- El Sisi announces EGP 100 bn stimulus and bailout package. (What We’re Tracking Today)

- CBE to launch unprecedented EGP 20 bn share-purchase program in a bid to stem EGX sell-off. (Speed Round)

- House suspends discussions on auto strategy, Public Enterprises Act amendments indefinitely. (Speed Round)

- Will Egypt extend the flight ban beyond 31 March? (What We’re Tracking Today)

- Maridive in talks with creditors amid struggles with covid-19, plunging oil prices. (Speed Round)

- Gov’t to award two-year exploration licences for winning bids in mineral exploration round. (Speed Round)

- US Senate fails to agree multi-tn USD stimulus package amid tanking GDP forecasts; markets are not happy. (What We’re Tracking Today)

- How schools and universities are adapting exams in the midst of the covid-19 outbreak (Blackboard)

- The Market Yesterday

Monday, 23 March 2020

CBE to launch EGP 20 bn share-purchase program to halt EGX sell-off

TL;DR

What We’re Tracking Today

Egypt now has 327 confirmed cases of covid-19 after 33 new cases, all Egyptians, were reported yesterday by the Health Ministry. Four more people are confirmed to have died of the disease — all aged between 51 and 80 years old — bringing the death toll to 14. A total of 56 patients are now reported to have fully recovered, while others seventy-four now appear to be on the path to recovery after having tested negative for the virus that causes covid-19.

Nearly every governorate now has covid-19 cases: Cases have been reported in 24 of the nation’s 27 governorates, Health Ministry spokesman Khaled Megahed told El Shorouk yesterday.

Egypt sees first high-profile casualty of covid-19: Maj. Gen. Khaled Shaltout has died after contracting the virus while helping with sterilization efforts in Minya Governorate, the Armed Forces said in a statement, Al Masry Al Youm reports. The Associated Press also picked up the news, which led the news last night (watch, runtime: 1:03).

The president speaks on covid-19: President Abdel Fattah El Sisi gave his first televised address on the state’s efforts to combat the virus during a meeting with cabinet members yesterday (watch, runtime: 48:06).

El Sisi announced a stimulus and bailout package worth nearly EGP 100 bn as Egypt manages fallout from the global and domestic spread of the covid-19 virus:

- The Central Bank of Egypt will allocate an unprecedented EGP 20 bn to support the stock exchange (See detailed coverage in Speed Round below);

- EGP 27.6 bn will be disbursed to 2.4 mn families, totaling some 10 mn citizens. The funds could be disbursed “possibly within weeks,” Al Masry Al Youm reports Social Solidarity Minister Neveen Qabbaj as having later said. The funds will be funnelled through an amendment to the recently ratified Social Security and Pensions Act that will allow pensioners to add the previous five raises to their pensionable pay under the new law (approved in principle) at 80% of their basic wages.

- The CBE’s EGP 50 bn tourism bailout fund earmarks for impacted hotels;

- Implementation of the tax on agricultural land will be suspended for two years. Policymakers had been on track to bring it into effect in July of this year after imposing a three-year suspension back in 2017.

- Annual raises for pensioners will be 14% starting next fiscal year.

El Sisi stressed that Egypt is not past the worst of the crisis and vowed that the Health Ministry and the Armed Forces’ chemical warfare and sanitation crews will be doing more in the coming days. He thanked citizens for their steadfastness in enduring hardships from the country’s economic reform plan, saying the country would not be in a position to cope with covid-19 had the reform package not been enacted..

Social media sites are humming with commentary on the virus and Egyptians are maintaining a good sense of humor, El Sisi said. He called on citizens, however, to maintain discipline and abide by the state’s precautionary measures, sta: home where they can and work hand-in-hand to prevent “great losses.” He said that the state was dealing with the contagion according to World Health Organization’s guidelines and thanked Egypt’s heroic medical doctors. He added that closing down houses of worship was “a given” under the circumstances and added that his administration was committed to being transparent with the public about the crisis.

COVID-19 IN EGYPT-

Will the suspension of international flights to and from Egypt be extended? An extension to the two-week flight ban has been floated for the first time after tourism chamber head Hossam El Shaer told El Kahera Alaan’s Lamees El Hadidi last night that the Civil Aviation Ministry could move to delay the resumption of flights (watch, runtime: 04:51). The government halted all inbound and outbound passenger flights last Thursday in a bid to contain the spread of covid-19. Flights are due to resume on 31 March. We have more on El Shaer’s interview in Last Night’s Talk Shows, below.

Lower energy costs for industry will go into effect in bills for March 2020, Al Mal reports, citing unnamed sources.

Folks feeling the pinch of credit card debt can reach out to their bankers for help: The Central Bank of Egypt’s (CBE) decision to postpone interest payments on bank loans also applies to payments on credit cards as well as personal car and home loans, the CBE said in a circular to banks (pdf). CBE Governor Tarek Amer said last week the central bank is extending the tenor of all bank loans for a period of six months, after it enacted an emergency 300 bps rate cut to shield the economy from the covid-19 outbreak.

No commission on local transfers: In another bid to support customers, the CBE ordered banks to charge no fees or commissions on transfers between local banks for three months, according to another circular carried by Al Mal.

The Labour Ministry may set up a fund for day laborers who fail to find work in the period to come as a result of the economic fallout from the covid-19 outbreak, according to a cabinet statement.

In other Egypt covid-19 news:

- An exceptional flight repatriated 150 Egyptians in the UK on Sunday, a Foreign Ministry statement said.

- It is haram (impermissible, wrong) to pray in mosques after the state-mandated closure of mosques to hedge against covid-19 spread earlier this week, Egypt's top Fatwa authority tweeted yesterday.

- Egypt’s production of masks will increase to 80-120 mn masks annually from 60 mn, Youm7 reports, quoting an industry official.

- Egypt has sent Italy medical aid that includes over a mn surgical masks, the local press reports. The aid arrived in Milan on Sunday for distribution in the Lombardy region. Italy is the country hardest-hit by the covid-19 outbreak in Europe.

A sign of things to come? The Suez Canal started feeling the effects of the pandemic in February as the number of container ships passing through fell by 7.3%, according to Al Mal. The number of passenger ships using the canal fell by 22.2% and the number of cargo ships dropped by 1.3%.

ON THE GLOBAL FRONT-

Talks on nearly USD 2 tn stimulus program fail in Washington, DC, setting up another [redacted] date in markets. Democratic senators yesterday blocked emergency stimulus legislation worth USD 1.8 tn as partisan arguments threatened to derail efforts to prevent the economy from suffering an unprecedented shock, the Washington Post reports. Democrats are opposing the Republican-led bill on the grounds that it does too much for big business and not enough for workers and the healthcare sector. The story is front-page news in the global business press: FT | WSJ | Reuters | Bloomberg.

Markets are not impressed: Stocks are being pummelled in New Zealand and Australia and merely battered in China, Hong Kong, Japan and South Korea. Among the major global markets open as we head to dispatch this morning, only Indian equities are in the green. Futures suggest London will open in the red, and it looks even worse in America, where Dow futures hit limit-down overnight and both Nasdaq and the S&P are set to open in red.

The UK’s market regulator wants LSE-listed companies to … not release their financials for at least two weeks. The Financial Conduct Authority writes in very polite language that effectively suggests auditors need the time to reconsider their opinions whether they need to raise going concern flags at companies worst-hit by covid-19.

All the latest on lockdowns, shutdowns, travel bans and everything else that is bringing life around the world to a standstill:

- India: More than 1 bn Indians were subject to a 14-hour curfew yesterday. (BBC)

- Turkey has imposed a curfew on people over the age of 65 and those with underlying health conditions. (Daily Sabah)

- Germany: Germany has banned all public gatherings of more than two people. (NYT)

- Italy: Italy has banned all movement within the country after 1.4k people died over the weekend. (The Guardian)

- US: Almost a third of Americans are now under orders to stay at home. (Reuters)

- UK: The British government could move to impose a Italy-style lockdown on the country, PM Boris Johnson suggested yesterday. (BBC)

- Singapore: Singapore has indefinitely banned all short-term travellers to the country starting today at midnight. (Washington Post)

- Australia: Australia has ordered public venues including bars, gyms and cinemas to close after the number of confirmed covid-19 cases rose to 1,098 and the death toll hit 7 on Sunday. (Reuters)

Lockdowns not enough to stop the spread -WHO expert: Governments cannot rely on lockdowns to half the spread of the virus and must focus also on “strong public health measures,” Mike Ryan, one of the World Health Organization’s top emergency experts, said yesterday. “What we really need to focus on is finding those who are sick, those who have the virus, and isolate them, find their contacts and isolate them,” he said. “if we don’t put in place the strong public health measures now, when those movement restrictions and lockdowns are lifted, the danger is the disease will jump back up.”

Merkel goes into quarantine: German Chancellor Angela Merkel has quarantined herself after coming into contact with a doctor who tested positive for covid-19.

Is Japan backtracking on its plans to hold the Olympics this summer? In spite of loud and public assertions that the games will go forward even amid covid-19 disruption, contingency plans for potential delays are now being drawn up behind the scenes, Reuters reports. At risk is over USD 3 bn in domestic sponsorship, an Olympic record, and USD 12 bn spent on preparations.

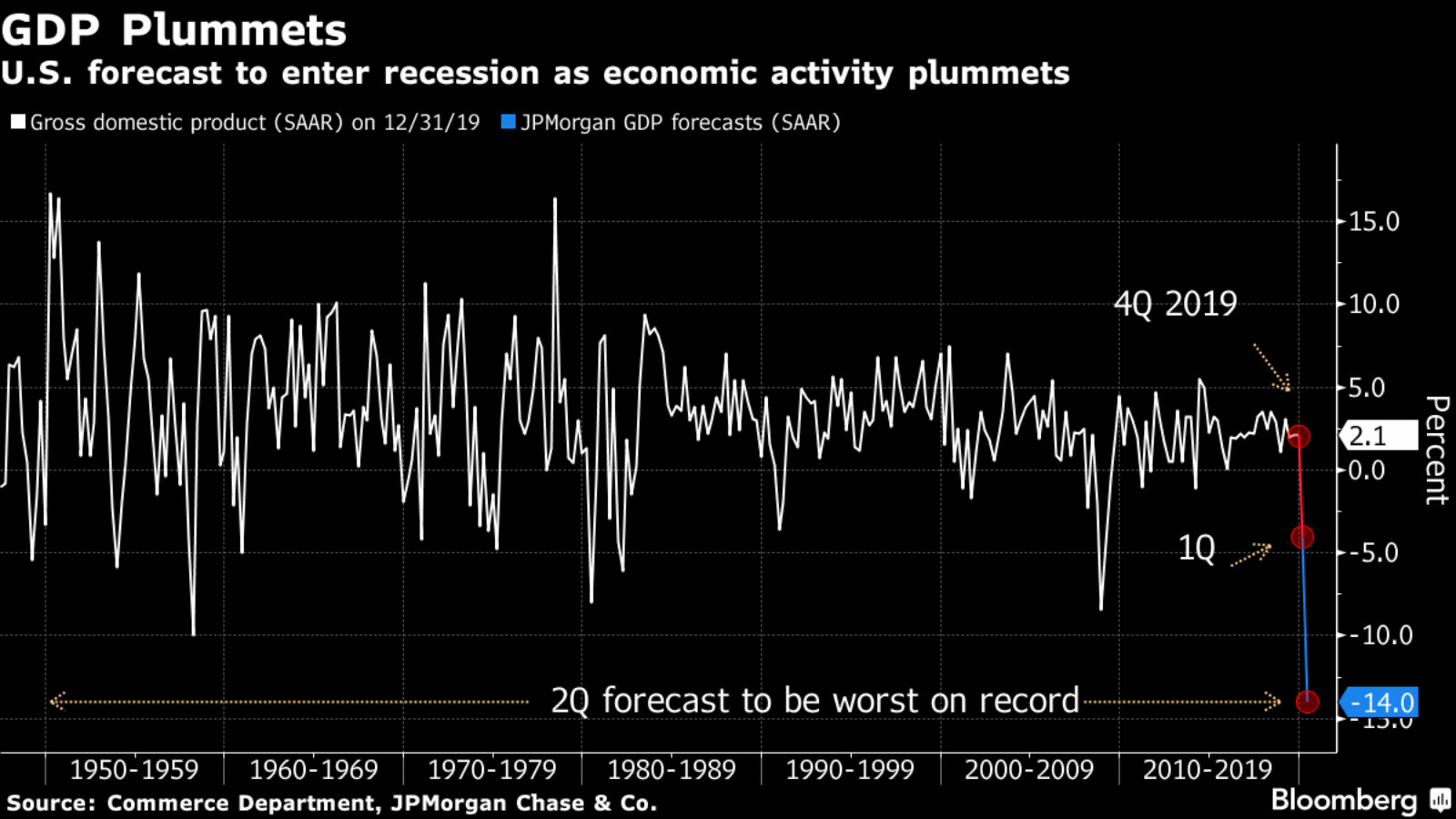

Anyone in the US may want to look away: The latest GDP forecasts are not looking good. Last week a JPMorgan economist predicted that US economic growth could fall by as much as 14% in the second quarter, handsomely beating the worst period of the Great Recession which saw output fall 8.4% in 4Q2008.

But Morgan Stanley’s new projection makes this look reassuring by comparison: The US investment bank is projecting economic growth to fall by more than 30% in the second quarter as efforts to contain the outbreak grind the economy to a halt. “We now see 1Q GDP dropping by 2.4% as economic activity has come to a near standstill in March, followed by a record-breaking drop of 30.1% in 2Q. We estimate that March will also mark the first drop in nonfarm payrolls, down 700k. We expect a record-high unemployment rate, averaging 12.8% in 2Q,” analysts wrote in a report.

What will this mean for the global economy? “Incorporating revised forecasts for the US economy, we see an even deeper recession in 1H20, taking full-year global growth to 0.3%. If the COVID-19-related economic disruption continues into 3Q20, in the bear case scenario we see global growth contracting by 2.1%Y in 2020, which will bring the global economy well below what we saw during the global financial crisis, when global real GDP contracted by 0.5%Y in 2009,” the report says.

China, on the other hand, is talking big about its economic prospects: Beijing has claimed that economic data will show “significant improvement” in the coming quarter as the country shows signs of success at stemming the virus and restarting economic activity, Bloomberg reports. Will it all be based on domestic consumption? Because it doesn’t look to us like global demand is all that strong at the moment…

The shuttering of industry around the world is exacting a heavy toll on global supply chains, further fueling a conviction that the world is sliding into a recession for the first time in over a decade, Bloomberg reports. “This is kind of a rolling natural disaster,” said Ethan Harris, head of global economic research at Bank of America. “In terms of the impact on global production, the shutdown outside of China will likely become bigger than the impact from China.” Major companies like Apple were able to withstand the February slowdown in China but will now have to cope with the shutdown of hundreds of component manufacturers in Italy, Germany, Malaysia and South Korea. The auto industry is particularly vulnerable, given its complex supply chains reliant on lithium and cobalt and its logistics that are designed to have storage times of only 1-2 months.

WORK-FROM-HOME TIP OF THE DAY- As the entire house fights over bandwidth, the Wall Street Journal provides tips on how to speed up your wifi: If you’re anything like us and your house has turned into world war wifi, Wall Street Journal’s Joanna Stern recommends a few ways to make sure the work-from-homers can speed up the wifi and send in that email (watch, runtime: 02:15). Some tips include buying a new modem, making sure you’re connecting to the 5GHz network, plugging into the modem, and surprise surprise, unplugging everything and plugging it back in.

A DISTRACTION FROM ALL THINGS COVID: Go watch a documentary about … typography. “Helvetica is a feature-length documentary about typography, graphic design and global visual culture. It looks at the proliferation of one typeface as part of a larger conversation about the way type affects our lives.” Filmmaker Gary Hustwit is streaming (without charge and with no geographic restrictions) his catalogue of documentaries for the duration of the covid-19 outbreak. Helvetica (watch, runtime: 1:21) is available today and tomorrow. (Look for the link at the very top of the page.)

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We look at how covid-19 has impacted the exam schedule for schools and universities in the 2019-20 academic year. It’s extensive, but it has also forced us to think creatively on how we assess and test students.

Enterprise+: Last Night’s Talk Shows

The government’s spending package to tackle covid-19 took center stage on the airwaves last night: Al Kahera Alaan’s Lamees El Hadidi covered yesterday’s cabinet meeting during which President Abdel Fattah El Sisi announced that the central bank would allocate EGP 20 bn to support share prices on the EGX alongside other economic measures. He stressed that this package would not have been possible without the country going through three years of economic reform (watch, runtime: 0:57), (watch, runtime: 2:51). Al Hayah Al Youm’s Lobna Assal (watch, runtime: 5:32) and Masaa DMC’s Eman El Hosary ( watch, runtime: 11:20) also covered the president’s statement.

El Hekaya's Amr Adib spoke by phone with Mohamed Farid, the head of stock exchange, to discuss the news (watch, runtime: 5:36). We have more on the CBE support for the EGX in this morning’s Speed Round below, and more on El Sisi’s speech in What We’re Tracking Today.

Lamees talks economic policy with Hala El Said: El Hadidi spoke via phone with Planning Minister Hala El Said to review the economic measures taken by the government in response to covid-19. El Said said the Sisi administration is focused on supporting local production and exporters and cushioning citizens from the blow of the novel coronavirus. The measures have been devised with a timeframe that sees the worst of the crisis over by the end of June, she said (watch, runtime: 16:21). Min Masr’s Amr Khalil (watch, runtime: 8:39) had the same report.

(Have we mentioned, lately, how good it is to have Lamees back on air?)

What the bankers are saying: El Hadidi also spoke with Akef El Maghraby, deputy head of Banque Misr, who said that the bank would postpone collecting loan installments, and waive credit card and ATM withdrawal fees for the next six months in line with a recent central bank directive. He also noted that the bank has seen a healthy demand for its new 15% certificates (watch, runtime: 14:46).

It could take a while for the tourism sector to regroup: El Hadidi spoke with Hossam El Shaer, the head of the Federation of Tourism Chambers, who said that the countries which most of Egypt’s tourists come from — Italy, Germany, and Russia — are still struggling to contain the virus, meaning the Tourism Ministry is not expecting a revival of the sector any time soon. He said the downtime will be used to deep clean Hurghada and Sharm El Sheikh’s hotels, such that they will be entirely “covid-19 free” by the first week of April (watch, runtime: 4:51).

The daily covid-19 update: El Hadidi covered the Health Ministry’s report of 33 new cases of covid-19, bringing the total to 327. She noted that there were four new deaths and that a total of 74 patients have recovered since the outbreak (watch, runtime: 3:03). Adib (watch, runtime: 2:51) and El Hosary (watch, runtime: 1:13) had the same report.

Medical supplies ample: Adib also spoke by phone with cabinet spokesman Hany Younis who discussed the Health Ministry’s crisis team meeting which focused on how to handle potential shortages of medical supplies. The Finance Ministry would offer support to ensure adequate stocking in the event of supply shortages, he said (watch, runtime: 9:11).

Speed Round

Speed Round is presented in association with

CBE to directly purchase equities in a bid to stem EGX sell-off: The Central Bank of Egypt (CBE) will buy up to EGP 20 bn worth of shares listed on the EGX to support asset prices amid sustained market volatility caused by the covid-19 outbreak, a senior official at the central bank told Enterprise last night. This amounts to more than 5% of the total EGX100 market cap, which currently stands at a little over EGP 380 bn. President Abdel Fattah El Sisi announced earlier in the day that the CBE would allocate EGP 20 bn to support the exchange but didn’t elaborate on how the funds would be deployed.

The CBE isn’t the only central bank to enter the equities market, but it is one of the few to do it on this scale. The Bank of Japan, which under its governor, Haruhiko Kuroda, launched in 2010 an unprecedented equity-purchase program as part of a package of measures designed to drag the country out of deflation and support asset prices. That program now sees the BoJ on track to become the biggest holder of Japanese equities. Globally, central banks were thought last year to hold more than USD 1 tn in equities, Bloomberg reported at the time, “as they sought to diversify their reserves away from low-yielding bonds.” The Bank of Israel and the Swiss National Bank “are among those to have publicly disclosed investments in stocks in the past,” the business information service adds.

There’s no clarity this morning on how the CBE plans to move into the market or a timeframe for the program. But the Bank of Japan buys exchange-traded funds, which seems to us to be the least-disruptive way to enter the market. With a paucity of ETF options, it will be interesting to see how the CBE will move into (and later get out of) the market without causing disruption. As Nikkei Asian Review notes: “And unlike bonds, ETFs lack maturities. The bank will have to sell them back to the market if it decides to decrease its holdings — but slowly and carefully to keep from driving prices down.”

The CBE’s statute (pdf) gives it wide leeway to intervene under articles 12 and 13, including authorizing it to “take whatever measures it deems relevant … in case of a financial disturbance” to “meet the necessary needs in the financial markets.”

Traders didn’t get a chance to react to El Sisi’s late-afternoon announcement, but the exchange still closed in the green yesterday: The EGX30 gained another 5.92% in trading yesterday, reaching intraday highs of 6.48% on announcements that state-owned National Bank of Egypt (NBE) and Banque Misr were plowing a combined EGP 3 bn into the market. This was the second consecutive day of gains after the benchmark index shed nearly 18% last week on covid-19 fears; the EGX30 rose 5% on Thursday.

The EGX is no longer the worst performing index in the region after two days of gains and as the sell-off in Dubai resumed yesterday. It is now down a little over 30% YTD compared to 37% at the end of Wednesday’s session.

Don’t expect that two days of gains means the volatility is over, analysts warn. A record-breaking emergency 300 bps interest rate, tax breaks for EGX investors and energy price cuts together with the Banque Misr and NBE stimulus have sent the right signals. But you can expect the market to remain highly sensitive to how the covid-19 outbreak develops — and impacts the global economy — over the next three months, Pharos Holding head of research Radwa El Swaify tells Enterprise. Market movements “will also rely on how the government responds to the outbreak. If there is a complete shutdown, it’s only natural stock prices will continue to fall,” El Swaify says.

Listed companies are still supporting their stock prices through buybacks. Eastern Tobacco (pdf), Madinet Nasr for Housing (pdf), Odin Investments (pdf), Raya Contact center (pdf), and Egypt Kuwait Holding (pdf) each said yesterday they are planning to or have already pulled the trigger on share buybacks. The companies are capitalizing on temporarily relaxed rules from the Financial Regulatory Authority on buybacks.

LEGISLATION WATCH- House suspends discussion of auto strategy, Public Enterprises Act amendments indefinitely thanks to covid: The House industry committee has decided to postpone discussions on the government’s auto strategy and the amendments to the Public Enterprises acts indefinitely due to the covid-19 outbreak, the local press reported citing parliamentary sources. It’s unclear when the discussions on the highly-anticipated bills will resume, but sources in the auto sector claimed that the auto strategy won’t be back on the agenda until the next legislative session in October.

A quick recap: The Madbouly Cabinet approved earlier this month the long-awaited automotive strategy to provide support to local car assemblers and feeder industries to compete with imported vehicles and stimulate the local sector. Meanwhile, the Public Enterprises Act amendments received cabinet approval last month. The 26-article bill removes state-owned companies from the legislation if they list 25% stake on the EGX and bring them within the scope of the Companies Act, thus giving general assemblies long-awaited governance.

Maridive is in talks with creditors as it struggles with covid-19, plunging oil prices: EGX-listed Maridive & Oil Services is negotiating with its creditors to postpone loan repayments as the twin threats of covid-19 and the collapse in oil prices take their toll on the business. The company has said in two regulatory filings over the past few days (here and here) that the travel suspensions in place across much of the world are making it hard for the company to deliver supplies and change crews on its offshore facilities. Plummeting oil prices, it added, are having a negative effect on demand for its services. This has forced the company to open talks to receive relief on its loan repayments in light of the central bank initiative announced last week which extends the tenor of all bank loans by six months.

Gov’t to award two-year exploration licences for winning bids in mineral exploration round: Companies awarded blocks in Egypt’s ongoing international bid round for gold and mineral exploration will be given two-year exploration licenses, according to a copy of a conditions booklet seen by Al Mal. License holders can apply to renew for up to two times, or up to three under certain circumstances. The booklet suggests that bids will be valid for one year from when the bidding window closes and can be renewed upon request, but it remains unclear what this means on the ground. New rounds will be launched every four months, confirming what Oil Minister Tarek El Molla said last month.

Other details: Companies will be required to submit technical and financial bids. The Egyptian Mineral Resources Authority will decide on the winning bid based on several key factors. Companies will need to demonstrate commitment to the minimum amount of time required to make discoveries and to pay the minimum 5% royalty and 15% profit share to the government. Eligible bidders also have to submit an irrevocable bank guarantee amounting to 10% of the estimated cost of the early exploration phase, and a USD 20k insurance deposit that would increase to USD 50k for the winning bid.

Background: The ministry started accepting bids for a 56k sq km exploration area in the Eastern Desert last Sunday. The bid round will end on 15 July with investors awarded blocks of around 170 sq km each. This will be the first time the industry tests out new legislative amendments passed last year that scrapped production sharing agreements in favor of a more investor-friendly tax, rent and royalty model.

It’s still early to tell who’s interested: While no company has yet confirmed its interest, the leaders of Canada’s Forbes & Manhattan Group, Franco-Nevada Corporation, and Kinross Gold — as well as US-based Newmont Corporation, Barrick Gold, and Sprott — have all shown enthusiasm in recent meetings with El Molla. Centamin, currently Egypt’s sole gold producer, and Naguib Sawiris’ La Mancha are two other names to look out for.

World Bank gives social housing funding program a USD 500 mn boost: The World Bank is increasing by USD 500 mn the amount of funding provided under a program to develop low-income housing in Egypt, cabinet said in a statement citing a bank announcement last Friday. The loan brings the total amount committed by the bank to social housing to USD 1.3 bn, benefiting over 300k families since 2015, Social Housing and Mortgage Finance Fund CEO May Abdel Hamid said.

MOVES- Banque Misr’s El Etreby named FEB chairman: Banque Misr Chairman Mohamed El Etreby has been selected to succeed CIB’s Hisham Ezz El Arab as the chair of the Federation of Egyptian Banks for a three-year term, according to Masrawy. National Bank of Egypt Chairman Hisham Okasha will serve as El Etreby’s deputy on the board while CIB CEO Hussein Abaza has been named the new treasurer.

Egypt in the News

It is a quiet morning for Egypt in the international press.

How schools and universities are adapting exams in the midst of the covid-19 outbreak: Egypt’s private and public schools and universities are having to adapt their planned examinations and standardized tests as the education sector grapples with a nationwide shut down, enforced by the government to slow the spread of the covid-19 virus. When schools announced an early spring break and began rolling out online learning platforms, we noticed widely varying policies on exams. Some schools and universities were putting in place provisions to keep exam schedules intact where they can. Others, particularly institutions issuing international standardized tests, have had to cancel or move their exam dates.

Last weekend, both the education and higher education ministries moved to enact some smart policies which encompassed a number of measures already being implemented by some schools and universities. These include a reliance on assignments and projects and online exams. In today’s Blackboard we explore how universities and schools in the public and private sectors have adapted their tests and schedules for what remains of the 2019-20 academic year.

Where they can, some private schools are using different assessment options as an alternative to exams. Students up to K-12 won’t sit end-of-month exams in schools owned by Cairo for Investment and Real Estate Development (CIRA), says CEO Mohamed El Kalla, but will instead be assessed on their work through day-to-day e-learning.

Thanaweya Amma and middle school finals will take place as scheduled: Major final exams of the national education system — namely Thanaweya Amma and its middle school equivalent — will take place on site as scheduled “in thoroughly sterilized test rooms,” Education Minister Tarek Shawky said in a statement on Thursday. The ministry has also issued the following guidelines for public schools:

- KG1 and KG2 pupils will be assessed by teachers based on their daily performance. Parents must verify that children have completed the coursework they were set.

- Students in grades 3-8 will not sit final exams but will complete an end-of-year project or assignment for each subject, submitted through the e-learning platform.

- Students in grades 10-11 will be examined electronically using their school tablets, and their grades will be sent to them electronically. Mock exams designed to test this system were scheduled to be held yesterday but have been postponed to 5 April.

- Students who are homeschooled or have special educational needs must submit an end-of-year project instead of taking an exam.

- Egyptian students who are due to sit Egyptian exams or their equivalent overseas must submit an end-of-year project instead of sitting a proctored exam.

- Technical and vocational exams will take place as scheduled and on site.

The curriculum for public school students will not change, emphasized Shawky, and parents are encouraged to use the coursework and resources made available by the ministry through its online learning platform.

A number of major int’l exams, including IB, have been shelved: The International Baccalaureate is expected to officially announce today that it will cancel International Baccalaureate (IB) exams from 30 April until 22 May. “Depending on what they registered for, the student will be awarded a Diploma or a Course Certificate. This is based on student’s submitted coursework and the established assessment expertise, rigour and quality control already built into the programme,” the organization said in a letter to schools and examiners on Sunday. Sources we’ve spoken with confirmed that the letter was sent out to schools yesterday.

May’s SATs cancelled: The SAT tests that were scheduled for 2 May have been cancelled due to the virus, College Board has announced.

The British Council has also pushed its IELTS exams scheduled for March to April, although it is monitoring the situation closely to be able to make the final decision in April as to whether the exams can go ahead, said Dina Lotfy, communications manager at the council. “When the British Council runs school exams will be decided according to local government directives. We’re in touch with the awarding bodies in the UK, but at this stage we don’t have clarity on when the exams will take place,” she adds.

IGCSEs to proceed as scheduled: While the UK has cancelled its domestic GCSE and A level exams for this year, it will proceed with the IGCSEs or international A levels ― which are not regulated in the UK. Examining bodies that offer IGCSEs and international A-levels stated the following: Cambridge IGCSE, Cambridge O level, Cambridge International AS and A level, and the Cambridge AICE Diploma will “go ahead outside the UK in countries where schools are open or exams can be held safely.” Oxford AQA will also “proceed with our summer series of international GCSEs and A levels as planned.”

Education Ministry will have its say on int’l exams in the coming weeks: Initial statements by some of these organizations have noted that they are coordinating their responses with the Education Ministry, which will announce its policy on international exams in the coming two weeks, said Shawky in a call to Masaa DMC on Friday night.

Supreme Universities Council cancels midterm exams and pushes back finals to after 30 May: The Higher Education Ministry’s Supreme Council of Universities on Saturday cancelled midterms for the Spring term across all public, nonprofit and private universities. Weight will be added to final exams for the term, according to an emailed statement from the council. Final exams may not be scheduled before 30 May. Any finals scheduled for that day must be moved accordingly, the statement read. As for grad students, the council left scheduling of exams to the universities.

Prior to the council’s decision, a number of universities spoke to us on how they were planning to adapt exams and assessments to the covid-19 situation. The British University in Egypt (BUE) has shifted its exams online and is working in parallel with e-learning platforms, but is determined to maintain its exam schedule because it is connected with international exam schedules, said Mohamed Eid, director of the university’s internationalization office. The American University in Cairo (AUC) said that it is considering holding off on exams and tests that require proctoring for at least the next two weeks but that oral exams can still take place and essays be submitted. The university is encouraging different kinds of assessment to be used rather than relying exclusively on exams, says Ahmed Tolba, associate provost for strategic enrollment. Students at universities owned by CIRA will not face mid-term exams, says El Kalla. The biggest problem he anticipates is what to do about practical and technical exams, such as those taken by medical and nursing students. The council’s decree does not clearly outline how these subjects will be assessed.

Despite the disruption, it’s encouraging to see creative solutions being adopted to keep the wheels turning, both from the private sector and the government. From what school owners have told us, online education and e-learning has been widely adopted and the transition to working from home has been relatively easy. We are also hearing of a newfound affection for teachers by parents not used to homeschooling. We’re seeing this collaborative attitude being taken by all stakeholders when it comes to assessments and final exams.

Institutions are advocating flexibility and promising regular updates. These are unprecedented circumstances for educational bodies, and they are clearly making huge efforts to respond appropriately, with accurate information and empathy. The IB has urged schools to upload predicted grades for their candidates, along with as much of their coursework as possible, as soon as possible. UK and European universities have reportedly extended deadlines for candidates to submit relevant paperwork. And across the board, institutions, ministries and international bodies are all promising to issue regular updates as the situation continues to unfold.

Your top 5 education stories of the week:

- School shut-down: Education Minister Tarek Shawky said the two-week shutdown of Egyptian schools and universities will likely be extended.

- Orange Egypt, Avaya cooperate on e-learning: Orange Egypt and Avaya are partnering to provide e-learning technology to all educational institutions, including schools and universities in Egypt through the Avaya Spaces app.

- Abwaab raises bumper pre-seed funding: Jordan’s Abwaab raised USD 2.4 mn in pre-seed funding round for its online tutoring platform, which hosts over 1k instructional arabic videos and personalized lessons by qualified teachers, with regional curriculum expansion in the pipeline.

- Parents demand refunds on closure of private schools: Tarek Shawky is mediating disputes between schools and families who are demanding refunds for paid private school tuition after school closures have been announced.

- Gov’t begins deep cleaning schools: Schools nationwide began deep cleaning on Friday amid continued closures to prevent the spread of covid-19.

The Market Yesterday

EGP / USD CBE market average: Buy 15.68 | Sell 15.81

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Sunday): 9,751 (+5.9%)

Turnover: EGP 756 mn (26% above the 90-day average)

EGX 30 year-to-date: -30.2%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 5.9%. CIB, the index’s heaviest constituent, ended up 6.1%. EGX30’s top performing constituents were Orascom Construction up 10.0%, Eastern Company up 9.8%, and Telecom Egypt up 9.6%. Yesterday’s worst performing stocks were Credit Agricole. The market turnover was EGP 756 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -175.9 mn

Regional: Net short | EGP -66.4 mn

Domestic: Net long | EGP +242.3 mn

Retail: 41.2% of total trades | 35.5% of buyers | 46.9% of sellers

Institutions: 58.8% of total trades | 64.5% of buyers | 53.1% of sellers

WTI: USD 22.63 (-12.66%)

Brent: USD 26.98 (-5.23%)

Natural Gas: (Nymex, futures prices) USD 1.60 MMBtu, (-3.02%, April 2020 contract)

Gold: USD 1,488 / troy ounce (+0.39%)

TASI: 6,171 (-1.53%) (YTD: -26.43%)

ADX: 3,552 (-3.61%) (YTD: -30.01%)

DFM: 1,781 (-2.06%) (YTD: -35.55%)

KSE Premier Market: 4,902 (+5.1%)

QE: 8,589 (+0.15%) (YTD: -17.61%)

MSM: 3,567 (-1.10%) (YTD: -10.39%)

BB: 1,394 (-0.97%) (YTD: -13.37%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist-sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action,” new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.