- El Sisi inaugurates Qalaa’s Egyptian Refinery Company, warns of possible second covid wave. (Speed Round + Last Night’s Talk Shows)

- Egypt’s maiden green bond issuance will soon go to market. (Speed Round)

- Orascom Financial Holding eyeing United Bank of Egypt? (Speed Round)

- Turki Al Shikh, Estadat Holding among bidders for share of Makkasa Sport. (Speed Round)

- Cement producers call for gov’t intervention to save ailing sector. (Speed Round)

- The New York Times has the dirt on Trump’s tax affairs — two days before the first presidential debate. (What We’re Tracking Today)

- Can Egypt’s internationalization strategy persuade Egyptians to study here at home? (Blackboard)

- The Market Yesterday

Monday, 28 September 2020

Green bonds soon?

Plus: El Sisi inaugurates ERC and Naguib may be eyeing United Bank

TL;DR

What We’re Tracking Today

Good morning, friends. It’s a moderately light news day, so what better way to get started than to recognize members of our community whose hard work is being recognized on the regional stage?

KUDOS #1- Our friends at CIB, Sodic and EKH have taken home prizes from the 2020 Middle East Investor Relations Association Awards. CIB was named leading corporate for IR in Egypt, while Sodic took home the prize for best print annual report in the region. EK Holding’s Haitham Abdel Moneim, meanwhile, was given the nod as best investor relations professional in Egypt. You can tap or click here to catch the full list of winners (pdf).

KUDOS #2- The 2019 IPOs of Rameda and Fawry are on the short list for the International Financial Law Review’s “equity transaction of the year” in the Middle East, competing against Aramco’s blockbuster listing. Rameda went public on the Egyptian Exchange late last year, while Fawry went out in late summer. Nominees for Rameda include Matouk Bassiouny & Hennawy, Al Tamimi, Clifford Chance and Norton Rose Fulbright. Meanwhile, Zaki Hashem & Partners and Zulficar & Partners share the nomination for Fawry.

Also getting nods: Zaki Hashem and Matouk Bassiouny are nominated for their work on the acquisition of diagnostics network Metamed from Gulf Capital by a consortium led by Mediterrania Capital Partners. Every lawyer and their pet beagle who touched a part of the Uber-Careem merger has gotten a nomination. Mahmoud Bassiouny is a finalist for managing partner of the year and EFG Hermes is on the list for in-house team of the year (investment banks).

Short-listed for Egyptian law firm of the year: Zulficar & Partners, Zaki Hashem & Partners, Shalakany Law Firm, Sarie El Din & Partners, Matouk Bassiouny & Partners, Helmy Hamza & Partners, Al Tamimi & Company. The full shortlist is online here for your viewing pleasure.

Egyptians abroad have until 10 October to register to vote in the upcoming parliamentary elections. Expats from 14 governorates will go to the polls on 21-23 October in the first phase of voting while the remaining governorates will vote on 4-6 November. Voters abroad will need to register via the National Election Authority’s (NEC) website to cast a ballot. Check out our calendar below for a reminder on which governorates vote when.

The election authority released a preliminary list of candidates in the early hours of this morning. Those who have failed to make the list have three days to appeal, before the Administrative Court deliberates for another three days. The final list of candidates will be announced on 5 October.

EFG Hermes’ virtual investor conference is in its final stretch: The conference, where more than 650 institutional investors with aggregate AUM north of USD 17 tn with top listed companies are chewing over the prospects for frontier and emerging markets, is set to wrap this Thursday, 1 October. You can visit the conference website here.

The Health Ministry reported 104 new covid-19 infections yesterday, down from 111 the day before. Egypt has now disclosed a total of 102,840 confirmed cases of covid-19. The ministry also reported 14 new deaths, bringing the country’s total death toll to 5,883. We now have a total of 102,840 confirmed cases that have fully recovered.

EgyptAir will resume direct flights from Cairo to Oman, Jordan, Rwanda, South Africa and Uganda next month, Sky News Arabia reports. A source at the national flag carrier said that it would start 2x weekly flights to Muscat on 1 October, 2x weekly flights to Amman from 4 October, one weekly flight to Kigali from 8 October, as well as two to Johannesburg and one to Entebbe from 9 October. There will also be three weekly flights between Alexandria and Dubai as of 9 October.

The Czech Republic intends to restart direct flights to Egypt from 1 October, the country’s ambassador to Egypt told Tourism Minister Khaled El Enany.

Americans will likely have to wait until 3Q2021 for any covid-19 vaccine to make a serious impact on the course of the pandemic, even if companies begin disbursing vaccines before the end of the year, the US’ top virus expert Anthony Fauci said, according to Bloomberg.

Meanwhile, China has already begun administering three unproven covid-19 vaccines to government officials and those it considers to be essential workers, in spite of potential risks and unknown side-effects, the New York Times reports.

Europe’s offices and schools are inching back to business as usual — but entertainment services still lag behind: Public transport use is on the rise across Europe as schools are reopening, allowing more parents to head back into offices more frequently. But footfall to leisure venues like movie theaters, bars, and hotels have taken yet another hit as covid-19 case numbers go up, putting a damper on earlier signs of a recovery in these industries, the Financial Times reports.

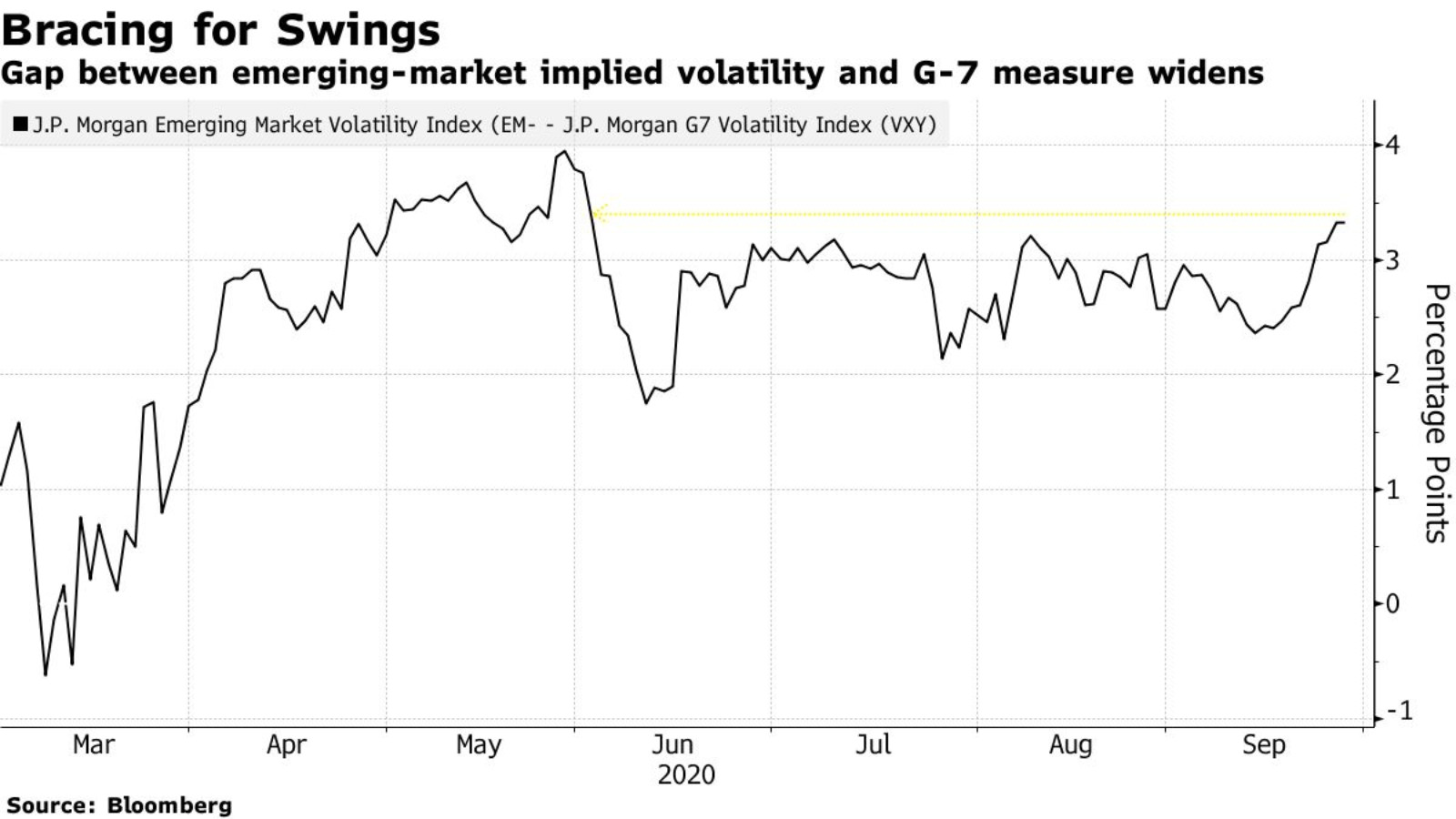

Emerging-market investors are on edge as volatility rises: Developing-nation stocks, currencies and bonds come out of their worst week since the height of the pandemic in March, amid concerns over renewed lockdown measures and delays to further U.S. fiscal stimulus, Bloomberg reports. With investors braced for higher price swings around the US election in November, Deutsche Bank is taking a “defensive stance” on EM debt amid a potential selloff in risky assets.

Goldman Sachs has a favorite EM currency for the post-covid carry trade — and it’s not the EGP. The Mexican peso is the emerging-market currency to count on as the most attractive for the carry trade “once the dust settles” from the pandemic, Goldman Sachs analysts wrote in a research note picked by CNBC. “The South African ZAR and Russian RUB were also named by the investment bank as EM currencies to watch.

NMC enters administration in the UAE: Troubled Emirati healthcare firm NMC has been placed in administration, allowing it to meet September salaries by securing an additional USD 325 mn in funding, the Financial Times reports. The UAE’s largest private healthcare provider was brought to the edge of collapse earlier this year after an internal investigation revealed evidence of fraudulent accounting involving USD 4-5 bn in undisclosed debt.

Trump’s TikTok ban blocked by US court — for now: A US judge has blocked the Trump administration’s move to ban TikTok downloads from app stores, the Wall Street Journal reports. The ruling gives Chinese parent ByteDance a few more weeks to secure approval from US regulators for its agreement with Oracle and Walmart that would see the two US companies take shares in a separate US-based entity.

US ELECTION WATCH- The New York Times is out with a carefully-timed info dump on Trump’s secret tax affairs: Less than 48 hours before the first presidential debate, the New York Times has finally given the world a glimpse into what King Cheeto (Cheato?) has steadfastly refused to disclose: his tax affairs. Among the key takeaways: He paid zero taxes in 11 of 18 years examined; in 2016 and 2017 he paid only USD 750 (no, we’re not missing a few zeros there); large losses in some of his signature businesses, notably his golf courses, have helped him lower his taxes; he enjoys tax deductions on what most would consider personal expenses – including residences, aircraft and over USD 70k in TV hairstyling – while enjoying a lavish lifestyle.

True to character, Trump blasted the report as “totally fake news” during a presser, Bloomberg reports.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: As an increasing number of Egyptians look to foreign universities, can Egypt’s internationalization strategy persuade them to take another look at local institutions?

Enterprise+: Last Night’s Talk Shows

The grand opening of the Egyptian Refinery Company’s Mostorod petrochemical complex yesterday was the top story on the talk shows last night. Consumer protection, school fees and the auto market also got a look-in on a night that was otherwise dominated by the refinery.

Qalaa Holdings Chairman Ahmed Heikal took a victory lap last night as he celebrated keeping the USD 4.3 bn ERC on track through the global financial crisis, the 2011 revolution and the Morsi interregnum. Heikal spoke with Al Hayah Al Youm’s Lobna Assal (watch, runtime: 15:43), Masaa DMC’s Eman El Hosary (watch: runtime: 8:19), El Hekaya’s Amr Adib (watch, runtime: 3:20), and Salet Al-Tahrir’s Azza Moustafa (watch, runtime: 3:18) about the inauguration of the complex by President Abdel Fattah El Sisi. Among the takeaways:

- A fair price for gas: Heikal called for a reduction of gas prices to USD 3.8-4 mmBtu for industry and said the inauguration of the refinery makes it clear there is a place in the economy for the private sector.

- Heikal praised the Sisi administration’s response to covid 19, singling out programs to cushion the economic and human impact of the pandemic by cutting interest rates, allocating EGP 100 bn to support the economy, and disbursing emergency payments to day laborers.

- Qalaa scholarships: Heikal said that in addition to a large-scale program that sends students abroad for graduate degrees, Qalaa has 30 scholarships for outstanding high school students from Mostorod (the area in which ERC is based), sending them to universities such as the American University in Cairo, Nile University and Zewail City of Science and Technology.

A step toward energy independence: Assal also spoke with Medhat Youssef, the former deputy head of the state-run Egyptian General Petroleum Corporation, who noted that ERC will help Egypt sharply reduce its imports of refine petroleum products — and said there are plans to establish other refineries in areas similar Mostorod, which was home to an existing refinery that ships feedstock to ERC. He added that Egypt intends to reach self-sufficiency in diesel and be in a position to export gasoline and jet fuel by 2023 (watch, runtime: 9:31).

Demand slump continues in car industry: Adib phoned Khaled Saad, the secretary general of the Automobile Association, who said that the car prices this year would be “different” because of covid-19, without elaborating (watch, runtime: 2:34). Saad stressed that there is currently low demand for new vehicles — but a pickup in demand for used cars (watch, runtime: 1:16).

Another person who popped up in several places yesterday was Consumer Protection Agency head Ahmed Samir Farag, who appeared on Al Hayah Al Youm (watch, runtime: 21:11) and El Hekaya (watch, runtime: 3:03) to discuss the agency’s work (watch, runtime: 3:39) and the ongoing dispute over school fees. The agency will investigate parents’ complaints over school fees at international and private schools in light of covid-related closures and amendments to curriculums, Farag said, adding that 75% of schools have so far refunded bus fees.

COME BE OUR STYLE AND GRAMMAR NAZI- We’re looking for a full-time copy editor to enforce house style, police facts and generally make us sound smarter than we really are.

OR HELP US MAKE AWESOME GRAPHICS, bring our brand to life in all media (including new products and IRL) and develop our photo style as our first in-house photo and design editor. Solid chops with the usual apps (Adobe’s suite, Procreate, Pixelmator, etc) a requirement, as is a strong visual aesthetic. It would be awesome if you had strong opinions (loosely held) on FF vs APS-C vs. film, too.

Interested in applying? Send us your CV along with proof y’all can edit (if you are interested in the copy editor vacancy) or that you have visual taste (for the design gig) and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but the most important thing is a well-written cover letter. Please submit all applications to jobs@enterprisemea.com.

***

Speed Round

Egyptian Refinery Company’s Mostorod petrochem refinery is inaugurated: Qalaa Holdings subsidiary Egyptian Refining Company’s (ERC) USD 4.3 bn facility in Mostorod was inaugurated yesterday by President Abdel Fattah El Sisi. As the largest private sector project of its kind in Africa, the refinery will produce each year some 2.3 mn tonnes of diesel fuel and 860k tonnes of high octane fuel as well as jet fuel and butane, Qalaa Chairman Ahmed Heikal said at the inauguration (watch, runtime: 11:03). The facility is expected to result in a USD 600 mn-1 bn reduction to Egypt’s annual import bill that had previously been earmarked for petroleum products that ERC is now producing, Heikal said. ERC became fully operational in September 2019 and, by using modern technologies, will help substantially lower Egypt’s carbon and sulfur dioxide emissions.

You really should take a tour of ERC with Heikal — we had that pleasure just as the refinery was nearing completion, and the place is staggering. You can watch a video Heikal produced (runtime: 6:52) with great drone footage in which he explains that the idea is to take “low value products produced by the Cairo Oil Refining Company and turn them into high value distillates that the market currently needs.”

Speaking at the inauguration, El Sisi lauded Qalaa and ERC for the project’s contribution to the economy, stressing the importance of private sector involvement in large-scale projects that spur growth.

El Sisi used the occasion to promise he would extend an emergency stipend for day labourers. The EGP 500 monthly stipend will run through the end of the year, El Sisi said (watch, runtime: 2:46). The government had first said in March it would dish out a one-time EGP 500 payment to seasonal workers as compensation for lost income from the pandemic, before deciding in April to continue disbursing these payments for three months.

Also from the president’s speech yesterday:

- El Sisi warned of a potential covid-19 second wave, urging citizens to remain vigilant and avoid falling into a false sense of security.

- He briefly took note of limited demonstrations last week and reiterated his call to citizens not to heed “false claims” (watch, runtime 2:12)

- The president called on the government to resolve settlements of building code violations, end its six-month construction ban, and announce new building criteria as quickly as possible.

Egypt will soon go to market with its first maiden sovereign green bond, Finance Minister Mohamed Maait said yesterday, saying the ministry was “preparing to launch” the offering. Maait stopped short of offering guidance on timing, but had said in July that the USD 500 mn offering was in “advanced stages.” The Madbouly government has positioned the bond as the first sovereign green issuance in the region.

What’s a green bond? Funds raised from green bonds are typically used to finance green and environmentally friendly projects. Egypt currently has a portfolio of USD 1.9 bn-worth of green projects in the pipeline, including pollution reduction initiatives, renewable energy projects, low carbon transport, and sustainable water management systems. Bloomberg also had the story.

The planned issuance comes as part of the government’s broader debt diversification strategy that will see the government offer green bonds, sukuk, eurobonds, and potentially zero-coupon bonds to capture a wider investor base and shift the government’s budget financing towards longer-term borrowing. The strategy is meant to reduce our reliance on short-term debt instruments to plug fiscal deficits and help reduce the annual debt servicing bill to 20% of GDP and raise long-term debt to constitute some 52% of borrowing by June 2022.

And it’s not just sovereign green bonds that are in the making: CIB is expected to issue the country’s first corporate green bond issuance next month. The USD 65 mn offering will see the International Finance Corporation snap up the first tranche of the five-year bonds.

M&A WATCH- Is Orascom Financial eyeing the United Bank of Egypt? Orascom Financial Holding (OFH) could look at acquiring a controlling stake in the United Bank of Egypt in what could be the newly formed company’s first acquisition and foray into the country’s banking system, Orasom Investment Holding (OIH) Chairman Naguib Sawiris told Hapi Journal. Sawiris didn’t explicitly say he was going ahead with a bid, noting just that United Bank would within OFH’s price range more than the Lebanese banks currently up for sale — Blom Bank and Bank Audi — which will likely cost somewhere between USD 600-900 mn. Naguib’s son Onsi — who will play a leading role in OFH — had told Enterprise last week that the company has yet to make any decisions on its investment plans and is still working on a strategy that it will announce by the end of the year. OFH was created through a demerger earlier this month (OFH) to manage Orascom’s financial investments.

Naguib has for more been looking for a way into the nation’s banking industry, but has been rebuffed by successive central bank governors. Sawiris confirmed in 2017 that he had been rebuffed in his quest for a banking license, saying that “if the governor of the Central Bank of Egypt gives me a license for a bank, I’ll open it tomorrow.” Naguib has since said he would like a license to open an SME-focused lender and has pushed ahead since 2015 with a foray into non-bank financial services that has seen companies he controls acquire significant stakes in investment bank Beltone and consumer and structured finance player Sarwa.

Separately, OIH is looking at other new ventures in the transport and logistics industries, including multipurpose transport projects on offer from the Transport Ministry, Naguib told Hapi Journal. OIH is waiting on these projects to be opened up to the private sector, he said, without providing further details.

Background: The sale of United Bank — which is 99% owned by the Central Bank of Egypt (CBE) — was reportedly put on hold earlier this year as the pandemic delayed the completion of the due diligence. CBE Governor Tarek Amer had said last year that the sale was moving forward, after tapping EFG Hermes and New York-based Evercore to act as advisors. The CBE had first announced in 2017 its intention to sell the bank to a strategic investor.

M&A WATCH- Turki Al Shikh, state-owned Estadat and an unnamed Gulf buyer are competing for MCDR’s stake in Makkasa Sport: Saudi investor Turki Al Sheikh, Estadat Holding and an unnamed Gulf buyer are all in the running to acquire Misr for Central Clearing, Depository and Registry’s (MCDR) 71% stake in Misr Lel Makkasa SC owner Makkasa Sport, Al Mal reports, citing unnamed sources close to the matter. Al Shikh, the former owner of Pyramids FC, could make an offer in the coming days, according to the sources. State-owned Estadat — which was founded last December and owns a 51% stake in Presentation Sports — is also a contender in the acquisition as it looks to expand its portfolio with the purchase of a sporting club.

Background: MCDR has already rejected a USD 2 mn offer from a Gulf investor, valuing the company instead at more than USD 2.5 mn, the sources said. MCDR abandoned its plans to IPO Makkasa Sport earlier this year in a bid to focus its strategy.

The cement industry is calling for gov’t intervention to save crippled sector, saying it is time for the state to explore “radical” solutions, Al Shorouk reports. The call came during a meeting of the Cement Division of the Federation of Egyptian Industries, during which division head Medhat Stephanos claimed that the sector is facing a 40 mn-tonne shortfall in demand this year. Demand is likely to come in at around 43 mn tonnes this year, compared to 83 mn tonnes of supply, he said. This is only a slightly grimmer prospect than the one offered by Arabian Cement earlier this month, which forecast demand to fall to 45 mn tonnes this year from 49 mn tonnes in 2019.

Background: Things have gone from bad to worse for the cement industry since a supply glut began in 2016. The inauguration of a large state-owned cement factory in 2018 intensified preexisting supply issues, quickly leading to several companies suspending operations, some temporarily but others permanently. Now, with demand taking a further hit thanks to the covid-19 pandemic and the government’s six-month ban on construction permits, six more producers are apparently on the verge of collapse. You can read our deep dive into the cement industry from earlier this year, when prospects for the sector already looked bleak.

MOVES- Kamal Negm is staying on as the head of the Customs Authority until his legal retirement age or a suitable replacement is found, according to a decision from Finance Minister Mohamed Maait carried by Al Mal. Negm has been serving as head of the Customs Authority since 2018.

CORRECTION- We picked up a report from the local press yesterday that incorrectly claimed Arabian Cement is in the market for USD 280 mn in fresh loans from CIB and the European Bank for Reconstruction and Development. This amount is existing debt, which the company had restructured in 2018, according to a disclosure to the EGX yesterday (pdf). The story has since been removed from our website.

Image of the Day

Who knew solar parks could be so visually attractive? CNN is out with a photo gallery of the world’s biggest solar projects — including Egypt’s massive Benban park (pictured above).

Egypt in the News

There’s not much going on in the pages of the foreign press this morning: The Associated Press reports that Egyptians have been pushing ahead with their wedding plans despite the covid-19 ban.

Worth Watching

Gold’s relationship with the stock market is changing: Historically, gold prices and the performance of the US stock market have an inverse relationship — investors pile into the safe haven asset when markets decline, while a stock rally typically drives down the price of the metal. This traditional wisdom hasn’t quite held true over the past few months, which have seen the stock market jump and fall without resulting in significant price shifts in gold. According to Bloomberg’s QuickTake, gold needs more impetus to see its price rise, such as lasting inflation or a declining USD (watch, runtime: 01:03).

Diplomacy + Foreign Trade

Leading diplomatic coverage this morning: Egypt will host a Libyan peace conference in the first half of October that will bring together political figures and tribal representatives, El Mogaz reports, citing Hassan Mabrouk, a member of the conference’s organization committee. Mabrouk called for the release of detainees from the former government of Muammar Al Gaddafi, including his son Seif, so that they are able to participate in the inclusive discussions. The report did not specify whether representatives from the Tripoli-based Government of National Accord — which opposes the Egypt-backed eastern commander Khalifa Haftar — will attend the event. Egypt has been one of the countries leading efforts to end the conflict, launching a parallel initiative to the UN-backed talks in June dubbed the ‘Cairo Declaration’ that would see foreign mercenaries put down their weapons and leave the country.

Shoukry talks Libya, Palestine with Pompeo: Foreign Minister Sameh Shoukry discussed efforts to end the conflict in Libya and developments in Palestine with US Secretary of State Mike Pompeo during a phone call yesterday, the ministry said in a statement, without giving much away.

There’s export news aplenty: The General Organization for Import and Export Control is considering reducing fees for customs certificates, as well as easing the procedures to obtain permits, following a call by a group of exporters last week, the local press reports. The agency is planning to meet again in a week’s time to discuss the proposals, the report adds.

The government will pay out before the end of the year overdue subsidies owed until the end of September in a single lump sum, rather than spacing out the payments over four to five years, a Finance Ministry statement said on Sunday. Exporters last week agreed to take a 15% haircut on their arrears as a condition of receiving the payouts this year. Exporters who choose to receive the full amount will be paid out under the original timeline.

Also worth noting this morning:

- The World Bank is out with an update on its USD 500 mn Sustainable Rural Sanitation Services project in the Nile Delta launched in 2015, which has helped one of the six local companies implementing the project increase its share of wastewater plants to 55% from 9% by improving maintenance management, according to a press release. In the coming period, the program will focus on implementing contracts to build household sanitation connections.

- The US Department of Energy is allocating USD 1 mn to the International Atomic Energy Agency to improve radiation therapy used to treat Egyptian cancer patients, the State Department said (pdf) said on Wednesday.

As an increasing number of Egyptians study abroad, reform is underway to keep them here: Egypt’s students are looking to study in foreign universities at ever-increasing rates, taking much-needed FX out of the country and likely contributing to a brain drain. To reduce the depletion of FX and loss of human capital, the Higher Education Ministry is now working to provide quality in-country alternatives designed to retain more domestic students and attract more international students, says ministry spokesman Hossam Abdel Ghaffar. The approach has worked in countries not traditionally renowned for higher education, including Qatar and the UAE. Will it work for Egypt too?

The c.20k Egyptians currently studying abroad are spending the equivalent of EGP 20 bn attending university overseas, Higher Education Minister Khaled Abdel Ghaffar said in a recent statement. The total number of Egyptians who study overseas has almost quadrupled in the past two decades, growing from 8,802 in 2000 to 34,922 in 2017-2018, according to UNESCO data (pdf).

Many students at Egypt’s top international schools aspire to an overseas university education in OECD countries from a young age: Almost 100% of the Cairo American College’s graduates attend university overseas, with over 50% studying in the US, many in Canada, the United Kingdom, and Europe, and a few in Australia and Asia, says school head Jared Harris. Some 70% of American International School students go overseas for university every year, with most attending universities in Europe, says Director Kapono Ciotti. And anything from a third to two-thirds of Schutz American School’s students attend university overseas every year, says Assistant Head of School Massimo Laterza. Ambitious, academically-inclined families will start conversations about which universities to apply to as early as the ninth or tenth grades, with parents deeply involved in the decision, say Ciotti and Laterza.

Among universities in Egypt, only AUC and GUC are prestigious for these students, says Ciotti. Some 25% of the Schutz students who attend university in Egypt go to AUC, with the Arab Academy for Science Technology & Maritime Transport also having relatively high attendance rate, usually for parents who either prefer their children don’t travel far or who face financial constraints, says Laterza.

Some top overseas destinations like the GCC aren’t traditionally renowned for higher education: Roughly one-third of Egyptian students who study overseas go to the UAE and Saudi Arabia, with Qatar and Malaysia also having high representation among non-OECD countries, according to a 2019 World Education Services report.

But the UAE, Saudi Arabia, Qatar and Malaysia have become top global destinations for overseas students because of internationalization strategies: These include improving university rankings, a focus on international partnerships and scholarships, increasing public and private universities, and policies to establish international branch campuses. Saudi Arabia had over 73k international students as of 2017, up from 18.7k in 2008. Malaysia is one of the biggest global markets for transnational education, with 100k international students in 2014 — more than double the 2007 number — and the highest number of UK transnational students in Asia (pdf) in 2018.

The growth of countries like Malaysia as educational hubs shows that in-country internationalization both attracts overseas learners and retains domestic students: Internationalization offers more domestic educational options for citizens through transnational education programs, while attracting international students. The country had a total of 563 accredited foreign programs in 2012, with the top three providers being the UK, Australia and the United States. In Malaysia’s case, this was part of a plan to transform the country into a developed knowledge-based economy, in response to the 2008 financial crisis.

For Egypt, government policy has also been a driver in students looking abroad: The Egyptian government has a long history (pdf) of providing scholarships for students to attend universities overseas as part of importing knowledge and skills — particularly focused on scientific advancement. From 2007–2012, the yearly budget for state-financed scholarships for doctoral study was approximately USD 80 mn.

But encouraging more students to study abroad appears to be contributing to the brain drain. Gallup research found that some 77% of 5k Egyptian diaspora members surveyed want to continue living in their current residential location, with only 9% wanting to return to Egypt.

Now Egypt is adopting a similar strategy to retain students: This includes building new public and private universities, working to boost the rankings of existing universities, and policy reform to attract international institutions to set up branches in Egypt, says Mohamed El Shinnawi, advisor to Egypt’s Higher Education Minister. Since Egypt’s international branch campus law (pdf) was ratified in July 2018, at least three universities have established branches in the new administrative capital. And regulations obliging universities wanting to launch new faculties to form academic partnerships with foreign universities will now be enforced.

Does Egypt have the funding and resources to deliver? It’s upping its spending on higher education: GCC countries that have become educational hubs have done so through significant investments in education. In its 2019 budget, the Saudi government allocated USD 51 bn for education, up from USD 35 bn in 2011, representing 7% percent of total GDP. The government will invest EGP 424 bn (c.USD 26 bn) in education and scientific research in the current fiscal year, and according to Abdel Ghaffar is currently spending EGP 90 bn on higher education alone.

But private investment is still key to building capacity: Naturally, this spending will need to be augmented with private sector investment in quality and new facilities for the plan to properly take root. We’re seeing some progress on that front, with investments in three recently-established international branch campuses exceeding EGP 2 bn. Private sector players appear to have maintained capex spending on university projects during covid-19. It has yet to be seen if these policies will encourage them to get on the same page as far as internationalizing education is concerned.

Your top education stories of the week:

- Public school students will be headed back to their physical classrooms twice a week starting 17 October.

- The Health Ministry has published the procedures schools should follow in case of a second covid-19 outbreak, which could include shutting down the school for up to 28 days, Youm7 reports.

- New distance-learning platform for universities: The Higher Education Ministry launched a new distance learning platform for universities built by Microsoft and BlueCloud Technology.

- The vocational schools accreditation body received cabinet approvals last week. Government schools and private institutions have no more than five years to meet the authority’s quality standards and obtain accreditation.

- School transfer deadline extended: The deadline for students to transfer between schools has been extended until this Thursday, 1 October.

- Parents might be waiting a while for a resolution to private school fees: The dispute with private sector schools over tuition fees might take three months to be resolved. Parents have been lobbying to defer installments on the coming year’s fees after private schools demanded that they begin paying early.

- The Education Minister has outlined a breakdown of the EST test which American diploma students will sit for on Monday and Tuesday, including the time allocated for each section, Youm 7 reports.

The Market Yesterday

EGP / USD CBE market average: Buy 15.70 | Sell 15.80

EGP / USD at CIB: Buy 15.71 | Sell 15.81

EGP / USD at NBE: Buy 15.70 | Sell 15.80

EGX30 (Sunday): 10,902 (-0.1%)

Turnover: EGP 1 bn (11% below the 90-day average)

EGX 30 year-to-date: -21.9%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.1%. CIB, the index’s heaviest constituent, ended down 0.1%. EGX30’s top performing constituents were Qalaa Holdings up 5.2%, Dice up 3.9%, and Orascom Investment Holding up 3.8%. Yesterday’s worst performing stocks were Eastern Company down 2.2%, CIRA down 2.2% and Cleopatra Hospitals down 1.6%. The market turnover was EGP 1 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -24.0 mn

Regional: Net short | EGP -2.5 mn

Domestic: Net long | EGP +26.5 mn

Retail: 82.7% of total trades | 85.0% of buyers | 80.4% of sellers

Institutions: 17.3% of total trades | 15.0% of buyers | 19.6% of sellers

WTI: USD 40.25 (-0.15%)

Brent: USD 41.92 (-0.05%)

Natural Gas: (Nymex, futures prices) USD 2.14 MMBtu, (-4.85%, October 2020 contract)

Gold: USD 1,866.30 / troy ounce (-0.56%)

TASI: 8,293 (+0.70%) (YTD: -1.14%)

ADX: 4,485 (+0.43%) (YTD: -11.62%)

DFM: 2,244 (-0.32%) (YTD: -18.80%)

KSE Premier Market: 6,183 (-0.61%)

QE: 9,815 (+0.28%) (YTD: -5.85%)

MSM: 3,621 (-0.17%) (YTD: -9.05%)

BB: 1,451 (+0.05%) (YTD: -9.88%)

Calendar

September: The Egyptian Federation for Securities will hold elections for its board of directors after they were postponed in March due to the lockdown.

September: The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

21 September-1 October (Monday-Thursday): EFG Hermes’ second Virtual Investors Conference.

27 September (Sunday): Former Finance Minister Youssef Boutros Ghali to be retried on charges he squandered public funds in a case related to the printing of coupons for butane canisters.

28 September-3 October (Monday-Saturday): CIB PSA World Tour Finals, The Park, Mall of Arabia, Egypt.

End of September: Last chance to settle building code violations for illegal buildings.

October: Trade and Industry Ministry allocates SMEs seven industrial complexes.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

1 October (Thursday): Deadline for students to transfer between schools.

1-10 October (Thursday-Saturday): Alexandria Book Fair, Kouta, Alexandria.

4 October (Sunday): Senate convenes for its first session.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

12 October (Monday): The Egyptian Iron and Steel company general assembly would discuss demerging its mining and quarrying unit and restructure the company’s board of directors

10-17 October (Saturday-Saturday): CIB Egyptian Squash Open, New Giza Sporting Club / Pyramids of Giza.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities.

18-22 October (Sunday-Thursday): The annual Cairo Water Week event — which will be semi- virtual this year — will be held under the slogan “Water Security for Peace and Development in Arid Regions”

21-23 October (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

24-25 October (Saturday – Sunday) Polls open for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

19-28 November (Thursday-Sunday): Cairo International Film Festival, Cairo Opera House, Egypt.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries.

December: IMF delegation visits Egypt to in first of two reviews ahead of disbursement of second tranche of USD 5.2 bn SBA.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, venue TBD.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.