- Meet Abdalla ElEbiary, the new chief investment officer of the Sovereign Fund of Egypt. (Speed Round)

- IFC is investing USD 10 mn in smart meters outfit Globaltronics. (Speed Round)

- P&G to invest USD 50 mn in Egypt by the end of 2021 to expand manufacturing. (Speed Round)

- Egyptian Steel mulls post-covid IPO, says some investments on hold. (Speed Round)

- Egypt, Southern Africa were the two bright spots in Africa last year as FDI dipped across the continent –UNCTAD report. (The Macro Picture)

- Prospect of intervention in Libya dominates the conversation on Egypt in the international press. (Egypt in the News)

- What you really think of e-learning. (Blackboard)

- The Market Yesterday

Monday, 22 June 2020

Egypt was Africa’s FDI bright spot last year

TL;DR

What We’re Tracking Today

It’s a deceptively slow news day, ladies and gentlemen, with few “big” business / finance / econ stories vying for headlines as attention is squarely on the trifecta that is covid-19, the breakdown of GERD talks with Ethiopia, and the spectre of military intervention in Libya.

It’s an even slower newsday abroad — slow enough that CNBC is making into front-page, above the fold news a piece on a 39-year-old guy watching the Star Wars movies for the first time…

Worth reading for the startup types and fintech bros out there: German fintech outfit Wirecard, a payments firm and erstwhile success story, is scrambling to figure out how EUR 1.9 bn has gone missing. They asked their auditors, who don’t know where it’s gone, either. Investors and regulators both appear to have been asleep at the switch, exposing the global fintech industry to new calls for sharper regulatory oversight. The FT literally owns the story. Raising money for fintech? Expect some pointed DD questions ahead.

Over in the US of A: The Donald’s desultory rally was trolled by US teens and K Pop fans, and the Wall Street Journal is cheering the fact that non-tech shares are now helping lead Wall Street’s rally.

For the iSheep among us: The outcome of this evening’s keynote to open Apple’s first-ever virtual WWDC at 7am CLT will likely lead business news tomorrow. You can watch the keynote here live.

News triggers in these final days of the month: The CBE will review interest rates this coming Thursday, and the IMF’s executive board is to meet on Friday to discuss Egypt’s request for a USD 5.2 bn standby facility, according to the fund’s calendar.

A little less certain: Founding members of the East Med Gas Forum were to meet this month in Cairo to finalize their founding charter, but no date has yet been announced. Meanwhile, the government’s fuel pricing committee is set to meet in the first week of July for its quarterly review of fuel prices. The committee cut prices on all grades of fuel by 0.25 EGP at its last meeting in April.

COVID-19 IN EGYPT-

The Health Ministry confirmed 87 new deaths from covid-19 yesterday, bringing the country’s total death toll to 2,193. Egypt has now disclosed a total of 55,233 confirmed cases of covid-19, after the ministry reported 1,475 new infections yesterday. We now have a total of 16,214 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 14,736 have fully recovered.

The Health Ministry expects to see a drop in new covid-19 cases by mid-July, head of the ministry’s covid-19 control committee Hossam Hosny told talk show host Khaled Abu Bakr last night. Hosny also hinted at forthcoming news on the availability of more beds for covid-19 patients (watch, runtime: 4:45).

The Central Bank of Egypt has extended until 15 September its decision to exempt EGP-denominated transfers between local banks from fees and commissions, according to a circular (pdf). The CBE first ordered banks to charge no fees and commissions on these transfers in March as part of a bid to reduce footfall in branches.

Cleopatra Hospitals transformed two of its hospitals — El Katib and Queens — into covid-19 isolation and treatment facilities in mid-May, the company announced yesterday (pdf). The group has also launched home visits and a telemedicine app to aid patients who wish to be treated from home.

“Work, engage and communicate in an environment inspired by tranquility promoting productivity, clarity, and peace of mind.”

“Work, engage and communicate in an environment inspired by tranquility promoting productivity, clarity, and peace of mind.”

ON THE GLOBAL FRONT-

It may be time to think of covid-19 as a long-burning forest fire and not something that comes and goes in waves, a top US epidemiologist says.

Dubai is opening its doors to tourists on 7 July for the first time since going on lockdown, according to Bloomberg. Incoming visitors will have to present certification verifying they have tested negative for covid-19 or be tested at the airport.

Israel may reimpose lockdown measures if citizens don’t abide by mask-wearing and social-distancing rules, Prime Minister Benjamin Netanyahu warned on Sunday, following a spike in new covid-19 cases, Bloomberg reports.

AND THE REST OF THE WORLD-

Japan is trying to lure Hong Kong-based financial institutions to Tokyo as concerns about Chinese encroachment in the territory grow, the Financial Times reports. The government is reportedly considering offering visa waivers, office space without charge, and tax advice to asset managers, traders and bankers in a bid to capitalize on fears triggered by China’s national security law. The bill would give Beijing the right to intervene directly to disperse gatherings and supervise policing of “subversive events” in the city and would see China setting up a central office in Hong Kong authorized to gather intelligence, among other things, reports the Wall Street Journal, citing newly released details of the controversial bill.

Making It is back this Thursday for the final episode of its second season. Until then, catch up on season two on: Our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Enterprise+: Last Night’s Talk Shows

Foreign policy was in the limelight once again on the airwaves last night.

Shoukry speaks on GERD, Libya: Egypt is working to bring all parties to the Libyan conflict to the negotiating table to work out a political resolution and avoid a military escalation in our western neighbor, Foreign Minister Sameh Shoukry told ‘Ala Mas’ouleety’s Ahmed Moussa. The minister noted that the emergency Arab League meeting on Libya, which Egypt called for, is scheduled to take place today. Shoukry also discussed Egypt’s decision to turn to the UN Security Council on the Grand Ethiopian Renaissance Dam, telling Moussa that the council should block Ethiopia from unilaterally deciding to fill the dam’s reservoir before reaching an agreement with its downstream neighbors (watch, runtime: 10:56).

Elsewhere, Education Minister Tarek Shawki recapped the first day of Thanaweya Amma exams and the ministry’s efforts to prevent any coronavirus infections inside exam halls in a phone call with El Hekaya’s Amr Adib (watch, runtime: 0:54).

Speed Round

Speed Round is presented in association with

MOVES- Meet Abdalla ElEbiary, the new chief investment officer of the Sovereign Fund of Egypt: The covid-19 crisis has shifted the calculus for nationstates and investors alike, with many having to shift gears on both long-term and short-term investments. Egypt is no different. But while worrying about the short-term is essential, it is almost equally important to not lose sight of the long-term goals that will position us to better take advantage of the recovery. That’s precisely what the Sovereign Fund of Egypt (SFE) hopes to do, and you can see that in the transactions it has so-far disclosed. The SFE signed an MoU last month with New York-based Concord International Investments to set up a joint venture to manage a USD 300 mn healthcare fund focused on Egypt and the Middle East, while also expressing interest in logistics and transportation projects. This is in turn balanced by long-term transactions in sectors that are underperforming during covid-19 today, such as tourism with the Bab El Azab revamp. As the SFE’s role in this balance becomes more crucial during the crisis, having the right CIO is important.

Enter our friend Abdalla ElEbiary, who many readers may remember from his time with private-equity outfit turned investment company Qalaa Holdings. He’s no Nostrodamus (as much as we may feel like we’re living through a film based on some Nostradamus fever dream). But he is someone who knows private equity and balancing long-term risks and rewards, having joined Qalaa in the early days after a run at at the investment banking division of Meryll Lynch.

In his first interview since his appointment, ElEbiary discusses what the role of the SFE is during the crisis. He walks us through how best to navigate it, and how best to position Egypt for a recovery. He also updates us on the fund’s strategy, the status of key transactions, his ideal investment scenario, and what investors want to get out of Egypt in these times.

Edited excerpts from the interview:

What’s the role of the SFE during the crisis? In general, the fund’s goal is to enhance investment in Egypt and maximize the value of public sector assets for future generations. In a perfect scenario, a consortium of local, regional, and international investors would be assembled, some bringing operating experience and specific technical knowhow, to join forces with the SFE to refurbish or add value to a public sector asset. The partnership would result in a successful transaction, with generous, private-sector targeted returns for investors, sustainable development, and knowledge and management transfer to the Egyptian economy, says ElEbiary. “That scenario would hit all my high notes.”

Covid-19 has meant refocusing on healthcare, food and food security, logistics and infrastructure during the crisis period. The SFE already announced its intention to do this, says ElEbiary. “Globally, the pandemic has highlighted the need for more healthcare investments, and I think Egypt would benefit from this.” It’s also demonstrated the importance of food security, part of which comes from solid and uninterrupted supply chains. The SFE is emphasizing partnerships and investment projects that tackle these specific industries, launching a healthcare fund, considering setting up strategic medical warehouses, and planning other investments that will be announced in due course, he adds.

But creating long-term value requires a long-term investment outlook, so hard-hit key areas like tourism won’t be overlooked either. Private equity as a vehicle has a 7-10-year investment horizon, but the SFE takes an even longer-term view, says ElEbiary. “We need to make the right fundamental investment decisions, not based on anomalies or where we are in the business cycle.” Tourism, specialized real estate projects, and hospitality management are sectors where Egypt has a strategic advantage, so it’s important to continue investing in them, even if they’re temporarily hit by covid-19. So developments like the recently announced Bab El Azab revamp or developing the Mugamma El Tahrir are long-term projects that will take years rather than months, and ultimately add value to the Egyptian economy in a sustainable way.

We’re also looking to monetize the fruits of previous long-term investments that are garnering investor interest. The government’s investment in infrastructure projects from 2016 onwards has built up Egypt’s economy so it continues to attract investors. Projects like the Siemens-built combined-cycle power plants, and the construction of desalination and wastewater treatment plants are large-scale, successful initiatives that are attracting interest from local, regional and international investors, says ElEbiary. Now it is time to monetize these projects, he adds.

SFE transactions including sale of the Siemens power plants and the potential listing of Armed Forces companies are still on the table, but details are limited. All of these projects are moving forward, says ElEbiary, but they are ongoing processes, so there’s a limit to how much information can be disclosed. Investors have expressed interest in the Siemens plants, and discussions with others about buying shares in army-owned companies are expected to take place “in the very near future.” The Bab El Azab project agreement was signed in early June, and now developing the plans and structure of the investment is the priority, before securing the right investors and setting the budget, he says.

The SFE’s partners should expect returns that are in line with the private sector, says ElEbiary. Investors should also expect ROIs in line with market performance, especially as Egypt’s country risk keeps coming down over the long-term. A fund’s ROI needs to be measured against its lifecycle, which is typically 7-10 years, says ElEbiary. Thanks to the devaluation, the IMF program, subsidy cuts and other measures, Egypt has taken important steps to improve the government balance sheet, and its risk-adjusted return keeps decreasing. All this helps to make Egypt’s investment climate more attractive.

And the SFE’s current focus of capital and resources on specific sectors, as well as its ESG plan, align with global investor priorities. Sustainable development and having environmental, social and governance (ESG) criteria for projects doesn’t necessarily mean you should expect them to yield returns lower than private sector-targeted returns, ElEbiary emphasizes.

What also helps? The SFE is designed to be as agile as a private sector entity: The SFE has been set up to work and undertake transactions like a private sector outfit, meaning it is flexible to move as rapidly as possible, says ElEbiary. The people who work there are dynamic and responsive, and all are aligned in wanting the best for Egypt and wanting to act quickly. The first item on the agenda when he settles into the role and checks on safety protocols is some organizational housekeeping, he tells us. It’s about making sure the right people are sitting round the table and they have the right hiring policy in place to continue attracting top talent.

Whatever shape the recovery will take, the SFE has to lay the groundwork for it: Whether we’re set to see a V-shaped, U-shaped, or W-shaped recovery is very difficult to judge and will depend on global trends and how the pandemic changes, says ElEbiary. The IMF has said that for the first time since the Great Depression, both advanced and emerging market economies will be in recession in 2020, so it really becomes a question of who can best weather the storm and rebound the fastest. “The post-2014 economic reform, the pipeline of transactions we are developing in multiple industries, are all testament to how solid the Egyptian economy is today,” he adds. Though they have a long list of prospective investments and partners, it’s relatively easy to prioritize some investments — which could be quick wins — and put others on the back burner, in response to the ups and downs of the market. “This is not a one or two-year race, or even a ten-year race. This is a much longer race than that,” he says.

You can catch the rest of the interview here, in which ElEbiary talks about expectations on the M&A and IPO fronts for the coming period — and why the SFE is fundamentally not about crowding out the private sector.

INVESTMENT WATCH- IFC is investing USD 10 mn in smart meters outfit Globaltronics: The International Finance Corporation (IFC) is investing USD 10 mn in Egyptian electricity measurement technology manufacturer Globaltronics to help expand the company’s prepaid digital meter installation program across Egypt, according to an IFC statement. The smart electricity meters are designed to provide both the government and households with more accurate billing information for home electric consumption. Globaltronics will use the funding in part to set up a new manufacturing facility in Saudi Arabia as part of its planned expansion across the Middle East and Africa, Chairman Hany Assal said.

INVESTMENT WATCH- P&G to invest USD 50 mn in Egypt by the end of 2021 to expand manufacturing: Procter & Gamble (P&G) is planning to invest USD 50 mn by the end of 2021 to expand production capacity, Near East Vice President Tamer Hamed told GAFI Chairman Mohamed Abdel Wahab, according to a cabinet statement. The new investment will add a new production line to manufacture protective face masks and expand existing lines at its two factories in Sixth of October. The US consumer goods giant has invested more than USD 200 mn in Egypt to date, and exports USD 200 mn of products each year to 35 countries.

IPO WATCH- Egyptian Steel Group could go public on the EGX once the covid-19 crisis has died down, founder and CEO Ahmed Abou Hashima told Hapi Journal, without providing additional details. He added that the crisis has postponed a number of investments it had in the pipeline, including the opening of sister company Egyptian Cement’s factory in Sohag.

DEBT WATCH- AIH’s Rawaj to recall EGP 226.5 mn of securitized bonds to benefit from falling interest: Rawaj Finance is planning to recall EGP 226.5 mn of securitized bonds from investors and reissue them at a lower interest rate following the central bank’s 300-bps cut in March, the local press reports, quoting an unnamed source at Rawaj’s parent company, Arabia Investments Holding (AIH). The consumer finance company had used proceeds from a recent securitized bond sale for onlending. Raya Holding was involved in a similar move earlier this year, when it said it was looking to reissue EGP 500 mn of securitized bonds in response to the central bank’s rate cut.

Rawaj has also been given preliminary regulatory approval to set up a factoring arm and plans to have the subsidiary up and running this year, the source said. This would improve its access to liquidity amid plummeting demand for car loans due to the covid-19 pandemic. We took a deeper look into how the virus is impacting the auto sector last week.

Cabinet has ratified twelve oil and gas agreements the Oil Ministry signed with international companies in February, the ministry said in a statement. Companies including Royal Dutch Shell, Chevron, BP, Total, Noble Energy will invest upwards of USD 1 bn in concession areas in the Mediterranean, the Red Sea, and the Western Desert. The House of Representatives still needs to give a final signoff.

STARTUP WATCH- Egyptian fintech startup MoneyFellows has raised USD 4 mn in series A funding from Sawari Ventures and Partech, according to an emailed statement (pdf). MoneyFellows plans to use the funds to finance its expansion in Africa, as well as the roll-out of a “slew of new products in the coming months,” the statement says. The company, which digitizes “money circles” (known in Egypt as gam’eyas) using a scoring model, had raised USD 1 mn in pre-series A funding last August to scale its user base.

EARNINGS WATCH- Cleopatra Hospitals Group reported a net profit of EGP 88 mn in 1Q2020, up 60% from EGP 55.1 mn in 1Q2019, the company said in an earnings release (pdf). Revenues came in at EGP 502.9 mn, a 21% increase from EGP 416 mn last year. CHG was able to “deliver strong top and bottom-line growth with margins in line with their historical averages” and now has a strong liquidity position with cash on hand as of 31 March, CEO Ahmed Ezzeldin said. “This serves as a testament that the group’s underlying business development remains intact and that our business model is resilient.”

Looking ahead: Ezzeldin expects a slowdown in second quarter results with volumes falling to pre-covid levels. “We are cautiously optimistic that once the crisis resolves our proactive response to the outbreak, the strategic initiatives we have taken to mitigate the operational and financial impacts, the outstanding efforts of all our staff, and the solidity of our business model, will see us emerge in an even stronger position within the Egyptian healthcare industry,” Ezzeldin said.

MOVES- Mohamed El Saadawi, head of the Egyptian Ferro Alloys Company (EFACO), is likely to succeed Medhat Nafea as chairman of the state-owned Metallurgical Industries Holding Company after Nafea resigned from his position on Saturday, according to Hapi Journal.

The Macro Picture

Egypt, Southern Africa were the two bright spots in Africa last year as FDI dipped across the continent: Egypt remained the top recipient of foreign direct investment (FDI) in Africa last year, with inflows rising 11% y-o-y to USD 9 bn, according to UNCTAD’s 2020 World Investment Report (pdf). Egypt’s rising FDI receipts bucked the downward trend in the rest of Africa, which saw a 10% y-o-y drop in inflows to USD 45 bn last year. Southern Africa stood out as the continent’s only subregion with higher FDI flows in 2019 (+22%) but the report notes that this uptick was mainly driven by a slowdown in net divestment from Angola, as inflows to the region’s largest economy, South Africa, decreased by 15% in 2019.

The downtrend preceded covid-19, but the pandemic is likely to continue weighing on FDI prospects for the continent this year. The first quarter of 2020 already saw a notable dip in greenfield investment, with the value of these projects taking a harder hit than their volume. Monthly cross-border M&A targeting Africa also plummeted 72% in April. UNCTAD now projects a 25-40% drop in FDI this year, particularly as GDP forecasts have been slashed from 3.2% growth to a 2.8% contraction in 2020 as investment projects are being put on ice due to the economic uncertainty surrounding the pandemic. The report sees investments in aviation, hospitality, tourism, and leisure — which accounted for 10% of the USD 77 bn-worth of greenfield projects last year — being affected more than other industries.

A beacon of hope: Even with global FDI expected to nosedive 40% in 2020 and fall another 5-10% next year, UNCTAD sees a rebound in the cards in 2022 — but still notes that the outlook is “highly uncertain.” The recovery will be led by a restructuring of global value chains “for resilience, replenishment of capital stock and recovery of the global economy,” the report says. In the meantime, UNCTAD stresses that focusing on investing in developing infrastructure and domestic resources in Africa will help make individual countries more resilient.

Image of the Day

“Ring of fire” eclipse lights up eastern hemisphere: Yesterday’s summer solstice brought with it a rare kind of solar eclipse. Sometimes referred to by astronomers as a “ring of fire,” the annular eclipse appears as a disk of light in the sky, caused by the moon being too far from Earth to cause a total solar eclipse. The eclipse passed from west to east over 12 countries.

Egypt in the News

Egypt signaling it could intervene in Libya is still leading the conversation in the foreign press this morning. The National notes Saudi Arabia, the UAE, and Bahrain backing Egypt’s right to stage a military intervention to protect its borders if the Government of National Accord attempts to seize the Libyan city of Sirte. A ceasefire in the strategic city depends on whether Russia and Turkey can reach an agreement, Financial Times’ Heba Saleh says.

Also getting attention in the foreign press:

- Egypt’s papyrus industry is in trouble: The absence of tourism in Egypt the past few months has caused the demand for papyrus to plummet, causing manufacturers to stop production and wait for better days, according to Reuters.

- Reuters took note of the start of Thanaweya Amma exams yesterday, which saw masked highschoolers screened for fevers before packing into testing centers.

Diplomacy + Foreign Trade

Egypt’s potential Libya interaction is legitimate, Shoukry reiterates: Foreign Minister Sameh Shoukry yesterday echoed Saturday’s statements by President Abdel Fattah El Sisi, telling Al Arabiya (watch: runtime: 13:15) that any military intervention in Libya to protect our western borders with Libya would be legitimate, but stressed that such a course would be Egypt’s last resort. Cypriot Forein Minister Nicos Christodoulides told Shoukry in a phone call yesterday that Nicosia supports Egypt’s position. Shoukry also discussed the Libya issue with his Russian counterpart, Sergei Lavrov.

Shoukry also maintained the government’s willingness to find a political solution with Ethiopia over the Grand Ethiopian Renaissance Dam, stressing that the decision to escalate the dispute to the UN Security Council following the breakdown in talks last week came as Ethiopia “has consistently refused to mediate." The minister also discussed Egypt’s position on the negotiations with the Associated Press.

The World Bank has disbursed the first USD 325 mn tranche of a USD 500 mn facility to subsidize the Takaful and Karama cash subsidy programs, Social Solidarity Minister Nivine El Kabbag tells Al Mal. The remaining USD 175 mn is expected to land in Egypt within days, according to El Kabbag.

e-School: How’s that working out for students and parents? The nationwide closure of in-person learning in mid-March saw schools scrambling to roll out e-learning systems as quickly as possible. The shift toward blended or distance learning could be a long-term development when school as parents pray they can ship their kids back to school this fall. But just how effective are the e-learning platforms being used? And how have teachers adapted to leading remote classes? We put these questions to parents in a poll.

The results: Overall, the platforms still need to be more interactive and should be supplemented by more feedback from teachers and less overall reliance on parents. Schools should also be offering a longer academic year or reduced tuition fees, as the platforms are not a complete substitute for classroom learning, many of you believe. 45% of respondents said they have children in elementary school (KG1-Grade 5), 17% in middle school (Grades 6-8) and 19% in high school (Grades 9-12).

The jury’s out on how effective online e-learning platforms are at helping your children master the curriculum. 44% of you found them somewhat effective, while 56% weren’t so sure. Several parents said the platforms work well as tools for learning, but only when they are used by effective and committed teachers. One respondent wants all school subjects covered through online sessions, and not just core subjects such as math, English and science. Others were less convinced of the effectiveness of the platforms themselves: Children are learning 10% of what they would usually learn in school, and the content they’re being presented with is insufficient to match what they would learn in a regular school setting, says one.

Online learning is a good way to deliver content, but doesn’t do a great job of assessing students’ progress or offering them chances for interaction. 41% of you found e-learning most effective as a way to deliver and explain lessons, while 38% think it is best for assigning and submitting homework and research projects. A substantial 42% of you think e-learning is least effective at assessing a student’s progress, and almost two-thirds of you (63%) also give it a low ranking for student interaction, communication and participation.

Interaction is one area where parents feel online platforms could improve a lot. One parent recommends allocating at least one online class every other week as time for children to ask their teachers general questions. Another believes monitoring processes should be in place to ensure that teachers pay attention to every student, and that it should be a requirement for every student to actively participate in class discussions. And there need to be more chances for children to interact with their peers as well, says a third parent.

Parents are on the fence about whether e-learning platforms work well for their child’s age. 84% of you came down somewhere in the middle, with 34% agreeing that the platform works well for your child’s grade and 25% disagreeing.

Not surprisingly, parents of very young children are feeling the strain of e-learning the most. Online learning isn’t as effective as traditional schooling, because younger children haven’t developed the commitment to complete work online, a parent tells us. A child-friendly interface that would spark children’s interest in the online learning experience would be better for pre-K children than what they have at the moment, said another parent.

Most of you find your online learning platform user-friendly, with 25% saying it’s very user-friendly and 47% saying it’s somewhat user-friendly. The majority of your children are using their school’s in-house e-learning platform (44%) or an external platform (31%), with far fewer using the government’s platform (16%) or another.

But the platforms need to be more integrated, and technical issues — including connectivity problems and how to mute or unmute students — need to be overcome. Assignments should be completed online, rather than being printed out, completed, scanned and then reuploaded, one of the parents we asked said. And some special sessions should be held for students and parents to get to know the technical aspects of the platforms, said another. Technical problems don’t always come from the school’s side, but we need support overcoming them, she adds.

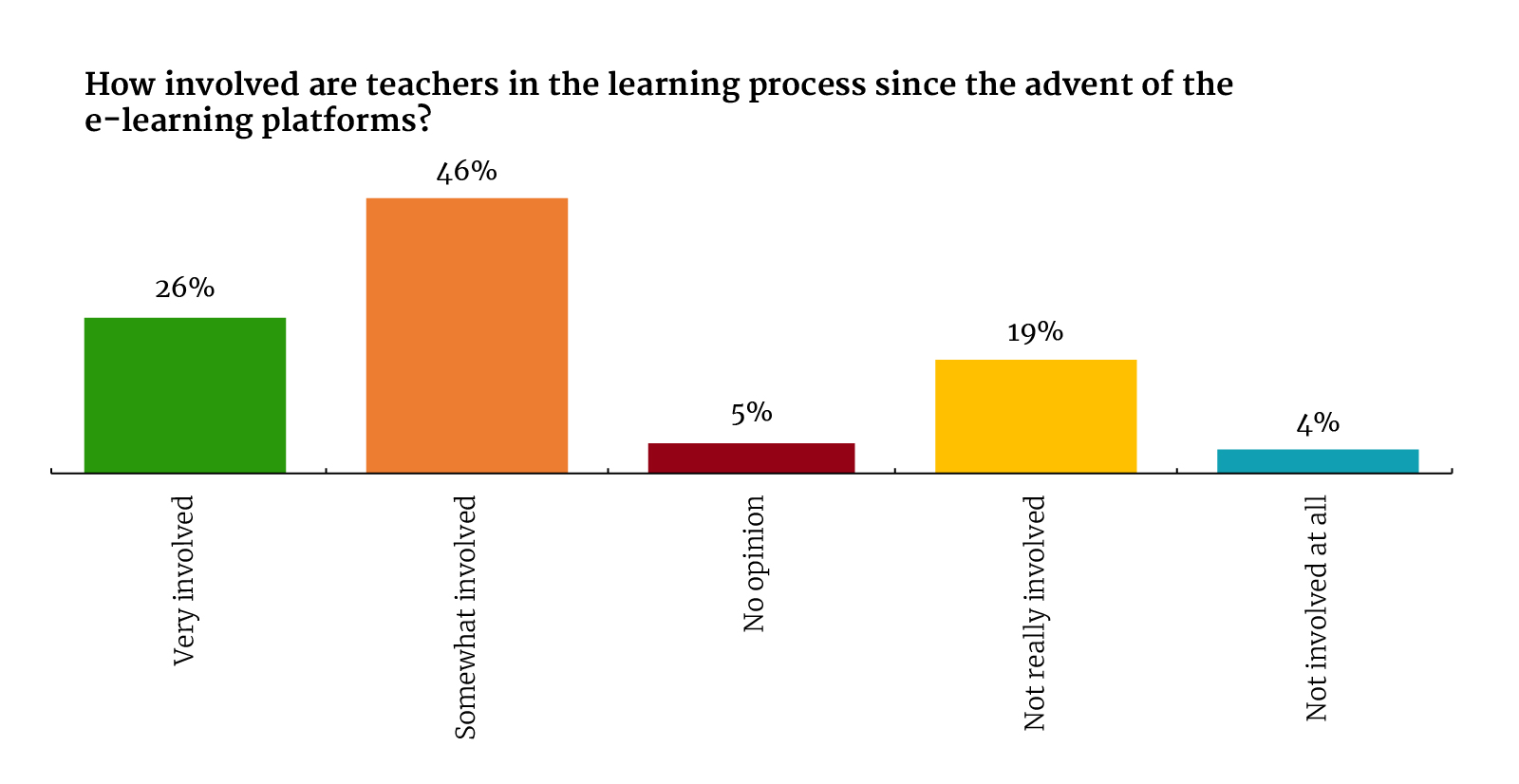

72% of you said that teachers were either somewhat or very involved in online learning.

But many parents believe that more teacher involvement is needed. The value of the online platform depends to some extent on how committed the teachers are to giving classes. The platform itself is good but is missing the degree of teacher engagement that you would get in the classroom, said one parent. Another parent reported that not all teachers show the same interest in using the platform.

Generally you feel the biggest burden has fallen on parents. 81% of you say that parental involvement has been a feature of online learning.

This heavy involvement is a strain for many parents. A virtual classroom setup would allow children to work independently on tasks and assignments without needing so much guidance, said one parent. Schools need to consider children’s mental health when setting tasks, and they should also consider the needs of working parents, one woman said.

Many parents want more communication and feedback from teachers. 67% of you feel that teachers are doing a good job explaining lessons and setting assignments through distance learning. But only 8% of you feel teachers are communicating clearly, 10% feel they are giving effective feedback, and only 6% feel that they are providing extra support.

Teachers should be stepping up when it comes to checking that students understand the lessons and providing clear feedback, one parent said. There’s too much reliance on parents for this, they added. Another would like to see more dialogue between parents and teachers on how children are performing. And one parent proposes adding an explanation tab or video to assignments set, providing answer sheets to quizzes, and giving children more one-to-one feedback.

And teachers who are also parents face frustration on two fronts. “I just want social interaction for my child again. And as a teacher, I just want to go back to the classroom and see the students again, and teach purposefully with interaction,” said one parent.

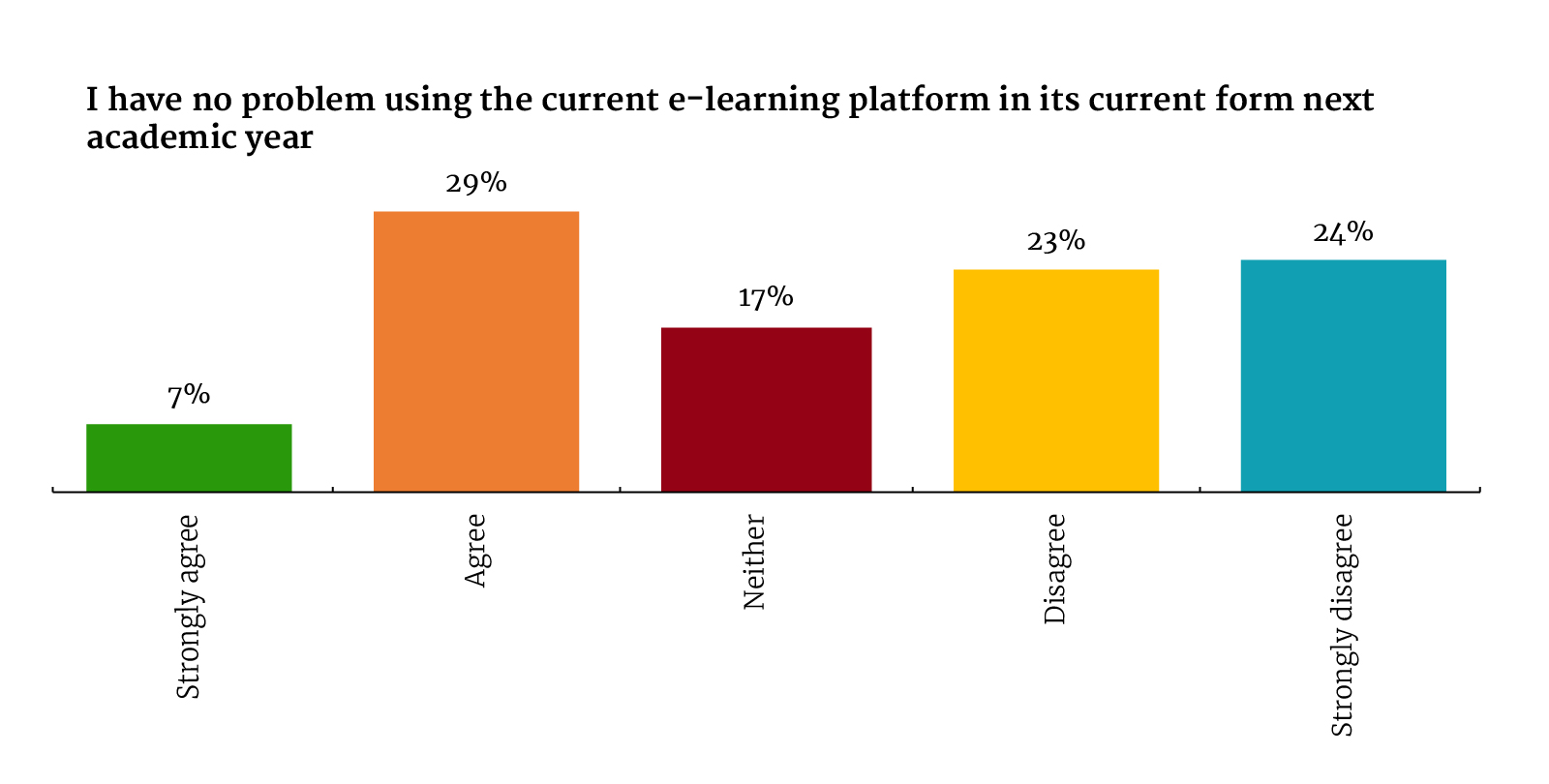

Almost half of you want to see changes made to the e-learning platforms if they’re going to be used again next academic year. 47% either disagreed or strongly disagreed with using the platform in its current form.

And many of you are pushing for compensation or a reduction in fees: As we noted earlier this month, parents at some private schools, who have requested a deferment of at least 15% of total 2019-2020 tuition fees, are fighting requests by some schools to pay next year’s fees early. Lockdown severely impacted workers, therefore school fees should be significantly lowered too, said a parent. E-learning is no substitute for the classroom, said another, and because children are missing a big part of what they would learn in school, there should be compensation next academic year — either by the school year being longer, or through a reduction in tuition expenses. “I think you have to overhaul the whole system from pre-K to Grade 12, if you want to make it work right,” he adds.

Your top education stories of the week:

- The government has raised its forecast spending on education and health next fiscal year, according to a final version of the budget that made it through the House.

- Leading private sector education outfit Cairo for Investment and Real Estate Development (CIRA) is in talks to purchase an 11k sqm land plot in Assiut to build an international school.

- CIRA’s flagship Badr University has ranked 79 in the 2020 list of the top 100 World Universities with Real Impact (WURI) index.

- Cabinet has approved amendments to the executive regulations of the Universities Act to set up an artificial intelligence department in Tanta University.

- Arabic-language learning and development platform Zedny.com launched last week with a pre-seed investment of USD 1.2 secured from unnamed angel investors.

The Market Yesterday

EGP / USD CBE market average: Buy 16.12 | Sell 16.22

EGP / USD at CIB: Buy 16.12 | Sell 16.22

EGP / USD at NBE: Buy 16.10 | Sell 16.20

EGX30 (Sunday): 10,824 (-0.3%)

Turnover: EGP 761 mn (2% below the 90-day average)

EGX 30 year-to-date: -22.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.3%. CIB, the index’s heaviest constituent, ended down 0.6%. EGX30’s top performing constituents were Eastern Company up 2.4%, KIMA up 1.8%, and Juhayna up 1.5%. Yesterday’s worst performing stocks were Pioneers Holding down 3.2%, Qalaa Holding down 2.8% and Palm Hills down 2.0%. The market turnover was EGP 761 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -3.9 mn

Regional: Net Short | EGP -1.7 mn

Domestic: Net Long | EGP +5.6 mn

Retail: 83.7% of total trades | 82.3% of buyers | 85.1% of sellers

Institutions: 16.3% of total trades | 17.7% of buyers | 14.9% of sellers

WTI: USD 39.75 (+2.34%)

Brent: USD 42.19 (+1.64%)

Natural Gas (Nymex, futures prices) USD 1.67 MMBtu, (+1.89%, July 2020 contract)

Gold: USD 1,753.00 / troy ounce (+1.27%)

TASI: 7,345.88 (-0.13%) (YTD: -12.44%)

ADX: 4,334.75 (-0.24%) (YTD: -14.60%)

DFM: 2,058.55 (-0.94%) (YTD: -25.54%)

KSE Premier Market: 5,482.08 (+0.71%)

QE: 9,285.13 (-0.38%) (YTD: -10.94%)

MSM: 3,525.34 (+0.27%) (YTD: -11.45%)

BB: 1,274.55 (+0.02%) (YTD: -20.84%)

Calendar

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26 June (Friday): The IMF’s executive board will decide on whether to disburse a USD 5.2 bn standby loan.

30 June (Tuesday): Anniversary of the June 2013 protests, national holiday.

1 July (Wednesday): Official reopening of Egypt’s airspace to inbound and outbound international flights.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.