- The private sector had a reasonably good July, according to the PMI. (Speed Round)

- Raya’s BariQ looks to take EUR 40 mn green bond to market by early 2021. (Speed Round)

- Naguib Sawiris is no longer acquiring City Gate from Qatari Diar. (Speed Round)

- Gastec is setting up more natgas fueling stations as gov’t pushes ahead with its natgas transition plans. (Speed Round)

- Stimulus overkill could trigger a fiscal crisis in emerging markets. (The Macro Picture)

- Things to think about this weekend: You’re working too hard + covid is changing your personality (and messing up your marriage). (What We’re Tracking Today)

- My WFH Routine: Ayman Hakky, CEO and founder of The TriFactory.

- The Market Yesterday

Thursday, 6 August 2020

July was good for business as Egypt as lockdown measures ended

TL;DR

What We’re Tracking Today

The death toll from Tuesday’s massive explosion in Beirut has climbed to 135, and dozens more are still missing, Reuters reports. More than 5,000 others were injured in the Tuesday blast, which initial reports suggest was caused by a fire that broke out from welding work at the port.

The explosion is estimated to have caused losses worth USD 15 bn, Beirut Governor Marwan Abboud said. Lebanon has already been facing a severe financial crisis over the past several months.

As many as 300k people are believed to be homeless or living in homes that have experienced significant structural damage. The story leads the front pages of the global business press for a second day in a row, topping the New York Times | Financial Times | Wall Street Journal | Bloomberg.

Three Egyptian nationals are among the dead, according to statements from the Egyptian embassy in Lebanon (here, here, and here). Cairo is sending two planes loaded with medical supplies to Beirut, according to a State Information Service statement. Egypt’s Medical Syndicate could also be sending Egyptian doctors to help treat the victims.

Things worth thinking about heading into the weekend:

1- The Donald will lose this fall’s election, claims Allan Lichtman, the historian whose “13 keys” system has correctly predicted the outcome of every US presidential contest since Ronald Reagan’s re-election in 1984. You’ll have to watch this short (07:13) video to get the full rundown.

2- If you’re a white-collar worker, the odds are good you’re working a lot more than you need to. Go back a couple of years into the New Yorker’s archive for a reminder that “once upon a time, it was taken for granted that the wealthier classes enjoyed a life of leisure on the backs of the proletariat. Today it is people in skilled trades who can most find reasonable hours coupled with good pay,” while office workers are among “those subject to humiliation and driven like beasts of burden.”

Why are you working harder than your parents when we’ve seen massive gains in productivity and women’s participation in the labor force in the past half-century, so? Very probably because the “system” is broken in a way that allows you or your “boss” to keep creating more work for yourselves. (Pro tip: Your “boss” can mean your CEO for line staff — or faceless “shareholders” and their demands for “value” if you’re CEO). Go read: You really don’t need to work so much.

Maybe that’s why eliminating your daily commute hasn’t made your workday shorter: The covid-19 workday is 48.5 minutes longer on average and has 13% more meetings and 1.4 times the number of emails that a pre-pandemic workday would have had, according to a new study published by the National Bureau of Economic Research cited by Bloomberg. The study covered workers from North America to Europe and the Middle East, so don’t dismiss it out of hand as being relevant only to ‘western’ markets.

3- How has lockdown changed your personality? More than you may imagine right now and in ways that may not already be clear, the BBC argues in a must-read piece. Even more challenging for the marrieds among us: Covid is messing up marriages, with the WSJ warning that lockdown measures and pandemic uncertainty have “produced a pressure cooker inside homes, hurting even strong partnerships and, experts say, likely breaking others.”

4- Are you an old who is newly single and ready to mingle? The Journal suggests that it is Never too late to start your YouTube career, whether you’re a 68-year-old fitness instructor or a 57-year-old music buff.

5- And for the tech nerds among us: Samsung is out with a new folding device, the Galaxy Z Fold 2 alongside its Galaxy Note 20 Ultra. The Financial Times and the Verge have the details, but for iSheep like us, we’ve frankly taken a long look at this year’s newly announced Google Pixel phones, which run a clean version of Android that’s functional, looks reasonable and lacks all of the crapware Samsung installs. Verge reviewer Dieter Bohn argues that the stripped-down Pixel 4A is a worthy bargain-priced entry.

COVID-19 IN EGYPT-

The Health Ministry confirmed 18 new deaths from covid-19 yesterday, bringing the country’s total death toll to 4,930. Egypt has now disclosed a total of 94,875 confirmed cases of covid-19, after the ministry reported 123 new infections yesterday. We now have a total of 47,182 confirmed cases that have fully recovered.

Almost all hotels in Cairo, the North Coast, and Ain Sokhna are now licensed to operate at the government-decreed 50% capacity and a total of 620 hotels across the country have earned the health safety certificate required to operate at the reduced capacity, Assistant Tourism Minister Abdel Fattah El Assi told Al Mal.

Nearly 50k tourists have visited Sharm El Sheikh and Hurghada since Egypt reopened its airports on 1 July, Tourism Minister Khaled El Anany said, according to Al Mal. The primary inbound markets: Ukraine, Belarusia, Serbia and Hungary. The news comes as Air Serbia resumed charter flights to Egypt, EX-YU Aviation News reports. The carrier has 16 charters scheduled for the Red Sea through the end of summer, with 15 of them Hurghada-bound.

GLOBAL MACRO-

This ETF has more gold than most of the world’s central banks: SPDR Gold Shares is now among the biggest owners of physical gold in the world, holding more bullion than even the Japanese and Indian central banks, the Financial Times reports. The exchange-traded fund’s holdings climbed to 1,258 tonnes on Tuesday as investors continue to pile into the precious metal. Gold prices hit new record highs yesterday, rising to USD 2,053.50 / oz.

Investors hatch plan to reach zero emissions by 2050: A group of investors with USD 16 tn AUM has unveiled the world’s first step-by-step plan to help pension funds meet the Paris climate targets and cut emissions to zero by 2050, Reuters reports. In a bid to encourage greener investing, the Institutional Investors Group on Climate Change has laid out specific targets for funds, such as increasing holdings in low-carbon passive indexes and putting pressure on portfolio companies to tie pay to climate-related targets.

AND THE REST OF THE WORLD-

Saudi Arabia is moving forward with its nuclear plans (with a little help from Beijing), taking it a step closer to producing nuclear material, the Wall Street Journal reports. Weapons-grade enrichment remains a distant prospect for Saudi, but the plant, which allows it to produce yellowcake from uranium ore, is causing concern in Washington about the kingdom’s nuclear ambitions, the paper says. This comes days after the UAE inaugurated the Arab world’s first nuclear power plant.

Microsoft’s acquisition of TikTok could be worth between USD 10 and 30 bn, CNBC’s David Faber reported yesterday. If the acquisition materializes before a 15 September deadline, after which it seems likely King Cheeto may ban the Chinese video-sharing app, which his administration has accused of exposing data on Americans to the Chinese government. The news comes as Instagram has launched a TikTok competitor dubbed “Reels” and amid not-so-veiled threats from the US Secretary of State that a broader crackdown on Chinese apps could be in the cards.

Gulf countries are scrambling to invest in foreign agribusinesses and agri-tech solutions as the pandemic forces a reckoning with their precarious food situations, the FT reports. Predominantly reliant on imported food, Gulf states are becoming painfully aware of the need to diversify where they get their sustenance. This means technology based agriculture — like cellular food development, AI-driven farming and high tech greenhouses — at home and big ticket purchases in foreign food groups like India’s Daawt’s food abroad.

Enterprise+: Last Night’s Talk Shows

The airwaves are still a wasteland. Chalk it up to the very real summer news slowdown.

Speed Round

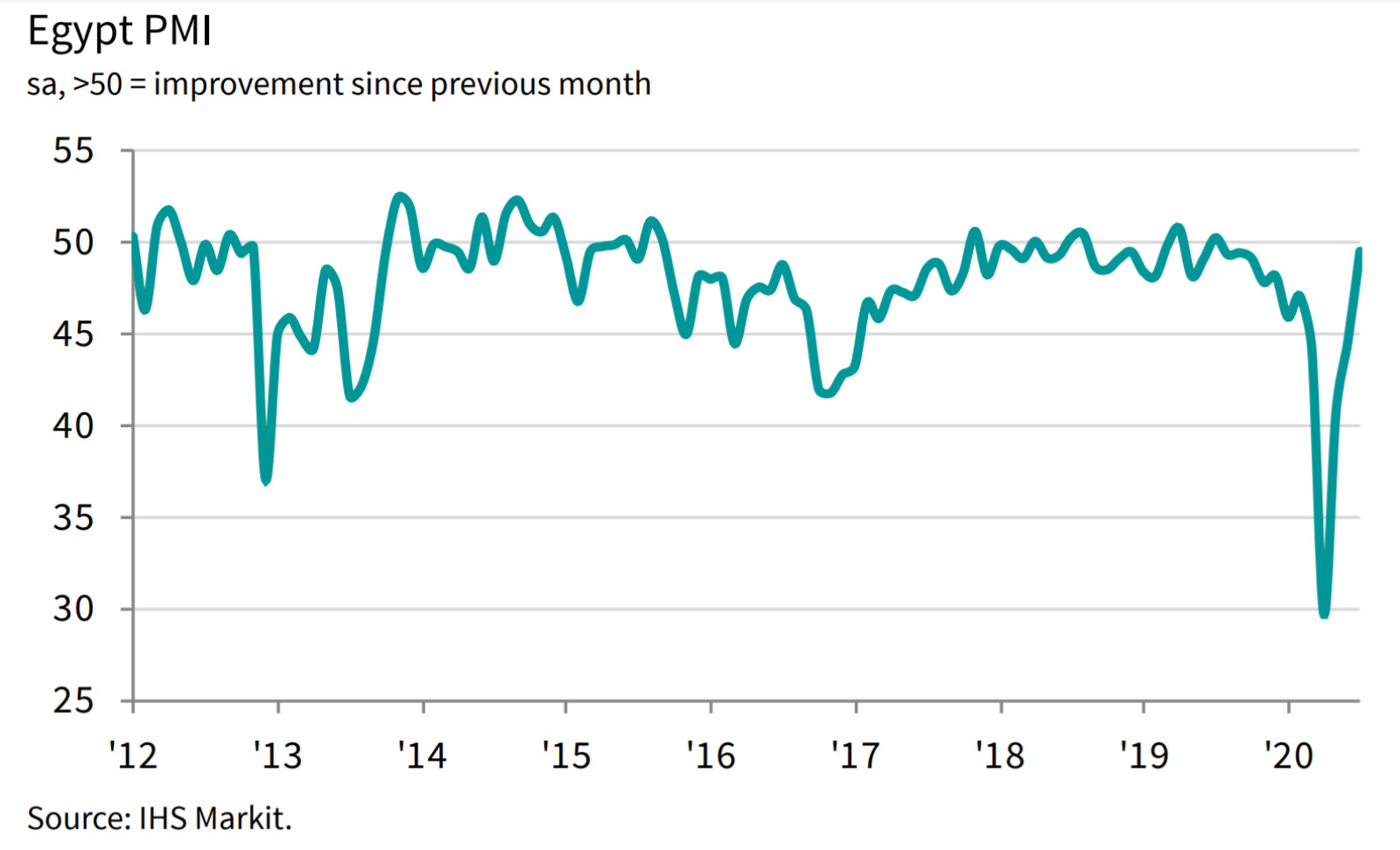

Non-oil business activity hits 12-month high in July: Activity in Egypt’s non-oil private sector contracted at its slowest rate in a year in July as rising output and expanding exports signalled improved business conditions after activity fell to an all-time low at the height of the covid-19 crisis. IHS Markit PMI figures (pdf) released yesterday came in at 49.6, only slightly missing the 50.0 mark that indicates an expansion of activity, and rising from 44.6 in June.

Output rose last month for the first time in a year as areas of the economy previously shuttered during lockdown reopened. Activity in the tourism and hospitality sectors picked up as tourists returned following the lifting of the ban on international flights at the beginning of July.

New business also recorded the first monthly increase in a year as export demand increased, particularly from European and African countries.

But let’s not get too carried away: “Egypt still has some way to go to return to pre-covid levels of activity and demand, with the recent upturns only mild overall,” said David Owen, economist at IHS Markit. “The landscape for Egyptian businesses remains both competitive and daunting, but can be improved in the coming months should tourism and other sectors be given a boost.”

The after-effects of lockdown continued to weigh on the labor market: Despite recovering output and new orders, employment continued to decline in July, after falling at its fastest rate in four years in June. Businesses told IHS Markit that this was mainly due to companies not replacing ex-employees who had left voluntarily.

Weak purchasing activity continued into July, with stock purchases falling for the eighth consecutive month albeit at the slowest rate since December. Inflation hit a nine-month high, accelerating the rise in purchasing costs, while firms continued to offer discounts on orders to boost sales.

The private sector is strongly optimistic for a near-term recovery: Sentiment reached its highest level in almost two-and-a-half years, with firms expressing optimism that a recovery in the tourism sector will support broader economic comeback over the summer.

Over in the Gulf, Saudi Arabia and the UAE also posted improved PMI figures. Private sector activity in the UAE expanded at a faster pace in July while Saudi climbed to a five-month high of 50. Bloomberg breaks down the figures here.

Raya’s BariQ is looking to take a EUR 40 mn green bond to market by early 2021 to finance the expansion of its recycled plastic food packaging operations, Al Mal reports, citing people familiar with the matter. The company plans to close the issuance at the end of this year or early in 2021 and is in talks with the Financial Regulatory Authority to begin preparations in the coming days, they said.

What are green bonds? A green bond is a type of fixed-income instrument that is specifically earmarked to raise money for climate and environmental projects. The World Bank was the first organization to offer green bonds in 2008 and has since issued over USD 13 bn worth through more than 150 transactions in 20 currencies.

Advisors: BariQ has reportedly tapped Misr Capital as financial advisor for the issuance and appointed Zaki Hashem & Partners as legal counsel.

CIB is about to issue the nation’s first corporate green bond: Working alongside the International Finance Corporation (IFC), the bank is hoping to finalize the issuance through a private placement later this quarter, Heba Abdellatif, head of debt capital markets at CIB, told Enterprise in June. The IFC is on board to invest USD 65 mn in the first tranche of the five-year bonds, but could bump this up to USD 100 mn if the initial offering is a success, Abdellatif said at the time.

M&A WATCH- Talks that could have seen Naguib Sawiris acquire City Gate from developer Qatari Diar have collapsed after the two failed to land necessary approvals within an agreed timeframe, Orascom Investment Holding said in a disclosure (pdf) yesterday. Sources said earlier this year that OIH Chairman Naguib Sawiris had agreed in principle with Qatari Diar to acquire a 60% stake in the project through his real estate business Ora Developers, rather than OIH. The two sides were waiting on the New Urban Communities Authority (NUCA) to approve a deadline extension for the project beyond 2021, which sources said last month was contingent on the acquisition going ahead. The project is owned by Qatari Diar subsidiary East Gate Developments.

Back to the drawing board for Diar: Diar has long sought an exit strategy from the New Cairo development — which it says is now valued at north of EGP 32 bn — after consistently failing to deliver on construction targets, which it had blamed on equipment theft, vandalism and worker intimidation by armed groups. The Qatari developer has tried to terminate contracts, return customer installments and even renegotiate contracts to reel themselves out of the onslaught of lawsuits from City Gate clients. The agreement with Sawiris would have seen the two companies forming a partnership to develop the project, and Diar paying a EGP 1.25 bn fine to NUCA for the delay in completing the project.

Gastec plans to open 23 new natural gas filling stations and five integrated natgas and gasoline stations this year as the government pushes ahead with an ambitious program to convert the nation’s vehicles to run on natgas, Al Mal reports, citing unnamed sources at the company. Trade Minister Nevine Gamea said last month that the government will open another 366 natgas stations around the country as part of a new initiative to outfit mns of vehicles with dual-fuel engines. There are currently 190 natgas stations in the country, 100 of which are operated by Gastec.

TAKE A DEEP DIVE into the subject with Hardhat, our weekly infrastructure vertical, which wrapped up yesterday its three-part look at the conversion plan: Part 1, Part 2 and Part 3.

The great big natural gas transition: The Sisi administration earlier this year announced a multi-year plan to convert or replace 1.8 mn cars to run on both gasoline and natural gas. Owners of vehicles over 20 years’ old will receive low-interest loans through the MSME Development Agency to purchase new dual-fuel vehicles, while those with younger vehicles will be able to access zero-interest finance to outfit them with new engines. President Abdel Fattah El Sisi said that car licenses will be conditioned on citizens complying with the program and converting their vehicles.

Expect to see more cars running on natgas on the road as car distributors look to import CNG-powered models: Fiat and Alfa Romeo’s local agent Dynamics Distribution is planning to roll out passenger cars and cargo vans that run on natural gas “as soon as possible,” CEO Emad Helmy told Hapi Journal. Helmy did not provide further details on the timeline.

STARTUP WATCH- The Egyptian nationalist inside us is *REALLY* unimpressed: Food delivery service formerly known as Otlob will soon become Talabat. Berlin-based Delivery Hero has announced that it will rebrand its Egypt arm Otlob as Talabat from 1 September, Menabytes reports. The name change comes as the company seeks to “consolidate” the Talabat brand, which operates in most of the region outside of Egypt. Otlob has been a mainstay of Egypt’s delivery services and was the first online delivery platform in the region when it was founded in 1999.

Talabat is also planning a major recruitment drive: The Dubai-based company will add 50k new delivery drivers to its fleet, and launch a new mobile app as it expands its operations in Egypt, CEO Tomaso Rodriguez said.

MOVES- Alaa Amer has been named chairman of Misr Central Clearing, Depository and Registry (MCDR) with 93.5% of the total votes cast at a shareholder meeting, according to Hapi Journal. Amer is also currently the chairman of Guardian Capital and previously held the position of vice-chairman at the Capital Market Authority. Amer was running against lawyer Ashraf El Dabaa and will succeed Mohamed Abdel Salam, who resigned in April.

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A senior editorial leader, who will work on this product and help launch new products.

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

The Macro Picture

The wave of covid-19 stimulus is putting emerging markets in a bind: Emerging markets may be lining themselves up for a fresh fiscal crisis caused by the very stimulus measures that prevented a financial meltdown earlier this year, Sydney Maki writes for Bloomberg. Governments and central banks in the emerging world ramped up spending and slashed interest rates as the pandemic intensified, and lockdown measures crippled consumer demand and stifled investment.

A catch-22: Having ridden out the worst of the initial economic storm, markets are now likely to hone in on the troubling levels of debt accumulated during the crisis. Debt-to-GDP levels in emerging markets rose to a record 230% during 1Q2020, and around USD 3.7 tn of debt is due for repayment this year, according to the Institute for International Finance. If limp growth rates persist in the coming months, countries may be forced into more spending, intensifying scrutiny on public finances. Yet, responding to these concerns by cutting back on spending and raising interest rates risks killing off a potential recovery and inviting a protracted recession.

And of course the threat of the virus remains ever-present: A resurgence of the virus in emerging markets will increase the likelihood of a fresh emerging-market debt crisis, the IMF said on Tuesday. Countries with large current account deficits, high levels of foreign currency debt or dwindling foreign reserves may be forced into default if a renewed outbreak sparks further unrest in the markets, the fund said.

And this time a weak USD is unlikely to help them: Emerging markets are unlikely to benefit from the weakening USD as they have in the past due to heightened levels of risk, analysts tell Reuters. In normal times a falling USD tends to translate into higher inflows into emerging markets as investors seek higher rates of return. But although the USD suffered its worst month in a decade in July, bondholders continued to plough more money into US and European junk-rated assets than they did into emerging markets amid concerns over debt sustainability and low levels of liquidity.

Egypt in the News

It’s all geopolitics as far as the eye can see in the foreign press this morning: The Wall Street Journal’s Jared Malsin looks at how the parties to the conflict in Libya are each looking to secure their interests — including Turkey angling to get a piece of Mediterranean energy resources — and how a face-off between Cairo and Ankara on Libyan soil would worsen the crisis. Meanwhile, Reuters and the Associated Press took note of Egypt and Sudan’s withdrawal from GERD talks. Forbes’ contributor network suggests that Egypt’s purchase of Russian warplanes despite potential US sanctions is meant to diversify its arms procurement network.

Worth Watching

2020 sucks, but folks in the GCC are increasingly optimistic about prospects for a recovery: Although low oil prices and covid-19 have left the Middle East battered this year, optimism remains high for a recovery in the near future. This is the message relayed by some of the Gulf’s leading business figures in this Bloomberg special looking at the region’s prospects in the months ahead (watch runtime 24:06). Dubai Tourism chief Helal Al Marri told the news information service that he expects to “see the last quarter of the year much improved” while Emaar chairman Mohamed Alabbar says the firm will be in “good shape” by this time next year. Governor of the Saudi Arabian Monetary Authority (SAMA) Ahmed El Kholifey sees “light at the end of the tunnel but remains vigilant” until a full recovery is complete. The precise timing of the recovery varies but the messaging remains the same. One exception is Qatar Airways CEO Akbar El Baker, who warns that it may take two or three years before a sense of normalcy is restored to the aviation industry.

Diplomacy + Foreign Trade

Egypt is officially taking its objections to Ethiopia’s GERD proposal to the AU: Egypt has formally voiced complaints to the African Union (AU) regarding Ethiopia’s proposal on filling the Grand Ethiopian Renaissance Dam (GERD), which failed to include a binding dispute resolution mechanism, the Irrigation Ministry said in a statement. In a letter to South African President Cyril Ramaphosa, who currently chairs the AU’s, the ministry also called out Ethiopia for its recent unilateral filling of the dam’s reservoir. Egypt and Sudan said earlier this week they’re walking away from the latest round of talks after Ethiopian presented the proposal.

Shoukry talks Libya, regional developments with Spanish counterpart: Foreign Minister Sameh Shoukry discussed political settlement in Libya and other regional development in a phone call yesterday with his Spanish counterpart, Arancha Gonzalez Laya, according to a ministry statement. Shoukry stressed the importance of following through with Egypt’s proposed roadmap to peace in the war-torn country — known as the Cairo Declaration.

Energy

Egypt’s solar energy production up 306% y-o-y

Egypt produced 3,655 GWh of solar energy during the state’s 2019-2020 fiscal year, a 306% y-o-y increase from the 900 GWh recorded the previous fiscal year, reports Al Mal, citing unnamed sources from the New and Renewable Energy Authority. The increase is largely a result of Aswan’s Benban solar power park, which officially came online in December.

Manufacturing

Rubex to restart expansion plans after covid-caused delays

Plastic and acrylic manufacturer Rubex is restarting plans to build four new factories this year, after having put the expansion plans on ice due to covid-19, Chairman Magdy El Taher told the local press. The new facilities include an acrylic recycling plant, a factory to recycle PET, and a wood-plastic composites recycling plant, and the company also plans to modernize and refurbish a solid surface product factory.

IDA to offer 10 mn sqm of industrial land in FY2020-2021

The Industrial Development Authority (IDA) is planning to tender 10 mn sqm of industrial land in FY2020-2021, according to the local press, citing unnamed government sources.

Real Estate + Housing

Emaar Misr obtains approval for EGP 11.5 bn Cairo Gate project

Emaar Misr has obtained Housing Ministry approval for the blueprint of its EGP 11.5 bn Cairo Gate residential project in Sheikh Zayed City, which will be implemented within seven years, reports the local press.

Jaz Group to inaugurate Hurghada, Soma Bay hotels in September

Jaz Hotel Group will open two new hotels this September, one in Hurghada and the other in Soma Bay, at a combined cost of EGP 1.4 bn, Jaz Hotel Group Egypt CEO Alaa Akel told Hapi Journal. The company is planning to inaugurate two more hotels in early 2021 in Marsa Alam.

NUCA reassesses tenders for third phase of PPP program

The New Urban Communities Authority (NUCA) is reassessing issuing land tenders for the third phase of its public-private partnership program, the local press reports, citing a Housing Ministry source. The third phase includes 10k acres of land spread over 20 plots. NUCA is also mulling expanding the program beyond residential projects to include commercial, administrative and recreational projects as well as private universities.

Telecoms + ICT

Egypt signs Arabic-Chinese language research agreement with Iflytek

The ICT Ministry signed a research agreement with China’s Iflytek to develop research projects in Arabic speech recognition, speech synthesis, and Chinese Arabic translation, according to Ahram Gate.

Banking + Finance

Tasaheel and Aman have requested nano financing licenses from the FRA

GB Capital subsidiary Tasaheel, Raya Holding subsidiary Aman, and five other unnamed companies filed for nano-finance licenses from the Financial Regulatory Authority, Al Mal reports. Pharos-backed Kashat, which launched earlier this year, became Egypt’s first ever nano-financing provider, offering loans between EGP 100 and EGP 1,500 to the country’s large unbanked population.

Egypt Politics + Economics

Egypt’s prosecution launches investigation into ‘Fairmont crime’

The public prosecutor’s office has ordered an investigation into allegations of a gang [redacted] incident in 2014. The probe was ordered after the National Council for Women demanded an investigation into allegations on social media that six men intoxicated and [redacted] an 18-year-old woman at a party organized at a prominent Cairo hotel. The case comes amid national uproar against harassment and assault. France’s AFP has taken note of the story. (A note from the editor: We’re using [redacted] not because we’re afraid of saying the words, but because they cause issues with the algorithms that govern our delivery to your inboxes.)

My Morning Routine

Ayman Hakky, CEO and founder of The TriFactory: My Morning / WFH Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Ayman Hakky, the CEO and founder of The TriFactory.

My name is Ayman Hakky, and I’m a proud husband and father to a lovely little baby girl. I’m the founder of The TriFactory, a Cairo-based company that organizes sports events all over Egypt. I have always been passionate about sports and grew up playing tennis and later water polo, winning the national league for Gezira Sporting Club, where I now proudly serve as the youngest board member.

A bad knee injury 10 years ago led me to discover a new passion: Triathlons. Being a former competitive athlete and overall sports enthusiast, it was hard to face the reality of having to leave behind contact sports and find an alternative. My first experience with triathlons was in 2011 while visiting Trinidad & Tobago on a work assignment with my previous employer, BP. One race and I was immediately hooked.

I decided to form a triathlon team, ‘Train For Aim,’ and to start training for races with a group of amateur athletes. This was the kernel of my current business. The group expanded quickly and we traveled all over the world to participate in endurance events, which made me wonder why Egypt lacked such good quality endurance races. Eventually, I organized the first triathlon event in Gouna in the summer of 2014, followed by the first Sahl Hasheesh Triathlon in December of the same year. That’s when I realized I had built something special and decided to quit my corporate job to establish The TriFactory. Today, The TriFactory has a strong management team and organizes popular mass participation sports events in Egypt, including the Pyramids Half Marathon, Sahl Hasheesh Endurance Festival, and Tough Mudder Egypt.

I’m responsible for managing the team and the growth of the company as the CEO. I work closely with a team of 10 managers and employees to apply international standards across all of our races and deliver the best sports events in Egypt.

On a normal day, I try to get as much sleep as I can until my daughter wakes me up around 7am — 8am if I’m lucky. I spend time with my family in the morning, have breakfast and play together before I shift my attention to work and spend a few hours on my laptop and phone at home. At around 10am, I read Enterprise to get caught up on the news. On days when I need to be fully focused, I head to our currently empty office to get things done. In the evening, I enjoy a run or bike ride around Zamalek with friends.

Working from home was very challenging for me. I don’t usually have a strict routine and I’m constantly on the move every day, managing our events or exploring new venues and attending meetings.

There are obviously many distractions at home and to be honest it’s not easy to stay on task for long periods of time, so I instead try to work in several short periods during the day or just put everyone to sleep as early as possible and work at night.

As an event management company, it was hard to do our usual thing during the lockdown, but we launched a series of virtual races — the Stay Safe Marathons. These proved to be very popular and attracted hundreds of participants. In virtual races, participants “join” remotely using smartphones or gadgets that allow us as organizers to track progress and send a finisher medal when they complete the race. Several editions of the Stay Safe Marathon also included charitable elements, which we are very proud of. As well as managing our virtual races, we were also able to develop and launch new events for the future, which we hope to organise in real life starting on October 1st.

I think that the 9-5 office job isn't necessarily dead yet, but that the general trend seems to be moving in a new direction. People probably now finally understand that success is not about the number of hours spent at work but rather the quality of the work delivered. In the future, I think we will see companies offering their staff a new combination of greater flexibility and greater accountability, allowing them to manage their work-life balance safely and appropriately, while ensuring deliverables and KPIs are met.

We were quite lucky at The TriFactory to have already had experience organizing virtual events. During Ramadan in previous years, we had organized virtual running competitions, so we were able to build on the concept quickly once the coronavirus lockdown began.

With more time on my hands, I decided to use the knowledge and entrepreneurial experience I built over the past 5 years to contribute to new projects. I helped establish Doctor Online, a new telemedicine app offering real virtual clinic experiences, founded by one of my business partners, Mahmoud Abdelhakim. I also co-founded Leya Olive Oil with my wife Dina Targam and other business partner, Seif Fawzy, offering all natural and cold pressed extra virgin olive oil, sourced from my family’s farm.

I’m actually a big fan of the Enterprise podcast Making It and in general love reading or watching success stories and biographies, especially in the field of sports because they really inspire me. During the lockdown I really enjoyed watching Michael Jordan’s docu-series The Last Dance, and I also enjoyed reading Andre Agassi’s biography Open, and Shoe Dog, the autobiography by the founder of Nike.

I can’t wait to start organizing events and reuniting with all of our participants. Just before the lockdown we organized our biggest event to date, the Pyramids Half Marathon, attended by over 4000 participants from 80+ countries, and we’re excited to get back out there and build on this major success.

One of the major events we were looking forward to all year long was the 10th edition of the Sahl Hasheesh Endurance Festival, a major milestone for me personally and The TriFactory as a whole, which we are looking forward to seeing happen in the next few months.

The Market Yesterday

EGP / USD CBE market average: Buy 15.94 | Sell 16.04

EGP / USD at CIB: Buy 15.93 | Sell 16.03

EGP / USD at NBE: Buy 15.92 | Sell 16.02

EGX30 (Wednesday): 10,704 (+0.8%)

Turnover: EGP 1.3 bn (36% above the 90-day average)

EGX 30 year-to-date: -23.3%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.8%. CIB, the index’s heaviest constituent, ended up 0.9%. EGX30’s top performing constituents were Dice up 9.2%, Sodic up 5.5%, and Orascom Development up 5.4%. Yesterday’s worst performing stocks were Credit Agricole down 1.3%, Sidi Kerir down 1.2% and AMOC down 1.2%. The market turnover was EGP 1.3 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -97.5 mn

Regional: Net Long | EGP +9.0 mn

Domestic: Net Long | EGP +88.5 mn

Retail: 71.7% of total trades | 68.3% of buyers | 75.1% of sellers

Institutions: 28.3% of total trades | 31.7% of buyers | 24.9% of sellers

WTI: USD 42.19 (+1.18%)

Brent: USD 45.36 (+2.09%)

Natural Gas (Nymex, futures prices) USD 2.19 MMBtu, (-0.09.%, September contract)

Gold: USD 2,053.50 / troy ounce (+0.20%)

TASI: 7,470.26 (+0.15%) (YTD: -10.95%)

ADX: 4,305.92 (-0.28%) (YTD: -15.17%)

DFM: 2,079.39 (+0.03%) (YTD: -24.79%)

KSE Premier Market: 5,490.97 (+0.35%)

QE: 9,321.96 (-0.49%) (YTD: -10.59%)

MSM: 3,568.10 (+0.28%) (YTD: -10.38%)

BB: 1,292.44 (+0.14%) (YTD: -19.73%)

Calendar

5 August (Wednesday): IHS Markit PMI for Egypt released.

9-10 August (Sunday-Monday): Egyptian expats vote by post in Senate elections.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 August (Thursday-Saturday): RiseUp from Home digital event. Pre-registration available here.

16 August (Sunday): House of Representatives reconvenes after a brief recess.

20 August (Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.