- EGX struggles on low trading volumes, lack of new listings. (Speed Round)

- Banque du Caire could sell as much as 49% of its shares when it IPOs. (Speed Round)

- CBE confirms tenfold increase to its tourism support initiative to reach EGP 50 bn. (Speed Round)

- House committee to wrap debate of proposed Customs Act in two weeks. (Speed Round)

- World Bank, EBRD to lend Egypt USD 1 bn for new Alexandria metro line. (Speed Round)

- ESG is gaining traction in the world of finance. (What We’re Tracking Today)

- Private credit has boomed thanks to the super-rich. (What We're Tracking Today)

- Blackboard: How Egypt is positioning itself as an educational hub for international students.

- The Market Yesterday

Monday, 16 December 2019

What’s up with low volumes on the EGX? Plus: CBE’s tourism support initiative gets 10x funding increase

TL;DR

What We’re Tracking Today

It’s not the busiest of mornings, but there’s more news today than there was trading on the EGX yesterday, where total turnover was an anaemic EGP 205 mn, or 72% below the trailing 90-day average. Reuters’ Arabic service has picked up on lackluster energy on the EGX and has a long piece that will spark conversation this morning, with the other big headline being the launch of the CBE’s EGP 50 bn tourism fund we flagged yesterday.

It’s the penultimate day of the World Youth Forum in Sharm El Sheikh today and will still make headlines in the domestic press as it does.

African defense meeting in the new capital: Preparatory meetings for the African Defense, Safety and Security Committee, an African Union body, kicked off in the new administrative capital yesterday, according to an Armed Forces statement. The five-day event includes three days of expert meetings to discuss the African Union’s efforts on security and peace issues in the African continent.

The two-day Tech Fuze conference wraps up today at the Nile Ritz Carlton. The gathering features 150 speaks from some 120 companies and has its sights on big topics in tech including artificial intelligence, the internet of things, and fintech.

The next round of GERD talks is coming up this weekend: Irrigation ministers from Egypt, Ethiopia and Sudan will meet in Khartoum on Friday and Saturday for another round of technical talks on the Grand Ethiopian Renaissance Dam. The talks come ahead of a meeting scheduled between the three parties for 13 January in Washington, DC.

PSA- You may now put your umbrella away. You can expect a daytime high in the capital city of 21°C and an overnight low of 11°C. Look for sunny skies with cloudy periods, according to both the national weather service and our favorite app.

Sound smart this morning: ESG is gaining traction in the world of finance: Investors are increasingly seeing environmental, social, and governance (ESG) policies and performance as key priorities for the companies in which they invest, according to a survey by the world’s largest independent PR firm Edelman in their 2019 Trust Barometer survey (pdf). The survey, which polled 600 institutional investors across six countries with some USD 9 tn in AUM, found that 61% of investors increased their exposure to companies with strong ESG track records, and more than half vote their shares more often to support ESG-focused board members and policies. The majority of those polled also want to see executive compensation linked to their businesses’ progress on ESG issues, saying that this kind of compensation structure would increase their trust in a company.

In other words, an investment is not just about shareholder returns. According to the poll, 84% of respondents said that businesses need to strike a balance between maximizing returns and ESG responsibilities towards their employees, suppliers, and local communities. “Long considered a money-losing nicety, ESG is rapidly going mainstream. The Edelman poll of big investors found that 52% said they’d put more trust in a company that linked executive compensation to ESG goals — like data privacy and cybersecurity, diversity and inclusion, and fighting global warming,” Axios says.

Investors exit safe havens as global sentiment improves: Investors have been pulling out of precious metals, the JPY and dividend-paying stocks as fears over trade and global growth ease, the Wall Street Journal reports. Gold prices have fallen USD 85 per ounce since September, the USD and JPY have fallen, and yields on US 10-year bonds have risen from near-record lows to 1.82%.

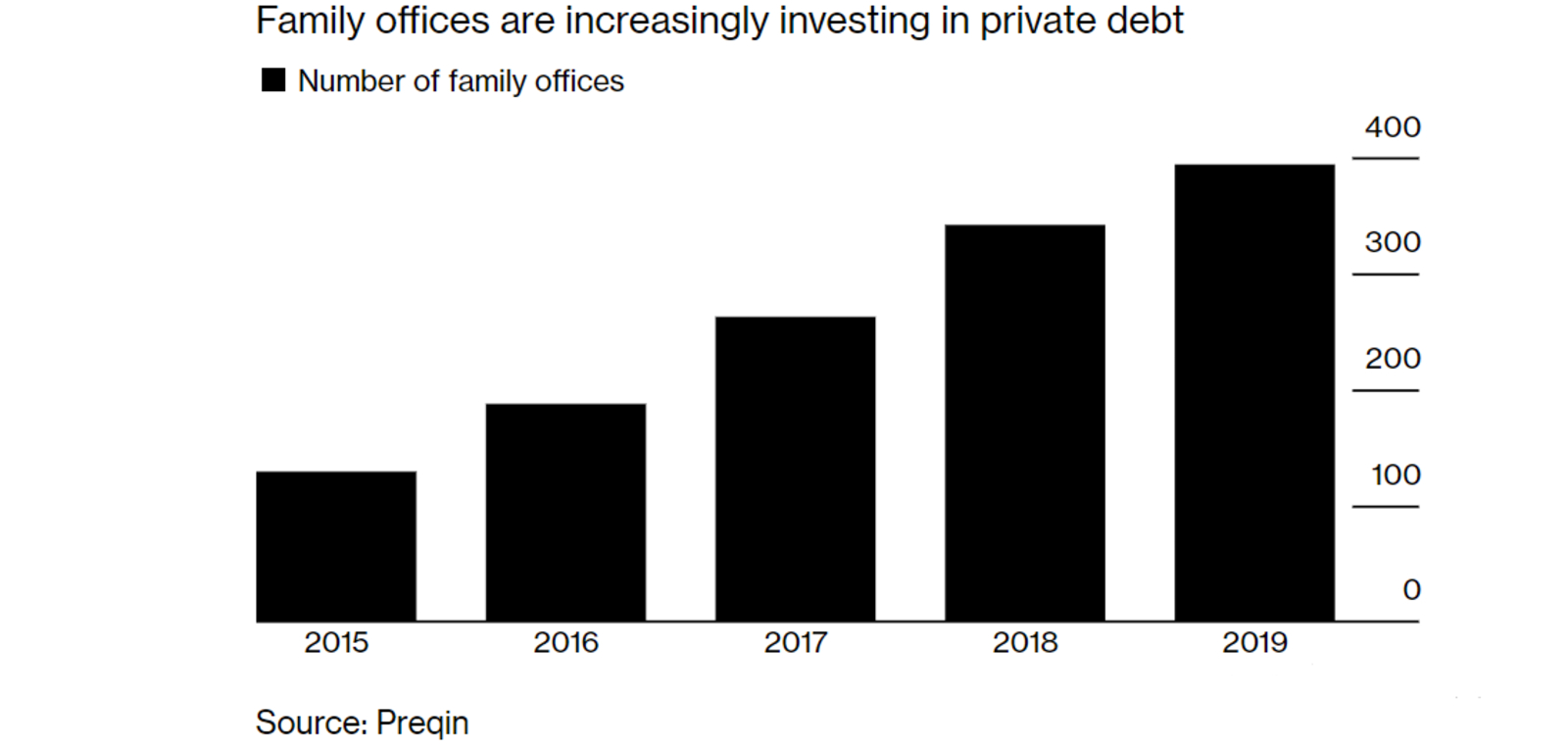

How are the super-rich ensuring they stay that way? Offering direct lending where banks won’t: A number of family offices, “mini-investment firms set up by the super rich to manage their personal wealth, are piling into the high-risk, high-reward market of offering direct loans to ventures that are struggling to secure bank funding, Bloomberg says. “Private credit has boomed globally as banks, under pressure from regulators since the global financial crisis to reduce risk, have pulled back from lending to smaller, potentially more vulnerable companies,” the news information service says. In the past two decades, the private credit market grew 18.5 times to USD 787.4 bn, from USD 42.4 bn, London-based research firm Preqin says.

Is Trump’s war on trade about to pivot to Europe? The Trump Administration is considering whether to ramp up tariffs on European goods just days after signing a preliminary trade pact with Beijing, according to a document (pdf) published by the Office of the US Trade Representative. The proposals would see the US increase existing tariffs on certain foods and aircraft to 100%, and introduce 100% tariffs on a new range of products. But there are doubts that China can deliver on a key aspect of the agreement, the Financial Times reports.

UN climate talks went nowhere fast: UN climate talks hit a brick wall as the 197 countries that signed up to the 2015 Paris climate agreement failed yesterday afternoon to agree on a framework for a new global carbon trading market that would allow countries to exchange credits for emissions reductions, according to the Financial Times. Critics say the US, Brazil and Australia scuppered the two weeks of talks in Madrid.

*** It’s Blackboard day: Our every Monday look at the business of education in Egypt, from pre-K through the highest reaches of higher ed, focuses this week on how Egypt is trying to position itself as a hub for international students seeking college degrees.

Enterprise+: Last Night’s Talk Shows

The World Youth Forum was once again in the spotlight on last night’s talk shows as the nation’s talking heads recapped the event’s second day.

Al Kahera Alaan’s Lamees El Hadidi was the sole talking head to take note of the CBE’s EGP 50 bn tourism support initiative and phoned Egyptian Travel Agencies Association boss Hossam El Shaer for his two cents. El Shaer outlined the broad strokes of the initiative (which we break down in detail in this morning’s Speed Round, below) and said that the financing program will breathe new life into Egypt’s tourism sector. He noted that hotels and tourism fleets are in dire need of development and the CBE’s initiative will make these developments more feasible (watch, runtime: 6:40).

Lamees also paid special attention to President Abdel Fattah El Sisi’s remarks at the World Youth Forum’s international peace and security session, in which the president touched on the importance of a coordinated international effort to combat terrorism, as well as the ongoing political transition in Libya (watch, runtime: 14:26). Also taking note were Al Hayah Al Youm’s Lobna Assal (watch, runtime: 4:56), Masaa DMC’s Eman El Hosary (watch, runtime: 5:11), Min Masr’s Amr Khalil (watch, runtime: 1:57), and El Hekaya’s Amr Adib (watch, runtime: 7:57).

Min Masr’s Amr Khalil hosted a series of interviews on the sidelines of the event, including with CIT Minister Amr Talaat, who discussed the importance of the government’s digitization drive in monitoring government performance and providing citizens with simplified and efficient services (watch, runtime: 3:16).

In a separate sit-down, World Bank Group Senior Vice President Mahmoud Mohieldin told Khalil that Egypt is outpacing its regional peers in terms of economic growth, but needs to focus on attracting investments to sustain growth levels. Mohieldin expected Egypt’s GDP to grow between 5 and 6% over the next two years (watch, runtime: 13:22).

Khalil also had a chat with FAO Director-General Qu Dongyu about the organization’s cooperation with Egypt to support food security and agricultural development by focusing on women and youth in rural areas (watch, runtime: 9:21).

Libya and Turkey’s recently-signed maritime border demarcation agreement was the topic of a lengthy discussion between Lamees and Nasser Military Academy advisor Major Gen. Mahmoud Khalaf, who said that Tripoli-based Prime Minister Fayez Al-Serraj is angling for a piece of the Mediterranean gas pie through the agreement. Khalaf schooled Lamees’ viewers on the basics of international maritime law to stress that the agreement is illegitimate since it includes two countries whose coastlines are not directly across from each other, and fails to include other neighboring states (watch, runtime: 29:53).

Speed Round

Speed Round is presented in association with

EGX struggles on low trading volumes, lack of new listings: Egyptian equities are struggling to attract investors due to low trading volumes and a lack of new listings, analysts tell Reuters’ Arabic service. The state privatization program, announced 21 months ago with the promise of listing minority stakes in 23 state-owned companies, has so far only delivered a secondary sale of Eastern Company shares. “We have few products with little variety and shares are illiquid,” said Mona Mostafa, trading manager at Arabeya Online Brokerage, adding that domestic investors have lost confidence in the market and its management.

Where we stand: Reuters’ figures show trading volumes have fallen a little over 40% since 2017, and turnover on the bourse yesterday was an anemic EGP 205 mn, more than 70% below the trailing 90-day average. The benchmark EGX30 is up just 3% for the year as of yesterday’s close, and the exchange’s aggregate market cap is down 15% since 2017. “Retail investors are in control of the exchange,” said Mubasher’s Ihab Rashad.

A lackluster start for short selling: Short selling, which was launched on the EGX earlier this month, is yet to take off, with analysts reporting only dozens of trades. Many brokerages simply don’t know how the short-selling system operates, the newswire claims.

Poor IPO flow in 2019: The piece, by Reuters’ Ehab Farouk, notes that of the year’s two IPOs, the first (Fawry) attracted strong interest, while Rameda’s shares fell in their EGX debut and saw corporate founders “exiting rather than increasing the company’s capital.” (The transaction did, in fact, see selling shareholder Greville effectively reinject a portion of the proceeds into the company through a capital increase prior to the start of trading.)

Shares are well-priced right now because retail appetite is low, and the solution is “new stocks in new sectors to spur liquidity,” says Amr Al Alfi, head of research at Shuaa Securities Egypt.

Saudi Aramco’s recent IPO has also hit the EGX, spurring Arab investors to liquidate positions here to buy into Aramco, El Alfi suggests. Trades by Arab investors fell by half in 11M2019, coming in at 5.2% of total trades against 10.3% in the same period last year.

IPO Watch- Banque du Caire to offer up to 49% in 1Q2020 IPO: State-owned Banque du Caire (BdC) could sell as much as 49% of its shares in its upcoming IPO, which is expected to hit the EGX in 1Q2020, Chairman Tarek Fayed tells Al Arabiya (watch, runtime: 1:58). Fayed did not clarify whether this is the exact size of the offering, or if the number remains subject to change before going to market. Previous statements, including from majority shareholder Banque Misr Chairman Mohamed El Etreby, had indicated BdC would offer a 30-40% stake in its long-awaited IPO.

Background: The government is expected to kick off next month a roadshow for the sale of BdC. The bank, along with payments platform e-Finance, is first in line to IPO under the state privatization program. The program, which the government first announced back in 2018, includes eight companies slated to make their EGX debuts. Banque du Caire’s IPO is expected to include a primary offering and to see the state simultaneously offload part of its equity stake in a secondary sale. The transaction is expected to attract investors from beyond the region, Tellimer’s head of equity strategy Hasnain Malik said last week.

M&A WATCH- CBE to ink contracts for United Bank sale with advisors EFG, Evercore in two weeks: The Central Bank of Egypt (CBE) will sign within two weeks contracts that will see a consortium of EFG Hermes and New York-based Evercore act as advisors on the sale of state-owned United Bank, sources close to the matter said, according to Al Mal. The consortium will go ahead with a fair value study, market United Bank to target financial institutions, and draft a plan to transform the bank into an SME-focused lender, the sources claim. The CBE last month appointed the EFG Hermes-Evercore consortium to lead the transaction, which will see the CBE offload its 99.9% stake in the bank.

CBE confirms EGP 50 bn tourism support program: The Central Bank of Egypt (CBE) will increase tenfold the funding it has made available to support the tourism industry to to EGP 50 bn, allowing more companies in the sector to access soft loans to renovate and upgrade tourism infrastructure, the central bank confirmed yesterday. The new iteration of the initiative, which was reportedly agreed at the World Youth Forum over the weekend, will run until the end of 2020. Reuters also has the story.

Special benefits for struggling companies: Struggling companies eligible for the previous initiative — including those operating in Nuweiba, Taba, and Saint Catherine — will be relieved of up to 50% of their outstanding debts and be exempt from marginal interest on the remainder. Their placement on the database of Egyptian credit bureau i-Score will remain unchanged for two years.

CBE plans debt relief for individuals: The CBE is expected to announce soon a separate debt relief program to forgive interest payments for individuals who have defaulted on their loans, banking sources told Masrawy. The initiative could offer to eliminate marginal interest provided the borrower pays 30% of the principal. More details will reportedly be announced after an expected shakeup in the CBE board.

DEBT WATCH- Egypt’s first corporate sukuk issuance coming in two weeks: Aircraft leasing company CIAF Leasing is gearing up to issue Egypt’s first corporate sukuk within two weeks, CIAF Chairman Hassan Mohamed said, according to the local press. The company will issue USD 50 mn in Islamic bonds, which will be divided into a USD 7 mn tranche sold locally and a USD 43 mn tranche sold locally and to foreign investors. The first tranche will carry a tenor of three years, while the second will carry a tenor of 5-8 years. CIAF is currently in talks with local corporate and Islamic banks and other financial institutions to cover the first tranche, Mohamed said.

LEGISLATION WATCH- House committee to wrap debate of proposed Customs Act in two weeks: The House Planning and Budgeting Committee is expected to wrap up ongoing talks of proposed changes to the Customs Act in two weeks’ time, committee member Talaat Khalil said, according to Al Mal. The committee has finished discussing a large part of the 55-article bill, which would:

- Expedite clearance through a white list of importers;

- Broaden the powers of customs clearance agents;

- Provide an alternative pathway to settle customs disputes;

- Include customs breaks for local manufacturers.

Committee signoff would pave the way for the act to head to the House general assembly for a vote in the new year.

Next on the committee’s agenda: The unified tax law and the tax dispute bill. After green-lighting the draft Customs Act, the committee is expected to dive into discussions about the unified tax law — a bill to create a single income tax filing system that received cabinet approval in October, Khalil added. The temporary tax dispute resolution bill is also expected to be brought to the committee’s table within the next two weeks, deputy chair Yasser Omar said. The legislation, finalized earlier this month by the Finance Ministry, would extend the recently expired Tax Dispute Resolution Act, which would mandate newly-established dispute settlement committees to handle tax disputes until 30 June 2020.

New specialized customs committees to set clearance process, duration: On a related note, Prime Minister Moustafa Madbouly issued yesterday a decision to set up permanent committees at customs ports of entry to outline a clear mechanism and timeline for shipping containers to be opened, inspected, and cleared, according to a cabinet statement. Each committee will include representatives from the Customs Authority, the General Organization for Export and Import Control, the Egyptian Food Safety Authority, the Agricultural Quarantine Authority, and any other body mandated with inspecting imports and exports.

World Bank, EBRD to lend Egypt USD 1 bn for new Alexandria metro line: The World Bank and the European Bank for Reconstruction and Development have agreed to provide a USD 1 bn loan to partially finance the project to convert Alexandria’s Abu Qir railway into an underground metro, sources in the Transport Ministry said, according to Al Mal. Authorities are now negotiating the loan’s grace period, interest, and repayment timeline. Sources revealed that separate talks are also ongoing with the Russian, Canadian and Hungarian export-import banks to secure an additional USD 500 mn loan to cover the remaining costs of the USD 1.5-2 bn first phase, which will link Abu Qir in the east to the mid-western Mahatet Masr in Attarin. The Alexandria governorate will launch the tender for the project in 1Q2020.

Fatma Ghali, managing director of Azza Fahmy, on generational change in a family business: It has taken 50 years and two generations to get to where they are, starting with the founder and matriarch Azza Fahmy. And like a prized family heirloom, the business has been handed down to her daughters. Fatma Ghali, the global fashion and design brand’s managing director, joined us in the studio to talk about how she and her sister spent their childhoods immersed in the business, learned the art of jewelry design, production and marketing, and overcame the challenge of taking on her family’s legacy.

** Listen to this week’s episode (runtime 29:27) on our website | Apple Podcast | Google Podcast.

CORRECTION- Yesterday we incorrectly stated that Professionals for Investment Banking were quarterbacking the Emerald IPO on the EGX. Odin Investments will actually be leading the transaction and Professionals for Investment Banking are on board to provide the IFA report. The story has since been updated on our website.

We also incorrectly referred to NI Capital as CI Capital in yesterday’s story on the EGP 450 mn National Investment Charity Fund for Education.

Image of the Day

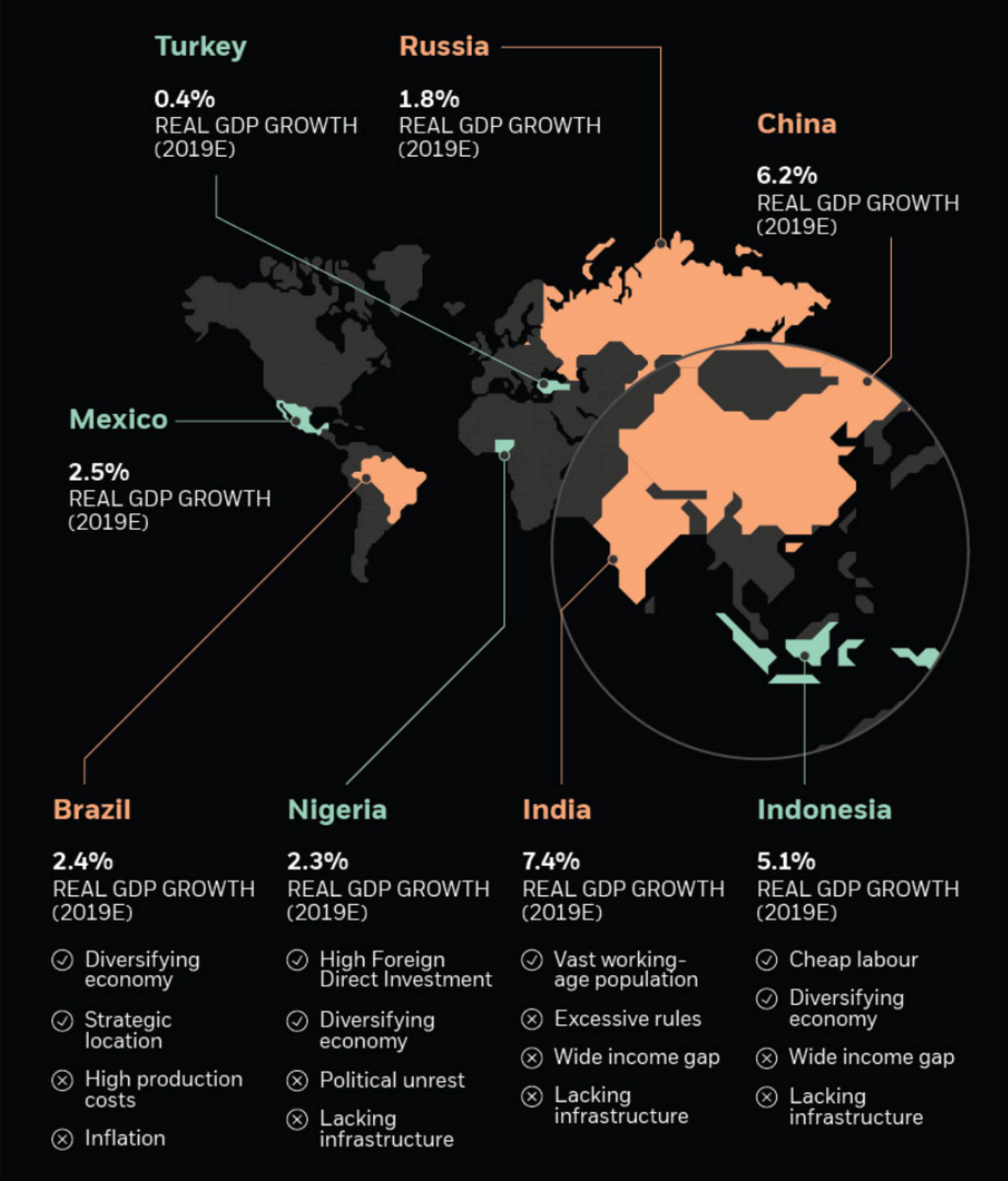

Emerging wealth visualized: Two decades of globalization and an exodus of manufacturing from advanced economies have led to the creation of an emergent middle class in what were once developing countries. Today, these emerging markets are responsible for a greater share of wealth production than ever before, a trend visualized by BlackRock’s iShares (and presented by Visual Capitalist).

Egypt in the News

The foreign press is giving Egypt a break this morning, giving us no noteworthy coverage to highlight.

Worth Watching

Here’s something we haven’t explored much on Enterprise: Econometrics, or the use of statistics to make sense of economic data, has an uncanny power to separate fact from fiction. The use of regression models is often able to overcome the notorious “selection bias,” which makes the “search for causal knowledge” all the more complicated. In this episode of YouTube series "Mastering Econometrics" (watch, runtime: 9:32), MIT professor Josh Angrist breaks down how the discipline can overcome selection bias. Most notably, regression allows econometricians to look at the effect of one variable on another while isolating all others, creating a situation known as ceteris paribus, which is Latin for "other things equal.” Angrist illustrates this using the example of wage differences between graduates of state-owned universities and those who studied at private universities.

Diplomacy + Foreign Trade

Libya closes Egyptian embassy as tensions rise over Turkey military pact: Libya’s Tripoli-based government has announced that it will close its embassy in Egypt due to “security reasons” amid fallout over the military and maritime agreements signed with Turkey earlier this month. Turkey, whose parliament yesterday ratified the agreement to provide military support to Fayez Al Serraj’s government, has suggested that it could send troops to the country to defend the capital against forces allied to General Khalifa Haftar, who leads the rival government in Tobruk. Egypt’s parliament speaker Ali Abd El Aal yesterday restated that Egypt considers Haftar’s government to be the country’s legitimate authority, leading to a firm rebuke by Libya’s High Council of State which accused Egypt of attempting a “military coup.”

El Sisi talks reform program with World Bank’s Mahmoud Mohieldin: President Abdel Fattah El Sisi discussed Egypt’s progress on its economic reform program and increasing the World Bank’s cooperation with Egypt with World Bank Group Senior Vice President Mahmoud Mohieldin, according to an Ittihadiya statement. The two met on the sidelines of the World Youth Forum in Sharm El Sheikh yesterday.

The president separately talked cooperation and food security with the UN Food and Agriculture Organization (FAO) Director-General Qu Dongyu. The meeting focused on working to improve food security in Egypt and across Africa, Ittihadiya said.

New Zealand has agreed to begin importing Egyptian oranges after two years of negotiations with the Agricultural Quarantine Authority, according to an Agriculture Ministry statement. Egypt’s orange exports have been gaining ground in European and global markets for the past few years and was expected to overtake Spain and become the world’s largest orange exporter.

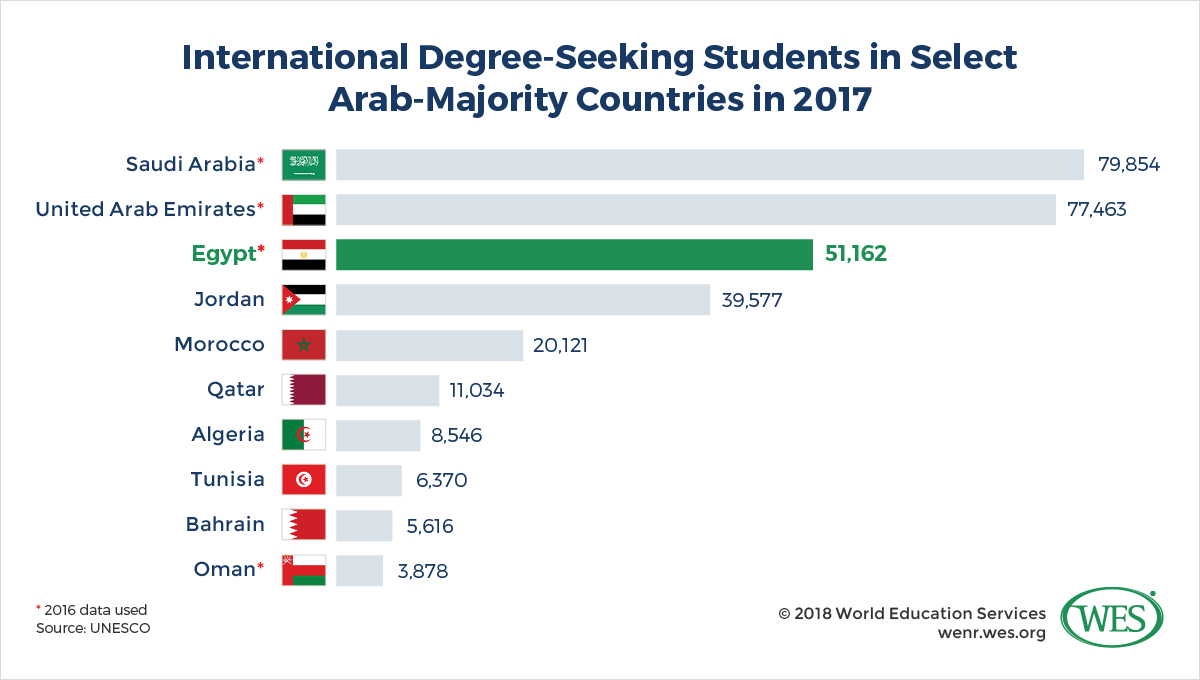

How Egypt is positioning itself as an educational hub for international students: Attracting more international students is a key priority for both private universities and the Egyptian government, opening up important avenues for investment as well as increased revenue generation thanks to higher fees being paid in foreign currency. Now a comprehensive strategy — including the internationalization of private and public universities, ministry-led reform and partnerships with a host of overseas entities — is driving an influx of international degree-seekers.

In 2016, Egypt was the third-largest destination for international degree-seeking students within the MENA region, behind Saudi Arabia and the UAE, with inbound mobility having shot up to some 51k students from an estimated 27k international students in 2003, according to the World Education Service (WES).

That figure is even higher today: A current listing by Rasha Kamal, the Head of the Central Administration for International Students at the Higher Education Ministry, puts the number of international students studying in Egypt at around 87k (the figure excludes international students studying at private universities in 2019-20). She hopes to increase the number of incoming first year international students attending Egyptian universities to 20k for 2020-21. The Supreme Council of Universities announced in 2017 a strategy to increase the total number of foreign students in Egypt to 200k, according to a statement by the council cited by Al Fanar.

Where are the international students coming from? Perhaps surprisingly, many students come from Southeast Asia, with Malaysia sending the vast majority (just over 4.5k in 2016, according to UNESCO data), but other countries in MENA (notably Syria) and Africa (notably Nigeria) are also important markets. Some 70% are male, and most study at public universities, according to WES. 18.8% of the country’s international undergraduates coming to Egypt’s public universities in 2018 came from Kuwait, making it the country with the largest representation that year — while in 2019, the greatest number of international undergraduates entering public universities were from Jordan, says Kamal.

Each international student will generate significantly more revenue for private universities than their Egyptian counterparts. At the American University in Cairo, international undergraduate students pay USD 735 per credit hour, while Egyptians pay USD 583 per credit hour. Egyptians pay USD 522 per credit hour for a graduate program, whereas international graduate students will pay USD 735. We see this discrepancy in other universities, such as the British University in Egypt (BUE), where annual fees for an undergraduate international student can range from USD 10,193-11,193, while Egyptian students can expect to pay annual tuition of USD 1,242-5,277. The same pattern holds at the German University in Cairo and Modern Sciences and Arts Academy (MSA).

What’s also significant is that international students must pay in FX, while their Egyptian counterparts are allowed to pay in EGP. This makes international students one of a university’s leading sources of hard currency.

These universities are pulling out all the stops to attract more international students. AUC has employed several strategic approaches to attracting international students, after its numbers fell dramatically between 2011 and 2015, says Ahmed Tolba, AUC’s Associate Provost for Strategic Enrollment Management (SEM). The university now has a recruitment team that attends high school study fairs in target countries, has contracted a market study to help inform its targeted outreach and messaging, engages in digital marketing campaigns, and offers scholarships. It has also set up some 202 study abroad partnerships all over the world, most of which are in North America and Europe. Meanwhile, BUE subscribed to a digital marketing platform back in 2018 that saw its website translated into 46 languages, resulting in a fivefold increase of roughly 1,900 international applicants this year, says BUE’s Mohamed Eid.

Gov’t looks to raise revenue generated by international students in Egypt: International students studying in Egypt generated some USD 186 mn for the Egyptian economy in 2017, according to University World News. The government is reportedly aiming to increase this contribution by as much as USD 700 mn by 2021.

The government is leveraging partnerships to attract students from overseas. The ratification of the International Branch Campus Law (pdf) in July 2018 has allowed international universities to set up branch campuses in Egypt by: building their own campus, like the German International University; partnering with an Egyptian company that can build an educational hub, like the Knowledge Hub, which hosts Britain’s Coventry University campus; and by partnering with existing Egyptian public or governmental universities, which Arizona State University is reportedly interested in doing.

Having big-name global universities set up shop in Egypt is attractive to international students, says Mohamed El Shinnawi, advisor to the Higher Education Minister. This strategy forms part of what Thomas Hale in the Financial Times calls a “model for indirect international study,” developing all over the world. “[Establishing] campuses in intermediary countries avoids requiring fee-paying international students to have the kind of wealth usually needed to study directly in the UK or US,” Hale writes. So for students who want to obtain a degree from a UK, US, or European university, but face the constraints of the high cost of living or indeed the difficulty of procuring a visa, this offers a viable alternative.

Egypt’s international student recruitment is in the same boat as tourism: “In 2010, international students — both degree-seeking and study abroad — made up about 17% of our student body. This number dropped as low as 3% in subsequent years, because of the situation in the country,” said AUC’s Tolba. Between 2011 and 2015, the US State Department issued security warnings against traveling to Egypt. Reclassifications in 2015 and then in 2018 is reversing the falling trend of international student recruitment. “International students made up about 6% of AUCs student body this year,” adds Tolba. These, however, still fall short of the 15% quota for 2019 set by AUC Provost Sherif Sedky back in 2016.

We should be thinking of attracting international students in the same way we think of foreign direct investment. Internationalization has significant direct and indirect economic benefits, enhancing economic competitiveness and boosting Egypt’s global reputation, argues Associate Professor Jason E. Lane, of State University of New York at Albany in a University World News opinion piece. It is a means of “importing academic capital” that is similar to FDI, he adds, and could allow Egypt to “leapfrog educational development that would likely be slower by only investing in domestic institutions.”

Your top education news stories in Egypt this week:

- Sphinx Private Equity Management will launch a USD 100-120 mn private equity fund with an eye on education and health.

- Spain’s Mediterrania Capital Partners is looking to raise USD 100 mn for its MC III fund. The fund will focus on education, health and other B2C services.

- CIRA will invest more than EGP 2 bn to develop several ongoing and future education projects and will turn to a securitized bond issuance as part of its financing plans, CEO Mohamed El Kalla said last week.

- King Salman University in Sinai is expected to open its doors in March 2020, Higher Education Minister Khaled Abdel Ghaffar said, according to Ahram Gate.

- MOVES- Reda Hegazi was appointed as Assistant Education Minister for Public Schools yesterday, according to Youm7. He had headed the ministry’s public education department since 2015.

The Market Yesterday

EGP / USD CBE market average: Buy 16.03 | Sell 16.16

EGP / USD at CIB: Buy 16.05 | Sell 16.15

EGP / USD at NBE: Buy 16.05 | Sell 16.15

EGX30 (Sunday): 13,434 (+0.6%)

Turnover: EGP 205 mn (72% below the 90-day average)

EGX 30 year-to-date: +3.1%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.6%. CIB, the index’s heaviest constituent, ended up 0.7%. EGX30’s top performing constituents were Pioneers Holding up 3.0%, Egyptian Resorts up 2.8%, and EFG Hermes up 1.9%. Yesterday’s worst performing stocks were CIRA down 6.6%, Ibnsina Pharma down 0.8% and Oriental Weavers down 0.4%. The market turnover was EGP 205 mn, and domestic investors were the sole net sellers.

Foreigners: Net Long | EGP +17.3 mn

Regional: Net Long | EGP +2.4 mn

Domestic: Net Short | EGP -19.2 mn

Retail: 63.7% of total trades | 60.4% of buyers | 66.9% of sellers

Institutions: 36.3% of total trades | 39.6% of buyers | 33.1% of sellers

WTI: USD 59.77 (-0.50%)

Brent: USD 64.89 (-0.51%)

Natural Gas (Nymex, futures prices) USD 2.31 MMBtu (+0.57%, January 2020 contract)

Gold: USD 1,478.20 / troy ounce (-0.20%)

TASI: 8,049.50 (+0.55%) (YTD: +2.85%)

ADX: 5,029.92 (-0.13%) (YTD: +2.34%)

DFM: 2,727.34 (+0.18%) (YTD: +7.81%)

KSE Premier Market: 6,828.32 (+0.85%)

QE: 10,262.84 (+0.06%) (YTD: -0.35%)

MSM: 4,012.19 (-0.19%) (YTD: -7.21%)

BB: 1,583.65 (+1.04%) (YTD: +18.42%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

23 December (Monday): The Cairo Economic Court decided to adjourn the lawsuit filed by Americana Egypt minority against the independent financial advisor to Monday 23 December.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

17-20 June 2020 (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.