- EFG Hermes, Egypt’s sovereign fund to finalize AIB takeover this year. (Speed Round)

- RenCap sees muted consumer demand keeping inflation below CBE target this year. (Speed Round)

- Bahrain’s Ahli United Bank submits offer to buyout Egypt unit. (Speed Round)

- CBE extends fee waiver on EGP transfers, ATM withdrawals until year-end. (What We’re Tracking Today)

- German solar firm Ib Vogt sells Benban solar plant. (Speed Round)

- Cement oversupply crisis could force six producers out of Egypt by 2021. (Speed Round)

- Is the tech-driven EM rally running out of steam? (The Macro Picture)

- How the pandemic has (temporarily) cooled growth forecasts for Egypt’s construction industry. (Hardhat)

- The Market Yesterday

Wednesday, 16 September 2020

EFG Hermes, SFE look to close acquisition of AIB by end of 2020

TL;DR

What We’re Tracking Today

It’s another busy news day as we hurtle toward the end of the week, so let’s get this show started.

The Central Bank of Egypt has extended until the end of the year the decision to waive fees associated with EGP transfers and ATM withdrawals put in place on 15 March as part of its measures to drive transactions to online channels and cushion the economic impact of the covid-19 pandemic, a bank statement (pdf) said. The bank will also defray itself the c. EGP 50 mn total cost of fees associated with withdrawals of pensions to alleviate the financial burden on the elderly, it said.

And that’s not all: There will be no fees for the opening of e-wallets, the issuance of prepaid cards, and balance transfers between mobile phone users. The CBE also instructed banks to waive fees for merchants on contactless “tap & go” transactions worth less than under EGP 600. The measures were designed to cut footfall at banks and financial institutions, promote social distancing, and gradually move Egypt toward becoming a cashless society, the statement added. The bank decided earlier this week not to extend payment holidays on bank facilities.

We’ll know today the results of last week’s run-off elections for the Senate. The first round of voting last month saw 174 members elected to the newly-constituted upper chamber, and the run-off will determine the outcome in another 26. President Abdel Fattah El Sisi will appoint the remaining 100 members of the 300-seat Senate after the final results of the votes are announced.

The Food Export Council will hold a meeting tomorrow with Brazil’s ambassador to discuss increasing exports under the 2017 Mercosur Agreement, Youm7 reports. Egyptian exports to Brazil have surged 74% in the three years since the trade agreement was signed.

Today is the second day of the US Federal Reserve’s meeting to review interest rates. The bank may announce new three-year interest rate projections and elaborate on its recent break with tradition to allow inflation to shoot past 2% and unemployment to fall further than previously allowed, per CNN.

The Health Ministry reported 163 new covid-19 infections yesterday, down from 168 the day before. Egypt has now disclosed a total of 101,340 confirmed cases of covid-19. The ministry also reported 18 new deaths, bringing the country’s total death toll to 5,679. We now have a total of 85,745 confirmed cases that have fully recovered.

Egypt is strategically placed to serve as a distributor of Russia’s Sputnik V covid-19 vaccine to Africa, Kirill Dmitriev, head of the Russian Direct Investment Fund, told MENA news agency, Al Mal reports.

The Emirati government has approved an emergency use of a vaccine candidate by China’s Sinopharm and will give first access to “frontline workers,” Foreign Ministry spokesperson Hend Al Otaiba said on Twitter. Phase three trials conducted in the UAE involving 31k participants were successful, she said, paving the way for the government to begin rolling out the vaccine.

Saudi Arabia is easing entry restrictions for some categories of visitors, according to a statement from EgyptAir yesterday. As of today, EgyptAir will board Saudi nationals returning home; non-Saudis (including spouses and children) accompanying a Saudi citizen; and male travelers who already have a valid visa or work permit. Hit the link to see if your circumstances are covered and remember — you’ll need to cough up the results of a PCR test completed no more than 48 hours before you board.

STC mulls IPO for internet services arm as Vodafone Egypt acquisition talks continue: Saudi Telecom Company (STC) is considering the sale of as much as 30% of its internet services subsidiary Solutions by STC in an IPO on the Saudi exchange next year that could value the company at c.USD 2.7 bn, Bloomberg reports, citing sources familiar with the matter. STC has invited banks to pitch for the financial advisor role on the transaction, Reuters said. The move comes as STC remains in talks with Vodafone Group to purchase its 55% stake in Vodafone Egypt in a transaction that, if executed, could be the biggest-ever M&A in Egypt.

Global demand for oil is likely to be even lower than previously feared as a resurgence in covid-19 cases around the world hits consumption, according to OPEC and International Energy Agency (IEA) forecasts published this week. The IEA now sees demand falling by 8.4 mn bbl/day to 91.7 mn bbl/day in 2020 (down from 8.1 mn bbl/d forecast in August), while OPEC expects an even more dramatic fall of 9.5 mn bbl/d, down 9.5% from last year. The gloomy outlook comes after BP suggested this week that demand may have already started a terminal decline as the pandemic delivers a knockout blow to the fossil fuel.

Also worth knowing this morning:

- Has ByteDance found a way to calm US natsec fears? ByteDance will place TikTok’s global business in a new US-based company of which it will be majority shareholder, and Oracle (and perhaps Walmart) investing as a minority shareholder, the Financial Times reports, citing unnamed sources familiar with the matter. Secret Agent Orange is expected to sign off on the transaction today.

- The US-China trade war is making US-based passive funds think twice about buying into Chinese equities, as an increasingly hostile political climate towards Beijing heightens risk, suggests this piece by the Financial Times.

- Daimler will pay out USD 2.2 bn in penalties and settlements over allegations it rigged vehicles to cheat on diesel emissions tests, CNN reports.

The UAE and Bahrain formalized their normalization treaties with Israel at a signing ceremony at the White House south lawn yesterday. Presided over by US President Donald Trump, the accords were sealed by Israeli Prime Minister Benjamin Netanyahu and the Gulf states’ foreign ministers. “We mark the dawn of a new Middle East,” Trump said, thanking the leaders for taking steps “toward a future in which people of all faiths and backgrounds live together in peace and prosperity.” The three countries will soon exchange embassies and collaborate across sectors including tourism, trade, health care and security, he added.

The story is getting top billing in the global press: AP | Reuters | NYT | Washington Post | Bloomberg | WSJ | BBC.

Libya’s UN-recognized Prime Minister Fayez Al Serraj could announce his resignation by the end of the week ahead of talks to end the country’s civil war in Geneva next month, Bloomberg reports, citing unnamed officials. The leader of the Tripoli-based government would likely stay on in a caretaker capacity through the negotiations with eastern military commander Khalifa Haftar’s Libyan National Army, which aim to agree a new presidential council to unify the fractured country.

US ELECTION WATCH- Presidential cagefight? While observers have mused about the idea of podcast host and MMA commentator Joe Rogan moderating a presidential debate, President Donald Trump tweeted on Monday that he would actually do it. The Joe Rogan Experience is one of the country’s most popular podcasts and hosts guests from both sides of the political aisle, even if considered fringe, giving Rogan’s show a reputation for impartiality. Rogan’s guest, retired MMA fighter Tim Kennedy, proposed an improbable, uncut, 4-hour one-on-one debate, which The Donald said he would accept, the New York Post reports. The first of the three actual US presidential debates will be held on 29 September in Cleveland, the second on 15 October in Miami and the third on 22 October in Nashville.

Apple announces revamped iPad, Apple Watch 6, Apple One subscription plan: Apple yesterday unveiled a raft of new and revamped products, including a redesigned iPad Air (if you can make do with the smaller of the two iPad Pros and you’re the market today, but the new iPad Air and not the smaller Pro, tbh) and the sixth generation of the Apple Watch with a blood oxygen sensor. The company also announced its new Apple One subscription plan, giving users access to all of the company’s subscription services through a single plan. The plan will also include its soon-to-launch Fitness+ package, which features online fitness classes integrated with Apple Watch plus your iPhone, iPad or Apple TV. Want to dive deeper? 9to5Mac, the Verge and Business Insider have wall-to-wall coverage.

But wait, where’s the new iPhone? There was no “one more thing” last night — thanks to covid-19, it seems we won’t be getting a peak at the next iPhone (or Arm-based Macs or the Apple tiles) until sometime next month at the earliest.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: We look at how the covid-19 pandemic has affected the outlook for Egypt’s construction industry, particularly after construction sites across the country were shut down at the outset of the crisis.

Enterprise+: Last Night’s Talk Shows

The nation’s talking heads continued to pore over the government’s efforts to crack down on building violations last night, while government plans to address anticipated Nile flooding and the covid-19 vaccine trials also received air time.

Phase three clinical trials of a Chinese covid-19 vaccine to last two months: Yahduth Fi Misr’s Sherif Amer phoned Hossam Hosni, the head of the Scientific Committee to Combat Coronavirus, who said that phase three clinical trials in Egypt of a Chinese covid-19 vaccine will last for two months. The ministry is currently gathering 6k volunteers to participate in the tests, which are being run by the Chinese government and Emirati health firm G42 Healthcare. Hosni said that production will begin after the trials have ended and analyses have been completed, while a year-long follow-up period continues after the trials, (watch, runtime: 3:02).

All the latest on informal housing and the construction code: Amer phoned Local Development Ministry spokesperson Khaled Kasem, who said that EGP 6.9 bn in settlement fees have now been taken by the government, with Alexandria Governorate taking the most, followed by Cairo, Menoufia (which saw the largest number of requests submitted), Beheira and Qalyubia. The ministry is working overtime to accept as many reconciliation requests as possible ahead of the end-of-month deadline, he added. (watch, runtime: 5:32). Local Development Minister Mahmoud Sharawy yesterday announced the new figure, adding that the government has received 1.1 mn settlement requests. Masaa DMC's Ramy Radwan (watch, runtime: 9:12) and Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 24:56) also covered the topic.

Emergency flooding plans: Masaa DMC’s Ramy Radwan covered the emergency plans to prevent Nile flooding reviewed by Prime Minister Moustafa Madbouly yesterday. The plan includes securing vital facilities, preparing evacuation procedures for land and homes along the river’s banks, mapping out areas that will likely require drainage, and the safe disposal of pollutants in the Rashid and Damietta branches of the river. Madbouly assigned the irrigation minister to prepare maps of the most vulnerable areas, and directed local governors to take all the required measures. Madbouly said that most of the buildings adjacent to rivers are illegal constructions, and that every governor should warn citizens about the dangers of flooding while they implement their emergency plans (watch, runtime: 4:09).

Egypt UN rep wins reelection: Al Hayah Al Youm’s Mostafa Sherdy, highlighted the reelection of Egyptian candidate Mohamed Ezz El Din to the UN Committee on Economic, Social and Cultural Rights. Ezz El Din won with a majority, securing 49 out of a total 54 votes cast by committee members (watch, runtime: 3:53).

Speed Round

M&A WATCH- EFG Hermes, SFE to finalize AIB acquisition this year: EFG Hermes and the Sovereign Fund of Egypt (SFE) expect to close their acquisition of a 76% stake in state-affiliated Arab Investment Bank (AIB) before the end of 2020 through a capital increase to EGP 5 bn, SFE CEO Ayman Soliman told Al Mal. The SFE will acquire its stake through its newly-established, EGP 30 bn financial services sub-fund, Soliman said. AIB’s paid-in capital last stood at EGP 1.84 bn in May. Issuing new shares would help the bank meet the new capital requirements mandated by the newly-passed Banking and Central Bank Act, Soliman said. AIB is both a commercial and investment bank and offers traditional and sharia-compliant services.

Background: The acquisition will see EFG take a 51% stake and the SFE up to 25%, the two investors said in June. EFG and the SFE could also acquire shares from state-owned National Investment Bank (NIB), which presently holds 91.4% of AIB, with the remaining 8.6% held directly by the Federation of Arab Republics. NIB had announced a plan earlier this year to take several other of its portfolio companies to market with the help of the SFE.

SFE wants healthcare providers to start looking beyond Cairo: The SFE is involved in separate talks with leading healthcare players to partner on adding hospital beds outside Cairo, Soliman said. This would improve access to surgery for residents of other cities and promote competition on pricing, he said. The SFE will nudge things in that direction by offering land to some projects through its healthcare sub-fund. The fund recently set up a JV in partnership Concord International Investments, the SEC-regulated firm set up by Mohamed Younes and Prince Abbas Hilmi.

Plenty of room for private sector in the SFE’s health fund: The SFE will soon be on the lookout for more limited partners to sign up as financial or strategic investors in the healthcare sub-fund, Soliman said yesterday, adding that the sovereign fund will only contribute a small part of the capital. This gives the private sector plenty of room to participate, and is in line with the SFE’s mandate to encourage private participation in development projects. Once it formally launches, the sub-fund will primarily target supporting and expanding both public and private healthcare infrastructure projects. The SFE announced earlier this month that it plans to formally launch two more sub-funds besides the healthcare and fintech vehicles: one covering tourism and real estate and another infrastructure.

Plan to increase agricultural efficiency: The SFE’s financial services sub-fund is also currently studying another plan that will see it partner with the Agricultural Bank of Egypt (ABE) to offer fintech solutions to farmers. The sub-fund will be working with the ABE to encourage unbanked farmers to use a fintech platform that will most likely be built through mobile apps, Soliman said. The aim is to give the farmers access to financial services, and encourage them to purchase modern irrigation equipment, he said without giving further details.

RenCap sees muted consumer demand keeping inflation below CBE target this year: Inflation in Egypt should close out 2020 just below the Central Bank of Egypt’s (CBE) inner band target of 6-12% as consumption — particularly of food and beverages, which typically drive up inflation — is still “depressed,” Renaissance Capital said in a research note yesterday. The only scenario in which inflation figures would come within the CBE’s inner band target is if food prices rise 0.75% per month, which the firm says is not a probable scenario. “On our calculations, non-food monthly inflation has averaged 0.3% YtD and is expected to remain at these levels on the back of depressed consumer demand (except in October to reflect the annual increase in school tuition fees).” The firm sees inflation coming in at 5.1% in December and averaging at 4.5% in 4Q2020, as long as food prices don’t sustain any shock effects.

If inflation does fall outside targets, the CBE will be expected to take measures to restore inflation to be within its targeted range, as per Egypt’s 12-month stand-by arrangement with the IMF. RenCap says that the CBE will not necessarily cut rates to nudge inflation back up, but could instead take other monetary policy routes. One possible scenario is “canceling the 12-month 15% high-yielding certificates of deposits (CDs), which have attracted EGP 380 bn since issuance. This should be supportive of growth, equities and banks net interest margins.”

WATCH THIS SPACE- Bahrain’s Ahli United Bank is seeking 100% ownership of its Egypt unit, with the Financial Regulatory Authority (FRA) saying (pdf) yesterday that AUB and “Misr Strategia” (which reads to us like a special purpose vehicle or “SPV” set up for the transaction) have submitted an offer to buy 14.52% of the Egyptian entity from undisclosed parties. AUB’s 2018 annual report suggests that the bank already owns 85.5% of its Egyptian subsidiary; AUB entered the market in 2006 with its acquisition of Delta International Bank. The bank’s website says AUB has 42 branches in Egypt. The transaction, which the FRA is still reviewing, would be worth about EGP 1.29 bn, according to the statement.

Background: The news could signal an about-turn by the parent bank after local press reports earlier this year suggested that it was looking to sell its Egypt unit — or it could just be AUB clearing out minority shareholders to streamline things ahead of a divestment. Kuwait Finance House has been in the process of acquiring AUB since 2019 but the potential USD 8.8 bn transaction was postponed until December earlier this year due to the coronavirus pandemic. Though Egypt’s banks are considered desirable M&A targets, it’s rare that they are up for sale. Acquisitions are currently the only way into Egypt’s banking sector, as the CBE has for years denied new banking licenses and has told new entrants to see whether any of the country’s 38 licensed banks might be for sale.

M&A WATCH- Ib Vogt sells one of its Benban plants to Masdar, looks to offload three more: Germany solar company Ib Vogt has sold its entire share in its 64.1 MWp PV plant in the Benban solar park to Abu Dhabi-based renewable energy company Masdar, it said in a statement. The company did not disclose the value of the transaction or the reason for the sale. The two companies also signed letters of intent for Masdar to buy Ib Vogt’s shareholdings in three more Benban plants with a combined capacity of 166.5 MWp. In the meantime, Ib vogt will continue to provide operation and maintenance services for its 230 MWp portfolio in Benban. The German company had jointly developed, built, and operated the plant together with its partner Infinity Energy, which was one of only two projects that qualified for the first phase of the Feed-in Tariff program back in 2018.

Supply glut could push six cement producers out of Egypt by next year, Lafarge boss says: As many as six cement producers could be forced to exit the Egyptian market by 2021 if the ongoing oversupply crisis doesn’t abate, Lafarge Egypt's CEO Solomon Baumgartner Aviles said during a webinar, Hapi Journal reports. Companies across the sector have been mired in crisis over the past several years amid increasing production costs and a prolonged oversupply crisis that has forced them to slash prices in a bid to stay afloat. With little being done to alleviate the situation, firms are now “on the edge of a precipice” and face collapse, Aviles said yesterday. The covid-19 pandemic and the government’s six-month ban construction permits has only intensified the downward pressure on demand, causing production to fall to record lows in May, he said, adding that demand is expected to fall 15% to 42 mn tonnes in 2020.

Calls for gov’t intervention: "Urgent decisions are required from the government, because unfortunately, if action is not done quickly, a number of companies may not be able to continue and bear more losses and are forced to close," Aviles said. He also suggested a proposal to set production quotas for companies linked to carbon emissions, to achieve the joint goals of reducing production and preserving the environment.

The glut has already hit several companies: National Cement, Tourah Cement, and El Nahda Cement have all either permanently or temporarily suspended production over the past two years, as new government-owned factories exacerbated the already serious supply crisis.

We took an in-depth look into the challenges facing the sector earlier this year.

PRIVATIZATION WATCH- State-owned Heliopolis for Housing and Development (HHD) submitted a request to the EGX to amend its mission statement to enable it to carry out its new development plan, according to an EGX disclosure on Tuesday. The company’s general assembly agreed in an extraordinary meeting to amend HHD’s articles of association to enable it to undertake real estate development autonomously, for itself or other companies, and to establish new cities and tourism destinations. It also amended another article to enable it to distribute and sell electricity, Masrawy reports. The disclosure is currently being reviewed by the EGX’s registration committee.

Background: HHD said in July that it was scrapping plans to offer a stake of up to 25% with management rights as part of the state’s privatization program, and would work instead on a new development plan. Hesham Aboul Atta, the chairman of HHD’s parent company, the Holding Company for Construction and Development,said the plan will see the company partnering with other developers (presumably private sector players) for joint projects, without providing further details.

LEGISLATION WATCH- Gov’t drafts law to set up vocational schools accreditation authority: The education, manpower, and planning ministries have finished drawing up a draft law that would establish a government body to accredit institutions offering technical learning and training programs, and ensure they meet educational standards, cabinet said in a statement. The new authority would formulate a plan to improve schools and academies, applying German standards, Education Minister Tarek Shawki said. The authority would also develop accreditation policies for both government schools and private institutions, and focus on setting up new schools in collaboration with the private sector as part of a larger strategy to develop the vocational training sector in Egypt, spanning through 2030, Deputy Education Minister Mohamed Megahed told us earlier this month.

Currently, the ministry is responsible for accreditation in both technical and traditional schools through the National Authority for Quality Assurance and Accreditation of Education (Naqaae). The proposed authority would fulfil Naqaae’s role for vocational education, according to Megahed. It would be set up as a body independent of the ministry, with a separate budget and reporting directly to the cabinet, he said. The authority is targeting handing out accreditation to 2.5k schools after it’s up and running, significantly increasing the number of schools with accreditation certificates from 35 currently, Megahed told us yesterday.

Where things stand on the law: The bill should be reviewed and approved in an upcoming cabinet meeting, but had already received an early nod from ministers, Megahed previously told us. It would then be expected to be on the House’s agenda when MPs reconvene in October and should be voted into law by January 2021, he said.

BRIEFLY NOTED- The Court of Cassation upheld a three-year prison sentence and EGP 99 mn in fines imposed on Mubarak-era Information Minister Safwat El-Sherif on charges of illicit gains, Al Shorouk reports. The ruling from the nation’s highest appeals court cannot be appealed. The former minister also served as head of Egypt's Radio and Television Union, as well as the speaker for Egypt's upper house of parliament.

EARNINGS WATCH- Maridive Oil Services’ net loss widened to USD 18 mn in 1H2020 from USD 3.6 mn in 1H2019, according to a company earnings statement (pdf). Maridive’s revenues also fell to USD 24 mn during the first six months of the year, from USD 35.9 mn in 1H2019. The company, which is looking to divest a key subsidiary to Jeddah-based Khaled Abdullah Al Subaie Holding Company, opened talks with creditors in March as it grappled with the twin threats of covid-19 and the collapse in oil prices.

MOVES- Mohamed El Gamal has been selected to become managing director at Maridive Oil Services, replacing former director Emad Fawzi, according to an EGX disclosure (pdf).

Finance Minister Mohamed Maait has renewed Reda Abdel Kader’s appointment as head of the Tax Authority for one more year, according to a Finance Ministry statement (pdf). Abdel Kader assumed the role of acting head earlier this year after the authority’s former boss, Abdelazim Hussein, was arrested on graft charges. He previously served as the authority’s co-head.

The Egyptian Countryside Development Company, which is responsible for the 1.5 mn feddans project, has tapped Major Gen. Amr Abdel Wahab as chairman and managing director, according to a statement (pdf). Abdel Wahab succeeds Ater Hanoura, who will retain his spot on the company’s board as the Finance Ministry’s representative.

CORRECTION- We picked up a report from the local press yesterday that incorrectly claimed e-commerce giant Amazon is looking to buy 100 feddans in New Sohag to set up a fulfilment center. The story has been removed from our web edition. We have reached out to Amazon, who have confirmed that they have no current plans for a fulfillment center in the city. The company also declined to comment on speculation regarding their future plans. Amazon currently has one fulfilment center in Tenth of Ramadan City, which accommodates its subsidiary Souq’s growth and customer demand. Amazon also has delivery stations in Cairo, Alexandria, Tanta, Ismailia, and Assiut.

The Macro Picture

Has the EM rally peaked? In recent months a handful of largely China-based tech stocks have gone on a tear to put a floor underneath emerging-market stocks, bringing emerging markets on par with equities in developed countries. Outside of China, though, the outlook is a little more precarious. WIth the global tech boom seemingly running out of steam and a host of problems plaguing the emerging world, investor enthusiasm is dwindling, despite the cheap valuations, Barron’s says, citing industry analysts.

Too good to be true? An array of bargains appears to be on offer in Brazil, India and other markets beyond China, where currencies are around 20-30% below historic averages. “Whether it’s the [South African] rand, the [Indian] rupee, the [Mexican] peso, or the Brazilian real, currencies are incredibly undervalued,” says Ricardo Adrogue, head of global sovereign debt at Barings. Equities, too, look undervalued: companies trade at less than half the average price-to-book ratio than those in the US, with blue chip firms offering 5-6% yields. EM central banks have also slashed interest rates, causing domestic savers to pile into equities.

Investors are holding back for now: Despite the generous returns on offer, the continuation of the pandemic and the rapid accumulation of debt is giving investors pause for thought. India and Brazil are both struggling to get a handle on the outbreak, while countries across the world have taken on worrying levels of debt to prevent their economies from spiralling. “During the next quarter or the beginning of next year, markets are going to ask, ‘What are you doing to offset this debt?'” notes Eric Baurmeister, senior portfolio manager for emerging markets debt at Morgan Stanley Investment Management.

Egypt in the News

The foreign press doesn’t have a lot to say about Egypt this morning: Reuters reports that conservationists and Egytologists are less than happy about the government’s plans to build two new highways close to the pyramids. The newswire also picks up the news that Egypt’s media watchdog is investigating TV presenter Radwa El Sherbiny for commenting that women who wear the hijab are “100,000-times better” than women who do not, triggering a heated debate.

Diplomacy + Foreign Trade

Topping coverage on the diplomatic front this morning: Egypt and Greece will hold further talks to finalize the joint economic zone in the Mediterranean agreed in August, Greek Foreign Minister Nikos Dendias said yesterday following talks in Athens with FM Sameh Shoukry. The two ministers condemned Turkey’s “provocations” in the region and called for a deescalation of tensions. Shoukry also met with Greek President Katerina Sakellaropoulou at the presidential palace yesterday, a Foreign Ministry statement said.

Meanwhile, the government has disbursed EGP 1.4 bn in overdue export subsidies in 1Q2020-2021 so far, Prime Minister Moustafa Madbouly said during a meeting with the heads of export councils yesterday. Payments made over the past 10 weeks brings the total amount of subsidies disbursed since the beginning of FY2019-2020 to more than EGP 7 bn, he said, adding that continuing at this rate will see the government finish paying its arrears within three years. The Export Subsidy Fund is paying out EGP 600 mn each month over four EGP 150 mn weekly payments, advisor to the Vice Minister of Finance Nevine Mansour said. The government allocated EGP 7 bn towards subsidy payments in its FY2020-2021 budget, up from EGP 6 bn the year prior.

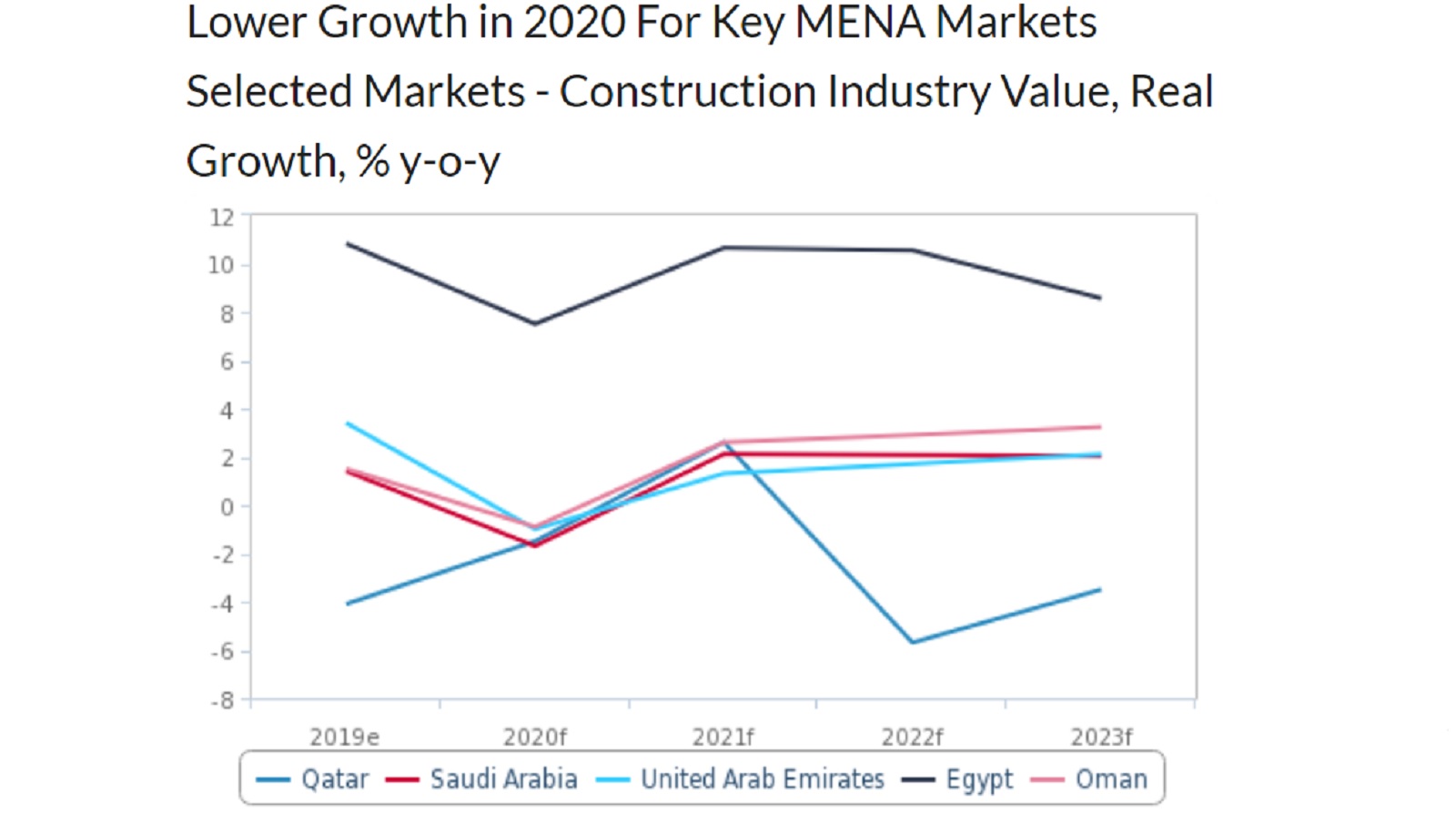

How the pandemic has (temporarily) cooled off growth forecasts for Egypt’s construction industry: While the covid-19 pandemic has had minimal impact on some industries in Egypt — such as education, whose defensive mettle was proven both in equity markets and on the capex side — other industries have not fared as well. Construction has slowed, particularly at the outset of the pandemic, and reports suggest that the sector’s growth over the next few years will be weaker than previously anticipated. Earlier this year, we spoke with two of the largest players in the construction industry — Orascom Construction and Hassan Allam — and even then, before government-imposed lockdown measures came into effect, it was clear that the industry was in for a slowdown.

In 1Q2020 alone, the construction sector contracted 9.1%, accounting for EGP 91.35 bn of the country’s GDP income, adjusted for current prices, according to Planning Ministry figures. By way of comparison, agriculture contracted 1.9%, transport, storage, and ICT contracted 8.4%, water and sewage contracted 13.2%, Suez Canal revenues dropped 16.7%, hotels and restaurants shed 20.7% of their GDP contribution, and crude oil and mining nosedived 27.7% during the quarter.

On the employment side, however, the fallout in the construction sector appears to be largely contained when compared to other industries, according to state statistics agency Capmas. The sector lost only 288k jobs — less than half the 624k jobs shed by the retail and wholesale sector.

Infrastructure-related state megaprojects — such as the new administrative capital, New Alamein, and New Galala — played a significant role in upholding this trend, economics professor at the Sadat Academy for Management Sciences Abdel Mottaleb Abdel Hamid previously told Al Monitor. This was anticipated by Hassan and Amr Allam, who told us back in March that they expected to see the government looking to “kickstart the economic cycle and pump liquidity into the economy” to improve the macro climate as soon as the pandemic was under control — and said that construction would likely be the go-to industry to reach that goal.

The expectation for the years ahead is that the sector will reverse the contraction trend, but growth forecasts have broadly been revised downward. Between 2020 and 2024, Egypt’s construction industry is expected to grow at an average 9.6% per year, data and analytics company GlobalData said in a June report. The firm had previously expected the industry to expand at an annual average 11.3% clip between 2019 and 2023, driven by Cairo’s urban development program.

Fitch said much of the same in an April report, saying it anticipates construction growth to register a “still strong” 7.5% in 2020, down from its previous forecast of 9.7%. At the time of the report’s release, many construction sites had yet to resume work as the pandemic continued to unfold and as the government’s lockdown measures to contain the outbreak weighed on activity. The extent of the downside risks to this outlook, Fitch said at the time, “depend[s] on the country’s ability to see a timely resumption of works later in the year.”

But even with the downturn, Fitch sees Egypt outpacing its regional peers’ construction growth. According to the report, the UAE’s construction industry is expected to contract 1% in 2020, “with both covid-19 and the weakening in the oil market hitting oil production levels and business sentiment in the country.” Saudi Arabia — another key market in the MENA region — is expected to see a 1.7% contraction in its construction industry this year due to a “limited ability for construction activity to continue” during the pandemic. The report has also cut its construction industry growth forecasts for Iraq by a whopping 6%, and each of Morocco, Algeria, Bahrain, Iran, Kuwait, Jordan, Oman, Qatar, Libya, and Yemen between 2 and 4%. Fitch attributes the industry slowdown in these markets in large part to disruptions in global supply chains.

Not helping matters in Egypt, meanwhile, is the continuing cement supply glut: The private cement industry, which has already been reeling from an oversupplied market for months, has been dealt a fresh blow by the pandemic, GlobalData says. Back in April, the outlook for the cement was already less-than-rosy, with industry leaders forecasting a slew of production shutdowns — after National Cement, Tourah Cement, and El Nahda Cement all shut down operations either temporarily or permanently last year — and declining revenues. According to the report, overall demand for cement dropped on a year-on-year basis by 3% in March and 8% in April, after inching up 8% in January and 9% in February.

That being said, the construction industry is expected to stage a comeback in the near future, buoyed by “a strong pipeline of government investments and projects, including the new administrative capital, GlobalData says. The report notes that the new capital’s two residential districts and the business district should be finished in late 2021 and early 2022 — which are expected to help spur a recovery in the industry.

Your top infrastructure stories for the week:

- Transit: The National Authority for Tunnels awarded a consortium of Hill International and HJI Group Corporation the consultancy services contract for the new monorail lines connecting the new administrative capital and Sixth of October city.

- Debt forgiveness: The New Urban Communities Authority has granted a six-month grace period for companies to pay for land plots in fourth generation and Upper Egypt cities.

- New Alamein development: Orascom Construction and Hassan Allam have won contracts from the New Urban Communities Authority to build five towers in New Alamein.

- Water security: The Housing Ministry is in talks with seven unnamed companies to build seawater desalination plants as part of the government’s recently-announced 30-year plan to increase potable water capacity.

- Financing: The European Bank for Reconstruction and Development has approved a two-year USD 25 mn working capital loan to Orascom Construction to support the company’s working capital requirements.

The Market Yesterday

EGP / USD CBE market average: Buy 15.70 | Sell 15.80

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.72 | Sell 15.82

EGX30 (Tuesday): 11,028 (-0.1%)

Turnover: EGP 934 mn (17% below the 90-day average)

EGX 30 year-to-date: -21.0%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.1%. CIB, the index’s heaviest constituent, ended up 0.5%. EGX30’s top performing constituents were Sidi Kerir Petrochemicals up 2.1%, Dice up 1.7%, and Sodic up 1.2%. Yesterday’s worst performing stocks were Orascom Investment Holding down 2.3%, Porto Group down 2.3% and TMG Holding down 2.2%. The market turnover was EGP 934 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -55.2 mn

Regional: Net long | EGP +25.9 mn

Domestic: Net long | EGP +29.3 mn

Retail: 80.7% of total trades | 81.0% of buyers | 80.3% of sellers

Institutions: 19.3% of total trades | 19.0% of buyers | 19.7% of sellers

WTI: USD 38.57 (+0.76%)

Brent: USD 40.79 (+0.64%)

Natural Gas: (Nymex, futures prices) USD 2.37 MMBtu, (+0.42%, October 2020 contract)

Gold: USD 1,960.20 / troy ounce (-0.31%)

TASI: 8,321 (+0.80%) (YTD: -0.80%)

ADX: 4,509 (-0.14%) (YTD: -11.17%)

DFM: 2,293 (+0.47%) (YTD: -17.06%)

KSE Premier Market: 5,882 (+0.09%)

QE: 9,892 (+0.20%) (YTD: -5.11%)

MSM: 3,677 (-0.18%) (YTD: -7.62%)

BB: 1,401 (-0.03%) (YTD: -12.98%)

Calendar

September: The Egyptian Federation for Securities will hold elections for its board of directors after they were postponed in March due to the lockdown.

September: The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

Mid-September: Proposed time slot for UAE-Israel normalization agreement signing ceremony which will be held in Washington, US.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

17 September (Thursday): OPEC and its allies will meet to assess whether their recent vast oil production cuts have saved the market from the global glut.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

20-27 September (Sunday-Sunday): Welcome Schools expo, Cairo Fair Zone, Nasr City.

21 September (Monday): Government to relax some of the restrictions on mass gatherings.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24-25 September (Thursday-Friday): The European Union will discuss imposing sanctions on Turkey to limit the country’s ability to expand its search for oil and gas in contested eastern Mediterranean waters.

27 September (Sunday): Former Finance Minister Youssef Boutros Ghali to be retried on charges he squandered public funds in a case related to the printing of coupons for butane canisters.

28 September-3 October (Monday-Saturday): CIB PSA World Tour Finals, Cairo, Egypt.

End of September: Last chance to settle building code violations for illegal buildings.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

1-10 October (Thursday-Saturday): Alexandria Book Fair, Kouta, Alexandria.

4 October (Sunday): Senate convenes for its first session.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities.

21-23 October (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

24-25 October (Saturday – Sunday) Polls open for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

December: The 110th regular session of the Egyptian-Iraqi Joint Higher Committee will be held under the chairmanship of the prime ministers of the two countries

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.