- Egypt secures USD 2 bn loan from int’l banking consortium. (Speed Round)

- Bank ABC asks CBE to start due diligence on Blom Bank Egypt. (Speed Round)

- Raya denies subsidiary BariQ is issuing green bonds. (Speed Round)

- Foreign holdings of Egyptian t-bills rebound in June. (Speed Round)

- Carrefour Egypt to open nine new stores this year. (Speed Round)

- Madbouly issues ultimatum on wildcat building. (Speed Round)

- Egypt, Cyprus talking ‘extensively’ about moving ahead with gas pipeline. (Speed Round)

- The future of SWFs is at risk as covid-19 turns the industry on its head. (The Macro Picture)

- The Market Yesterday

Tuesday, 1 September 2020

Egypt lands USD 2 bn in financing from 12 int’l banks

TL;DR

What We’re Tracking Today

Welcome to September, ladies and gentlemen, and with it the promise of (slightly) cooler days, a return to school for kids of all ages and the start to 2021 budget planning season.

Starting today, Egyptian nationals will join foreigners in needing to show a negative PCR test to enter the country. Travellers flying to Hurghada, Sharm El Sheikh, Marsa Alam and Taba will be able to get a PCR test on arrival for USD 30. Passengers arriving at other airports will need to take the test in their home countries no earlier than 72 hours prior to arrival. Children under the age of six are exempt.

PCR tests on arrival could mitigate the risk of holiday cancellations. Tourists from Ukraine and Belarus have already shelved their travel plans due to the high costs of PCR tests in their home countries, where tests can cost as much as USD 150-200, said Mohamed Farouq, head of the e-tourism committee at the Egyptian Travel Agents Association, Arab News reports.

Luxor and Aswan will reopen today for tour groups as temples, archaeological sites, attractions and museums open their doors countrywide following a five-month closure. Polish and Belgian charters are scheduled to land as early as later today, with tourists from Japan, South Korea, and France expected throughout September, Mohamed Osman, the head of an Upper Egypt-based body that promotes cultural tourism said, according to Al Shorouk. The expectation is that Upper Egypt travel will pick up in December for the winter season after Nile Cruises resume in October.

Speaking of back to school: Last Saturday’s SAT in Egypt was cancelled after the College Board learned that there had been a “test security matter” related to the exam scheduled for 29 August, a College Board spokesperson said in an emailed statement to InsideHigherEd. This wasn’t the first time this has happened, as the March 2019 SATs were canceled in Egypt, Morocco, and Saudi Arabia, with reports indicating that an early copy of the exam were leaked and were being offered for sale. The Scholastic Aptitude Test (SAT) are required examinations for students applying for undergraduate university admission and scholarships, particularly those bound for the United States.

This comes after Cambridge Assessment International Education (CAIE) cancelled its exams earlier this year due to covid-19 related concerns. The IGCSE adopted a new algorithm for determining predicted grades that significantly disadvantaged many students and had parents up in arms. You can take a more in-depth look at yesterday’s edition of Blackboard for more details.

Meanwhile, we’re still waiting for more clarity on what shape K-12 education in Egypt will take this fall. We’re expecting Education Minister Tarek Shawki to announce more details later this week or the next.

Other key news triggers coming up in the next two weeks:

- PMI figures for August will land on Thursday, 3 September;

- Foreign reserves figures should be out early next week;

- Runoff elections for Senate seats are scheduled for 8-9 September. Look for final results on the 16th;

- Inflation data for August should be out on or around Thursday, 10 September.

September is shaping up to be virtual conference season. Among those that you may want to poke into:

- An Egyptian Businessmen Association online meeting with its Bahraini counterpart will discuss mutual trade and investment opportunities on 8 September.

- The Chemical Industries Export Council and Expolink will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda from 14-15 September.

- Talents Arena will host Egypt’s first tech job fair which will be held online on 19 September under the banner JobStack;

- GAFI is hosting a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt sometime this month.

The Health Ministry reported 212 new covid-19 infections yesterday, down from 230 the day before. Egypt has now disclosed a total of 98,939 confirmed cases of covid-19. The ministry also reported 22 new deaths, bringing the country’s total death toll to 5,421. We now have a total of 72,929 confirmed cases who have fully recovered.

EgyptAir is losing EGP 600-700 mn every month, chairman of EgyptAir Holding Company Roshdy Zakaria said in an interview with MBC Masr 2 on Monday (watch, runtime 4:02), noting that the national flag carrier was profitable before the pandemic. The company lost some EGP 3 bn during 2Q2020 when flights were grounded due the pandemic, he said. Demand for domestic air travel is still “not great,” he added.

Reopening economies without covid safety controls in place would be a “recipe for disaster,” warned WHO director-general Tedros Adhanom Ghebreyesus on Monday, Reuters reports. Countries around the world are moving toward a resumption of pre-covid life after eight months of disruption, but the health organization cautioned that reopening too quickly could cause “explosive outbreaks” and urged governments to act safely.

Europe is worried that a second wave in Spain signals that “a new surge” is coming for the continent despite “a relative lull during the summer,” the New York Times writes.

Covid-19 cases in the US surpassed 6 mn yesterday, accounting for almost a quarter of the world’s total, according to data collected by Johns Hopkins University. More than 184k in the country have now died from the virus.

Fed policy switch heaps pressure on the USD: The greenback suffered a fourth consecutive month of losses against a basket of six global currencies after US Federal Reserve Chairman Jerome Powell on Thursday announced a major change in policy that investors believe could lead to higher inflation, reports Reuters. The USD index has fallen more than 1% since the announcement, which will see the Fed pivot to “average inflation targeting” and allow inflation to exceed the standard 2% target for longer than usual before hiking interest rates. This helped the greenback to lows not seen since May 2018 after recording its worst August in five years.

Good news for the global economy? Not so much: The USD index has lost over 9% since a pandemic-induced peak in March. But the weakening isn’t as likely to boost global trade and correct imbalances as it was accustomed to doing, suggests the Financial Times (paywall). Why? The basket of currencies included in the index is dominated by developed countries, meaning many emerging market currencies didn’t experience a devaluation. Other reasons include what analysts are saying is a loss of appeal in the USD as a safe haven asset due to a lower interest rate environment in the US and also the spread of covid-19 making economies less agile and less able to adjust to currency movements.

EGP WATCH- The EGP has been one of the currencies to fare well against the greenback over the past few months, strengthening to EGP 15.8108 per USD yesterday, up 2.2% from a low of EGP 16.1683 in June, according to central bank data (pdf).

It’s official: Global stocks just had their best August since 1986. The MSCI World index of stocks surged 6.6% in August, capping the best gains for the month in 34 years, the Financial Times reports. The panic that gripped the markets earlier this year now seems a long time ago, as the weakening USD, the flood of monetary and fiscal stimulus, and hopes for a global economic recovery drive the unprecedented rally, leading some analysts to voice concerns over the widening gap between the state of the real economy and the sky-high stock valuations.

China has struck agreements with 10 low-income countries that have requested debt restructuring to help them weather the covid-19 pandemic, according to its foreign ministry. Negotiating under a debt standstill scheme led by the G20 known as the debt service suspension initiative (DSSI) launched in April, Beijing is offering indebted countries relief by freezing bilateral loan repayments until the end of the year. All eyes are on Angola, Africa’s largest recipient of Chinese lending over the past two decades, to see what precedent China will set and how transparent its terms will be. The African nation could see USD 2.6 bn — 3.1% of its GDP — in repayments due in 2020 frozen under the DSSI, the Financial Times reports.

Other international news of note:

- A delegation from Abu Dhabi has been invited to visit Israel, after the two countries normalized ties in a US-brokered agreement on 13 August, the Times of Israel reports.

- Lebanon’s ambassador to Germany Mustapha Adib was appointed as prime minister yesterday and will be tasked with forming a new government after his predecessor resigned last month, according to a presidential statement. Parliament will begin consultations over forming a new government tomorrow.

- Japan’s Liberal Democratic Party will hold a vote on 14 September to replace former Prime Minister Shinzo Abe, with four candidates currently in the running, according to Reuters. Yoshihide Suga, a long time ally of Abe, is the frontrunner to become the next PM.

- Trump provoking violent unrest, says Biden: Democratic presidential candidate Joe Biden emerged from the basement yesterday to give a speech casting himself as the law and order candidate and accusing King Cheeto of fomenting violent protests, the Financial Times reports.

Enterprise+: Last Night’s Talk Shows

The word on the street is that Lamees El Hadidi won’t be returning to our screens on Al Hadath this month: Sources told Masrawy last week that Al Kahera Alaan has been cancelled by Al Arabiya Al Hadath and that Lamees has left the channel. We had expected her to make her return this month after she announced in July that she — along with her other half Amr Adib — would be taking August off. Adib is due back in the studio on Friday night.

Until then, we’ll have to make do with Ahmed Moussa, who once again dominated the airwaves last night.

The end of the first wave or the beginning of a second? Moussa also spoke with Hany El Nazer, the former head of the National Research Center, who said that although there has been a slight increase in the number of covid-19 infections recently, this does not necessarily signal the beginning of a second wave. He advised citizens to maintain social distancing, mask wearing, and other safety measures, stressing that preventative measures are vital to ensuring the health system is not overwhelmed (watch, runtime: 19:56).

The government’s crackdown buildings that lack construction and other legal permits continued to get attention last night: Ala Mas’ouleety’s Ahmed Moussa spoke with Cabinet spokesman Nader Saad to discuss the ongoing issue of land reclamation. Saad said that the newly-amended law is a “historic” chance for citizens to legalize the status of their buildings. He stressed that the government will start demolishing buildings put up without permits in cases where owners have not demonstrated seriousness in addressing violations on 1 October, and that cases could be referred to the military prosecutor’s office. Saad dismissed uncorroborated reports circulating on social media that the new reclamation law was unconstitutional and added that some 400k settlement requests have been submitted since the 15 September deadline was announced (watch, runtime: 33:33).

Latest on the Fairmont Hotel case: Moussa highlighted the public prosecution’s latest statement about the Fairmont Hotel [redacted] assault case. The prosecution said that authorities had detained three of the nine suspects for four days, then released each of them on EGP 100k bail. It added that it is taking action against the suspects who fled the country and were apprehended abroad (watch, runtime: 3:40).

Crowds at Cairo airport: Moussa spoke with Assistant Civil Aviation Minister Bassem Abdel Karim, who commented on video clips of crowded scenes at Cairo airport making the rounds on social media. Abdel Karim said that the video simply showed a congested quarantine center as two flights had arrived earlier than scheduled, causing some 650 passengers to check in to the center at the same time. He appealed to passengers to remain patient and adhere to social distancing guidelines (watch, runtime: 7:29).

Speed Round

Egypt has closed a USD 2 bn financing package with regional and international banks to plug budget shortfalls resulting from the covid-19 crisis, Finance Minister Mohamed Mait said in a statement yesterday. The one-year facility is divided into two tranches: USD 1.5 bn offered on conventional terms and a USD 500 mn Islamic financing tranche, a source at the Finance Ministry told Enterprise. This would be the third major borrowing in the pipeline for Egypt after the IMF disbursed a USD 2.8 bn rapid financing instrument, and green-lit a USD 5.2 bn standby loan, USD 2 of which has been disbursed. Reuters also has the story.

High demand for Egyptian debt: The ministry was originally looking to borrow USD 1.5 bn, but said it bumped its request to USD 2 bn when it found lender appetite for c. 1.75x its request.

Parliament has already given the all-clear for the agreement to go ahead, the statement said.

Disbursement imminent: The Finance Ministry will draw down the full value of the package this week, ministry sources told Enterprise.

Emirates NBD and First Abu Dhabi Bank led the consortium that arranged the financing, the ministry said. Twelve financial institutions including HSBC, Citibank, Abu Dhabi Islamic Bank, Standard Chartered and Al Ahli Bank of Kuwait participated in the loan.

M&A WATCH- Bank ABC asks CBE for green light to start due diligence on Blom Bank: Bahrain’s Arab Banking Corporation (Bank ABC) has submitted a request to conduct due diligence on Blom Bank’s Egypt assets ahead of a potential acquisition, Hapi Journal reports. Bank ABC is in the running to acquire the Egyptian branch of Blom, alongside Emirates NBD, which Hapi claims is close to completing its own DD on a transaction that could value Blom’s Egypt arm at USD 250-300 mn. Blom confirmed earlier this month it is looking to sell its Egypt assets as its home country suffers its worst economic crisis in decades. We had more on what seems like a scramble by GCC banks to enter Egypt in yesterday’s issue.

Raya denies its subsidiary is issuing green bonds: Neither Raya Holdings nor its recycling subsidiary BariQ have filed for Financial Regulatory Authority approval to issue green bonds, the Raya said in a regulatory filing (pdf). The disclosure comes as a surprise after repeated reports in the domestic press that BariQ not only sought the FRA approval for EUR 40 mn green bonds, but had actually received it earlier this week to take them to market by early 2021.

The only other private green bond issuance we know of is CIB’s: Our friends at CIB have been working with the International Finance Corporation (IFC) to issue Egypt’s first green bonds through a private placement this quarter, Heba Abdellatif, head of debt capital markets at CIB, told Enterprise in June. The government, meanwhile, has been working to issue up to USD 500 mn worth of green bonds in FY2020-2021, Assistant Finance Minister for Debt Khaled Abdel Rahman told us.

Foreign holdings of Egyptian t-bills rebounded in June following four straight months of decline, according to CBE data (pdf) released yesterday. Holdings rose to USD 7.71 bn during the month, up from USD 7 bn in May. Total holdings of Egyptian bonds (including short-term t-bills and long-term t-bonds) rose to USD 10.6 bn during the month, Bloomberg reported in July. Egypt witnessed massive capital outflows earlier this year amid a global financial panic caused by the covid-19, which saw t-bill holdings fall 64% from c. USD 19.5 bn in February.

The trend continued into July: Foreign holdings in sovereign debt climbed rapidly in July, rising to USD 14 bn, Bloomberg reported last month.

INVESTMENT WATCH- Carrefour Egypt to open nine new locations at a cost of EGP 200 mn this year: Majid Al Futtaim (MAF)-owned supermarket chain Carrefour Egypt is spending EGP 200 mn to open nine new stores in Cairo and Alexandria before the end of the year, the chain’s Egypt country manager Jean Luc Graziato said at a press conference yesterday, Reuters reports. The new branches will bring the company’s total number in the country to 63. The plan comes despite the covid-19 pandemic reducing consumer footfall at the supermarket’s physical locations, causing sales to fall 18-20%. Now, with the easing of the government’s lockdown restrictions, Graziato said that the company is beginning to see a return to pre-covid conditions.

INVESTMENT WATCH- Greece’s Mac Optic to launch USD 100 mn Egypt investment arm focuses on financial services, media, education and healthcare: Greek industrial investor Mac Optic Investments is looking to set up by the end of the year a USD 100 mn holding company, Mac Holding, that will invest in financial services, media, education and healthcare in Egypt, Mac Optic CEO Ahmed Radwan told Al Mal yesterday. Mac Holding’s financial services plan would see the company get in on investments in SMEs, real estate financing and securities trading while its healthcare endeavours would supposedly bring some 15 new clinics and general hospitals between Cairo and Alexandria under its wing. The fund is also considering establishing new international schools in Cairo and Alexandria and a technical institute in Cairo in addition to the two sites already owned by Mac Optic subsidiaries in both cities.

Madbouly takes hard line on wildcat building after El Sisi’s warnings: Illegal builders have until the end of September to settle building code violations or see their buildings demolished, Prime Minister Moustafa Madbouly warned, stressing in a statement that the deadline is non-negotiable. Governorates will be getting new powers to monitor and report violations to a central administration, and police forces will be called on to secure the demolition of unsettled buildings, the PM added. The government will also show no tolerance when it comes to building over agricultural land, which it considers a “matter of life and death,” Madbouly said. Madbouly’s comments came after President Abdel Fattah El Sisi last week threatened to deploy the army to crack down on those who build without permits or flagrantly violate construction code.

Progress in clearing violations: The Local Development Ministry said it has addressed 11k cases of construction violations in its 16th stage of reclamations (which ends with the 15 September deadline), recovering 2.9 mn square meters of state property and 211k feddans on agricultural lands, in a statement on Monday. It has cleared 16k contracts to proceed with construction, collecting EGP 4.4 bn, and received another 769k settlement requests, collecting a further EGP 4.6 bn.

Background: The government recently extended until mid-September a deadline to settle building code violations in an effort to tackle the long-standing issue. The fees would be submitted alongside settlement applications, and deducted from the overall charges if the applications are accepted. Under executive regulations to a recent law, settlements can be processed no later than the end of September. Demolition procedures would commence right away for rejected applications.

Egyptian and Cypriot officials are in “extensive discussions” on a planned natural gas pipeline linking the two countries, Al Mal reports, citing an unnamed government official. The construction of the pipeline is proceeding according to schedule despite the covid-19 pandemic, the official said, without mentioning dates or milestones. Once completed, it will allow natural gas from the Aphrodite gas field to flow to Egypt’s liquefaction facilities at Idku and Damietta. This gas could then be liquified and re-exported to Europe and elsewhere. Egypt and Cyprus signed in 2018 an agreement to collaborate on setting up the direct pipeline, which received presidential approval in July last year.

Egypt should be looking to begin receiving Cypriot gas in 2022, Al Mal cites government officials as saying. Cypriot Energy Minister Yiorgos Lakkotrypis suggested last year that the wait could be much longer as output from the Aphrodite field will come between 2024 and 2025.

Background: The new pipeline is a crucial milestone in Egypt’s goal of becoming an energy export hub in the East Mediterranean, and Egypt will also be importing natural gas from Israel under a landmark USD 19.5 bn agreement. Egypt will re-export the LNG to Europe after it satisfies local demand. Alongside our plans to emerge as the region’s premier natgas hub, the country has potential to become a regional leader in electricity, with agreements with Saudi Arabia, Sudan, Cyprus and Greece set to see it send electricity in almost all directions.

Cue expletives in Ankara: Even though the planned Egypt-Cyprus pipeline is unlikely to pass through waters claimed or controlled by Turkey, the Nutter in Ankara has been consistently at odds with every attempt by an Egyptian-Greek-Cypriot alliance to cooperate on exploiting the energy-rich eastern Mediterranean. Turkey has long been attempting to lay a claim to the region’s energy resources, efforts which intensified last month after Egypt and Greece signed a maritime demarcation agreement nullifying Ankara’s competing accord with Libya. Since then, Turkey has become more belligerent with its gas exploration efforts, launching a seismic survey with military escorts in areas it unilaterally claims for itself.

News of Turkey’s efforts to hijack the EastMed didn’t end yesterday, with Ankara demanding Athens pull troops from Kastellorizo, an island between both countries, Turkey’s Foreign Ministry said, according to Bloomberg.

The EU yesterday renewed calls to ease those border tensions, which also involve Cyprus, Reuters reports. If efforts come to no avail, EU authorities could impose sanctions on Turkey that would, among other things, limit its access to European ports.

The New York Times editorial board weighed in on the dispute on Monday, calling on Turkey to heed mediation efforts by Germany, and recommended a pause on exploration activities until cooler heads prevail.

Ethiopia after US for answers on possible halt to aid: The Ethiopian government is seeking clarification for recent reports that the US could withhold some USD 130 mn-worth of assistance programs to the African nation in order to mediate its dispute with Egypt and Sudan over the Grand Ethiopian Renaissance Dam (GERD), Fitsum Arega, the country’s ambassador to the US said on Twitter. An explanation was due to be issued yesterday evening, Arega claimed. Foreign Policy quoted USD officials and congressional aides last weekend as saying that Secretary of State Mike Pompeo has signed off on plans to suspend US funding to Ethiopia for security, counter-terrorism, and anti-human trafficking. This came as the GERD talks reached yet another impasse last Friday, when the negotiating irrigation ministers failed to see eye-to-eye during a meeting to resolve sticking points on the filling and operating the dam.

The Macro Picture

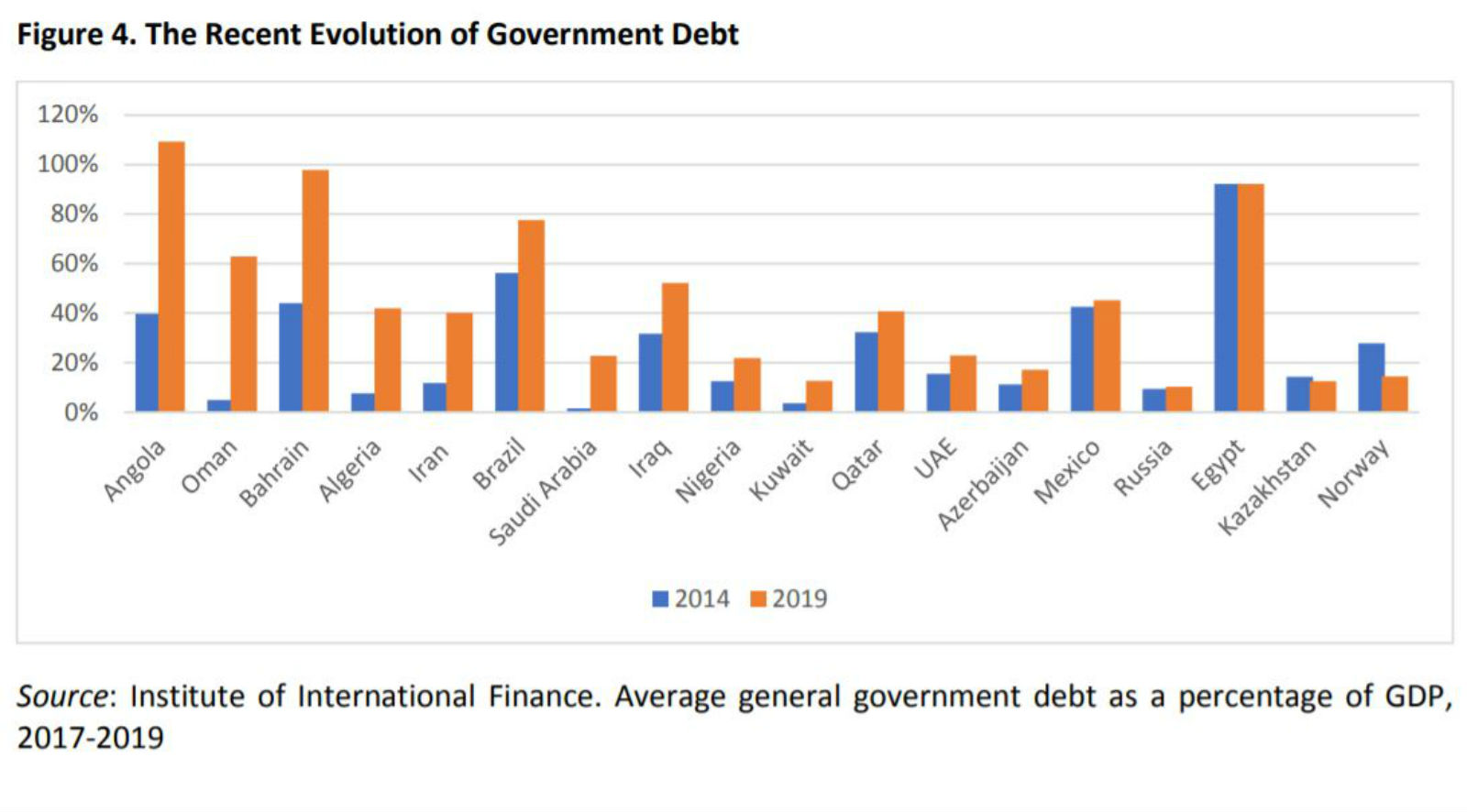

The future of SWFs is at risk as covid-19 turns the industry on its head: Sovereign wealth funds (SWFs) around the world may undergo “profound changes” as cash-strapped governments turn to them to help them plug revenue shortfalls and support local economies, academics from Bocconi University, New York University and the London School of Economics said in a report (pdf). Funds in oil-dependent economies in particular are facing “the most severe adverse shock of their history” as one of the deepest demand slumps in living memory wreaks havoc on state revenues, while at the same time a pandemic forces them to ramp up fiscal stimulus. In response, JPMorgan sees MENA SWFs offloading almost USD 225 bn of their equity assets, while the Institute of International Finance is forecasting Gulf funds to draw down around USD 80 bn.

Lots of money out: SWFs in Norway, Iran, Kuwait and Nigeria have seen withdrawals to fund government spending while Singapore, Malaysia and Turkey have used them for corporate bailouts. And Diego Lopez, managing director of Global SWF — a firm that follows SWFs — expects there to be several more withdrawals coming, particularly among Gulf states.

SWFs are becoming more leveraged and less focused on profitability post-pandemic: Instead of investing globally, the covid-19 pandemic could create “more leveraged” SWFs, and ones that turn to domestic investments, rather than looking abroad for returns, the report suggests. What this would mean is that SWFs who together have over USD 6 tn in assets stand to lose on financial returns as they “focus on [the] broader economic and social impact,” the report adds, estimating “paper losses” of USD 800 bn. SWFs have already been seeing a fall in direct investments, even before the covid-19 pandemic hit, CNBC recently reported.

Is the “golden age” of SWFs actually over? The short answer is yes, according to the report, which says that falling oil prices, increasing protectionism and new barriers to cross-border flows have stymied SWFs over the past two decades. While some will remain powerful players in international finance, the pandemic and the economic downturn pose a “quintessential challenge” to the industry. “The disruptive potential of the crises is such that no country, nor SWF, will be spared. Sovereign investors of all stripes will be called to reassess their investment strategies, as new public-sector liabilities will have to be accounted for,” the academics write.

Image of the Day

Egypt’s jasmine trade captured in photo series: Did you know the Jasmine trade provides the country with USD 6.5 mn annually and contributes to the income of 50k people, according to data (pdf) from the International Federation of Essential Oils and Aroma Trades. 95% of the world’s jasmine extract for perfumes comes from Egypt and India. Jasmine harvests are usually done at night with Egyptian workers harvesting as much as 5kg of petals a day. Gulf News picked up AFP’s photo series about the jasmine flower trade in Gharbiya, and the photos are quite stunning.

Egypt in the News

It’s a mixed bag of nuts in the pages of the foreign press this morning: AFP and Arab News picked up Egypt’s latest counter-terrorism operations in Sinai that resulted in the killing of over 70 terrorists.

Human rights is again a hot button topic: The Washington Post reported on the 15-year prison sentence handed down in absentia to human rights activist Bahey Eddin Hassan for social media posts critical of the government, under the country’s new cybercrimes law and before a counterterrorism court. It noted the condemnations by media and internet freedom campaigners.

Worth Watching

You might want to keep your mask on the next time you're in a ‘ezba, as it seems likely that the next pandemic could come from industrial farms, according to Vox (watch, runtime: 09:15). Industrial farms or “concentrated animal feeding operations” (CAFOs, in industry terms) have become a model for efficient and high profitability farming across the globe — and a watchword for despicable conditions for animals that even obligate carnivores deplore. CAFOs have proved to house the ideal environment for the pathogens that cause pandemics. The petri dish farms are overly crowded with one virus easily jumping from one animal host to the other, with scientists worried that a mutation could occur that would give the pathogen the ability to transmit to humans. Their apprehension didn’t appear out of thin air, with the recent outbreak of H1N1 or Swine Flu having emerged from CAFOs in Mexico.

There are ways to lower the risk of CAFO-born pathogens, with scientists suggesting countries decrease the global transport of live animals, have less crowded farms, eat less meat, or transition back to the traditional (and vastly more humane) farming practices that were prominent before the industrial revolution .

Diplomacy + Foreign Trade

Top stories on the diplomatic front this morning: President Abdel Fattah El Sisi’s meeting with Eni boss Claudio Descalzi and a landmark peace accord in Sudan.

Eni looking to expand operations in Western Desert, Red Sea -CEO: Eni is looking to increase its exploration and production activity in the Western Desert and Red Sea regions, CEO Claudio Descalzi told President Abdel Fattah El Sisi during a meeting on Sunday, an Ittihadiya statement said.

The Foreign Ministry has welcomed a historic peace agreement signed by Sudan’s ruling transitional council and a rebel alliance known as the Sudan Revolutionary Front on Monday. The accord comes after more than 10 months of negotiations and marks a significant step toward bringing an end to the country’s civil strife, though some powerful factions refused to come on board. The agreement will see rebel groups gain political representation, economic and land rights, the ability to integrate with security services and return displaced people, Reuters notes. The Arab League also welcomed the accord, as did the US, the UK and Norway in a joint statement.

Real Estate + Housing

Banque Misr, NBE sign EGP 4 bn agreement with Talaat Moustafa subsidiary to develop residential projects

Banque Misr and the National Bank of Egypt (NBE) have signed a EGP 4 bn financing agreement with Talaat Moustafa Group subsidiary the Arab Company for Projects and Urban Development to construct two mixed-use projects in Madinaty and Rehab City on a combined 341k sqm of land, according to an EGX disclosure (pdf). The developments will include primary homes along with commercial and office space.

Telecoms + ICT

Cell phone retailers allegedly must log KYC info on smartphone sales

Cell phone retail outlets have reportedly been instructed to log know-your-customer (KYC) information when selling a smart phone — in the vein of telecoms being required to obtain KYC info, Al Mal reports citing an unnamed source.

Automotive + Transportation

GB Auto to locally assemble buses in partnership with Higer Bus

GB Auto has entered a partnership with Chinese bus manufacturer Higer Bus to represent it in Egypt and locally assemble buses at GB Polo, the company announced on its LinkedIn page.

Banking + Finance

Al Ahly Capital to set up new financial services arm Tamkeen

National Bank of Egypt (NBE) investment arm Al Ahly Capital is looking to set up a new financial services holding company, Tamkeen, to house its micro-lending and e-payments operations, Al Mal reports, citing unnamed sources familiar with the matter. Al Ahly is reportedly seeking approval from the Financial Regulatory Authority (FRA) to establish Tamkeen while it positions itself for a potential acquisition of e-payment platforms Sadad and Momken.

BdC SME lending up 23% in 1H2020

Banque du Caire increased its lending to SMEs by 23% to EGP 11 bn during 1H2020, Chairman Tarek Fayed said in a statement on Monday, Hapi Journal reports. The state-owned bank has been working with the European Investment Bank to channel finance to SMEs after the multilateral lender signed off on a EUR 90 mn credit line in April. The bank also increased its microlending by EGP 192 mn during the six-month period, bringing the total size of the portfolio to EGP 7.16 bn by 1 July, Fayed added.

On Your Way Out

Your feel good moment of the week: Young Alexandrian freska seller received a full scholarship to study medicine from Higher Education Minister Khaled Abdel Ghaffar after a video went viral of high school graduate Ibrahim Abdel Nasser explaining his dream to a beachgoer. Hany Younes, media advisor to Prime Minister Mostafa Madbouly reposted the video (watch, runtime: 01:07) on Facebook, relaying the good news and adding that Abdel Nasser could attend the university of his choice.

The Market Yesterday

EGP / USD CBE market average: Buy 15.81 | Sell 15.91

EGP / USD at CIB: Buy 15.81 | Sell 15.91

EGP / USD at NBE: Buy 15.82 | Sell 15.92

EGX30 (Monday): 11,366 (-0.6%)

Turnover: EGP 1.6 bn (48% above the 90-day average)

EGX 30 year-to-date: -18.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.6%. CIB, the index’s heaviest constituent, ended down 1.1%. EGX30’s top performing constituents were Dice up 5.7%, TMG Holding up 2.7%, and CIRA up 2.4%. Yesterday’s worst performing stocks were Juhayna down 2.5%, Elsewedy Electric down 2.2% and Orascom Construction down 2.2%. The market turnover was EGP 1.6 bn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -73.2 mn

Regional: Net long | EGP +40.0 mn

Domestic: Net long | EGP +33.3 mn

Retail: 77.3% of total trades | 78.2% of buyers | 76.4% of sellers

Institutions: 22.7% of total trades | 21.8% of buyers | 23.6% of sellers

WTI: USD 42.61 (-0.8%)

Brent: USD 45.28 (-1.2%)

Natural Gas (Nymex, futures prices) USD 2.63 MMBtu, (-1.12%, October 2020 contract)

Gold: USD 1,974 / troy ounce (-0.07%)

TASI: 7,940 (-0.54%) (YTD: -5.35%)

ADX: 4,519 (-0.4%) (YTD: -10.96%)

DFM: 2,245 (-0.72%) (YTD: -18.79%)

KSE Premier Market: 5,854 (-0.34%)

QE: 9,845 (-0.78%) (YTD: -5.57%)

MSM: 3,771 (+0.54%) (YTD: -5.26%)

BB: 1,380 (+0.57%) (YTD: -14.24%)

Calendar

September: The Egyptian Federation for Securities will hold elections for its board of directors after they were postponed in March due to the lockdown.

1 September (Tuesday): Tourist activities will resume in Luxor and Aswan.

1 September (Tuesday): All travelers to Egypt — including citizens, long-term residents and tourists — must show PCR tests.

3 September (Thursday): Details on the establishment of Egypt’s commodity exchange to be announced.

5 September (Saturday): Ahmed Shafik faces retrial at Cairo Court of Appeals in so-called Aviation Ministry corruption case.

1-7 September (Tuesday-Tuesday): Possible announcement from the Education Ministry on what the new academic year will look like,

September (date TBD): The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

8 September (Tuesday) Online Egyptian-Bahraini Businessmen Association meeting to discuss mutual trade and investment opportunities.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

9 September-25 October: KLM to run passenger flights to Cairo for the first time since 2017.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against the Tourism Development Authority

14-15 September (Monday-Tuesday) The Chemical Industries Export Council will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

Mid-September: Proposed time slot for UAE-Israel normalization agreement signing ceremony which will be held in Washington, US

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September (Thursday): The European Union will discuss imposing sanctions on Turkey to limit the country’s ability to expand its search for oil and gas in contested eastern Mediterranean waters.

27 September (Sunday): Former Finance Minister Youssef Boutros Ghali to be retried on charges he squandered public funds in a case related to the printing of coupons for butane canisters.

End of September: Last chance to settle building code violations for illegal buildings.

Late October or November: Voters head to the polls to elect a new House of Representatives. Election dates still TBD.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

4 October (Sunday): Senate convenes for its first session.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.