- The company that runs Paris’ subway system just landed a EUR 1.1 bn contract to manage Cairo Metro’s Line 3. (Speed Round)

- Americana Egypt moves forward with EGX delisting. (Speed Round)

- FinMin taps Ernst & Young to build electronic billing, taxation platform. (Speed Round)

- Pico’s Salah Diab arrested on unspecified financial charges. (Speed Round)

- El Sisi says government will build 10 new tech universities. (Speed Round)

- Ahmed Bassem Zaki charged with assaulting three minors. (Egypt in the News)

- Why Chinese social media apps have become the ICBMs in the US-China trade war. (Worth Watching)

- What a truly privatized electricity grid in Egypt could look like. (Hardhat)

- The Market Yesterday

Wednesday, 2 September 2020

Paris metro company lands Cairo Metro Line 3 contract

TL;DR

What We’re Tracking Today

It’s relatively quiet on the news front on this second day of September as the business community begins a two-week-long trudge back to Cairo from Sahel to kick off fall and, with it, the 2021 planning season. Expect the pace of business and news to steadily pick up through mid-September, by which time most private schools should be back in session.

We should know more about K-12 education at public schools in the coming days, with Education Minister Tarek Shawki due to announce how things will look sometime next week. Shawki is expected to announce measures to reduce classroom density and push toward a hybrid of in-school and at-home learning before public schools resume in mid-October as his cabinet colleagues continue to warn about the potential for a second wave of covid-19.

Davos in the Desert delayed: Saudi Arabia is pushing its annual Future Investment Initiative conference to 26-28 January over covid-19 concerns, the organizers announced on Twitter yesterday. The gathering was previously scheduled for October; past iterations attracted global figures including BlackRock’s Larry Fink and JPMorgan Chase’s Jamie Dimon.

MORNING MUST-READ for finance nerds: Investing in social good is finally becoming profitable in the New York Times, which reports that impact investments are outperforming traditional approaches whether they’re in public or private equities. Interestingly, RBC Capital Markets data suggests that “64% of actively managed ESG funds beat their benchmarks versus 49% of traditional funds through the first week in August.”

PSA #1- Moderate weather is expected along the north coast until Friday, according to the Egyptian Meteorological Authority, but our favourite weather app is suggesting we’re looking at a heatwave accompanied by high humidity in Cairo. Temps in the nation’s capital will be in the 39-44°C bracket today through Monday, while central and south Sinai will see moderate-to-heavy rainfall through Friday that threatens flooding.

PSA #2- Otlob has rebranded as Talabat, and is offering a 30-minute (good luck…) grocery delivery service, Menabytes reports. Does it herald a move towards faster delivery time and better customer service? The rebranding was announced last month.

Key news triggers coming up in the next two weeks:

- PMI figures for August will land tomorrow;

- Foreign reserves figures should be out early next week;

- Runoff elections for Senate seats are scheduled for 8-9 September. Look for final results on the 16th;

- Inflation data for August should be out on or around Thursday, 10 September.

September is shaping up to be virtual conference season. Among those that you may want to poke into:

- An Egyptian Businessmen Association online meeting with its Bahraini counterpart will discuss mutual trade and investment opportunities on 8 September.

- The Chemical Industries Export Council and Expolink will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda from 14-15 September.

- Talents Arena will host Egypt’s first tech job fair which will be held online on 19 September under the banner JobStack.

- GAFI is hosting a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt sometime this month.

The Health Ministry reported 176 new covid-19 infections yesterday, down from 212 the day before. Egypt has now disclosed a total of 99,115 confirmed cases of covid-19. The ministry also reported 19 new deaths, bringing the country’s total death toll to 5,440. We now have a total of 73,828 confirmed cases that have fully recovered.

The Supply Ministry made it compulsory for families with 4+ members to receive a face mask on their monthly ration cards as of yesterday, a cabinet statement said on Tuesday. The move comes as cabinet continues to warn of a possible second wave. The ministry began distributing up to two masks per month to people with ration cards at the beginning of July.

Karnak Temple yesterday received French and Ukrainian tour groups for the first time since March, after opening Luxor and Aswan for tour groups, according to Al Mal. Tourists will now be able to visit Egypt’s temples, archaeological sites, attractions, and museums following a five-month closure. Tourists from Japan, and South Korea are expected throughout September, and the expectation is that Upper Egypt travel will pick up in December for the winter season after Nile Cruises resume in October.

Three covid-19 vaccines are entering final stage testing: UK-based AstraZeneca said its vaccine candidate is entering its final stage of testing in the US. Another vaccine created by the National Institutes of Health and manufactured by Moderna began final testing this summer, as has another developed by Pfizer and Germany’s BioNTech, the Associated Press reports.

The UAE yesterday reported over 500 new covid-19 cases for the second consecutive day, the government said yesterday. Government officials previously said the curfew could be reinstated if the trend continues. The curfew was lifted on 24 June, and Dubai began welcoming foreign visitors again on 7 July.

Airlines are still hurting as international flights start to resume, with planes still flying half empty and long-haul flights yet to rebound to pre-covid levels. Passenger traffic improved marginally in July as domestic travel picked up but remained at “critically low” levels, the International Air Transport Association (IATA) said yesterday. Global traffic was down almost 80% y-o-y during the month, a slight but hardly reassuring improvement on the 86.6% decline witnessed in June.

Turkey insists on reaching level 12, Super-Saiyan pariah status: Turkey intends to carry out seismic surveys in the disputed area of the eastern Mediterranean with Greece until 12 September, Turkish Press reports. Earlier this month Turkey resumed energy exploration (accompanied by naval vessels) in the EastMed after Greece and Egypt signed a maritime accord delineating borders between them. Exploration vessel Oruc Reis (named after the brother of famed pirate Redbeard, so you know where their heads are) was supposed to complete seismic research on 1 September. Greece’s ratification of the accord last Thursday appears to be driving the escalation.

This comes as Ankara again warned Greece yesterday against sending troops to Kastellorizo, an island between both countries that has become a flashpoint in recent days — the second such warning in as many days.

Dubai is looking to issue a rare USD-denominated bond and sukuk issuance — the latter of which hadn’t taken place since in 2014. Dubai is hoping to raise USD 2 bn or more for its budget by selling 10-year sukuks and 30-year bonds, a person close to the matter told Bloomberg. Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC and Standard Chartered, will be managing the sukuk sale. Last month, Abu Dhabi issued a USD 5 bn triple-tranche USD-denominated debt offering.

The UAE and other EM are taking advantage of the Fed keeping interest rates low and investors chasing yields to hit global debt markets and plug shortfalls from the covid-19 crisis. Egypt announced on Monday that it had concluded a USD 2 bn financing package with regional and international banks.

The big surprise: Dubai’s debt burden is lower than many expected: The prospectus puts it at AED 123.5 bn (USD 33.6 bn) or 28% of last year’s GDP, according to Bloomberg. Estimates from S&P and Bank of America had previously suggested it was in the range of 56-66% of GDP.

US ELECTION WATCH- Joe Biden smashed records with a USD 300 mn fundraising haul in August, according to an exclusive from the New York Times.

Is the Trump administration finally getting serious on stimulus? US Treasury Secretary Steven Mnuchin has reached out to Democratic House Speaker Nancy Pelosi to restart talks on a stalled relief package that broke down a month ago, believing it’s urgently needed for a full recovery from the pandemic, Bloomberg reports.

Apple is gearing up for its fall product launch season and doesn’t seem to expect a covid-related slowdown in demand. Apple has ordered its suppliers to manufacture some 75 mn 5G iPhones alongside its latest batch of iPads and watches, Bloomberg reports, suggesting a launch could come in the first week of October — two weeks later than last year. Also look out for: a new iPad Air with an edge-to-edge display, two new watches, over-ear headphones, and a smaller HomePod speaker.

Meanwhile, Samsung’s second kick at a folding smartphone is will be out on 18 September, the Verge reports, but if we iSheep were going to switch teams, we’d be much more likely to want to check out the upcoming Microsoft Surface Duo, which will launch on 10 September and (at USD 1.4k) cost about USD 500 less than Samsung’s Galaxy Z Fold 2.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: We wrap our three-part series on the state of Egypt’s electricity generation and transmission infrastructure. This week we look at how the government intends to bring the private sector in from the cold and increase its involvement in the generation and distribution of electricity.

Enterprise+: Last Night’s Talk Shows

With Amr Adib returning to the airwaves on Friday, we have just one more night before we resume our normal coverage (although it will admittedly remain Lamees-less for the foreseeable future, with suggestions that the queen of night-time talk is taking her show to a new channel). Luckily Sherif Amer was on hand last night to break up the Ahmed Moussa-fest. Variety is the spice of life and all that…

Latest on settling building violations: Ala Mas’ouleety’s Ahmed Moussa discussed the Fayoum governor’s initiative with the National Bank of Egypt to help citizens settle building violations by providing loans covering 25% of the amount owed. Borrowers would have 10 years to pay back the loans (watch, runtime: 4:08). Members of parliament on Tuesday called on citizens to swiftly settle any violations as the government has stressed that the end-of-month deadline is non-negotiable.

El Sisi calls for new universities: Moussa spoke with the Higher Education Minister Khaled Abdel Ghaffar who discussed President Abdel Fattah El Sisi’s call to build 10 new tech universities across the country. Abdel Ghaffar said that the cost of the universities will vary according to their specializations and required resources, but should average around EGP 3-4 bn each, with a capacity for 10-12k students each in their first years. El Sisi has requested that they be completed in under three years, Abdel Gaffar noted (watch, runtime: 12:21). We have more on this in this morning’s Speed Round, below.

Covid-19 treatment: Mousa spoke with Amgad Talaat, general manager of domestic manufacturer Eva Pharma, which has acquired the license to locally produce covid-19 treatments remdesivir and favipiravir, as well as distribute them to 126 countries worldwide. He said that many African countries have already put in requests to obtain Remdesivir, without providing details. Early results of remdesivir, which has been approved by the US Food and Drug Administration, are already promising, proving at least as successful as in the US (watch, runtime: 27:48).

Covid is weakening in Egypt -health advisor: Yahduth Fi Misr’s Sherif Amer phoned presidential health advisor Mohammad Awad Tag Eldin, who reported that the number of people requiring ventilators has decreased and that the severity of the disease has weakened (watch, runtime: 4:53), (watch, runtime: 2:53).

Arrest of Salah Diab: Moussa also took note of the arrest of businessman Salah Diab, who faces charges of construction violations and is being questioned about alleged misconduct in what authorities said were financial cases (watch, runtime: 6:46). Check out the Speed Round below for more.

Speed Round

French transportation firm RATP Dev will run Cairo Metro Line 3: The National Authority for Tunnels (NAT) signed a EUR 1.14 bn contract with French transportation firm RATP Dev to operate the Cairo metro’s third line for a period of 15 years, according to a Transport Ministry statement. RATP Dev — short for Régie Autonome des Transports Parisiens — operates urban transport systems on four continents, including the Paris metro line.

Metro Line 3 houses Egypt’s first transit hub… Adly Mansour station — the final station on Line 3 which was inaugurated last month by President Abdel Fattah El Sisi — is now officially the country’s first transit hub. The hub will connect the New Administrative Capital to the rest of the nation and include a commercial investment zone alongside a full-service transport complex. The station, which was constructed by Orascom Construction and the Arab Contractors, will also connect five different modes of transportation and serve some 1.5 mn passengers per day.

…And the Middle East’s largest metro station: Heliopolis metro station was declared the largest metro station in MENA when Transport Minister Kamel El Wazir inaugurated it in October of last year, becoming the largest in the Middle East. The station is slated to accommodate an entire shopping mall this year.

Advisors: Zaki Hashem & Partners acted as the legal advisor on the transaction.

M&A WATCH- Americana Egypt moves forward with EGX delisting following Adeptio purchase: Americana Egypt has submitted a request to the EGX to delist 400 mn shares from the exchange at a nominal value of EGP 1 per share following their purchase by Adeptio, the EGX said yesterday. Americana Egypt is transferring ownership to the Emirati outfit, which last month purchased the remaining 9.6% of the company for EGP 6.32 per share in a mandatory tender offer. Americana Egypt’s board of directors earlier this month approved delisting the company’s shares from the bourse after its minority shareholders approved Adeptio’s offer price in July. By delisting, the company will take the shares off the main market before transferring them to Adeptio through its subsidiary and Americana Egypt’s parent company, Americana.

The Finance Ministry tasked Ernst & Young with building its new electronic billing and tax payment platform — the mechanism through which companies and individuals will be filing their taxes, unnamed sources told the local press. The move to a new platform is provided for by the Unified Tax Act, which would create a single tax platform through which to file income tax, VAT, stamp tax, and real estate tax returns. Earlier this month, the Tax Authorities made it mandatory for companies to file their taxes electronically by November.

EFG Hermes topped the EGX’s brokerage league table in August with a market share of 16.7%, according to EGX figures (pdf). CI Capital came second with a 7.4% share, followed by Pioneers (5.7%), and Beltone (4.9%).

EFG Research ranks #1 in frontier markets, #2 in MENA, #7 in EMEA in 2020 Institutional Investor’s Poll: EFG Hermes’ research division has been recognized as the top frontier-market research house and the second-best in the MENA region in the 2020 Institutional Investor Poll, according to a press release (pdf). The division also came in at #7 in the wider Europe, Middle East, Africa (EMEA) region.

Six of the top 15 MENA analysts came from EFG, with Mohamed Abu Basha and Ronak Gadhia securing second and third place while our friends Nada Amin, Hatem Alaa, Kato Mukuru and Luis Colaco were all recognized as runner-ups. EFG Hermes also managed to rank #2 in corporate access in frontier markets and MENA, #6 in EMEA, and #9 across overall generalist sales.

Salah Diab arrested on unspecified charges: Salah Diab, founder of Pico Group and Al Masry Al Youm newspaper, was arrested at his home yesterday morning on as-yet unspecified charges, AMAY, said quoting unnamed security sources.

Speculation in the domestic press is that the arrest has to do with building code violations, a hot button issue for the government these past two years that both President Abdel Fattah El Sisi and Prime Minister Moustafa Madbouly have recently emphasized. El Watan is alleging that Pico’s La Poire factory in Basateen was found in violation of the building code; Youm7 is claiming that Diab declined a settlement offer in connection with the alleged violation.

Background: Diab was arrested and faced an asset freeze and travel ban in November 2015 when he was detained in a case related to the use of state land. Prosecutors added a weapons charge after Diab was arrested at home. He was subsequently cleared of the charges and the travel ban was lifted. More recently. AMAY was handed an EGP 250k fine in April after the newspaper carried an opinion column by the anonymous columnist Newton (widely believed to be Diab himself).

President Abdel Fattah El Sisi wants to see Egypt open 10 new tech universities nationwide, saying during a meeting with the prime minister and higher education minister yesterday that the government will lead on the porgram, an Ittihadiya statement said. The universities will specialize in technology and advanced sciences and will offer twinning programmes with high-ranking international universities. Early plans were reviewed for the construction of the institutions in Ismailia, Port Said, Helwan, Benha, Minya, Beni Suef, Alexandria, Mansoura, Assiut and Aswan, the statement added.

Alexandria International Container Terminals doubled its fees for handling containers carrying “hazardous materials” on Monday, Al Mal reports, citing an unnamed source. Fees for handling these types of materials went up to USD 216 per 20 ft container from USD 108, while fees for 40 ft containers went up to USD 320 from USD 116. The move follows new safety guidelines by the Egyptian Authority for Maritime Safety for the storage and disposal of hazardous waste, seemingly prompted by the Beirut blast. This will certainly add to the woes of shippers and truckers who were hurt when Maersk last month raised the value of letters of guarantee it requires from trucking companies.

EARNINGS WATCH- Palm Hills Developments (PHD) saw its net profit after tax fall 37% to EGP 195 mn in 2Q2020 from EGP 310 mn in the same period last year, according to its quarterly financials (pdf). Revenues fell 42% during the quarter to EGP 873 mn from EGP 1.5 bn in 2Q2019.

BdC profits fall 12% in 1H2020: Banque du Caire generated a net profit of EGP 1.7 bn during 1H2020, down 12% from EGP 1.93 bn in the same period last year, according to figures released by the bank on Monday.

Heliopolis Housing and Development Company (HHD) saw net profit decline 0.9% y-o-y during its 2019-2020 financial year to reach EGP 372.8 mn from EGP 376.4 mn the year before, according to an EGX disclosure (pdf). Disruptions caused by the covid-19 pandemic and a slowdown in consumer demand saw the company’s revenues fall 20% to EGP 1.1 bn during the year. HHD’s financial year runs from August-July.

MOVES- Nairobi-based FX broker and fintech company Aza has appointed Meryem Habibi (Linkedin), formerly of Diebold Nixdorf, as its chief revenue officer, the company said in a press release (pdf) on Tuesday. Habibi will drive AZA’s expansion in sub-Saharan Africa and the MENA region — particularly in Egypt, where AZA is in the final stages of establishing an office and where it sees significant demand, the firm said.

MOVES- Ahmed Abdel Aziz appointed SCMR sec-gen: The Supreme Council for Media Regulation has appointed Ahmed Abdel Aziz as its secretary-general, Al Shorouk reports. Abdel Aziz was formerly a member of the technical office at the Maglis El Dawla (State Council). The Administrative Control Authority last year arrested former secretary-general Ahmed Gamal El Din Selim on bribery charges.

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A full-time copy editor (no freelance applications, please) to be the guardian of house style and make sure we’re always on our game when it comes to factual accuracy.

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

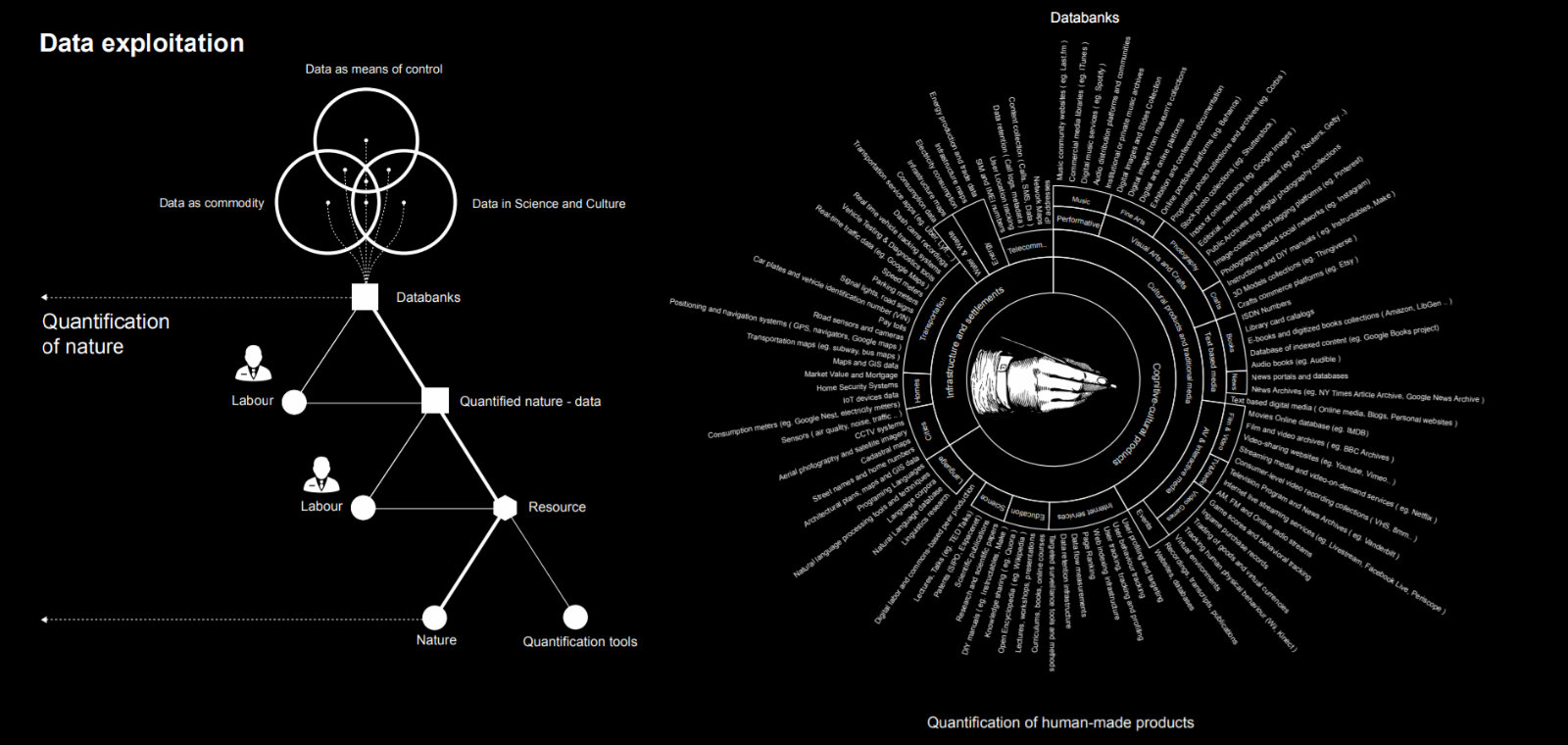

Image of the Day

Anatomy of an AI system: The image above is just a tiny part of an absurdly detailed infographic mapping the entire value chain and labor structure of Amazon’s Echo Dot, from the rare earth mines in the Congo to the harvesting of user data for predictive analytics. Check out the entire graphic here (pdf) and read a detailed explainer here.

Egypt in the News

It’s a quiet morning in the pages of the foreign press. The only story of note: Ahmed Bassem Zaki, a former student arrested in July, has been charged with [redacted] harassing three women who were then-minors, the Associated Press reports. Zaki also stands accused of using explicit images of the women for blackmail, Public Prosecutor Hamada el-Sawy said.

Worth Watching

Explainer- Why Chinese social media apps have become the ICBMs in the US-China trade war: Chinese social media apps WeChat and TikTok have found themselves in the frontline of the every evolving global trade war between Washington and Beijing, after US President Donald Trump threatened to ‘close down’ TikTok on 15 September unless an American company buys it. FT's Washington bureau chief Demetri Sevastopulo and global China editor James Kynge discuss the implications of the move (watch, runtime: 10:44).

Why is this happening? Grand standing in an election year aside, the Trump administration has made technological superiority to China and limiting what it alleges as espionage by Chinese tech firm has been a crucial dynamic of the trade war since the Huawei ban. With the upcoming sale of TikTok and the IPO of Jack Ma’s Ant looking set to break records in a tech landscape starved of new blockbuster listings, the Trump administration feels the need to act.

The implication: As with the Cuban Missile Crisis, the fear is retaliation. US companies such as Apple see China as an important growth market, and any attempts by Beijing to retaliate could jeopardize that growth. We’re already seeing signs of that as China updated it’s export controls over the weekend to ensure that TikTok owner ByteDance must be granted government approval before an agreement is signed

Diplomacy + Foreign Trade

There’s not a whole lot happening on the diplomatic front this morning, with the major issues of the day remaining Libya, Turkey’s stumbling about in the Eastern Med and stalled talks on the Grand Ethiopian Renaissance Dam.

Egypt looks set to pursue funding for waste-to-energy from development partners: International Cooperation Minister Rania Al Mashat, Environment Minister Yasmine Fouad, and Local Development Minister Mahmoud Shaarawy will form a committee that will be tasked with preparing a pitch to international partners to fund waste-to-energy projects. The pitch is expected to take place in a meeting that Al Mashat will organize in October, according to a cabinet statement. The government currently has four WtE projects funded by international partners, including the European Union, Germany, Italy, the World Bank, the European Investment Bank, and the French Development Agency at a total cost of USD 238.2 mn.

What a truly privatized electricity grid in Egypt could look like: Part 1 of our ongoing series on electricity started off as a deep dive into why we have been experiencing power cuts, an electricity production capacity surplus of nearly 30 GW. We found that our investment in generation capacity has far outpaced the rate at which we’ve strengthened the transmission infrastructure of the national grid. In part 2, we looked at the main components of the smart grid and how it would completely change the electricity sector and the way it operates.

In Part 3 today, we explore the upcoming changes in policies that are meant to increase the role of the private sector across the electricity value chain, with the ultimate goal being to reduce the immense expenses incurred by the government as a result of being the sole operator. But notable hurdles remain: namely, an electricity supply glut which slowed down the pace of private sector-led renewables projects — and what the government sees as an outdated framework for buying and selling electricity.

A history of deregulating electricity in Egypt: Since the Sisi administration kicked off its economic reform program in 2016, cutting subsidies and privatizing the electricity sector were the overarching goal. Legislative changes were first introduced back in 2016 as part of the Electricity Act, which transformed the state from the sole market player to a market regulator, while separating the activities of production, transmission, and distribution. This supervisory role was handed to the Egyptian Electricity Transmission Company (EETC), which would also be setting a strategy for deregulating and expanding the national grid over 5-10 years. Shortly after, the EETC began procedures to splinter off from the Egyptian Electricity Holding Company and restructure to meet its new role.

This deregulation helped set the groundwork for the FiT program: With the introduction of the new legislation, Egypt began allowing the private sector into the renewable energy market through the introduction of the Feed-in Tariff (FiT) program, which governed the price and system through which private energy producers would sell to the government. After a rocky start, the FiT got underway with the government agreeing to pay USD 0.084 per kWh for 20-50 MW projects with 30% of the 25-year contract being paid in USD. This framework helped bring us the acclaimed Benban solar park.

While ensuring speedy construction, the framework ultimately became too expensive for the government. The Electricity Ministry was prompted to look into ditching the FiT in favor of the independent power producer (IPP) framework. The move was meant to open up space for the private sector to produce and sell power independently to consumers while paying the state a fee to use the national grid for transmission. A government source tells Enterprise that now the government is considering stopping the IPP framework because of…

…the great electricity glut, which made renewables a less attractive option for the private sector: As we noted in our previous feature, as of June 2020 our electricity capacity reached 58 GW, with consumption reaching a height of 32 GW during the summer. This capacity was largely on the back of government projects. The government took steps this year to limit renewable energy generation so as to not exacerbate the oversupply issue, largely through changes to Egypt’s net metering system — a pay-as-you-go billing system for renewable energy producers. The Egyptian Electric Utility and Consumer Protection Regulatory Agency (Egyptera) began imposing caps on how much solar energy private-sector players can generate, starting at 20 MW for most independent producers. The decision also lowered the price the state pays producers for excess feed.

We’re now seeing upcoming investors freeze plans or lower the capacity they intend to generate. One CEO told us that we can expect investment in renewables to slow down substantially for the next 18-24 months. Meanwhile, TAQA Arabia recently announced that it will be focusing on small-scale solar projects to the tune of 2-10 MW in Egypt for the next two years because of the glut.

The gov’t envisions that one way out of the supply glut problem is exporting: The government is looking to export around 15 GW of the excess capacity to neighbors in Europe, Africa, and the GCC, the source noted. Egypt’s grid is currently linked with Jordan, Palestine, Libya, and most recently Sudan and is hoping to move forward with an interconnection agreement with Saudi Arabia, which has reportedly been delayed. The first phase of the USD 4 bn EuroAfrica project is scheduled to connect Egypt’s grid to Cyprus by December 2022.

But ultimately the government has had to rethink its pipeline of private sector-led projects until 2025, a government source told Enterprise. The World Bank is consulting on a government study that will determine the number of projects and their capacities that were planned to be launched this year, the source explained. The government has since scrapped a tender to establish a 250 MW wind farm and a 200 MW solar plant in the West Nile region, the source tells us.

And it’s now looking to offload fossil-fuel-fired plants to the private sector. The Sovereign Wealth Fund of Egypt has been charged with selling the three Siemens-built combined-cycle power plants. Blackstone Group’s Zarou and Malaysian company Edra Power Holdings have both expressed interest in taking over the operation of the plants and take on the responsibility of meeting debt repayments for the EUR 6 bn facilities.

In tandem, the country is testing new contracting models, including reverse auctions: This type of auction will see producers bid by quoting their selling prices while the government decides at the end of the auction who to buy from. Unlike a tender where the vendor would present a closed envelope with the financial and technical offer, the process in the reverse auction would take place entirely online at an agreed date so that sellers can compete among themselves, the source explained.

Egypt is set to offer reverse auctions for solar power plants before the end of the year, Electricity Minister Mohamed Shaker told the local press. While Shaker did not state what the timetable was, sources told Enterprise that the ministry will offer one pilot project under the reverse auction that will be decided on the recommendation of the World Bank. The project will have a relatively small capacity of 50 MW (again, thanks to the glut).

The privatized value chain of electricity: The hope is that these policy changes will expand the role of the private sector beyond the generation stage to distribution and all the way down to bill collecting. The government is now making pre-paid meters available through specialized private sector suppliers, Electricity Ministry spokesperson Ayman Hamza tells Enterprise. Private companies will be involved at every stage, from manufacturing and installing meters to running payment systems through e-payment firms such as Fawry, Khalis and e-Finance, Hamza added.

The ultimate goal? A truly privatized and efficient electricity market in less than 10 years: With further deregulation, customers will be able to choose their energy provider just like they choose a mobile operator based on their location, needs, and budget. This vision may be only a few months away in new areas like the new capital or new Alamein but would eventually be the new normal in many existing cities around Egypt in less than a decade, former Head of the New and Renewable Energy Authority (NREA) Mohamed El Sobky tells Enterprise.

Your top infrastructure stories of the week:

- Egypt-Saudi energy connection project: Hitachi ABB Power Grids has been awarded a three-year contract by the Gulf Cooperation Council Interconnection Authority (GCCIA) to boost energy system infrastructure and oversight capabilities for the Egypt-Saudi Arabia energy connection project, the company said in a press release (pdf).

- Alexandria national projects: The Bashayer El Kheir 2 housing project, the new Borg El Arab sewage treatment facility, the Mahmoudia highway development project and a number of oil and gas projects were inaugurated in Alexandria earlier this week.

- Zafarana solar plant: The New and Renewable Energy Authority (NREA) signed an agreement with Belectric to construct a 50 MW solar power plant in Zafarana.

- TAQA thinks small-scale: TAQA Arabia will focus on small-scale solar projects for the next two years as the government puts the brakes on large renewable projects amid an electricity glut.

- But renewables haven’t lost their pulling power yet: Japan’s Marubeni wants in on Egypt’s renewables sector, the company’s director in Cairo Osamu Tanihata told Electricity Minister Mohamed Shaker.

- Giza transit hub: The National Railways Authority (NRA) plans to issue in January a tender to construct the second phase of the EGP 4.7 bn central railway station in Giza’s Bashtil that will include a large passenger station, commercial center, administrative buildings and a residential complex.

The Market Yesterday

EGP / USD CBE market average: Buy 15.81 | Sell 15.91

EGP / USD at CIB: Buy 15.81 | Sell 15.91

EGP / USD at NBE: Buy 15.82 | Sell 15.92

EGX30 (Tuesday): 11,234 (-1.2%)

Turnover: EGP 1.3 bn (20% above the 90-day average)

EGX 30 year-to-date: -19.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 1.2%. CIB, the index’s heaviest constituent, ended down 1.1%. EGX30’s top performing constituents were Telecom Egypt up 3%, Credit Agricole up 1.1%, and Orascom Construction up 0.2%. Yesterday’s worst performing stocks were Kima down 4.9%, Porto Group down 4.1% and Qalaa Holding down 4.1%. The market turnover was EGP 1.3 bn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -400.3 mn

Regional: Net long | EGP +415.8 mn

Domestic: Net long | EGP +984.5 mn

Retail: 45.9% of total trades | 61.0% of buyers | 30.7% of sellers

Institutions: 54.1% of total trades | 39.0% of buyers | 69.3% of sellers

WTI: USD 43.00 (+0.92%)

Brent: USD 45.79 (+1.13%)

Natural Gas (Nymex, futures prices) USD 2.52 MMBtu, (-4.30%, October 2020 contract)

Gold: USD 1,976.60 / troy ounce (-0.10%)

TASI: 7,898 (-0.53%) (YTD: -5.85%)

ADX: 4,525 (+0.13%) (YTD: -10.84%)

DFM: 2,252 (+0.32%) (YTD: -18.54%)

KSE Premier Market: 5,889 (+0.59%)

QE: 9,850 (+0.06%) (YTD: -5.51%)

MSM: 3,780 (+0.22%) (YTD: -5.05%)

BB: 1,405 (+1.79%) (YTD: -12.70%)

Calendar

September: The Egyptian Federation for Securities will hold elections for its board of directors after they were postponed in March due to the lockdown.

1 September (Tuesday): Tourist activities will resume in Luxor and Aswan.

1 September (Tuesday): All travelers to Egypt — including citizens, long-term residents and tourists — must show PCR tests.

3 September (Thursday): Details on the establishment of Egypt’s commodity exchange to be announced.

5 September (Saturday): Ahmed Shafik faces retrial at Cairo Court of Appeals in so-called Aviation Ministry corruption case.

1-7 September (Tuesday-Tuesday): Possible announcement from the Education Ministry on what the new academic year will look like,

5-9 September (Saturday-Wednesday): China International Fair for Trade in Services (CIFTIS), Beijing National Convention Center, China. Registration can be found here.

September (date TBD): The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

8 September (Tuesday) Online Egyptian-Bahraini Businessmen Association meeting to discuss mutual trade and investment opportunities.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

9 September-25 October: KLM to run passenger flights to Cairo for the first time since 2017.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against the Tourism Development Authority

14-15 September (Monday-Tuesday) The Chemical Industries Export Council will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

Mid-September: Proposed time slot for UAE-Israel normalization agreement signing ceremony which will be held in Washington, US

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September (Thursday): The European Union will discuss imposing sanctions on Turkey to limit the country’s ability to expand its search for oil and gas in contested eastern Mediterranean waters.

27 September (Sunday): Former Finance Minister Youssef Boutros Ghali to be retried on charges he squandered public funds in a case related to the printing of coupons for butane canisters.

End of September: Last chance to settle building code violations for illegal buildings.

Late October or November: Voters head to the polls to elect a new House of Representatives. Election dates still TBD.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

4 October (Sunday): Senate convenes for its first session.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.