financial Regulatory Authority’s advisory committee will meet again in the coming days to discuss the final ownership structure. The EGX will take the largest stake in the new exchange. State-owned and private Egyptian banks, Misr for Clearing, Depository, and Registry, domestic and foreign financial institutions and foreign exchange operators, as well as the Central Bank of Egypt are also among the potential shareholders.

SMART POLICY- As many as 1 mn additional students are lined up for state support to fund their education under a new directive by President Abdel Fattah El Sisi, Social Solidarity Minister Nevine El Kabbaj said. The support will be given to students from families that were either found ineligible for or taken off the Takaful cash transfer program, which already helps 2.4 mn students. They will be added to other families supported directly by the state, bringing the number of students receiving social aid directly and through Takaful to a combined total of 4.4. The directive also covers students with disabilities or those enrolled in community and vocational schools or literacy classes, and those who were covered by Takaful and made it to university, El Kabbaj said.

Background: The government has removed at least 8 mn people from its subsidy rolls in recent years under reforms to the subsidy program that have recently entered their fourth phase. It then said it’s restoring as many as 1.8 mn after a tweet by El Sisi on measures to shore up social safety nets and help “protect the rights” of low-income citizens affected by subsidy cuts.

Indian retailer Lulu is in talks with the New Urban Communities Authority to establish a hypermarket in New Cairo’s First Settlement, Al Mal reports, citing sources with knowledge of the plans. Negotiations are in their final stages and an agreement is expected to be signed by the end of the year, the sources said. Lulu is one of the largest retailers in the Middle East by turnover and has been planning to invest USD 1 bn in Egypt since at least July, when it opened its second hypermarket in the country, an EGP 180 mn branch in Sheraton. Abu Dhabi’s sovereign wealth fund announced last week that it would be investing USD 1 bn in Lulu’s Egypt expansion to fund the creation of up to 30 hypermarkets and 100 mini markets, as well as logistics hubs and distribution and fulfilment centers.

CORRECTION – Production at Egypt’s Sukkari mine is ongoing: We had incorrectly reported last week that the entire Sukkari mine would be out of action until 2H2021. The mine’s Stage 4 open pit has been closed following a safety issue, but the rest of the mine remains operational. The story has been updated on our website.

If your company sells the experience of its employees, it faces the same set of issues as other service providers. From no clear model for billing, to the challenges of finding and retaining talent, we discuss the dynamics of businesses that revolve around people in this week’s episode of Making It with Bahaa Alieldean, managing partner at ALC Alieldean, Weshahi & Partners.

You already have a podcast player on your iPhone, or you can listen to the episode through our website (no download required). We’re also on Google Podcasts | Anghami | Omny. Making It is on Spotify, but only for non-MENA accounts.

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

- A full-time copy editor to enforce house style, police facts and generally make us sound smarter than we really are.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

The Macro Picture

Global foreign direct investment fell 49% y-o-y in 1H2020 as lockdowns across the world and recession fears caused a slowdown in cross-border investment, the United Nations Conference on Trade and Development (UNCTAD) has said in its latest investment monitor (pdf). All forms of FDI felt the impact of the coronavirus, with the value of greenfield investments falling by 37%, new financing agreements slipping by 25%, and M&A dropping by 15%.

The developed world returns to 1994: Advanced economies suffered the steepest decline, with FDI plummeting by 75% to USD 98 bn — a level of investment last seen in 1994. M&A values in developed countries saw a drop of 21%, but the decline was tempered by continuing M&A activity in digital industries. Italy, the US, the Netherlands and Switzerland saw particularly heavy declines.

China proves its resilience: Developing economies fared slightly better, witnessing a 16% decline in investment, a better than expected outlook attributed to China, which only saw inflows fall 4%. Asian economies saw only a 12% drop-off in FDI, while investment in African economies fell by 28% and Latin America saw inflows decline by 15%.

Don’t expect much improvement for the second half of the year: Although investment in developed economies may have picked up in the third quarter, the UNCTAD is sticking with its earlier projections for a 30-40% decline in FDI over the course of the whole year. This, of course, will depend on the trajectory of the virus and the continued effectiveness of stimulus measures deployed to prop up economies.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning is a rare shark attack off the Red Sea coast in Sharm El Sheikh on Sunday, which cost an Egyptian tour guide a leg and a 12-year-old Ukrainian boy an arm, reports the Associated Press. The boy’s mother also sustained light injuries in the attack.

Preserving Esna’s monuments: Ongoing work by the government and urban developer Takween to preserve the heritage of Esna also got some ink in Al Monitor. The Rediscovering Esna’s Culture Heritage Assets (RECHA) project, which began in 2016, is being funded by USAID.

Diplomacy + Foreign Trade

The biggest diplomacy story of the day: Egypt, Ethiopia, and Sudan could have a draft agreement on filling and operating the Grand Renaissance Dam within a week. Sudan, which chaired the first meeting yesterday of African Union-brokered negotiations that resumed yesterday following a seven-week hiatus, is expected to send out a formal invitation to technical teams from the three countries, the Irrigation Ministry said in a statement. Talks to resolve the drawn-out dispute kicked into gear yesterday after US President Donald Trump weighed in.

Cairo and Khartoum aren’t budging on their position that the negotiations must produce a “legally binding agreement,” President Abdel Fattah El Sisi and Sudan’s transitional Sovereignty Council head Abdel Fattah al-Burhan agreed in a separate meeting on Tuesday, according to a statement. Speaking ahead of the negotiations, members of Ethiopia’s negotiating team said talks would continue with a “general understanding” of contentious issues and that they were confident an agreement could be reached, Bloomberg reports.

Egypt will establish a rail network connecting Aswan to South Wadi Halfa in

Sudan in accordance with a MoU signed by Transport Minister Kamel El Wazir in a virtual meeting with Sudanese Minister Hashem Ibn Auf, according to a ministry statement. The project will be jointly funded by both countries as well as the Kuwait Fund for Arab Economic Development. The ministers also discussed a potential road project connecting Egypt and Chad through Sudan that will serve as a gateway for trade between Egypt and other African nations, as well as the Cairo-Cape Town highway, which is set to pass through nine countries.

Scottish companies are kicking the tires on investing in Egypt’s energy sector as part of a UK bid to help Egypt achieve “net zero” carbon emissions, the British Embassy in Cairo said. This came following a webinar held yesterday by the UK Department for International Trade and the Scottish Development International to listen to an overview of Egypt’s priorities to reform its energy sector and major oil and gas projects in the pipeline.

The MENA region is planning more gas + petrochems investments in 2020-2024, despite covid-19: There’s a rise in planned investments in gas and petrochemicals projects in the MENA region over the next five years compared to the 2019-2023 outlook, multilateral development bank Arab Petroleum Investments Corporation (Apicorp) says in its latest MENA Gas & Petrochemicals Investment Outlook report. According to the report, planned gas investments across the region for 2020-2024 are up 29% from the 2019 outlook figure, rising to USD 126 bn, while planned investments in the petrochemicals sector are also up around 4.4% to USD 95 bn when compared to last year’s outlook. Of the 12 countries included in the report, Egypt is expected to see the largest petrochemicals investments, but comes in seventh place in terms of planned gas investments.

That’s not to say it’s all smooth sailing: Projects that are already in the proverbial pipeline are expected to “face headwinds in terms of payments, supply chain issues and delays” as governments and the private sector alike cope with significant fiscal pressure caused by this year’s economic downturn. And any new planned projects — “specifically in upstream and international downstream ventures” — will be under the microscope and more likely to be postponed altogether.

Covid-19 is also taking a toll on oil and gas exports, meaning demand is turning inwards. According to Apicorp, industrial demand is set to account for a larger share of petrochemicals and gas demand on a domestic level, which is also slowing down because of the pandemic. Across the region, slower GDP growth and lower industrial output mean gas demand will grow between 3.8 and 4% this year — a downwards revision from the 6% growth in demand seen last year.

What’s driving the growth in planned regional gas investments? The ramped up investment plans are mostly accounted for by Qatar’s USD 50 bn North Field Expansion — USD 22 bn of which will be invested in the five-year outlook period. This is in addition to the regional push towards cleaner power generation and “improved monetization of gas as a feedstock for the industrial petrochemicals sectors.”

In Egypt, LNG facilities “will remain heavily underutilized” until 2022 on the back of reduced domestic gas prices for heavy industries, and “depressed global prices” in 1H2020 meaning LNG exports are largely on hold, the report says. Egypt will export only 35% of its production capacity over the next two years, according to Apicorp.

What’s driving the growth in planned regional petrochemicals investments? Egypt, Iran, and Saudi Arabia are driving regional petrochemicals investments, “driven by the localization of specialty chemical industries and feedstocks import substitution,” the report says. Egypt’s push to pursue its “petrochemicals ambitions” comes despite the slump in LNG exports and as we continue to push ahead to cement our status as a regional energy hub.

Key drivers of the expected growth in Egypt’s petrochemicals industry: The Oil Ministry’s 2020-2035 national plan for the industry includes a USD 8.5 bn crude and condensate refinery plant in Al Alamein, which is expected to produce 1 mtpa of petrochemicals and 0.85 mtpa of refined products. The facility is set to cover domestic consumption needs by providing industry with “specialty chemicals feedstocks,” while earmarking surplus output for exports. State-owned Enppi is expected to issue a tender for the project before the year is out, according to the report. The ministry’s plan also covers the Egyptian Petrochemicals Holding Company’s (ECHEM) planned petrochemical plant and refinery in the Suez Canal Economic Zone, the construction of which will be managed by the US’ Bechtel. Previous reports had indicated the project is expected to cost USD 6.7 bn, but Apicorp suggests the figure is now at USD 7.5 bn.

As for the private sector, there’s the Egypt Hydrocarbon Corporation’s (EHC) planned Ain Sokhna ammonia plant. EHC had signed a USD 550 mn agreement with Italian company Maire Tecnimont in May to set up the plant, but the project has yet to reach financial closure, according to Apicorp. The plant could come online as early as 2025 if EHC manages to reach financial closure next year, the report says.

You can read the full report here (pdf).

Your top infrastructure stories for the week include:

- Data centers: Liquid Telecom is planning a new wave of investment in Egypt’s internet infrastructure.

- Solar energy: B-Electric-led consortium signed an initial agreement with the New and Renewable Energy Authority to establish a 50 MW solar power plant in Zafarana.

- 5G tussle: The US State Department is urging Egypt to avoid working with China to develop its 5G infrastructure and instead work with American firms.

- Vocational schools: Elsewedy Technical Education (STA) signed an MoU with the Education Ministry to establish 10 vocational schools in the next five years.

- Road safety: Deaths in Egypt from road accidents fell 44% y-o-y during the last fiscal year.

The Market Yesterday

EGP / USD CBE market average: Buy 15.66 | Sell 15.76

EGP / USD at CIB: Buy 15.65 | Sell 15.75

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Tuesday): 10,560 (+0.5%)

Turnover: EGP 1.5 bn (33% above the 90-day average)

EGX 30 year-to-date: -24.4%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.5%. CIB, the index’s heaviest constituent, ended up 0.4%. EGX30’s top performing constituents were Egyptian Iron & Steel up 6.6%, Dice up 5.4%, and Export Development Bank up 3.7%. Yesterday’s worst performing stocks were GB Auto down 1.1%, Ibnsina Pharma down 1.0% and Juhayna down 0.9%. The market turnover was EGP 1.5 bn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -331.8 mn

Regional: Net Short | EGP -33.1 mn

Domestic: Net Long | EGP +364.9 mn

Retail: 55.6% of total trades | 58.2% of buyers | 53.0% of sellers

Institutions: 44.4% of total trades | 41.8% of buyers | 47.0% of sellers

WTI: USD 38.93 (+0.96%)

Brent: USD 40.69 (+0.57%)

Natural Gas: (Nymex, futures prices) USD 3.03 MMBtu (+0.20%, November 2020 contract)

Gold: USD 1,910.00 / troy ounce (+0.23%)

TASI: 8,198.90 (+0.53%) (YTD: -2.27%)

ADX: 4,682.82 (+1.25%) (YTD: -7.74%)

DFM: 2,191.16 (+1.14%) (YTD: -20.75%)

KSE Premier Market: 5,979.24 (-0.95%)

QE: 9,853.16 (+0.47%) (YTD: -5.49%)

MSM: 3,555.68 (-0.23%) (YTD: -10.69%)

BB: 1,427.46 (-0.52%) (YTD: -11.35%)

Calendar

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

End of October: Last chance to settle building code violations for illegal buildings.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo.

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

7-9 November (Saturday-Monday): Techne Summit 2020, Bibliotheca Alexandrina, Alexandria.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 November (Friday-Sunday): A conference on banking in the time of covid by the Union of Arab Banks, Sharm El Sheikh, Egypt.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

22-25 November (Sunday-Wednesday): Cairo ICT 2020, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December (date TBC): Egypt Economic Summit, Cairo, Egypt, venue TBD.

December: Fifth round of Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

5 December (Saturday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria.

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.